The long-standing, well-funded campaign to make America more conservative and business-friendly, delineated in the 1971 Powell Memo, has borne great fruits, at least if you are a capitalist. A new Reuters article describes in considerable detail how judges routinely accept the request of corporate defendants to keep their dirty laundry secret, even though court records are supposed to be public. This has come at a very high cost to Americans, via defective products staying on the market far longer than they would have otherwise, and in the case of Purdue Pharma, its finely-tuned pill-pushing sales machine operating unimpeded for at least a decade longer than when some prosecutors got wind of Purdue Pharma’s predatory conduct.

The Reuters findings are dramatic: over the past two decades,

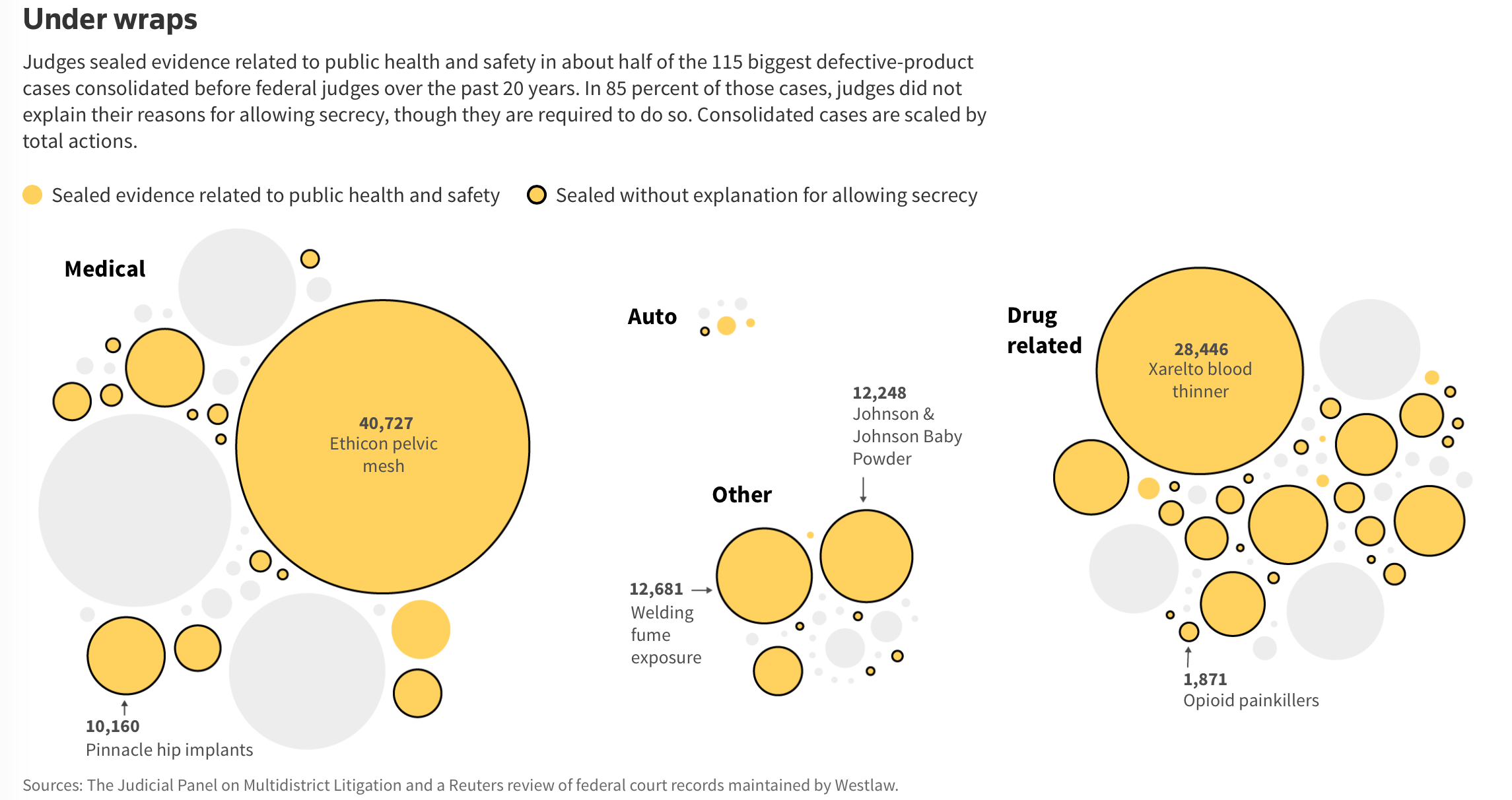

…judges sealed evidence relevant to public health and safety in about half of the 115 biggest defective-product cases consolidated before federal judges in so-called multidistrict litigation, or MDLs. Those cases comprised nearly 250,000 individual death and injury lawsuits, involving dozens of products used by millions of consumers: drugs, cars, medical devices and other products…

…in at least 31 of the 115 large federal product-liability cases Reuters reviewed, judges sealed entire arguments that dealt directly with the strength of the evidence. Court rules frown on such broad sealing practices because truly confidential information rarely spans an entire legal brief. In most of those cases, nothing in the court record indicates that the judge conducted any analysis of whether secrecy was merited.

The reason? It is sometimes spurious claims that documents obtained in discovery rise to “trade secret” status, which as we’ll discuss shortly, is a very high bar and not operative in the cases Reuters probed. But in many other instances, judges simply rubber stamped big corporate demands. From the must-read Reuters piece, How judges added to the grim toll of opioids:

….court records are presumed to be public as a matter of law. They can only be sealed for valid concerns about privacy, including personal medical records, and to protect company trade secrets.

In most states and nearly all the 13 federal appellate circuits, judges are legally obliged to weigh any litigant’s request that information be sealed against the broader public interest in making it public. They also must explain in the court record any decision in favor of secrecy. Judges incur no penalty for failing to do these things.

In practice, secrecy has become so ingrained in the system that judges rarely question it. In 85 percent of the cases where Reuters found health and safety information under seal, judges provided no explanation for allowing the secrecy.

This deference to business is a product of the law and economics movement, which sought to influence judges way before they sat on the bench, while they were in graduate school. As we wrote in ECONNED:

The law and economics promoters sought to colonize legal minds. And, to a large extent they succeeded. For centuries (literally), jurisprudence had been a multifaceted subject aimed at ordering human affairs. The law and economics advocates wanted none of that. They wanted their narrow construct to play as prominent a role as possible.

For instance, a notion that predates that of the legal practice is equity, that is, fairness. The law in its various forms including legislative, constitutional, private (i.e., contract), judicial, and administrative, is supposed to operate within broad, inherited concepts of equity. Another fundamental premise is the importance of “due process,” meaning adherence to procedures set by the state. By contrast, the “free markets” ideology focuses on efficiency and seeks aggressively to minimize the role of government. The two sets of assumptions are diametrically opposed.

Reuters gives the mundane reasons secrecy has become institutionalized. Corporate defendants ask for it and plaintiffs’ counsel routinely agree because they don’t want to waste time and firepower fighting over public access. Judges go along because they can hear more cases.

Reuters argues that based on its analysis of “a handful of cases,” that “hundreds of thousands of people were killed or seriously injured,” by keeping information about defective or destructive products under wraps. For instance, evidence in an early 1980s case showed that the Remington 700 hunting rifle had a bum trigger and the company had known about it for decades. But that information wasn’t public until a judge in a 2014 case denied the request to keep the records secret. Almost 200 hunters dies in the intervening years.

Reuters also described how General Motors kept the rollover risks of its cars hidden until a judge in 2004 honored the plaintiffs’ request to make the documents public for the benefit of regulators.

But the big grim example is Purdue Pharma:

Booker T. Stephens… sat on the West Virginia Circuit Court in Welch, deep in Appalachian coal country…where the first lawsuit filed by a state against OxyContin’s maker, Purdue Pharma LP, landed in 2001.

West Virginia accused Purdue of duping doctors into widely prescribing the drug by minimizing its risks, convincing them it was less addictive than other opioids because just one dose delivered steady relief for 12 hours. In the pretrial “discovery” phase of the case, Purdue sent thousands of pages of internal memos, notes from sales calls on doctors, marketing plans and other records to the state’s lawyers who had requested them.

That evidence was clearly compelling: In a 2004 ruling, Judge Stephens rejected Purdue’s motion that he dismiss the case….

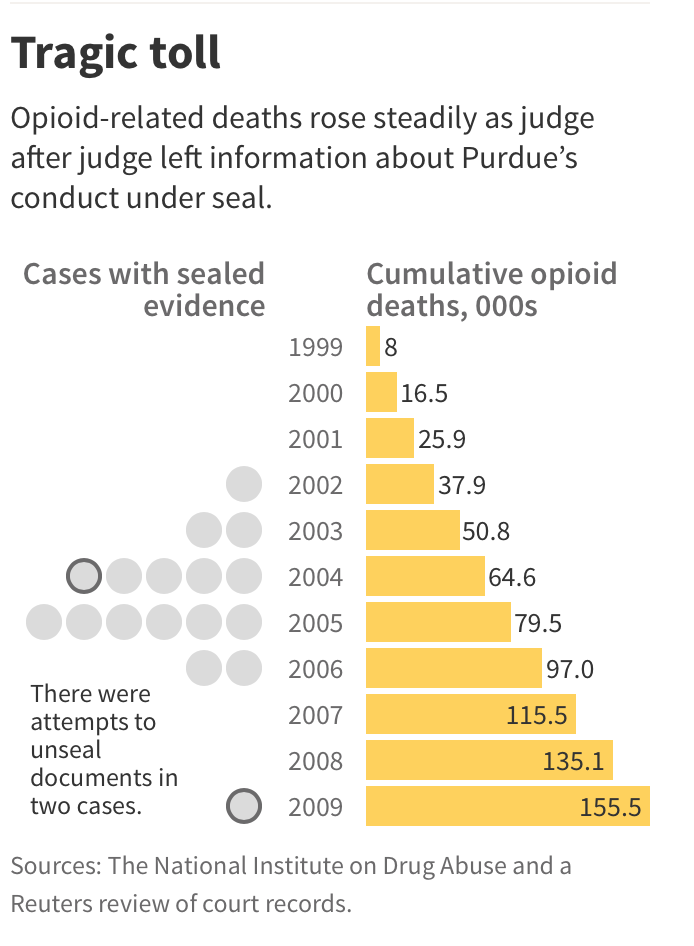

But Stephens sealed the evidence on which he relied in that ruling. And when Purdue and the state reached a settlement that year, before the case went to trial, the evidence remained hidden, out of sight to regulators, doctors and patients. Over the next few years, as OxyContin sales and opioid-related deaths climbed, more than a dozen other judges overseeing similar lawsuits against Purdue took the same tack, keeping the company’s records secret.

It would be 12 years — and 245,000 overdose deaths — before evidence Stephens and other judges kept hidden was made public, and then only after it was leaked to a newspaper. What it showed was revelatory: OxyContin, the first billion-dollar-a-year narcotic, was not the reliable 12-hour painkiller Purdue long claimed it was. Its effects often wore off much sooner, exposing patients to a relapse of pain, withdrawal, or both – suffering relieved only by the next pill. When doctors raised concerns, the documents showed, Purdue sales reps counseled them to put patients on bigger, more dangerous doses.

The eventual release of the evidence reinforced the widely held view that OxyContin was a catalyst for the epidemic, which by then had expanded beyond prescription opioids to include illicit drugs such as heroin. The material also informed hundreds of new lawsuits seeking to force accountability on the entire opioid industry for its role in the addiction crisis.

But for untold numbers of opioid users who had overdosed, it was too late. “Heartbreaking and sickening” is how Congresswoman Katherine Clark, a Massachusetts Democrat who has been involved in investigating the causes of the opioid epidemic, described the early decisions to seal the Purdue evidence… “We don’t know how many lives we could have saved,” she said.

The Reuters story is particularly critical of Judge Dan Polster, who is presiding over a number of multidistrict litigations, which consolidate parallel suits:

Each decision the judge makes applies to all of the consolidated lawsuits. Thus, with one sealing order, a judge can impose secrecy in thousands of cases….

That is now happening in federal district court in Ohio, where Judge Polster is managing nearly 2,000 lawsuits filed against the opioid industry. Cities and counties across the country claim that companies up and down the supply chain – drug makers like Johnson & Johnson’s Janssen Pharmaceuticals subsidiary and Teva Pharmaceutical Industries Ltd, as well as Purdue, distributors like McKesson Corp, and retailers like Walgreens Co – contributed to the public-health disaster by using misleading marketing and other ruses to boost sales at the expense of public safety.

So far, Polster has imposed a draconian secrecy on the proceedings. The judge, a former federal prosecutor confirmed to the bench in 1998, has given the litigants broad discretion to determine what records remain secret. As a result, entire lawsuits have been filed under seal in his court, including supporting evidence drawn from millions of records that detail the industry’s conduct over two decades.

These excerpts only scratch the surface of this impressively well-researched and documented article. Be sure to read it in full and circulate it widely.

Great post, Yves — thank you! One detail: presiding over the multi-district opioid cases here in Cleveland is Judge Dan Polster (not Stephen).

Will correct, thanks.

See now, that second sentence proves the first sentence incorrect. If you can blatantly shirk an “obligation” and have no consequences for such, then the obligation never really existed in the first place, did it (regardless of the letter of the law)? As ever, Catch 22 applies: they can do anything we can’t stop them from doing.

Very shocking. So what will happen to the judges promoting this kind of behaviour?

They are Federal judges, appointed for life. However, they aren’t used to being criticized in the press for doing societal harm and falling down as judges. Judge Stephens eventually released the records after most of them had gotten out. Not clear if this was pragmatic or not liking having been called out.

All of those opiod deaths over the last 30 years amount to casualties in the line of duty fighting just to survive what has become unethical capitalism. Over a 20 year period there were approximately 50,000 deaths of Viet Nam soldiers. So 225,000 deaths for domestic cases of friendly profiteering really puts this in perspective. No wonder we feel we are used and abused. Unethical pharma and a justice system on the take. I’m not sure but I think something is going on at the State level here in Utah to slam the breaks on prescription opioids. Yesterday I was sent to a nearby pharmacy because it was the only store that carried this particular drug and when I pulled out my credit card the cashier said “Oh, we don’t accept credit cards.” I was so stunned I was speechless. It was an antibiotic, a life-saving one. And her’s was the only pharmacy in the valley that carried it. They dithered around for almost a half hour; I stood my ground at the front of the line and made phone calls to the ER to tell them the dire situation. Eventually they tracked down the manager; in the meantime I had turned into an outrageous screaming a&&hole and he just took one look at me and said, “You can just have these, no charge.” What a fiasco. And my point is the reason I think the pharmacy has stopped taking credit cards is because of the extreme abuse of prescription opioids in this state. Just a hunch.

I’m an honorably retired, inactive member of the State Bar of California. Here’s the deal: Counsel and I (that would be all the lawyers involved in the matter) have just negotiated a settlement. The judge is going to sign off on any settlement we present as long as it doesn’t involve crushing babies with steamrollers.

As a general statement of opinion I oppose commercial secrecy every time. This goes back to the beginning of this commercial system. I have the details of a company that listed on the Royal Exchange in about 1820 with a prospectus that said we are so clever we have thought up a really profitable idea but cannot publish it in case foreigners find out. Invest with us and go for a fortune. Its not just Judges that are taken in, stock exchanges fall for it too.

Posts like this make NC great.