Yves here. It’s frustrating that writers treat it as news that Americans want more social spending. It’s another example of how positions presented in the media as mainstream are actually to the right of the center of gravity of political opinion.

As Richard Kline wrote in a classic post, Progressively Losing:

“Progressive goals are not popular.” Even with the systematically distorted polling data of the present, this is demonstrably untrue. Inexpensive health care, progressive taxation, educational scholarship funding, curtailment of foreign wars, environmental protection among others never fail to command majority support. It is difficult to think of a major progressive policy which commands less than a plurality. This situation is one reason for the lazy reliance upon electioneering by progressives, they know that their issues are popular, in principle at least. Rather childishly, they just want a show of hands then, as if that is what goes on really in elections.

“The ‘Right’ is too strong.” The oligarchy specifically and the Right in general are far less strong in American society apart from what their noise machines and bankroll flashing would make one think. The great bulk of the judiciary remains independent even if important higher appellate positions are tainted. Domestic policing is, by tradition and design, highly decentralized, with a good deal of local control, making overt police state actions difficult, visible, and highly unpopular (think TSA). While the military is a socially conservative society in itself, it is also an exceptionally depoliticized one, with civilian control an infrangible value. Popular voter commitment to the nominally more conservative political party has never been narrower or more fragile.

The rightist oligarchy does have a stranglehold on the major media, despite which accurate, uncensored, news is widely and readily available to anyone who wants to hear it. The other principle advantage of conservatives is that they are highly organized. Consider how the oligarchy effectively took over the ‘Tea Potter’ lunatic fringe in no time, and still presently stage manages it behind the curtain, or how they are paying some outfit(s) to constantly monitor and surreptitiously disrupt liberal to progressive blog-spaces. The powers of the Right are broad but thin and brittle, like a coat of lacquer on everything. Any organized citizen resistance would shatter that surface grip without great difficulty.

By John Duda, the Director of Communications at the Democracy Collaborative. Originally published at openDemocracy

The debate around modern monetary theory (“MMT”) is picking up steam – with its partisans pushing the model further into the public sphere than one might expect, and the old guard of establishment economics, together with some more interesting critical voices, pushing back.

The questions at stake can make the average person’s head spin: can a government with sovereign control over its currency create money at will to meet social needs, or would this create out of control inflationary spirals? Does tax income precede government spending, or does spending create the money that’s then taxed back to tweak the distribution of incomes and rein in inflation?

To most Americans, this is all probably a bit opaque and abstract – the inner workings of our money supply and its deep connections to the banking sector are, after all, as Bill Greider memorably put it, “the secrets of the temple.” But when we look at the core issue, we find that more Americans than not agree with the basic political judgement that MMT tries to justify theoretically – namely, that deficits shouldn’t matter if social needs are not being met.

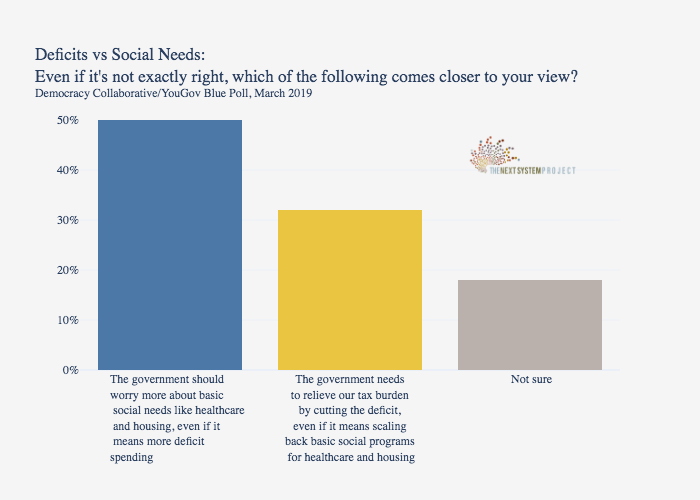

At the Democracy Collaborative, a poll we commissioned with YouGov shows this preference clearly. 50% of respondents thought “the government should worry more about basic social needs like healthcare and housing, even if it means more deficit spending” compared to just 32% who felt that “the government needs to relieve our tax burden by cutting the deficit, even if it means scaling back basic social programs for healthcare and housing.” So while most Americans probably don’t have an opinion on the intricacies of heterodox monetary theory, by a significant margin, more of them agree with MMT’s political conclusions about spending.

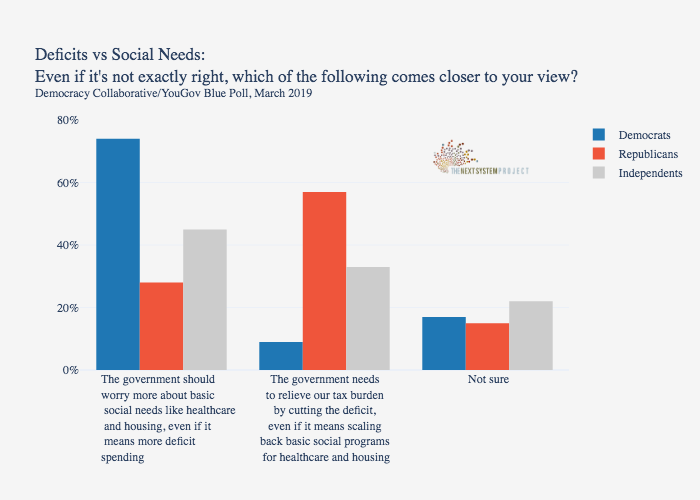

Of course, with trigger words like “tax burden” and “deficits” included, we did see a sharp partisan tilt in our results. Still, it’s encouraging to see that nearly 1 in 3 Republicans don’t think deficits matter more than social spending. And with 74% percent of Democrats ready to spend more to meet basic needs even if it increases the deficit, the kind of austerity-lite Paygo triangulation advanced by Speaker Pelosi seems utterly incomprehensible.

The point is to recognize that whether or not we can decide in favor of or against MMT is somewhat academic. There are a wide range of important technical issues to be worked out around tax, interest, and full employment policies – but when we’re operating in a context where actually existing financialized capitalism regularly features negative interest rates, trillions of dollars of central bank asset purchases, and seemingly unlimited tax cuts for the rich, letting ourselves be boxed in by technocratic assumptions about what’s feasible according to economic theory seems uncalled for.

We should identify the priorities we want, and then build the monetary and fiscal mechanisms we need to get there – rather than cowering before the supposedly terrible and unknowable forces of money and the economy. The lesson of the last crash should not be that the market is an unpredictable and capricious god, it should be that when you design a system to incentivize untrammeled financialization you get exactly what you asked for. So let’s start instead with what the majority of people want the economy to do for them, and then design and build with those goals in mind.

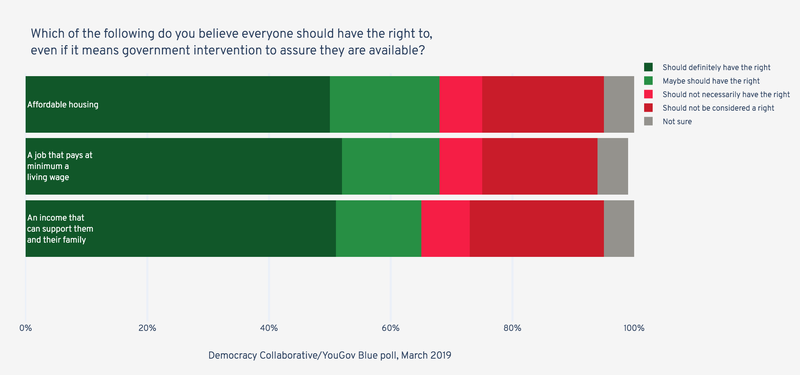

As our polling showed, these goals are simple but powerful. Fundamentally, most people agree that the economy should be delivering better outcomes, and believe that government intervention is a good way to guarantee that these outcomes happen. We asked whether people had a right to “an income that can support them and their family,” “a job that pays at minimum a living wage,” and “affordable housing” – for all three of these basic demands, respondents who thought people “should” or “maybe should” have this right was between 65% and 68% of those surveyed, compared to just 26%-30% of respondents who felt that people “should not” or “should not necessarily” enjoy those rights.

Austerity’s insistent nag “but how will we pay for it?” should not be the starting point of our political imagination. Rather, we should start from an economic agenda designed to deliver better outcomes on key goals in the most direct way possible, and then creatively work out “how will we pay for it” as a matter of technical due diligence – with the understanding that deficits are only an absolute constraint for those intent on austerity at all costs. The answers we arrive at may or may not draw from MMT’s proposed insights, although they should be honest and realistic in either case. When the policymakers and central bankers of the 1% are willing to break every rule in the economics textbook to protect and expand an unequal status quo, we shouldn’t be afraid to demand basic economic human rights first, and leave it to the economists to invent a way to pay for it.

Thanks for this post. In a related vein, I noticed the other day that MMT economist Stephanie Kelton has written a book titled “The Deficit Myth”. I haven’t yet read it, but the jacket suggests she discusses some of these issues.

There’s a video of her on this topic: https://www.youtube.com/watch?v=cMuay5_pmrI

“nearly 1 in 3 Republicans don’t think deficits matter more than social spending”

I wonder if people are finally catching on that deficits only seem to matter when a Dem is in the White House and when a Republican is, in the words of a Dick Cheney, deficits don’t matter.

Would be nice to see this myth put to bed along with so many others that are used to get voters to vote against their best interests.

Deficits generally only matter when white people think that poor black and Hispanic people, gays, and unmarried moms will receive benefits. Infrastructure is a bit of a different issue because proposals are usually coupled with a user fee, such as highway gas tax, that gets squashed quickly by Republicans who signed Grover Norquist’s pledge to never, ever increase a tax.

And from Twitter today, look at this chart of public opinion: https://twitter.com/leedrutman/status/1138442237866598401

And FWIW, the more that Trump, Wilbur Ross, dark money, tax havens, are brought to light, the more obvious it becomes that much of neoliberalism is a fraud exploited by narcissists. They don’t appear to be capable of creating solutions to social or economic problems (same coin: two sides).

I feel fortunate to have lived long enough to see this, and I’m deeply grateful to all who are working to reveal neoliberalism as an economic deceit.

me too

What a beautiful little synopsis by John Duda. I like him. Thank you Yves. So, agreeing with everything above, I’d just like to give a shout out to Nancy to please, please step aside. And another one to Liz to encourage her to stay in for the long haul. This modest little tidbit by Duda is better than a can of spinach.

Susan,

Liz Warren is my senator and I wrote to her several months ago urging her to take MMT mainstream as a way to serve her presidential aspirations and to genuinely serve the public. I received a boilerplate reply, similar to the one my congressman, Joe Kennedy, Bobby’s grandson, gave me a few weeks ago at a constituents meeting. They know about MMT but it scares them.

This is a pretty nice article, and it comes close to but doesn’t quite reach an essential point for understanding the current political landscape: the Democratic party elite are fundamentally conservative. Pelosi’s triangulation is only incomprehensible if you think her aim is to advance progressive goals. If instead you realize her intention is to strangle them, it makes much more sense.

I agree with this part:

“we shouldn’t be afraid to demand basic economic human rights first”

But really disagree with this:

“and leave it to the economists to invent a way to pay for it.”

When will we ever learn? We can’t leave the hard work to others — they are not trust-worthy! Devil is in the details. And 99% of economists are NOT on our side!

I’m all for MMT, got the T-shirt and all that. And there is no use lying about stuff to achieve your goals, it always backfires (at least for the good guys).

But we still need to rein in our military, for a bunch of reasons well beyond finances. And “spend whatever you need” doesn’t help with that, because the MIC sees it, as always, as “spend whatever you want”.

I have no idea how to actually tackle this problem, of course. “Patriotism is the last refuge of the scoundrel” seems like it should be a good starting point against the chest-thumpers, but making insanely powerful enemies right off the bat actually does not seem like a promising way forward.

MMT is not a friend (and I know it’s not supposed to be anybody’s friend, it’s just the technical explanation of how things work) in this case.

the military is the poster child for the reality of MMT…i use it all the time with all the random texans i run into.

so long as i make certain to respect the troops, that is.

the other, still more esoteric, poster child is wall street…and the still esoteric trillions they got bailed out with(not just tarp, or whatever…but the multi trillion dollar back door shadow money creation that only came out later, and to little fanfare)

ordinary folks can understand all this if it’s explained to them in their own terms.

indeed, i’ve confirmed in my ramblings everything Yves quoted at the top, that “progressive” (ie: sane and fair) policies enjoy wide support, so long as the triggerwords are avoided.

the problem is that the “liberal”/”progressive” party is neither…so it’s up to us to tell that story.

Nancy sure as hell ain’t.

MMT and the Green New Deal are a waste without stopping wars and invasions which also increase pollution, displacement, and disease. And all of these affect health care costs.

Jobs created have to become divorced from creation of death and destruction

A major way to increase the SUPPLY of fiat that may be created for a given amount of price inflation is to increase the DEMAND for fiat by allowing all citizens to USE fiat in account form and not just banks.

And once that’s allowed, then all other privileges for “the banks” can be justly and responsibly abolished too which will also increase the amount of fiat that may be created for the general welfare.

They have. Student debt. Mortgages with 3% down. Credit cards.

The big difference is that the businessmen (like Trump) can walk away from some or all of their debt and get more. However, it is immoral or illegal for the average minion to do the same. Student debt can haunt you to your grave. Sub-prime mortgages meant that many people lost their house and all their equity. Credits cards are designed with usurious interest rates and fees with posses of debt collectors to hunt you down like a dog.

They have. Student debt. Mortgages with 3% down. Credit cards. rd

Those things are bank credit creation, not fiat creation, and they promote the private welfare of the banks themselves and of the most so-called “credit worthy” of what is, due to government privilege for the banks, the public’s credit but for private gain.

Fiat creation, otoh, should promote the general welfare only and might include such things as a Citizen’s Dividend to all citizens equally and, of course, deficit spending by the monetary sovereign for the common good of its citizens.

Invoking “demand inflation” is a blunt instrument. Time was when wheat was scarce, often due to hoarding, and the price skyrocketed. Think French Revolution. Time was when credit was scarce and the price of money skyrocketed. Think the Vietnam War. Time was variously when all sorts of commodities and finished products were scarce and if they were needed or clever the price went up. If they were a status symbol the price went up. Some of that was fake demand; it was actually orchestrated supply or scarcity. We have lived through all that, much of it looking pointless now, but the economists are still fighting the last war. They haven’t noticed that it’s different now. We have reached the limit to the carrying capacity of the planet, so you could say that we have reached the pinnacle of demand which includes fake demand too. Resources must be managed. Population must be limited. The good health of the planet must be a priority. There will be a need to use resources wisely; to manufacture wisely; to clean up and recycle. That need is the new “demand”. And a demand to make things right, to reclaim the good things and dispense with the useless ones, does not cause inflation. The two are not even in the same universe. We just need to, demand to, get on with it now and make things right.

Perhaps status is the demand. People are getting the real commodities in America, by and large.

People keep their bellies full and the lights on, by and large.

What they need and can’t afford are education healthcare and economic independence.

Maybe people without artificial shortages of these services would make smarter choices with our real resources.

The imbalance of social capital and the devaluing of everyday human life is why polluters are protected by the law while minorities fill the jails.

Population growth needs to be curbed but it seems moderated by living wages.

Good to see Pelosi at the Peter G. Peterson Foundation today, fighting the good fight https://thehill.com/homenews/house/447892-pelosi-on-trump-attacks-im-done-with-him

After watching the banksters get bailed out in 2008, I don’t know how anybody can believe that myth about deficits. What did we spend on that? One trillion? Fourteen trillion? Somewhere in between?

I did hear it was more than America ever spent on anything, ever, combined, and counting inflation.

It doesn’t exist. The Fed has whisked it away to Never-Never-Land.

I think the big thing is to use debt to build for the future (infrastructure) similar to using a mrotgage to build structures or fund short-term deficits within long-term stable programs that recirculate cash to the economy quickly (Social Security, unemployment insurance, pension fund insurance etc.),

We should not use government debt to prop up inefficient systems like the US medical system that have grossly excessive costs or fund tax cuts that do not recirculate quickly into the economy (e.g. tax cuts for the wealthy that just increase savings for a few people).

Expenditures should be either self-sufficient in the long-run (e.g. Social Security) or be an investment with an expected return over the next 30+ years (education, infrastructure) as government can fund things with a long time horizon. We can think about using 50 year or 100 year bonds for really long-lived things.

Things like Social Security, Earned Income Tax Credit, Food Stamps recirculate instantly in the economy providing funds to many vendors within 30 days of receipt. This is really valuable during recessions providing stable cash flow through the system. Tax cuts for the wealthy largely get saved and build up wealth and increase stock market share prices, but don’t do much to stimulate to day-to-day local economy. Corporate revenues and earnings are much more likely to get slashed if those social spending programs are reduced than if the tax cuts on the wealthy go away.

But why issue bonds at all?

Exactly. Municipal bonds, for example, add 40% to long-term infrastructure projects. The folks who really make out are the Wall Street financiers. Sure, some folks get a tax break for renting their money out for 30 yrs., but the big, quick-return fees go the the financiers.

Governments that are not monetarily sovereign (which includes US States and municipalities) are currency constrained, so they do have to issue bonds to borrow money.

The US Federal government has no such constraint and does not have to issue bonds, though legal arrangements over which it exercises control currently require it to do so — it could change those arrangements and cease to issue bonds.

and thanks, Yves, for re-linking that Richard Kline article.

lots to chew on, there, 8 years on.

ex:”To me, the only way out of these dead ends lies in committing to a defined agenda of institutionalized, economic justice because this affects all. Social justice cannot be secured absent economic justice. Any such agenda is going to be anti-corporate, anti-poverty, pro-education (and job re-education), and pro-regulation. It has to be citizen-based outside of existing political parties. This kind of program can be articulated as pro-community rather than pro-faction if the organizing is done. This has to be pursued from a defined agenda, unapologetically, and from a pro-citizen(ship) position regardless of other more discrete goals.”

I think of Kerouac’s Rucksack Nation, and the evangelists wandering the late Roman world.

“Relieve our tax burden by cutting the deficit” makes absolutely no sense. Lower deficits means higher taxes as a percentage of spending, by definition.

It’s true but I tend to view it more as an indication of the insane insularity and inward-looking nature of the US media who project their own biases, obsessions and fetishes onto the US public.

Not only is it clueless and narcissistic in its own way, it’s a complete abdication of their role as journalists. They’re not supposed to dreaming things up, they’re supposed to be finding stuff out and reporting on, y’know, facts. And it means their “analyses,” such as they are, are invariably wrong because their premises are.

Richard Kline! Great to see him linked here; thanks, Yves! I miss his incisive commentary. Anybody know what he’s up to these days?

Pelosi… incomprehensible…

No, entirely comprehensible. She is the bag lady in power precisely because she funnels donor cash to the non progressives, of which there are many, in her caucus.

She also conducts a poll, of the donors. More social spending? No? Less is better? What about the military? Right, more of that. Got it.

More military… gotta support the troops… and maybe just a few more tax cuts, nobody likes those. Just gonna have to cut out that social stuff for balance… and anyway, everybody I know has excellent health care.

Man, this stuff just writes itself.

No one understood the monetary system during globalisation.

You wouldn’t support financial liberalisation if you did.

Bank credit being used to inflate asset prices leads to financial crises and economies around the world have been blowing up in Minsky Moments, e.g. Japan, the UK, the US and the Euro-zone. China has seen their Minsky Moment on the horizon.

Government surpluses are thought of as good, but the US Government was in surplus from 1927 – 1930.

Governments are often running a surplus when a financial crisis hits.

If the Government is going positive something else is going negative.

This is Japan when its economy blew up.

Richard Koo shows the graph central bankers use and it’s the flow of funds within the economy, which sums to zero (32-34 mins.).

https://www.youtube.com/watch?v=8YTyJzmiHGk

Richard Koo’s graph of the flow of funds shows the Japanese Government ran a surplus as the Japanese economy blew up.

The terms sum to zero so, as one is going positive, another is going negative.

The Government was going positive as the corporate sector was going negative.

A government surplus is sucking money out of the economy.

A government deficit is pushing money into the economy.

The Americans thought they could balance the Government budget and run a big trade deficit as they didn’t understand the monetary system

This is the US (46.30 mins.)

https://www.youtube.com/watch?v=ba8XdDqZ-Jg

Look at the chart at the times when crises hit.

The private sector going negative (into debt) is the problem.

As the Government goes positive, the private sector goes negative.

As you reduce the Government deficit, you drive the private sector into debt.

The University of Chicago forgot what they used to know.

Henry Simons was at the University of Chicago as he was a firm believer in free markets, but he had learned the lessons of the 1920s and 1930s.

“Stocks have reached what looks like a permanently high plateau.” Irving Fisher 1929.

Irving Fisher was a neoclassical economist that believed in free markets and he knew this was a stable equilibrium. He became a laughing stock and worked out where he had gone wrong.

What goes wrong with free markets?

Henry Simons and Irving Fisher supported the Chicago Plan to take away the bankers ability to create money, so that free market valuations could have some meaning.

The real world and free market, neoclassical economics would then tie up.

https://cdn.opendemocracy.net/neweconomics/wp-content/uploads/sites/5/2017/04/Screen-Shot-2017-04-21-at-13.52.41.png

1929 – Inflating the US stock market with debt (margin lending)

2008 – Inflating the US real estate market with debt (mortgage lending)

Bankers inflating asset prices with the money they create from loans.

https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

1929 and 2008 are Minsky Moments.