The Financial Times has done a lot of important reporting on Brexit, such as being early to warn of the utter lack of customs IT systems preparedness (Customs was almost certain to be getting an inadequate upgrade planned before Brexit in place late) and on the number of agreements the UK would need to renegotiate. But it would also run the occasional too-obviously-planted story, such as ones that took the City’s demands way too seriously.

Today the Financial Times published a supposedly important story (a “Big Read”) on the impact of a Brexit crashout that was stunningly uninformative. Any two posts on Richard North’s blog would be more educational.

It may be that the authors were trying to say something new and the piece didn’t come together well by deadline. But it gives the impression that the analysis, such as it is, was poorly framed so as to make the impact seem less bad and to give near-equal play to harm suffered by the EU.

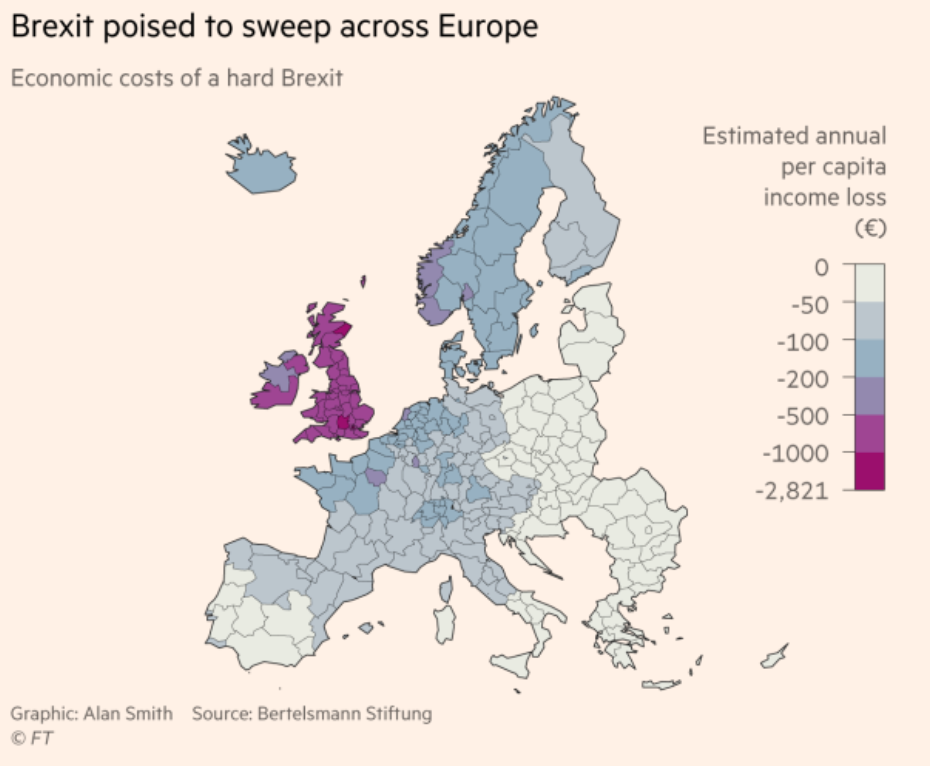

Having said that, it does have an important chart near the top:

But then it breathlessly promises to tell readers where “the biggest impacts” from a crash out might be, and comes up with an apples and stinky fruit set of categories:

Data flows

Financial services

Customs

Transport

Fisheries

Huh? These aren’t commensurable.

Two, financial services and transport, are industry sectors, so for instance, transport includes airlines, Eurostar, and truckers. Fisheries is just one industry. The impact of data flows and customs cuts across many industries, and this short article does not do a great job of parsing that out. By contrast, Richard North has done many deep dives on how the imposition of a hard border between the EU and UK will affect documentation requirements, compliance, and other controls. For instance, North anticipates that a hard Brexit would wipe out the UK live animal shipment business. Herds would be slaughtered because animals once destined for export could not be sold due to the double whammy of tariffs and non-tariff trade barriers, meaning no longer being in compliance with EU regs by virtue of being outside the EU (and not having replacement mechanisms in place). On top of that, North anticipates that these farmers won’t even be able to sell in the UK after they’ve thinned their herds. The UK will almost certainly eliminate tariffs on food imports, which would make these farmers uncompetitive.

The piece reaches conclusions for each item, in order:

VERDICT: Both the UK and the EU face equal damage.

VERDICT: A key part of UK economy faces significant disruption.

VERDICT: The UK is likely to be disproportionately hit by disruption.

VERDICT: Both sides will face temporary disruption.

VERDICT: EU stands to lose more than UK.

It looks like the list was constructed to create the impression that the two sides would suffer similar levels of damage, while conceding the UK will take the worse hit. But come on. The EU is not going to have to worry about food shortages. The EU is not going to have to worry about manufacturers that are party of global supply chains see their non-UK-end-market business stripped from them over time. And US and EU firms will try to take advantage of the hit to the City. Even if UK firms hold their own, the cost will still be loss of UK-based activity.

The section on data flows is so vague on what the practical impact on particular businesses would be so as to make the problem sound trumped up, particularly since Silicon Valley ignores rules and boundaries until a big regulator tries to hit key players between the eyes with a two by four….which usually turns out to be more like a ruler. No one has been willing to impose fines big enough to make the law-breakers scream “uncle”.

Maybe Clive can translate but despite the apparent illegality of post-crashout data transfers, I don’t see a mechanism by which the officialdom readily finds out about misconduct, much the less intervenes. And it appears the issue is personal data privacy. Can’t firms get waivers from customers?

Vast volumes of personal digital data from EU and UK citizens are transferred by businesses and public sector bodies across the English Channel every day.

Under no-deal, the legality of these data flows will be under question, having an impact on businesses including tech groups, healthcare companies or any services that deal with EU customers.

The disruption to data flows would be a significant barrier to trade and in the worst cases could force British companies to halt their European operations.

A system of contractual clauses offered by Brussels, allowing non-EU companies to carry out data transfers in compliance with European law, could offer a fallback….small and-medium sized enterprises have little awareness of what a hard Brexit means for them and the contingencies available.

In the longer term, the UK says it wants to sign an agreement on data-flows with the EU that would effectively treat Britain as if it was still a member state….but Brussels officials have warned it could take “years” for it to be concluded.

In practice, one would assume that government-related data transfers would be held up unless it suited the EU to give interim relief. Elsewhere, query how the EU would find the point of entry to intervene.

Other parts have me again scratching my head. For instance, the comparatively cheery section on transport ignore draft EU ownership rules that could give some important UK carriers real grief. From AirlineGeeks in February:

The measured proposed by EU officials in a draft law, involves European carriers requiring at least 50 pecent EU ownership and control in order to obtain or maintain full flying rights across the continent. This presents additional challenges for some of the region’s most important airline groups to maintain operations within the EU bloc and will potentially require the forced sale of UK and non-EU owned shares from some operators to meet legislative measures.

EasyJet, on one hand, has been preparing for such scenario, by increasing EU ownership on UK registered EasyJet plc, which owns EasyJet’s subsidiaries in Austria and Switzerland to meet European Union requirements on ownership and control. Up to now, 47 percent of EasyJet plc shares have already been transferred to European owners.

On the other hand, under its current ownership structure, only 25 percent of IAG’s shareholders are from within the European Union, which is causing concerns amongst EU officials.

The parent company of British Airways and Iberia, presented a contingency plan late last year in case of a non-deal Brexit; which would involve individual airlines being domestically owned through trusts and companies in order to maintain operating rights in both the UK and the EU. Yet, this move has been questioned by authorities as it would maintain IAG’s headquarters in London, with Iberia, Vueling and Level being based in Spain; raising further questions about the group’s ownership structure post-Brexit.

To allow airlines time to find a way around this, EU officials have proposed a seven-month grace period for airlines to present a plan that complies with EU ownership legislation.

Some of this may have been resolved but if so, the press has been slow on updates.

And this bit is maddening:

UK truckers — the lifeblood of goods trade with the EU — will be granted temporary haulage rights to ensure “basic connectivity” to help minimise disruption and queues at ports like Calais. The measures will stay in place until the end of 2019 but restrict UK lorries to limited deliveries in the EU.

This completely misses the point that UK truckers do round trips into the EU carrying loads both ways. “Limited deliveries” will wreck their routes and their economics. And what will fill in? Plus “to the end of 2019” is hardly any time.

You get the picture.

Is the pink paper punting on tough Brexit talk? Its comment section has a surprisingly high representation of Brexit cheerleaders given its presumably high London/finance industry readership. Or was it just having a bad day?

IMO, FT Brexit reporting is all over the place, but I’d say mostly falling in the “wishful thinking” and “we don’t have a clue” categories. By the looks of this, this is sort of a mixture.

On the verdicts:

– the UK and the EU face “equal” damage. Equal how? In absolute monetary terms? In absolute terms? How goes it square with “the EU stands to lose more then the UK”, or “The UK is likely to be diproportionately hit by disruption”?

I’d argue that:

– in absolute monetary terms the EU is likely to face smaller (short term) impact, because the UK is more likely to keep the imports open than the EU is (if the UK doesn’t keep itself open to the EU imports, it will suffer the shortages etc. everyone is talking about)

– in relative terms, the EU (as a whole) will always suffer less than the UK. It will differ for the individual states, with Ireland being hit the worst, possibly close to the UK hit.

– The EU in general is pretty good at exporting, and has already arrangements for most of its export markets. The UK rolled about 10, mostly very small trade deals so far. The largest was a Swiss one, and IIRC (but I may be wrong here), that rolling of that assumes a deal, and comes off in case of no-deal (can’t remember where I read it, so I could be wrong here – but it would make sense, as given that most of the UK imports to Switzerland aren’t for Swiss direct consumption but for inclusion in goods for export, mostly fo the EU, they would have to meet the EU rules).

In the end, yes, the EU will be hit by no-deal, and the timing is bad as Germany (and thus countries that are closely linked to its economy) is already on the edge of recession.

But for the UK, it could well be depression like situation. And, as I keep saying, MMT can be of only limited help, because while MMT can be the “magic money tree”, it’s not a “magic real resource tree”.

The UK needs to import most of the resources, and limit on that is their foreign reserves (including foreign income) + exports. Unless the government rations the foreign exchange, it has a limited ability to deal with it. Even strengthening the services exports is of limited use (with one exception, foreign students, as it’s effectively export service delivered locally, but that has a differnet set of problems), as the services will be hit most by various NTBs.

well, as we are living in a world where we must dramatically cut back on energy consumption and CO2 production, then Brexit could be a god send if correctly interpreted.

As far as capital control goes, I remember as an expat child not being able to move much currency intop and out of the UK, Wiki….

Exchange controls were originally enacted at the outbreak of war in 1939, to prevent a run on sterling, and to prevent any potential panic outflow of capital from the UK.

In 1966[5] the Labour Government of Prime Minister Harold Wilson restricted the amount of currency that British holidaymakers could take out of the country to £50[6] plus £15 in sterling cash.

Exchange controls in the UK were abolished by the Conservative Government of Prime Minister Margaret Thatcher in October 1979.

So, what’s new ? It worked then it can work now. How we get to “there” from “here” is not clear, but there seems to be no reason to doubt that it can be done.

In 1966, most people had direct experience of food coupons, as the food rationing ended in only 1954. Most of them never were, and never expected to go, on a foreign holiday (I don’t count the overseas experience by armed forces as “holidays”), much less see it as their god-given-right to go and get sloshed somewhere on the continent at least once a year.

Yes, it could drop the CO2 emissions. But hey, a plague killing half of the Earth’s population would do it too.

I don’t want unnecessary suffering of people “for the greater good”, whatever that may be.

SJ

I chanced on the writings of Tim Watkins recently who is an Social & economic scientist, with the first bite at his output being ” The Art of Painting Lipstick on a Pig “. It covers the UK retail downturn, the usual financial bullshit & the depletion of energy sources required to maintain forward economic momentum.

He also jeers at the positive spin put by Reuters on the June rebound in retail sales caused by an increase in sales of antiques & second hand clothes. He does point out that especially the latter phenomenon is good for the environment which I suppose would of course be much more sustainable if Gaia got rid of the lot of us, which if we don’t cut the crapping in our own backyards is likely to be our collective fate.

Anyhow, you & others might find his analysis interesting as I did also in his latest offering called ” Reliving Old Glories ” which partly features Brexit BS, but also covers how coal powered the British Empire which is something that I for one was not aware of. He is not seeking a major panacea on climate change but rather investigating localism which might come in handy.

I do agree with Vlade in the sense that people should not be thrown under a bus in order to protect others.

http://consciousnessofsheep.co.uk/2019/07/24/the-art-of-painting-lipstick-on-a-pig/?fbclid=IwAR0hgf1tg2U4U3dP639Rr16T9Uo_nSETnyEgwQqLOvXyBFsTtf780bRGo2E

To state that MMT is a magic money tree reeks of ignorance and an arrogant dismissal of how modern monetary systems actually function. The import scenario doesn’t even make sense, let alone the comment that the UK imports most of the resources – really? Do you seriously think that Sterling will drop to a level that will make it an untenable medium for trade – think Norway. As for the economic depression prediction, it is nonsense to make such a sweeping statement. Read the OBR literature for a run down on the scenario.

State resource that the UK produces in self-sufficient quality.

Food? No.

Energy? No (except maybe for coal if it decided to reopen some mines, but right now it imports more than produces)

Ores? No

Steel? No.

Wood (both as building material and anything else)? No

Parts? No

Arrogance? Yes

Pomp? Yes

Pretense? Yes

I think it is never a good idea to mess with one’s neighbours.

I’m not Clive, but I might be able to shed some light on the issue with the personal data transfers.

The EU has pretty strict guidelines regarding the storage and processing of PII, namely that the data can only be stored and processed legally in EU countries or countries that have been certified to offer an equivalent level of data protection. Stating that the local laws are equivalent isn’t sufficient, it actually has to be certified by the EU as being equivalent.

IIRC the US, for example, isn’t on that list right now due to the lack of privacy protections over here and the recent land grabs along the lines of “if the data is stored on a US company’s servers abroad, it’s under US jurisdiction anyway no matter what the pesky local laws say” laws. That’s why a lot of the large US internet monopolies have subsidiaries incorporated in EU countries and data centers in EU countries, mostly in Ireland and also some in the UK.

As soon as the UK leaves the EU or crashes out, they’d have to prove that their data protection laws are the equivalent of the EU laws. I’m sure they’ve already prepared for all of that (yeah, right, there’s a nice bridge I’d like to sell you) and the recent events around the Schengen Information System data are obviously also going to work in their favour. Not.

Given the very high likelihood of this data ending up in places it shouldn’t legally end up in (like the US – the UK is after all, a member of the five eyes) it’s pretty much a given that one won’t legally be able to transfer PII data from the EU to the UK after Brexit, until they’ve been certified to offer at least the same level of data protection as the rest of the EU. That’s going to be a tall order given how fast and loose the UK has been playing with EU data protection rules over the last few decades, especially compared to the EU countries that are more sensitive to privacy issues like Germany.

The issue with data flows is related to the recent GDPR. It makes any transfer of personal data to a third country illegal unless the customer gives their express permission or certain other legal actions are taken. This means any company working with EU27 data in the UK has to either revamp their business processes or jump through a lot of legal loops to be ready for a crash out. The potential fines with a maximum of 4% of yearly turn-over should be high enough to at least inconvenience most companies.

More info (German): https://www.computerwoche.de/a/nach-hartem-brexit-droht-das-datenchaos,3335085

You know what, the interesting bit on this is that Johnson’s campaign certainly broke GDPR. When I was younger and more naive (as far as the UK politics goes), and Johnson run for London Mayor in 2007, I think I subscribed to his newsletter.

In June, I got this email from him saying “Dear XYZ, are you with us for Boris as PM” (give or take).

This is a flagrant GDPR breach, as when GDPR came into effect, any and all that had your personal information had to (IIRC) either delete it, or as you for your explicit assent to continue using it for any marketing purposes. I’m pretty damn sure I never granted it to Johnson, because they never asked in the first place (and I would not do it anyways, I ignored all the requests to do so from all comers).

So, should I sue the PM’s campaign or not?

Good Friday Agreement pops up on The Guardian

Johnson’s rise to power, and his demand for the EU to drop the backstop, which is intended to safeguard the open border after Brexit, has galvanised determination in Congress to make a stand in defence of the landmark accord, to which the US is guarantor.

On the other hand Ukraine has found guarantors unwilling in the end. But then all affirmations aren’t created equal.

Post Brexit impacts: a recent OBR study determined the 1st year GDP loss would be 1.5% which is roughly half of the impact of the GFC – and that is if the Government makes no fiscal intervention. They will of course, as currently 22% of British are living in poverty so the social pressure will be too great for the Johnson Government to risk due to upcoming elections. The second year worse case scenario was 2% reduction under the same criteria and from year three that shortfall would be erased.

Given the gloomy predictions of the OBR in recent times, none of which have come to pass, this hardly counts as a catastrophe. Brexit will be messy and inconvenient, and the pound will cop a hit (who cares) but at least the UK will be out of that corporatized neoliberal beast called the EU. Time to stop hand wringing and just get on with it methinks. All the pontificating is just noise.

Where do I start? Well, I won’t.

Because when someone says “who cares” on “pound takes a hit”, they clearly have no idea that say oil is priced in USD so “pound takes a hit” means “everyone who drives or uses or provides most means of transportation directly or indirectly” cares.

Or when someone believes that a Tory government would make a fiscal intervention just because quarter of Brits live in poverty (or did they magically slide into poverty between May’s resignation and Johnson’s being appointed?).

So there’s no point in even starting.

I made the assertion a few week ago that MMT is not applicable to countries with significant trade deficits, because of the inflationary effect of falling currency values, because of increasing the balance of payment deficits.

With the exception of the US, as monetary hegemony.

That is countries with deficits are not sovereign in their own currencies.

Yves strongly disagreed, and stated that the UK pound was freely trade-able, and could settle its trade deficits in UK pounds.

But, my view was probably not well argued and unclear. For that I apologize.

I agree with Valde. We’ve been here before, under Harold Wilson, in Autumn 1968.

Apart from what any stupid economic model with faith in forever growth says, which is meaningless I think that in this case long term effects are much more important that short term effects. This is particularly true as if in this case one cannot foresee a commercial agreement signed in less than 5 years.

The best predictor for future performance is past performance.

Following that model, I predict that Brexit will be a resounding display of gross incompetence and crass stupidity. The Jackpot comes early to the UK and people will die because of it. Sadly, the instigators will probably make it.

Anyway, I have heard so much bullshit from the Brexiteers that I don’t care anymore and I would be very annoyed if the EU once again makes an opening for them to ooze out from under the hammer.

Come on buddy, those numbers don’t even think about credit contractions which means 20% GDP collapse. US will be in recession asap. I am amazed people still don’t get it

I’m constantly startled by the number highly educated people in the US press and govt – who have probably never had a manual labor job even in college – who don’t know how things like the ships-and sea lanes-in-shipping or truck routes-in-trucking for example actually work. And will not ask for explanations from people who do know before making pronouncements. Why, for example some city roads are designated ‘truck routes’, how and why those differ from regular roads; that you can’t just wave your hand and say, for example, lets move the truck route to a different street to make way for ‘x’. It’s maddening, this level of disconnect from the real world in politicians and the msm at all levels.

I’m beginning to thing the UK isn’t immune to the highly-educated-idiots (for lack of a better term) malady – idiots in govt, the press, the hand-waving crowd who assume they know everything important because they’re highly educated. So, there’s no reason for them to ask questions – the answers to which they probably wouldn’t understand or like. Brexit could work, imo, if the people in charge… but that horse left the stable some time ago…

My 2 cents from the US, where we have more than our share of highly educated idiot, imo.

They are ignorant, coupled with no interest in Engineering or “how things work,” because they believe it beneath them.

An example, because I grew up in that group:

In 1964 we had a workshop as part of the School Curriculum, and my prior year built some stage lighting. I attended a 50 year reunion in 2014, and there were the stage lights, still attached, and not working!

I was told that no one knew how to repair (or rewire) a string of lights in bulb holders, and when I asked about the workshop, was told it was discontinued years before the anniversary.

It’s the similar to the US. “Shop” in high schools was discontinued due to budget cuts.

The “highly-educated-idiots,” are upper class or aspiring upper class. Engineers are middle class, and not a part of the upper class dialog.

I agree and find this attitude both maddening and dangerous. The United States is about to find out how important STEM knowledge is as it tries to rebuild a manufacturing base after spending the last several years wrecking its foreign trade connections. Britain will have an even tougher go of it due to smaller size and fewer resources, both natural and labor. The patrician attitude towards work that’s ‘beneath them’ will rapidly put those patricians in a situation of being irrelevant if it weren’t for their financial control over family businesses and fortunes. They know it- and their fears of losing control and relevance will echo through the class struggles to come as the West comes to terms with the fallout of decades of neoliberalism. I see a lot of unnecessary suffering visited on those with little culpability but lots of vulnerability, namely that uncomfortably large and growing percentage of poor in the population.

The US can’t rebuild a manufacturing base without a large contraction in GDP first. You still don’t get it.

Thanks. It’s not the ignorance I mind so much; we’re all ignorant about the actual workings of most things, I think. It’s the hubris I mind. Ignorance + hubris : a Dilbert cartoon motif.

Your first post is a great, explanation of why it’s a mistake to take ‘smart’ as a proxy for ‘will not believe or do stupid things.’

I find it entirely credible that Boris, for example, might believe that No Deal Brexit will involve a small amount of localized pain and disruption followed by the UK taking her rightful place as a titan of global commerce. All the people that he listens to are telling him so, and I doubt that he has either the inclination and discipline to delve into the details and check for himself or the humility to realize that perhaps he isn’t in possession of all the relevant facts.

Maybe this is obvious, but why is this likely to be true?

Because the imports will be cheaper (since they will be mass produced cafo crap) than the cost of production for these farmers.

Or because they’re from commonwealth countries like Canada and New Zealand that have the climate and industry to make better meat, more cheaply.

Both those countries are quite keen to see the removal of current tariffs on meat and dairy as part of their new improved uk specific trade agreements.

No doubt that pressure will exist, but there will also be pressure to protect their own farmers/producers. Some countries maintain substantial tariffs on food sectors that they deem too politically important to sacrifice to free trade.

“Thanks. It’s not the ignorance I mind so much; we’re all ignorant about the actual workings of most things, I think.”

Ummm… no, not really.

Most of the people running countries seem to be, but lots of them tend to be business people and lawyers… two groups that scored at the bottom when someone tested ‘ability to understand a technologically advanced society’… twenty years ago.

No one can know everything, of course. My knowledge of biology at the organism level is not great, and except for specific areas, even weaker on cellular mechanisms. On the other hand, physics, chemistry, engineering are all pretty accessible if you have the right background. So are pragmatic systems, such as transportation and communications.

If you are not going to drill down to the gate-and-voltage level, much of electronics is reasonably understandable.

Most of my friends can say the same. Of course, most of us have degrees in science or engineering, though we have a couple of artists, and a librarian or two in the mix. One lawyer, but her undergrad degree was in science, and she has a pretty good handle on how much of the universe works.

Yes, the level of detail to actually build many things is rare, but understanding how and why they work shouldn’t be.

Then again, I don’t think anyone should get out of high school without significant amounts of science and math education, nor out of university without a significant additional amount of the same, including a course in understanding the meaning and limitations of statistics.

On the other hand, I would support a ‘no computers until 14’ policy, and teaching cursive writing for the positive effects it has on logical thinking and expression. Technology has its place, and it is not everywhere, all the time.

You are the club bore, and I claim my ten pounds. By the way, you forgot to mention your huge bank balance, big house, hot wife, and 10-inch whang.

When Britain has been stuck before with a loss of carrying biz to or from a market, we have transferred ownership of our ships/lorries/whatever to abc country to bypass the restrictions. UK factories can package goods in an acceptable way to pass Customs muster. Fixed