Lambert here: “… which, taken at the flood, leads on to fortune.”

By Maurizio Michael Habib, Senior Economist, European Central Bank, and Fabrizio Venditti Principal Economist, ECB. Originally published at VoxEU.

There is global cycle in capital flows that is intimately connected to global risk. This column argues that, contrary to common wisdom, US monetary policy is not the only factor, or even the main factor, behind global risk and this global cycle. Financial shocks matter more than US monetary policy. Domestic policies may still mitigate the cycle of global capital flows at the country level.

Apparently, international financial integration has generated a global financial cycle, leading to increasing cross-country co-movement of financial variables – either flows or prices (Rey 2015). But a global financial cycle strongly challenges one of the cornerstones of international macroeconomics, namely, the policy trilemma which suggests a trade-off between an independent monetary policy and an exchange rate target under full capital account liberalisation.

A global financial cycle would significantly reduce the ability of policymakers to steer domestic financial conditions away from global trends, for instance by adopting flexible exchange rate regimes and running a monetary policy independent from that of the US, which sets global monetary conditions. The global financial cycle would reduce the trilemma to a dilemma – policy choice would be solely between an independent monetary policy and capital account openness. The exchange rate regime would become irrelevant (Rey 2015, 2016).

Others maintain that a flexible exchange rate regime still allows for a higher degree of monetary autonomy (Klein and Shambaugh 2015), and so they challenge the concept of a dilemma. Our recent research (Habib and Vendetti 2019) offers three important insights:

- We confirm that for capital flows a global cycle is intimately connected to global risk.

- We investigate the drivers of global risk.

- We show the extent to which domestic policies may partly stem the tide of capital flows at the country level.

The Global Capital Flows Cycle and Global Risk

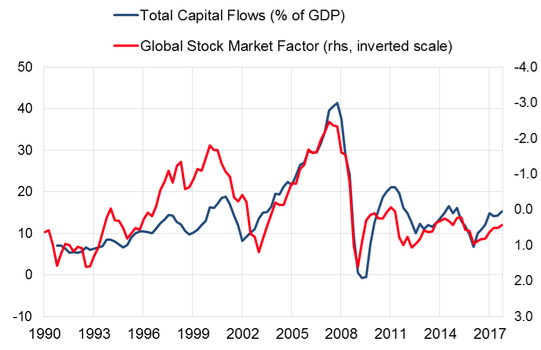

The global financial cycle is strongly influenced by US monetary policy and related to both financial market volatility and to the degree of risk aversion of global investors (Miranda-Agrippino and Rey 2015). Our Global Stock Market Factor – a data-parsimonious version of the global factor of Miranda-Agrippino and Rey (2015) that summarises the co-movement of stock market returns in 63 economies – is tightly connected to a cycle in global capital flows, as measured by the sum of gross capital inflows across 50 advanced and emerging economies (Figure 1). The correlation between the two series is remarkably tight (75%). To our knowledge, it is extremely difficult to find empirical studies that find such a close link between measures derived from prices (as our Global Stock Market Factor) and those derived from cross-border capital flows.

Figure 1 Global capital flows are tightly connected to global risk

Notes: Total capital gross inflows aggregated across 50 economies as share of total GDP. The Global Stock Market Factor is constructed from stock returns for 63 countries.

Sources: IMF Balance of Payments Statistics, Global Financial Data and authors’ calculations.

The Drivers of Global Risk: Not Only US Monetary Policy

The second important pillar of the theory of the global financial cycle is the role of the US, the centre country in the international monetary system, in influencing global risk and shaping financial conditions globally (Bruno and Shin 2015). In our analysis, we did not find that the US monetary policy has a robust and significant direct impact on capital flows. We did find that that US monetary policy may have an effect on capital flows indirectly, influencing global risk.

In particular, we investigated the structural drivers of our Global Stock Market Factor and identified four shocks that should be expected to impact global risk:

- a US monetary policy shock,

- a US aggregate demand shock,

- a global financial shock, and

- a geopolitical risk shock.

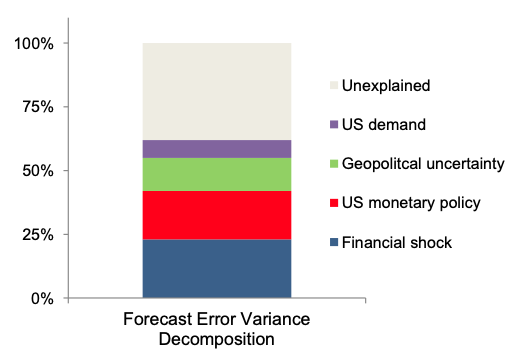

As shown in Figure 2, financial shocks, which can be interpreted as exogenous changes in the risk-bearing capacity of the financial sector, matter slightly more than US monetary policy shocks in driving global risk. Other shocks, such as those driven by geopolitical or economic policy uncertainty or by the US demand are not particularly relevant. Notably, global risk still includes a significant idiosyncratic component that is not explained by our shocks.

Figure 2 Financial shocks and US monetary policy drive global risk

Notes: forecast error variance decomposition (12 steps ahead) of the Global Stock Market Factor: average across posterior draws of the model.

Source: authors’ calculations

The Transmission of Global Risk to Capital Flows

Finally, we studied how capital account openness and the exchange rate regime influence the transmission of global risk to different types of capital flows. Remarkably, we found confirmation of a trilemma in the transmission to capital flows, as countries that are more financially open, and that adopt a strict peg, are more sensitive to global risk. This trilemma is largely driven by one category of cross-border flows – ‘other investment’. This is largely made up of bank loans, confirming the importance of global banks in the narrative of the global financial cycle. In particular, for emerging markets with open capital accounts and an exchange rate target, global risk shocks may impart a significant shift in capital flows compared to normal times. To get a glimpse of the economic impact, a sharp rise in global risk – for example, a two standard deviation shock to our risk measure – would translate into a decline in gross capital inflows of 1% of GDP in a quarter for emerging markets, but a decline of more than 4% of GDP for those emerging economies without capital controls that adopt a fixed exchange rate regime.

Reconciling the Global Capital Flows Cycle with the Trilemma

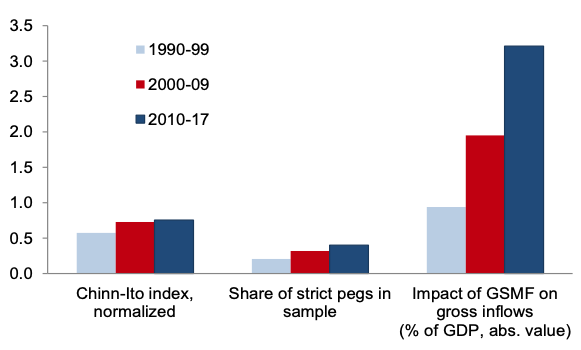

Is there a contradiction between the tight link between our Global Stock Market Factor and global capital inflows, lending support to the presence of a policy dilemma (Rey 2015), and the evidence of a classical trilemma? Not necessarily, as the policy regimes may change through time, reinforcing or weakening the link between global risk and capital flows. Figure 3 shows the average level of de jure capital account liberalisation and the share of countries adopting a strict peg in our sample in the 1990s, the 2000s, and since 2010.

Figure 3 Policy regimes and sensitivity of total gross capital inflows to the global stock market factor (GSMF) since the 1990s

Notes: the normalised Chinn-Ito (2006) index is a measure of de jure capital account openness ranging between 0 (completely closed) and 1 (fully open). Strict pegs are defined according to the de facto exchange rate arrangement classification by Obstfeld et al. (2010). The last three columns report the absolute value of the coefficient associated with the Global Stock Market Factor (GSMF) in the benchmark panel fixed-effects model for total capital inflows, estimated across the three sub-samples.

Both measures tend to increase over time. The higher these two measures, the stronger the expected sensitivity of capital flows to global risk according to the trilemma. Indeed, this is exactly what we find once we re-estimate the impact of global risk on capital flows in our empirical model across these three decades.

Concluding Remarks

There are interesting implications for the future analysis of international macroeconomic models and the international transmission of monetary and financial shocks.

First, it is important to isolate the contribution of US monetary policy shocks to global risk to understand its international transmission. It may be difficult to establish a direct link between US monetary policy and capital flows, without ‘passing through’ global risk. Nevertheless, global risk is also driven by other shocks, in particular financial shocks, and has a large idiosyncratic component, so that US monetary policy may be considered neither as the unique nor as the main factor behind the influence of the global financial cycle on capital flows.

Second, domestic monetary and exchange rate policies may still influence the transmission of global risk to capital flows, especially cross-border bank loans. On the contrary, portfolio flows appear to be less sensitive to global risk and completely insensitive to the prevailing exchange rate regime, because the adjustment to risk shocks, most likely, takes places through prices and not quantities.

Our results call for a careful assessment of the financial stability implications of global risk shocks. As the composition of global liquidity shifts away from bank loans to other sources of financing, such as equity and bonds, sudden shifts in investors’ risk attitude could propagate faster than in the past, through sharp fluctuations in market prices rather than capital flows.

Authors’ note: The views expressed in this column belong to the authors and do not necessarily represent the views of the ECB.

Would an analysis like this ever get written unless there was a hefty fee or profit for it? A truly global financial cycle by definition has no firewalls under full capital liberalization. But “domestic policy can mitigate the cycle of capital flows.” But god forbid we should come right out and say that there should be sovereign domestic capital controls. No no no. And what’s more an independent exchange rate has nothing to do with an independent monetary policy. All that nonsense about the interest rate (ultimately connected to the thigh bone) has nothing to do with inflation. But disruptions can happen by monetary policy shock; demand shock; financial shock (liquidity drought); geopolitical risk shock. Gee, really? And when enough of those shocks happen in relentless succession does a national currency fall to clearance sale prices and can fat cats make a killing? Just wondering. So please explain how the category “unexplained risk” is analyzed. What is unexplained risk? Does it have to do with the seat-of-the-pants survival of unbanked cooperation. All that untapped small change that Facebook wants to appropriate so that the world can completely collapse? Back to the stone age.

I mean what’s money for, to coordinate demand and production for scaling societies, or to make sociopaths rich?

This post was baffling to me. “Global Capital Flows Cycle” implies a periodic recurring cyclical phenomena. Is this really so?…

Re: “Financial shocks matter more than US monetary policy.”

The monetary policy of large central banks; i.e., the Fed, ECB and the BOJ itself leads to financial shocks, as do the money-creation and interconnected structure of the global financial system and massive speculations by large financial institutions in financial derivatives, markets and debt; as well as fiscal austerity policies, geopolitical events like war by sovereign governments, and other factors. Are any of these cyclical in nature?… I think not.

This is wrong. All capitalism leads toward financial shocks ala since the beginning of capital. My advice is don’t post lazy. This post was lazy.

You are not a moderator and assigning yourself that role earns you troll points.

Plus this is projection. Your comment was lazy.

Carmen Reinhart and Kenneth Rogoff’s study of 800 years of financial crises disproves your contention. The frequency and severity of financial crises is strongly correlated with the level of international capital flows, and there have been protracted period in the history of capitalism where international capital flows were muted.

Frankly, when and where??? Capital flows being muted is impossible. It’s always flowing. How it flows changes depends on circumstances when debt doesn’t rise as fast.

How to get a understanding of international capital flows? Forget the graphs and charts, study war. Study the history and reasons why peoples across the globe are killed.

When considering the capitalist system, the question of international capital flows seems to be the elephant in the room. Every country cannot base its economy on exports, and a level of trust must be established if the exchanges between separate societies will be beneficial in the long term. If not, over time those societies will destroy one another. Is this not what we are seeing in todays world- the playing out of this broken trust? The desire of peoples across the globe seeking release from the bonds of exploitation.

Papers like this one seem to be taking a simple fact of life and making it unnecessarily complicated. For what true purpose, who knows.

One must be a true partner and ally to have capital flows that don’t destroy separate societies. Societies can co-exist separately on respect, they can intermarry thus forming a hybrid society and culture, they can wall themselves off, or they can be destroyed by conquest. All cases are happening to some degree simultaneously.

In the end, capital flows can only be understood thru the political dimension. These are political choices on how to build your society and who gets to participate in the decisions. What doesn’t work is having a political elite rising to the top of the social turmoil and somehow believing that the consequences of these social arrangements don’t effect them. This is our world today and it isn’t working.

This seems to be a choice between living in a rational world where peaceful co-existance is the goal, or a world of conflict.

“As the composition of global liquidity shifts away from bank loans to other sources of financing, such as equity and bonds, sudden shifts in investors’ risk attitude could propagate faster than in the past, through sharp fluctuations in market prices rather than capital flows.”

?…..In other words, active investors/finance professionals are a collection of people & software where everyone is looking at the same thing at the same time, all the time…?

That first graph certainly shows it. Ok.

What might be of interest now would be analyses of how state-run (China ) or state-influenced (Russia ) capitalism is influencing capital flows.

On a completely different topic, but since the moderator (Ms. Smith ) is observing:

From prior posts you’ve indicated you have moved from Manhattan to a much smaller city (though still a large one) in the Southeast US. I’d be interested over time on your observations of the economic issues, both good & bad, that your new neighbors have (ie, beyond the bubble ). Thanks.