Yves here. Wowsers. Recall that when a California bill to bar so-called surprise billing, which ought to be regarded as a consumer fraud, was suddenly withdrawn due to some sort of dark force at work, the opponents didn’t even stoop to trying to offer a reason.

Now we discover the reason why. They can’t come up with a coherent story.

By Rachel Bluth, Kaiser Health News reporter, who previously was the lead political correspondent for the Annapolis Bureau of Capital News Service. She has also written for the Maryland Reporter and the Prince George’s Sentinel. Produced by Kaiser Health News in partnership with PolitiFact.

What Congress is considering would cut money that vulnerable patients rely on the most. That means seniors, children and Americans who rely on Medicaid would be hurt. … Tell Congress we can end surprise billing without shredding the safety net.

Physicians for Fair Coverage, in a national commercial which began airing in mid-July.

Chances are, you or someone you know has gotten a surprise medical bill. One in six Americans have received these unexpected and often high charges after getting medical care from a doctor or hospital that isn’t in their insurance network.

It’s become a hot-button issue in Congress, and high-profile legislation has been introduced in both the House and Senate to make the medical providers and insurers address the billing question and take the consumers out of the dispute. That means doctor specialty groups, hospitals and insurers are among the stakeholders that could be financially affected by the outcome.

The effort has caught the attention of Physicians for Fair Coverage, a coalition formed by large companies — firms such as US Acute Care Solutions, U.S. Anesthesia Partners and US Radiology Specialists — that serve as corporate umbrellas for medical practices. The group is running a $1.2 million national commercial about these congressional efforts. The ad began airing in mid-July.

The ad issued a warning: “What Congress is considering would cut money that vulnerable patients rely on the most. That means seniors, children and Americans who rely on Medicaid would be hurt.”

We wondered: Will any of the surprise billing proposals being debated in Congress really affect Medicaid and these patients — “shredding the safety net,” as the ad claims? So we dug in.

We reached out to Physicians for Fair Coverage (PFC) to find out the basis for this claim, but the phone number listed on their website no longer worked. Several emails and a direct message on Twitter later, we connected with Forbes Tate Partners, the public relations firm that produced the ad. We were then referred to Megan Taylor, a spokeswoman for PFC.

“When we talk about the safety-net, we’re talking about the health care system that the uninsured and underinsured rely on — like emergency departments, where two-thirds of the acute care is provided to uninsured Americans and where half of the acute care provided to Medicaid and Children’s Health Insurance Program patients is delivered,” Taylor wrote in an email.

To be sure, studies have shown that ERs see a large share of vulnerable patients. But independent experts we spoke with still didn’t follow the ad’s logic.

“I’d like to think that I’m fairly well-informed about surprise billing legislation, but I’m struggling to understand what argument they are even trying to make here,” Benedic Ippolito, a research fellow at the American Enterprise Institute who has testified before a Senate committee on this issue, wrote in an email.

Focusing On The Real Trouble Spot

The surprise medical bill legislation is an effort to help consumers who generally mistakenly thought they were getting health services covered by their insurers but instead find themselves dealing with an out-of-network provider.

The insurance often covers a small portion of services, and the patient is on the hook for the rest. It’s called a “balance bill.” That happens, for example, when people seek care at an in-network hospital but the doctor treating them doesn’t accept their insurance. The consumer can be responsible for paying the entire bill.

Most surprise bills come from specialty physicians — such as anesthesiologists, radiologists and emergency room doctors — like those in the practices represented by Physicians for Fair Coverage.

There are two major solutions on the table in the congressional legislation: arbitration, which would send the insurers and health care providers through an independent review to determine a fair price, and benchmarking. The ad doesn’t explicitly say so, but it’s referring to benchmarking.

Under this approach, when a doctor sees an out-of-network patient, the patient’s health plan pays the doctor the median of what other doctors in the area are paid for the procedure.

The ad paints a grim picture — complete with photos of children, families and even older patients in wheelchairs — of what will happen if Congress adopts benchmarking. It suggests insurance companies will offer doctors artificially low in-network rates, which, in turn, will bring down out-of-network rates. Those low rates will make it hard for doctors and hospitals to make up for uncompensated care or low payment rates from Medicaid and Medicare patients. The concern is that this will make it difficult for emergency rooms and rural hospitals to operate and force them to close.

Taylor pointed to California’s 2017 law that set up a statewide benchmarking system as Exhibit A.

“By setting a guaranteed benchmark rate at the median in-network rate, it means that insurers can push doctors out of their network, by cancelling contracts or demanding artificially low rates, in order to make the benchmark rate the default. In California, where a benchmark rate has been implemented, doctors report that insurance companies are already doing this and that Californians’ premiums are rising,” she wrote in an email.

She also cited a letter from the California Medical Association about this state law that reiterated how it is affecting patients’ access to care.

So we turned to Anthony York, the director of communications for the California Medical Association, to ask about how the law was affecting the supply of doctors. He said at least nine medical facilities in the state have no anesthesiologists that are in network for some local health plans.

For instance, he added, a search on Anthem Blue Cross, Blue Shield of California, United Healthcare and Health Net shows no contracted anesthesiologists within 30 miles of Children’s Hospital of Orange County.

But Loren Adler, associate director of the USC-Brookings Schaeffer Initiative for Health Policy, wrote in an email that there is not enough data yet from California to say whether insurance companies are kicking doctors out of networks. He said networks are often in flux as insurers and providers wrestle about payment rates or other contract issues.

“Despite what the medical association is saying, we don’t have any evidence on this question one way or the other,” Adler said. “Of course there are anecdotes of contract cancellations, but contracts change over frequently.”

How Does Medicaid Fit Into This?

One thing needs to be clear: No piece of surprise bill legislation is cutting the federal funding for Medicaid or Medicare. The text of the House bill doesn’t even mention either program; the Senate bill mentions them only in the course of data collection or cost studies.

“No one on Medicaid would be affected one way or the other by any of the surprise billing proposals on the table,” noted Adler.

So how can the commercial claim that either one is “shredding” the safety net? It goes back to Taylor’s view that the safety net includes having access to an emergency room. This point brings up a broader issue raised by the ad: that ERs would close if physicians were paid the median in-network rate for out-of-network services.

And that drew skepticism from Adler, who pointed out that many factors are responsible for emergency physician shortages or rural hospital closures. Letting doctors send large bills to patients, he said, won’t keep ailing hospitals open.

“That’s a completely illogical and contradictory set of claims they’re making,” he wrote.

Both he and Ippolito think the link to ER closures is overblown.

Ippolito called the commercial a “vague scare tactic.” He acknowledged that problems do exist with rural hospital closures and emergency room staffing, but he said solving those problems should be separate from dealing with surprise bills.

“Policymakers should solve surprise billing in the best way they can,” he wrote, adding that concerns about access to care should be “dealt with directly.”

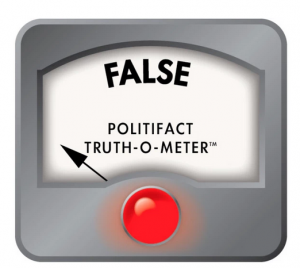

Our Ruling

Physicians for Fair Coverage claims in this commercial that Congress is considering a surprise billing solution that would “cut money that vulnerable patients rely on.”

This, in itself, is inaccurate. Neither of the proposed pieces of legislation would cut money to any programs, specifically Medicaid, CHIP or Medicare.

There is also scant evidence that these proposals would trigger emergency room closures. The group claims the consequences of this proposal would ultimately lead to ER closures. But experts say their evidence is anecdotal at best.

This claim raises serious health system alarms — reduced access to care, higher premium costs and even shuttered emergency rooms — without logically supporting these concerns.

We rate it as False.

Always blaming the physicians. Corporate Umbrellas represent the corporations employing physicians. They love to sell out the people they allegedly represent. Sort of the way Purdue says they take care of their chickens then kill them.

I dislike reporters who get sucked in on this dodge. Physicians are generally paid a salary in these systems, ER physicians especially traditionally are paid that way. There are fee for service doctors as well in that setting obviously.

Why don’t they talk directly to doctors to get their opinions instead of what amounts to a corporate entity that is solely profit driven? I for one am up front about my rates and charge fair rates and get tarnished with this kind of BS. I am all for open disclosure of fees. Just for the record. Now I have to go to a 12 hour day to take care of people who need me. And who know exactly what they owe before they see me.

I have never known “exactly” what I would be owing any physician before seeing them so good on ya. What’s your secret? Are you a GP or a specialist?

You are exceptional, Juneau. Since I was thrown out of emergency rooms twice in the1980s for trying to pay for care with a credit card, I’ve made a point of asking my physicians how much their care will cost. Only one has ever known. She’s been my doctor ever since.

my doctor(20 years, now…so he’s a friend, too) does the same…does his best to stick at least a ballpark pricetag on things beforehand….and roots around for cheaper prices on mri’s, generics, etc

he’s also the only doctor we’ve seen in the ER(rural hospital hub, most of the docs do a rotation) who will even attempt to ballpark it. the caveats and contingencies are given, and forgiven…because we trust him.

at the hospital? not so much,lol.

opacity is the name of the game…which is not an accident, nor an artifact, but instead an essential part of the fog that obscures the hand in your pocket.

the oncology clinic, on the other hand, is kind of in between the two…i must take the extra step to talk to one of the financial people(same one, every time) to get the pricetag. I’m ok with this because there’s no hassle, and the reason given—that it relieves the doctors and nurses and aides and phlebotomists and lab people of worrying about the grubby money—is a good one: again, because we trust them(and not out of some savior complex, but because they have earned that trust.

note the recurring word in examples 1 and 3: “Trust”.

Good on you, Juneau if you’re that kind of Doctor.

I salute your doctor for the effort, but this is a huge waste of his/her time. He should have someone else shopping around for the best generics, when he/she should be seeing patients. This system is so inefficient.

i get the feeling its just his style. he’s very personable(and loud. you can gear him through walls with other patients, yukking and all).

all that stuff is in his ever present laptop, and doesn’t seem to take too long…and it’s rare that we’ve had to wait around a long time.

i also think its that he’s got a settled practice…people like us, and their kids, and their kids. small town. real “family practice”.

he stopped taking new patients that weren’t related to old patients some time ago.(and we recognize most of the other patients when we go,lol–again, “family practice”…mostly same staff for all that time, as well)

says he made his book delivering all those babies for all those years(stopped that, too)

and it’s him and 3 other doctors in the practice, which they own.

300 or so families is what i think he said he sees

we were lucky to have found him when we did.

if we could replicate what he does, things would be better.

ie: supply and demand…make more of him and his personable way of getting things done….because i don’t believe there are near enough like him to go around.

healthcare is better when the docs and their staff are essentially part of your extended family, rather than strangers.

the question is , how do you replicate that by a factor of a million or so?

That kind of practice is becoming all too rare.

Juneau has an important point, mentioned in the article but not emphasized: a big part of the problem is the “medical” corporations. OTOH, to some extent the doctors are hiding behind those corporations, which in my experience (again, small city) belong to the doctors in them. And also in my experience, are less and less acceptable.

Granted, one of my beefs with the clinic (pushing hard on the “portal” for my health records – aka the internet) was actually foisted on them by Obamacare.

At this point, I actually plan to switch to a rural doctor who actually works for Public Health, partly because I’m told he has a better medical philosophy, as well as because I don’t like dealing with the Clinic. But that won’t happen until I get sick.

This is the common playbook –

Introduce an element of fear – i.e. they will take your (add noun here) away

Claim that it (whatever it is) will cost too much without any comparison of actual costs. We see this in the discussion of healthcare issues, light rail, long distance rail, Social Security, Medicare, toll roads, clean water, herbicide free food stuffs, and on and on.

Claim that it (whatever it is) will destroy the present system.

In short the flacks use fear as a motivating factor. And if there is no real basis for fear the flacks will try to introduce or gin up an element of fear.

I recall seeing something about this and immediately thinking bull! nice to see someone went to the effort to confirm my initial impression. Well done.

Short version: “We have to steal from you because others are stealing from us”.

Still waiting to hear back from Northwell Health on setting up a system to remind patients to follow up 1 year after incidental lung spots etc. are noted during ER visits. I asked them to explore if their EMR/computer systems could be upgraded to match that of my local Jiffy-Lube, who somehow are capable of sending out timely oil change reminders. Since that incident (luckily the lung was removed in time, tumor only spotted because of SECOND incidental discovery of it), a suspicious colonoscopy finding that required 3 year instead of 5 year follow up was also missed by their “system”. Luckily, again, the 5 year result was clean.

I acknowledged that one can hold the patient legally responsible (assuming they were ever told about need to follow up 1-3 years later, but that some patients are forgetful, some are mentally ill etc.), but why not be like Jiffy-Lube and maybe save some lives?

Historically, Medicare created the flaw in the system when it determined its rate to be a percentage of customary usual rate. Private insurers then followed suit, occasionally paying a percentage that was pegged to medicare. The end result was that no coverage had to be your highest rate, as covered individuals paid a discount.

If you charged the uninsured less, Medicare would call it fraud and come back for any money it paid over the percentage of the new discounted rate, and private insurance may sue or penalize to stay in network. In fact, Medicare would do the same thing if you routinely waived patient copays.

Excuse me we aren’t talking about charging the uninsured less than the Medicare rate. Uninsured are routinely charged much higher rates than that paid by either the insurance companies or the government. But worse in balanced billing with few exceptions the INSURED person is charged much higher than insurance company rates for the services provided by an out of network in an in network hospital.

For emergency care that is beyond egregious. Really think about it. During an emergency you are supposed to be checking on the network status of everyone who looks at you AND wait if your insurance company has not bothered to include everyone in the “group” who are the ER team in their network or be liable for thousands of dollars.

Your explanation doesn’t begin to hold water and the greed from all the rentiers is grotesque and appalling.

Remember the admonition regarding shooting messengers, I definitely am not defending the dysfunction, but…

insured and out-of-network is ‘uninsured.’

Uninsured means having no insurance.

While I am.not sure you meant it to indicate this, but apparently you are equating having paid thousands of dollars to an insurance company who begins the rip off by not providing adequate network coverage to that.

If you did mean to point out that insurance companies who do not cover all care in an emergency room for their clients is part of a giant fraud and theft and that hospitals allowing or encouraging out of network providers while contracting to be an in network hospital is also a giant fraud and theft that allows them to charge huge fees to insured patients caught in the loophole well good on you. But somehow I think you really meant to blame the victims.

I should add that even a minimal attempt to demand adequate healthcare and insurance coverage would have all emergency room services covered in an in network facility. Thus letting the big players fight out the rip off.

But then if you really wanted to do anything but provide a lifeline to a dying insurance industry, the government would have included a very central rule of the Swiss system, you sell any insurance in an area you have to sell insurance on the market place. Since something so simple and easy to bs about was too much trouble for the industry and was dropped, obviously something that really protects the public aka customer would be beyond reason.

Out -of-network means not covered to both parties to the contract (hospital and insurer), hence the term ‘third party payment.’ So you paid for insurance but it isn’t any good at that hospital, hence you get billed as-if you had no insurance.

Is that a rip off? of course!

My point was that the system is rigged to screw any patient that doesn’t have accepted coverage, as much as the person who has no coverage.

I’m for Bernie’s plan, not here to defend the capitalization of our healthcare system. Be warned, our current system is turning toward private equity buying up failing non-profit hospital chains so the disagreements with the big insurers is liable to worsen. As is the shuttering of valuable facilities -Hahnemann being the tip of what may be an iceberg.

Late to reply, but apparently we are on the same page if not about the huge gap between going to an ‘in network’ hospital and being hit with out of network physicians charges not really being uninsured than at least about they why and wherefore this has been allowed to occur.

Not that it is, but when we get single payer (and it will happen because eventually too many people are going to find themselves in the position of having useless expensive insurance and little or no health care) one of the provisions will need to be the requirement to take and treat single payer covered even if it is only 40% or you don’t have the necessary licensing necessary to work as a hospital, physician, etc. Yes it is draconian, but without it we will find those private equity vultures doing their best to starve the system of providers.

Can someone explain this ‘network’ thing in moderate detail? And how it works? And how one deals with it or its failures?

I am unfamiliar with the concept, though I have a vague impression of the general meaning from the comments here.

What I think I’ve learned by reading here seems more than a little dysfunctional.

Math is Your friend, I will take a shot at answering your 5:05 PM question, since no one else seems to have done so . Be warned, my answer may not be right, but this is how I understand it.

Begin with the understanding private practice physicians offer services to patients on a fee-for-service basis. A medical insurance company wants to compete for more subscribers by lowering its premiums below what its competitors charge. To achieve this, it has to lower its costs, which equate to the lowering the fees it pays to doctors for the services they render to its subscribers. Therefore, the insurance company pursues a strategy of approaching doctors with an offer to direct patients their way, in exchange for the doctors’ agreements to accept lower fee for services they render to patients covered by that insurance company. Some doctors will accept this offer, some won’t, The doctors who accept this offer are hoping the volume of patients coming from that insurance company will be big enough to compensate for the reduction in fees charged to members of that group of patients, leaving the doctors with more revenue than they would otherwise receive.

In other words, the doctors end up offering a volume to discount to a group of patients covered by that insurance company. They accept an obligation to do so by entering into a contractual agreement with the insurance company in question.

In this discussion, the word “network” refers to to the total group of doctors who accept that offer from that insurance company.

Likewise, an “out of network” doctor is a doctor who has no contract with that insurance company, and therefore no obligation to accept the discounted fees that the insurance company pays to those doctors with whom it does have such a contract.

The terms “network” and “out of network” are therefore always defined by reference to to a particular insurance company.

Pat deals with the confusion, but more generally:

This issue, including perverse effects of discounting, is a perfect example of the problems with such a complex, multi-payer system. Inevitably, the little guy winds up paying for the resulting mess

I have a question:

Given the example of an anesthesiologist, when the balance billing occurs, is there a difference in what the hospital would receive from an an and out of network doctor?

I am thinking that part of any anesthesiologist’s fee will go to the hospital for their use of hospital facilities.

If an in-network anesthesiologist charges $1500, and remits $150 to the hospital, and an out-of-network anesthesiologist charges $20,000, does the hospital get the same $150, or does it get $2000?

I am wondering if hospitals are incentivized to set up patients for surprise bills.

If so, it would explain the reason that so many hospitals are outsourcing their ER services to out-of-network (and private equity owned) practices.

A very good question, and one I have had myself.

Hospitals aren’t getting much scrutiny on the surprise billing issue. However, they are the ones contracting with these physicians and they are the ones professing to have no ability to control what physician attends to what patient. I just can’t believe that the hospital isn’t getting a piece of the action.

I have heard (not sure if this is accurate), that some hospitals contract out their entire ER operations to PE-backed physician groups. Through surprise billing, aggressive collection and other tricks these physician groups believe they can squeeze a profit out of the ER where the hospital can’t. Since the ER is the one place where the hospital has to look like the non-profit charity it nominally is, washing their hands of this typically money-losing department can be very attractive.

Most surprise bills are for specialty docs’ professional fees. Those can’t be split with the hospital due to Stark laws. Hospitals can reap more technical service fees, facility fees from those docs ordering and doing more in house testing, for instance.

If the hospital weren’t in on it, it won’t be so common. Why do you think they’re so eager to have out of network providers in their facilities? Not a single in-network anthesiologist within 30 miles — that doesn’t happen on its own.

The fee “charged” by the doctor/provider doesn’t go to them directly. A much larger chunk goes to the facility than you suggest in your examples.

Unconscionable and actively evil — that’s the “health” industry in America. And most of our other industries too…

Oh no! Don’t get rid of surprise billing! If you do, the sky will fall.

The whole medical establishment is crooked. Time to nationalize and put them on a low fat ($) diet.

yes, and istm that the insurance companies are like the dragon guarding the cave filled with loot. They have this gigantic pile of money and they give out as little as possible. I’d say they like surprise billing as their prime customers can be cajoled to up their coverage to avoid “surprises”. because no one likes that kind of surprise. M4A.

…gouging of patients could be random; might be arbitrary; or possibly systematic! As long as its not discriminatory….

The health care industry has its head stuck in the sand. For all of the 20th Century the economy worked – it only stopped working in the 90s – before that people had jobs, money; were young enough to have reasonably good health without much “health care” at all. General public health was good. The demographics were favorable to the business model that the health care industry offered – a monopoly of services structured to make maximum profit off of a relatively healthy population.. When profitability was inflated away in the 90s, hospitals and clinics outsourced/privatized many of the services they had previously done in one comprehensive billing process. I remember my thyroid lab tests going up from $30 to $90 – a triple increase in just one year. And at the same time, maybe a decade later, the demographics changed as our population got older and sicker. But hospitals did not look for anything but profit. They are still standing around under the streetlamp looking for their keys. And it is getting much harder to pretend they are even serious people.

After a 23 day stay in hospital ( covered by my insurance) I was profoundly dismayed by the billing procedures of all. Shortly after being admitted a young man came into my room and said if I paid my $500 hospital deductible right then and there the hospital would give me a 10% discount. Fortunately I wasn’t in agony or heavily sedated so I asked him to get my wallet out of my pants and gave him my credit card.

Once home the bills started arriving. I accumulated a shoe box full of them. I had no idea from whom or what service they had provided but it did occur to me that a person could make a pretty good living if you got the names and addresses of people admitted to hospitals and just sent them nuisance bills from say “Pyramid Laboratory Services” for $50 and see how many people paid them. If just 20% did and you sent 1000 bills out each month you could make $100,000 per year for doing nothing!

10% discount on what? What you pay, which is $500? Or your insurance pays?

“Ippolito called the commercial a “vague scare tactic.”

Here’s a less vague criticism (for whoever is behind the ad or problem)…it amounts to:

“Coming after my billing, huh? I’d hate to see something happen to that little safety net of yours…”

And just now I receive an ad on my tablet telling me to “contact Congressman Keller” (not my Congressperson) and tell him “Vote No on Rate Setting”.

At the bottom, they are “helpfully” pushing

Biden33030http://www.stopsurprisemedicalbills.com, which of course claims to be against surprise medical bills, but has wonderful factoids like:“…improve the health system”. So one for-profit business (hospital) wants you to be upset that another for-profit business (insurance) isn’t just giving the first business money. I’m going to need a violin constructed by and for nanobots.

Hasn’t it been in NC/WC recently that hospitals won’t divulge the discounts they’re getting from insurers? So insurers *are* giving hospitals money, and it’s enough hospitals don’t want you to know how much, but at the same time upset it’s not more?? I don’t know if rating setting is a good answer, but the more these shady actors are trying to muddy the waters the more it looks like it might be a good piece of this puzzle.

Don Coyote, I think you’ve got the payment sequence reversed when say “hospitals won’t divulge the discounts they’re getting from insurers.” Hospitals give discounts to insurers, hospitals don’t get discounts from insurers. Hospitals get fees from insurers; when a hospital is in an insurer’s network, the fees the hospitals get are discounted.'”

I suppose you meant to say “hospitals won’t divulge the discounts they are giving to insurers.” The likely reason is that the insurers, who dictate the terms of the network agreements, include a clause to prohibit the hospitals from divulging the discounts they are getting. That information would be very sensitive competitive information from the insurers point of view. But it would also divulge the fees the hospitals would charge, before the discount were applied, and the hospitals wouldn’t want that to be made public either.

I don’t suppose trying to turn hospitals into profit centers, the demand for artificially high profits from health insurance and drugs could possibly be having the biggest detrimental., effect on ERs and rural hospitals. And that private equity and corporations scooping up doctor’s practices couldn’t possibly make it worse.

Nah…what I am thinking, I’m sure all the efficiencies this type of consolidation although administrative heavy that they have put into the system makes that impossible./s

A.k.a. a classic FUD campaign, which Wikipedia describes thusly:

“Fear, uncertainty, and doubt (often shortened to FUD) is a disinformation strategy used in sales, marketing, public relations, politics, cults, and propaganda. FUD is generally a strategy to influence perception by disseminating negative and dubious or false information and a manifestation of the appeal to fear.”