The Wall Street Journal has an important story on how people with what seems like pretty good household incomes are getting more and more indebted in keeping a middle class lifestyle.

The Journal gives a sympathetic portrayal, using some recent work by Georgetown law professor Adam Levitin to show how much significant costs have risen relative to wages

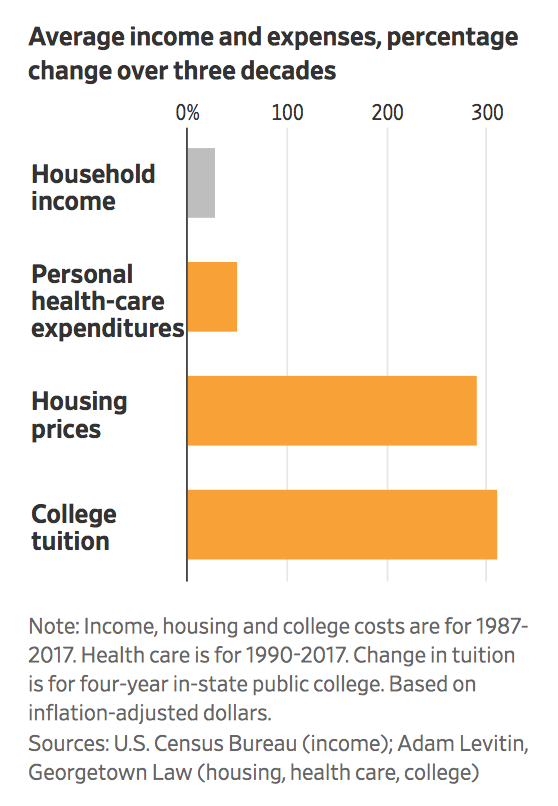

Median household income in the U.S. was $61,372 at the end of 2017, according to the Census Bureau. When inflation is taken into account, that is just above the 1999 level. Over a longer stretch—the three decades through 2017—incomes are up 14% in inflation-adjusted terms.

Average housing prices, however, swelled 290% over those three decades in inflation-adjusted terms, according to an analysis by Adam Levitin, a Georgetown Law professor who studies bankruptcy, financial regulation and consumer finance.

Average tuition at public four-year colleges went up 311%, adjusted for inflation, by his calculation. And average per capita personal health-care expenditures rose about 51% in real terms over a slightly shorter period, 1990 to 2017.

The article gives a layperson-friendly version of a traditional economist’s argument in favor of easy access to consumer debt, namely “smoothing of expenditures.” That’s a polite way of saying going into debt to buy education, or a car, or a vacation, or Christmas presents.

The problem, of course, is that that view assumes that future income will be there. In a world where the average job tenure is only a bit over four years, anything other than very modest use of debt runs the risk of getting caught on a treadmill, particularly with so many lenders set up to kick already not-low interest rates up to penalty levels in the event of a late payment.

Of course, in the bad old days of my youth, most people saved to buy a car or a vacation or presents. But young people weren’t carrying student debt millstones. If they went to coastal cities to build their careers or enjoy an urban lifestyle, the cost premium over living in a city in the heartlands wasn’t as high as it is now (save maybe for San Francisco and New York, which have long been very expensive relative to the rest of the US).

Arguably things are better on some fronts:

Counting all kinds of debt, including mortgages, consumers aren’t nearly as debt-burdened as they once were. In the fourth quarter of 2007, the last year before the financial crisis struck, households devoted 13.2% of their disposable income to debt service. In the first quarter of 2019, that number was 9.9%, largely due to low interest rates.

Partly because of widespread refinancing, mortgage payments since the start of 2017 have claimed the smallest slice of disposable personal income in decades, in the low 4% range, according to Fed data.

The reason this is less meaningful than it might seem is that the rise in health insurance and medical care costs have eaten away at disposable income. In addition, with interest rates super low, saving enough to have an adequate income in retirement becomes more daunting. And parents are pressured to save to help put their kids though college.

The article gives a high-level profile of two struggling couples. The first:

Jonathan Guzman and Mayra Finol earn about $130,000 a year, combined, in technology jobs. Though that is more than double the median, debt from their years at St. John’s University in New York has been hard to overcome.

The two 28-year-olds in West Hartford, Conn., have about $51,000 in student debt, plus $18,000 in auto loans and $50,000 across eight credit cards. Adding financial pressure are a baby daughter and a mortgage of around $270,000….

They no longer dine out several times a week. Other hits to their budget were hard to avoid, such as a wrecked car that forced them to borrow more.

Ms. Finol hasn’t used her T.J. Maxx credit card in more than a year. She makes the minimum monthly payment on its balance of approximately $7,500. Her monthly statement says if she continues at this pace, she will need about 23 years to pay it off.

Earlier this year, Mr. Guzman put his credit cards in a Ziploc bag with water and placed it in the freezer. In May, however, they went to two weddings, and needed a card to cover the cost of a gift and a rental car.

Mr. Guzman removed one of the credit cards from the freezer. “A lot of things came at once,” he said. Since then, he’s taken the rest of them out, too.

The Wall Street Journal was hostile, deeming the couple having bought a new car back in the day as opposed to an under $10,000 used car and going to weddings when they were so heavily indebted as profligate.

But even if that’s narrowly true, it misses a bigger picture, which is their budget-buster was almost certainly having a child. And US society is strongly oriented towards young people having children, as witnessed by the fact that fertility treatments are covered by health insurance. We don’t know the size of their house, but it’s almost certain the Guzmans bought a place that was bigger and/or in a “better” neighborhood because they planned to become parents.

A corroborating anecdote: a friend whose Yale-graduate son married a fellow Yalie is torn over whether or not to have children. They are kid-crazy, but to be able to afford a bigger house, they’d have to live so far from their jobs that they’d each have a one-way commute of an hour+ when things went well. And that sort of time sink doesn’t mesh well with attentive parenting.

Another story where the housing demands of having a child further stress shaky finances:

Elizabeth and Andy Bauerle have been trying to buy a house for seven years without success, despite having combined income of about $155,000—in the top 20% of households, according to census data.

The two 34-year-olds face a common conundrum. Their jobs are in the Seattle metro area…

The Bauerles have $30,000 in their down-payment fund, but the kind of house they want—a two-bedroom, two-bath with a yard—starts at around $600,000 in and around Seattle.

They figure they would need to make a down payment of $70,000 to keep the mortgage payment manageable, given their other obligations. These include student-loan debt of about $88,000 that consumes around $1,000 of income every month.

Ms. Bauerle said about half of their take-home pay goes out the door for that plus $1,750 in rent and $1,200 in child care for their son. “Four thousand dollars of our income is immediately spoken for,” she said.

Like many families, they have stretched out the monthly payments on an auto loan. They have a 2013 Subaru, bought used three years ago. They won’t write the last $240 monthly check on the car until it is about nine years old.

The problem with renting is of course that renters are exposed to escalating lease costs and don’t build equity, although housing market volatility means that isn’t a given. One of my siblings bought his house in 2007 and even though he lives in an affluent university town, it’s only in the last year that his house is worth more than he paid for it.

The story also fails to mention another wealth-sapper, that of divorce. Couples that stay married do best in net worth terms.

One solution might be more communal living (retirement centers are a commercial response to this need) but technology, schooling, and other forms of acculturation seem to be weakening social skills and encouraging more isolation. So while there may be local exceptions, on a collective level, we are working against our best interest on many levels.

`

I imagine each of these couples weddings was a significant debt driver, too. I almost felt haughty regarding $50k in credit card debt, but remembered there are worthwhile bthinga that can drive that debt.

I think it has to be emphasised that this is not accidental or some inevitable outcome of ‘free’ markets – it is driven by policy.

I was reading the latest Irish Central Bank quarterly bulletin (as one does when a little bored) and what is striking is just how much private debt has fallen among Irish consumers over the past 9 years – even during a time of expansion. This was part of a deliberate regulatory strategy of squeezing new loans, in particular making it far harder to get a mortgage, in addition to restrictions on personal loans for things like cars.

The striking thing is that the economy has grown during this period (which no doubt austerians will point to as a success), but Ireland is very different to the US in that as a very open small economy it has the advantage of being able to ‘import’ growth even when the domestic economy is very tight.

Having lived through the Celtic Tiger and the current expansion (not as crazy as the Tiger, but still very impressive growth figures for the past 5 years or so), I much prefer a low credit environment. It is very easy to be tempted by credit, I know even very financially literate people who made some stupid (with hindsight) decisions driven by a sort of mad group-think, not to mention the marketing pressure of the finance industry. People simply seem calmer when they are buying things out of savings and earnings, not from lending.

I’m very glad to hear that the debt levels are down, and rather surprised to hear that government policy is involved… when we were there it was all “get on the property ladder” with queues to buy ratty new semi-d’s on a postage stamp lot, Sight unseen. Not to mention mad weddings preceded by mad hen-bachelor parties, new cars etc.

I suspect that the marked difference between Ireland’s GDP and GNP is still a thing? When they talk about the amazing growth, PK, which number are they referring to?

As to your first point, I think the craziness of the Tiger years was due to so much credit being handed out. I remember my amazement when I moved to Dublin in 2000 on being offered so much cheap credit without asking for it. It was very tempting, and I’m glad I didn’t go down that road (although of course my mortgage was crippling for years, but I’d no choice if I wanted somewhere to live). Strictly speaking, the government hates the restrictions, but they made the Central Bank pretty much independent as a regulator of the banks and they have stuck to their guns over restrictions on lending. Although I’ve noticed lately that while mortgages are still very hard to get, some of the non-Irish banks are starting to increase personal loans. My unofficial ‘tracker’ for lending is the number of cars bought* and house extension planning applications as both are purchases that need bank loans. Both are well down on equivalent growth years for the Celtic Tiger. Growth is almost entirely been driven by investment and productivity improvements, not debt. Which is of course very good news.

Yes, the difference between GDP and GNP is still a huge thing here, but all the Central Bank figures are adjusted with as close as possible a ‘real’ GDP growth figure given, although their calculations are controversial as there is no universally agreed method of calibration. As a rule of thumb, the ‘real’ growth is about 50-60% of the ‘headline’ GNP growth figure.

*It must be said that the car market has been highly distorted by people buying cheap used cars from the UK, so it can be hard to know the real situation. The drop in sterling is absolutely killing car dealers, poor dears.

Thank you PK, I am somewhat surprised that sterling is down enough to go for a used car over the border — I mean you still get hit by VRT correct? But maybe there’s fewer of the “Eh, I’ll do ye a deal, okay boss?” types up there, like I encountered when looking for my first car. Sigh.

Yes, oh boy, credit offers were like Skittles back then. But being an American expat with no clue, I was deterred by 1) how long it was taking to get my citizenship (our joke was that there were two fellas processing all the applications and they couldn’t be arsed when the match was on), and 2) I didn’t realize how unusual fixed rate mortgages were worldwide and didn’t trust variables.

And of course I too was in Dublin, and also arrived there in 2000 (Blanchardstown for my sins), and the prices were dire even then.

I am actually happy that BoI is doing this, I know so many young people who trusted in what they were told, and lost so much before and during the crash.

The chart mentions ‘personal health expenditures’. I question if that includes health insurance? My monthly premiums have been going up at least 10%, to more often 20%, per year. Over 20 years that cost has become quite a significant chunk of our families budget.

In any case, there are a lot of expenses people are delaying: buying a home, having children etc etc. Maybe not amongst the top 10%, but the rest are not doing great.

Thus, political candidates who address reality will do better than those who offer half measures.

Hard to believe the line,

“And average per capita personal health-care expenditures rose about 51% in real terms over a slightly shorter period, 1990 to 2017.”

I’ve come across several articles like this where one statistic jumps out as crazy low. Don’t know what to mske of it.

Nice to see this feature prominently in a paper like the WSJ–for a change. I think a lot of its readers spout platitudes about fiscal responsibility without thinking about just how hard it is to live on $60k/year.

Personally, 15K for Health Insurances, + 4K * 2 (one each) Deductible. I have health insurance and can JUST afford to use it out of 125K. It’s 19K spent before Aetna pays a penny. Seriously considered giving it up and going pay as you go. Except the list prices are double/triple/quadruple the insurance prices (real examples from this year). I’m in a nice neighbourhood in flyover country so we live OK, but the healthcare is now more than the mortgage & taxes. God help those earning less or in more expensive places.

Medicare for all now.

Headline in today’s NYT , not the Onion.

“Opinion

Democrats Are Having the Wrong Health Care Debate

“They should skip the argument over Medicare for All and find the best ways to tackle affordability. ”

https://www.nytimes.com/2019/08/02/opinion/democrats-health-care.html

Everybody is focused on “how to pay for it”. If the per capita healthcare costs can be lowered to the upper end of the other OECD countries, then it is already paid for. We already pay pretty close to the highest amount of public money into the healthcare system of any country in the world, so we shouldn’t have to increase taxes to have a universal private option. Ideally, we would pay about the same in taxes but the private expenditure on healthcare would drop 50%. I have been utterly baffled why corporate America has not been all over this – it would be a huge saving on their labor costs. The multi-national corporations must see the difference in their US labor costs and their overseas labor costs, including healthcare – the healthcare costs are probably one of the reasons they have been offshoring many jobs, not just the basic hourly wage.

The assumption by everybody in the US appears to be that the total cost can’t be reduced and it is simply a matter of reshuffling whether it is paid for by taxes or private money. No company would tackle their internal cost and margin analysis that way.

The problem is similar to the issue of reducing military expenditures in the USA.

Assuming the medical labor costs and fees do not go to foreigners (or Martians) USAians working in the medical/pharma/medical insurance industries will attempt to preserve their income stream if threatened by cost cutting efforts.

Given the debt load discussed in the article, that probably includes many indebted people employed in the industry.

If private expenditure on healthcare were to drop with large job loss or income stream loss, there would be many people, including indebted people, pushing for returning to the status quo.

There are a number of industries in the USA that employ people yet may not provide cost-effective value to society (in my view).

That includes the military expenditures for wars (and consequential high military budget spread around the country), the USA financial industry (which Paul Woolley has suggested is 2x to 3x the size it should be), the Medical/Pharma complex and the higher education complex.

The only USA segment that TPTB deemed disposable/downsizable was the union dominated manufacturing sector, which DID lose a lot of jobs as production was shifted overseas.

Corporate America is probably well aware of their healthcare costs, but may not want to push for cost cutting reform that may eventually loop back to them.

One could even argue that higher efficiency and resultant lower consumption would put more time on the climate change doomsday clock, another positive.

But I am not sanguine about significant reform as both political parties seem built to avoid reform.

Given the debt load discussed in the article, that probably includes many indebted people employed in the industry.

The irony is a lot of that debt might be medical debt. See: Methodist Hospital in TN suing its own workers for unpaid medical bills.

https://www.npr.org/sections/health-shots/2019/06/28/736736444/a-tennessee-hospital-sues-its-own-employees-when-they-cant-pay-their-medical-bil

Corporate America doesn’t want single payer healthcare because then it would be easier for people to quit their jobs, or be more comfortable demanding higher wages.

Also it helps that investors can buy shares in insurance companies, and so get a piece of cost back.

It’s not hard: companies want desperate workers. When I got out of the navy I actually had a hiring manager for a courier service refuse to hire me because I didn’t have any student loans.

Also, taxes will have to go “up” to pay for universal healthcare. The savings are simply too great to be put in so many hands, and it would likely cause by itself moderate inflation. I wonder how much one could put into universal higher education and infrastructure if you could only increase those budgets by the minimum amount required to avoid steep inflation (maximizing the middle class tax cut that single payer healthcare represents)

You pay for it the way we have paid for 18 years of overseas warfare, because we want it. We being us, the people, not we the MIC in this case.

shorter: writer says we should reject Medicare for All (which fixes the affordability problem) and instead use even more convoluted schemes to fix the affordability problem the last fix – ACA – was supposed to solve (but didn’t).

Is this column a NYT self-parody? /s

The New York Chimes strikes out again !

“We can’t afford to spend less, while providing healthcare (not “access”) to everyone! Our way of life™ depends on the parasitism!”

With combined monthly premiums of $900+ and $6,500 deductibles, we gave up on ACA plans a few years ago. Instead, we signed up for one of those healthcare sharing ministries at about half the cost. So far it’s worked out fine. In fact, when I recently visited an out-of-network ER (in a panic after smashing my hand), my plan wasn’t going to cover it. I wrote an appeal letter and to my amazement they approved my appeal! Would that have happened with a traditional insurer? I think not.

Tell me more.

Becoming educated, getting married, having children, finding somewhere nice for the children to grow up – what wasters and profligates, they should keep their heads down and work their lives away for the corporation and know their place

Fair enough health expenses are increasing and the whole system is inefficient. However, don’t lose sight of this fact: Americans live in one of the wealthiest societies ever to exist in the history of the world, and the middle class enjoy a standard of living that is the envy of most of the world and far higher than that of their ancestors.

So sure, there are some problems, but let’s keep things in perspective.

Americans live in one of the wealthiest societies ever to exist in the history of the world

Also one of the most unequal.

It’s the old saw, if there are 60 homeless and destitute people in a room and bezo’s walks in they’re all billionaires.

Yes, but the artcle is about middle class woes.

The definition of “middle class” has changed drastically due to the unequal growth in ‘basic’ costs versus wages. With medical, educational, transportation, and other costs having grown much faster than wages have, previously ‘marginal’ drags on the cost of living are now despoilers of the general standard of living.

As for the argument that the absolute standard of living has risen, I will counter with the observation that what drives social ferment is the perceived inequality between standards of living. As the wedding ‘trip’ anecdotes show, ‘Keeping Up With the Joneses’ is not a myth but an example of the reality of social conformity pressures.

Tolerating going backwards because some people have it worse is how things fall apart.

People in the 1770’s American colonies had the highest standards of living in the world, so did they go, “well, its worse in France…could you imagine being Irish?” No, you don’t gain by going well at least its not a dump.

the middle class enjoy a standard of living that is the envy of most of the world

It seems that either you are writing from a country other than the United States, or your comment was held in moderation for 50 years. The “American middle class” has been hollowed-out and “off-shored”… the people who 50 years ago would have worked those “middle class” jobs are now stockers at Amazon or greeters at Wal-Mart. If they’re “lucky”. Add to that fact the lack of any social safety net, an inadequte, degraded and decaying public infrastructure (transportation, utilities, health care, and education, for example — things which any “middle class” depends on), and the fact that Americans are held prey to companies which extract rents, steal their personal data, and poison their bodies.

Third World poverty does not look the same in the United States as it does in less-industrialized nations. But this is now a Third World nation, with its own unique problem of poverty.

The airline pilot who got laid off, and who now works at Walmart a couple days a week as a greeter, is fully employed isn’t he?

And if he can only get a part time position there, an orthodox economist will reassure you that he is merely exercising his “preference” for leisure.

*eyeroll*

I am not American but I am from a similarly wealthy country where the midde class whine about how hard they have it, and I have lived in several 3rd world countries where I’ve seen what ‘hard’ really is. Where basic health care is unavailable, and education and jobs are hard to get.

Trust me, modern developed countries are rich and pleasant to live in. That’s why all those people want to move there. Do you think a Honduran migrany who read this article would be turned off?

With all due respect, you must read US propaganda where you live.

Basic health care IS unavailable to many people due to not being insured or the insurance being so costly with such high deductibles (over $6K). And the costs for services are high. Haven’t you read that many people can’t afford insulin?

Public education, save in wealthy communities, has really deteriorated and college is unaffordable. Jobs aren’t easy to get either, despite all the palaver about our unemployment rate. The jobs created since the crisis are overwhelmingly low-skill, low wage, unstable “McJobs”. Our labor force participation rate isn’t so hot. And even those stats don’t reflect the fact that the US also has a lot of involuntary part time unemployment.

And our roads and bridges are falling apart. A California friend recently took a driving holiday in France and was shocked at how much better their roads are than ours. Road condition is even worse in flyover states and in parts of the country that get winter, which is hard on roads.

“With all due respect, you must read US propaganda where you live.”

And they’re watching the most propagandistic tv shows from America.

It will take centuries for reality to crack the great fantasy machine.

Yeah dude, we’re so lucky to live in a predatory environment USA USA! where our thoughts are mainly

“how do I try to avoid the next screwing?”

F•ckin shill

Is this some kind of twisted joke? That Americans live in the wealthiest society ever to exist is precisely why the dreadful living conditions of so many of its citizens is on ongoing scandal.

Perhaps, but the article was talking about the middle class, not the poor.

The US has the 1%, the 10%, middle class, and homeless.

Middle class US is working class or proletariat elsewhere.

What “middle class” is that?

I grew up in the middle of the middle class.

It’s long gone, Chief, here in the Exceptional Nation.

“..Americans live in one of the wealthiest societies ever to exist in the history of the world, and the middle class enjoy a standard of living that is the envy of most of the world..”

If you are talking about the top ten percent, you might be right. If you

are claiming that this is the lived experience of most Americans, you

are very, very wrong.

#shitHoleforthe many

… the middle class enjoy a standard of living that is the envy of most of the world…

If wealth was directly correlated with quality of life this would be true. But that’s not reality. How many people work 60+ hours a week and spend 10 or more commuting? What’s the use in having a nice home if you’re never there to appreciate it? Eating fast food and skipping the gym because we had to work an extra long shift, ultimately leading to more medical needs for things like heart disease and depression. While we do have a lot of great privileges, there’s something to be said for what we sacrifice on the altar of ‘progress’.

Retirement communities? Are they joking? Those are popping up all over the place, at least in areas where the prior generation is able to cash in on the appreciation in their housing and 401k’s. Fidelity and Schwab can produce a heat map showing the areas of the highest value 401k’s and bingo, we have our place to build an assisted living center. Here’s One I’m looking for my parents and it’s over $7000 a month for a 2br in a recent new build. What will become of those places when the debt generation reaches retirement age, possibly with social security garnishing payments for 40+ year old student debt? Not to mention the people who need those services. Maybe renovate those Aetna, Kaiser, and Blue Cross buildings and put all those insurance workers to work actually doing something meaningful?

Yeah, are you joking? that was my thought too. Retirement communities are fine for some people (not me though), but although in THEORY group or co-op living could save money, retirement communities being built are expensive and you are going to spend MUCH MORE than before so most people can’t possibly afford.

My recently deceased mother was in one of those areas that’s a prime target for the developers of assisted living centers. Did she want to move to one of them? Nope. Too expensive, and, as she put it, too mono-generational.

She was able to remain at home, with a 4-hour-per-day caregiver, until three weeks before she died. Then it was off to the hospital, with discharge to a nursing home, then back to the hospital, and, finally, into hospice. Not the ideal way to go, but it was what it was.

Slim, your mother’s plan is mine — I’m in my 70’s and reality is on the horizon. Home care, hospital, (skip the next two steps), hospice + palliative care. We’re learning about some wonderful hospices as our friends sadly need them.

Staying in your home late in life isn’t feasible for many. Maintenance, cleaning, emergencies make it difficult without assistance. My mother lived into her 80’s staying in her single-family residence, but only with the assistance of her heirs maintaining the physical structure, and providing transportation and personal care. After a medical emergency sent her to the hospital for longer than she could tolerate, she realized it was time to say Goodbye and expired at home on her terms under the care of my sister.

Having the determination to end life on your terms is a challenge.

Sounds like a golden profit opportunity for Big Tech to market personal-assistant-robots.

thank you anon for this info. too rarely spoken of.

my partner has a similar exit plan, and our local hospice will support it.

peace of mind.

many things will happen before then that one cannot plan for,

but it still helps both of us to have that particular plan

and for him to know he can count on me to support him through it

if/when the time comes.

Knowing when that time is nigh is one of the hard tasks.

If one is strong willed enough, one will be capable of enduring a Hell of a lot of pain. Plus, at least as I see it, among the older cohorts, self murder is still considered a sin. Also, many of us are secretly hoping for that elusive “miracle cure.” That’s why there are so many snake oil salescreatures out there today. The message of the Cult of Science is being peddled divorced from the work of the Cult of Science.

Retirement communities are poised to adopt some of the aspects of college housing. Many apartments are rented by the room to people without any prior affiliation or acquaintance. That helps landlord income by reducing vacancy downtime to beds instead of entire units.

How does that work for the non-student demographic? Seniors can look forward to a menu of options. Those with more resources to mine can opt for the traditional approach of, say, $7,000 per month after a buy-in of tens of thousands. Down the menu come the cheaper options like glorified people warehouses with fewer amenities such as an old television in the common room. The next step will be those disparate roommate facilities, ranging from spartan rooms to barracks, naturally without the bunk beds. The disaster relief shots of families in school gymnasia aren’t too far off.

For want of a vote, a humane health care policy was lost.

Why not bunk beds? With catheters and robotic diaper change and feeding tubes, they can be stacked 20 high. Think the “coffin” hotel rooms in Japanese train stations or cyber punk scifi. You just gotta keep yer neoliberal thinking cap on and you can solve any problem.

College costs are up waaaay more than 300 percent in 30 years. The article references tuition, and in low cost Kentucky annual tuition costs are more than 8 times what they were 30 years ago.

Notably, the article judges college cost increases by tuition alone. Excluded are housing, meals, books, fees, all of which are up far more than 300% in the past 30 years.

But what is notable about any measure offered in this article is this: college costs have far, far outpaced the ability of those in the middle class to afford them. That is why student loan debt is so high: working your way through college is no longer possible as it was up until at least 1987.

When I look at the chart I see a wall st that would rather have the gov buy all of their distressed student loan bonds and give up on m4a, which would wipe out all their pin money, and would mostly screw over what they mostly see as liberal academics.

I mostly intended to excise one or the other of the mostly’s, but didn’t get the chance…

Can rent-control be extended to something like tuition-control?

Isn’t that cheaper than the government paying 300%-change-in-three-decades tuition?

One important reason college has become so expensive–at least public colleges and U’s–is that many, probably most states have been cutting funding for higher education ever since the 70’s. This process of crapification has led to: 1. More extensive use of TA and adjunct professors, tenureless; 2. Annual tuition raises that outpace inflation; 3. Increasing reliance on student loans, and boy, that’s going well.

Low interest rates equal higher principal.

So if you you want to pay down your loan with low interest you are stuck for the full amount.

If you had high interest lower principal paying down your loan would save a lot of money.

The median new construction home size has increased by 50% over the past 45 years while the sq. ft per person of the median new house and the median household size has doubled. This is a key area where families can save money by living in a square foot per person similar to 40 years ago: http://www.aei.org/publication/new-us-homes-today-are-1000-square-feet-larger-than-in-1973-and-living-space-per-person-has-nearly-doubled/

Much of that came out of the zoning law successor to the FHA redlining of the 30s to the 60s. Many subdivisions have been zoned to require larger lots and bigger homes which pushes the price up which controls who can live there. In our area (fly-over country), homes in subdivisions with 0.5 acre lots or bigger cost about $150k to $450k. Smaller houses on smaller lots can be bought in the older city and village cores in our area for $80k to 150k. As a professional, I live in a 2,300 sf house (smaller than median new home construction) and the house is less than 20% of my total assets. That I have been able to control.

However, college costs and healthcare costs are a completely different challenge. What you get at college really hasn’t changed much in 50 years but the costs have skyrocketed. This pricing is unlike just about anything else in our society. I think the push to get a college education along with more accessible student loans and the increased ability to tap into HELOCs has pushed much more money into the universities so they have been able to raise their tuition rates. Savvy consumers are still able to get an affordable education, but you have to navigate a lot of complexity involving community colleges, state universities, etc. to do that. There are also far more education scams out there where the cost-benefit is not remotely rational. Raising four kids, navigating college costs was far more important to our finances and much more difficult to manage than our house cost especially with the low mortgage rates over the past 20 years.

Healthcare is just a mess. There is much more that you get now to cost money in healthcare compared to 50 years ago, but the US has done an abysmal job at managing the process unlike pretty much every other OECD country. So our healthcare costs are effectively 25% to 50% higher than they should be.

“What you get at college really hasn’t changed much in 50 years but the costs have skyrocketed.” — That’s just not true, especially at private universities, in particular. The level of instruction may be more-or-less similar, heavier on tech and lighter on lecture halls.

They look a lot more like swanky country clubs now. They’re filled with wealthy scions of foreign oligarchs from China, India, and the Gulf region who are there because they pay the full sticker price (it’s a narrow pool of US families that can fork over the nosebleed tuition levels). The food used to be mediocre fast-food type options. Now, there’s a stunning variety of very high quality options.

Plus, the entire university housing stock has gotten a massive upgrade. Everyone’s got private rooms and kitchens in full blown apartments that are like rentals, instead of just a dorm room. Same thing with the gym and sporting facilities and and other recreational options.

Honestly, compared to 20 years ago….the place I went to school has been transformed. It was above my pay-grade at the time, but only mildly so. Now, it’s up into the stratosphere.

This also doesn’t address the increase in amount of administration positions and higher compensation for presidents and deans, which are a huge cause of cost growth for the institutions.

Regarding quality, some schools have reduced the amount of lectures (and size of lectures) compared to 50 years ago, but more, have moved away from tenure-tracked positions and towards lower-paid adjuncts teaching, yet the costs have sky-rocketed.

^This. I work at a large (for our state) land grant university with multiple campuses in the IT department repairing computers.

I tell our many many student workers to enjoy their super luxo dorms because they might be the nicest domicile they live in for many years – true for my eldest in Minneapolis who despite being hired by a big software company before graduating in 2011 is still looking for an affordable house or even condo in the Twin Cities.

Inclined to believe that the US may have reached Peak Higher Ed already. Made in USA means squat any more: F35s can’t fly, Littoral Combat Ships and Ford aircraft carriers don’t work, even Boeing can’t make airliners that don’t crash. Trump and the GOP’s idjit trade tariffs are killing international ag markets and our foreign policy killing alliances… maybe it’s not just Peak Higher Ed but peak USA!

Peak higher ed for Americans….maybe. But there’s a tuition-based racket to soak the foreign oligarchs and bring the money back to the US, after we send it abroad for cheap imports.

It also has the effect of globalizing the elites in this country (and other countries). When they go to school now, they get familiar with oligarchs from abroad and learn to share the same perspective.

In medieval times, arranged marriages bound aristocrats to one another. Now, it’s done via socialization at top universities. Then, it gets deepened by jobs at the elite set of multinational corporations. Look at Pete Buttigieg, he’s one of the best specimens they’ve developed, yet!

Peak higher education is indeed a thing. Link:

https://bryanalexander.org/future-of-education/academia-after-peak-higher-education/

As a person who was born into a nuclear family unit with one foot in the middle class and one foot in the working class* (my father was an accountant,my mother a switchboard operator -(guess how old I am?)) and the older generations solidly in the working class and working poor, one observation I have made over the years is that people born into the middle class do not know how to be poor. In fact I have been in the middle class so long, I wouldn’t know what to do if I were stripped of my current financial cushion. By saying we don’t know how to be poor certainly doesn’t mean that we can’t be poor, but we don’t have the intimate understanding of how to survive being poor.

The best example I can give of that in modern times is with only the vaguest sourcing: A young woman – a single mother living in an SRO hotel wrote an essay in the Huffington Post, I think during the period of 2015-2016. I just erased a synopsis of my memory of the article because I found it had melded with my memories and knowledge of earlier generations of my family. But basically she wrote because of her daily experience of being stopped on the street by her economic betters who lectured her on her choices – one of which was smoking. The article was to educate the fortunate of the realities of a poor single mom and how and why she made her choices. I believe she said smoking kept her hunger down so that more food resources were available for her child. As a middle class non-smoker, I could argue with that but, then, I don’t have to make that choice.

I don’t know how to find the article for you, if you are interested, I don’t remember the author or the title, ony that it was Huffpost.

—

* – In the mid-1990s, during the height of corporations saying that the US didn’t have the computer talent necessary and brought in foreign workers to replace US programmers, the company I worked for fired its IT staff of 75, moving the department to corporate headquarters making it a 25 person operation (don’t know how they’re doing today). We were promised a certain payout, then they cut it in half. When challenged the corporation said “so sue us.” They also sneered at us, “we can’t wait to get rid of you, but we can’t let you go until you finish your projects.”

That was when I morally and psychologically returned to the working class, the true roots of my family. I don’t care how many degrees you have, how professional you think you are, if you are beholden to somebody else’s sayso to be employed, you are not middle class, you are working class. Once you come to that realization, politics is a whole new game.

You sure it wasn’t from Barbara Ehrenreich?

“I don’t know why the antismoking crusaders have never grasped the element of defiant self-nurturance that makes the habit so endearing to its victims — as if, in the American workplace, the only thing people have to call their own is the tumors they are nourishing and the spare moments they devote to feeding them.” “

I recall that article. Having been there, and often seeing people in that situation who smoke the article resonated with me. I reckon its this one:

https://www.huffpost.com/entry/why-poor-peoples-bad-decisions-make-perfect-sense_b_4326233

And you only have to go a slum in a Third World country to see this aplenty. I hope articles like that open people’s minds.

Good for you that you recognize so many of the lies that are told about who is and is not middle class — “if you are beholden to somebody else’s sayso to be employed, you are not middle class, you are working class.”

On the whole, I believe that Europeans have a better grasp on what constitutes “middle class” as akin to the petit bourgeois who themselves employed servants — anything less is working class, and Americans would do well to recognize this.

People would not be people if they stopped wanting to marry or have children. They won’t stop wanting a good safe life for their families. That requires education, housing, and (in the US) access to employer-provided health insurance.

Finance capital and employers ruthlessly take advantage of that. So do neoliberalism-addicted legislators who insist that no or low taxes on wealth and corporations is a higher priority than funding education, libraries, and public services. The punitive carceral state imposes substantial direct costs, electoral injustice, divisive racism, and economic inequality.

Systemic problems demand systemic fixes, although short-term palliatives, such as reinvigorating communal living arrangements (starting with rooming houses), would alleviate some of the pain.

Thanks for this timely post. You’re right to tease out the issue of parenthood as a driver of the immiseration of the ‘middle class’ (my Marxist upbringing tells me that there’s empirically no such thing, but let’s roll with it for now :)

The couple mentioned in the article paid $300k+ for a house in West Hartford when there are nearly identical houses a few blocks away in Hartford proper for half that, and many fixers under $100k. The difference of course is schools – Hartford is a mostly black and brown city, so you can guess how much the state cares about funding education there. (West Hartford is mostly white and middle-class, thus has tolerable public schools.) I do wonder how much correcting the sickening educational injustices in this country would affect the housing markets, especially in the large cities. I imagine the premium prices that some neighborhoods draw are based on the artificial (i.e. policy-driven) scarcity of ‘good schools’.

And I would love to see another bar on the headline graph that depicts trends in childcare costs – here in the SF Bay Area $2k/month is not unusual, but I have no idea of the historical trend. We decided (since we have two kids) to go with one working parent until the kids are in school, since a second income would be almost entirely absorbed by childcare. We are fortunate to have a decently high single income and the chance to rent a nice place from family at a way-under-market rate – or there’s no way we’d still be in California.

I’m very excited my youngest child is about to turn 5 and will enter kindergarten in Sept. No more daycare costs for me!!!

We used to call our childcare costs “the car payment” but they appear to have increased so dramatically as to qualify for a sobriquet like “the second mortgage” …

THe only thing I feel that’s keeping USA birth rates up is the american’s sickening daily optimism. I reckon if you guys started to seriously take your country’s situation into account, you wouldnt be having children and stick to that smaller house.

The year before my dad was eligible for Medicare, he lost his group health insurance. I helped with the accounting, so I remember vividly that the cost for buying his own health insurance worked out to $30k for that year. Insane.

As I get older, I worry about losing my employer sponsored care; I suppose as Alan Grayson once said of the Republican health care plan, I ought to not get sick or die quickly if I do.

Pardon me if I seem obtuse .. but couldn’t that be categorized to mean the ‘Duopoly’ health care ‘All-accord-to-plan’ plan ?? Cuz both the Rs, and the Ds, are in on the Joke ..

Don’t know about you, but I’m gettin really tired of being constantly hit over the head .. by that Big Club that I ain’t in !

The lowering floor of our economy doesn’t help:

https://ritholtz.com/2019/08/longest-period-in-history-without-an-increase-in-minimum-wage/

What do we say about a society that makes reproducing itself so difficult?

Nothing positive, I should imagine …

How many ways must we contort ourselves into saying the same thing over and over and over? Neoliberalism is a failed sham economic policy that must end. Not tomorrow. Now.

“There is a reason why the State is involved in housing, education, health, the social fabric, the long-term view and justice, etc. It’s because the market patently *doesn’t* provide those core meanings, not only because it is so often most profitable to exploit and destroy function in the short-term, but also because so many of the critical foundations of a decent society require a sense of community and place, and cooperation. The idea that life and commerce is all about competition is a nonsense to anyone who has ever been part of a team, a family, a decent workplace, a county culture. We cooperate so strongly at some levels and compete at others. Cooperation is integral to any cultural life. Life is patently not about competition of individuals divorced from any society, as Neoliberals presume.

But it’s more than that. Life is not a market. The market should never be the first option in policy, the prime directive. Life is the prime directive. Life in the long term. Our culture. Our reason for being. Government at its core is about protecting and conserving our people, communities and lands to ensure we can have meaningful life into an uncertain future.”

“Neoliberalism is anti-woman, anti-family, and anti-human rights.”

I’m not sure that this is a bad thing. Back when it existed, the American middle class consumed disproportionate resources. I am a childless homebody with a low carbon footprint, and on my cranky days, I would prefer to drown the bourgeousie not in debt, but in water.

The problem came when they began to believe their heavily govt subsidized existence wasn’t worth anything if anyone else got the same thing.

I feel like I’m not understanding something from the article: if the Census Bureau is saying that incomes are up only 14% in inflation adjusted terms over thirty years, but then you have big ticket items like housing and health care and college that are spectacularly more expensive in the same inflation adjusted terms, what are the other domains of consumption that must be substantially cheaper than they were thirty years ago, in order to even out the calculations?

It’s primarily access to credit, things like seven-year car loans, minimal down payment mortgages, low-interest everything. It wasn’t long ago that a five-year car loan or using a credit card to buy fast food was a sign of financial distress; now it’s completely normal.

I do agree with your sentiment. When I look at housing prices I just don’t get it. Are all these households making $150K? Where is all this money coming from?

Go play with a loan calculator that tells you how much house you can “afford.” I used the zillow calculator and plugged in 90K as annual income – and it told me I could “afford” a 385K house on that income, and the payments of $2400/month would be “comfortable.”

Fortunately, I know better.

It’s true. It’s no longer “college”; it’s “the college experience.” Very different things, and a good deal of the marketing of higher ed (which is also a new thing, as in the old days education ‘sold itself’) actually emphasizes the latter.

Not a big deal, but San Francisco was actually a very inexpensive city to live in until the 80s when loads of people decided that they wanted to live there. Starting at that point, rents went sky-high and got worse over the years, which is the major reason they have so many homeless people.

What about the cost of food? It’s skyrocketed the past few years. Between that and outrageous health costs (I have company issued insurance), I am stretched. And I make 6 figures. It’s insane.