Lambert here: If Sanders wants to appeal to a no-longer-young demographic, here it is: Precarious old codgers. (For myself, I want to write ’til I drop, because shuffleboard is a death sentence, but I recognize that I’m an outlier.)

By Julianne Geiger, a veteran editor, writer and researcher for Safehaven.com. Originally published at SaveHaven.

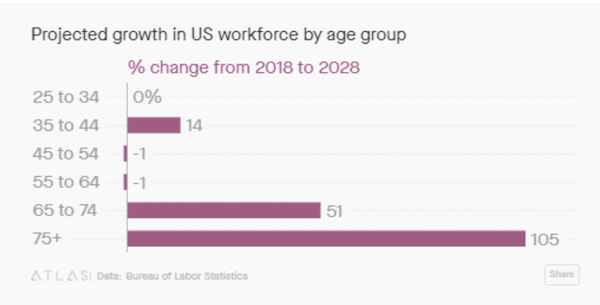

The US Bureau of Labor Statistics is predicting a major increase over the next 10 years in the number of age 75-and-older workers in the workforce.

The increase, from last year’s 1.8 million workers who are 75 or older to 3.7 million in 2028, shows a remarkable 105% growth rate for that demographic. The second largest growth rate for the next 10 years will come from those workers aged 65 to 74, at 51% growth.

In a nutshell, those who are 65 and older are simply staying in the workforce longer.

There is no growth expected from those in the 45-64 bracket, and—it may come as a surprise—there is no change expected in the 25-34 age bracket, either.

Chart courtesy of qz.com

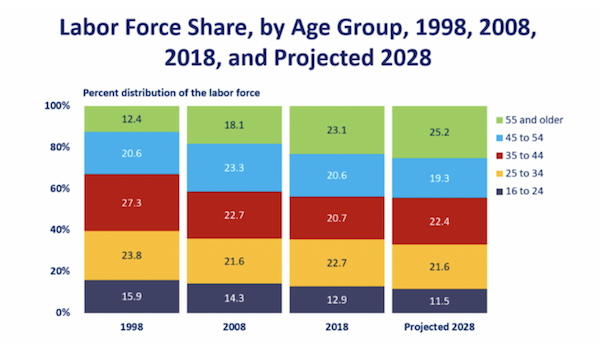

For labor force participation rates, there is actually negative growth expected from those age 16 to 24, declining to 51 percent by 2028.

Part of the shift from younger to older workforce is because the younger demographic is expected to stay in school longer, living up to their reputation as one of the most educated generations. The other reason is that the older generation is working in jobs traditionally held by younger workers.

Source: US Bureau of Labor Statistics

So, what’s behind the sharp increase that is expected in the oldest work-age demographic?

Money, money, money. The 55 and older crowd is not financially prepared to bow out of the workforce. The idea of the private pension is dead. And many this age haven’t saved enough for retirement. The result is that they are working longer and longer.

Increased life expectancy. People are living longer in general, meaning this age group is growing. The average life expectancy in the United States as of 2016 was 78.69 years old. The trend just in the last three years is flat, but over the last decade or couple of decades, the upward trend is clear.

People that age are healthier than they were a decade or two ago. People are smoking less, eating healthier, and are getting more—and better—vaccinations such as for Hep B and chickenpox. There are also better diagnostic tools such as the MRI that wasn’t available way back in the 70s. This means people are capable of working longer because they are physically able to. Other things such as seat belt laws, nutrition fact labeling, organic food choices, and a reduction in the number of HIV/Aids cases all contribute to increasing life expectancy and/or increased health.

Satisfaction. Some people are working longer just because they like their job. Job satisfaction has reached the highest level in two decades, thanks to the improved labor market. In fact, according to the most recent version of The Conference Board survey, 54% of US workers are satisfied with their employment. The increase in job satisfaction for the year represents the second-largest increase in the survey’s 32-year history, according to Industry Week.

The last reason for the shift is likely due to the decrease in labor-intensive employment.

“As much as we like to talk about millennials, the future of work is much older,” Roy Bahat, head of Bloomberg Beta and co-chair of Shift: The Commission on Work, Workers and Technology, told attendees at the Milken Institute’s Global Conference last year, according to Forbes.

So all the beatings really did improve morale.

Or rather than coming up with tortured justifications for why people are working so long, couldn’t we just provide increased social security benefits so people who have already put in 50 years in the workforce don’t have to toil until the grave?

Wait, that’s crazy talk. Get to work grandpa! Those MallWart customers aren’t going to greet themselves.

job satisfaction is relative, maybe at a certain point people are just glad if they have a job with a few benefits or a job at all (aka “I survived the Great Recession and I all I got for it was big gaps in my resume”).

Meanwhile with all this job satisfaction, everyone one knows is burned out of their job. Can’t we just retire after this hell sytem has used up our best years and our energy anyway and we’re old and sick?

Quoting from the article:

The idea of the private pension is dead. And many this age haven’t saved enough for retirement.

To which I say:

Why is the idea of a private pension dead? Who killed it? And why?

My prime suspect: The financial industry. Which wanted to get its paws on the money that companies used to put into pension plans. Hence the push to get workers into 401k plans.

As for not saving enough for retirement, enough of the finger wagging already. There’s quite a bit of statistical evidence that shows workers’ wage growth flatlining as productivity and CEO compensation have skyrocketed.

So, where is this saved money going to come from?

+1

I remember some years ago reading a financial advice book by an accredited financial advisor about how to manage your money. Printed by a good publishing house, good blurbs on the back of the dust jacket, it appeared to be written by a sensible guy. Appearances can be deceiving.

Can’t remember the book’s title or author’s name (lucky for him). The gist of his book was that while many of his clients had faithfully followed his past financial advice they were now broke, or nearly broke, and desperate for new strategies. His book was the answer to their questions. And his answer?

“Your aim should be to die broke. So take out a reverse mortgage and spend. Pretend you’ve already retired and ignore the office stresses you’re under.” Basically, his earlier advice wrecked his clients’ finances; he was giving even more lousy advice in the book to ‘fix’ what he got wrong in the first place. I couldn’t stop shaking my head at all the nonsense in the book.

The book is called “Die Broke” by Stephan M. Pollan. I just finished reading it.

It was written in 1999, and like most personal finance books, it has not aged gracefully. HIs predictions for the future are especially eyebrow raising (example: “Real estate will remain flat for the rest of your [1999 boomer’s] life.”).

As for the meat of the message, you’ve summarized it well, but the details he provides don’t make sense. Avoid credit cards, pay cash (and he means real cash). Save “as much as you can” in tax-advantaged accounts like 401ks, because your income will likely go down as you age, but at the same time he suggests living close to your means so that you don’t die with money. There was not coherent advice about how to predict or optimize this burndown; I don’t think it is possible without running the possibility of running out of money while still alive.

The end of the book has a bunch of short sections on specific topics, a few of which seem quite good. For example, the section on disability insurance seemed excellent to me.

It’s a bitter book.

Yes! That’s the book. Thanks for the review.

Knowing when you are going to die is usually a BAD thing, because that usually means that it is close.

Die Broke? Better yet, slowly build up your credit and get lots of cards.

Plenty of online methods to borrow a small amount, wait a while, then pay it all back early, etc.

Die deep in debt to the bankers.

It’s a “Disruptive financial strategy.” ;-)

You would have to structure it in such a way that they can’t go after your family. But yeah, that’s an attractive idea.

A lot financial advisors are in it to make money for themselves, clients’ portfolios be damned, and they are often not real strong on how the financial system actually works.

A couple decades ago while working for WAMU I got to be friendly with one of the brokers for FirstUnion who worked in my building, and he invited me to his office where we discussed option strategies. He described one where he advised well-heeled clients to sell options contracts on large blocks of stock they owned that had already appreciated significantly in value but that he felt weren’t likely to move much in the near term. This is really kind of a no-brainer. Most options are never exercised so it’s a good way for the stock owner to make a little extra and likely keep their stocks to boot. The worst case scenario is the option does get exercised and you make a large profit on the underlying stocks.

I asked this guy how many of the other brokers he worked with advised their clients to use this or similar strategies and he replied that most of the other brokers had no idea what he was talking about.

This is a “covered call”, and it’s the only options thing you can do in an IRA.

And, yeah, options & futures brokers are all about bleeding out doctors & lawyers by making them compulsive gamblers.

Many employers have a 401K match which helped workers save more money for retirement. During the financial crisis, quite a few firms took that away.

It seems that I’ve had employer matching about 15% of my working life. Color me utterly unimpressed with that concept as providing much help to working people. Gen X here.

When bank robber WIllie Sutton was asked why he robbed banks he supposedly replied, “Because that’s where the money is”.

Well, there’s an awful lot more money in folks’ 401k accounts than any bank branch plus – a big bonus for perps – there is very, very little chance of jail, even if caught (itself exceedingly unlikely).

Slim, the private pensions were killed by the flat out assault on unions that’s been going on for twenty five or so years. Unions “bad”. Large greedy corporations; GOOD ! See, that’s America Slim, in all it’s splendor and don’t forget it. Unions, like the one at GM (currently on strike) keep wanting their wages to go up to keep up with the skyrocketing costs around them. I just saw a home in Shasta County in Northern California for sale for $ 945,000.oo That’s dollars. Maybe a retirement bungalow for some ? There needs to be an equitable method of sharing the success of the corporation with the workers, and so far, the best way is Unions.

Funny how so many of the same people who understand ‘heard immunity’ when it comes to the importance of vaccines for wider population health scream to high heaven if one suggests that Unions and many New Deal programs constitute a ‘heard immunity’ in national financial health and social health. my 2 cents.

There needs to be an equitable method of sharing the success of the corporation with the workers, and so far, the best way is Unions. Leroy

So long as human workers are needed in sufficient numbers and, due to automation, that’s increasingly NOT the case.

Otoh, if we did not have what is, in essence, a government-privileged credit for usury cartel, then the benefits of automation would be much more broadly shared since automation would be much more broadly OWNED.

But let’s have a Citizen’s Union to fight for and OBTAIN ethical finance such as a Citizen’s Dividend to replace ALL other fiat creation beyond that created by deficit spending for the general welfare.

I suspect the destroying of workers financial security in old age was by design. Policy makers were aware of a future aging population many decades before it was made public. Financial insecurity is was a way to keep people working to an older age and a way to make up for the lack of younger workers. The anti immigration fever sweeping the country is also doing part of the job of keeping older workers in the work force. Immigrants could help buffer the shortage of young workers so keeping them out in effect also promotes an older work force. Japan is a good example of our destiny. It’s really an economic issue because the money saved by older people still working, instead of being spent on retirement benefits, can be transferred to the wealthy because of bigger profits on investments.

The anti immigration fever? Sounds like whatever job you do is not impacted by an unlimited flood of cheap labor keeping pay levels the same for the last 30 years (that’s right immigration issues precede trump). I agree that destroying financial security was by design, and turning a blind eye towards employers who exploited carte blanche illegal immigration, and more recently the various classes of work visas was very helpful for the employers financial security, workers not so much.

Thank you, tegnost. Agreed. I wish I could say more but don’t feel comfortable doing so.

I doubt very much that immigration is the cause of American workers’ pay being stagnant for decades, and I don’t think that there is any evidence which supports that. Do you think that people over 65 are holding down the kinds of jobs that compete with immigrants? Perhaps it is the case with some tech workers (HB-1 visas, etc) but that would be a small minority of jobs. I don’t see too many seniors running gardening services, picking fruit and vegetables, staffing food trucks, working on construction sites, etc.

Blaming immigrants for America’s employment ills is dangerous and misguided in my view. The much bigger issue is the exporting of American jobs to developing nations.

Apologies for not noting the author of what I think is this brilliant summation:

“Although this stream of cheap labor benefits the ownership class while hurting the poorest, it is presented, often earnestly, as an act of solidarity with the downtrodden.

Blacks, brown citizens and legal immigrants are among illegal immigration’s worst victims, and of course, poor whites, but if these dare to demand their lowly jobs back, they must be racists! No wonder so many are killing themselves with opiods.”

Lord Koos, I plenty of “immigrants” doing the jobs teenagers used to do, paperboy, lawns, deliveries, gardening and janitorial jobs that lessor educated Americans once did. Also, there’s the linguistic apartheid in the kitchens and shops, that is, if you don’t speak Spanish, no one will hire you. Let’s not even talk about construction, plumbing, electricians, painting, once jobs that paid high wages and were often unionized.

How can Americans go on strike to demand higher wages by withholding their labor when there’s a river of pliable scabs pouring across the border ready, willing and able to work weekends, holidays, nights, in dangerous circumstances, that at their worst, are better than where they came from?

Picture the dead Americans lying face down on the sands of Iwo Jima with waves breaking around their corpses. Is our current economy and immigration policy what those guys died fighting for?

5 service jobs disappear to automation

10 manufacturing jobs disappear overseas due to tariffs

15 service jobs disappear overseas due to absurdly cheap international telephony

3 remaining jobs that can’t be moved are filled by immigrants

2 jobs pay 3x more because executives loot their companies

All you see is the immigrants.

Well, who could possibly argue that his is not high enough:

I mean, only 46% dissatisfaction :) Any business with 54% customer satisfaction would risk going under but employers with 54% employee satisfaction is just fine…

Being “satisfied” that you have a job you can tolerate isn’t the same thing as being happy with your job.

I wonder how much this statement

reflects an attitude of “better than the alternatives” rather than “I like my job”. It would be interesting to see how and in what context the question was posed.

Unsaid in this post: large entities stopped the pipeline of hiring and training young people some time ago, young people who would then be able to move up in the corporation to the next step on the ladder. Instead, large entities kept piling more and more work on the older workforce (those that weren’t ‘right-sized’ out). What I see now is hiring of young people because so many 60-66 year-olds are retiring, but very little mid-career employee hiring. There’s a huge gap between senior experienced employees and starting-career young employees, a gap that should be filled by mid-age mid-career employees, but isn’t.

So, along with financial stress, a lot a people might be kept on at improving salaries in their 60s because big entities suddenly see they destroyed the pipeline of trained replacements and now they have to scramble to fill the gap. imo.

adding: I file this business mentality of use-it-up-til-it-breaks-then-move-on-to-something-new-to-loot as the essence of neoliberalism. See also: Boeing, Air Marshals Service, etc.

And the screwing over of Gen X by the Baby Boomers continues… Note -1% growth rate for that demographic.

Uh, how is keeping a job “screwing over” younger people? I guess you would prefer that boomers die more quickly so that GenXers can take their shitty jobs?

Granted that I am on the edge of the baby boom, and thus am not a dispassionate commenter, I take exception to this characterization.

Besides painting such a large cohort with this very broad brush, it’s also historically inaccurate, when it’s well known that the architects of the demise of the middle class are much older than the boomers. Powell, Hayek, Friedman …Rand …..

Also, the fact that many boomers want to retire but can’t is an obvious tell that they too are victims, and the war is a class war, not a generational one. Seriously, do you really think boomers are plotting how to screw over their own children and grandchildren?

“Cm” of the famed “the chinese commies are going to attack us” posts of yore.now doing the bidding of the social security privatizers.

Now that’s what you call ‘institutional memory’.

link, please?

As Lambert often points out – “generations do not have agency”. Thus, your comment that “Baby Boomers” are screwing over Gen X”, implying agency to that generation, does not hold water. We’re all, Boomers, Gen-X, millenials, etc, being screwed over by the system. I suspect that there’s more than a few Gen-Xers who are happily contributing to or supporting that system.

And I’m equally sure that whatever generation that follows the Gen-Xers will make the same hollow claim about them.

I am about to turn 76. Meanwhile, I’m packing to vend at a weekend event where I will do most of the setting up and tearing down myself with a little bit of help from show volunteers. I will sleep in my car to save money, and I will bring a cooler with food and drink for the same reason. I know I will have to keep doing this until I physically can’t or until I die. And I am doing this because I can’t hold a regular job due to where I live (impassable winter road). I wish there was less strain in my life, but I don’t mind that I will never “retire.”

I find it very hard to believe that 54% of workers are “satisfied’ with their jobs, whatever that means especially given the growing precariat and employer benefit cuts. I find it even harder to believe that an appreciable minority of senior citizens is satisfied to be working in their twilight years. The workplace is not a democracy, and most workers take orders rather than give them. Even workers who issue orders, take their fair share of them. I retired as soon as I could to escape this form of oppression. And I did not want to die at my desk and be escorted out of the building in a body bag. Retirement has liberated me from the grind of daily commutes, billable hours, and annual performance reviews, and – best of all – given me a freedom and autonomy that are delicious.

As others have hinted in this thread, I think it is a product of the lowered expectations of the American workforce. Now just having a job is considered a victory and if it has some benefits you are really doing great. Of course 50 years ago that would be considered close to the norm instead of something grand and exotic.

On the subject of retirement, I think it depends on the person. My guess is that some older people like working for whatever reason. My boss is in his 70s and enjoys working for the challenge, for the social aspect and because, as he puts it, “it gets me out of the house and out of my wife’s hair.” On the other hand, I know a good number of older people who are very happy to be retired and finished working. I suppose a person’s attitude toward working in their old age probably depends on what kind of job you have, how much it pays, their savings, the state of their health and other factors.

I will admit that I am somewhat heartened by this news because perhaps it means that maybe I won’t be thrown on the trash heap of unemployment when I get to a certain age. I am already “too old” for a number of industries today so the idea that I can work into my old age is something that makes me feel a little bit better. I don’t have the pension that my father had so working is likely my only option besides being broke and unemployed. Ageism scares the hell out of me.

The myth of millennial entitlement is both ironic and dangerous in this regard. Most of us are satisfied with any job that pays the rent and view a 401k with a 2% employer match as a serious perk. The myth is there to cow us into long-term compliance.

Part of this rationalization by the (corporate) media of older people supposedly being satisfied with their jobs is a desire of the elites (as stated in a George Carlin bit) to steal the remainder of the Social Security Trust Fund – for tax cuts for the wealthy and the MIC. Not to mention that the banks will clean up in the form of commissions from those private accounts. Hope and pocket change that seniors can count in the palm of their hands.

Don’t believe the hype, or rather the homilies of old people loving to work.

Let’s see how many seniors survive the heat waves of the next ten years…

Myself, I’ve always loved what I do, so I hope to keep working until I can’t.

I love what I do too, but all the love in the world doesn’t pay the rent. And the older I get, the less willing I am to let others take advantage of that love.

I’m particularly curious about how those seniors will survive the heat of the southwest in the next decade or two since so many choose to live there? Not to mention water resource issues for seniors and everybody else.

I’ve never seen a human carcass in the desert….much less one with dentures.

I find it stunning that this post does not cite the depression as a major reason that so many older employees are clinging to jobs.

Didn’t save enough??? How about having your life savings wiped out by the depression? How about losing your accumulated wealth (like houses) during the depression? How about not having a job for several years during the depression?

Yup

Bear-Stearns stole ours

Unfortunately we are in great health and will probably live a long time Joe

Fortunately our property is located in a preferred landing spot, so it should work out ok

Did Bezos commission this report? Can there it now:

“You have a future in CamperForce!”

“Part of the shift from younger to older workforce is because the younger demographic is expected to stay in school longer, living up to their reputation as one of the most educated generations.”

As I reach (ahem) retirement age, I see young people who have spent thousands on highly-specific certifications that would have been on-the-job training a couple of generations ago. The risk and expense of training employees has been shifted onto the employees themselves. I question the phrase “most educated generation” in this context.

Indeed. Once upon a time the HS degree or college degree was considered only the entrance to the real education of a trade or craft or profession. Said entrance would require further long hours learning the things not taught in books. The most important information wasn’t in books.

Spread sheets can’t account for the analogue (human and mathematically unmeasurable ) knowledge acquired by apprenticeship and necessary to really understand the requirements of all trades or crafts or professions. There is always an apprenticeship beyond the credential, though it doesn’t go by that name anymore.

Most ‘educated’ by degrees earned hardly constitutes ‘most knowledgeable’ by trade or profession, imo.

Since education has gone up at 2x the rate of inflation (at least), and

Since employers are going to require xyz certification/credential, then:

maybe employers should be paying for it.

I’ve been saying for several years now, that a general strike ala France would do wonders in the USA. Completely shut the economy off and support each other meanwhile. Watch the upper class run around screaming with their hair on fire for a few months. After all, it wasn’t the working classes that raised the cost of living.

That’s how it used to be. Big employers like HP and others would hire BS/BA grads and pay for their MS//MA degree education from, for example, Stanford. Not cheap. That was back in the 80’s and early 90’s, before the cult of neoliberalism (where all “inputs”, including labor (employees), are widgets) took hold.

I knew several 20-somethings back then who had a full ride at their employer’s expense to earn their Masters degree at whatever uni their employer deem appropriate, on the assumption that the person so gifted would be of long-term benefit to the company. That was back when companies still thought about mentoring employees and the long-term health of the company.

Absolutely. I worked for HP back then and took several televised graduate classes at Stanford until they discontinued the program. HP then switched to a consortium of schools that still offered excellent classes, but none leading to a Stanford degree.

Only reason is Social Security fails to keep up with real inflation and the longer you live the more you are screwed by the system and are forced back into the workforce or you can just run up credit cards and stay out of it.

Please note two american current features:

1) Most retired americans have spent all their savings by age 73

2) Over 4 million grandparent households are raising their grandchildren. Usually without additional income from outside. Relying on their own resources per AARP.

If you’re an employer, you don’t hire anyone over 50 because your group insurance rates will increase. But once they’re 65, they’re on Medicare, so no worries.