By Nick Corbishley. Originally published at Wolf Street.

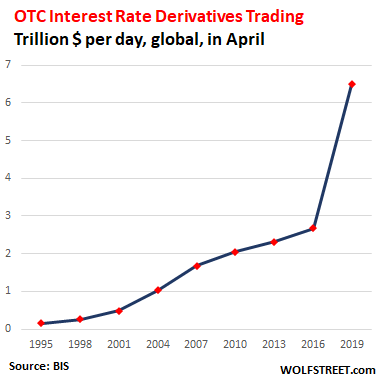

The volume of over-the-counter (OTC) interest rate derivatives traded globally soared by 141% in three years to $6.5 trillion per day in April 2019, according to the Bank for International Settlements’ new Triennial Survey of Global Derivatives Markets. In the prior survey period, April 2016, $2.7 trillion per day in trades were executed. Since 2001, the magnitude of trading volume has multiplied by a factor of 13, from $490 billion per day to $6.5 trillion per day, with a gigantic spike over the past three years:

OTC derivatives are securities that are generally traded through a dealer network rather than on a centralized exchange such as the London Stock Exchange or the New York Stock Exchange.

Some derivatives can be explosive, such as the credit default swaps (CDS) that brought Lehman Brothers and AIG to their knees in the last crisis, and which still remain a threat today, especially with the U.S. government this week bowing to Wall Street pressure to dilute regulation that had been designed after the crisis to reduce the risks of these instruments.

Interest rate derivatives, whose value rises and falls depending on the movement of interest rates, or sets of interest rates, tend to be more straightforward. They are often used as hedges by institutional and retail investors, banks and companies to protect themselves against changes in market interest rates. If managed properly, they shouldn’t pose undue risks to the financial system.

The BIS attributed much of this 141% three-year surge in trading of these instruments to increased hedging and positioning “amid shifting prospects for growth and monetary policy.” It also cautioned that some of the turnover in April 2019 was in shorter-term contracts, which are rolled over more often, leading to higher volume of trades. The 2019 survey also featured more comprehensive reporting of related party trades than in previous surveys. After adjusting for these trades, the actual increase in trading volumes since the 2016 survey is more likely to be around 120%, the BIS concluded.

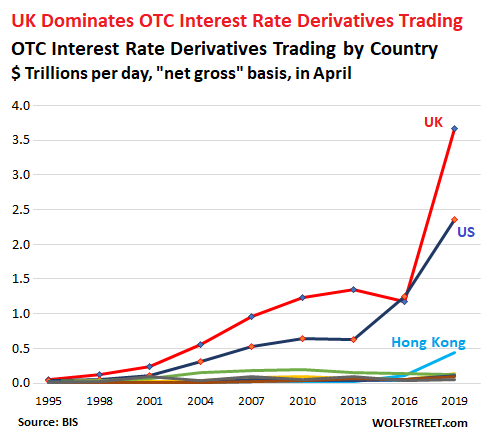

Here’s where most of the trading OTC interest rate derivatives took place:

- The City of London: $3.7 trillion per day or 56% of global trades were executed at trading desks in the United Kingdom, a 213% leap from the $1.18 trillion of average daily turnover in April 2016. Most of those trades took place in the City of London.

- The United States: $2.35 trillion per day, or 32% of the global turnover, up 9.8% from $1.24 trillion in 2016. Back in 2016, the U.S. had been for a brief moment the world’s biggest market in these instruments with a share of 41%.

- Hong Kong SAR: $436 billion per day. This was up almost four-fold from $110 billion per day in April 2016. Driven largely by increased turnover in Australian dollar-denominated contracts, this growth in trades takes Hong Kong’s share of global turnover to 6%, from 3.6% share three years ago. In mainland China, by contrast, an average of just $16 billion of interest rate derivatives were traded daily in 2019.

- The Eurozone. Turnover reported at sales desks in euro area countries remained relatively meager this year, reaching $256 billion per day, or 3.5% of the total turnover in April 2019.The largest euro area trading center, France, saw turnover fall from $141 billion per day to $120 billion per day in the last three years, taking its share of global turnover to 1.6% from 4.6% in 2016 and 8.1% in 2007.

- Other worthy mentions: Japan saw daily trading volume rise to $135 billion per day (from $56 billion), and Singapore, to $109 billion per day (from $58 billion), taking their share of the global total to 1.8% and 1.5% respectively.

The U.S. and the UK combined accounted for 82% of total turnover of interest rate derivatives in April this year, up from 79% in 2016. Even after three years of regulatory tussles with its biggest trading partner, the EU, the UK has not only maintained its grip on the vast and fast growing OTC derivatives markets, it’s strengthened it, pulling away from New York and leaving Paris in the dust.

“London is the capital of capital and this report shows that despite challenging times, the fundamentals of the City remain strong,” saidCatherine McGuinness, policy chair at the City of London Corporation, the municipal governing body.

The UK trading also dominates in global currency markets, albeit not quite as much. In April 2019, its FX trading desks generated a turnover of $3.58 trillion per day, up from $2.41 trillion per day in 2016, taking its share of total global FX activity from 37% to 43%. By contrast, the US share of trading declined during the same period from 20% to 17%.

In France, the UK’s biggest EU competitor, the trading volumes also fell, from $181 billion per day three years ago to $167 billion per day in April 2019, tiny compared to the $3.58 trillion per day on London’s exchanges. In Germany, the average daily FX trading volumes are even smaller, clocking in at $124 billion per day, up from $116 billion per day three years ago.

That London has also managed to increase its share of trading euro-denominated interest rate swaps, accounting for 86% of the global total, up from 75% in 2016, will be of particular concern to Brussels. For years, the French government, together with the ECB, have sought to wrest control of the trading and clearing of euro-denominated transactions from the City of London, for mainly justifiable reasons. And Brexit was supposed to provide the perfect alibi. But alas, as this BIS report emphatically shows, it hasn’t happened yet!

Ginormous numbers, FX swaps and spot trades, USD, EUR, JPY, GBP, Australian & Canadian dollars… but where the heck is China’s CNY? Read… Foreign Exchange Trading Soars to $6.6 Trillion a Day, US Dollar is Total King

“If managed properly,

they shouldn’t pose

undue risks to the financial

system.”

Needed to break that down into assumptive phrases. (Opionated commentary follows.)

“If managed properly”: isn’t the point of insider information and large market share to manage improperly?

“they shouldn’t pose”: “shouldn’t” ain’t “won’t”. These are designed systems: “MAX shouldn’t crash…”

“undue risks to the financial”: the point is the crash happens when the risks become due.

“system”: lotta ifs & shouldas for a whole system. We’re talking about the whole system.

Reminds me of

“If prescribed properly, opioids (such as Oxycontin) shouldn’t lead to addiction.”

As I wrote before – those massive numbers mean very little, they are just gross notional values of the derivatives which have about zero informational value.

Generating massive gross notional numbers is trivial. And can carry zero risk, as I can gross my numbers with equal-but-opposite trades.

Or, I can build a massively leveraged small notional trade that plays with a few cpties and carries some nasty wrong-way risk (i.e. the risks compound when things start going south). And, as a result, I can blow up the system.

It’s all about the risk – but unfortunately, that doesn’t get published.

vlade, I have a question I’d like your opinion on:

Given these three cases:

: United Airlines shares before 9/11;

: reported movement in oil futures before the recent drone attacks on Saudi facilities; and

: the $1.3B drop in share value after the Kylie Jenner tweet;

AND

: the tbtf fact that Goldman won at Bear’s expense;

am I being twitchy to think that some players believe they could benefit by blowing up the system?

The problem with blowing up the system is that there may not be anyone left standing to pay you. Not that it stopped some people..

Thank you for replying, Vlade.

Sure, it’s all gross notational that is until a trading partner or two can’t write a check. Then the gross becomes Net.

And it was the hedge funds holding credit default swaps against Thomas Cook debt that pushed them out of business over the weekend. Financial Engineering, anyone?

A cpty not writing a check has in vast number of cases nil effect on gross vs net, because pretty much all all vanilla IR derivatives (which are like > 99% of the trillion numbers mentioned) are required to be cleared, which has offsetting clauses.

Sure, there will be damage – but that’s risk related. Not gross notional.

Credit default swaps can’t, in and of themselves, push the underlying debtor out of business. That’s like saying betting against a football team causes the team to lose.

Vlade, I value your comments and insights here, and you have stated this before as you mentioned. I disagree with your assertion because of the interconnectedness of the major institutions in the global financial system, as we saw in 2008 with AIG, regardless whether swaps and derivatives are traded OTC or in the exchanges. What might have happened if the spike in overnight Repo rates last week to over 9 percent had been allowed to stand?…

Continuing to apply band-aids to address a fundamentally flawed system is not destined to end well IMO. A new Glass-Steagall Act which separates financial engineering and speculation from the nation’s depository and payments system appears to me to be a better solution if we are to continue with a debt-based monetary system. Just my view as an ordinary citizen who attempts to avoid involvement in the financial markets, and I welcome counter-arguments.

Further, Steve H’s question regarding the ethics of some of the major players merits a response, particularly in light of the cases of market rigging we have seen in the recent past.

Excuse me sir, but ‘market rigging in recent years’?…

From tulips, to south sea bubbles, to Alex Ham’s govt note fixing, to andrew jackson v. Bank of US straight up extortion, to J Gould and Standard Oil, or J Kennedy and the entire 1920’s, then the skip over to Reagan’s ‘freedom for corruption’ and the double-down of Bushs-Clinton-Congrrss deregulation of everything(deriviatives), and of course don’t forget your fav and mine, ‘Disaster Capitalism’ for everyone and ‘Doing God’s work’. These guys, and now women are bastards. Have always been. And soft pedalling regulation against them has never, ever worked, save once.(Roosevelt)

Glass Steagall renewal and the end of the Commodities Futures Mod Act is the only solution. And Bernie is our best chance.

”

Continuing to apply band-aids to address a fundamentally flawed system is not destined to end well IMO.”

IF one knows the “system is fundamentally flawed” and does not correct the flaw, that it is destined to not end well-that would be a fact not an opinion.

Our present economic system is “flawed” and there is never any mention of how to correct it.

Ask not why; ask when?

“Ask not why, ask when?”… I like Yoda, and George Bernard Shaw too. When?… In the 100 day period beginning on January 20, 2021. {See the concluding sentence in the comment immediately above yours. :)

Repo is not a derivative, it’s a secured short-term loan.

AIG got killed because of margin calls on CDSes, more specifically loss of its AAA rating (because as long as it had it, it didn’t have to post collateral). The only IR derivatives where the margin call can approximate notional are cross-currency non-principal resetting swaps. Which is why almost everyone now trades principal resetting ones (althought he non-principal resetting are still important in securitisation, but they trade very rarely, definitely not daily. Maybe low hundreds of billions annualy, if that).

My point is not that derivatives trading is not dangerous. My point is that measuring it by notionals is irrelevant and misleading, as majority of derivative volumes are futures and vanilla FX/IR. Most of which would be hard pressed to do a supermassive damage.

Even in 2008, the major crisis driver was credit derivatives (not IR or FX), but very specifically CDS on asset backed securities. Corporate CDS can wreak havoc too, but rarely on a systemic scale (which doesn’t mean they shouldn’t be treated as insurance contracts).

Thank you for your thoughtful reply, Vlade. Am considering the secondary effects if last week’s big spike in overnight funding rates in the repo market had not been corrected, particularly on counterparties to interest rate and currency swaps and futures contracts, but also credit default swaps. Your comments are helpful to me in broadening my understanding. The many comments here and elsewhere about whether this is a productive activity for bank holding companies, quantifying their speculative exposures, operational risks, and internal and external controls, still stands in my mind, but I very much appreciate the time you took.

The only derivative I can comprehend is the one that protects the contract price of farm produce – the rest just looks like gambling with occult rules. Why mainline naked derivatives? They are rationalized as useful because they balance out the losses of currency fluctuations. Those derivatives work in the opposite direction of the price mechanism so doesn’t that make them antithetical to the purpose of “the market”? And when it comes to interest rates, why do zirp and nirp need to be hedged so aggressively? It looks like a market unto itself. One of pointless maintenance costs for the global over-accumulation of capital – and the risks are being phased out because anything beyond the range of zip-nirp would be astronomical – because profits are disappearing. No wonder there is no more “pricing mechanism” – actual prices are no longer important. Would the Fed have taken all these looney measures to stabilize prices otherwise? Therefore the “free market” (the one that allows derivatives to flourish in the first place) has very little if any usefulness.

At Jackson Hole in August BoE’s Mark Carney came forth to announce negative interest rates are necessary, and that a global virtual digital currency is a worthy goal. …I’m sure these ideas are totally unconnected to the froth in the interest rates derivatives markets… (hold on to your hats.)

adding, per Mark Carney interview, August 26th:

Now, in that world we are starting from basically full employment, inflation at target, businesses with a lot of fire power on their own balance sheets, good financial condition, and we’re likely to see some of the catch-up of that investment in the economy pick up. That’s a world, I know it doesn’t sit with the theme of the day, but that’s a world where actually we probably would be raising interest rates at a limited — you know, limited pace, gradual extent. But you get the point. Now, in a world where there’s no deal [Brexit] and there’s no transition, the other extreme, which is a possibility — not a given, but a possibility. Then in that world, you know, we would expect that we would lose demand from Europe in the short term. There probably would be an adjustment domestically as well of consumer spending, so demand goes down. We will have to make a judgment in that world because the supply capacity of the economy will also go down. This is an economy well-integrated to Europe. It is going to take a while for businesses that are very flexible, labor market is flexible, but you have to redeploy that. That takes some time. So, it is the balance of those two effects. On balance, I have said this before, my personal view which we probably would ease into that world, that scenario. But it is not a given and it depends on how it shakes out.

https://www.valuewalk.com/2019/08/mark-carney-boe/

So it’s hard for me to see how proposed neg int rates are anything other than QE for the BoE to bailout the City and Wall St. derivatives…. again.

It’s hard for me to see how proposed negative interest rates are anything but organized financial thievery.

That’s why all citizens should be allowed inherently risk-free individual debit/checking accounts at the Central Bank or Treasury itself FOR FREE up to reasonable limits on account size and transactions per month – as a normal right of citizenship – and government deposit guarantees then abolished as 1) unnecessary and 2) special privilege for banks and the rich, the most so-called credit worthy.

I was with you until: and government deposit guarantees then abolished as 1) unnecessary …

Can’t agree, unfortunately, because it’s the current govt system that has let the derivatives markets get so out of hand.

No reason to think that without govt guarantees on individual deposits the govt would act properly in a crisis. I can imagine the current system acting improperly by, for example, demanding depositor buy-ins to protect the banking system, which has been proposed. Said proposed buy-ins rob small depositors to make whole a banking system undermined by the large gamblers. It puts the risk on the wrong parties (the small depositors), who are left hold the bag as an ‘insurance policy’ for the current system that doesn’t do due diligence for the big players. imo.

Said proposed buy-ins rob small depositors to make whole banking system undermined by the large gamblers. flora

Only if they choose to leave their deposits with an UNINSURED depository institution.

Would you if you had a convenient, inherently risk-free alternative FOR FREE?

And when I say abolish, I don’t mean abrupt cessation of deposit guarantees but progressive abolition to allow the finance system time to adjust and to allow all but 100% voluntary depositors to transfer their deposits to their accounts (set up by default for them?) at the Central Bank or Treasury.

At interest rates already being so low and going negative who is taking the position on the opposite side to these derivatives.

I estimated once that about two thirds of people alive today were born after financial regulation, and have no experience whatsoever with a regulatory regime in which interest rates were tightly regulated — and there were NO interest rate derivatives. None, Zilch. Same thing with currencies, futures of which are much, much larger in trading volume.

Usury law preemption began with Volcker’s “breaking the back of inflation” and was made official by Congress with the Depository Institutions Deregulation and Monetary Control Act of 1980. Interest rate derivatives were very rare before then.

That none of this trading has anything to do with real, productive economic activity is indicated by the fact that London is the largest center, not USA. (Apologists for usury of course will argue that in an international market, buyers will buy where they want, blah, blah.)

If a “bank holiday” al la FDR 1933 were declared in derivatives markets, how much real economic activity would also cease? I would argue almost none, though I would accept an informed argument of a hit of one or two percent.

What happened in 2016?