Yves here. We’re heavy on health matters tonight because the Trump/Ukraine scandal is eating the news. These stats on health insurance costs are damning. And remember these are averages, so think of what it’s like for those who pay even more than the nosebleed levels shown. Our earlier story tonight, on private equity, describes one of the big hidden forces behind the relentless cost rise. And it’s not just physicians’ practices. Private equity has been consolidating hospitals (with less economic success than they had hoped due to state regulation), dialysis centers, rehab centers, medical device makers…..oh, and J&J’s diabetes unit.

The poor prospects for stopping health care industry looting are the biggest reason I am seriously considering becoming an expat, although even the first steps, like figuring out where to go, is daunting.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

Something is seriously wrong with this system.

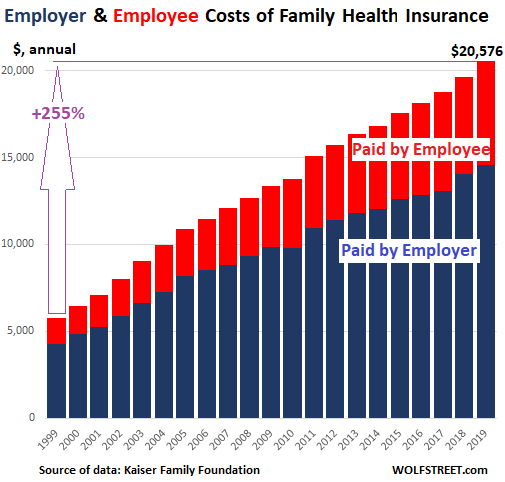

The annual cost of the average health insurance family plan through employers — employer and employee contributions combined – rose another 4.9% in 2019, to $20,576. This is up 255% from 20 years ago, having soared five times faster than the Consumer Price Index (+52%).

Employees paid about 29% of the premium for family coverage ($6,015 annually, red portion) and employers paid about 71% ($14,561 annually, blue portion). Over the past 20 years, the employee contribution has increased by 290%.

These are among the findings of the annual survey of over 2,000 companies, both small (3-199 employees) and large (200+ employees), including non-federal public employers, by the nonprofit Kaiser Family Foundation. Employers and employees both are groaning under the relentlessly ballooning weight of health insurance costs. And the numbers are large: 153 million Americans are covered by employer sponsored health insurance.

At companies with few lower-wage workers, the employee contribution for family coverage was on average $5,968 annually.

But at companies with many lower-wage workers, the employee portion for family coverage was $7,047 annually.

“The single biggest issue in health care for most Americans is that their health costs are growing much faster than their wages are,” KFF CEO Drew Altman said. “Costs are prohibitive when workers making $25,000 a year have to shell out $7,000 a year just for their share of family premiums.”

Many lower-wage workers cannot afford the contributions and forego the health insurance even if their companies offer it. As a result, at companies with many lower-wage workers, only 33% of the workers are covered by the employer’s health insurance, compared to 63% at the other companies.

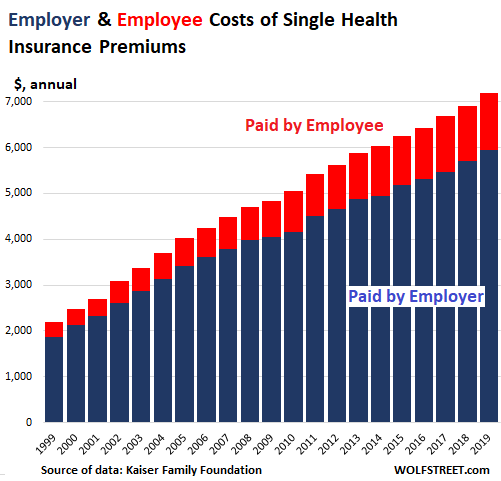

For single coverage of the employee only, the annual cost of the average health insurance premium — employer and employee contributions combined — rose 4.2% in 2019, to $7,188, with the employee paying 17% or $1,242 (up from 14% in 1999) and the employer paying 83% or $5,946 (down from 86% in 1999).

What the above chart shows is that over the past 20 years, the employee contribution to the average single plan has surged by 290%, compared to 52% for CPI. The employer portion has increased 200% over the same period.

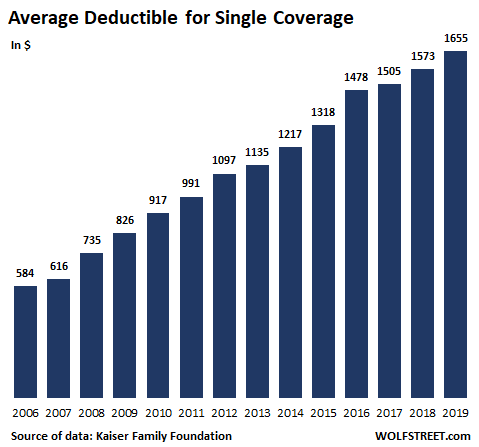

Employers, who over the years have been straining to deal with the surge in these healthcare costs for their employees, have shifted ever more costs directly to the employee. This includes increasing the employee portion of the premium – see above. And it includes raising the deductibles (the portion of medical costs that the employee must pay before the insurance kicks in), copayments (fixed dollar amounts), and coinsurance (a percentage of the charge).

In terms of the deductible by itself, for employee-coverage only (single), the average annual amount in 2019 across all types of plans for employees who have a deductible rose by 5.2% to $1,655. Over the past 20 years, deductibles have increased by 183%:

Not all employees have a deductible, but the proportion has been growing: This year, 82% of employees face a deductible, up from 63% in 2009.

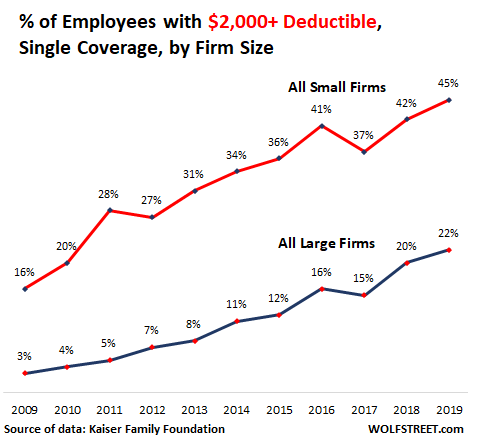

And the deductibles are getting big for a larger number of people: 45% of the employees at small companies have deductibles of at least $2,000, up from 16% in 2009; and at large firms, 22% have deductibles of over $2,000, up from 3% in 2009:

But there are big differences in the amounts of the deductibles by employer size: Employees at small firms (up to 199 employees) get hit with an average annual deductible of $2,271; employees of large firms (200+ employees) face an average deductible of $1,412.

Health care and insurance are large parts of the US economy. Effectively cracking down on the costs of the system would by definition crush the revenues of the companies in that system. And some of those companies would have to restructure and others would disappear.

But in terms of the overall economy, employees and employers would spend or invest the money that they saved on health care and insurance. For employers, it could mean money would be available to expand operations, hire more people, and pay higher wages.

The service sectors are Hopping. The #1 Biggie is Hopping the Fastest. It all adds to GDP! Read… The Financialization of the US Economy

Regarding your expat comment, I seriously regret returning to the US a few years ago. Biggest life mistake I made. It’s much worse than I thought it would be, and watching the frogs boil is excruciating. I really wish I would have stayed overseas, and it’s going to be much more difficult to move back now, but I am going as soon as the kids are set out of college. A village hut in Asia will be paradise compared to what is going to hit this country.

I recently moved into a new job and the health care benefits, which are considered some of the best available, are a joke. Pay massive monthly fees or pay massive deductibles, oh but we’ll give you these pre-tax accounts you can stuff with money to pay for it. Oh and deductibles after you pay your deductibles are called “co-insurance”. We’ll pay 100% for “preventative”. Things like um, well not Doctor visits, not prescriptions, not anything really.

Anyone with a family in a 5 figure income bracket would be paying 25-50% of their take home pay in health care costs. I can go overseas, pay 12% income tax and free health care. I can pay through the nose for real estate, take a massive pay cut and still be way ahead, if they don’t come after me with pitchforks because I’m American.

One of the challenges of being in the world’s largest economy in one of the physically largest countries with a moat on three sides is that it is easy for most people to live in obliviousness to what the rest of the world is doing.

The other countries with smaller populations or lots of interactions with neighboring countries have lots of opportunities to see and understand what other countries are doing and liberally steal ideas or learn from others experiences. There are several models out there that have been shown to work well if executed properly with adequate funding (half to two-thirds US expenditures per capita). Instead American Exceptionalism means that there is nothing to learn from abroad except art and food.

The inordinate American fear of “higher taxes” and “regulation” means that Americans are willing to pay twice as much to the private sector as other countries pay in taxes or regulated prices in the private sector. Freedom can be very, very expensive.

you say that as if there’s no turning back, but you can always (try to) be an expat again, right? even if you turned down an opportunity i’m sure there are or will be others.

it may already be rational price-wise to get dental work done outside the US; i’ve heard a handful of people on return to US telling border agents the purpose of their trip was getting dental work done. unclear if they have “coverage” or whatever of course but has the nice add on effect of keeping money away from the US system.

We moved back to California from Australia 3 years ago. If I consider my portion of health coverage a “tax”, then my “taxes” in Australia were lower than they are here in the US. But since I’m paying a private company (more money for lessor service) rather than the government, it’s a-ok by American standards.

Hell, we pay more per month in health premiums than we do for our mortgage! For a plan that cost me, out of pocket, $3000 and counting recently for an ER visit thanks to a broken collar bone (deductible + ER copay + ambulance copay + Othro visits + Xrays…). Beast of all… my first “facilities” bill was overdue before I received the “professional” bill which was the only way I’d ever figure out what the holy hell all their numbers meant. $15 covered on a $70 x-ray, why? Or $2600 facilities fee to walk into the ER’s Xray room!?

I learned long ago to not pay something I didn’t understand, as it was easier to rectify the bill if I hadn’t paid it yet.

If anything major were to happen, it’d be far cheaper for us to buy airline tickets and get private (so, not even public!) procedures in Australia. Just doesn’t work well in emergencies…

And on top of this horror show, it seems to me that the insurance companies have also discovered that it’s profitable to make their, um, “customers” work very hard and demonstrate uncommon wherewithal in order to get them to actually honor their agreements even if you do win the surprise billing lottery and ostensibly have coverage for the care you received.

This is very true. It took over a year of persistent and tenacious work to get my first child’s postpartum care paid. For procedures that insurance is legally obligated to cover. The issue was resolved only when we got the state insurance regulator involved.

Of course we were not compensating for the time we invested.

And of course the anesthesiologist (who had an exclusive contract with the hospital and was therefore the only option) was “out of network” and the insurance company tried to dodge that as well.

What a joke.

RE: Wolf Richter: How Employees & Employers Get Bled by Health Insurance.

Solution: Expat yourself to CANADA!! Its certain that Medicare for all, will be the same political football for decades if not Centuries.

The Canadiens will not take in American precariats. The wealthy and in demand credentialed professionals, sure. I check every few years with futile results.

This article doesn’t even mention costs besides the premium and deductible, which are equally outrageous. Out-of-pocket costs like co-insurance and prescriptions have skyrocketed. And I agree with other commenters, the amount of hassle and hair-pulling involved in getting an insurer to actually pay for anything, and the gimlet-eyed determination of health providers to get paid the instant you walk into their office, have turned the process of getting health care into literal torture. And we inflict this on people with serious and chronic health conditions.

Anyone who supports the current system, especially the politicians, has blood on their hands. The entire system should be burned to the ground.

Numbers don’t lie and these are statistics that should probably be taught in American high schools to prep everyone for the real world.

To play devil’s advocate, it would be important to consider quality of outcomes, wait times as well as access to newest and typically best pharma (as everyone loves to jump on the Canada healthcare band wagon as probably it’s nearest and dearest) across a range of common ailments including cancer, simple & high frequency surgeries, bone breaks etc in America vs other G7 compatriots….including Canada Japan and the EU member states. I think you will find some interesting data there.

The following is not yet true.

======

Cuban healthcare provider AmerigoBueno announced the latest addition to its fleet of CareVessel ships. The company has assembled its fleet of health-care hospital ships from the bankruptcy sales of former cruise ship operators.

The latest CareVessel will ply the northeastern U.S. coastline, along with seven other sister-ships, providing daily stops in Washington, DC, Baltimore, Philadelphia, New York, and Boston. The ships take on patients at one stop, perform various health care functions, and drop the patients off at the next stop along the way.

The cost of most procedures is less than half of what the patient would pay if the work was done domestically. The CareVessels are able to provide these savings because staff wages are at world rates, not U.S. domestic rates. The doctors are trained outside the expensive U.S. medical schools, and they use drugs obtained on the global market. Management is very lean and efficient. The facilities costs are a fraction of what U.S. hospitals must pay; the ships merely pay momentary berthing fees instead of expensive real estate mortgages.

Of course, not all procedures can be performed on a CareVessel, but most routine operations that don’t involve long recovery periods can be performed on-vessel.

To see a cost comparison between CareVessel and domestic hospital charges for typical operations, visit the company’s website at http://www.FightBackHealthPlan.com

======= remember, that was a fictitious story.

Your link doesn’t work.

Of the doctors I’ve seen recently… maybe 60% were educated in the US.

Of course this is leaving out worker’s comp which in California, for example, is astronomical. Worker’s comp is healthcare with settlement money thrown in at the end and temporary disability payments and the amount of treatment is not dictated by common sense but by plaintiff attorneys to a large degree. Back ache with physical therapy or no treatment is one thing but it is not in the attorney’s interest so what we get is back surgery with plates and screws, astronomical costs etc. Look up “operation spinal tap” on the internet. Anyone who has a manufacturing business in Ca is out of their mind. Most employers have only warehouse and automated operations in the state. The rest gets outsourced to Asia or Mexico.

The information age is slowly turning the tide, even if most of it is just young malleable people. We all just need to keep sharing the info like this article.

So it’s just as well that Jeremy Corbyn announced that a Labour government in the UK would institute a generics drugs manufacturer to supply drugs at cost to the NHS. It would also re-fund the health service to make it truly free at point of service and deny US healthcare companies the chance to move in and take over UK healthcare at the profitable points. Given the crazed behavior of PM Johnson, and general sucking-up to Trump’s agenda, Brits can’t wait for a general election that would put Labour in power.