This is Naked Capitalism fundraising week. 1672 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in the financial realm. Please join us and participate via our donation page, which shows how to give via check, credit card, debit card, or PayPal. Read about why we’re doing this fundraiser and what we’ve accomplished in the last year, and our current goal, more original reporting.

By Michael Pettis, an expert on China’s economy, and professor of finance at Peking University’s Guanghua School of Management, where he specializes in Chinese financial markets. Cross-posted from his blog.

Modern monetary theory (MMT) isn’t discussed much in Chinese universities as far as I can tell, except by a few of my Chinese friends and former students who mostly work in banking and finance. Analysts abroad often claim that China is somehow proof that MMT “works,” but to me and most of my Chinese friends, this statement is either unintelligible or just wrong.

Every Sunday afternoon, a few of the brightest math, finance, and economics students from Peking University converge on my courtyard house for an informal seminar on debt-related issues. For our first meeting of the new school year, I had them read up on MMT and research the MMT debate so that we could work out how it might apply to their own thinking.

From these readings (including a 1943 piece on “functional finance” by economist Abba Lerner), we assume that the key insight of MMT is not that debt doesn’t matter, as mistaken stereotypical views seem to assume, but rather that governments that issue their own fiat currency have no funding constraints insofar as they do not need to issue debt or raise taxes to spend money. They simply budget the expenditure, and then go ahead and spend the money.

There is a lot of confusion about this. A January 2019 Financial Times article had this to say:

Advocates for modern monetary theory argue that, for a sovereign country with its own currency, there is no inherently unacceptable level of government debt—that country does not automatically begin to collapse when debt reaches 90 per cent of GDP, or even 200 per cent of GDP. The country appropriates what it believes is necessary for domestic programs, regardless of revenue.

This, however, is almost certainly an unfair caricature of MMT. It assumes that if a country increases debt to fund spending until the economy is at capacity, it will cause the country’s debt-to-GDP ratio to rise. But if government spending directly or indirectly causes productive investment to rise in line with the debt, this kind of spending increases both debt and GDP, so neither the debt ratio nor the debt burden changes.

It is only when money is borrowed (or created) and spent in ways that do not cause GDP to rise that the debt burden rises. For that reason, a rising debt-to-GDP ratio over the medium term is almost prima facie evidence that the government should cut back its spending (over the short-term there can be timing differences between when an investment is made and when it starts to pay off). This is also true of inflation: if the government “prints money” to spend on projects that reduce excess capacity or employ workers productively, the result will not be inflationary to the extent that the increase in demand caused by printing the money will be matched by an increase in supply.

What MMT actually does say is that governments must issue debt or raise taxes if either is necessary to control the potentially adverse economic impact of the additional demand created by spending the additional money. As Lerner puts it:

The first financial responsibility of the government (since nobody else can undertake that responsibility) is to keep the total rate of spending in the country on goods and services neither greater nor less than that rate which at the current prices would buy all the goods that it is possible to produce. If total spending is allowed to go above this there will be inflation, and if it is allowed to go below this there will be unemployment. The government can increase total spending by spending more itself or by reducing taxes so that the taxpayers have more money left to spend. It can reduce total spending by spending less itself or by raising taxes so that taxpayers have less money left to spend. By these means total spending can be kept at the required level, where it will be enough to buy the goods that can be produced by all who want to work, and yet not enough to bring inflation by demanding (at current prices) more than can be produced.

Lerner points out that this idea, “like almost every important discovery,” is very simple (albeit counterintuitive), to the point that when academics understand it, they often dismiss it as “merely logical.” He goes on to explain:

An interesting, and to many a shocking, corollary is that taxing is never to be undertaken merely because the government needs to make money payments. According to the principles of Functional Finance, taxation must be judged only by its effects. Its main effects are two: the taxpayer has less money left to spend and the government has more money. The second effect can be brought about so much more easily by printing the money that only the first effect is significant. Taxation should therefore be imposed only when it is desirable that the taxpayers shall have less money to spend, for example, when they would otherwise spend enough to bring about inflation.

This seems to be where much of the confusion lies. One of the main criticisms of MMT is that it seems to imply to some people that governments can spend on any project they like without worrying about the consequences. By extension, these critics also assume that for this reason there are no effective limits to government borrowing: debt can always be serviced by creating additional fiat money for the sole purpose of servicing the debt.

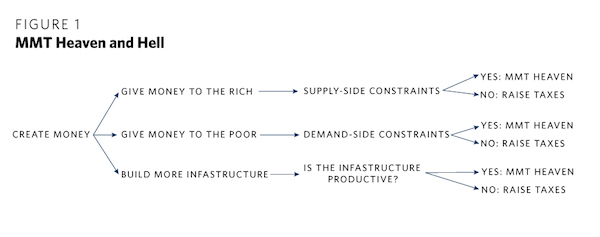

To sort through these various claims, our seminar decided to concentrate on the conditions under which there are no intrinsic constraints on government spending, a state that can be called MMT heaven. We also considered the conditions under which there are constraints, in which case governments would have to raise taxes to balance the government expenditures. To simplify matters, we decided that the government could basically spend the money in three ways:

- Give to the rich: The government can fund projects that effectively give money to businesses or the rich, who, for simplicity’s sake, can be defined as entities who consume little or none of any incremental increase in income and who therefore save all or most of it. The government can do this by cutting taxes on businesses and the rich, or by engaging in polices that directly or indirectly increase the income or wealth of the rich, such as certain kinds of quantitative easing, which tend to cause a rise in the prices of assets, most of which are owned by the rich.

- Give to the poor: The government can fund projects that effectively give money to average or poor households, who can be defined as entities who consume most of any incremental increase in income and who therefore save little of it. The government can do so by cutting taxes, funding social safety nets, creating jobs, or setting minimum basic income policies, and so on.

- Build infrastructure: The government can also spend more on infrastructure.

In all three of these cases, the bottom line is this: if the government can spend these additional funds in ways that make GDP grow faster than debt, politicians don’t have to worry about runaway inflation or the piling up of debt. But if this money isn’t used productively, the opposite is true. The flowchart below shows how each of these forms of government spending might or might not affect the economy.

Give More Money to the Rich

Taking the first case, assume that the government implements central bank or fiscal policies that effectively deliver additional income to the rich, who (by definition) save all or most of these proceeds. These policies could be enacted under two different sets of circumstances. In the first scenario, assume that there are supply-side constraints on investment and that interest rates are quite high. Businesses have many profitable investment opportunities that would increase productivity, in other words, but they are unable to invest in many or most of them because the cost of capital exceeds the risk-adjusted expected return. To put things another way, desired investment in this economy exceeds actual investment.

Under these conditions, creating money and passing it on to the rich may lead at first to inflation, depending on how tight the resources and labor markets are, but this effect should be temporary. These policies increase savings and consequently lower the cost of capital. This causes businesses to invest more and labor productivity to increase, so the total value of goods and services produced in the economy (GDP) also rises. Because GDP goes up by more than the amount of additional money created, in the end there is no inflation and the additional value created is more than enough to service the debt.

Essentially, the government can create money or debt, so to speak, to fund transfers to businesses or to the rich without worrying about funding the expenditures through taxes or borrowing. This is what is meant by MMT heaven.

But now assume that there are no supply-side constraints on investment: this second scenario looks a lot like today’s world, with low interest rates, weak demand, and businesses hoarding huge amounts of cash for which they can find little purpose beyond speculating on stock buybacks or acquisitions. The reason businesses don’t invest, in other words, is not because they cannot access reasonably priced capital but rather because demand for their products is too weak to justify investing in additional capacity.

If that is the case, what happens when the government borrows or creates money and passes it on to the rich? As I discussed in a June 2017 blog post, when such policies are enacted under such conditions, there is no corresponding increase in investment because the inability to access savings was never a constraint on investment. This also means that, in a closed economy (or in an open economy whose capital account, like that of the United States, is determined by foreign conditions), there can be no increase in savings within the economy. This might sound strange, given that the savings of the rich definitely would have increased, but this only means that the increase in the savings of the rich had to result in a decrease in savings elsewhere in the economy. (In an open economy, of course, the increase in the savings of the rich would flow out in the form of a capital account deficit.)

There are many ways that savings in another part of the economy could decline. If the government borrowed the money, for instance, the corresponding decrease in savings could be explained by a rise in government debt (which is just negative savings). If instead the central bank created the money and used it to buy assets, the resulting rise in asset prices could create a wealth effect that would cause households to consume a larger share of their income (and therefore save less), or it could cause lenders to lower their lending standards and encourage a rise in household debt. Or if the increase in savings were to flow abroad, it would be matched by a current account surplus as some of the goods produced at home were exported. The larger point is that, however it happens, because the increase in domestic or foreign demand is not met by an increase in the value of goods and services produced, ultimately these policies enacted under these conditions must result in higher inflation, which in turn would reduce real household income to balance out the increase in the wealth of the rich.

A second adverse effect could easily occur too. Because this policy effectively would transfer wealth from the poor to the rich, there would be a net reduction in consumption. In a closed economy (or in an economy that has little or no control over its capital account, as I explain here) that net reduction would result in a further decrease in business investment and with it, by necessity, a further decrease in national savings, driven by a rise in unemployment, household debt, or the fiscal deficit.

Again, creating or borrowing money does not increase a country’s wealth unless doing so results directly or indirectly in an increase in productive investment. In this second scenario, creating or borrowing money and passing it on to businesses or the rich only redistributes wealth from those who did not benefit from government policies to those who did. That requires that the government raise taxes to reduce demand and prevent unwanted inflation.

Give More Money to the Poor

In the second case, the government enacts policies that directly or indirectly give more money to average or poor households. Again, these policies could be enacted in two different scenarios. For the first scenario, assume that the economy operates under demand-side constraints. This mean that the economy suffers from weak demand—consumption and investment—and that there is resource and labor slack, or inefficiencies in the economy.

Under these circumstances, delivering money to the poor directly boosts consumption (because, by definition, they consume most additional income) and indirectly boosts investment as businesses increase capacity to meet this additional demand. There are various iterations in which the increase in household income would be partly consumed and partly saved, with the saved portion funding new investment to serve the increase in consumption, which further increases household income and, in doing so, creates additional consumption and savings, and so on. The basic arithmetic (found in any introductory economics textbook) isn’t worth getting into, but it is easy to show that as long as there is slack in the economy, both investment and savings will rise as consumption is boosted.

Once again, the result is MMT heaven. The government can create money or debt, so to speak, to fund transfers to the poor, but because the consequence is that investment grows by at least as much as the amount of money or debt, there is neither inflation nor an increase in the country’s debt burden (as the debt grows by less than GDP does, which is a proxy for debt-servicing capacity).

In the second scenario, however, assume that there are no demand side constraints. In such a world, growth is constrained by high costs of capital, regulations, or other supply-side constraints. Under these conditions, delivering money to the poor boosts consumption, but because the supply-side constraints aren’t addressed there is no equivalent boost in investment or GDP. This means that, at current prices, total demand for goods and services has risen with no equivalent rise in the supply, so the country must suffer from inflation or, if unlike the United States it has control over its current account, it must run a trade deficit, which is balanced by equivalent capital outflows. The way to prevent either outcome is for the government to raise taxes enough to reduce aggregate demand to its original level.

Spend Money on Infrastructure

For the third case, a government could pour money into building new infrastructure. Again, assume that this policy could be enacted under one of two scenarios: either there is substantial room for productive infrastructure spending or there isn’t. In the first scenario, if the government creates debt or money to fund productive infrastructure spending, the result is MMT heaven once again because the total value of GDP—that is, the goods and services produced by the economy—rises faster than the money created, so there is no inflation, and rises faster than the debt created, so the country’s debt burden doesn’t increase.

In the second scenario, government spending on infrastructure is largely nonproductive and creates little value for the economy—as is the case in China today. This time, the consequences are a little more complicated because they can involve wealth transfers from one group to another. But ultimately, either money increases faster than the value of goods and services produced, in which case there is inflation, or debt rises faster than the country’s overall debt-servicing capacity.

For an example of MMT working under the first scenario, consider China in the 1990s. Money creation and debt went mostly to fund businesses and the rich (as ordinary households were forced to heavily subsidize borrowing costs), thus forcing up Chinese savings rates; the proceeds were then poured into productive investment, generating enough growth to trickle down to the poor at a substantial rate. Perhaps that is what people mean when they say that China supposedly proves the validity of MMT. There seemed to be no constraints on the country’s ability to expand its money supply directly or via increases in debt because real GDP grew at least as quickly as the money supply and the debt, so there was little inflation and no increase in the country’s debt burden (since debt grew no faster than GDP).

More recently, however, China represents the second scenario. Money creation or debt still go mostly to fund businesses and the rich, but there are few productive investment opportunities left. Although investment still continues to rise quickly, much of this investment is nonproductive and only shows up as increases in GDP because the entities responsible for the investment are not subject to hard budget constraints, so they never write down bad investments on the books. That being the case, debt creation causes a surge in the country’s debt burden as debt rises much faster than the country’s debt-servicing capacity. Because of the distribution of income, money creation shows up more as asset price inflation than as consumer price inflation.

When Do Increases in Money or Debt Matter?

As always in economics, it depends on the circumstances. It is easy to consider cases in which rising debt or money creation results in an equivalent or greater increase in total GDP or debt-servicing capacity. In such cases, in the aggregate, an increase in debt or money mostly doesn’t matter insofar as it results in greater wealth and a declining debt burden. It is also easy to consider cases in which rising debt or money creation doesn’t result in an equivalent increase in total debt-servicing capacity. In these scenarios, in the aggregate, it does matter because rising debt or money results in less wealth due to inflation and/or a rising debt burden.

For simplicity’s sake, it can be assumed that rising debt or money creation doesn’t matter under the following conditions that characterize MMT heaven:

- When it involves a transfer of wealth to the rich or to businesses—in a way that boosts domestic savings—in a supply-constrained economy with high capital costs (typically, developing countries);

- When it involves a transfer of wealth to the poor in a demand-constrained economy with a great deal of slack or inefficiency (most advanced economies today);

- When it involves the building of needed infrastructure.

All that being said, I don’t want to be too cavalier about rising nominal debt levels. Balance sheet conditions and constraints matter to a country’s future economic growth in at least three ways not discussed above.

First, an economy driven by rising debt tends to adjust in ways that systematically incorporate strong positive feedback mechanisms (as I explain here), pushing domestic balance sheets away from their optimal structures. These balance sheet mismatches can lead to suboptimal resource allocation and can cause future growth to slow.

Second, high levels of debt directly increase the volatility of earnings and income, so a country with more debt has less room to withstand temporary shocks, even if more debt comes with more assets that can service the debt over time.

Third, when debt levels are high enough and balance sheets sufficiently fragile that there is uncertainty about how future debt-servicing costs will eventually be allocated, the different sectors of the economy that might be forced to absorb the debt-servicing costs will change their behavior in ways designed to protect themselves. As financial distress theory shows, the ways in which they change their behavior almost always reduce growth, further increase balance sheet fragility, or both.

It is not clear to me that pure money creation under the positive circumstances listed above comes with comparable problems, so perhaps this means that governments should fund wealth-enhancing income transfers or productive investment mainly by creating money, not by borrowing. This suggests that hard-core MMT proponents are right when they say that governments don’t borrow or raise taxes to fund spending. Instead, they simply spend. The purpose of borrowing or raising taxes in those circumstances is to counter the impact that MMT can have in some cases, but not in all.

There are, on the other hand, cases in which governments can simply create money or borrow with no ill effects, that is to say, with no inflationary impact and no increase in the debt burden. As always in economics, the outcome depends on the underlying conditions.

So how do these insights apply to the world today? If they so choose, the U.S. and European governments should be able to create money or debt with no ill effects if the proceeds were used to fund needed infrastructure or to reverse income inequality by increasing the incomes of the poor and middle classes. Either way, productive investment would rise faster than debt or the money supply, as would the total value of goods and service produced.

As for China, money or debt can no longer be used to fund infrastructure because the resulting increases (in money or debt) will not be matched by increases in real GDP. Beijing should, however, be able to create money or debt with no ill effects if the proceeds were used to reverse income inequality by increasing the incomes of the poor and middle classes.

Wow, thanks for this – I’d always wondered where Michael Pettis stood with regard to MMT – this is very illuminating and interesting.

It does however highlight something I’d always wondered about China’s economic policy – their response to anything looking remotely like a slow down has always been to pump money directly or indirectly into physical infrastructure, rather than address the many glaring social needs within the country – just as one example helping the many older Chinese who have lost pensions due to fraud. I wonder if its a failure of the imagination, structural issues within the government, or just plain corruption.

He always used the accounting identities that MMTers use to explain their models -for instance I have read paragraphs from Parenteau and Pettis explaining exactly the same- so I guessed that Pettis was receptive to MMT. I was shocked to read about those ‘stereotypical’ visions that say MMT states debt doesn’t matter. It looks pretty much like reading MMT without being able to remove the Loanable Funds framework whose models explicitly say that debt doesn’t matters. The debt of someone is just the asset of another one.

Yes, every time I read his articles I felt he was giving an MMT type analysis, but he never mentioned MMT at any time – I’d wondered if I was missing something.

Wynne Godley’s “Monetary Economics”

I too, and suspect some degree of central pressure to avoid letting the MMT cat out of the bag. He probably wants to continue to live and teach in China.

The Chinese gumment learned from the USA to only give money to the rich and large corporations and not to the poor. /s

I’m also very happy to see his take on mmt…

It’s always seemed he looks at an economy from an accountants perspective, much like mmt does. What I like about his easy to follow presentation is that it is a cookbook for politicians; first identify the current conditions, then determine policy. Never a better time for spending on infrastructure in US/ Europe, and long past time for such spending in China.

I’ve long preferred infra to a Jobs Guarantee because our stuff is falling apart, plus strong popular support, easier to pass. My own wrinkle is to focus on states or more districts with highest unemployment.

“the many glaring social needs in the country” – that sounds like you have the wrong country PK, even the wrong continent. Excuse me speaking frankly.

Someone please tell us why Japan, with a debt-to-GDP ratio north of 200% for the past twenty years and now around 250%, does not seem to be in much trouble.

Because bondholders[.]

They get by on less. A lot less. And old people work – everywhere. And they have ancient infrastructure. A glimpse of America’s future.

Japan has ancient infrastructure? The bullet train system continues to expand. Airports and rail stations have been renovated. I see changes every time I visit, once a year. What are you talking about? Housing stock? Water and sewerage (no problem I’m aware of, and nowhere near as old as NY, because of the war)? If anything, too many civil engineering projects in the countryside and along coasts.

Ancient infrastructure? I’m sorry, what? They have too damn much infrastructure, so much so that they regularly have to knock bits of it down to make room to build something new. In place a military-industrial complex Japan has a construction complex that wields enormous ower. Remember that whole bridge to no where thing we had in Alaska? Japan is an entire country of that, all the time.

All good policy starts by assessing the desired outcome and figuring out a path given current and near term constraints to get there. A key component of MMT is reminding policy makers that if their currency is fully sovereign (meaning they issue it, their debts are denominated in it, they collect taxes in it, and key, their currency floats on the forex market) then they are not fiscally constrained. As you have correctly reminded people that does not mean they are not constrained at all, there are other factors that need to be considered as constraints to policy options. O that policy choices could turn out to be in error or have unintended effects that could lead to less than optimal outcomes.

My biggest quibble is your example of using “Giving Money to Rich People”. Yes, MMT would say that if the supply-side effects occurred it would lead to growth; but what I can’t see is anyone from the MMT background suggesting it as policy. Not because they are all anti-rich people, but that it is almost certainly not the optimal policy choice ever. One should start by asking why is the country capital constrained. It is never because of the lack of existing savings. It is credit creation (investment) that leads to savings. The policy question should be why is the nations financial system not extending sufficient credit to fund investments? If it is because interest rates are too high then monetary policy would likely be the better policy tool – MMT doesn’t say there is no use for monetary policy (side note, if capital flight is a worry, MMT would remind people that capital controls are real tools even if it’s heresy to some). Since banks are capital (equity) constrained it could be do to having insufficiently capitalized banks. In this case one should/could directly address this issue with a fiscal spend, direct investment into the banking system; government owned investment bank where equity can be fiscally replenished periodically; etc… But giving money to rich people ASSUMING they’ll capitalize the financial system or spend it on new business expansion/ventures is just a recipe for failure or even disaster.

I have really appreciated Pettis in the past (used to follow his ‘blog years ago) and I’m glad that he has a clearer understanding of MMT than the financial press tends to, but I get occasional hints in this that he continues to interpret MMT through a more mainstream economics lens (“debt burden”, for example, which is an oxymoron for a sovereign fiat-issuer, I think),

An example:

” These policies increase savings and consequently lower the cost of capital.”

looks to me to an instance of the “loanable-funds” fallacy.

The emphasis on GDP as the fundamental metric also seems IMO misguided. Policies that led to full employment at living wages might reduce GDP (if it starved less useful sectors of the economy — parasitic finance, for example) and increase debt/GDP.

The way GDP and inflation are so flawed and to use any of these as a base to explain MMT is also flawed.

Absolutely. You can almost see loanable funds, the paradox of thrift, crowding out etc. in this piece. What makes it less than obvious is that he’s not showing the equations he’s using in his head, and how the equations interlock!

This was a beautiful exposition, in the way some mathematical proofs can be beautiful. Some old Keynesians sniff that MMT is “merely” a different way to talk about Keynesian theory, but even if that is all it is, as far as I’m concerned it’s a tremendous accomplishment. It’s rare to say so much about economics without a single formula or line graph.

I do feel, though, that all MMT discussions will need soon to nod in the direction of climate change. That is a prime example nowadays of a reason it is “necessary to control the potentially adverse economic impact of the additional demand created by spending.” And more than just economic impact. This is especially true for China, which produces more than one-quarter of the world’s greenhouse gas emissions, still increasing.

From a climate perspective, there are lots of ways China can still spend usefully on infrastructure and increase real GDP, replacing coal plants being #1. But I don’t know how that would show up in Chinese GDP figures or balance sheets, since it is only avoiding long-term losses, and the majority of the benefits will accrue to people outside China. What does MMT have to say about that?

In this regard, I’d point to a 2018 paper by Christensen, Gillingham, and Nordhaus, “Uncertainty in forecasts of long-run economic growth,” which argues that there is a one in three risk of reaching something called RCP 8.5 this century. RCP 8.5 is kind of a worst-case climate scenario, perhaps the civilization-ending kind. The main risk factor the paper identifies is higher-than-expected economic growth in developing countries, particularly China. MMT theorists, like all of us, should be careful what they wish for.

Is there really any ideology that addresses Global Baking? The acid test: will it allow the US to annex Canada?

Apparently, China is already on the march northward, setting up agriculture in Southern Siberia.

Very interesting. It reminded me of something I had long forgotten: the “stop-go” economic policies in Britain in the 60s and 70s. Essentially, in an attempt to keep full employment, governments would stimulate the economy by various means. In the days of very high marginal rates of income tax, this meant, for the most part, “giving money to poor people”, or at least to the average citizen. This increased purchasing power, but the expected increase in investment by manufacturers never materialised. The latter, in spite of then-dominant economic theories, reacted by putting up their prices rather than producing more. As a result, exports flooded in, inflation rose, the pound collapsed, and measures had to be taken to “cool” the economy. Of course, we no longer care about trade imbalances, and currencies have been floated, but it still seems to me that the weakness of any stimulus is the preparedness and ability of the private sector to respond to it. Even if supply is not constrained in theory, it can be constrained in practice.

The US Bureau of Economic Analysis (BEA) makes interactive tables available for examination. According to the the BEA’s “Value Added by Industry as a Percentage of Gross Domestic Product” table, agriculture/mining/manufacturing dropped from 15% of GDP to 13.8% since 2010. These are areas that, to ordinary laymen, represent the productive part of GDP — actual production of things.

But this decline has been offset by the increase in the finance component from 19.6% to 20.7% of GDP.

We therefore see that ag/mining/manufacture can drop a further 13% as long as the drop is offset by a corresponding 13% increase in finance.

Of note, “Federal Reserve banks, credit intermediation, and related activities” comprises a meager 3.1% of GDP. A massive increase in credit intermediation will immediately increase GDP, to the benefit of all. MMT helps policymakers identify and implement such strategies.

Oh, where to begin.

1.) I’ll start with the rich being savers, “by definition”. Watch out for the assumptions embedded in definitions! So, what I see here in my gentrifying neighbourhood, is that the rich don’t ‘save’, they invest, either directly or else indirectly, that is through corporations in which they hold shares or loan money to (bonds), mutual or pension funds which do the same, or just plain old bank deposits earning interest. Investment *always* is looking for a return. Money sovereigns — which includes banks here in Canada, since they have no reserve requirements for their lending — can create principal but not interest. Currently, the Cdn govt has not adopted MMT, being still keen on austerity. However, Canadian banks have embraced MMT with gusto since 1985 (Canada Banking Act of 1985). So, Canadian banks can can create principal at no cost (well, yes, there are overheads) and an asset (house, condo development, rental units) is worth whatever a bank will lend to purchase it. Result: housing prices rise astronomically. EG, my little two-story brick house, purchased in early ’80’s for $40k; my cross-the-street neighbours’ smaller vinyl-sided story-and-a half sold this past spring for a cool million the first day it was listed. That’s insane. And remember, MMT only creates the principal, the interest is ‘real’ money, ie earned by people from jobs, so, a redistribution of previously-created monay, and in the case of a mortgage, greatly exceeds the amount of the principal over the life of the mortgage.

2.) Very few countries anymore can buy every good or service they need domestically. PERI’s Matías Vernengo discusses this with The Real News’ Greg Wilpert from the point of view of a developing country, but similar constraints apply to ‘First’ World countries that have voluntarily hollowed out their manufacturing capacity (eg, US, UK, Canada), lack critical raw materials (eg. UK, China), or have criminally insane leadership (take your pick).

3.) Another assumption is that the purpose of human life is to increase wealth.

We really, really have to get over the assumption that wealth is the ultimate goal and only meaningful measure of humanity, and that more must be better.

When the world runs out of productive investments, old ideas about debt and debt servicing no longer apply. MP did recommend that China, now “developed”, should apply the rules of MMT to raise the living standards of its poorest citizens. But he also said that supply side would not work, aka more investments. But he avoided saying that if China does do demand side infusions of money it could rapidly create an imbalance of demand (because China’s population is so enormous) and set off either a spiral of inflation and/or frivolous growth. China can’t continue to be a giant mercantilist in world so saturated with consumer products and so environmentally devastated; a world of foolish neoliberal capitalist competition. MP sounded like he was playing Debt-Whack-a-Mole. Or Whack-an-Accounting-Identity. Which sounded very neoliberal – always tracking money flows, counting beans, considering the environment and human well-being as random variables; just obsessed with tracking money flows; returns; and debt as somebody’s asset. In the last paragraphs he seemed to come to his better senses and credited MMT with the best idea in all of modern economics – Direct Spending. The picture here is one of an investor In China, either in debt or equities, looking at how volatile China’s population could be, and will be, unless they nip inequality in the bud. Oh god, we could lose our entire investment unless these guys pace themselves.

Thank you Susan, that’s quite prescient. I believe if a change is to come, to avoid inflation and/or the frivolous growth you mention, it will come from the people.

While this MMT analysis is great, there needs to be a followup analysis on the moral imperative essential to any successful society. Without some moral framework directing society, you just have a bureaucratic shell- a soulless society- or a divided one.

Deciding what to produce is predicated on what kind of society you are trying to create. That takes planning and leadership dedicated to social welfare. Welfare for whom? For all- for the few? In the West, social welfare for all seems to be of secondary concern, a happy byproduct, to be appreciated when available, of no concern if circumstances prevent its formation. The weak and poor are seen as destine to suffer- and to serve.

That sentiment is simply best expressed in the phrase, ” heads I win, tales you loose”- and then the people are told to deal with the consequences- to accept their suffering- and if for some reason these poor cry out for justice and something more, they will be browbeaten into acceptance of their lot with tales of overpopulation and their inherent worthlessness- they are conditioned to desire worthless products in order to keep a vicious cycle of wasteful consumption flowing.

Getting people to understand that there is no monetary restraint on attempting to achieve some social aim is impossible without a certain type of moral framework. A framework supporting the majority is different from a framework supporting an elite. The elite show no moral uncertainty toward their own interests so they consistently prevail. Their moral authority comes from their desire to rule and to dominate. The moral certitude of the masses is always thrown into doubt- so this group consistently looses.

MMT seems like a great tool for societies on the upward slope in development- a nightmare for those on the downward slide. Maybe that should be the definition of a corrupt and illegitimate government- are the authorities using the power of sovereign currency to enrich the elite- or improving the lives of the citizens of a nation.

This notion seems to prove the need for a multipolar world. A Republic of individual states is probably the best humans are capable of on a planetary scale- individual States able to protect their borders and live in peace.

That is a vision worth working towards. But then again, such a simple view will be ridiculed by the elites as naive and impractical- once again, a self-serving view. Kill the peacemakers follows next.

A moral argument must be made, backed up with technical truth and maturity. Without that moral argument, MMT can be used for anything, and those more powerful and violent will reap the benefits- or continue to reap the benefits in another form.

“If” and “could”…

Can this be re-written addressing directly what “IS”?

” . . . a rising debt-to-GDP ratio over the medium term is almost prima facie evidence that the government should cut back its spending.”

Actually, that is a common belief, but has not been the case

Historically, there is no relationship between the Debt-GDP ratio and inflation.

I’m not an economist, but I think I’m gradually getting my head around what MMT is and what it isn’t.

Admittedly, this article is explicitly about China and the USA, but I notice the same issue I find with so much written about MMT: it has precious little to say about small, developing countries.

Adam 1 above says “A key component of MMT is reminding policy makers that if their currency is fully sovereign (meaning they issue it, their debts are denominated in it, they collect taxes in it, and key, their currency floats on the forex market) then they are not fiscally constrained.” Just how does a small developing country go about getting its debts denominated in its own currency? And if it can’t, what relevance does MMT have for it? I have seen answers to these questions, but they are usually very brief and not particularly convincing.

I will watch the video with PERI’s Matías Vernengo suggested by HotFlash, but I’d like to see more from Naked Capitalism or its commenters about this. It appears to me to be glossed over in most accounts of MMT. If MMT could work for large entities like the EU, USA and China, but not for Laos, Liberia or Lesotho (assuming they fulfilled the other criteria for sovereignty), what does that mean? And if countries such as the latter three can achieve monetary sovereignty, how?

Hoping someone will clarify!

I’ve watched the video, and this seems to me the crux of it: “The policies that they [eg. South Korea, Israel, China] pursued is that they do control the exchange rate. It’s managed, they do control reserves, they accumulate significant and large amounts of dollars, and they also use strategies to industrialize policies; interventions to increase their exports, to develop their own national champions. There are companies that are technologically advanced and so on and so forth. What they need is a developmental state. And in that sense, in the sense that you need a state that is strong and capable of promoting development, I think that there is a sense in which there’s a commonality of ideas with MMT.”

“A strong commonality” with MMT sounds as if MMT doesn’t apply. Is that because these countries chose not to do MMT, or because they couldn’t, being able at best to have something in common with MMT? And, again, where does that leave smaller countries like Laos or Lesotho? To be sure, a developmental state that successfully manages investment, exchange rates, etc. sounds necessary. But is it MMT, or the nearest they can hope to get?

Still hoping for clarification!

@xkeyscored,

MMT is basically a description of how the global monetary system works, stripping away the layers of financial mumbo jumbo. (MMT does contain one policy recommendation — the use of a government job guarantee as an automatic fiscal stabilizer. Fiscal stabilizers based on welfare spending and progressive taxes are widespread, but a government job guarantee is an unproven, if promising, idea.) So to question whether MMT “works” or can work for a small country rather misses the point.

Small, underdeveloped countries are by definition facing obstacles to development. The most successful have used mercantilism (government industrial policy) to develop industries which can export to meet import needs. On the other hand, World Bank or other foreign-denominated loans are problematic as small countries are subject to many forces beyond their control which can affect their ability to repay such loans.

In sum, MMT is not a theory as to how a country can be successful, rather it is a description of how the global financial system works. Understanding modern money systems can help any country, individual, or organization.

You may be right about MMT not being a theory as to how a country can be successful. But that is very often how it comes across in the articles and papers I read, and quite strongly too. Then again, I don’t tend to read the more academic theoretical papers, so maybe I am getting a skewed view of what MMT is.

It does indeed strip away much of the mumbo-jumbo traditionally suffusing monetary theory. I always had trouble with that; most of it seemed to ascribe magical and sacred properties to money. MMT seems like a breath of fresh air, facing the facts instead of starting from theories and dogmas.

Thanks for the reply. My understanding is deepening! I have a day off tomorrow, and a small pile of MMT stuff I’m planning on working through.

I agree about the way MMT comes across.

Here’s my “elevator speech” on MMT, complete a few links to some of my favorite MMT documents: MMT Elevator Speech

MMT applies mostly to countries in which their currency is sovereign and they have no debts denominated in outside currency. Many developing nations have taken outside loans from the World Bank and IMF which are typically in dollars. As such, they are not sovereign in their currency and must bow to the whims of their creditors. The World Bank is sadly a known neo-liberal institution used to subjugate developing nations under the guise of helping them get out of poverty. Often, when countries have trouble paying their loans, the creditor forces them to sell off national resources. (Search “privatization of water supply”). The MMT recommendation to international loans is “if possible, don’t.” Sadly, many smaller developing nations are already in a position from which they can’t recover.

… that the debt burden rises. Michael Pettis

The debt of a monetary sovereign, being inherently risk-free, should return no more than zero percent NOMINALLY* and that’s for the longest maturities; shorter maturities should yield even less with fiat account balances at the Central Bank costing the most**, having zero maturity wait.

So what debt burden? Rather, the debt of a monetary sovereign can be a revenue earner.

*Or do the richer deserve to be shielded from price inflation anymore than the poorer?

**Except individual citizens, up to a reasonable account limit, should be allowed to use fiat for FREE as an inherent right of citizenship.

But still the discussion revolves around the word “debt” which unhinges the thought processes due to negative word association. The only “debt” sovereign Governments truly have is that denominated in another currency which has to be “repaid” in some form. Every “debt” the sovereign creates in it’s own currency is never repaid, it is simply extinguished in the same way it was created. This occurs now, so MMT is not promoting any new method. It is simply stating the reality. Sovereign bonds are only required as a monetary function and are not needed for fiscal processes as we are all aware if we care to look.

It would improve understanding to call public debt (public sovereign created debt) a “record of issuance’ or something as benign, which would change the way in which we think about it. Economists could then concentrate their efforts on ensuring that the “issuance” conformed to the capacity of the economy with regard to prices so that inflation did not become an issue. This would remove the hysteria in the debate.

Until economists and sovereigns in the world agree on using more appropriate language to distinguish between the fiscal and monetary functions of sovereigns and those bodies who are “users” of currency like households and businesses, then we remain in this quagmire of misunderstanding. And yes, I’m looking at you Central Banks, OECD, IMF and Co and all the other plethora of useless organisations around the globe who developed this neoliberal order in which we find ourselves immersed. Of course the political creatures running sovereign Governments have no interest in this common sense approach as it would remove their capacity to obfuscate and propagandize the business of governing for their own selfish purposes and their mates, the trough snuffling corporates alung with their attached parasites

.

Wheel out the guillotine!

Your first three paragraphs are the best — most succinct and yet exactly complete — distillation of what the story with MMT is, to my layman’s mind.

And of course it puts Pettis’s post in the right light for analysis.

Thank you for that.

What MMT actually does say is that governments must issue debt or raise taxes if either is necessary to control the potentially adverse economic impact of the additional demand created by spending the additional money.

Please be specific about the the debt, who are the creditors?

The Japan question raised above is answered if the Japanese economy runs a trade surplus (which I believe it does), thus has dollars to pay for imported oil and other commodities, and the bonds are issued are in Yen, and are settled in yen, and not some other currency.

The denomination of the bonds or sovereign debt issued is an important little detail.

Recognising what we have now doesn’t work is a good start.

We should recognise this version of capitalism never had a long term future. Maggie brought it to the West in 1979 and it immediately set off on the road to its own demise.

https://www.housepricecrash.co.uk/forum/uploads/monthly_2018_02/Screen-Shot-2017-04-21-at-13_53_09.png.e32e8fee4ffd68b566ed5235dc1266c2.png

The global economy is now slowing down as this version of capitalism reaches the end of its natural life span. China was the last real engine of global growth and now that has gone the way of the rest.

At 25.30 mins you can see the super imposed private debt-to-GDP ratios.

https://www.youtube.com/watch?v=vAStZJCKmbU&list=PLmtuEaMvhDZZQLxg24CAiFgZYldtoCR-R&index=6

What Japan does in the 1980s; the US, the UK and Euro-zone do leading up to 2008 and China has done more recently.

Adair Turner took over at the FSA when Lehman Brothers collapsed and this gave him the incentive to find out what was going on.

https://www.youtube.com/watch?v=LCX3qPq0JDA

Adair Turner has looked at the situation prior to the crisis where advanced economies were growing by 4 – 5%, but the debt was rising at 10 – 15%.

This always was an unsustainable growth model; it had no long term future.

After 2008, the emerging markets adopted the unsustainable growth model and they too have now reached the end of the line.

Adair’s solution?

Government created money (MMT)

The problems actually go a lot deeper.

We really need to start again.

Everyone assumes our current knowledge has built up over time as we learn from past mistakes.

With economics and the monetary the system there is too much to lose from allowing knowledge to develop in the normal way.

Our knowledge of privately created money has been going backwards since 1856.

Credit creation theory -> fractional reserve theory -> financial intermediation theory

“A lost century in economics: Three theories of banking and the conclusive evidence” Richard A. Werner

http://www.sciencedirect.com/science/article/pii/S1057521915001477

The European aristocracy lived in luxury and leisure while other people did all the work. The Classical Economists realised they were being maintained by the hard work of everyone else.

The Classical economist, Adam Smith:

“The labour and time of the poor is in civilised countries sacrificed to the maintaining of the rich in ease and luxury. The Landlord is maintained in idleness and luxury by the labour of his tenants. The moneyed man is supported by his extractions from the industrious merchant and the needy who are obliged to support him in ease by a return for the use of his money.”

Economics was always far too dangerous to be allowed to reveal the truth about the economy.

How can we protect those powerful vested interests at the top of society?

The early neoclassical economists hid the problems of rentier activity in the economy by removing the difference between “earned” and “unearned” income and they conflated “land” with “capital”.

They took the focus off the cost of living that had been so important to the Classical Economists to hide the effects of rentier activity in the economy.

The landowners, landlords and usurers were now just productive members of society again.

Our knowledge of economics and the monetary system are fundamentally flawed.

Economics, the time line:

Classical economics – observations and deductions from the world of small state, unregulated capitalism around them

Neoclassical economics – Where did that come from?

Keynesian economics – observations, deductions and fixes for the problems of neoclassical economics

Neoclassical economics – Why is that back?

We thought small state, unregulated capitalism was something that it wasn’t as our ideas came from neoclassical economics, which has little connection with classical economics.

On bringing it back again, we had lost everything that had been learned in the 1930s, by which time it had already demonstrated its flaws.

William White (BIS, OECD) talks about how economics really changed over one hundred years ago as classical economics was replaced by neoclassical economics.

https://www.youtube.com/watch?v=g6iXBQ33pBo&t=2485s

He thinks we have been on the wrong path for one hundred years.

The Mont Pelerin society developed the parallel universe of neoliberalism from neoclassical economics.

Did you know capitalism works best with low housing costs and a low cost of living?

Probably not, you are in the parallel universe of neoliberalism.

Globalisation never really stood a chance with today’s totally corrupted economics.

We need to build up again from solid foundations.

Economics was always far too dangerous to be allowed to reveal the truth about the economy.

I’m sure I’ve seen quotes by mainstream economists saying exactly that, admitting their mumbo-jumbo is some kind of necessary falsehood.

I saw a recent video from Steve Keen, and he said the biggest danger to capitalism is neoclassical economics.

I had come to the same conclusion myself.

THIS is the best explanation of MMT I’ve ever heard. “If this, then this” is the only appropriate means of discussing MMT.

Anything else leaves it open for misinterpretation and misuse.

They should never included the word ‘theory ‘ . The dictionary definition ( a system to explain something ) because the colloquial understanding of ‘ theory ‘ is something akin to ‘pie in the sky ‘ . MM without the T would have been just fine. But the coiners of the phrase had a hold in academia and thus desired credibility . Well sorry guys academia , where finance , money are concerned – sucks. MMT at it’s tap root says ‘ money is created by depressing some computer keys and removed by depressing some other computer keys’. ‘ Theory ‘ says we all need to work on this for a little while longer until we all accept it as reality.

Templar– I’ve read Modern Monetary Operations suggested as an alternative name. That sounds right to me.

i have a theory. interest rates the fed sets can only nudge in direction but have no ability to make large changes to the growth direction of an economy if the growth decides to go one way. another thing i suscribe to is the idea of richard Werner, the quantity theory of credit, which is an expansion on the idea of the credit theory of money. basically money is debt not a form of trade. its an IOU first and foremost and itself a commodity.

A bond is an IOU at its purest form, so the value of bonds reflect the value of money. If bond values are up, it means yields are down. Money is overvalued, if bond values are down and yields are up. That implies money is undervalued in the economy. so you have a supply of money(finance) and a demand of money(consumption)

10 year bond yields are a way to see the value of capital. people with money that dont have anything to do with it park it in bond yields.

say taxation is high for the rich and workers have a lot of power like in the 1950s you have high inflation in the consumption side, thats MMT hell because the value of money is undervalued and you have supply side constraints and that rises the prices of everything else instead.

What about when money is over valued? well people dont want to spend it, they want to lend it. but say you have demand side contraints that stop people from using that money in a useful way. well the only direction is down till you get to negative rates. now the importance of this is, negative rates taxes the supply side and directly give the money to the demand side(i borrow $100 at -1% interest and i am $1 richer per year till the bonds turn back to zero or go up). so falling bond yields represent MMT hell too and lead to inflation in the value of money.