Yves here. It is striking how many times you’ll see the less than rosy career prospects for young people (outside the elites) combined with their debt servitude mentioned in economic studies or in passing in the press as if it were some sort of new normal everyone ought to accept. Why does it take a study by Sanders to get this issue out of the shadows? Maybe because too many vested interests are profiting?

Separately, props to Teen Vogue for being first to publish this story.

By Jake Johnson, staff writer at Common Dreams. Originally published at Common Dreams

A new government study commissioned by Vermont Sen. Bernie Sanders details how crushing student loan debt and stagnant wages are threatening to make millennials the first U.S. generation with a lower quality of life than their parents.

The Government Accountability Office report (pdf), obtained Wednesday by Teen Vogue, found that millennials between the ages of 25 and 37 have substantially less wealth, lower homeownership rates, and fewer retirement resources than Generation X and the Baby Boomers.

“The millennial generation (those born between 1982 and 2000) might not have the same opportunity as previous generations had to fare better economically than their parents,” the GAO report states. “Millennial households had significantly lower median and average net worth than Generation X households at similar ages.”

In a statement to Teen Vogue, Sanders said the study confirms his fears about the grim financial prospects of young people in the United States.

“If we don’t fundamentally transform our economy, we are facing—for the first time in the history of this country—the possibility that our young people will suffer a worse future than their parents had,” said Sanders, a 2020 Democratic presidential candidate. “We must tell the economic elite who have hoarded income growth in America: No, you can no longer have it all.”

The new study, according to Teen Vogue, shows that “student loan debt is what really differentiates millennial finances from other generations, with millennials more likely to have student debt that exceeds their annual income.”

The report says that “high levels of student debt may affect the ability to accumulate wealth, which may be why average net worth levels have decreased for college graduates.”

Sanders is the only 2020 Democratic presidential candidate who has proposed wiping out all $1.6 trillion in U.S. student loan debt currently held by around 45 million Americans. The Vermont senator, who consistently polls at the top of the 2020 field among younger voters, has also proposed making public colleges, universities, and trade schools tuition-free.

“It is about time we take a hard look at this research and stand up for our young people who dream of making it into the middle class,” Sanders said Wednesday. “In the richest country in the history of the world, we have an obligation to turn this around and make sure our kids live healthier and better lives than we do.”

Of course we Americans are entitled, naturally, to always have More and Better than the generation before us, because what, growth is sustainable year over year?

Somebody (along with the biosphere) seems inevitably to end up holding the hand grenade when the time fuse burns down and it explodes.

But Bernie and what looks to be a significant organizing effort sure look like the last, best hope that anything moving toward sustainable decency might be achieved. One might ask how many Americans have any notion of yielding any modern conveniences and energy uses at the scale that seems necessary and inevitable? Whatever age set or category they might be assigned to by the powers that run things?

What kind of political economy do we want? Do we as a species actually need?

Your comments betray your innocence of the magnitude and effects of upward wealth transfers in this new millennium. There’s no upper bound of growth our country is currently running into; rather it’s the systematic stripping of wealth from the lower classes to the uppermost that’s behind all this. Not even during the Gilded Age of a century ago has wealth and income inequality been so extreme, yet this fact continues to be ignored, willfully so. I suppose next we’ll hear about how lazy millennials are, how coddled and entitled- the better to obfuscate the effects of systematic attacks on social services (like college tuition) in order to pay for yet more tax cuts for the ultra wealthy?

When things can’t go on as they are indefinitely, they don’t. The tipping point is coming very soon. I’m going bird watching; has anyone seen a black swan lately?

JTM is innocent, as in naive? I don’t think so, particularly concerning the topic of the post

I have a new and untested line of thought on how to get the debt written off.

The 13th Amendment.

You can not legally sell yourself into slavery or indentured servitude, and for some borrowers, that is what student loans have become – to the state or Navient.

How long do you need to pay back a loan that can not be discharged in bankruptcy ?

If you argue the contract is de-facto indentured servitude, then it must be null and void, for an illegal contract is not enforceable. Perhaps student loan contracts don’t start out like this, but could be ruled as becoming de-facto indentured servitude after a period of time ? Retiree’s certainly have a reasonable case, their working days are over.

What does it matter if the master is a Company (companies are people according to the Supreme Court — blow back is a bitch ).

No, I am not a lawyer, but still there are lots of historical contracts for indentured servitude to compare against. If a student’s loan contracts / position looks worse, how can you rule that it isn’t indentured servitude ? I mean I know judges can and will, but the PR will be awful (or great depending on where you sit).

Indentured Servitude Definition

Under indentured servitude, the contract stipulated that the worker was borrowing money for his transportation and would repay the lender by performing a certain kind of labor for a set period. Skilled laborers were usually indentured for four or five years, but unskilled workers often needed to remain under their master’s control for seven or more years.

A specific similarity between slavery and indentured servitude is that indentured servants could be sold, loaned, or inherited, at least during the duration of their contract terms

Ahem, student loan debt is traded in this fashion between “servicers”, effectively the same as selling the person.

I hate to tell you, I do not think mere debt qualifies, even high levels of debt.

The essential quality of indentured servitude is being a servant, as in having your daily activities in thrall to another person to pay off the debt.

The debtor is paying interest and principal, not acting as a personal servant to satisfy a debt.

I met an Uber driver who didn’t have a car when he started, and went through their sub-prime lending to get a car to start working. He said he was paying $750+/month for his car and insurance and worked feverishly just to pay that debt, yet alone make any money for himself.

Would that be considered indentured servitude? I think Uber would argue that the driver was ‘serving’ the rider, not Uber. But the debt is to Uber (I think Uber has since sold off their vehicle leasing division so this might not be the case anymore), and the driver must work for them to pay the debt.

Presumably, the driver could find other sources of income to pay the debt, but I’ve also heard that Uber incentivizes drivers to stay on their app through bonuses and other rewards. Maybe not an exact parallel to 18th century, but updated to fit our modern world.

He asked me how much my car payment was, and I think I can pinpoint the moment I saw his heart break when I told him it was no more than $300 including insurance.

No, again he does have to work for Uber. He is not subject to the abuses that indentured servants often suffered, like being beaten, being forced to live in whatever shoddy housing and substandard food their master provided, being forced to move with them, having no choice over when they worked or what they did.

Disagree. The fact that the debt is:

1) Un-dischargeable in the court of law

2) Grossly higher than the ‘market price’ for services rendered

3) Needed to even obtain basic certification for jobs

Would make it “undue hardship” that targets a specific sub set of the population.

But of course, they wrote it into the law, Section 523 of 11 U.S.C. The only thing currently dis-chargeable is un-paid tuition. Of course, the funny fact is that colleges will never allow a student to go to school unless someone, gov, parent, etc pays the tuition.

Honestly, the easiest way for the law to get changed is to try to illustrate the harm to the economy of having a massive portion of the educated populace indebted FOR LIFE. Nothing gets America tweaked than something negatively affected the markets. The Market/Wallstreet is the actual unspoken god of America, money the religion.

Hence, you get the current 21st century US, where money reigns supreme over all things including life, education, liberty, etc. And the Supreme Court sure isnt helping with all their pro-business rulings.

You are straw manning what I said. The point at issue is trying to position student debt as indentured servitude. It isn’t because there is no personal relationship with a lender to whom you have given the legal right to control your activities and order you when, how much, and how to work with no restriction on that authority.

There is also no legal notion of debt being impermissible because the rates are arguably high. The students signed up to the debt knowing the terms. The rates kick up to higher levels if payments are missed. There are similar terms for credit cards, where default rates are as high as 34%. The system is ugly but illegal it is not. Usury laws were made inoperative for most purposes via a Supreme Court decision allowing banks to market products across state lines, and certain states such as South Dakota getting rid of usury laws to attract bank operations.

I am very aware of the terms of student debt and how difficult it is to discharge. We’ve been writing about it for years.

The court enforcement & lack of remedy (no bankruptcy) means the debt is permanent even when it’s clear that there is no chance of repayment. There is no “betterment” of a person until the debt is repaid. Normal debts risk the legal remedy of bankruptcy to prevent this. It is the non-dischargeable nature of student debt that creates a defacto peon. The only other option is not to work – hardly viable in the current USA. If student loans were dischargable like other debts, there would be no crisis, just lots of bankruptcy.

This story should be today’s headline news, not Pelosi’s impeachment farce.

As much as the shysters and hucksters of the GOP have financialized young people’s lives and ram-rodded a massive redistribution of wealth, it was “New Democrats” like Joe Biden, Arne Duncan, Rahm Emmanuel, and the entire Bill Clinton administration who slammed the door of indentured servitude on people under the age of 30.

These younger people vote, but their struggles are ignored. How can they be expected to take the political establishment seriously? When they become the majority, they will have nothing but anger and resentment against the older generations.

Including homeless people of the older generations?

Funny that you never hear of “overpriced college educations”. So let’s now have student loan forgiveness and “free” college tuition so colleges don’t have to do any cutting of their bloated budgets. That’s so special. How about clawing back money from price gouging colleges and using it to reimburse folks?

The outrageous costs are often discussed on this site. Search the archives. Plenty of discussion.

https://www.nakedcapitalism.com/?s=high+college+costs

Could it be programmed a price gouging app for college applicants? Class sharing?

Sorry today I cannot switch off the stupid mode control

Yeah! So let’s load people up with debt they can never pay off! That’ll show ‘em!

David H, returning to public funding would involve budgeting for colleges. The current system allows bloated budgets on the back of students. I suspect the professional and managerial class like this ability to use college students as money conduits. I think it is deeply immoral and unwise.

Yes, exactly! If there are buyers, then there are sellers. Who has made the windfalls from the exponential rise of college costs and financing over the past ~ 30+ years? Any ‘splainin’ to do?

Which state colleges price-gouged? Which state colleges raised collective tuition by exactly the same amount of money as was embargoed from those state colleges by the great tax revolt and the state governments’s cancelling of their formers levels of support to state colleges?

SUNY (NY). And in particular, community colleges in that system. I’m sure there are others. Their rates accelerated steeply beginning in the 1990’s, outpacing state-level changes.

“When I kid and duking it out with Corn Pop and Banana Split, I would tie an onion to my belt as was the style at the time and smell all the women I wanted. My doctor has declared me even healthier than the President of the United States who I could also beat up.” -Joe Biden upon being asked about the state of the millennial economy.

Grandpa Simpson. Confuse them by telling long stories that don’t go anywhere. As was the style at the time.

I think that you called it-

https://www.youtube.com/watch?v=Yu9ShccG_SU

This is in part a side effect of the ever greater concentration of wealth in this country. When the wealthy have more money to invest than Wall Street can find productive use for, it causes an explosion of lending. Which, in turn means that the prices rise for stuff bought with borrowed (or leveraged) money: Stocks, real estate, college degrees.

Looks like we need to subscribe to Teen Vogue now to stay truly informed. Props to them. It must be a profitable business model, but it’s so counter to the standard upper middle class propaganda that is usually enforced that I wonder how long it can last. Maybe it’s hip reporters and editors just doing their thing.

Subscribing to Teen Vogue: you will have to wade through vacuous celebrity articles, with glossy photos, (although a day in the life of a Brooklyn Public Defender looks interesting), 10 ways to make your skin look fresher, and gobs of ads for Stuff. Maybe it’s a case of, I buy Teen Vogue, buy only to read the articles on Socialism!

(I was checking it out as a possible gift for my granddaughter.)

‘the richest country [of Financial Ferengi] in the world …

fixed ! – as in ‘the • fix • is • in – siders’ .. right joe, billy, nancy, lloyd, warren, mitch, chuck, alan, lawrence, berry, ben, jamie, peter .. ??

Did I miss anyone ?

The article has

“The Vermont senator…has also proposed making public colleges, universities, and trade schools tuition-free.”

The obvious point of concern is: currently, where are numerous well-paid college degree requiring jobs?

American corporations, at least in the electronics industry I worked in for many years, know they can hire foreign college degree holding workers via outsourcing operations overseas or in-sourcing foreign workers (H1-B).

In a tuition free USA, If nothing is done about college costs and producing better paying jobs, a lot of the nation’s wealth will be used to produce debt-free college graduates destined to be employed in low wage jobs.

Will these debt-free low wage workers spend enough to move the US economy to a better paying jobs creation phase?

you have touched on the ugly secret that even well-meaning people who truly believe or at least want to pretend this is a meritocracy if only college were available to all:

it’s often more *who* you know than what you know.

Student debt is just a symptom of much bigger problems in our economy and society. Eliminate student debt — Millennials will still “… suffer a worse future than their parents had.” For that matter — I am not so sure Boomers are better off than their parents were. I won’t even mention how Climate Chaos and the Peak fossil fuels will affect Millennials — and Gen-X and probably Boomers too — as the problems multiply and changes accelerate. We live in such interesting times.

Boomers are/were WAY better off economically than the Silent Generation that survived the Great Depression. In every conceivable way. What is the point of your comment if not false equivalency and muddying the waters?

Making shit up is against our written site Policies. You are already in moderation for past violations. You can’t afford to accumulate more troll points.

Your comment is utterly false. Among other things, private pensions were VASTLY more prevalent for members of the Silent Generation. Those are not included in any net worth statistics even though they have a huge impact on the standard of living (need to save less while working, higher standard of living in retirement).

This is one of many articles saying members of the Silent Generation are the wealthiest:

https://www.journalgazette.net/business/Silent-generation-wealthiest-3458110

On top of that, they grew up in an era when:

I could go on….

Well said! Might the high tax rates on corporations and the wealthy during that era also contribute to their relative prosperity? I think that’s part of the formula that spread the good fortune so widely, unlike today.

The Sanders tuition plan includes community college and vocational programs.

The Sanders platform includes:

– Enact a federal jobs guarantee, to ensure that everyone is guaranteed a stable job that pays a living wage.

– Create 20 million jobs as part of the Green New Deal, rebuilding our crumbling infrastructure and creating a 100% sustainable energy system.

– Create millions of healthcare jobs to support our seniors and people with disabilities in their homes and communities.

– Create new jobs in early childhood education.

https://www.congress.gov/bill/116th-congress/house-bill/3472/text

https://www.congress.gov/bill/116th-congress/house-bill/3472/text

I hate to be that person, but, it isn’t true that the millenials are the first to be worse off than their parents. That distinction belongs to Generation X, but as we were much smaller, as a cohort (thus less noticeable), and because the phenomenon was so new, at the time, as to be unheard of, no one paid much attention to our bouncing in and out of parents’ homes in our twenties (and even thirties), not to mention our inconvenient tendency, now, to be dying in our 40s and 50s, etc.

I absolutely do not dispute how sh*tty the millenials have it, and I think it’s probably arguable that they have things worse, in many respects (student debt) than we did/do, simply because the process of immiseration is that much further along than it was 20/30 years ago. However, it isn’t fair to ignore X’s role in having reached freefall first. Whenever I see such claims on the internet, I always speak up because it’s important that our experience isn’t lost to whitewashing and revision.

My father (Silent Generation) was a poor kid from a poor family on the wrong side of the tracks. He rose easily, in his twenties, to become a distinguished engineer who retired with a military pension, a civilian pension, and, of course, social security. His daughter, me, in her early 50s, having struggled to find employment and a place in the world after college, in the late ’80s/early ’90s, had a decent career for a few years and began to accumulate some property, only to see it all drowned in the economic tsunami of the Great Recession. Once the economy had finally begun to pick up again, I was too old and had been unemployed too long, and now I live on the margins, doing gig work delivering groceries for cash and wondering if I can possibly make the rent just one more month. I feel like I am the future of “elderhood” in the United States. No more “Silver Surfers”, no more Boomers “spending their children’s inheritance”, just a pack of wandering, malnourished and ignored zombies who haven’t been to the dentist in 10 years.

So. No shade intended, I know the millenials have it rough. But it’s important that the record remain accurate. There may be exceptions, but I think it’s arguable that X entered this territory just as the millenials were being born. We were, in a sense, the canaries in the coal mine, and so much of the contemporary world of 2019 could be felt in the screaming angst of Kurt and Courtney, all those years ago.

Elder millenial here. You are correct that the ladder was beginning to be pulled up as you came of age. However, in the unlikely event you were in tech stocks in your late teens or early-to-mid 20s and got out prior to the crash, you could have made some money. My friend who is 44 and works in graphic design told me he worked for a company doing the exact same thing he does now, but for more money back then. In 1999.

What was our tech boom? Bitcoin if you got in and out within the right 6 month window?

We need to go full Thomas Paine and give every 18 or 21 year old 10 pounds of sterling silver. UBI/Job Guarantee/Med4All would be decent and humanist as well. But we don’t do decent and humanist here. The rich would rather build bunkers for themselves to hide in than schools and apartments and jobs for anyone else to have a decent life.

Evan Spiegel (Snapchat) apparently applied for, and was granted, French naturalization. I stumbled across that on Le Monde, this morning. He’s not French by ancestry, and has no real connection to the Hexagon other than that he’s apparently a francophile and speaks the language. And kudos to him, I’d love to be granted French citizenship, even with Macron in office. But, in any event, yes, they’d rather build bunkers in New Zealand, or just have a ticket to France if things really fall apart than actually do anything to contribute to society. But then, according to Margaret Thatcher, “there’s no such thing as society”, so, here we are.

At 20, in ’86, I absolutely wasn’t in stocks or bonds, so I missed that boom. I was struggling with college biology and trying desperately to get out of my mother’s house. The finance economy of the ’80s might have been roaring along, but in flyover land things were already rapidly falling apart (Roger and Me paints a really good picture of what was going on in the Rust Belt and much of rural, and semi-rural, America in the ’80s).

The charts above seem to show Gen X isn’t doing worse. But lived experience, that’s an entirely different matter!!!

Millenials bane is student debt. Fine mine has been frequent sometimes long term unemployment even in “good times”. Is that somehow better? Many millenials have known unemployment too of course. Yes, everything is expensive now and it’s getting worse and worse, but I’ve NEVER been able to afford to buy housing where I live, when I was about the age it would make sense, the housing market went FULL HOUSING BUBBLE and there went any hope of buying! So now I pay expensive rent along with the millenials and fear rent increases as well.

Polls show 40 somethings like me don’t actually support the ok-Boomer candidates that the Boomers do. We do know some of what is going on now.

I am sorry about climate change, the youngsters are screwed, and I won’t escape it. I’ve never had much power, and felt even less powerful than that, and tried to live my life right, but I am sorry.

Ted Rall has an occasionally good article about us Xers on Counterpunch, some of us are going to spend our old age homeless, but we’re still going to be imagined that we’re the privileged old people.

Divide and conquer by names instead of by economic policies works against changing bad economic policies for better policies, imo

If, instead of names one used phrases like people born between 1947 and 1964 are all (this – whatever supposed id cultural characteristic) , and people born between 1965 and 1980) are all (that – whatever) and people born between 1980 and 1992) are all (the other)… The problem of generational blaming becomes clear.

That sort of labeling, while accurate (and I probably got the actual years wrong but you get the idea), leaves out the larger question of economics and power. What economic policies were in force; which were changing; w hich were being abandoned for new economic policies and why; what economic powers were pushing for the changes; and how did these new policies affect the chances of most of the people living through them?

Why did the housing market go full housing bubble? Why did multi-millionaires and billionaires get huge tax breaks, giving them money to bid up housing and real estate prices beyond reach of so many? Why did politicians in both parties start favoring financialisation over investment in productive enterprises that employed people at decent wages? I don’t think it had anything to do with the year(s) the politicians were born.

So, yes, things have been getting worse and worse for most people for the past 30-40 years. It’s about the policies enacted, not the age of the politicians, imo. Yes, each new generation has had it tougher than the earlier for the past 40 years. But generational blame isn’t an effective response and won’t change the economic trend by itself. Generational blame is the wrong target, imo.

We all have an interest in replacing the current neoliberal economic order with something closer to the New Deal economic order, imo. Arguing over who has it tougher won’t help make that change.

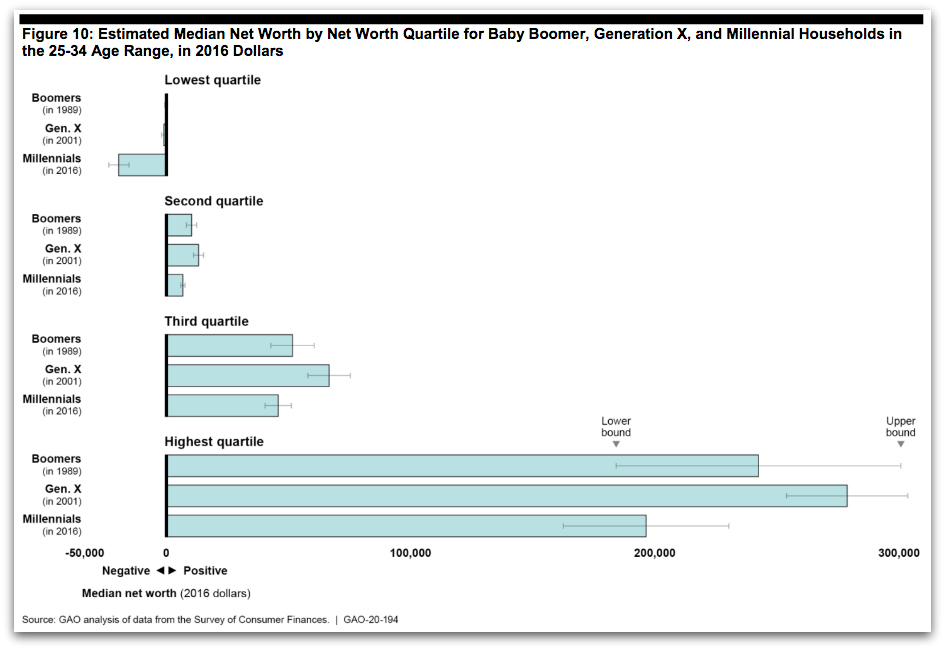

adding: see Figure 10 chart in the original post. The wealth disparity is by economic class across generations, and a direct result of neoliberal economics, imo. This stands to reason with neoliberal economics, and will become even more extreme with the next generations, where rich parents can gift there children enormous advantages and middle class and poor parents will struggle to provide decent basics to their children. Unnless the economics change. imo.

I completely agree that arguing over who has it tougher is a negative to be avoided, and hope I’m not seen to be doing that. My point, really, is just to keep the record straight about my own birth cohort and the ugly path so many of us have walked these past forty years (due to the timing of our birth and the world we entered, as adults, in the aftermath of the Neoliberal Revolution) because we’re always at risk of being overlooked and, ultimately, forgotten. I’m not, on the other hand, saying that “Boomers did this”, or, “this is all the fault of the Greatest Generation”, etc. Statements like those are lazy and ultimately only serve to divide (and conquer).

And, again, I totally agree about the neoliberal order and the absolute necessity of replacing it. Just not sure how that’s going to happen without an outright catastrophe to upset the order. Occupy was squashed by Obama, after all.

Thanks. I didn’t think you were arguing over who had it tougher. I was only adding the point that, say. boomers, for example, were born into a time when New Deal economics were in full effect: tight regulations on finance, Wall St, and banking; regulations on employment practices and wage and allowing union formation; taxes on capital with tax exemptions for expanding productive capacity and tax burdens for looting the company or trying to offshore production. etc. Taxes that supported both k-12 and higher education cost and heavily subsidised (unseen) college costs for the student. I could go on. You get the idea.

Now, New Deal programs have all but been eliminated, one piece at a time, by the neoliberal revolution. As the Neo revolution began and continued, each new younger cohort has had a worse economic world to enter. Why did so many Dem politicians after 1982 go along with this, the economic destruction of their core voters? You’d have to ask them. Thomas Frank wrote a couple of books about the New Dem betrayals of their voters.

My point is that, as the economics favoring financialization and the organized money power has gotten stronger, 80% or more of each new generation has had it worse than their parents’ generation. It’s about the economic policies govt pursues.

+1

We are in complete agreement. :)

AMEN I remember the giant sucking sound of jobs leaving the country when I was finishing school and going to work, back in the 1980’s. All those jobs I thought I was gonna have when I was in school, suddenly gone. It’s only gotten worse since then, as greed drives up the real inflation.

I don’t have any other answers left any more except to drag the upper class out behind the barn and shoot them. They certainly aren’t going to fix anything.

AMEN. :)

Perot was absolutely spot on, but I feel like no one could believe, at the time, just how dystopian things would become, you know? “That could *never* happen to the mighty United States of America, not in a million years!”

So they just mocked him and sent him off to history’s dustbin. Thirty years later he seems almost prophetic!

I love Ted Rall. :)

As for housing, etc., “me too”. When I was of the age, and had the income, to buy something, the housing market was at the beginning of the craziness that ended with the Crash in ’06-’08. I was terrified by that market and decided to hold off for a few more years figuring that my career would still be in place, etc. I’m glad I didn’t buy something in 2005, so I was right about holding off. As for my career, I couldn’t have been more wrong.

So now, me too, like you I pay expensive rent that I really can’t afford, and I work with millenials doing gig work and scrambling to get by. Not all Xers have it as badly as me, but many do. It’s important that we’re acknowledged, that this precarity isn’t assigned only to the young (and, hence, painted as an attribute of being young which the millenials will eventually age out of if they just have patience, etc).

Warren Buffett: “There’s class warfare, all right, but it’s my class, the rich class, that’s making war, and we’re winning.”

Class warfare on the poor class — it’s a big club, and almost all of us are in it. Too many not believing it, or playing the temporarily distressed millionaire planning to join the rich class at the first opportunity, stabbing sideways and kicking down to get there… All those mopes, thinking they are potentially the next Jeff Bezos or George Soros or Jamie Dimon, or even Donald Trump!

You about nailed it

I did say “young people” in my tag line and I probably should have revised the headline. I agree these marketing-created cohorts have lots of problems.

The school debt grift was instituted by neoliberal wingnuts cons to punish and silence the hippies for the 60’s free speech movement. It’s an artifact of the culture wars. Very effective in the short term too. Suck the little sh*ts into eyeball deep debt and that will shut their pie holes.

The economy will not be there without serious government GND planning in the economy to climb down the suicide tower of the fossil fuel economy. I don’t know if that can happen at this point. Some suicides jump before intervention is available.

The enforced austerity may fare the millenials well in prep for giving up all the useless crap of the squander consumer economy. The debt tax on education is another suicide move for any society and is grossly unfair

>>The enforced austerity may fare the millenials well in prep for giving up all the useless crap of the squander consumer economy.

No.

Hypothetical monthly budget:

Rent (one miserable bedroom in a 3-bed, 1-bath apartment): $800

Student loan payment: $700

Health insurance: $300

I could keep going, but you get the idea. A $30 sweater from some chain store, or even a $250 pair of earbuds or a $250 roundtrip flight to the Caribbean, doesn’t look too expensive in this situation. If that trip to the Caribbean allows you to face down your horrible abusive job another few months, it was a sound investment.

The tapeworms on the US economy are finance/real estate (which is now totally financialized) and healthcare. Consumer goods cost very, very little in comparison.

Also, four years ago, I splurged and spent $300 on a pair of Bose noise-cancelling headphones. I am still wearing them now as I type this. An excellent investment even if on paper I couldn’t “afford” them.

Also, the olds really don’t know how bad it is.

Well, from a certain warped POV this makes sense:

With the decline of decent paying jobs, fewer college grad’s will be able to buy a home & incur long-term debt (mortgage). So, what is to be done?

Get ’em deep in debt before they even start thinking about buying a home!

Which is more profitable – building & selling a house (or an auto for that matter) or financing the purchase? I have a suspicion that financing is, but I don’t have the stat’s to confirm.

Sanders is correct. We do need to rebuild much of our economy. 30-year mortgages aren’t sustainable without 30-year jobs.

Capital accumulation from the bottom is nigh impossible. This is not how to set a country up for success.

I’ve been pondering, and I’d like to ask the commentariat. It seems to me that the function of a guaranteed job is to allow for capital accumulation, thus freeing people to invest in themselves further; and this investment serves to stave off the entropy of closed-system capitalism. Someone, I’m not sure, I think Ambrit, posted a link that mentioned a land guarantee. It seems to me this would accomplish the same thing as a job guarantee. Can I ask folks for their thoughts on any of this?

I’ll take a chunk of downtown Denver, others can have a chunk of Death Valley…

Seems like a good idea, right? How many of us have the physique, the intelligence, the endurance, the background to be stewards of even an urban garden patch? Native Americans were offered this kind of deal they couldn’t refuse — did not take long for the White Man (and other colors too) to figure out how to steal their allotments from them.

The US is about 3.8 million square miles, population density about 94 persons per square mile. There’s about 640 acres in a square mile, so given simple distribution, there’s enough to go around, at what, 6.8 or so acres? So every many, woman, other, and child gets about 6.8 acres. I say that four of five of us should put our allotments together and claim the Pentagon’s footprint (about 1 million sq ft, about 23 acres, and kick them out. Same for Langley, etc.

Isn’t that what Lech Walesa did in Poland? Ushering in some of the greatest prosperity they had ever seen, each Pole could get enough land to support themselves. Frankly the idea appeals to me both economically and environmentally.

Just FYI, I just got an enormous overlay ad on this page that took up most of the right half of the screen on Windows 10. I am in the US.

The ad’s full link was: https://adclick.g.doubleclick.net/pcs/click?xai=AKAOjsta3vgrJzzg6v5hlPaNiAol5TYqSG-djxJYVDVn6nNQdKU1d0DFbFVst9eEkmGKgN5LiREnR7j6RqRpx07W35fFmYyXrMuxwy3PHTIyBpu8DJf2b_t_wveCEIy3d1DqvJFQUvKWii5ZHU724qqzaZbkuI4&sig=Cg0ArKJSzENbctqHAeFq&urlfix=1&nx=128&ny=88&dim=600×400&adurl=https://www.tradestation.com/promo/ira/%3Foffer%3D0035AEYL%3Futm_campaign%3DIRA-Fall-2019%26utm_source%3DInvestingChannel%26utm_medium%3Ddisplay-IRA%26utm_content%3DInvestingChannel%7CCT%7CIRA%7CInterstitial%7CTargeting%7CAudiences%7Cwith%7CA%7CHigh%7CConsumption%7Cof%7CIRA%7CTax%7Cand%7CRetirement%7CContent%7Ccpm%7C600x400%7CStnd_DFA%26utm_term%3DIRA%26offer%3D0203AFLM

Edit: after I posted this comment it came back up. Here is a screenshot image: https://ibb.co/svXDtnK

Sorry, our ad service is prohibited from serving popups. I saw the ads too and chewed the agency out. Might take until Fri before they are gone.

I’ve been puzzled as to why none of the democratic candidates are willing to expose the fact of Joe Biden key role in keeping students in debt. Or his support of the Iraq War. Or his role in filling the prisons with crime bills written with the worst of the racist senators. Is this his idea of reaching across the aisle? And there are other points such as these that could be made but so far this has not happened.

He is sliding so badly in the early state polls (where Sanders is the closest thing to a frontrunner but not quite dominating it), plus the fact of how bad he looks and sounds on live TV or in person…only time will tell if he was actually underestimated.

I think Education should be free and open to those who want learn. Knowledge is crucial to enjoying the Good Life. Education and Knowledge have value in and of themselves. With the exception of certain of the professions I believe the strong coupling between Job and Education — credentialization — should be severed.

Student debt is unconscionable — as is the entire Neoliberal Project.

‘are threatening to make millennials the first U.S. generation with a lower quality of life than their parents.’

I think that that should read as follows

‘have made millennials the first U.S. generation with a lower quality of life than their parents.’

I still think that looking at this as a generational thing is just divisive – by design. How about we look at it another way. How about wage earners versus salary earners instead? I’m sure Bernie could agree with that one.

Here is a fun fact. If you got all the millionaires in the US and made them a country, then they would rank only 62 out of 233 countries in terms of population.

This is not a hugely popular opinion possibly, but I don’t think college should be universal… I don’t think it should be free or expected for everyone to attend. I think people should have choices (and more widely-available funding/apprenticeships/grants) to pursue technical or manual or artisan work that may not be best taught in a normal 4+ college institution. But beyond that I think people should be taken seriously and treated with dignity regardless of how many years they attend school. It doesn’t matter if state college is free if it just means people need an undergrad degree to work at McDonalds. I appreciate that the Sanders plan emphasizes trade and non-university programs.

I am, however, very in favor of making student debt dischargable in bankruptcy again, as well as programs to write off debt from fraudulent, for-profit, and other scammy institutions that duped so many people out of so much and incentivized so many to sign up for the debt because they thought it was what they were ‘supposed’ to do.

I don’t think anyone suggested it should be universal. Even public colleges have entrance requirements.

Sanders and Warren completely miss the biggest policy window that can achieve everything they want. They need advisors who are fighters and know how to win in great power politics.

We are in a World War. The CCP/PLA are playing for all the marbles.

In the past we have mobilized our population and economy to address mortal threats to our country and all humanity.

There are several policy paths the US could follow to deleverage and restructure the economy that addresses many of these problems.

First, recognize that the elites have been at these scams against all generations for decades. Second, the rapacious, greedy elites in the US have been played by the Chinese Communist Party and fooled into moving large industrial capacity out of the country resulting in immense harm to our citizenry.

In the name of national security this must stop. In the name of our collective survival we should ruthlessly root out all of these things that make us weaker and less resilient as a society. This is war and we need every citizen because we are all soldiers whether we like it or not.

This war requires us to reinvigorate our economy, rebuild our infrastructure and industrial capacity, get everyone more skills and education, get everyone healthy and able to serve the needs this effort demands. And we need allies across the West. Wars are moral conflicts so we must be the city on the hill and defend human rights.

The elites are smart and stupid at the same time. But many of them have become witting and unwitting traitors. Regardless, these policies damaging people across generations have been harmful to our country.

1. If you think in these terms, you can enact monetary reform like the Chicago Plan with 100% reserve banking allowing all household sector debt to be forgiven and ending too big to fail policies. And allow for public banks in the states to target credit for strategic purposes.

2. You can enforce 100+ year antitrust law charging healthcare industry executives with countless felonies–see how they negotiate from prison. Then enact rules to get universal care for 10% of GDP. The other 8% can flow to other sectors and investments in the economy.

3. You can enact expansion of education from high quality preschool to 16th grade.

4. You can dramatically expand investment in basic and applied research across all scientific disciplines–including sustainable processes that eliminate or mitigate pollution.

5. Everyone on this (including me) blog hates these perpetual, wasteful wars. This war calls for a policy of restraint because we need to husband our resources. We only deploy forces for real threats.

I could go on.

The elites need to choose if they want to remain a risk to all of us or become part of the solution. If they sell out to the CCP, then our national security apparatus should deal with them using extreme prejudice. We need to choose if we are going to force our elected and un-elected leaders to fight and win this world war.

Why do the candidates continue to focus on Russia? They are blind to the real issues demanding all of our attention.

A ridiculous ideology from the US swept the world.

Capitalism is about capital.

If you are working hard, you’re doing it wrong.

Your capital should be doing the work not you.

In 1984, income from capital gains, rent, interest and dividends over-took earned income in the US.

That’s the way it should be, no work involved at all.

“We haven’t got any capital and are unlikely to acquire any with our rents and student loans” the millennials.

Capitalism isn’t for you then, is it?

Have you thought about socialism?

They are gradually working it out.

The muppets are trying to earn a living in a rentiers paradise.

With economic liberalism people go for the easy money of “unearned income”.

With a BTL portfolio I can sit on my backside and live off the hard earned income of generation rent.

It’s easy money with no hard work involved at all.

Some parts of the economy are a lot more useful than other parts.

Capitalism has two sides, the productive side where people earn their income and the parasitic side where the rentiers lived off unearned income.

We are getting a much better idea of how this capitalism thing works already.

Where did it all go wrong?

William White (BIS, OECD) talks about how economics really changed over one hundred years ago as classical economics was replaced by neoclassical economics.

https://www.youtube.com/watch?v=g6iXBQ33pBo&t=2485s

He thinks we have been on the wrong path for one hundred years.

The Mont Pelerin society never stood a chance, they were always going to develop a parallel economic universe from neoclassical economics.

They called it neoliberalism.

Thanks for this link.

adding: I liked this line, which comes a bit before the starting point in your link.

As soon as you start believing that [income distribution] is not an interesting topic, the whole question of power, and the exercise of power, and the interrelationship between power – economics – legislation just disappears. … It’s something the classicals [economists] wouldn’t have missed.

-White

The USP of neoclassical economics – It concentrates wealth.

Let’s use it for globalisation.

Mariner Eccles, FED chair 1934 – 48, observed what the capital accumulation of neoclassical economics did to the US economy in the 1920s.

“a giant suction pump had by 1929 to 1930 drawn into a few hands an increasing proportion of currently produced wealth. This served then as capital accumulations. But by taking purchasing power out of the hands of mass consumers, the savers denied themselves the kind of effective demand for their products which would justify reinvestment of the capital accumulation in new plants. In consequence as in a poker game where the chips were concentrated in fewer and fewer hands, the other fellows could stay in the game only by borrowing. When the credit ran out, the game stopped”

The problem; wealth concentrates until the system collapses.

“The other fellows could stay in the game only by borrowing.” Mariner Eccles, FED chair 1934 – 48

Your wages aren’t high enough, have a Payday loan.

You need a house, have a sub-prime mortgage.

You need a car, have a sub-prime auto loan.

You need a good education, have a student loan.

Still not getting by?

Load up on credit cards.

“When the credit ran out, the game stopped” Mariner Eccles, FED chair 1934 – 48

Deja Vu?

Einstein’s definition of madness “Doing the same thing again and again and expecting to get a different result”

I see what you mean Albert.