For some time, we’ve maintained that negative interest rates would fail at achieving their intended results, which was to stimulate spending. Honestly, it beggars belief that economists could have convinced themselves of that idea. As we’ll discuss, the Swedish central bank has just thrown in the towel on them.

We’ve heard for years that the Fed had privately come to the conclusion that its experiment with super low interest rates was a bust, even though it still hasn’t figured how to move away from them to a more normal rate posture. In keeping with that line of thinking, the Fed had also concluded that negative interest rates were a bad idea and was unhappy that other central banks hadn’t figured that out. The Fed’s distaste for negative interest rates was finally made official with the release of FOMC minutes saying as much last month.

One of the many times we debunked the official rationale for negative interest rates was in a 2016 post, Economists Mystified that Negative Interest Rates Aren’t Leading Consumers to Run Out and Spend. We’ll hoist at length:

It been remarkable to witness the casual way in which central banks have plunged into negative interest rate terrain, based on questionable models. Now that this experiment isn’t working out so well, the response comes troubling close to, “Well, they work in theory, so we just need to do more or wait longer to see them succeed.”

The particularly distressing part, as a new Wall Street Journal article makes clear, is that the purveyors of this snake oil talked themselves into the insane belief that negative interest rates would induce consumers to run out and spend. From the story:

Two years ago, the European Central Bank cut interest rates below zero to encourage people such as Heike Hofmann, who sells fruits and vegetables in this small city, to spend more.

Policy makers in Europe and Japan have turned to negative rates for the same reason—to stimulate their lackluster economies. Yet the results have left some economists scratching their heads. Instead of opening their wallets, many consumers and businesses are squirreling away more money.

When Ms. Hofmann heard the ECB was knocking rates below zero in June 2014, she considered it “madness” and promptly cut her spending, set aside more money and bought gold. “I now need to save more than before to have enough to retire,” says Ms. Hofmann, 54 years old.

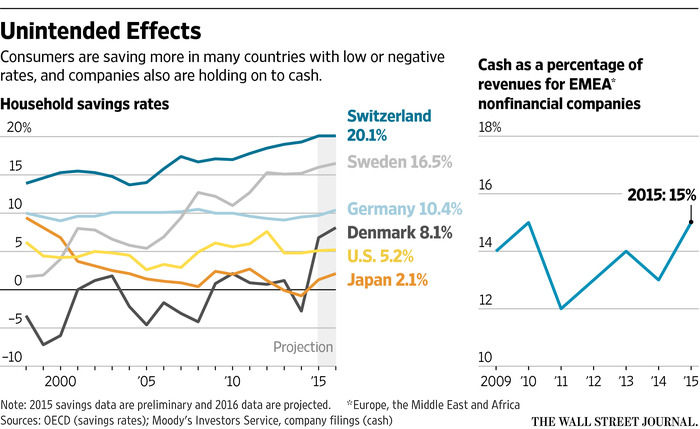

Recent economic data show consumers are saving more in Germany and Japan, and in Denmark, Switzerland and Sweden, three non-eurozone countries with negative rates, savings are at their highest since 1995, the year the Organization for Economic Cooperation and Development started collecting data on those countries. Companies in Europe, the Middle East, Africa and Japan also are holding on to more cash.

The article then discusses that these consumers all went on a saving binge..because demographics! because central banks did a bad job of PR! Only then does it turn to the idea that the higher savings rates were caused by negative interest rates.

How could they have believed otherwise? Do these economists all have such fat pensions that they have no idea what savings are for, or alternatively, they have their wives handle money?

People save for emergencies and retirement. Economists, who are great proponents of using central bank interest rate manipulation to create a wealth effect, fail to understand that super low rates diminish the wealth of ordinary savers. Few will react the way speculators do and go into risky assets to chase yield. They will stay put, lower their spending to try to compensate for their reduced interest income. Those who are still working will also try to increase their savings balances, since they know their assets will generate very little in the way of income in a zero/negative interest rate environment.

It is apparently difficult for most economists to grasp that negative interest rates reduce the value of those savings to savers by lowering the income on them. Savers are loss averse and thus are very reluctant to spend principal to compensate for reduced income. Given that central banks have driven policy interest rates into negative real interest rate terrain, this isn’t an illogical reading of their situation. Ed Kane has estimated that low interest rates were a $300 billion per year subsidy taken from consumers and given to financial firms in the form of reduces interest income. Since interest rates on the long end of the yield curve have fallen even further, Kane’s estimate is now probably too low.

Aside from the effect on savings (that economists expected negative interest rates to induce savers to dip into their capital to preserve their lifestyles and make up for lost interest income), a second reason negative interest rates hurt, or at least don’t help spending is by sending a deflationary signal. If things might be cheaper in a year, why buy now?

Some economists had nevertheless believed they could force consumers to spend in a negative rate regime by getting rid of physical cash. If citizens could not hoard cash, their monies would (presumably) be in bank accounts, where bank would charge them to hold funds, providing an incentive to go out and buy things. Note that negative interest rate fan Ken Rogoff has been a noisy advocate of getting rid of currency as important for this very reason.

Of course, the wee problem with that is banks don’t like charging consumer negative interest. They’ve kinda-sorta gotten there with fees, but a lot of countries make it hard to have a checking account relationship for less than $25 a month anyhow.

It is therefore particularly noteworthy that the Swedish central bank has deemed its negative interest rate experiment to be a flop since Sweden has one of the highest rates of digital currency use. From a September 2019 article:

Ask a Swede when they last paid for something in cash. The probable answer is last month or week….

Bengt Nilervall ot the Swedish Trade Federation explains why:

‘In terms of the cashless society, I think Sweden is ahead compared with other countries because in Sweden there is – in general – a trust in the government, the system, the banks and the authorities.’..Every two years, Sweden’s central bank, Riksbanken, carries out a survey on payments patterns in Sweden. Between 2016 and 2018 card payments increased by 25 per cent, at the expense of cash payments.

Four out of five purchases in Sweden are made electronically, and Sweden’s central bank, Riksbanken, estimates that between 2012 and 2020, cash in circulation will have declined by 20–50 per cent.

In light of the above, the Financial Times article on the Swedish central bank raising rates to zero despite the economy being crappy is awfully muddled. It is hard to fathom if this results from the central bank sources trying to obfuscate for PR reasons or whether the arguments against a negative interest rate policy went over the reporter’s head and hence weren’t well represented in the story.

Sweden’s central bank ended its five-year experiment with negative rates amid growing concern about the implications for the economy, businesses and investors from sub-zero monetary policy….

The Riksbank on Thursday repeated its warning from October that if negative rates continued for too long “the behaviour of economic agents may change and negative effects may arise”.

The problem with the article is nowhere does it say why negative interest rates can be (ahem, are) counterproductive. Instead, the article dignifies critics who depict the Riksbank’s change as hawkish. Nowhere is there a peep as to the logic of the bank’s shift, save vague intimations of distortions. And nowhere is there a mention of more fiscal spending as a way to kick the economy out of the ditch.

Sadly, to paraphrase Max Planck, it appears that economics advances one death at a time.

Is this the paradox of the paradox of thrift?

“When Ms. Hofmann heard the ECB was knocking rates below zero in June 2014, she considered it “madness” and promptly cut her spending, set aside more money and bought gold. ‘I now need to save more than before to have enough to retire,’ ”

By buying gold she placed a bet in the casino economy and therefore a win for the economists?

So as Swedes et. al. switch from cash to digital the banksters are able to shave transaction fees from merchants and customers.

And that is a main key to this cashless grift: that banksters (and all other sorts of middle men) would able to shave EVEN MORE transaction fees from merchants and customers.

And don’t forget about all the data they can collect and sell to the highest bidder!

“People save for emergencies and retirement.”

I refuse to believe that economists and bankers aren’t fully aware of that.

It really is time to stop mincing words.

They do not care. They want you to spend, make themselves and their peers even more wealthy, and they need this every quarter.

What happens TO YOU when you run out of money is of no concern to them. Zip. Nada.

Confront the problem these very no-nonsense words.

It is NOT policy that is concerned with the lpng term health of ANY particular country.

Nobody owes the rich a living.

I am not my keeper’s brother.

Besides their counterproductive economic and social effects and their demonstrated failure elsewhere, negative real interest rates are raw expropriation and taxation without representation, plain and simple. Ed Kane’s observations in this post are absolutely “on the money”. They have been a massive transfer of wealth to the predatory elements in the One Percent and a subsidy for Wall Street in all its various manifestations, including private equity, hedge funds, and the speculative arms of the TBTFs who have so damaged productivity. They have impaired the capacity of pension funds to honor their obligations, by intent and design. Further, they have served to defund entire constituencies of voters and concentrate political power in the hands of a few in a system where money drives the policy bus.

But the question in my mind is how to go about reversing the damage they have caused without seriously damaging those many innocents who depend for their livelihoods and their families’ welfare on continued low interest rates in a heavily financialized and debt-leveraged economy? Never has the old proverb “An ounce of prevention is worth a pound of cure” been so true. In this latter regard, I particularly appreciated Yves’ mention of fiscal spending in her concluding remarks. Seems to me there are also other policy options as well.

Honestly, it beggars belief that economists could have convinced themselves of that idea.

Does anyone still think that “economics” is a “science” instead of a religion posing as such?

I’ll spend more with negative rates. Just let me borrow a billion or two for a Month at -1.0% !

The mainstream theory of lowering interest rates goes like this:

“At lower rates, people will borrow more money and invest that extra money in growth.”

If negative rates are to work by the same mechanism, you would have to let people borrow money at a negative rate. Instead, they only changed rates to negative on deposits. If you want to take out a loan they still charge a positive rate. Only now if you keep your money in a deposit account, they are charging you for that too.

Funnily enough, if they actually let people borrow at negative rates, I’d bet that WOULD work. I’d certainly take out the biggest loan they’d give me.

The only way negative rates could help savers would be a policy aimed at savers to make them wealthier than they could otherwise be from interest income. Or at least as wealthy. But there’s a double standard. Negative rates save the bacon for businesses and corporations, and financial institutions. (The immediate goal of government.) There shoulda been a special purpose vehicle for savers that hedged their losses risk free. Guaranteed their income. But of course, nobody was interested in that. Much like Obama being too important to help people getting foreclosed on… all 10 million of them. The crime is that everything is possible, it’s just a question of policy. They’ve all underestimated the importance of demand in such an arrogant and perverse way; it’s almost a pleasure to watch. As my grandmother always said. Because there’s no way out. Except universal debt forgiveness and intelligent financial regulation.

“The bank is slowly taking away my savings, better spend it all right now” – No one, ever

Here is a way to stimulate the economy, repeal SEC Rule 10b-18, which allows companies to manipulate their stocks through stock buybacks, and favors financial manipulation over investment.

“We’ve heard for years that the Fed had privately come to the conclusion that its experiment with super low interest rates was a bust, even though it still hasn’t figured how to move away from them to a more normal rate posture.”

Well yeah, they could raise rates any time they want but who would it hurt? If it was just going to hurt “us” the little people, they would have done it. So who does that leave that would be hurt the most from high rates? Most of the feds fixes have been complete BS. Here is why they can’t get away from zero:

“A credibility trap is when the managerial functions of a society have been sufficiently compromised by corruption so that the leadership and the professional class cannot reform, or even honestly admit and address, the problems of the corrupted system without implicating a broad swath of a powerful elite, including themselves.

The moneyed interests and their enablers tolerate the corruption because they have profited from it, and would like to continue to do so. Discipline and silence is maintained by various forms of soft financial rewards and career and social coercion.” JESSE

The essence of this article is that savers will be punished mercilessly while speculators will be handsomely rewarded. Yeah, that should work out well for the economic health of a nation. I seem to recall that China got where it is today through the Chinese being intense savers of their money. And that money was lent out for construction and infrastructure instead of having to depend on the overseas money market with its “hot” money.

” Now that this experiment isn’t working out so well, the response comes troubling close to, “Well, they work in theory, so we just need to do more or wait longer to see them succeed.”

One of the things I found very amusing when studying economics was that it’s a field where there are many people, regarded as highly credible (Very Serious even) who have repeatedly said essentially “That may be all well and good in practice, but it will never work in theory.”

The more I study the actual societal application of economics, the more suspicious I become that it’s less a science than a form of propaganda, the targets being whomever needs to be convinced to do what the elite and those who manipulate money want. How else to explain negative interest rates?

“A credibility trap is when the managerial functions of a society have been sufficiently compromised by corruption so that the leadership and the professional class cannot reform, or even honestly admit and address, the problems of the corrupted system without implicating a broad swath of a powerful elite, including themselves.

The moneyed interests and their enablers tolerate the corruption because they have profited from it, and would like to continue to do so. Discipline and silence is maintained by various forms of soft financial rewards and career and social coercion.” JESSE

And this precisely explains the complete political economic insanity of our election process.

Who do you think payed for orthodox and do have a peek at the dominate economics awarded Nobels.

You’d think it was about Monet painting and that one mob that rules over what is and isn’t a Monet, regardless of documentation or facts.

I think it explains everything that’s happened since 2008, even before.

More evidence, were any necessary, that monetary policy is a sideshow. Fiscal policy is where it’s at.

We need a “The Onion” or “Duffel-bag” for economics. Lord knows most professional economists have trouble extrapolating from 2+2=4 to 2+3=5. Or extrapolating from individual behavior to the obvious macro consequences.

Physicists invoke classical mechanics only when quantum mechanics doesn’t contradict that choice.

I love nakedcapitalism.com

Surely the article could be considerably shortened by saying that banks refused to pass negative rates down to consumers, so the latter did not feel its impact?