By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

Tesla doesn’t disclose deliveries in the US, unlike other automakers. It only discloses global deliveries. We have to look at other data to see how Tesla is doing in the US; and in the US, deliveries have been plunging in recent months. In California, by far Tesla’s largest market in the US, registrations of new Teslas in the fourth quarter plunged by 46.5% to just 13,584 vehicles, from 25,402 vehicles in the same period in 2018. Model 3 registrations plunged by about half to 10,694 vehicles.

This is based on DMV registration data, compiled by automotive registration-data provider Dominion Cross-Sell, cited by Reuters.

The reason commonly mentioned for the plunge in sales in the US in recent months is the phase-out of the $7,500 federal tax credit in 2019 for Tesla’s vehicles. In Q1 2019, the federal tax credit fell to $3,750; in Q3, it fell to $1,875. And as of January 1, this year, it’s gone completely, though some state incentives are still available. In response, Tesla cut prices and came out with cheaper versions of its models, but to no avail.

The other and more troubling theory is that most people who had always wanted a Tesla and had waited for years in the deposit-line to get their Tesla, now have their Tesla, and the “pent-up” demand has been filled, and Tesla would have to get down and dirty and sell cars the hard way.

Instead of trying to slug it out in the declining US market, where its market share is just 1.3%, and watch its unsold vehicle inventory pile up, Tesla then chose to ship its US production to other countries. Makes sense. But soon those markets will be saturated too by the pricy niche-vehicles, and then the issue is how to go forward?

So Tesla decided to seek salvation in China in a big way, like GM had already done over decade ago.

Step 1: Built and Funded in China.

Tesla built its “Gigafactory” in Shanghai. Like all buildings in China, the factory sits on land that belongs to the state and is leased from the state. The factory was funded mostly by loans from a consortium of Chinese state-owned lenders. The last package of loans totaled $1.63 billion, according to Tesla’s filing with the SEC in late December.

The funds may be drawn in Chinese yuan or in US dollars. The package comes in two parts:

- A term loan of RMB 9.0 billion ($1.3 billion), secured by the factory, its equipment, and the lease. Of that amount, RMB 3.5 billion was used to pay off a prior bridge-loan from those lenders.

- An unsecured working capital line of credit of RMB 2.25 billion ($330 million) to fund production at the factory.

Step 2: “Designed in China”

Now Tesla plans to open a design and research center in China to design “Chinese-style” vehicles, according to a recruitment notice that was posted on Tesla’s official WeChat account on Wednesday and reported by Reuters. According to the notice, Tesla wants to recruit designers and other staff for the design and research center. The deadline for submitting applications is February 1.

The note said:

In order to achieve a shift of “Made in China” to “Designed in China,” Tesla’s CEO Elon Musk has proposed a very cool thing — set up a design and research center in China.

Tesla has not announced the location of the design and research center, nor when it expects it to open its doors.

Tesla’s market share in China, the largest market in the world, is essentially 0%. The Model 3 is a car, as in “sedan,” not an SUV, and cars have gotten tangled up in Carmageddon, even in China.

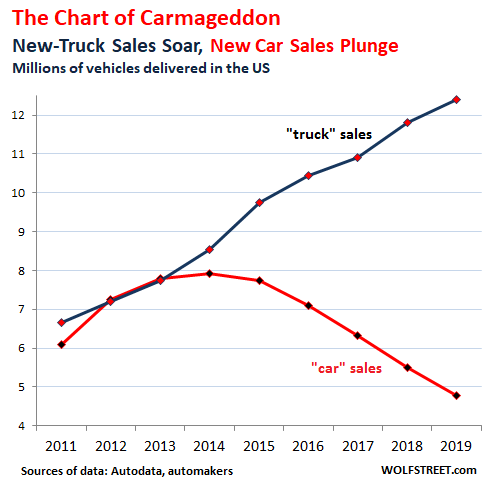

In the US, “car” (sedan) sales have collapsed by 40% from their recent peak in 2014, as consumers switched to SUVs, compact SUVs, and trucks, whose sales have soared. The idea for the Model 3 – a smaller less expensive version of the Model S – was hatched before the Financial Crisis. But now this is what the Model 3 is up against in the US – with the Model 3 being part of the red line:

Similar patterns are playing out around the globe, including in China. Tesla is countering this trend with hopes that its future compact SUV, the Model Y, when it will be finally available for sale, will have better luck than its immensely ill-timed – at least five years too late – Model 3.

In China, there is another thing: When the idea of the Shanghai factory was hatched, China was still piling huge incentives on EVs, and the EV market was booming. But China has now curtailed the incentives, and suddenly, beginning in July last year, the boom in EV sales fizzled.

And in China, there are hundreds of EV makers. Every global brand is now building EVs in China for the Chinese market, from the top luxury brands on down. For the first time ever, Tesla will face real competition in form of a full range of models of EVs that have been mass-produced by global automakers.

In addition, passenger-vehicle sales in China fell nearly 10% in 2019, the second year in row of declines, as the market, that had been booming for three decades, is retrenching.

On the positive side of the ledger: In China, luxury still sells, and the luxury brands had growing sales in 2019. But they too are now all coming out with EVs, not just cars but a broad range of SUVs and compact SUVs, and these automakers know how to get down and dirty and slug it out in a touch market. So Tesla’s shift to China might not be quite the entry into automotive nirvana.

“Challenging environment with weakened consumer demand”: This nosedive in a vast industry, affecting consumers and manufacturing, is happening even as GDP officially booms at 6%? Read… China’s Consumers Slam Automakers, Sales Drop Hard, 2nd Year. GM Sales Plunge. Ford Sales Collapse. But Luxury is Hot

For what I know in The Netherlands and Norway Tesla must be selling a lot of Model 3 cars. It is expected that the UK will become a hot market for electric and pluggable hybrids this year (particularly for company cars).

In European countries is easy to check sales by model and brand.

I think they are – I’m surprised at the number I see even here in Ireland (there is a free charging station near my home so I get to see a random selection of what people are driving).

The big problem for them however is that this year there is a flood of high quality EV’s hitting the market from nearly all the big manufacturers. BMW, Porsche, Jaguar, Mercedes, Audi, VW, etc are all launching mid market or premium EV’s, in addition to lots of hybrids from Toyota and Honda. The real test of Tesla is if it can keep market share in the face of this level of competition. While it still has a fairly cool brand aura, its hard to see more hard headed buyers straying from established manufacturers.

That might be the case. In Norway, Tesla has ranked laat in satisfaction.

https://thenextweb.com/cars/2020/01/14/norwegians-tesla-satisfaction-model-3-consumer-ratings/

That will be an issue in the long run. It’s not just about the first sale, but also about the support and ongoing future sales.

Actually, it’s not so simple to make a good EV:

• Mercedes? “Once-deemed ‘Tesla killer’ Mercedes EQC flops with 55 units sold in Germany to date”

• Jaguar? “Jaguar I-Pace Sales Have Crashed, Dealer Inventory Exceeds 6 Month Supply”

• Porsche? Their new EV, 6 years in the making and 6 billion dollars expensive, has only 192 miles of EPA range: “Porsche Taycan EV’s EPA Range Goes from Bad to Worse”

• Audi’s EV? “Audi e-tron Sales In U.S. Continue To Decline In September”.

• VW’s new EV? Deliveries delayed almost a year: “Volkswagen ID.3 Has Encountered ‘Massive Software Problems'”

• BMW? No new model coming out this year, and the BMW i3 is losing to the Model 3 in every market Tesla bothers to enter: BMW i3 sales in the U.S. were only 4,854 units in the U.S., despite BMW having a $7,500 federal tax credit price advantage compared to Tesla.

Meanwhile Tesla reached a 78% EV market share in the U.S. in 2019: “Tesla Gobbled Up 78% Of US Electric Vehicle Sales In 2019”, as Tesla’s sales soared and EV sales of competitors sagged.

And Tesla is just about to introduce their smaller SUV for $39k: the Model Y.

Just in case you are wondering why Tesla’s stock price rocketed from $180 last summer to $500+ right now. ?

The US is not the Netherlands and Norway. In 2019, there were more than twice as many registrations of the Audi e-tron than there were of the Model S+X combined. The Jaguar I-Pace outsold both the Model S+X. Meanwhile, sales of the aging and overly-expensive Model S+X collapsed across Europe. The competition for Tesla is coming in earnest for Tesla in 2020. It will be interesting to see how well (or poorly) they do.

2019 was the year the E-Tron was released – I presume there was plenty of pent-up demand in Europe from Audi fans who were waiting for the E-Tron for a decade, which was vaporware for 10 years. Here’s an article from 2009: “Watch Out, Tesla, Audi’s e-Tron Is Coming” (Wired, 2009).

E-Tron sales in the U.S. on the other hand are disappointing: only about 1,800 units per quarter, in Q2, Q3 and Q4 of 2019.

Furthermore, the E-Tron is Audi’s only proper EV – while Tesla has introduced the Model 3, which at a $39k starting price has displaced some of the Model S and Model X sales.

Finally, it’s not valid to compare the E-Tron to the Model X: the E-Tron is a “small SUV”, the Model X is larger and more expensive – one category higher.

I think Model Y sales, later this year, will be more comparable. ?

Tesla sold thousands of vehicles in 2H 2019 in the Netherlands largely for 2 reasons: the impending reduction of tax incentives for EVs in the Netherlands as of Jan 1; and other automakers holding back supply of their EVs because they have a huge incentive to sell as many EVs as possible beginning in 2020 owing to EU regulations that came into effect at the beginning of that year. Tesla’s sales are expected to decrease by at least 90% in Q1 2020 vs. Q4 2019.

As for Norway, although Q1 saw record registrations for Tesla in Norway with the introduction of the Model 3, every subsequent quarter saw lower registrations sequentially. Astonishingly, registrations declined YoY in Q4 2019 despite the Model 3 being unavailable in Q4 2018.

If you are interested, eu-evs.com tracks Tesla registrations in Norway, the Netherlands, and Spain and is usually updated daily.

Now and then, I see Teslas in Tucson. Can’t say that they stand out. Which makes me wonder why people pay so much for them.

They have way more range than other electrics and they can crush your neighbors ‘Vette at the dragstrip but still seat four comfortably, is why they pay so much for them.

Why anybody cares about the second part I can’t answer, but they do.

As far as “can’t say they stand out” — These are status purchases, and interestingly enough such purchases at a certain level of age and income are expected to not stand out. A Maserati sedan doesn’t stand out much, either. It’s the old money thing, even if the money ain’t so old.

There’s nothing that stands out like a Rolls Royce.

Regarding the dragstip–a friend who has a Model S took me for a ride. I am not a car guy–my taste in vehicles is utilitarian and cheap. But when he put the hammer down on a stretch of road, and it leapt into action and….just…kept….accelerating…I involuntarily giggled. He turned to me and said “it never fails, everybody giggles like that.” I still find the thought of buying an expensive vehicle just for that experience absurd, but I now understand the attraction a little better. It’s visceral.

The least expensive Rolls Royce starts at $312,000 in the U.S. The most loaded up with expensive options variant of the Tesla Model S comes to $116,000. The two companies aren’t remotely in the same market.

Tesla will be in progressively more trouble in years to come as other manufacturers are starting to produce electrics with the sort of range previously available only from Tesla and do it at a lower price point… and probably better build quality. And then there’s the undeniable fact that the automobile industry is a viciously difficult place to succeed. Just look at the record of the many failures of post WWII attempts to start new mass market car companies. Or the many who have disappeared in that time period, and the fact that two of the “big three” have needed government bailouts – one of them twice. Tesla’s not done too badly really, though the fact they’ve lasted as long as they have has a lot to do with the current investment climate’s weirder aspects that seem to allow years and years of losses, and even no logical route to profitability, as long as the company appears to have some sort of magical tech glamour about it.

I’ve had the chance to experience both a Model S and 3. Both were actually pretty impressive cars. The S is an early one which has been completely trouble free for the owner and the 3 exhibits decent build quality (especially compared to some Model 3 examples I’ve seen) and has been trouble free so far – one year’s ownership. The S would be way above my budget though and the 3, though it isn’t too far above what I can spend on a new car when the time comes wouldn’t be on the shopping list even if it was $10K cheaper. Many reasons for that. The all-touch screen interface alone is enough to make me strike it from consideration!

I experienced the same involuntary laughter during acceleration in a friend’s P85D Model S — it was like an amusement park ride.

Decent article but I’m surprised he misses the obvious:

>who had always wanted a Tesla and had waited for years in the deposit-line to get their Tesla, now have their Tesla, and the “pent-up” demand

People who buy Teslas have money or at least good credit. So they don’t have to postpone purchases. Thus they can take advantage of the “free money” if somebody is willing to give them that.

Marketeers look at curves like that as “falling demand, they’ve become unpopular!” but the popularity was just time shifted. Average out maybe 2 years on each side of a rebate (hard to do in this case because it was phased out, instead of simply withdrawn) and that’s Tesla demand.

Also we’ve flushed thru the early adopters, and other electric vehicles from other companies (whose dealerships people pass every day) are coming out.

Meanwhile in more “let them eat cake”, as Wolf points out luxury brands and especially Porsche are selling like, well hotcakes. The Revolution can’t come soon enough, I’m beginning to think….

Hats off to Monorail salesman Elon. Nothing greener than electric cars powered by coal*.

Grabbed as many US/EU tax breaks as he could and then when the well went dry, he’s going all-in on China.

* 4 trillion!!! kWh of coal-fired electricity with no meaningful decline even by 2040

https://www.eia.gov/todayinenergy/detail.php?id=33092

https://www.npr.org/2019/04/29/716347646/why-is-china-placing-a-global-bet-on-coal

Note that even fully coal generated electricity (which is very rare in the world) produces much less pollution than a diesel engine, because internal combustion engines and their fuel production is so inefficient:

• Crude oil typically takes 2-3% of energy to extract and transport to refineries.

• Refineries waste about 30% of the crude oil in the refining process.

• Typical diesel and gasoline engines are only 25% efficient.

• ICE powertrains like transmissions waste another 2-3% of energy.

In the end only about ~15% of the energy of crude oil is converted into kinetic energy.

Let’s take 100% coal powered electricity on the other hand:

• Coal power plants are 50-60% efficient

• Typical transmission losses to your garage (where most EV recharging takes place) are 5%

• EV powertrains are 95% efficient and typically don’t use a transmission.

• EV powertrains can use regenerative braking, which recovers 10% of the kinetic energy on typical trips.

I.e. an EV will convert about 60% of the energy of coal into kinetic energy: EVs are approximately 4 times less polluting, even in the worst-case.

But there are other factors as well: most of the diesel pollution happens where some of the most vulnerable citizens are living: children and the elderly walking in streets and living in urban areas. A modern coal power plant on the other hand is far away from residential areas, and will typically have filter modules, so mostly “only” the carbon dioxide escapes.

But 100% coal powered EVs are very rare – both solar installations and partly green grids are common – and the grids are getting greener: in the past 10 years the U.S. electricity grid got about 10% greener. I.e. an EV sold 10 years ago is now using a cleaner source of electricity.

Diesel engines on the other hand only get dirtier as they age.

Whatever happens to the Tesla company, they do have some extremely important patents and design expertise. Which will end up in China, and be valuable long after Tesla goes bankrupt (if it does). Because China has the industrial policy of building long-term real economic strength, and the United States has the industrial policy of maximizing short-term profits by stripping out assets and selling the seed corn.

SO TRUE! See 5G for example.

And that design/research center is not EM’s idea (what a joke!) — it is mandatory if you want to do business in China.

Sorry, this part is simply false reporting:

“Cross-Sell” is inexplicably misrepresenting the DMV data, without taking into account that registrations != sales and that registrations are on a 2-4 weeks delay.

This is how late-2018 registrations arrived at the DMV last year, with a phase delay.

See the huge peak in the first two weeks of January? That’s the late December sales of Tesla, registered by the DMV with a 2-4 weeks delay.

Note that in late-2019 Tesla’s California deliveres were even more concentrated into the second half of December: they had record sales in the Netherlands and other parts of the world, so they were only starting making cars for the U.S. in November, and for California in December. Their Fremont factory is so overrun with demand that they are switching production between geographical regions.

You can check the wait time on Tesla’s webpage: it’s 4-7 weeks even now, and months on other parts of the world.

So the title that says “sagging US sales” is false in its entirety (delayed registrations are not sales) – and the same research company made the same “mistake” last year as well.

A mild criticism, I have to say I don’t understand Wolf Richter’s reporting about Tesla, just a few months ago he reported this:

“Code Red” at Tesla as Carmaggedon Sinks Tesla Bonds, Carmaker May Need Another $1-2 Billion Before Year End

This was when the share price dropped below $200, yet none of the points of the article materialized:

• Tesla is running a consistent surplus of $1b+ cash flow from operations,

• Tesla’s cash reserves have increased to record levels despite 50% year-over-year growth,

• Tesla’s share price is now above $500, reaching new all-time-highs, due to record Q4 deliveries of 112,000 units, 50% YoY growth and the new China factory going online in record time

• Tesla’s long term debt has also effectively decreased by 4 billion dollars due to its convertible debt now being deep in the money with strike prices in the $240-$360 range: i.e. Tesla can pay debt with (dilution hedged) shares, not cash.

• All of Tesla’s bonds are trading above par and a Moody’s and S&P upgrades are very probable this year.

• Tesla will likely be included in the S&P 500 this year, triggering a big round of passive and active index fund buying.

I.e. Tesla has robust financials all around and recently announced that they’ll build a new European Gigafactory.

But you wouldn’t learn any of this reading Wolf Richter’s articles.

From the Reuters article:

“The report released on Wednesday showed registrations in California, a bellwether market for the electric-car maker, plummeted 46.5% to 13,584 in the quarter ended December 2019, from 25,402 in the same period a year earlier.”

https://www.reuters.com/article/us-tesla-registrations/new-tesla-registrations-in-california-nearly-halves-in-fourth-quarter-data-idUSKBN1ZF03N

I believe Reuters more than something posted on Twitter.

Also this is a YEAR OVER YEAR comparison. So whatever the delay is, it was there last year too — as EVEN pointed out in the linked twitter chart (first link in the comment).

When it comes to Tesla, folks are all over the place.

How are the claims you quote false? Even if registrations are not concurrent with sales, to report an accurate number of registrations remains truthful. Moreover, the comparisons are apples to apples. Again, even if registrations are not concurrent with sales, the same was true in Q4 2018 as it was in Q4 2019. Thus a 46.5% drop in registrations over the same time period last year is indeed indicative of declining sales in California. The CVRP decreased rebates for EVs on December 3, 2019, making the Model S + X ineligible for them and reducing the rebate for the Model 3 and other eligible EVs by $500. The market for Teslas in California is approaching saturation and there are too few Superchargers in California so it stands to reason that sales are declining there.

I can’t be bothered to debunk all of the claims you make but it’s amusing that you criticize Wolf Richter when his view that Tesla would need to raise 1-2 billion dollars before the end of 2019 (per the article’s headline) proved prescient. Tesla did indeed raise the equivalent of ~1.6 billion USD in debt for its China factory in December, not to mention the nearly $1 billion auto-lease securitization in November. Why would Tesla raise this money if it actually had > $5 billion in cash? Even FT has raised doubts about Tesla’s reported cash balance which is extremely suspicious.

Quite insightful with regards to Musk

“People become tycoons by borrowing their fortunes and having third parties service and retire the loans. The technical term for this process is ‘theft’: I buy the house, you pay for the house … you can’t live in it. This sort of thing is possible because the unremarkable taking on of debt allows entrepreneurs to divert some of it to themselves. Another reason is social orders are built around shared narrative myths that have compulsive power, such as the heroic innovator myth, the profitable large business myth or the efficacy of technology. Abandoning these narratives represents an enormous risk, after all, it’s unthinkable what might happen if people stop believing in entrepreneurs or the moral necessity of repaying debts or the ability of technology to solve our problems? (There is no debt-repaying technology in the pipeline, by the way.)”

https://www.economic-undertow.com/

wait until you check out these sites

https://tslaq.org

Crowdsourced Tesla Research

and

https://www.tesladeaths.com

Tesla Deaths is a record of Tesla accidents that involved a driver, occupant, cyclist, motorcyclist, or pedestrian death, whether or not the Tesla or its driver were at fault

btw anyone know when Musk gets arrested ?

Note that both websites are run by notorious Tesla short-sellers, who have a financial interest in smearing Tesla, misleading people about Tesla and seeing its share price drop.

Are you disputing the accuracy of the claims on these websites because they typically have named, reliable sources or present data from original research? Even if some Tesla skeptics have a short position in Tesla (though many don’t), that does not necessarily make their claims about Tesla inaccurate.

Poor analysis. Here’s an alternative:

Tesla 2019 production was constrained by battery production in Nevada. The company had a decision on where to allocate model 3 output. With new factories in China and Europe, deliveries there had to increase as Tesla relies on users being there main demand generators. In other words, Tesla stimulates demand by word of mouth. Ergo cars to China and Europe. China orders are currently 1200/day in China.

More broadly, some car industry experts see Tesla as not vulnerable to competition from established car makers as they cannot scale production for years due to battery supply limits. Mercedes, Audi, Jaguar, BMW have flopped with their initial offerings. VW gets the danger best as their CEO stated there is a real danger of VW becoming the next Nokia (as in getting crushed by Apple) relative to Tesla. Porsche Taycan has under 200 mile range on epa testing (most expensive Turbo S model, I think).

Between Christmas and New Years, Tesla car carriers were all over the highways here in California so actual deliveries versus registrations are likely to be closer than indicated. This will be easy to see when Tesla reports Q1 numbers. I believe that California demand is very strong.

Time will tell.

I will never climb into a Tesla, because after the impressive acceleration or whatever I’ve no assurance the driver will cease to be in control and the whole thing will veer off into a wall, or off a cliff. Or the battery will catch fire. Or the wheels fall off. Whatever. This is like the English royal family to me, there’s nothing to discuss, it’s just all attention wasting. Tesla are a joke. People write about billions gained, billions lost, here, there, in regards to Tesla. Without once considering how obscene and criminal it is, the very notion of billions of dollars being thrown one way or another. Does any one not respect the value of money? Why is it suddenly normal for a billion dollars to be burnt up instead of being used in pursuits that support, rescue, nurture, or inspire humanity? It’s not like good uses of money are hard to find. But no, lets salute some guy that wants to waste fortunes on BS cars he was never qualified to be involved in manufacturing to begin with, and soak up all the oxygen while he’s at it.

Quite possibly people, like me, are simply waiting for the cybertruck to go into production. Trucks are the #1 sellers after all.

My hundred bucks is down. I’m willing to wait.

I just hope my trusty 87′ Mazda holds out til then.