By Hubert Horan, who has 40 years of experience in the management and regulation of transportation companies (primarily airlines). Horan has no financial links with any urban car service industry competitors, investors or regulators, or any firms that work on behalf of industry participants

Uber’s profit performance and cash burn had ben dismal for years and got worse in 2019

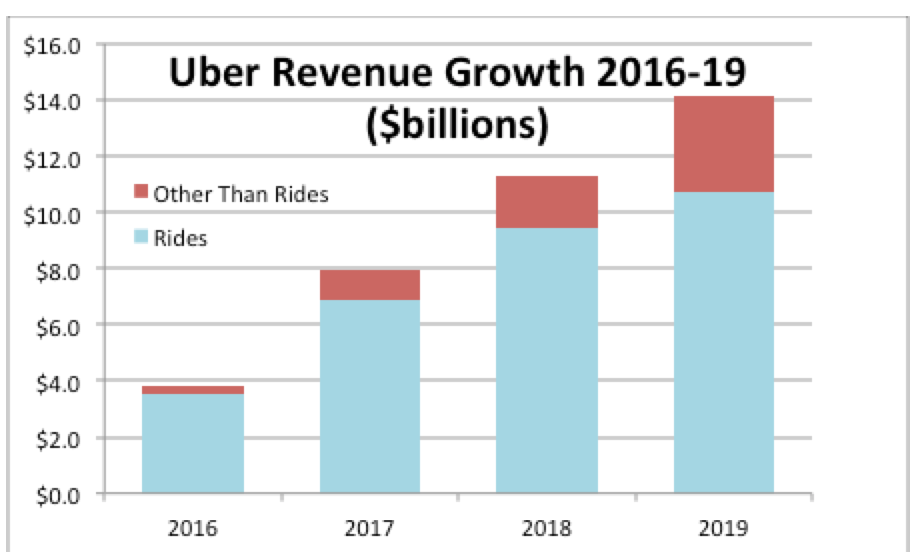

Yesterday Uber announced full year 2019 losses of $8.5 billion. This produced a negative 60% profit margin on total Uber revenue of $14.1 billion. Properly understanding Uber’s deteriorating profit performance over time will require a couple of simple accounting corrections.

Prior to 2019, Uber had shut down its failed operations in China, Russia and Southeast Asia in return for a debt or equity position in the larger local company (Didi, Yandex, Grab) that had driven it out of business. As discussed in Part 19 of this series,[1] Uber improperly included the claimed gains from discontinuing these operations in its 2018 Net Income from Continuing Operations. This created the false impression that its ongoing marketplace activities had achieved a $5 billion profit improvement in 2018.

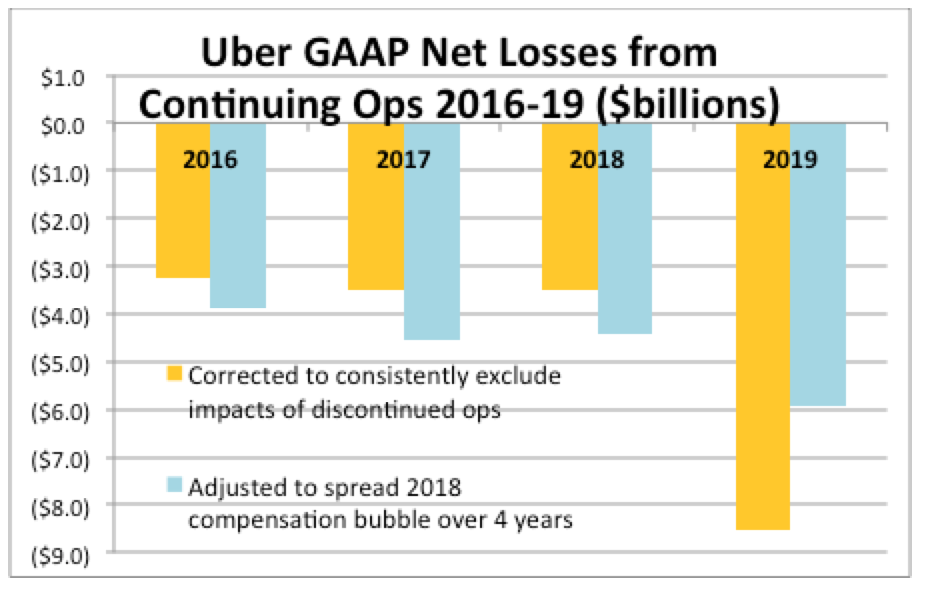

The chart below shows the corrected GAAP Net Losses, with the impacts of discontinued operations excluded on a consistent basis. Uber has lost $18.5 billion in the last four years.

Uber’s May 2019 IPO converted longstanding promises that stock issued to employees would someday have significant value into reality. Following GAAP rules, Uber recognized $4 billion in stock-based employee expense this year, but this was obviously compensation for work employees had done over many years. The chart spreads the $4 billion in suddenly recognized compensation expense over four years, on the basis of each years’ total expenses excluding stock based compensation.

With this adjustment one can see that Uber’s profitability hadn’t worsened by $5 billion in 2019, but it did deteriorate by perhaps $1.5 billion. Its underlying 2019 profit margin was roughly negative 42%, instead of the negative 60% shown in the annual report.

But Uber has clearly failed to improve the profitability of its business over the last four years. 4th Quarter 2019 GAAP losses were 23% worse than 4th Quarter 2018, a comparison that was not significantly affected by the stock-based employee compensation or other major accounting issues.

The year-over-year profit decline appears to have been driven by declines in the share of gross passenger payments retained by Uber (23% to 22%) and by declines in both gross passenger payments per trip (the sum of rides plus food orders, which fell from $9.54 to $9.41) and Uber retained revenue per trip (from $2.16 to $2.05).

The cash burned by Uber’s operations and investment activities also worsened, going from $2.2 billion in 2018 to $5.1 billion in 2019. Uber still has huge cash reserves, having raised $13.6 billion in the last two years, including $8 billion from the IPO.

Revenue growth in Uber’s core “Rides” business continues to slow down. Year-over-year growth of 95% in 2017 declined to 37% in 2018 and 14% in 2019. Uber’s “Other Than Rides” businesses continue to grow rapidly (up 76% in 2018 and 85% in 2019). This allows Uber to site somewhat stronger overall revenue growth rates (42% in 2018 and 26% in 2019), although growth is still slowing. And Uber acknowledges all its newer business have much lower profit potential than “Rides”, so the relatively faster growth of these lower margin businesses is undoubtedly contributing to the deteriorating overall profit picture.

For many years this series has argued that the market is fundamentally unwilling to pay prices that would cover Uber’s actual costs, that after ten years it has demonstrated that it cannot “grow into profitability” and that there is no evidence that Uber’s business model is capable of achieving the massive, multi-billion dollar improvements that would be required to achieve sustainable profitability anytime soon. There is no data in Uber’s 2019 Annual Report that would cast any doubt on these arguments.

As with its IPO prospectus, Uber’s 2019 8-K makes no attempt to lay out evidence showing a possible path to profitability, and provides none of the data outside analysts would need to understand whether at least some parts of the business are improving. Uber does not publish data that would allow investors to understand the actual unit revenue and unit cost performance of each business, or different markets served by each business. There is no data on market share or customer retention, or whether inventive or promotional programs are profitably improving either. There is no data on driver economics or driver retention/turnover rates. There is no data on driver or vehicle revenue productivity trends. There is no yield data, or Uber’s ability to achieve yield premiums based on time-of-day, customer loyalty, or any form of market segmentation. There is no data on synergies between Uber’s businesses, or anything that would allow investors to evaluate the economics of the company’s “Amazon of Transportation” strategy.

Uber’s communications appear focused on people who do not understand what “Profit” or “EBITDA” mean

Since its GAAP profitability results are so awful, Uber’s financial releases and Dara Khosrowshahi’s public statements have come to almost exclusively emphasize EBITDA measures. The problem is that none of these honestly measure EBITDA, and Uber aggressively misrepresents EBITDA as “profit.”

Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) is a non-GAAP intermediate contribution measure that has no obvious relevance to Uber, and even if accurately calculated should be ignored by investors. EBITDA is sometimes used by companies with very large fixed assets, large intangible assets (such as goodwill acquired after a major merger) or significant debt financing to give outsiders a crude sense of a company’s ability to meet its outstanding financial obligations. Uber has none of these characteristics.

More importantly, Uber’s reported “EBITDA” numbers exclude billions of expenses other than interest, taxes, depreciation and amortization. Its primary EBITDA measure excludes the $5 billion in stock-based employee compensation. Its “Segment Adjusted EBITDA” measure also excludes all of the IT expense supporting the Uber platform, and the corporate expenses (accounting, lobbying, etc.) directly supporting all of its current operations.

Uber calls these measures “EBITDA” in the hopes of misleading outsiders who would normally expect a small and fairly consistent gap between true EBITDA and GAAP profitability, and misleading people who might assume that overall “EBITDA and “Segment Adjusted EBITDA” would have been calculated the same way. If Uber were not trying to mislead outsiders it could have labeled them as “Earnings Minus a Bunch of Compensation, Indirect Operating and Non-Operating Expenses” or “Segment Revenue Minus Short-term Variable Costs” rather than using a well-established accounting term that means something materially different.

Uber’s presents “Segment Adjusted EBITAR” measures as a means of measuring the profitability of Uber’s different business units. Uber works aggressively to misrepresent it as a “profit” measure even though in 2019 it excluded $8.8 billion (40%) of the expenses relevant to an actual profit calculation. The press release announcing 2019 results claimed “Rides Adjusted EBITDA delivered a $742 million profit” instead of the more truthful “delivered a $742 million contribution against costs not directly related to specific trips”.

This series has highlighted Uber’s ability to get the financial press to endorse and amplify its false narrative claims. While Uber’s SEC filings have the actual definitions of each measure buried in footnotes, Uber knows that that almost no one in the financial press will dig them out and make sure readers accurately understand Uber’s claims.

One Wall Street Journal writer accepted Khosrowshahi’s Segment EBITAR/profit conflation at face value, reporting “Uber last year made money on its rides when unrelated costs were excluded, he has said” [2].

Another Wall Street Journal reporter’s article about Uber’s third quarter earnings emphasized that Khosrowshahi “is more upbeat about 2021, expecting to turn a profit” did not mention the $1.9 billion quarterly loss until the fifth paragraph, and did not mention that “profit” did not actually meant “profit” until much later. It also repeated Uber’s claim that “ride-hailing.is its only profitable business unit before interest, taxes, depreciation and amortization” without explaining that “ride-sharing EBITDA” also excluded significant employee compensation costs and all of the IT and other corporate costs needed to support ride-hailing. [3]

The Wall Street Journal reporter covering Thursday’s earnings release was even more incompetent. Even though the officially reported annual loss had skyrocketed to $8.5 billion, her story was headlined “Uber Moves Closer to Profitability as Revenue Climbs.” [4]

Khosrowshahi’s promise of profitability by the end of 2020 should be considered in the light of all of Uber’s earlier predictions of “profits just around the corner”

In the analysts’ conference callon 2019 results, Dara Khosrowshahi promised that the 4th Quarter of 2020 would be Uber’s first “EBITDA positive quarter.” He claimed Rides would achieve 45% EBITDA margins and Eats would achieve 30% margins.

In 2015 Travis Kalanick predicted that Uber’s North American operations would be profitable by 2017. [5] Several months after becoming CEO in 2017 Dara Khosrowshahi said that his goal was for Uber “to nearly break even in 2018 and be profitable by 2019” ahead of its planned public offering. [6]

Uber studies in 2018 used in discussions with prospective lenders delayed breakeven expectations by a year. “Under that same likely “base case” scenario, Uber management believed it could turn profitable by 2020, when it would make $1.5 billion in EBITDA. …Uber is banking on net revenue growth more than making up from the rise in expenses.” [7]

Uber avoided making any statements about future P&L improvements in its SEC-scrutinized IPO prospectus, but made a variety of claims in its IPO roadshow, including that future growth “will generate a profit margin of 7% as a percentage of all gross bookings” [8].

Following the dismal performance of the IPO the promised breakeven was pushed back another year (to 2021) and new “Segment Adjusted EBITDA” based claims emerged about the profitability of its core “rides” business. Khosrowshahi’s conference call claim advances this deadline by one quarter.

Needless to say, Uber has not explained whether its “EBITDA positive quarter” will be based on honestly calculated EBITDA, or a calculation that excludes 40% of expenses. Needless to say, Uber has not documented how many billions in P&L improvements would be required. Needless to say they have not explained where these billions would come from, or why Uber hadn’t achieved any of them in the last four years.

_____

[1] “Can Uber Ever Deliver? Part Nineteen: Uber’s IPO Prospectus Overstates Its 2018 Profit Improvement by $5 Billion” Naked Capitalism, April 15, 2019

[2] Brown, Eliot, “Uber Wants to Be the Uber of Everything—But Can It Make a Profit?” Wall Street Journal, May 4, 2019

[3] Somerville, Heather, “Uber Books Another Quarterly Loss as Revenue Climbs” Wall Street Journal Nov 4, 2019

[4} Rana, Preetika, “Uber Moves Closer to Profitability as Revenue Climbs” Wall Street Journal Feb 7, 2020

[5} Newcomer, Eric and Cao, Jing, “Uber Bonds Term Sheet Reveals $470 Million in Operating Losses” Bloomberg, June 29, 2015

[6]Efrati, Amir, “Uber Narrowed Loss in Q4: Full Financial Breakdown”, The Information, February 13, 2018; Efrai, Amir, “Uber’s Three Paths to Becoming Profitable” The Information, May 14, 2019

[7] Efrati, Amir, Uber’s Confidential Documents Show Path to $90 Billion IPO, The Information, January 7, 2019

[8}Efrati, Amir, “Uber Makes Big Promises in IPO ‘Road Show” The Information, May 3, 2019; also see Part 19 of this series

If Yellow Cab in San Fran a company of 750 cabs would fold before paying a 5 million dollar insurance claim what would the total Taxi business in the US be worth?

This was before Uber had really taken off.

I have played with figures and the best I can come up 3 to 6 billion dollars.

To think that Uber and Lyft have spent over 25 billion to capture this market shows what crazy times we live in.

The Overclass might well consider that worthwhile, if includes the collapse of mass transit, which here in NYC continues apace…

That they have $13 billion cash still on hand is mind boggling. Why investors keep shoveling cash at this loser and how so many have so much $$$ to burn in the first place is beyond me.

Uber is nothing but a solution in search of a problem. Just think of what could have been done with all those billions rather than simply subsidizing rides for hipsters who could well afford to pay what cabs charge anyway.

More like a solution that creates its own problem. All this stupid money, for what? “Disruption!”

… how so many have so much $$$ to burn in the first place …

quantitative easing? I don’t know, really, just a thought.

FWIW, in my CA Central Valley town Lyft seems to have 5-6 times more active drivers at most times than Uber. Not endorsing Lyft, of course, but it anecdotally appears drivers–many of whom drive for both companies–prefer to self-identify as Lyft drivers.

Hotel doorman here, a witness to the front lines of the Uber/Lyft/surviving taxi businesses.

Over the last year I have noticed a small increase in the use of cabs. Complaints about Uber drivers are now as common as complaints about taxi drivers once were. My city hosted the AFC championship game in January and not enough Uber and Lyft drivers were working, so very much more expensive than cabs, and much longer wait times.

In January, the 1099’s come out. I wonder how many drivers are unpleasantly surprised by a first run-through of their taxes. Could that account for a shortage of drivers? Uber seems to rely on the financial illiteracy of their drivers who seem unaware that they are earning after all taxes and expenses much less than the minimum wage.

I am amazed on an almost daily basis at how Uber still stays in business. Who in their right mind would invest billions in this enterprise? I await the demise of this zombie company and the resurgence of traditional cab companies, albeit in a much less regulated environment. The destruction of cab regulation in my city is lamentable and puts taxi customers at greater risk. Thanks for that, Uber. Disruptive, indeed.

Here’s just one use-case from here in Boston; The airport recently rerouted all Uber/Lyft pickups and dropoffs to a specific area in their central parking zone, while traditional cabs can still drop off at Departures and are still available from their pickup point at the curb outside Arrivals at each terminal. Now, my habit (with the sole motive of my personal convenience) is to take a Lyft if I’m headed TO the airport and a traditional cab if I’m headed AWAY from the airport. I’ve only flown once since the redirection to central parking, and having to walk with my luggage from there to my terminal was just annoying enough that it might prompt me to switch over to a cab for my next trip. On my way home after the trip, I had to wait in line for about 5 mins for a cab, whereas usually I can get one right away. (Not complaining, I’m sure I would have had to wait at least as long for a Lyft ride and walk a long way for my trouble). This seems like a good result for trad cabs. I am a penny-pinching bus advocate, so I rarely use Lyft for anything other than airport trips and the big monthly grocery shop, so for someone like me a change of pickup rules at the airport has an outsized effect on usage.

So what is Uber in reality for and about?

Originally Uber was a profitable concept—hailing app for livery cars.

Then Lyft (Zimrides) got into the jitney cab business and Uber followed with UberX.

Then the whole scheme fed upon itself and Uber-Lyft announced pivots to autonomous driving.

But the reality remains—structurally unprofitable business models regardless of whether it’s a human or robo-driver.

And in the event fares rise to the true cost of services + fuel/depreciation + profit, demand will collapse because many people will rather drive, take public transit or walk than pay 100% – 200% more in fares.

Take a look at the Uber share price history since the IPO. It is fascinating. This is what We was hoping to do, but got caught first.

Today UBER has a market cap of $68 billion. What will happen next?

A) UBER stock rises and achieves a market cap of $88 billion, or B) it falls to $48 billion (+/- 20b).

The next $20b is up, not down.

Uber = Socialism for the rides.

FWIW, in Madrid, where Uber has so called “VTC licences” together with another company namely Cabify and coexisting with traditional Taxis, electric car/motorbike sharing plus decent public transport services the market is beyond matureness. In cannot see increasing margins even searching below the stones. English lessons combined with rides? Not to mention if some day we manage to take the required corporate taxes that nowadays flight to The Netherlands.

FROM MOTHER JONES’ OWN KEVIN DRUM:

“Uber’s profitability target rests heavily on the success of its ride-hailing service, which brings in three-quarters of the company’s revenue and is its only profitable business unit before interest, taxes, depreciation and amortization.” [whatever all the latter means]

https://www.motherjones.com/kevin-drum/2019/11/is-uber-really-unprofitable-its-complicated/

Everybody knows that Uber is burning through new investor cash at $4 billion a year with no end in sight. This can make it much harder to legislate higher pay for drivers. If Uber’s ride service were known to be profitable, then, maybe prices could be legislatively set at a level that drivers could make a reasonable living at. New York and Chicago are heavy union towns where support for raising (now, pretty low) fares could be found.

Uber has managed to start operating in British Columbia. My own city was a holdout for a few weeks but apparently they will be given permission to operated here too if they pay for a city license. I was hoping the whole thing would implode before they got here but it was not to be.

What exactly is the end game scenario for the people dumping money into Uber and Lyft? Is it the hope that they will be able to run the existing taxi companies out of business, monopolize the market and then charge through the nose and finally make a profit then? Or is it a case of the “bubble and the bigger idiot business case” where they hope to pump the value up to insane levels, cash out and leave someone else holding the bag when it all collapses?

People with money desperately chasing pie in the sky to gain more money when they could easily retire and live comfortably for the rest of their lives and multi generations of their progeny going forward. Pure greed, it always costs them in the end.

I have many friends in Austin, TX who either use Uber or drive for it and my brother is an Uber driver in Southern New England. Uber’s problems are even worse than you think.

First, many of the Uber drivers can’t legally work in the U.S.; they are foreign students, or illegals, which is why Uber is so desperate to be allowed to hire with “a local police check” (meaning ask the local police if the person is wanted in TX) versus a check with the U.S. government registry (which would not only turn up the “Wanted for assault in CA” crowd but, even worse for Uber, would come back with a “Not a citizen or permanent resident allowed to work in the U.S.). If Trump’s Justice Department gets a leaked document or list from a Uber employee seeking a large reward for identifying an Uber false filing, the person filing the report could be in for a multi-million dollar reward. And if the government investigates the claim, Uber’s could collapse in short order.

Even more hilarious (this from a personal source), even the leegal foreign student (call him “A”) often has brothers or cousins who looks like him, are in the U.S. illegally, and don’t even have drivers licenses. So the relatives borrow A’s license and drive the car when he is asleep to make some money. But that means the car shows up on Uber records as being “on duty” for 16-20 hours/day, seven days a week, for months at a time. And Uber pretends not to notice. Wait til’ senor Trump and the Justice department figure that one out.

Finally, since the drivers work on 1099s, what are the chances that A and his brothers will pay any taxes at all? I hope the IRS is looking at what I’m sure will be the amazing “Not filing a tax form” rate for Uber drivers and doing a bit of investigating.

And yes; Lyft drivers are much happier than Uber drivers.

Well.. Uber may have some substantial amount of cash on hand but let us not forget that the careem purchase (3.1 billion USD in cash, as the convertible part is only relevant north of 55 USD per share) and cornershop (~ 800 million USD) will cut quite a dent into the cash position…. it may come down to 6-7 billion USD after Q1/2020. It is still enough but would mean Uber would have no cash left before end of 2022 – unless it can really turn some profit, lend more (current interest expenses on average around 6-7%+) or issue more stock (causing more dilution). It is a lose lose lose situation for all shareholders unless they can find a bagholder….