If you want proof that private equity is predatory, you need go not further than its concerted efforts to extend and intensify the devastating practice of surprise billing. Bad enough that patients develop afflictions or have accidents that land them in the hospital. Recovering physically is hard enough. But to then have the stress and financial damage of large and unexpected bills, which are exercises in rent extraction, is the sort of thing that creates Madame DeFarges.

Private equity experts Eileen Appelbaum and Rosemary Batt did the sleuthing to document how private equity has greatly extended and profited from this abuse. What most people do not realize is the degree to which hospitals have outsourced what most people would assume were core functions provided by doctors on the hospital’s payroll, such as emergency room doctors. With many large nominally not-for-profit hospital groups run by MBAs out to justify higher pay packages for themselves, many practice areas are in fact outsourced. Private equity has hoovered up these groups. They, and not the hospital, provide the personnel for a particular case, and they make sure to get some out of network practitioners on the team to pad the bills.

One metric: a Stanford study determined that the odds of getting a surprise bill had increased from 32% in 2010 to 43% in 2016, and the average amount had risen over that time period from $220 to $628. A new study in Health Affairs found that this out of network billing raises health care costs by $40 billion per year.

Appelbaum gave a high-level overview in a op-ed in The Hill last May:

Physicians’ groups, it turns out, can opt out of a contract with insurers even if the hospital has such a contract. The doctors are then free to charge patients, who desperately need care, however much they want.

This has made physicians’ practices in specialties such as emergency care, neonatal intensive care and anesthesiology attractive takeover targets for private equity firms….

Emergency rooms, neonatal intensive care units and anesthesiologists’ practices do not operate like an ordinary marketplace. Physicians’ practices in these specialties do not need to worry that they will lose patients because their prices are too high.

Patients can go to a hospital in their network, but if they have an emergency, have a baby in the neonatal intensive care unit or have surgery scheduled with an in-network surgeon, they are stuck with the out-of-network doctors the hospital has outsourced these services to….

It’s not only patients that are victimized by unscrupulous physicians’ groups. These doctors’ groups are able to coerce health insurance companies into agreeing to pay them very high fees in order to have them in their networks.

They do this by threatening to charge high out-of-network bills to the insurers’ covered patients if they don’t go along with these demands. High payments to these unethical doctors raise hospitals’ costs and everyone’s insurance premiums.

Appelbaum cited Yale economists who’d examined what happened when hospitals outsourced their emergency room staffing to the two biggest players, EmCare, which has been traded among several private equity firms and is now owned by KKR and TeamHealth, held by Blackstone:

….after EmCare took over the management of emergency services at hospitals with previously low out-of-network rates, they raised out-of-network rates by over 81 percentage points. In addition, the firm raised its charges by 96 percent relative to the charges billed by the physician groups they succeeded.

The study also described how TeamHealth extorted insurers by threatening them with high out-of-network charges for “must have” services:

…in most instances, several months after going out-of-network, TeamHealth physicians rejoined the network and received in-network payment rates that were 68 percent higher than previous in-network rates.

California and the Federal government tried to pass legislation to curb surprise billing. As we noted, the California bill was yanked suddenly and no one felt compelled to offer an explanation. The bi-partisan Federal effort also failed.

Appelbaum and Batt, in a new article at CEPR, explain how private equity has been throwing money at astroturf group to keep its scam going:

Early in the summer of 2019, Congress appeared poised to protect consumers from surprise medical bills and to hold insured patients financially harmless in situations where they were unable to choose their doctor….

Two solutions, both of which take surprise charges to patients out of the equation, have been put forward. Employers, patient advocates, and insurance companies favor paying out-of-network doctors a rate “benchmarked” to rates negotiated with in-network doctors to hold down health costs. Not surprisingly, this solution is opposed by large physician staffing companies and specialist physician practices that want to continue to charge prices higher than the in-network fees. These doctors’ practices, some backed by private equity firms, have been lobbying intensively for a second option that would allow doctors dissatisfied with a negotiated rate to seek a higher fee via an arbitration process that they believe will ensure higher physician pay and higher company revenues and profits.

The campaign by Physicians for Fair Coverage, a private equity-backed group lobbying on behalf of large physician staffing firms, launched a $1.2 million national ad campaign in July to push for this second approach.8 The lobbying campaign bore fruit. In July, [sponsors of the House bill] Pallone and Walden accepted an amendment to allow arbitration, but only in special cases, and it required the arbitrator to use negotiated rates instead of provider charges when deciding on disputes over payment.9 But the private equity-owned physician staffing companies were not satisfied. In late July, a mysterious group called Doctor Patient Unity launched a $28 million ad and lobbying campaign (now up to nearly $54 million) aimed at keeping any legislation to protect patients from surprise medical bills from passing. In mid-September, a representative for Doctor Patient Unity finally revealed what many observers already suspected — that PE-owned doctor staffing firms Envision Healthcare and TeamHealth were behind the campaign…

Agreement on a joint House and Senate bipartisan bill by Senators Alexander and Murray and Congressmen Pallone and Walden nearly made it into the omnibus continuing resolution that passed in December 2019. It was stymied when Massachusetts Congressman Richard Neal, Chair of the House Ways and Means Committee, offered a last-minute alternative. The Neal bill protects consumers from surprise medical bills but requires disputes between providers and insurance companies to be resolved through arbitration. This, of course, is what the PE-owned staffing firms and the doctors’ practices they own lobbied for. Lack of support from the Democratic leadership in the Senate and the House delayed passage of the legislation. In his September 2019 fundraising report, Neal reported receipt of $29,000 from Blackstone, owner of TeamHealth.

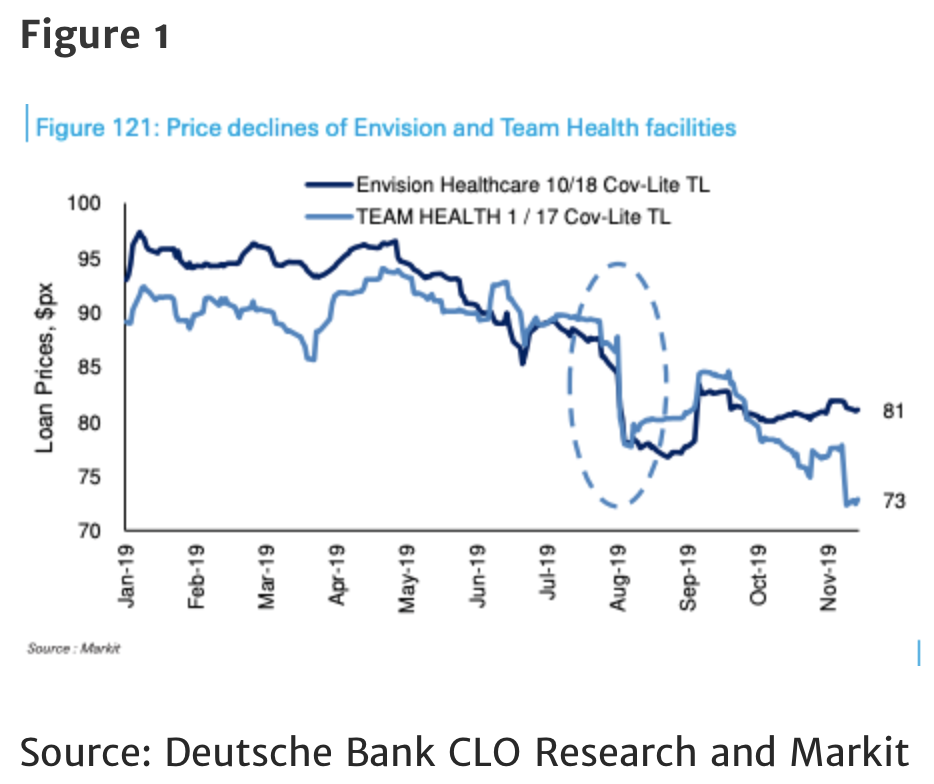

The entire article is very much worth reading, since it offers more detail on how the private equity firms tightened their grip on these chokepoints. And the threat of legal curbs has had an impact. As the piece also explains, the value of the debt on Envision, the parent of EmCare, and TeamHealth both fell into junk terrain and rebounded a bit when the bills were sidelined for 2019, but remains distressed:

Appelbaum and Batt are pessimistic that anything will get done in 2020:

In the current legislative session, Congress is again working to pass legislation to protect patients from surprise medical bills. But the disagreements in Congress remain unresolved…Chances of a compromise bill emerging in this session of Congress do not look good as of this writing (mid-February 2020), and relief for insured patients from unexpected medical bills does not appear to be on the horizon.

However, bond investors clearly think there’s still a risk of legislation with some teeth, although the earliest possibility is 2021. Keep your fingers crossed.

Where I live the emergency room doctors are contracted out to a private group. This has been the practice for over a decade. Recently the local hospital got rid of their dialysis services by selling it to a private company. When a person is sick they don’t think about asking if the provider is in their network. They simply want treatment to help recover.Another problem is in many areas there isn’t a choice. Expensive services can have only one or no providers. That means you have to go out of you area and probably your network. I’m on medicare and chose to be on traditional medicare. You aren’t locked into a small network of providers. My supplemental is through my former employer. Unfortunately it’s network plan. Occasionally I have services not paid because they are out of network, even though medicare covers 80%. The deductible for out of network is so high that I end up with paying the 20%. I believe there is only one reason for network heart care. It’s to increase profits and has little to do with reducing costs.

If Al Capone was around today he would be in this criminal enterprise.

Criminal prosecution is the solution. Not “single payer for racketeering” or “mob protection for all”.

Best government money can buy.

Capone famously once answered a reporter that, “Capitalism is the legitimate racket of the ruling class.”

I was thinking of Al Capone and his almost untouchable Chicago ‘enterprise’. He was untouchable in Chicago because his racket paid off the judges, prosecutors, aldermen, and politicians. It took the feds stepping in to shut Capone down.

How many more people will go bankrupt, or avoid going to the doctor or hospital for fear of bankruptcy because of this PE surprise billing racket? Several state leges are passing or trying to pass legislation to block surprise billing.

Thanks for this post.

A couple of NC-related anecdotes:

Recently in my store a customer started having seizures. Just collapsed and every two minutes or so would tense up and spasm. We quickly had 911 on the way, while the friend was on the phone to girl’s mom. Mom was insisting was okay, it happens, just need to get home for meds. I knew she was thinking about the multi-thousand dollar ambulance ride just to get to the hospital, let alone what a happens after…

Years ago when I worked in finance, we were analyzing an acquired portfolio of stinky mortgages that was defaulting in excess of 20%. We were looking for errors in the underwriting process, and boy were they legion. Of relevance was the underwriting standard that medical-related debt, even if in collections, could be ignored for ratio purposes. How this could be considered prudent is beyond this simple ex-banker.

Last story – when I was a grad student in France for a year I had to get health insurance. $90 for the year. Only time I went to the doctor was to see if I could get a head-start on the pee test for my internship at Boeing. Doc thought I was nuts and told me to go away.

Personally, I never go to the doctor. Once in the last ten years for a rollerblading accident where I almost broke my arm (but knew I hadn’t. Tore the muscle, though). Tried to go without health insurance since I never use it, but that was an exercise in government penalties that I really couldn’t afford.

In summary, the rot is deep in many, many of our systems.

I hope that you’ve been negotiating your out of network billings! A third or half off may not be unreasonable. Heck, the hospital only collects about 25% of its total billings!

This is one reason we need traditional M4A. Traditional Medicare has payment limits that the provider has to accept if they bill Medicare. (Medicare fraud is a problem, but it is tracked and prosecuted.)

Note: Medicare Advantage plans do not have this surprise billing limits protection. see:

https://pnhp.org/news/kathleen-sebelius-and-bill-frist-digging-for-the-medicare-advantage-gold/

Maybe I’m missing something, but offhand I don’t see how this can even be a thing under a single-payer health-care system. If someone knows better otherwise, please enlighten me.

If I’ve got that much right, could this be another part of the motivation against M4A?

Of course it is. A single-payer system will have massive leverage to achieve fair pricing and compensation.

Of course providers are all worried that compensations will be too meager and oppressive. For instance if the docs’ income expectations go unmet, then they will certainly buck!

But the “providers,” as in the MDs, are not the beneficiaries, or at least not much. It’s the companies that own the practices….which are owned by PE funds.

Economic factors have already been moving docs away from private practice and toward employment. A M4A scheme most likely would make things even more risky and tenuous for the private doc. Profits will have to come out of all layers…

Why more financially risky? Docs wouldn’t have to hire a fleet of back office billing specialists to deal with getting payments from private insurance companys. That should significantly reduce office costs.

Single payer is more risky than multiple payers. If the docs are not fairly compensated they will drag their feet. No one wants to be forced into anything. Patients and docs like choice in their care. Who to join up with or not.

There most likely would still be needs for billing and billing staff. More or less haggling for them as compared to the privates would have to remain to be seen.

It is not “economic factors”. It is Obamacare regulations, which make it very difficult to remain in private practice. MDs are close to forced to become members of what I believe are called “accredited care organizations.”

My GP is still in private practice by virtue of having about 40-50% of the services she provides not covered by insurance.

So far ACO’s – accountable care organizations have been optional for the docs. In can be anywhere from very involved and risky for the docs, or they can just stay out. Our group had several rather passive involvements with minimal work at our end. And yet with significant financial rewards for our less than completely ethical docs.

I just retired, but since 2011/12 Medicare has given us in primary care bonuses. So I can make about $200K with just 9-5 office work in a low COL area.

This reminds me of the TV ad running lately featuring a nice young couple opening their cable bill and declaring “Its a ransom note!” as if its the height of comedy that we are living in a kleptocracy where everyone is constantly subject to “your money or your life” banditry we pretend were left behind in central park muggings of the 1970s.

I have recently had multiple occasions that I needed to write on patient responsibility forms that out of network and balance billing is refused, followed with letters citing applicable state laws and CMS contracts barring conduct in my state. It’s insane.

Still I have stacks of collection notices I must beat back and win every time. They only need to win once to destroy someone. Have we no prisons?

The rapine and dispossession of late-stage American crapitalism (can we finally get to End Stage?) always exceeds our worst expectations.

Crime-infested swamp of a country.

Dare we hope a movement can coalesce and endure after a decent man in his waning years is thrust into an historical opportunity to move this train wreck from disaster?

He’s the community organizer Obama never was and the new dealer FDR never quite was.

In the flatness of our current political terrain, Bernie’s grandfatherly menscheism makes him a moral colossus next to the sniveling careerists and the nefarious old crassus.

1776, 1860, 1932, 1968. What will we make of this year?

On to Milwaukee

Can you put the rebuttal into your own easily reproducible form? Either a neat page to staple thoroughly to the bills (copied/printed in needed quantities) or a big rubber stamp with blanks to fill in if applicable?

Yes, if you can provide it, I would make it a post. Your version with your state’s language and how to find similar language in other states. This is VERY important.

Note I have heard one reader say that their doctors said they wouldn’t schedule the surgery if she made an issue out of out of network MDs, that she needed to go elsewhere. So those doctors were completely on board with this practice.

This is largely impossible in our local area hospitals/practices. You never even see a paper form. All “agreements” are in electronic form, and “signed” on a signature pad with a stylus.

No opportunity to add or change any wording.

Am I missing a step?

Good illustration of why we need patient-consumer protection laws.

A sample law would state:

1. For scheduled medical care, extra charges must be disclosed in writing before the care, and signed off on by the patient, at least 1 week before the care.

Otherwise, the patient has no liability to pay the bill.

2. For emergence care, all charges to the patient are limited to their normal insurance copay and/or coinsurance.

If doctors feel they are underpaid by insurers (and sometimes they really are), let them go on strike. Payors will have to come up with solutions.

Anyone who has not made themselves judgment proof really is the fool. No assets, nothing for them to get.

Disagree -as Chris Hedges says, those people have value as prisoners where they can generate $40K+/yr for some private prison.

Yep.

“You wouldn’t think you’d go to jail over medical bills”: County in rural Kansas is jailing people over unpaid medical debt

https://www.cbsnews.com/news/coffeyville-kansas-medical-debt-county-in-rural-kansas-is-jailing-people-over-unpaid-medical-debt/

I am in sympathy on this issue. For clarification, the story says that “failure to appear in court” for the “debtor exam” was the reason for the jail time. It wasn’t not paying the debt.

Doesn’t mean that can’t get a judgment against you! Then you spend the rest of your life trying to avoid having people send money via Paypal or other services direct to your bank account since they can take it. Or winning the lottery or buying a new car…the list is endless.

I am currently visiting some old colleagues in Denmark. I told them about the new practice in the United States of “surprise medical billing.”

They were shocked. “Sure that’s something Trump would do, but surely the Democrats would stop it?”

Hahahaha.

As in “Privatize Sovereignty, Socialize Property” by David Cieplay, Blackstone and its ilk have this very business model. In this case they are buying up emergency room doctors’ practices – with the promise they will make more money – and passing the cost on to insurance companies (poetic justice) and the state and federal gov. Because we have no laws against this sort of corporate privateering (heaven forbid congress should suddenly remember how and why to legislate), all the costs of health care are socialized and because the PE funds are untouchable they have effectively privatized sovereignty. When we all realize their useful function in this scam is one big nothing burger, congress will have to act. It’s just another testament to how venal, immoral, lazy and rotten congress is. I can smell it from here.

Besides PE, it also makes sense that the real estate sector in general would be opposed to anything that reduces financial burden (particularly anything that would lessen medical debt) on middle- and lower-middle-income households, because foreclosures and desperation fire sales would then dry up.

Even in my very GOP controlled state, the state lege is trying to craft regs or a law that will stop surprise billing. It’s a big problem everywhere. Don’t know what state leges can do, but more and more of them are trying to stop this practice with the state govt tools they have.

Here’s the California situation, from https://www.dmhc.ca.gov/Portals/0/HealthCareInCalifornia/FactSheets/fsab72.pdf

The law protects consumers from surprise medical bills when:

An enrollee goes to an in-network facility such as a hospital, lab or imaging center, but services are provided by an out-of-network health provider.

An enrollee receives emergency services from a doctor or hospital that is not contracted with the patient’s health plan or medical group.

Yet another anecdote…

I’ve been a relatively healthy individual and so rarely use my insurance. I used it for the first time in 20 years for a full yearly physical (just because it was “that time”, not for any health problems). The annual full checkup is, supposedly, fully covered, and I chose a local clinic in my network.

The various clinics involved ended up billing me directly, so far, for over $3500.00, and that was before the colonoscopy bill which still hasn’t arrived. I checked my Insurance Portal and, sure enough, the supposed covered charges were listed as “Denied”.

So, considering all these costs were supposed to be covered, I took a full day off work (6 solid hours on various phone calls) to get it straightened out. While going through all these bills and working through each charge I discovered 1 bill for a clinic appt (a subsidiary of CVS) that never happened and 1 very high bill for standard blood tests (Quest) that never happened due to a screwup initiated by the CVS-owned clinic. We’ll see what happens.

But… while talking with one of the Insurance Co. reps she told me a classic surprise billing horror story that happened to her. She gets occasional nosebleeds and one day got a serious one while on the highway before her exit. A CHP officer pulled up behind her after she pulled over to take care of the situation and refused to let her continue on without going to the nearest Emergency Room, so she went.

Her visit lasted 1/2 hour. She was handed a bucket of clean water and a towel. After cleaning up, she waited around for awhile, gave up waiting, washed the towel out, cleaned the bucket out and left. She went on to tell me that 30 days later she recieved a bill from the Emergency Services group at the hospital for $45,000.00. For a towel and a bucket of water.

It took her two days of unpaid time off to get it straightened out and the bill removed.

She then told me she’s voting for Sanders, too.

So I’ve learned three lessons from this; 1) even with insurance things go wrong far too often when it comes to billing issues, and 2) Surprise Billing is far more common than I was led to believe, and 3) Health Insurance/care in this country is riddled with fraud and outright criminality.

Hate to tell you, but with a colonoscopy, the exam is covered by Obamacare, but any snipping of polyps is not, and that can easily run to $1000.

The US Is the only advanced economy where colonoscopies are recommended for everyone over 50. In other countries, they are recommended only for people in high risk groups.

If you get an annual (and it needs to be annual) fecal occult blood test (easy and cheap, MD puts gloved finger in you, wipes test panel, and tells you right there), the results in terms of detection are on par with colonoscopies.

Thank you Yves.

Thanks Yves. Yes, I’m aware of that and I only planned on having one. That was my first and last. It came out 100% “clean”, so to speak, and from now on it will be a simple fecal occult blood test.

Never thought I would be chatting about fecal tests on NC, lol. Just to point out there are 2 types of fecal tests, the FOBT (which sounds like the one you had) and the FIT (Fecal Immunochemical Test). The FIT is the the more accurate (more sensitive and less false positives), but surprisingly a lot of Docs do not know about it and don’t use it. The FOBT is a good test, but requires more prep (dietary and medicine restrictions before taking). FOBT tests for any blood (not necessarily human, hence the restrictions before taking it) but the FIT tests specifically for human blood. I had to print out the info and take to my wife’s Doctors office before they finally accepted that it existed. Which was surprising, because the VA routinely uses the FIT test (I take it every year). They give you a little kit, you take it home, take a sample, and mail it in.

I’ve asked for the FIT test instead of the colonoscopy and they used to mail it to me automatically every year. Then they stopped. Had to beg for it over and over, and I don’t go in for annual physicals. Seems like they want to be able to tell me that I really should get a colonoscopy? Also, I wonder how much those FIT tests actually cost, it’s impossible to tell from the billing, but if it’s $200 each time then it’s actually more expensive than the once-a-decade colonoscopy?

Surprise billing is getting more common due to narrow plan networks, and many docs opting out of plans the hospital accepts.

Insurance and billing screws up are quite common. IMO as a recently retired doc, patient and care giver, far and away not of criminal intent.

I know that a lot of it was clerical screwups, and I’m not trying to infer that it is all intentional, but some of it clearly was either intentional or extremely inept. I grew up in a family full of physicians, father, great-uncle, and cousin, and usually defend them all to the hilt. But these outside organizations deserve very little sympathy from anyone.

And a screwup that costs me an entire day on the phone instead of at work is an additional, expensive, cost out of my pocket, and extremely frustrating on top of that.

For example, The first blood test bill was for $1250.00 with a bad billing code, so marked Denied by the Insurance Company. The results clearly stated that most of the tests could not be run since the blood was too old, submitted to the testing organization 4 days after it was taken from me. Another page on the original test clearly said that some of the vials were mis-marked regarding “the patient name”. So, of the 9 or 10 tests (psa, etc) only 3 were actually run, and I was billed $1250.00 for those three. Why were any of those tests run in the first place if the samples were too old and the patient name not clearly marked on the vials? Oh wait, silly question… I know… $1,250.00

So it all had to be done over again and the second time it was submitted to the Insurance Company with a totally different billing code by the testing organization at a cost of $1,750.00, and so, again, marked Denied. The Insurance Company was as confused as I was as to why the different billing codes for an annual checkup.

It will be at least another two weeks before I find out if it’s been straightened out (including the bill for a clinic appt. that never happened) according to the Insurance Company. My first appointment that started this mess was mid Dec, and here it is, mid Feb and I’m still dealing with what I thought was going to be a simple physical, and I still haven’t gotten all the results, or all the bills. No kidding.

The last time I had a full and complete physical was around 15 years ago. I had no insurance, it cost me about $200.00 (no colonoscopy, obviously), and all the results were in and bills paid within a week.

Times have changed, and not for the better. Thank goodness this was only a simple annual physical. I cannot imagine what people must go through when they are seriously ill.

I had a colonoscopy at 50. I am lucky enough to have very good insurance and chose an in-network provider who assured me it would all be covered by my plan because it was a preventative service. It was all covered except….two months later I received a bill for $550 that explained that one of the sub vendors was in fact out of network. I spent a few weeks talking to the provider and also to the insurance company and eventually it was acknowledged that that vendor was indeed in network so I owed no further monies. I hadn’t known the term Surprise Billing before but now it all makes sense. The funny thing is I was never able to exactly pinpoint who exactly was responsible for this obviously intentional over-billing. Do you know how restaurants work hard to keep positive YELP reviews? I was thinking that maybe a public service healthcare review site could provide the same watchdog/pressure function for Surprise Billing. In my case my insurance company was Blue Cross Blue Shield PPO…if I could have given a negative review to the person or department or executive from which my Surprise Billing had originated, it seems that could help through public shaming. Just an idea…

There are plans in AZ to help with surprise billings:

https://www.beckershospitalreview.com/finance/arizona-s-surprise-billing-law-takes-effect-4-things-to-know.html

I should say that my wife’s AZ BXBS Obamacare plan has honored almost all of her out of network billings these past three years. Over $5M in billings since 1/1/17. Some out of state, almost all out of region. Almost every time her plan sent us a check to pay these docs and facilities.

Yes, I have considered the old fashioned ink stamp, which has the benefit of affixing permanently on the signature page. A paper attachment could easily be thrown in the trash and your signature page kept in the file.

I think this falls under contract terms and documentation: asserting that the agreement is bound by the terms the patient has appended to that contract. Laymen’s law practice.

The other part is a complex web of state law protections (weak, currently 9 states deemed “comprehensive”) AND the insurance coverage you are using AND the facilities, providers and hedge funds seeking to make monetary claims on your injured, possibly unconscious body.

For example, any state law or contracts governing “in-network” facilities with CMS (Center for Medicare & Medicaid Services) naturally apply only to medicare/medicaid patients. However, some states have statutory protections for out-of-network or balance-billing for private insurance patients as well. YMMV.

Here is the most useful chart of state billing protection laws I have found. Scroll down below the map to the tables below for details. Or click your state on the map if you like.

https://www.commonwealthfund.org/blog/2019/state-efforts-protect-consumers-balance-billing

Thank you Cripes.

Here is Illinois law 2007, rev. 2011.

Sec a & b, seems pretty ironclad, but the full text gives more details here:

http://www.ilga.gov/legislation/ilcs/fulltext.asp?DocName=021500050K356z.3a

(215 ILCS 5/356) Sec. 356z.3a.

Nonparticipating facility-based physicians and providers.

(a) For purposes of this Section, “facility-based provider” means a physician or other provider who provide radiology, anesthesiology, pathology, neonatology, or emergency department services to insureds, beneficiaries, or enrollees in a participating hospital or participating ambulatory surgical treatment center.

(b) When a beneficiary, insured, or enrollee utilizes a participating network hospital or a participating network ambulatory surgery center and, due to any reason, in network services for radiology, anesthesiology, pathology, emergency physician, or neonatology are unavailable and are provided by a nonparticipating facility-based physician or provider, the insurer or health plan shall ensure that the beneficiary, insured, or enrollee shall incur no greater out-of-pocket costs than the beneficiary, insured, or enrollee would have incurred with a participating physician or provider for covered services.

Yet, Northwestern Memorial Hospital systems continues this practice habitually without fear, consequence or penalties. It’s completely out of control and no enforcement mechanisms of any kind. Toothless laws. And now the hedge fund pricks are piling on. Wild west.

Thank you for this information. I’ll try to find the relevant laws in my state.

So far, I have simply written by hand short text similar to this:

“Out-of-network and balance-billing explicitly REFUSED per (215 ILCS 5/356) state law and CMS contracts prohibiting this conduct.

I would like to see the process more formalized, perhaps with assistance from legal / paralegal peeps? What works in other contract transactions? Admin staff doesn’t care what you do, as long as they get their forms signed, except in cases cited above where dick physicians refuse surgery unless YOU WAIVE YOUR RIGHTS.

WHAT THE FU*KING FU*K IS THAT?

Are there no prisons?

I know with these ridiculously high charges, this would seem to be a great business and maybe it is, but look at Mednax symbol MD. Made its high at 80 several years ago, and is now around 20. They were just axed by United Healthcare.

Odd since UnitedHealth is only 2% of their billings. But they were price gouging worse than PE owned EmCare and TeamHealth, which takes a hell of a lot of nerve. And you are sympathetic? WTF?

See: https://www.fiercehealthcare.com/payer/unitedhealthcare-axes-physician-firm-mednax-from-its-network

Stop calling them ‘surprise’; these are fraudulent billings; not mistakes but fraud; not bugs but features of the ‘business plans’ of crime syndicates that rule the failed criminal state.

This is the term of art. If people want to search on that topic, those are the words they need to use.

Unfortunately, if you had bothered to read the article, they are legal, so they can’t be called a fraud, unlike many of the foreclosures after the crisis. If you start making inaccurate charges, it’s easy to be dismissed as an uninformed hysteric.

They are an egregious abuse and ought to be criminal, and people ought to be calling out the MDs that work for these practices as well as the hospitals that tolerate it.

Yves;

They are “legal” if immoral in some settings, but clearly fraudulent and illegal under the Illinois law and circumstances I have described.

Fraud certainly applies in many thousands of these abuses and deserve civil if not criminal sanctions.

I said so in my communications with collections and NMH successfully so far in my own and a second person’s defense against these practices.

Notably, they kept repeating that they were not balance-billing, despite having accepted the negotiated insurer rate and then billing me for the rest. That is the definition of balance billing.

Liars and criminals. Their poor call center staff likely has no medical insurance at all.

You did not parse the statute well enough. Hate to tell you, for most people, it does not do what you think it does.

The key bit is:

“the insurer or health plan shall ensure….”

You cannot obligate parties to do things they don’t have the power to do. For instance, you can’t “ensure” your neighbor obeys the speed limit.

If you are in a HMO or PPO run by the hospital, this language does work.

But if you have insurance, say with Aetna or Blue Cross, and go to a hospital in their network, this language does nothing for you.

If you read the post, the physicians practices have signed agreements with the hospitals that provide opt outs for the physicians’ groups: “Physicians’ groups, it turns out, can opt out of a contract with insurers even if the hospital has such a contract. ”

So Aetna and Blue Cross have no direct legal relationship with the physicians’ groups. They can’t “ensure” or compel anything with respect to how they bill. All they can do is yell at the hospital and the hospital says, “Too bad, we have an agreement with them and they are allowed to do this.”

In fact, for Aetna or Blue Cross to try to get the hospital to muscle the MD practices would arguably be tortious interference, a big legal no-no: https://www.law.cornell.edu/wex/tortious_interference. And PE firms can spend far more in legal dollars and hire much better lawyers than any insurer could.

Just curious about how invested these PE firms are in the insurance companies paying the patient bills?

Yves:

Yes, but there’s more.

I inserted the section for the benefit of readers concerned with “surprise” billing by out of network providers.

In my own case, its in-network providers accepting the negotiated rate and THEN trying to take the rest from the patient AND selling to collections.

The statute DOES direct the provider “shall not bill the beneficiary…” so the legislature tried here, but yes, an enforceable ban is required across the board

” The insurer or health plan shall pay any reimbursement directly to the nonparticipating facility-based provider. The nonparticipating facility-based physician or provider shall not bill the beneficiary, insured, or enrollee, except for applicable deductible, copayment, or coinsurance amounts…”

Hospitals accepting plans don’t always have all the specialists or facilities they need to cover the medical needs of all their patients. Or they can’t hold on to them. The hospital then has to inform every patient of the discrepancy. Not always fraud!

I should have said that after disputing a collections company threat letter, and sending a long form letter citing the law to that collector and to Northwestern billing, I HAVE HEARD NOTHING FURTHER from them about 4 collection notices they sent to me instead of my insurer.

They never admitted fault, nor pursued their wrongful claim, they just shut up. I probably should keep watch on their old claims as well as any new ones.

One thing that interests me is this: a huge hospital corporation like NMH certainly knows their billing department is engaged in these illegal practices on a large scale, frequently targeting the disabled, elderly or simply the uninformed, unwary patient who will PAY THE CHARGES, often to the benefit of outside physician/diagnostic or hedge fund pirates.

What’s their interest in this fraud?

Seems ripe for class actions all around the country don’t it?

This sort of thing is why the truth is that even the likes of Bernie Sanders, even if perhaps sincerely well meaning, are in fact misleading the public with promises of how “Medicare-for-all” will solve the health care crisis.

But the reality is that it is not just the insurers that are the problem. Everyone in the system is working on a for-profit basis, and because health care is not a real “market” (and can never be one) and it is full of opportunities for outright racketeering, racketeering is indeed what we get from everyone in the system who can set it up.

And that includes not just insurers but hospitals and individual doctors.

This article is in fact somewhat misleading too — it focuses on private equity, who are indeed truly evil actors in the story, but while it does talk about greedy doctors, it does not focus sufficiently on them, and they are key players in this too.

The only health care system that works well and in the interests of society as a whole is the Soviet one. Which is not “Medicare-for-all”, it goes much further than that — hospitals are government-owned, government-run and government-funded, doctors are civil servants employed by the government, medical schools are free, private practices are outlawed, funding is from general taxes, which were not regressive in any way, quite the opposite (note that even a “Medicate-for-all” system would probably run based on regressive taxes).

It worked very well in the USSR.

But even meek proposals for “Medicare-for-all” are considered “radical” in modern US politics…

It’s like a terms of service where you consent the moment you step inside the door. They should at least hand out a complementary jar of vaseline…

As for me, I wouldn’t step foot in a hospital unless I suffered some traumatic injury and was going to die in less than 5 minutes. Anything else can wait.

Justin:

Thats where we’re headed, and where many millions have been living for years. Often, their entire lives.

Coalition against surprise billing has more

https://stopsurprisebillingnow.com/

Great article, thanks for posting.

Regarding Medicare for All: it is hard to imagine these doctors accepting a national Medicare fee schedule, if they won’t even accept the more generous fee schedules of most private insurers.

Many private carriers have followed Medicare’s reimbursements downward. My wife’s Obamacare BXBS policy pays about 25% on the dollar. And that’s about what hospitals generally collect on total billings.

They will not.

And this is the big weakness of Medicare-for-All proposals.

They are just not realistic about what it will take to actually control costs.

Rent extraction by insurance companies actually accounts for only something like 20-25% of the total (do not recall the exact figures at the moment but it is in that range).

The rest we have hospitals, drug and device manufacturers, and yes, individual doctors, to thank for.

Medicare-for-all eliminates the insurance companies, and it could in principle do a lot to force Big Pharma and Big Biotech to lower prices due to its monopsonistic power.

But as long as hospitals and doctors remain private and out there primarily to make a profit, it is difficult to see how the problem will be truly solved even under a Medicare-for-all system.

I just don’t see a public-funding/private-providers model working very well in practice because of these factors.

It is also not a stable one in the long term.

See what is happening in the UK — there they have taken it a step further, to a public-funding/state-controlled-providers model. But is has nevertheless been gradually chipped away over the last few decades, and the trend is for it to be dismantled eventually.

Because the rich and powerful have no incentive to maintain the system in good working order other than public pressure (and “public pressure” in this day and age of powerful means for mind control on a massive scale just isn’t the treat it used to be).

Being rich and powerful they can always sequester themselves away from the public system and use private facilities of higher quality.

Which is why the only system that is stable in the long term is one that features no private for-profit players in it. In other words, all components of the system are government-owned/controlled (medical schools, doctors, hospitals, drug and device manufacturers) and private practices are completely outlawed.

But given how hard it will be to implement even Medicare-for-all in the US, there is absolutely no chance of something like this ever passing there.A lot of people will have to be sent to prison on long sentences for it to happen….