By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

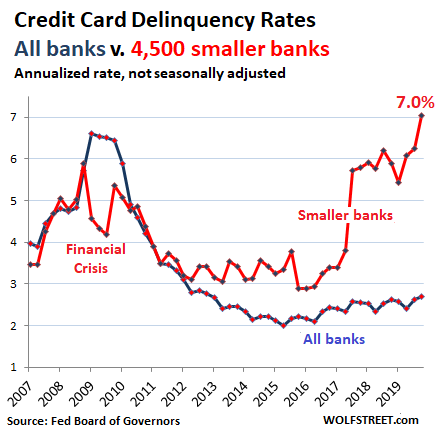

The rate of credit card balances that are 30 days or more delinquent at the 4,500 or so commercial banks that are smaller than the top 100 banks spiked to 7.05% in the fourth quarter, the highest delinquency rate in the data going back to the 1980s (red line).

But at the largest 100 banks, the credit-card delinquency rate was 2.48%, which kept the overall credit-card delinquency rate at all commercial banks at 2.7% (blue line), though it was the highest since 2012, according to the Federal Reserve. What’s going on here, with this bifurcation of the delinquency rates and what does that tell us about consumers?

Clearly, those consumers that have obtained credit cards at the smaller banks are in a heap of trouble and are falling behind at a historically high rate. But consumers that got their credit cards at the big banks – lured by 2% cash-back offers and other benefits that are being heavily promoted to consumers with top credit scores – do not feel the pain.

A similarly disturbing trend is going on with auto loans. Seriously delinquent auto loans jumped to 4.94% of total auto loans and leases outstanding. This is higher than the delinquency rate in Q3 2010 amid the worst unemployment crisis since the Great Depression. On closer inspection, there was that bifurcation again; prime-rated loans had historically low delinquency rates; but a shocking 23% of all subprime loans were 90+ days delinquent.

During the Financial Crisis, delinquencies on credit cards and auto loans were soaring because over 10 million people had lost their jobs and they couldn’t make their payments.

But these are the good times – with the unemployment rate near historic lows. And yet, there are these skyrocketing delinquency rates in the subprime subset of credit cards and auto loans. It means these people are working, and they’re falling behind their debts.

Consumers with subprime credit scores (below 620) can still get credit cards, but under subprime terms – namely interest rates of 25% or 30% or more.

These rates comes at a time when, according to the FDIC, banks’ average cost of funding was around 1.0%. The difference between a bank’s average cost of funding and the interest it charges is its net interest margin. For banks, subprime credit-card balances, with interest rates of 30%, are the most profitable assets out there.

To get these profits, banks take big risks. Even when a portion of those credit card accounts have to be written off and sold for cents on the dollar to a collection agency, they’re still profitable overall. In addition, banks offload part of the subprime risk to investors by securitizing these subprime credit-card loans into asset backed securities. And investors love them and chase after them for the slightly higher yield they offer.

So I’m not worried about the banks or the investors. If they take a beating, so be it. But what does it tell us about the consumers?

The largest 100 banks have a delinquency rate of just 2.48%, which is low by historical standards. With their sophisticated marketing, they go aggressively after consumers with high credit scores and high incomes, and to get them, the big banks offer big benefits, and so a bidding war has broken out for these high-credit-score consumers, with “2% cash back on every purchase” and other benefits that small banks cannot offer.

These big banks have most of the customers and most of the credit card balances (assets for the banks). Their special offers rope in the lion’s share of consumers with top credit scores. They also issue credit cards to consumers with subprime credit scores. But since these big banks have the lion’s share of prime-rated customers, their subprime customers, when they default, don’t weigh heavily in the mix.

Smaller banks can’t offer the same incentives and don’t have the marketing resources the big banks have. But subprime-rated customers are easy to hand a credit card that comes with few incentives and charges a 30% interest. And those credit card balances, producing 30% interest income, do wonders for a small bank’s bottom line. Proportionately, these small banks end up with more subprime customers. And in this way, they become a gauge for subprime credit card delinquencies.

So why are these delinquencies spiking now? We haven’t seen millions of people getting laid off. These are the good times.

It’s a sign of the sharp bifurcation of the economy for consumers. One group of consumers is doing well. They have rising incomes, and they can afford the surging home prices, the surging healthcare costs, and the surging new-vehicle prices. Those price increases are not reflected in the inflation measures. For example, the price of a Ford F-150 XLT has skyrocketed 163% since 1990 while the official CPI for new vehicles over the same period has increased only 22% thanks to “hedonic quality adjustments” and other adjustments (here is my pickup truck price index chart that overlays both).

Same with used cars. The official CPI for used cars has declined by 11% since 1995, an amazing feat of hedonic quality adjustments, as actual used-car prices have soared since 1995.

There are other consumers whose incomes have not budged much – maybe it went up in line with CPI, but CPI doesn’t reflect actual price increases of cars and homes and other items. Everything big they’re trying to buy or rent or use has soared in price – new and used vehicles, housing, healthcare, education, etc. And those consumers, though they’re working hard, are getting squeezed. That’s the bifurcation.

These are the people that are strung out. They have jobs but are living from paycheck to paycheck, and not because they’re splurging but because, at their level of the economy, prices of basic goods and services have run away from them.

And this can happen from one day to the next, for example when the landlord raises the rent by 15%, or when the car turns into a hopeless heap and has to be replaced, or when the insurance premium jumps 25%, or when the kid ends up in the emergency room. Or a combination. And suddenly, there is no money left to make the minimum payment on the credit card.

And this is happening while people are working. This subgroup of consumers that are getting squeezed is growing, and their problems are growing, and their credit-card delinquencies and auto-loan delinquencies are spiking into the stratosphere like never before – while many other consumers have the best years of their lives, relishing with gusto the out-of-control “speculative energy,” the blistering highs in the stock market, and the surging prices of their homes, vacation homes, and investment properties. And that’s the bifurcation that we’re seeing in the chart above.

bifurcation of the economy

Getting their chunks of flesh before Bernie lowers the boom on usury and raises the minimum wage?

One can hope.

On the other hand, we might see a capital strike and watch as the 401k class’s investment portfolios take a beating. Democracy can really suck for certain socioeconomic minorities if enough of the downtrodden get out and vote for someone who actually stands up for them after inauguration day instead of turning their back on them.

Credit cards were traditionally a gateway drug to HELOCs. When you got in over your head with credit card debt, you cashed in the equity in your property, cleared the credit card debt (with of course the implication that you’re paying the same debt off over a much longer period, but at a lower monthly cost) and started the whole cycle off again. Rinse and repeat.

The GFC initiated a great clear-out of this merry-go-round. But of course, it’s the only game in the modern capitalist town. Our economies know no other way of actually redistributing wealth (Wolf hints at this point when he rightly says that, in the inevitable unwinding of a credit cycle, banks and asset holders have to take a spanking — and in the inevitable unwinding of periodic credit super-cycles, governments in the form of sovereign debt expansion and QE take a bigger spanking, but they can’t run out of money so it is an effective socialisation of the losses).

Here in the UK, the UK government is happily kicking off another uptick in residential real estate. The UK economy is even more susceptible to the beneficial effects of this approach than the US is, I think (and the US is itself no stranger to this route). You can get easily a couple of years or three of 2-3% GDP growth before it’s time to pay the piper. Sometimes it can go on for half a decade or more.

Yes, I too wish someone would come up with something better.

Yes, I too wish someone would come up with something better. Clive

What’s that saying that it takes a lot of heat for some to see the light?

Who knows? We might even consider applying ethical principles to fiat and credit creation – after (as Churchill quipped) having tried everything else.

Meanwhile Deuteronomy 23:19-20 looks better and better or, at least, government privileges for usury look worse and worse.

How is this a mystery, exactly? “Full employment” isn’t, and the share of productivity going to labor is too low.

The official US poverty threshold for a single person in 2019 is $12,490. I think the primary justification of this value is that it makes a 2080 hr per year job at the US minimum wage of $7.25/hr above the poverty line, so the minimum wage doesn’t require adjustment. Anybody remotely close to these levels will struggle to pay off any sort of debt, especially at usury interest rates.

Except ANY positive interest rate is usury – until Calvin and his followers redefined usury to mean HIGH interest rates.

But even John Calvin thought over 5% was high and that the poor should not be charged any interest at all, iirc.

Nor is interest even required with lending since the loans can be slightly over-collateralized to compensate for risk.

If you’re living on 12,480 before taxes, you have other worries besides paying off some debt. Like, a place to live and food to eat. The poverty line is so ridiculously low in the US, I think it should be doubled.

Agree. But, in a global economy for labor what is considered to be “too low”? As low as labor price goes there will be another level to be descended into. With globalization the “manufacturing class” in the medium term may have condemned the world to mass poverty.

There is only one answer in a capitalist (global) economy. One that has rules (regulations) that allows innovation and the formation of organized workers to combat the outright brutal greed that is the push of the system itself. “Greed is good” is true…..to a point (even Adam Smith believed); we can’t afford to allow “un-barred ‘free’ markets” to rule the world. It will eventually strangle us all.

and the formation of organized workers to combat the outright brutal greed that is the push of the system itself. sierra7

And how is that not a doomed approach given ever increasing automation?

Otoh, ethical finance would preclude the ill-distribution of productivity gains, wouldn’t it? By eliminating the use of what is, in essence, the use of the public’s credit but for private gain?

Why should I care what this Adam Smith believed? I’ve read his works. I like the “even”. The actual Adam Smith can’t be understood correctly with the context of the society he lived. He also believed that belief in God and organized religion would offset the ‘evil’ of greed. In his Kirk, if a young women of modest means needing a dowry to get married did not have it, then congregation raised it. Without resentment. This Adam Smith you speak is more kin to Ayn Rand. Smith couldn’t possible fathom the world we have built.

What can’t go on, stops.

Watch out for the whiplash.

Vested interest theft. ‘Banks’ average cost of funding was around 1%. Subprime interest rates of 25-30%.’

Must be rough. I’ll take Regulatory Capture for $1,000, Alex.

So, what’s being said is that these banks aren’t losing any money, eh?

This is in line with the observations I made while knocking doors for Bernie in disadvantages parts of town yesterday. Here’s what I wrote about it last night…

‘What a great economy we have–the stock market is up 200% in the past 10 years, real estate prices in my town have nearly doubled in the past 8 years, and unemployment is as low as 2.6%. Who could complain, right?

‘And yet the neighborhood where I knocked doors for Bernie today tells a different story: bars on the doors and windows, peeling paint, dirt yards, cars on blocks, car windows broken out and covered with plastic. Little ragged $200,000 houses that have increased in value by 125% in the past eight years. But what good does that increase in value do for you when you can’t afford to keep it up, and if you sold it you can’t afford to buy or rent anywhere else? Meanwhile, taxes go up, the cost of living goes up, but wages are stuck. We can’t afford much more prosperity.’

Such an innocent start, 70 years ago.

I’m not falling for that fable. His wife would still have to bail him out if he were to forget his wallet.

Perhaps not where it all went wrong necessarily, but close to it, could have been a major turning point

around April Fools Day 2009:

“My administration is the only thing between you (Wall Street) and the pitchforks”.

All forecast to happen in the time of the end. We are at the last few seconds of this time period. 2 Tim 3:1-5 tells you what will be happening at this time and its all there to see out in the open.