Yves here. Aside from the fact that readers have indicated they’d like some breaks from COVID-19 programming, this post is important because it addresses what seems be a widely-held misperception of Modern Monetary Theory, namely, the role of tax.

Modern Monetary Theory scholars stress that tax is what legitimates a currency. Individuals and businesses must obtain it to settle their tax obligations to the state. They also point out that tax serves to drain demand, as in contain inflation. But Modern Monetary Theory proponents also (usually) point out that taxes also serve to provide incentives and disincentives and redistribute income. But they regard these as potential applications, as opposed to core to their theory.

As Modern Monetary Theory has started to be taken more seriously, critics have usually focused on either “This can’t work” or “ZOMG, free money, hyperinflation just around the corner!” That has led Modern Monetary Theory scholars to focus on the necessary purposes of tax in their system, validating the currency and curbing inflation, to the detriment of acknowledging the other important roles that taxation can play.

Another area for potential confusion is not recognizing the difference between a currency issuer (the US, the UK, the Eurozone) versus currency users (Italy, countries that have dollarized their currencies or borrowed in foreign currencies).

Having said that, I think Modern Monetary Theory proponents have made acceptance of their ideas a bit more difficult by not drawing a bright line between their theory, which is a description of how government spending works in a fiat currency system, versus what they believe are resulting sound policy approaches, such as setting the price of labor (a Job Guarantee) rather than the price of money.

By Richard Murphy, a chartered accountant and a political economist. He has been described by the Guardian newspaper as an “anti-poverty campaigner and tax expert”. He is Professor of Practice in International Political Economy at City University, London and Director of Tax Research UK. He is a non-executive director of Cambridge Econometrics. He is a member of the Progressive Economy Forum. Originally published at Tax Research UK

There seems to be the most, and quite extraordinary, lack of understanding of modern monetary theory and its interaction with tax in the tax justice world. John Christensen and Naomi Fowler of the Tax Justice Network and I were aware of this a year ago, and this blog and Taxcast were the result. I’m sharing both again because an appreciation that tax is not just about revenue raising, if it is about that at all, is absolutely fundamental now. Nick Shaxson added to the words:

Modern Monetary Theory (MMT) has gained prominence since the global financial crisis. The rising star US politician Alexandria Ocasio-Cortez said recently we should be “open” to its ideas, and some mainstream economists have given it a (qualified) endorsement. For many, it offers a powerful critique of the damaging austerity policies that were implemented in the western world since the global financial crisis, and an important plank of new progressive thought. MMT also has many critics.

For the tax justice movement, however, MMT opens an important debate about the role of tax. One of the MMTers’ central arguments — that governments don’t need tax revenues if they want to spend money — seems to conflict with our argument that governments must tax rich corporations and crack down on tax cheating and tax havens in order to pay for roads, schools, teachers and hospitals.

To illustrate this clash, take the words of UK Shadow Chancellor John McDonnell during the Panama Papers tax haven scandal that “every pound avoided in tax by the super-rich is a pound desperately needed by our National Health Service, our schools and our caring services.” We’d strongly agree with this statement — though Bill Mitchell, a prominent MMT economist, attacked it as a “dangerous and misguided narrative for progressives to engage in,” because it “fuels damaging myths” about how the tax and spending system works.

This blog asks some big questions about MMT. Is it ”correct“? If not, how not? But if so, is it compatible with tax justice – and could it even be useful? Is tax justice useful to MMT? We’ve given MMT a partial endorsement and suggest there is no real conflict between MMT and tax justice — that tax justice doesn’t especially need MMT, but without tax justice, MMT is incomplete. You can listen to a discussion here exploring these issues in this Taxcast Extra below: (our monthly podcast, the Taxcast is available here)

So What Is MMT Anyway?

There seem to be differing versions of MMT out there, but they contain a few core elements, three in particular. To understand the first part of the MMT canon, let’s start with another British politician, Theresa May, who once told an underpaid nurse she couldn’t have a pay rise because “there is no magic money tree.” We haven’t got the tax revenues, May was saying, to pay nurses a decent wage.

Her predecessor Margaret Thatcher, thrifty Germans, and many others, endorse this idea, which rests on the intuitively appealing notion that a government budget is like personal or household finances: that we need to earn money before we can spend it. This legitimises the alleged need to make “tough choices” (like paying wealth-creating nurses or teachers a pittance, while allowing wealth-extracting private equity titans to earn billions) and has underpinned vicious and counter-productive austerity policies around the world.

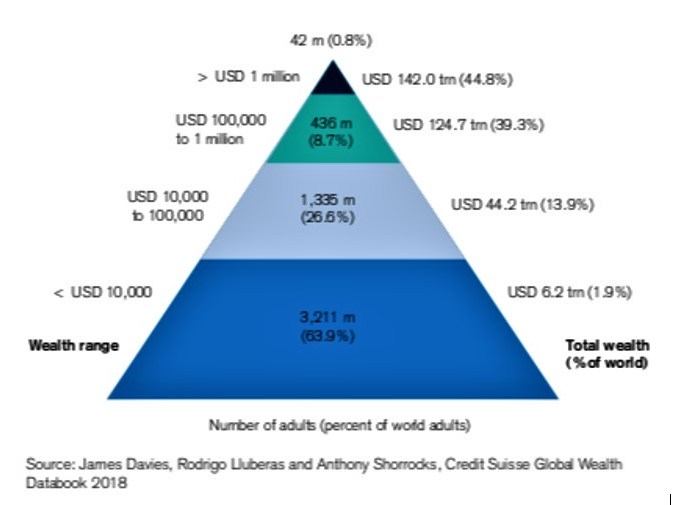

The tax justice movement doesn’t generally voice opinions about spending — our focus is on the revenue side of things — but we disagree with the “there is no magic money tree” worldview. We argue that there is a magic money tree or trees: one version of which would be “tax havens, multinational enterprises, and the mega rich.” If they stopped avoiding tax we could pay teachers better. In fact, we’ve even got a picture of one of these trees. It looks like the top section (or two sections) of this image, from the latest Credit Suisse World Wealth Report:

World Wealth Report 2018

(There are, conventionally speaking, other magic money trees – the debt markets, for instance: you borrow to pay for productive spending and investment — but let’s leave that aside for now).

MMTers take a different view. They also agree that there is a Magic Money Tree or trees, but they say it’s not in the tax havens: it’s elsewhere. Mitchell puts it, in a piece co-authored with Thomas Fazi:

The magic money tree does exist, but it’s located much closer to home than we think: in each country’s central bank, not on some faraway tropical island.”

In its crudest form, a central bank can use special papers, inks and a printer, to create money. A more sophisticated form of money creation is Quantitative Easing, where the central bank issues electronic money to buy real assets, simply by clicking the keys on a computer to credit someone’s bank account. (The private banking system can also create money, but again let’s not complicate things needlessly for now).

Governments that issue their own currencies can’t really “run out of money” since they can always create more if needed. Money is created first, and tax comes later. And spending and taxes don’t necessarily have to match. So that’s the first MMT concept: the idea that money can be conjured out of thin air. This idea isn’t really controversial either: the Bank of England has even endorsed a version of it. The tax justice community doesn’t need to generally disagree with it either — and this blog describes a framework that happily includes both varieties of the magic money tree.

But one also has to be careful here, because such thinking could encourage people to think ‘if governments can just create money, what’s the point of tax?’ Well, as we’ll see, tax serves a whole range of crucial purposes. MMTers tend to obsess about just one of them — which is the second MMT concept.

Just weird?

To grasp this, consider the curious words on a £5 note, under ‘Bank of England.’ It says “I promise to pay the bearer on demand the sum of five pounds.”

What could that mean? If you give the bank five pounds, they’ll give you five pounds back? This seems tautological and, frankly, a bit weird.

But in fact this goes to the essence of what money is. This bluish-green piece of paper isn’t worth anything in itself — nor is gold. They are only worth something because enough other people believe they are worth something, and are prepared to exchange them for real resources.

But why do we collectively believe they are worth something? Just because everyone else does? Isn’t this a bit fragile? Wouldn’t this confidence, and the value of money, evaporate if everyone got the jitters for some reason? Why would a soldier go off and risk his life in a foreign war, in exchange for these weird paper (or electronic) will-o-the-wisps?

Well, the MMTers explain, we believe in these pieces of paper ultimately because the currency has a large and stable anchor, which is the biggest player of all: the government. It will ultimately accept these pieces of paper, or electronic money, as payment of tax. For MMTers, the purpose of tax here isn’t to fund spending: it’s to provide that essential role tying money to something solid. Again, people in the tax justice movement don’t need to disagree with this idea, either, as far as it goes. It’s not wrong – although there aren’t many policy makers who think about tax in this way.

The third MMT principle follows on from this. A government, or your central bank, can’t just create money, willy-nilly, to pay for anything they fancy. An economy is essentially a circular flow of spending, production and income, but if you start flushing enough freshly-minted money into a system that’s nicely in balance, this might lead to Venezuela-ish hyperinflation, or a currency collapse, or some other unstable thing. Equally, if there’s too little money in the system there may be stagnation and under-employment. So, responsible governments should aim first to create sufficient money to make things go around in healthy ways, but when things go too fast use other tools, including (but not only) increasing taxes to withdraw money from circulation.

How does tax take money out of the system? Well, in a sense, tax destroys money. It is a bit like a cinema ticket: the cinema prints it, and it’s worth something in your hands as a temporary store of value — and then as a medium of exchange when you hand the ticket in just before you get your popcorn and take your seat. But when the usher takes your ticket, they tear it up and throw it in the bin. Having served its purpose, it can be dispensed with. This is essentially what happens when the government receives your tax payment.

Tax and money creation, the MMTers argue, are key tools for fine-tuning the amount of money whooshing around in your economy, to help keep it in the Goldilocks zone: not too hot, and not too cold. In very general terms, we don’t need to disagree that this happens — though again, this does not fit with how tax policy-makers generally think about tax.

Is MMT Right? Can It agree With the Tax Justice Movement?

These insights from MMT show that (i) spending comes before taxes, (ii) spending can happily outstrip revenue, and (iii) that while fiscal deficits (that is, more spending than revenue) do matter in some circumstances, there’s plenty more flexibility in the system than most people realise. So MMT is helpful as a political tool to push back against austerity.

We don’t disagree with MMT’s core principles. And we’re not alone. In the recent words of the (mainstream) US economist Brad DeLong, MMT “is a good gospel . . . much better than the ravings of those yahoos, including President Obama, who said nearly a decade ago that the United States government needed to freeze spending because it needed to tighten its belt just as American households had been forced tighten theirs.” In most ways, he summarised, MMT is “just macroeconomic common sense.”

But there are, as we’ve hinted, objections to MMT, from others, and from us. First, from others:

For one thing, MMTers admit that there are situations where it simply doesn’t apply. For example, unstable countries where people lack confidence in the state aren’t stable enough to serve as reliable currency anchors. Sometimes, an anchor is provided by pegging the shaky currency to another solid currency like the US dollar, or their economies become “dollarised” (which is when most people prefer to trade in dollars rather than in the local currency.) These governments can’t always create the money they need, and such countries have little alternative other than to match revenue and spending pretty closely, or risk bad things happening, like hyperinflation (one of your writers has lived through such times, in Angola, and it isn’t nice.)

There may also be institutional reasons why revenue and spending can’t diverge, or can’t diverge very far, as MMTers also generally accept. Governments which use the Euro currency are institutionally constrained in terms of what they can and can’t spend relative to their tax revenues, and the European Union also requires its members to exhibit a fair degree of austerity, (which may explain such lacklustre growth in Europe for so many years).

Similarly, local and state governments in many countries generally can’t create their own money, and they are also often constitutionally constrained from spending beyond their local and state tax revenues. Vermont in the USA can’t issue dollars, nor can it easily ”spend now and tax later,” (though it has some flexibility.)

Another possible objection to MMT is that if it is to serve as a useful policy tool, it needs debt markets to be efficient and investors to be wise, so that when the supply of money moves out of line with demand in the economy, it will show up quickly in shifting interest rates or rises in unemployment, which can be promptly addressed. Hence, among other important things, MMT may struggle to deal with bubbles, manias and panics, which are all too common. (It’s not alone, in not having a panacea for these things.)

Some have urged MMT to consider the private banking system, rather than the central bank, as the prime creator of money, though MMT does accept this. Others say that MMTers tend to sweep central banks and treasuries into a single entity, ‘government,’ while in reality the two are typically independent of each other. Treasuries, which make tax and spending decisions, generally do ‘fund’ their spending with tax revenues, whereas central banks don’t.

These are all big wrinkles, though they don’t need to negate the whole edifice.

So Where Does MMT Meet Tax Justice?

Now let’s return to UK Shadow Chancellor John McDonnell’s statement that “every pound avoided in tax by the super-rich is a pound desperately needed by our National Health Service, our schools and our caring services,” — and its apparent clash with the MMT view that we don’t need to collect taxes in order to achieve our spending goals.

From a purely economic point of view the MMT argument is that governments need not collect a dollar in tax for every dollar they spend. That’s fine: almost any (sane) economist would agree. Governments (or central banks) can create money, and fiscal deficits are acceptable in principle, and often healthy, in practice. MMTers agree that fiscal deficits can matter (though, as they put it, “not in the way you think”), and also that if there’s too much money in circulation, higher taxes can help re-balance things. So there are important links between levels of tax and levels of spending, even for MMTers. That’s already a move away from the argument that taxes don’t fund spending.

But there’s a still closer connection between levels of tax and levels of spending. Taxes and spending are not just economic matters: they are intensely political. It’s not just Eurozone countries and dollarised economies that face tax-and-spend constraints: it’s everyone. You may disagree violently with the deficit scolds, austerian hysterians, Swabian Hausfraus, Big Banker budget surplus fiends, hyperinflation hyperventilators, monetarist maniacs or those blindly following the credo of the confidence fairy — but that doesn’t mean these powerful people and institutions don’t shape the political climate or constrain a government’s ability to run deficits. They very much do.

The political climate — along with judicious dollops of corrupt money injected into politics — dictate how far government spending is constrained by the levels of taxes. The constraints can be shifted — and MMT can help shift them in a helpful direction — but they are still real constraints. (There are also people who argue that MMT is operationally wrong about the link between taxes and spending, but this is outside of our area of expertise.)

But overall McDonnell was correct: more taxes make more spending possible, certainly by creating the political space for it, and MMTers should concede this. Their attack on “tax the rich to pay for teachers and firefighters” is ultimately a presentational issue for them. They don’t generally oppose taxing the rich. They just think this statement makes it harder for them to get their points across. That’s not a good reason to attack and undermine the case for taxing the rich.

Yet at this point we might also make a concession. Instead of saying:

“Taxes pay for schools, hospitals and firefighters”

we are comfortable with adding a word:

“Taxes help pay for schools, hospitals and firefighters.”

And we’d go further still. Since this stuff is so intensely political, and tackling inequality is now such a monumental task, we need stout political mechanisms to tackle it. And we know from long experience that the slogan “Tax the rich to help pay for schools and hospitals” is a transformationally powerful political slogan that builds support for using the tax system to achieve urgent, vital goals. When MMTers attack this linkage, whatever the rights and wrongs of their technical arguments they are politically wrong, introducing a dangerous and misguided narrative of their own.

But beyond these questions of the relative levels of taxes and spending, there is a more fundamental set of points that MMT needs to take on board. Tax doesn’t just serve one purpose: it serves many. And this is where there’s enormous scope for MMT to become more sophisticated — and more acceptable to the mainstream and the wider public. There’s no need for a fundamental clash between our positions and those of MMT.

The Six Rs of Tax

In 2005 and 2007 the Oxford Council on Good Governance published two papers by Alex Cobham, now the Tax Justice Network’s Executive Director. Alex decried the ‘Tax Consensus’ advocated at that time by the IMF and other global actors, as a subset of the well-known ‘Washington Consensus’, which was pushing many countries into austerity, privatisation and financial liberalisation: policies that have been largely discredited in light of all that’s happened since.

The Tax Consensus had an overwhelming focus on ‘efficiency’ (a tricky term at the best of times) and wasn’t bothered about inequality. It focused on persuading countries to lower taxes, to aim for a “neutral” tax system whose taxes shouldn’t distort production or consumption decisions, and argued that any redistribution should happen via spending, not via the tax system. Cobham attacked this tax consensus, and laid out what he called ‘The Four Rs of Taxation,’ which he summarised as:

- Raising Revenue. The most obvious purpose of tax. We’ve laid out why the MMTers don’t like this message, because they say it gets the order of things the wrong way round, but also we’ve explained that more tax revenues at the very least create the political space, and even the economic space, for more spending on schools, hospitals etc.

- Redistribution. The tax system in itself is a fine tool for tackling economic (and political, gender, racial, and other) inequalities. And to be fair, most MMTers already accept the idea that a tax system should be structured to levy taxes in progressive ways.

- Repricing. Tax policy can also create incentives and disincentives to encourage or discourage desirable and undesirable things, like curbing smoking or alcoholism, tackling climate change, stimulating certain kinds of investment, discouraging excessive borrowing, curbing rent-seeking, and so on. (MMTers don’t reject this either.)

- Representation. This is a crucial, and the most forgotten, function of tax. The central bargain at the heart of a fiscal system is reflected in the American colonists’ slogan of “no taxation without representation.” Citizens pay taxes as part of a grand social and democratic bargain, that government will be accountable to them in return. This has been shown empirically, and it’s direct taxes that seem to be most effective in generating strong accountability.

More recently, Richard Murphy has added two or three more ‘Rs’ to this list, explicitly to reflect modern monetary theory. These are:

- Ratifying the value of money. That’s the anchor role discussed above: money has value because people have faith in it, and they have faith because they know government will accept it for tax payments.

- Reclaiming money that has been created. That’s the cinema-ticket role: using the tax system to take back (and Retire, there’s an alternative R word) money that’s been created, to help regulate the economy and stop it overheating or stagnating.

MMTers tend to pay lip service to the Rs that they aren’t busy attacking. Yet each is crucial.

The Structure of a Tax System

MMTers’ main fight is about overall levels of taxes, relative to overall levels of spending. It is not, in general terms, a theory about how to put a tax system together, which in turn hinges on the all-important question of who pays – or how the tax charge is shared among different constituencies. Yet this is the core of our work. We and the MMTers are mostly fighting different battles, so we need not necessarily clash. And MMT creates interesting insights about tax. If a core purpose of tax is to take money out of circulation (or ”destroy money“) to prevent excessive inflation, then the wealthy should love tax, because inflation erodes the value of their assets. The problem we point out is, the wealthy want poorer people, and not them, to have their money taken out through tax.

We’ve noticed that few MMTers are experts on international tax, or tax havens, or on how to structure a good tax system. This gap can be remedied, without doing any damage to MMT itself, except for perhaps that one presentational issue. These are huge areas, so we’ll just take a couple of examples to demonstrate what we mean, and to show how MMT is compatible with tax justice.

The Corporate Tax, Its Many Roles, and the Many Misunderstandings

Take, for instance, the Corporate Income Tax, and some of the roles it plays, even beyond the six Rs of tax. Our document entitled Ten Reasons to Defend the Corporate Income Tax, and accompanying articles, lay out a range of benefits that the corporate tax provides, far beyond what most people would imagine – and even beyond the Four (or Six) Rs. In practice the corporate income tax is one of the most precious taxes of them all.

Here’s one of its functions — one that is strong enough on its own to justify the corporate tax, and indeed was a key reason why many countries introduced the tax in the first place: it is an essential backstop to the personal income tax. If we abolished the corporate tax or cut it severely, large numbers of people would opt to convert their ordinary income into corporate forms held by personal shell companies, so as to pay the lower rate. (Unless they take their income out as dividends, they can defer paying tax on it indefinitely — and often forever.)

So corporate tax cuts can cannibalise the (much larger) personal income tax. In fact, different parts of the tax system ‘spillover’ like this into other parts of the tax system, and onto other countries’ tax systems. (This new article by Andrew Baker of Sheffield Political Economic Research Institute, and Richard Murphy outlines a new framework for understanding these spillovers.) Modern Tax Theory should be able to incorporate these kinds of complexities in how tax systems work.

Not only that, but any theory which has tax at its heart also needs to consider the international dimension.

MMT, International Tax, and the Race to the Bottom

The tax system of Country A can harm the tax system of Country B (tax havens provide ample evidence of this.) A related matter is something that is widely called ‘tax competitiveness.’ Here’s an example from the US economist Randall Wray, a prominent MMTer. He said:

Taxing corporations is a bad idea. It causes corporations to move out of the US. Or to cut special deals: ’give me a tax break and I will build a factory in your community.’ We ought to get rid of the tax. Level the playing field . . . Instead, if we wanted to, we just tax the owners [of corporations.]”

And on taxing the rich, more generally, he said:

Trying to reduce inequality using taxes is not likely to be successful—because the rich influence the tax code and get exemptions. . . I argue for “predistribution”—prevent the growth of excessive income and wealth by . . . eliminat[ing] the practices that lead to inequality.”

These statements don’t generally represent an MMT position on how to structure a tax system or on international tax — there isn’t an easily categorisable position on these matters, as far as we can tell — but it does show how easy it is for MMTers to fall prey to bad old ideas.

Let’s start with the second one: in its purest form — don’t tax the rich because they’ll dodge the tax — is a counsel of despair: a special case of a more general statement: “let’s not try and subject the rich to the rule of law because they’ll use clever lawyers and accountants to escape it.” It’s a version of an argument we see all the time – don’t crack down on tax havens because it’s too difficult, or because the real problem is elsewhere.

These are dangerous, anti-democratic arguments — and we spurn them. Wray’s argument isn’t as stark as this, but he does veer towards the “either/or fallacy” – either we do one thing (raise taxes on the rich) or we do the other (“predistribution.”) Obviously, we should do both.

On corporation taxes Wray, like many MMTers, enters complex terrain without acknowledging enough of the functions of the tax, as laid out in our “10 Reasons to Defend the Corporate Income Tax” document. For one thing, the argument that it’s more efficient to stop taxing corporations and tax the owners of corporations directly, would entail a vast giveaway to the billionaire classes, for reasons outlined here. And his view that corporate taxes encourage corporations to relocate elsewhere is part of a misguided old ‘Competitiveness Agenda,’ laid out here, whose core argument is that we must keep piling tax cuts and other goodies on multinational corporations and mobile global capital, for fear they’ll run away to more ‘hospitable’ locations. This idea is woolly-headed nonsense, from top to bottom.

This takes us into complex terrain, so read this article and this book to get a fuller picture of what we’re talking about. But as a taster, here are a couple of killer problems with this view. When you cut taxes on multinational corporations, or provide them with other goodies, certain things happen, which are eminently measurable. Corporate profits rise, at least in the short term. And corporations may (or, more likely, may not) change their investment plans. Crucially, while the gross benefits that flow from corporate welfare are measurable, many of the costs aren’t. And here are some of those costs:

- lower economic growth

- rising inequality

- greater financial volatility

- larger too-big-to-fail banks

- less competition, more monopolies

- more crime and fraud

- reduced efficiency of investment

- damage to labour and jobs

- less innovation

- corporate cash hoarding

(Click here and associated links to see how each of these works, or refer to the “10 Reasons” document.)

What happens, however, is that traditional tax theorists will look at the measurable benefits of the corporate tax cuts – especially higher profits for corporations – and highlight them, but then airbrush out that much broader range of equally important costs because so many of them are hard or impossible to measure.

Because of this generic imbalance between measurable benefits and unmeasurable costs, a body of tax theory and measurement has grown up that promotes this view that is favourable to corporate tax cuts but isn’t rooted in the real world. As a result, many, if not most of the conventional (academic and other) views on corporate taxes are downright wrong: rooted in generic distortions to the measurements that will never go away. (For a more detailed look at this imbalance, see the “Evidence Machine” in the UK edition of the Finance Curse book.)

Modern Monetary Theory needs to grapple with these issues. Our thinking in this area is a progressive, internally coherent body of work, which encompasses tax havens, the structure of tax systems, crime, and plenty more. Pretty much all of it — tax justice, or Modern Tax Theory, if you like — doesn’t need to be seen as incompatible with Modern Monetary Theory.

___________

NB: This paper by me was one of the consequences of this, and was recognised by Randy Wray as a major contribution to debate on this issue.

Yves, re your last point (line between theory and policies) – exactly. I had arguments with MMT people along this line, as they claim that things like job guarantee are part-and-parcel of MMT. When they cannot be (part of theory), as it’s a prescription for a policy decision, and policy is not theory. The invalidation of it’s trivial – MMT as a descriptive tool can describe current situation, regardless of whether there is or isn’t JG or any other MMT prescriptions.

It’s like saying that combustion engine is part and parcel of Boyle’s law, and without combustion engine it cannot exist on its own.

vlade, I thiink that the point you are making can be put in a different and I think more direct way. If I may, let me use the frame of analytic philosophy. In this way, we can construe MMT as a theory and the real world of fiat currency countries as its real world referents. Let me also divide MMT into two parts, the Special Theory of MMT and the General Theory of MMT, analogously to the Special and General Theories of Relativity where Special Relativity does not contain a theory of gravity while the General Theory does. The Special Theory of MMT does nnot contain a theory of the JG, while the General Theory of MMT does contain such a theory.

It is generally agreed I think that the Special Theory of MMT has the real world as a referent and is thereby true. Your contention, if I read you right, is that what I call the General Theory of MMT is false because it a theory of a JG which has no real world referent. That is, because it has a theory of a JG, the more general theory of MMT is false for lack of a real world referent. You are probably not wrong about this. That is, the Special Theory of MMT (without the theory of the JG) is true, while the General Theory of MMT (with the theory of the JG) is not, due to the lack of Job Guarantees specified by the theory in the social systems under consideration.

There is another way of slicing this conceptual cake. And this is to view the Special Theory of MMT as a descriptive theory, i.e., one correctly describing the real world and to view the General Theory of MMT as a normative theory, that is, as one that characterizes what ought to exist. This is along the lines of descriptive and normative ethics. A descriptive theory of ethics is one that sets out what a real system actually has as its ethical system, while a normative ethical theory sets out what ought to be the case.

It often seems as though both of these ways of thinking are operating in discussions of MMT without being set out explicitly. Which makes for confusion.

Regarding your relationship between the compustion engine and Boyle’s Law, I would rather point to the theory of MMT as a conceptual construct and a given concrete fiat currency system as that theory’s referent. If the theory is true, it will have the given fiat currency system as one of its referents, while if it is false, like the mainstream set of economic theories, it will not have it as one of its referents. Generally, this is the only referent of the theory we are interested in. The conceptual construct that is the theory and the concrete reality that is its referent are logically independent in that each can exist on its own. The only sense in which one is part of the other is that the concrete reality may well have psychologically led to the conception of the theoretical construct that is MMT. (I realize that there is more than one theory of MMT, each differing in one way or another from each other.)

In drawing the Special and General analogy, I am not in any way suggesting that MMT and Einstein’s theories of relativity are similar in any other way. In particular, I am not suggesting that they possess similar epistemological statuses. There may easily be a better way of distinguishing these two MMT “theories” than the one I have chosen but it was the one that came to mind and fit your point I thought. I trust that this does not distort the point you were trying to make.

In describing a table it is noticed that it only has three legs, and that a leg at the fourth corner would make it work as intended.

Adding the fourth leg is a policy decision, just as ripping one or more of the existing legs off is a policy decision. However, if you actually want the table to work as a table there is no decision at all, just an unfinished table.

@vlade I think respectfully, your analogy is wrong. MMT is not a theory, it is a body of work, a lens onto the monetary economy. (It’s unfortunate the “modern” and “theory” in the name was originally an inside joke.) It is not a theory in the sense of thermodynamics or General Relativity. The vast body of work that is MMT recommends just one policy preference regardless of ideology, the Job Guarantee. It is core MMT, because it is the superior wage and price stabilizer. One could, I suppose, argue an unemployed buffer stock is thus also equally core MMT, but as an alternative to full JG employment it makes no sense: why have people unemployed when you could instead employ them? To derive the JG from core MMT you only need to add a postulate of desired efficiency.

When I read “Taxes help pay for schools, hospitals and firefighters.” I sort of cringed, because this statement mixes state with federal taxing, and my understanding is that MMT only applies to Federal sovereign spending. States have to balance their checkbooks (live within their means) whereas the Federal government does not. Right?

You are right.

Currency issues (in the US federal government) doesn’t have to tax to spend.

Currency user (in the US state, municipalities etc) has to tax to spend, unless it gets distributions from the currency issuer.

Yep. I also cringed. But the Tax Justice folks have their hearts in the right place. The idea is one of creating fiscal space, not a “pay for”, so they are (in their weird way) accepting and respecting MMT. Richard Murphy’s & Tax Justice Network’s big mistake is that they do not understand correctly what creates fiscal space. Taxing wealth does not initially create any damn fiscal space whatsoever. To get the fiscal space they’d need to tax away ALL the rich folks wealth, down to the penny, then these folks would need to work to earn money to meet their tax liability, and that’s then the fiscal space.

What made me cringe more was their idea the tax havens are a real magic money tree, similar to government currency issuing. This was the worse idea because the government issuance power is unlimited and in- principle democratically controllable. Tax havens are finite and not controlled by the demos. There’s thus a world of difference..

Very interesting article (although it makes a few questionable points, notably about “objections” that are in fact fully acknowledged by MMTers), but a bit misguided in my opinion. It reminds me of those people who argue against atheism by saying that atheism would lead to social mayhem; that may be true (or not), but that’s not the point.

So basically, the idea is that sure, we need to take MMT into account, but at the same time, let’s tell only half the truth (“Taxes help pay for schools, hospitals and firefighters”), because the public is too dim to handle the naked truth in a responsible way.

Is it right to get a desirable outcome (reduce inequality by taxing the rich) by more or less lying to the public (“if we don’t tax them, we won’t have any money to spend”)? I don’t know.

Restricting my comment to federal taxation, if federal taxes are not needed for underwriting federal government expenditure, then how can they help pay for schools, or anything else. These contentions are incompatible, or there is a sloppy use of language somewhere. Since MMT says that taxes ‘destroy money’ and are not needed for revenue (a la Ruml), then the contention that they help pay for anything at all at the federal level must be false. Not pointing out this incompatibility would confuse anyone.

The distinction Tax Justice Network made was the taxes “help” to pay for, but are not “the pay for”. I think that’s an ok fair distinction. The reasoning is the fiscal space creation argument. That’s a valid reasoning according to MMT principles. The problem is, in this case, Tax Justice folks got it wrong. Taxes depleting rich folks savings does not create any damn fiscal space whatsoever. Not until their savings get fully depleted, which by then means they are no longer rich folks, so we are no longer taxing them.

Taxes serve a fiscal space creation opening only when they create added demand for the currency. That means (usually) tax on land, rent, capital gains, i.e., any un-earned or parasitic income flow. Taxing those flows is never a “pay for”, but it is a fiscal space opening mechanism, which is proper policy (core MMT I would argue). This is not standard MMT I know, but for me there are two MMT core policies, the Job Guarantee and steep progressive taxes on rentier incomes (I do realize this will be viewed more as a philosophical/ideological value overlay by some). Setting the desired levels is what is not core MMT.

Beardsley Ruml, then NY Fed Chair, addressed this issue in a speech to the American Bar Association and an article in American Affairs magazine back in 1946. It seems like a balanced approach, although he was arguing for abolishing taxes on corporations at the time. One snippet:

Ruml outlined four broad purposes for taxes. It’s worth a look.

It’s disappointing that it is so seldom explained in simple terms that taxes can be used to prevent the rich from purchasing our government.

IMHO, the central problem of our time is the fact that our government is now responsive only to the whims of the billionaire class, while the well-being of We the people is studiously ignored.

It has to be clearly explained that taxing the rich is necessary to prevent their doing great harm purchasing political power, and other forms of economic bullying.

That’s a totally fair point. But it is not the sole solution. Regulations are just as important, even more important, and laws preventing political donations, or laws that in some other way prevent democracy from being bought (campaign finance reform, abolishing poltical parties altogether and using a multi-tiered cumulative voting system).

Bit of a chicken-and-egg problem, since neither a progressive MMT inspired tax scheme, nor more robust democracy and regulation seems possible without first electing better representatives. As with most social chicken-and-egg situations, the only real solution to go forward is better education and stronger activism and grass roots pressure.

The average person on the street, or sheltering at home, would understand MMT better if presented with evidence on a post card.

Objective bullet points that are comprehensible, not a wall of text.

That would begin to expand the awareness of, and applicability of, MMT to kitchen table issues, where politics and economics are extremely local. The Guide provides some basis for a start.

If you want a succinct summary of how MMT compares to the mainstream neoliberal economic framework, then scroll down to the first table in this blog post of Bill Mitchell’s. It might help.

http://bilbo.economicoutlook.net/blog/?p=25961

How to discuss Modern Monetary Theory

Thanks. Didn’t see this comment before I wrote my own. I’ll take a look.

Thank you for this article, Yves. A lot to digest.

Whenever I try to introduce the concept of MMT to friends who are deficit hawks, I am met with violent reactions. Can somebody point to a primer of sorts on the subject? This article is good, but I think it is too advanced for the novices. TIA.

A fairly simple concept that I present to deficit hawks goes something like:

-The federal gov’t must create dollars BEFORE you can be paid in dollars.

-If there is to be growth in the general economy, the gov’t must issue more $$ than it takes in.

-Therefore, the gov’t must always run a deficit if there is to be growth. (If the gov’t runs a surplus, or just “breaks even” that means they are taking $$ out of the economy i.e. shrinking it – and that’s not what we want, is it?)

Oversimplified I know, but it gets ’em thinking…

@Bill. Try this explanation:

GDP is the measure of a nation’s PRODUCTIVE economy. GDP is the sum of household, business and government spending (and likewise the income of those sectors equals that spending, because ALL spending is someone else’s income). Our economy depends on household spending (2/3 of GDP). That spending is limited by household income (which comes only from those three sectors). Business provides that income to the extent demand (business opportunity) exists, and government provides the rest. All that’s important to the economy is maintaining this flow, and with a fiat currency (whose value, by definition, depends ONLY on currency-users perception), there are no limits other than that perception.

Now, if you’ll look at the income side of GDP, you’ll find that neither Federal borrowing or income taxes are part of that income – so they DO NOT (and never have) paid for (or “funded”) that spending. If you want proof for any of this, just pull up the GDP Primer at https://www.bea.gov/resources/methodologies

I really really liked that essay. Thanks much for posting it. There’s lots and lots to read and reread which takes more than one sitting. Two initial thoughts:

Its good that some key assumptions ( stable and [non-kleptocratic] governments, rational actors ( catering for manias, panics ) are laid out.

I liked your formulation :

Indeed all this free market ideology falls flat when the price of money, the interest rate, is not set “freely” at all but by central authority manipulators, the Federal Reserve. And if its ok to do that then why not the other ( Job Guarantee) and not by rate but by flow ! Really neat.

I don’t think anyone can argue with the above post. No one should disregard taxing, because it is a tool to stabilize money flows and thus both the health of the economy – the equality of it – and therefore also the stability of it, the “value” of it. Not the value of money (it has no value whatsoever) but the value of the society that creates the money. The value of a society ( which should be synonymous with an economy, but shit always happens to sidetrack this reality) dictates the value in its money by trust. That word ‘trust’ is everywhere in any economy worth its salt. I’m just personally annoyed by taxing because I think it (corporate taxation) is redundant, but it could be calibrated to not be, in fact to be obvious even to the dumbest person like me. I’m annoyed by personal income tax because I can’t understand the language, the logic, the calculations, or the “adjustments.” It’s a godawful boondoggle of deflection and language itself. It could be simplified; it could be made into the very logic of society – but it is not because we have bean counters (not to include Richard Murphy or MMTers – he’s/they are a lighthouse) who really don’t know how to verbalize the value of society itself; and are perhaps too self interested to bother. Hudson does bother. Pickett does but he doesn’t really admit it. Randall Wray has no problem admitting it – love him. We should tax people who have too much money. They put a big wobble in the economy – akin to the wobble China put in the spin of the earth when it filled up that ginormous dam on the Yangtze River. Good metaphor. Bottom line, I submit, is there is no value to money, only to society. That should be our priority – money is only its proxy.

I disagree with their statement “that tax justice doesn’t especially need MMT,…”. I consider the interest banks earn on money they create a tax on the rest of the economy, as is the seemingly inherent cyclical boom/bust bug/feature. I fully agree that “…but without tax justice, MMT is incomplete.” The imposition of the tax needed to give value to a currency needs to be imposed in Tax Justice-y ways which promote the public good, including by preventing harmful levels wealth concentration.

Sadly, we are in the midst of a multi-trillion dollar splurge of MMT that is very “incomplete”.

Yah. Note, the bail-outs are not MMT. MMT merely tells folks the bailouts are possible, but that does nothing to guarantee justice. Most MMT experts would argue the bail-outs are being done almsot diametrically wrongly, if one is concerned about economic justice.

Secondly, the way Taxation Justice Network think is deeply flawed. They fail to see that government spending can be done is independent of taxation. The deficit residual is mere accounting. The real residual is inflation. But inflation from excess demand is almost always a good thing, and a very effective indirect form of taxation, since inflation makes that money hoarded in tax havens less and less valuable over time.

A key is to realize demand-pull inflation has never caused hyperinflations, and demand-pull is easy to control and regulate, so it can be done to generate stable constant high inflation. This is always indefinitely sustainable for a currency sovereign which also runs a ob Guarantee program. Talk to any Austrian School economist nutters, they will tell you in no uncertain terms why they hate inflation, it’s because they know it is a powerful indirect tax. (Just beware, they are typically gold standard type thinkers, so they do not grok MMT, so they think all tax is theft.)

For the amounts in tax havens, we can’t wait for inflation to erode their value. They are stupendous. Cayman Islands, population about 75,000, own about $240 billion in US Treasuries. We need to tax this now.