Yves here. As much as Matt Taibbi has regularly been right, early, and outraged at the deserving targets, he nevertheless once in a while gets mired in views that presumably does not recognize as questionable orthodoxy (see here for an example a while back). Here, Richard Vague examines the blind spots about Modern Monetary Theory and the Fed that Taibbi and many others on the left hold.

By John Siman

It is now more than ten years since Matt Taibbi published his revelatory investigative essay The Great American Bubble Machine, which began with these immortal sentences: “The first thing you need to know about Goldman Sachs is that it’s everywhere. The world’s most powerful investment bank is a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.”

Taibbi collected “The Great American Bubble Machine” along with six of his other investigative essays about the complex thievery which led to the subprime crisis and the Great Recession to produce his 2010 book Griftopia. “The new America…,” he wrote in the first essay, “is fast becoming a vast ghetto in which all of us, conservatives and progressives, are being bled dry by a tiny oligarchy of extremely clever criminals and their castrato henchmen in government, whose job is to be good actors on TV and put on a good show” (p. 33).

So Taibbi established himself as America’s most important financial journalist over a decade ago. And by important I mean writing from a truly democratic — that is, an anti-oligarchic — perspective. Now that we have entered the Corona Crisis, I look to him to be one of America’s populist champions. And I use the word champion the way the plucky underdog Rebecca used it in the Walter Scott novel: “God will raise me up a champion”, she said when things looked bleakest.

Just last Monday (April 6) Taibbi declared his absolute journalistic independence from the corporate media and their coverage of the castrati henchmen and the well-acted shows, from their narrativized exercises in demonization, Maddow vs. Hannity, that now brand their business model: “From now on,” he wrote in an email to his readers, “my online writing will be published on Substack. This is my full-time job now.”

Furthermore, he states that his goal in his newly declared independence is to be an even more critical financial journalist than he was last time around: “Having spent the better part of eight years covering the subprime crisis and its aftermath, I hope to focus in this space on the financial aspects of the coronavirus mess. The moment we’re in right now equates to September 2008, when the world was melting down and historic, transformational decisions were being made at light speed. This time around, I want to catch as much of it in real time as possible, and will do so here on Substack.”

Who better to have fighting for us right now? No one, really. (Well, in addition to Taibbi for the best essays, I’m looking to Thomas Frank for the best books, Michael Tracey for the best Tweets, and Jimmy Dore for the best YouTube content.) But as I read Taibbi’s two most recent essays, Bailing Out the Coronavirus Bailout and Resetting the Bomb, I worry that his moral courage and corresponding moral outrage might get in the way of his being able to analyze possible ways of escaping the second Great Depression which the coronavirus mess might very well cause.

Specifically, in spite of all of his hard-earned knowledge of Wall Street, Taibbi seems to be a little apprehensive of Modern Monetary Theory at a time when, oh-so-suddenly-poof!, MMT, instead of seeming to be some arcane tranche of macroeconomic extremism, now appears to offer us the only workable programs for keeping the wheels of our economy turning.

Now because we have a tremendous amount of under-utilized resources, in the form of idle people and businesses, the Federal government needs to engage in massive spending to prevent a huge deflationary shock from turning into a full bore depression. MMT shows that the Federal government can readily inject trillions of dollars of rescue money because it can freely spend with its only constraint being real economy capacity limits.

However, because the US has outdated budgetary mechanisms, this spending requires issuing Treasury bonds, and most commentators have been indoctrinated to see debt, even the ‘debt for convenience sake only” of a currency issue like the US, as the same when that’s not the case.

Taibbi seems to become, naturally enough somewhat acrophobic when he thinks about it, as you can see 23:20 on his most recent show on YouTube.

So I turned to Richard Vague, Pennsylvania’s acting Secretary of Banking and Securities, to help me evaluate Taibbi’s new essays.

Vague, once a highly successful banker, has become an economic historian and theorist. His most recent book is A Brief History of Doom: Two Hundred Years of Financial Crises, which Steve Keen regards “as the best history of financial crises ever written — far better than Kindleberger and Mackay.” For in it Vague shows how runaway private debt — not government debt! — has been the primary cause of almost all financial crises in major economies over the past two hundred years.

As a sort of homework assignment, Vague has told me to read the second edition of Randall Wray’s Modern Money Theory.

Here is Vague’s first lesson about MMT in a few sentences, for you or me or Matt Taibbi:

A government that has the power to create money never has to default. That doesn’t mean that an unlimited amount of money should be created, but we are currently within the bounds of what’s possible. Here is my critique of unlimited issuance of debt: it is possible, but does further drive down interest rates which in turn exacerbates inequality. All current money creation creates equivalent liabilities/debt, so I’ve been exploring concepts for creating money without creating commensurate debt.

And Richard Vague was so gracious as to answer my questions about Matt Taibbi in great detail:

John Siman: Thank you so much for taking the time to look closely at Taibbi’s new articles “Bailing Out the Bailout” and “Resetting the Bomb.” Also for watching Krystal and Saagar’s “Rising” interview with Taibbi on Friday (Matt Taibbi: Why this bailout is worse than 2008). How do you want to begin to describe what he’s up to?

RICHARD VAGUE: He’s a very savvy reporter. He’s studying the flaws in the Congressional and Federal Reserve bailout efforts and the profiteering he believes will occur. Much of his reporting is on target. But he goes further, saying “the bailout looks like forever” and “we are resetting the bomb again.” As we begin to examine the considerable financial fallout of the Great Pandemic, I want to examine those and a few of Taibbi’s other comments and give them some deeper context and bring them into clearer perspective.

JS: OK, Richard, go ahead. Let’s hear it!

VAGUE: The scale of this crisis is extraordinary, with a projected decline in GDP of above 30% for this quarter. In the Great Recession there was less than a 5% decline for the full year of 2009. In the Great Depression, the cumulative decline was 46% from 1929 to 1933.

Before the crisis, the US economy was the subject of concern due to growth, stagnant wages, and rising inequality. Nevertheless, things improved through the past decade after the frighteningly high privatesector debt levels that brought on the Great Recession. As of December 2019, the privatedebt profile of the economy, though still unacceptably high, had declined from 168% of GDP in 2008 to 150%. Household debt had declined from 96% to 75%, and business debt had risen slightly from 72% to 75%. That was the situation we were in prior to 2020. High enough privatesector debt to slow growth and stultify spending, yes — but no profligate growth in new loans or bad debt, the things required to create a conventional banking crisis.

JS: So what do you want to say about Taibbi’s comment that “the bailout looks like forever?”

VAGUE: This comment belies the fact that we did largely unwind from the last bailout. The Fed unwound much of the market support mechanisms it had put in place, and the total notional value of Federal Reserve swap lines has declined from $583 billion at their peak in the crisis to $349 billion most recently. Total assets at the Fed had decreased from a peak of 25% of GDP down to 19%. In the overall market, credit derivatives declined from $16 trillion in 2008 to $3.9 trillion as of year-end 2019. As noted, the private sector deleveraged somewhat, and the notional value of total overall derivatives, which had peaked at $236 trillion in 2013, had declined to $171 trillion.

Furthermore, we need to note that much of the Fed’s trillions in credit market support were not a giveaway, but instead loans provided to support to those markets through its money creation powers that were calculated to be repaid over a reasonably short period. And most of them were. It is important to differentiate between spending support, such as in a stimulus package, where the money is given and not loaned, and the loans the Fed makes in its role as the emergency lender of last resort.

What was forever about the bailout, tragically, was how lopsided it was in favor of businesses and how much it neglected individuals. That brought us Trump. There is some of that same lopsidedness in the pandemic rescue efforts.

JS: This is where I totally trust Taibbi. On standing up to grifters. He is truly outraged by the injustice, the thievery he sees. But I worry that his moral outrage somehow limits his vision when he tries to make sense of the size of the stupendous piles of money that need to be created.

VAGUE: Yes, Taibbi laments that the Federal Reserve has grown to $5 trillion in assets and may now grow to $10 trillion, with “as much Fed support of mortgage markets in one day as was done across a month at the peak of the last round of Quantitative Easing.” But note that the Fed is not outsized in comparison to the economy or other central banks. At the end of 2019, its assets stood at 20% of US GDP, with the European Central Bank at 40% of Eurozone GDP, the People’s Bank of China at 40% of China’s GDP, and the Bank of Japan at 100% of Japan’s GDP. In fact, even before the Great Recession, the BOJ and the PBOC were larger relative to their respective economies than the Fed is now relative to the US economy.

JS: Well, in fairness to Taibbi, let me ask what happens if the Fed gets insanely huge?

VAGUE: OK, let’s take an extreme case then — let’s say the Fed grows to $15 trillion and the economy drops to $17 trillion. The Fed would still be smaller relative to its GDP that the Bank of Japan. And there’s another way to put the Fed’s $5 or $10 trillion in perspective, and that’s to compare it to the size of the financial markets within the US, such as [1] the money supply, which is $15 trillion, [2] the U.S. Treasury debt market which is $22 trillion, and [3] the total of public and private debt, which is $60 trillion. In fact, total financial assets in the US, including publicly traded equities, are $115 trillion.

This is all to say that, in my view, at $5 or at 10 trillion, the Fed’s total size is not excessive, and it has ample capacity to continue to perform its one original and most important function, which is to serve as the lender of last resort.

And as to whether the Fed will at some point have to shrink? Viewed in the context of markets, history, and other central banks, there is no imperative for the Fed to downsize.

JS: Taibbi writes that “a lot of these markets were already overinflated thanks to post-2008 bailouts and interventions like Quantitative Easing. We’re about to find out that the American economy has been living off dying, dysfunctional, or hyper-leveraged markets for more than a decade.…” That sounds apocalyptic!

Taibbi continues: “A major issue with the post-2008 bailout programs is that they tended to increase rather than decrease the risk in the system. A decade-plus of zero-to-low interest rates and massive central-bank buying programs like QE made traditional safe havens unattractive and pushed investors to chase returns in a variety of not-so-healthy ways.” So scary!

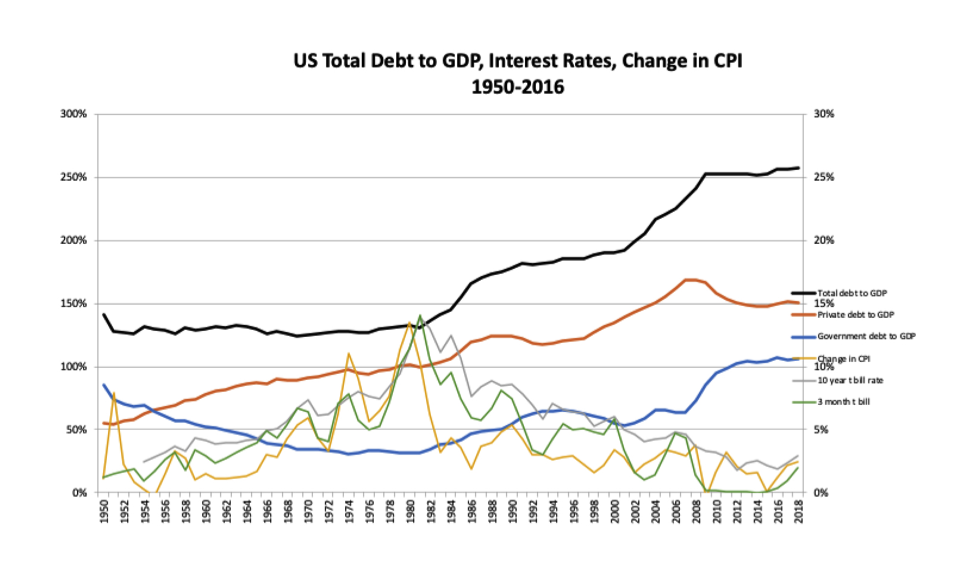

VAGUE: But the low rates and the unhealthy chase for returns we have seen this past decade are not because of the Fed and QE — but rather in spite of the Fed. The Fed has followed the economic trends rather than led them. Contrary to economic orthodoxy, higher debt levels don’t cause rates to go up, they cause rates to go down. (And these low rates have contributed to the rise in asset values that have exacerbated inequality.) It’s an inverse correlation that has played out continuously since 1981. When debt increases, rates decline. It’s one of the least-recognized and least-appreciated economic truths of our time. See the chart below. With debt now set to increase massively as a percent of GDP, we will see rates decline further!

So Taibbi writes that we’ve been living off highly leveraged markets for more than a decade, and, yes, he’s correct, but we’ve been living off highly leveraged markets for a hundred years or more.

What I’m here to tell people is that the governmentdebt component of this is not the problem. The problem has been and continues to be the private sectordebt component of this that is.

In a crisis like this, we have the capacity to fund higher levels of government spending and support much higher levels of government debt. In contrast to private sector debt, government debt to GDP did increase since the crisis, from 73% in 2008, to the current level of 106% as tax revenues fell short and stimulus programs were enacted. A $3 trillion increase would bring that to 120%. That ratio would still be well within the ratio of Japan, so often a harbinger of future trends, which now stands at 238% — and similar to the ratio of France at 99% and of Belgium at 102%. These countries have not seen much, if anything, in the way of adverse consequences from these government debt levels. Even if government debt >grows more than this and GDP declines, the level would still be supportable. It is high levels of private sector debt, not public debt, that most directly brings adverse consequences in an economy. And higher levels of government spending at this time will help mitigate dangerously higher levels of private sector debt.

Most importantly, the issuance of new debt and spending of new money by the Fed means that the private sector is receiving that money — that it ends up as income and wealth in the businesses and households of the country. $3 trillion of additional debt means $3 trillion in more money in the private sector’s pockets. That’s fundamental MMT macroeconomic accounting. And that is exactly what’s needed.

JS: Taibbi expresses concern about the private equity leveraged buyout sector, noting “A few years ago, for instance, the infamous junk-bond ghoul Mike Milken … gushed to Bloomberg that America was in a ‘golden age’ for private-equity takeovers.… ‘You can leverage, you can borrow without covenants, and so for equity holders it affords you a very unusual rate of return.’ … This dynamic spurred a boom in securitized commercial loans not totally unlike the boom in securitized mortgages pre-2008.” I totally trust Taibbi on this kind of reporting.

VAGUE: Yes, he is correct. This is an area of vulnerability for the US economy. But even this is something to be kept in perspective. Debt for this sector is less than $1 trillion out of the $32 trillion in total private sector debt. Real estate loans, in contrast, total $15 trillion ($10 trillion in home mortgages and $5 trillion in commercial real estate), almost half of total private sector debt. It took lending profligacy in a market that big to bring the Great Recession. The buyout sector is comparatively much smaller.

As of year-end, we did not have overleverage or overcapacity in the real estate market. But the pandemic will surely disrupt the real estate market too. Job loss will bring mortgage delinquency. Business failures will bring commercial real estate issues. How widespread that is will dictate much of what the level of damage is in the overall lending sector.

JS: Taibbi writes that we’re “institutionalizing the unfairness economy,” noting that “for instance, the world’s largest asset manager, BlackRock, will oversee the Fed’s new corporate bond-buying program, an arrangement that inspires gallows laughter among analysts.” This just sounds grim.

VAGUE: Again, Taibbi is correct. One of several areas ripe for conflict is the US Treasury’s extraordinary discretion in supporting large corporations. Oversight is lacking.

When something that goes to this scale this quickly, fairness is a casualty and favoritism and profiteering are hard to avoid. The SBA, for example, is being asked to process almost ten times as many loans in a month than is has historically processed in a year.

This is an unfortunate characteristic of every operation that has been required to quickly achieve massive scale — especially war, and the Civil War, World War I, and World War II were rife with waste, inefficiency and even profiteering. Business executives were put in charge of major aspects of each of these. American companies made massive profits in World War I, so much so that in World War II, the goal was to “take the profits out of war,” and Roosevelt promised “no war millionaires.” Roosevelt and the nation failed on both counts. Once the decision to enter these wars had been made, speed was of the essence, and problems such as these could only be addressed after the fact, if ever. That did not make it right. We should rail against it. But it does put it in historical context.

JS: Where do we go from here?

VAGUE: As the threat of COVID-19 abates and businesses start back up, we are going to find enormous financial carnage, with millions of unemployed individuals and thousands upon thousands of businesses that never reopen. The depression that came with the combined impact of reduced spending at the end of WWI and the Spanish Flu may offer a clue. It brought a drop in GDP from $85 billion in 1920 to $73 billion in 1921 and 1922, The economy was not back to its 1920 level until 1923

One of the most punishing aftereffects will be that battered household incomes will make it much harder for those households to pay their debts, which for many will be suffocating in the wake of the pandemic. Government debt will not be the debt bomb Taibbi fears. The private sector debt might very well be.

He laments, appropriately, that we never fix this stuff and that “the size of the bag the rest of the country is left holding get bigger with each cycle.” But we are left to wonder how he would fix things.

JS: Well, his job is to critique things and ask tough questions. Your job is to understand economic history and tell us how to fix things. So what would you propose as a solution to the current crisis?

VAGUE: To continue the what has already being done, adding oversight and fixing the inequities. But we need increased support to individuals, taking it from a single check and extending it to at least three months or more if necessary, and increase the support for small businesses loans from $350 billion to perhaps twice that number.

Longer term, individuals need mechanisms to bring relief from high levels of debt. For example, student debt borrowers need relief, perhaps forgiveness that would come through community service. Underwater mortgage holders need relief, perhaps getting principal reduction in exchange for giving part of the gain on the future sale of the home.

Climbing out of this economic quagmire will take everything we’ve got and more.

JS: So what do you want to say about Michael Hudson’s proposal for a debt write-down/jubilee? He just had a piece in the Washington Post in which he wrote:

The way to restore normalcy today is a debt write-down. The debts in deepest arrears and most likely to default are student debts, medical debts, general consumer debts and purely speculative debts. They block spending on goods and services, shrinking the ‘real’ economy. A write-down would be pragmatic, not merely moral sympathy with the less affluent.

VAGUE: I am an advocate of jubilee. Where the government is the lender, it is feasible, especially if some feature can be added that addresses the issue of fairness. For example, we’ve advocated that student debt be forgiven based on community service. Where the private sectoris the lender, it raises the question of who will take the loss. Again, if the government steps in to take that loss, it makes the idea more feasible. And there could be innovative ways to structure private sector jubilee using tax laws and accounting modifications. For mortgage loans, we’ve advocated letting the lenders of underwater mortgages write the loan down to fair market value, and those lenders 30 years to write off the loss, in exchange for receiving a portion of the gain when the home is eventually sold.

JS: You’ve been so generous with your time, Richard. Maybe, in the larger perspective, all of this — from the global plague right down to the jubilee idea — is straight out of the Bible. I guess we’ll see. But the good people need to take up the lance and fight!

The whole mess up there sounds like TeenSpirit© fear of any Freedom of Expression-

Please read The Coronation and stop crying… a yale grad created it and is knot a devolved human politician so incitement laden thought is knot being manipulated by base human coerced desire (epstein’D), to lie obfuscate and ruin humanity-

Cannot bring self to read that right n o w then sing out a mantra worth weight in gold::

“I don’t don’t know where I am going, because I don’t know where I have been”

Try that mantra 49bps earnestly and the tears will flow for all emotional separated human being(s) long as keep stuffing psycho time; pastanger, futureworry “inciteful thought” buttresses overflow of fact that capitalism MMT is naked and always behaves like human ego, with determined disregard for society, and an earth that supports all-

Change Capitalism based upon regard for Society and Environment and a real escape emerges… cannot recall that ???

Look at key leftmost portion of keyboard- (esc)

Your Welcome-

:♥)

Vague is absolutely correct from an economic standpoint AFAIK. Spot on.

Too bad the major issue here isn’t economic, but behavioral. So most of this, while absolutely sound, completely misses the issue.

The issue wasn’t the loans. The issue was the lack of punishment. Metaphorically, economics is biology, but biology doesn’t live outside of an ecology. Economics only has behavioral psych to help them guide through the real world where the three-body problem makes most ecomonics stale.

Akunin, right?

as in Erast Fandorin?

I liked @umairh ‘s suggestion a few days ago that if each US citizen were given an account with the Fed, it would make distributing bailout money a lot easier. Same for UBI.

I too just finished reading “Modern Money Theory” 2e by Wray. I am bogged down in writing my summary/review – I had taken a 1 yr hiatus from reading economics because the US political environment was just too, too depressing to dream about bright, shiny futures – and I’m out of practice.

Fortuitous that I chose MMT to come back too. I started searching for MMT after I retired in 2012 and started reading economics books. Most of orthodox economics seemed worthless – you call this a science, seriously???

Finally with MMT, something that makes sense. Money is software. MMT FTW!

if you think MMT advocates are for accounts for all citizens at the Central Bank, you’re either mistaken or they’ve changed their tune since last I checked.

Why? Because MMT advocates are decidedly pro-bank privilege and accounts for all citizens (at least) at the Central Bank puts those privileges on a decidedly slippery slope.

It saddens me that MMT advocates are, so far, just another form of bank toadie. We can do much better but not if we insist on maintaining privileges for usurers.

“…MMT advocates are decidedly pro-bank privilege…”.

Can you provide some examples for this assertion?

Sure. Google “Proposals for the Banking System- Warren Mosler.”

You’ll find that Mosler advocates:

1) Unlimited, unsecured fiat loans at zero percent interest for banks.

2) Unlimited deposit guarantees for free for banks.

And Warren Mosler is a co-founder and very big name in the MMT School. Nor have Bill Mitchell or any other big name in MMT I’ve questioned ever disavowed Warren Mosler even when directly confronted.

People are being duped and sold a “mess of pottage” (e.g. wage slavery to government) in exchange for a stolen birthright, an ethical finance system.

Specific references sir, please. Not assertions.

Thanks

re unlimited deposit insurance for free:

I have three proposals for the FDIC. The first is to remove the $250,000 cap on deposit insurance. The public purpose behind the cap is to help small banks attract deposits, under the theory that if there were no cap large depositors would gravitate towards the larger banks.

However, once the Fed is directed to trade in the fed funds markets with all member banks, in unlimited size, the issue of available funding is moot.

The second is to not tax banks in order to recover funds lost on bank failures. The FDIC should be entirely funded by the US Treasury. Taxes on solvent banks should not be on the basis of the funding needs of the FDIC. from http://moslereconomics-kg5winhhtut.stackpathdns.com/wp-content/pdfs/Proposals.pdf

re unlimited, unsecured loans:

1. The fed should lend unsecured to member banks, and in unlimited quantities at its target fed funds rate, by simply trading in the fed funds market. There is no reason to do otherwise. ibid

re at zero percent interest:

3. I would make the current zero interest rate policy permanent. ibid

None of that has any bearing on citizen accounts at the Fed. unless combined with Mitchell’s preference for nationalising the banks, which would make the FDIC redundant.

This is Making Shit Up. You need to stop.

Warren is on the record as believing that banks are like public utilities and should not be bailed out ( ie Share holders or Management) in crisis. FDIC insurance, etc, is another matter. You are way off base.

Mark Blyth said it best in a recent interview on Jimmy Dore (where I wish Yves would make an appearance one day): you don’t really need MMT — just get the Apples and Amazons of the corporate world to pay their damn’d taxes and increase the tax rate on mega-corporations and the super-rich to where it was 40 years ago. He also noted that pushing the idea of MMT – a darling concept of Silicon Valley – serves as a means of conditioning the public to the idea of redundancy once much of the workforce has been supplanted by automatons.

I support MMT, but I do have reservations. The MMT tenet that the “only constraint is real economy capacity limits” is true, but only theoretically. To see the actual limits, think of the politics in political economy. There is entrenched political opposition to deficit spending that is based on nothing but wrong-headed conservative and libertarian ideology. Wrong-headed it may be, and correct MMT may be, but the political opposition is a real factor that has to be considered and dealt with.

Moreover, “the only constraint is real economy capacity limits” should and must be conditional on the predicate of an existing institutional and social knowledge and awareness that “economic capacity” can only be safely ramped up IF that capacity is used to increase or improve future economic capacity. This is because of the finite resource problem — this is a finite planet and therefore resources are finite. This does NOT mean that there are limits to growth. What it means is that the most important economic activity of society is to develop the new science and new technologies that allow the “economic capacity” to use new resources (ie, computers chips could not be made from silicon 100 years ago because even though the same silicon existed 100 years ago, the technology did not), or to use resources more effectively and efficiently, with less waste and more recycling.

The issue here is what is “wealth”? Alexander Hamilton understood that “wealth” is actually the mental ability to improve the “productive powers of labor,” ie, science and technology. I can supply direct quotes if anyone wants them. But the point is, this is why Hamilton is so crucial and so revolutionary: he brings to fruition the combination of the scientific Enlightenment with the political Enlightenment and shatters feudal economics. It has nothing to do with creating the conditions for capitalism: socialist states have also be able to advance science and technology.

Now add to this the Constitutional mandate of promoting the General Welfare (and, again, there are important direct quotes from Hamilton) and you have the crucial essence of the political economy of a republic.

This is a point Blythe also misses. The primary purpose of taxing is not to raise money instead of creating it (MMT); the primary purpose of taxing is to tax away concentrations of economic wealth and thus prevent the growth of any oligarchs or aristocrats within a republic.

Also, the amount of money needed to implement the Green New Deal — on the order of a $100 trillion or so — and build the sustainable future the human race needs to survive, will probably require both taxing of existing agglomerations of money, and the creation of new money a la MMT.

. . .of the Economic Populist?

yes, please do provide a few quotes and further reading suggestions. Thanks.

Sorry I’m circling back and replying a few days later. I hope you find this nonetehless.

The key to understanding Hamilton on this point is his 1791 Report to Congress on the Subject of Manufactures, most especially “Section II: As to an extension of the use of Machinery”:

In that Report, Hamilton also explains why government must support the development of new science and technology:

Hamilton thus explicitly rejects Smith’s “natural state of things” in this passage from the Report on Manufactures:

Elsewhere in the same Report, Hamilton explicitly addressed the question of what is the General Welfare:

Note the open-ended nature of Hamilton’s definition: the General Welfare is what ever the representatives of the people, Congress, decides it is. I like to illustrate this my noting the absurdity of the Congress funding, in the 1800s and early 1900s, an expedition to land a man on the moon. The state of science at the time simply was not there, But by the 1950s and 1960s, it was, and it made sense to authorize and fund a manned moon landing, which in fact did push forward the frontiers of science and technology, and resulted in thousands of technological spinoffs that have basically revolutionized our lives. For example, the miniaturization of electronics achieved in the design of the Apollo flight control computer.

Anybody have a working link to that interview? I get Jimmy Dore notifications via email, but when I went to YouTube to view the Mark Blyth interview, the video was not available: marked “private.”

this be it I think

Thanks, mpalomar!

” He also noted that pushing the idea of MMT – a darling concept of Silicon Valley – serves as a means of conditioning the public to the idea of redundancy once much of the workforce has been supplanted by automatons.”

IIRC, he said that about UBI. I assume that’s what you meant, but MMTers tend to push jubs guarantee over UBI. At least, that’s the impression I’ve gotten. Though I don’t recall him using the term “jobs guarantee,” he talked about protecting wages. That would be better done through jobs guarantee than UBI.

Not that we need to defer to everything MMTers say, but we should all bear in mind that Republicans have been closet MMTers (but only for the policies they favor) since Reagan. As somebody at FT Alphaville put it over a year ago:

I see zero evidence of MMT being favored by Silicon Valley. MMT is a description of how government spending in a fiat currency system works.

Silicon Valley likes UBI.

Silicon Valley most decidedly does NOT back the Job Guarantee. which is the favorite policy proposal of MMT types. MMT types oppose the UBI.

I was trying to make those points to people further up the chain without being too confrontational. Somebody misquoted Blyth’s statement about Silicon Valley loving UBI and Silicon Valley loving MMT, and I was trying to gently correct that.

The misuse of MMT is to ignore the Question 2 that it raises.

MMT answers question 1 with the news that the financial system in place now gives the government a huge choice of options to deal with the problems and emergencies in national life. The government has great power to mobilize peoples’ efforts and deploy resources to get things done.

But people hate leaving the warm security of an answered question, and going to face Question 2. What choices should we make? What do we need? What do we have? What do we do?

Bill Mitchell argues, if I’ve got him right, that a big neoliberal project is to make politics go away. It tries to convince us that all questions of effort and resources are governed by alleged “Natural Laws” that prescribe our best use of effort and resources, and that disregarding the prescriptions will ruin everything. It’s the mission of neoclassical economics to supply the alleged “Natural Laws”.

Even this article stops with the discussion of dollar-value spending levels and private debt levels. BUT the thing is that we can’t answer question 2 without using politics. Question 2 isn’t to be answered by economists alone (that would be selfish on their part.) We can’t get the good answers without going to everybody.

Mel

April 14, 2020 at 8:51 am

But people hate leaving the warm security of an answered question, and going to face Question 2. What choices should we make? What do we need? What do we have? What do we do?

Dick Cheney: Reagan proved deficits don’t matter.

We have had defacto MMT for a long time now. The question isn’t “how” – the question is “who” – who gets all the MMT money? and it seems to me, new economic theory same as old economic theory… (the rich get all the money)

If your gonna vote for Biden and not M4A, than all that MMT will just support the status quo.

It looks like you’ve pointed out the main flaw in using MMT. The theory is not flawed but the execution will be. If MMT were to be used to help consumers directly – by fixing the infrastructure or for systems to help slow down climate change and the like, it would be put to good use. Instead its use by neoliberals would almost always help FIRE, Oil Companies, Pharmas, the MIC, crooked politicians (through kickbacks), big corps and making the rich richer. That’s my 2 cents.

It’s the flaw in everything. If the untrustworthy government is running the police as well as the money, then you’re not financially safe, and you’re not physically safe. Craig Murray is furious now over the Alex Salmond affair.

MMT has been hounded by orthodoxy and fundies – of all stripes – for more than a decade to take an ideological position. MMT responds by saying its only a description and everything else is a policy choice with in that framework.

The aforementioned won’t have a bar of it because it does not lend to their ring binder ideological canned counter arguments.

What some PK MMT people suggest is removing NIARU as a buffer stock with a JG but … the aforementioned above still want to have the whole free market liberty and freedom paradigm with some money crank tweaks – hence calls for a UBI. Seems Capital in its various manifestations is loath to give up its administration of labour, too the point, it will issue free money to consumers as a stipend of its vast sum of free money.

Rights is a whole other enchilada.

Amen!

Changing the 4+ decades of debt induced human hampsterwheel hollow hedonistic happiness begins with RE-redistribution via moral tax policies.

To fresno’s point, modern money should be deployed for production and demand in ways which benefit humanity or at the very least, stop destroying it.

You are correct, Mel. The neoliberal project was to neuter democratic politics by deluding the populace that “there is no alternative” (TINA).

But the politics never goes away. And the burden of choice is always with us.

Hold your politicians accountable.

Not worth propping up a completely corrupt, kleptocratic system.

“”Where the private sectoris the lender, it raises the question of who will take the loss.””

Huh? The Lender! Loss is part of life. Reduce leverage. Borrowers must be shrunk too.

Paging Richard Koo! Time for an update on Balance Sheet Recessions.

Look at JP Morgans $6.8B provision for loan loss reserves going forward this morning in their quarterly earnings release. Up from $1.43B in Q4 2019 to $8.3B.

And large speculators in financial instruments as a group should be taken down a notch also.

That touches on a sore spot for me.

In all these High Finance situations, the lenders (bond holders, especially) get to presume that there is no risk of loss for them. Because they hold BONDS, gilt edged paper (or electron positions in some silicon matrix) that MUST BE PAID. Like the Fokkers who bought up the bonds of the Commonwealth of Puerto Rico for cents on the dollar and then had the gall, and the clout, to demand that they be “made whole” by the sufferings of austeritization of the people of that unfortunate island, saddled with location on a storm track and massive corruption in their government and corporate institutions. Plus the audacity to stand athwart the bankruptcy process, intending to bar that place from getting a discharge until they took their gobbet of flesh off the body politic.

And that is just one of the manifold situations where “somebody” has to “bail out” (“bail in,” if one follows the real path of the money) the looters, because of the “sanctity” and unencumbered-by-risk-premium nature of their “investments.”

I got no bailout when the dot.com bubble blew up, or when the GFC happened, nor did any other people “exposed to risk” (what financial advisers now say, instead of what they said in the ‘60s when I bought some shares of AT&T and Wrigley, they said i was “investing in the corporation.”) lots of people castigated as muppets and pigs got the same result. And rightfully so, it was a shell game starting in the late ‘60s in retrospect. We just had an “asymmetry of knowledge,” carefully cultivated by these same people.

“Risk” is for the little people.

I’m sure that Richard Vague has forgotten more about banking since breakfast than I’ll ever know, but I think we’re missing something by not mentioning agency in these matters. He notes: “When something that goes to this scale this quickly, fairness is a casualty and favoritism and profiteering are hard to avoid.” Hard to avoid? Show me that favoritism and profiteering aren’t the very point. Any MBA who’s read “The Sporty Game” knows that the business of airlines and airframes has scarcely been profitable for their entire history. Stock buybacks (even with cheap debt) leave them leveraged and vulnerable in an industry where Black Swans come not single spies but in flocks. By making crisis and bailout such a great business model, I imagine we’ll get them more often in the future.

I too was stunned by the “hard to avoid” comment. It also may be that an enraged citizenry’s hauling out the guillotines may to “hard to avoid” as well.

The key sentences in this piece come right at the end regarding debt jubilee. ‘ Where the private sector is the lender, it raises the question of who will take the loss. Again if the government steps in to take that loss, it makes the idea more feasible. ‘ and Vague goes on to talk about mortgages . All good. What is missing is all those derivative contracts that at some point are going to go south as a second or third order effect of the crisis. Those of us who have obsessed about all this for the last 12 years haven’t forgotten the fact that the banks ( casinos ) were made WHOLE last time. From everything I’ve read and written, that is the private debt that MUST be jubilee’d , written off and if that scuppers the banks and they have to be brought to heel and put under some newly created post-virus reconstruction authority well GOOD . That’s what have happened in 2008 .

MMT notwithstanding, is it just me, or did Vague just make the case that there is room for the Fed to finance another 6-8, 10-12 year rounds of rinse-and-repeat, bubble-boom to elite bailouts, until .01% of the people owns 99.999% of whatever economy is left after that?

+1.

Yep, that’s my take on it too.

See JTMcPhee’s comment below @10:12 am for more info. on this Vague character.

I think so too. He’s a banker. Naturally he believes that ” financial assets” are worth something. He just told us that it’s OK to push the Fed’s famous balance sheet to 15 trillion because the US has 115 trillion worth of financial assets. But Vague never mentions any new balancing act. Debt must be serviced. If expanded debt creates low interest rates and inequality it will be at the exploitation of the environment. Instead of spiraling out of the universe, why don’t we invent a new accounting method, just for overextended brokers of financial assets. None of them seem to like negative interest rates because profit. Financialization is a trap as all debt must be serviced no matter how low the interest rate and so they plan to make it up in volume at the expense of the environment – what else is there? Well there is one other thing – extra-column bookkeeping. The anti-debt column. Not the credit column because one person’s credit is another’s debt. How does that control financialization? We desperately need reality based accounting. We could justify an anti-debt column by appraising how the “debt” was spent and what good it did for society and balance the entire thing out with the value of the spent money. Whereas debt and credit only “balance” the books, debt and value balance society. As in the “real” economy. And as far as the Fed goes in it’s little agenda to keep financialization alive, I really think it is entirely irrelevant.

Matt Taibbi is also a God That Walks the Planet !!!

I’d like to see an explanation for “Contrary to economic orthodoxy, higher debt levels don’t cause rates to go up, they cause rates to go down. “.

the conventional wisdom is ‘lower rates, more debt’. He seems to be saying “more debt, lower rates”. I’d really like to see which variable is leading and which following..

I’d point out we’re talking sovreign issuer debt, so no chances of default. But I still can’t think of mechanism how more debt lowers rates.

As long as banks can swap debt to CB at repo rates close to the official “target rate” in unlimited quantities, the long-term rates (more specifically the forwards) will follow the CB target rate, because there’s a clear risk-free arbitrage.

Causality could go either way, I guess. During the liars’-loan boom at the time of The Big Short, heavy pressure to come up with financializable things that looked like mortgages encouraged a huge drop in lending standards, aka severe underpricing of risk, aka very low lending rates.

I don’t normally recommend economics papers but this one, which coincidentally just came out, I think does a good job of explaining why high debt levels have not driven interest rates up. It disaggregates U.S. savings by economic class and finds that the so-called problem of low U.S. savings (a favorite hobby horse of Bernanke) is – no shock – a combination of a huge increase in savings by the 1% swamped in the data by an even huger increase in debt by the 90% (with the 1-10% netting out about even). And then argues that low interest rates can be explained by this “savings glut” of the very wealthy + net inflows from abroad (offset to trade/current account deficit).

The Saving Glut of the Rich and the Rise in Household Debt

Even if you don’t follow the math, which is pretty straightforward for an econ paper, the graphs are pretty self-explanatory.

The moral of the story is that high consumer debt levels are likely a result of “push” lending – expanded credit, low standards, low rates – by the 1% searching for somewhere to invest their excess $$$ (since they have no appetite for investing in real domestic businesses), not “pull” borrowing by the 90%. Though of course all lending requires both a borrower and a lender.

I was looking more at govt lending, private lending follows its own rules.

Although you’d argue that if the govt creates debt, it spends it into something (be it rich or whatever), and if majority of it can’t be turned around profitably it’ll even try to go into more govt debt, pushing the rates down.

The natural overnight rate of interest in a fiat currency regime is zero — the central bank has to “defend” any rate that it sets (the rate is a policy decision) above zero.

In theory the monetary sovereign can purchase all assets denominated in the currency over which it exercises a monopoly of issue. This means that if it wished to do so, it could establish rates further out the curve beyond the overnight rate (which it sets by policy) via purchases in the secondary market.

It can purchase it, but it cannot (purely by financial operations) determine the price it purchases it at. Of course, it can set the price floor (by purchasing anything less than that) – but if say it purchases all stock of the outstanding debt, then the concept of “curve” (government) disappears, as there would not be any longer-term rates.

Moreover, this would still be just an operation to transfer money to banks as profits, as it the COB established permanent low short rate and permanent high long rate, anyone able to borrow at the short rate would finance it short rate, making a nice arbitrage spread. The word “permanent” in the previous sentence is important.

I’m not an economist, but this article seems to be talking about “rearranging deck chairs on the Titanic. A debt based economy is contingent on an ever growing economy to provide resources to repay the debt. This is impossible in an era of limits (climate change, resource depletion, soil degradation, pandemics, over population…) that is our current reality. A Jubilee makes sense only if there is a radical paradigm shift from Capitalism to some form of Communalism reflective of the age of limits.

As Tim Morgan is fond of repeating, the economy is not a financial system, it is an energy system. The post and most of the comments reinforce the financial misconception. Of course in the short term, we are all concerned about who gets the money and who decides who gets the money, and where the money comes from. But ultimately the money is just a claim on resources, particularly energy resources, and that is where the real contention in the future lies. Our collective prosperity is declining and without a clear idea of why this is happening and the futility of trying to maintain or reverse the trend, we will devolve into a fog of pointless disputations.

Great response. If we don’t know where we want to go to, no amount of dial-twiddling will get us there. Hard choices are going to be necessary. Going back to ‘normal’ is neither possible or desirable.

The 1% know where they want to go. The rest may be smoke and mirrors. I don’t think the 1% plan to allocate hard times to themselves in any case.

Right. I forget for a moment that the non-1% don’t really have a choice and are just along for the ride. Sometimes it happens in my few moments of delusion.

That “ultimately” is doing a lot of work. I can agree with your basic premise about economies being energy systems and with the limits of purely financial analyses, but the notion that current (or future) distribution questions are “pointless disputations” doesn’t follow. I don’t think proving the energy limits of our current economic systems is going to persuade Bezos or hedge funders to give up their fortunes.

Nothing will persuade them. Only force majeure.

The money is important, because we have no other fully fungible (and the “fungible” is very important) way of exchanging things. The barter, substantially increases energy inefficiency, if we’re talking about economy as energy system. When you’ll have ways of transferring any amounts of energy, and storing them, then we can drop financialisation, except then we’ll still have money but backed by energy.

I am no economist either and am wary of “economists bearing gifts”.

Both the earlier GFC and this Covid-19 crisis have illustrated that CO2 production and pollution drops when economic activity drops.

Earlier NC link to NASA satellite data showing 30% pollution decrease USA Northeast:

https://www.nasa.gov/feature/goddard/2020/drop-in-air-pollution-over-northeast

This is an indication that economic growth and advocating for the current economic system to be preserved/restored is simply, as you say, “rearranging deck chairs on the Titanic”.

This is the elephant in the room, the world needs to allocate resources in a much wiser and fairer manner if we are to have human comfort in a much lower resource consumption world.

One can read concerns that businesses are only focused on the next quarter.

Each economic crisis indicates that governments are similarly short term focused as a return to high consumption lifestyles is assumed as an imperative.

MMT, isn’t debt driven anything. As a theory it has associated with it a series of rules that if used resulted in good outcomes. That anything can be misused is not an argument agaisnt it existing in the first place. Assuming a way to manage Covid-19 can be found, if MMT was used to fund a new power/storage grid for the US, then the US is now the proud owner of samesuch. I doubt anyone thinks of the interstate highway system as debt. Although it’s had its day. In accounting terms MMT allows the government to put on its books MMT outcomes as assets agaisnt no liabilities. Like buying a mountain of gold, something we did for 150 years or so.

No, the issue of private debt versus the “debt” of a currency creating government is fundamental. A fiat issuer never needs to borrow. It can just spend. Borrowing is an artifact of our political system, and arguably to create risk free assets for investors. It’s not necessary.

High levels of private debt creates financial crises. High levels of government does not, as the US exercise in WWII shows. The British government also had high levels of debt in the 19th century, when England was industrializing. High growth, no widespread crises (banks would fall over because they weren’t regulated, but that’s not the same as a systemic crisis).

That’s the economist in you, Yves. The social psychologist in me sees moral hazard as the driver in this bailout carousel. There are often multiple, legitimate economic perspectives on the same issue. But game theory is pretty clear as to what happens when risk of losses or punishments don’t exist for certain players. The results are always the same.

Yves is correct. The monetary sovereign never needs to “borrow” the currency over which it exercises a monopoly of issue — that’s logically ridiculous.

It does so by convention (holdovers from the gold standard era and mercantilism), which ends up being a “favour” to private sector entities that hold its securities as risk free assets.

Effectively (given who holds bonds) this ends up being welfare for the rich. Which ought not surprise anyone, given on whose behalf we are governed …

“Yves is correct. The monetary sovereign never needs to “borrow” the currency over which it exercises a monopoly of issue — that’s logically ridiculous.”

ok then, does the US government actually control its currency then? Have you ever seen money that was a silver certificate, or gold? They don’t say federal reserve note on them.

In any case we can be certain that without some sort of serious debt forbearance we will be in for a future of slow/no growth and economic stagnation for the masses. In the past the rare soul who protested, “It’s not about accumulation, it about distribution” was drowned out with shouts of the wonders of economic growth…a bigger pie for everybody. The fact that it was mostly going to a small percentage of people was of no concern. With the clear short-term end of economic growth and the beginning of long bread lines, the contradictions will be obvious even to the castrati. Debt servitude will be on the menu for many more Americans…

https://www.youtube.com/watch?v=xtz1bhHpurc

“Vague, once a highly successful banker…” Here’s what he offers as the abbreviated version of his CV: https://www.reddit.com/r/IAmA/comments/2cw5ix/i_am_richard_vague_former_bank_and_energy_ceo_i/

I’d say that success has colored his analysis and blotted out the problems with propping up the “banks” and the Casino at the expense of the rest of us. His prescriptions for relief for the mopes, and “fairness,” are puny and begrudging. Banksters can steal trillions, and get a transfusion of the nation’s lifeblood of trillions more, in activities that are fraud and theft on a sort of galactic scale, but mopes can get maybe “write-downs to market price” on asset-inflated homes. And student loan forgiveness only if they work for it in “community service.”

Vague and people like him understand how to move trillions around, both as spendable wealth and to assist leveraging, and are so glib about these huge numbers and the lumbering and complicit institutions that do the moving. All tied to ratios to GDP and comparison-shopping to other nations’ economies, ‘See, we are doing pretty well measured against Japan and Germany on debt-to-GDP.’ No notice given to the corruption that is the entire federal reserve system and how it is gamed along the lines that Taibbi and others have so well documented, and which is once again going to “give us” this:

When something that goes to this scale this quickly, fairness is a casualty and favoritism and profiteering are hard to avoid.

And he lays it on Taibbi to spell out ‘what is to be done,’ and his own prescription is:

To continue the what has already being done, adding oversight and fixing the inequities. But we need increased support to individuals, taking it from a single check and extending it to at least three months or more if necessary, and increase the support for small businesses loans from $350 billion to perhaps twice that number.

Longer term, individuals need mechanisms to bring relief from high levels of debt. For example, student debt borrowers need relief, perhaps forgiveness that would come through community service. Underwater mortgage holders need relief, perhaps getting principal reduction in exchange for giving part of the gain on the future sale of the home.

How generous of him, maybe support to individuals for a few more months in tiny amounts, and a little bit more of intermediated assistance to small businesses, a category to be defined how?

Bless him for making even the passing reference to jubilee as something to consider in dealing with “Crushing household debt.” But what would that consist in? For student loans where the government is the lender, some forgiveness in exchange for community service (usually thought of as part of the sentence for a criminal conviction.” For mortgage loans, write the loan down to market but when? Current inflated, or after a couple of years when the bubble has lost its gas? And then the lender can write off the loss, “in exchange for receiving a portion of the gain, when the home [how many “homes” are just “houses” in a rentier’s portfolio?] is finally sold.” How generous and curative of unfairness, this successful banker’s remedies…

I think his summation can be read a couple of ways. Here’s what he offers:

Climbing out of this economic quagmire will take everything we’ve got and more.

Yes, the oligarchy of which he is a part intends to do exactly that – take everything we’ve got. And they own the political mechanisms that facilitate doing just that.

For those interested, let’s remember Vague was eyeing a Presidential bid, https://thephiladelphiacitizen.org/richard-vague-for-president/ ,and that he currently is managing partner in an “early venture capital fund:” https://www.ineteconomics.org/research/experts/rvague He founded two “consumer banks,” First USA and Juniper. Juniper concentrated on issuing credit cards, and added insurance later. https://en.wikipedia.org/wiki/Juniper_Bank

Smart guy, knows how to swim with the sharks. Not a comforting notion for us mackerel…

But he sounds so reasonable. /s I’d really like to see Taibbi’s response to that response. Should be epic.

Me too, but there can be no winner when both are fundamentally wrong to begin with: Taibbi with his lack of MMT lensing of debt and Vague on What Should Be Done.

The first is more excusable than the second; all of us who now have a handle on MMT went thru a period of ignorance and disbelief about it until it sunk in. Matt just needs a Kelton or Wray to sit him down for an hour. While they’re at it, they could also have a word with another journo I admire, Mike Whitney, who also gets himself into a govt-debt fuelled lather here.

Vague though should be seen thru the prism provided by Upton Sinclair:

It is difficult to get a man to understand something, when his salary depends upon his not understanding it. It can be very hard to understand something, when misunderstanding it is essential to your paycheck.

Of course he does understand it, and I’m sure it is also true to say that it has been a fair while since he received anything resembling a ‘paycheck’. His ‘solutions’ are 1%er limited hangout.

While I’d like to see Taibbi square up to Vague, what I would really like to see is the pair of them face Kelton/Wray, Michael Hudson, Bill Mitchell, Steve Keen, etc… one to be educated, the other to be defenestrated.

As below, ad hominem with respect to Vague. And all you do is handwave and make insinuations as opposed to making an argument about what Vague says that you disagree with.

Vague says something which is unpopular: people who talk about the 2008 bailouts treat them as cash handouts when they were almost entirely emergency loans which were paid back.

The beef should not be about the FACT of the loans, but about their terms: that the board members should have been fired and replaced with people who’d do real oversight, execs on minimal pay for the next few years (and barred from working in the banking and securities industry for 5 years if they quit), limits on dividends, etc.). The complaints are instead “OMG lookie Fed scary big numbers!” which is a just lame and shows an utter lack of understanding about what was wrong.

And it goes without saying execs should have been prosecuted, but you can’t do that in the heat of rescues. That’s the next chapter.

And I have to tell you, not bailing out the system would now result in a collapse. The question is how to go about doing it. We have again too much directed at the top as opposed to workers, no strings attached, no supervision.

I’m late to this weenie-roast (I picked a bad day not to read NC), but THANK YOU for this post and for intervening when comments have gone off the rails in attempting to criticize some of the assertions made. The assertions should be criticized.

OF COURSE the “financial system” mustn’t be allowed to collapse. However, a bail-out can’t come without consequences for the people at the top whose wholesale looting was the root cause of the crisis in the first place. Sure, a few executives and board members ought to go to jail for placing their self-interest above the long-term health of their organizations. But more importantly, their ill-gotten gains should be disgorged and returned to the businesses that they were stripped out of for productive reinvestment. Loans can be repaid pretty quickly that way!

Instead, the miscreants all get bonuses because they’re Too Big to Jail. Believe me, a complex organization isn’t going to fail simply because a few bad apples at the top get lopped. Favoring wrong-doers is a choice. A corrupt choice. That choice means that the bailout really does go on forever.

As I like to say, Follow the Money…

I thought the biggest value amongst the government action during the Great Recession were the guarantees for the crappy loans the banks had racked up. Weren’t the loan guarantees much larger than the loans actually paid out to banks? I seem to remember banks being very shy about taking outright loans at the same time they were gasping for someone to guarantee almost the whole derivative market.

I even remember some bankers saying they were not taking loans, even as they were taking the TALC guarantees.

Money is money, but guaranteeing somone’s reckless debt is pure stupidity.

Apologies for getting a bit carried away there Yves. I should have read it again before posting. Suitably chastened.

Yves wrote: “when they were almost entirely emergency loans which were paid back.”

You make it sound like it was a simple mortgage taken out. I’m not calling you out on the numbers or the way the loans were allocated. What occurred was taxpayers were asked to backstop really bad loans. Thankfully the rest of the world piled into our equities as the least ugly thing available. Why? Because the world reserve currency was guaranteeing a bunch of toxic loans.

Vague’s argument absolutely deals in old world economic BS (sans change over time or the effects of other currencies) This completely ignores so many factors involved. I would argue the really interesting things going on in economics has moved on to include Social Psychology. Normally your arguments seem to align with this fundamentally and why I love your site so much. I’m pointing this defense out as the exception.

Talking about loans without including the reputations and the fact that the loans may *not* have been paid back seems so overly simplistic.

well, here it is, he’s kindly obliged

https://taibbi.substack.com/p/a-quick-note-in-response-to-naked

Taibbi drops some Yves respect!

Me too.

This is ad hominem and a violation of our site Policies. If you can’t argue on the merits, you have no business commenting.

Keynes was an extremely successful investor. By your logic, we should not listen to him and trust Bernanke and Geithner and Yellen, who were never bankers before they got their roles at the Fed.

Vague reports that he understood fully well that his business was based on regulatory arbitrage. He says he went repeatedly to regulators and said, “You understand what I am doing? Are you sure you want this to happen?” They not only said yes, they said they wanted more.

Regulators back in the 1980s actively encouraged financial products and structures that minimized the use of bank equity because they thought that risk cushion was too costly. The vogue (promoted by McKinsey) was for “recycling capital”.

First rule of Wall Street, or it should be. “Everyone talks their book.” Nothing wrong with knowing someone’s book when reading their theories, policy prescriptions and expert advice. In fact, I’d say it is essential, and that goes even for Keynes, whose ethics while investing for King’s College, would probably have landed him in prison today, that is if we were imprisoning any investment managers for inside trading these days.

Mr. Vague. Which regulators said step on the gas?

NAMES please!!!!

Can’t keep letting people get away with this…

…sorry, just watched the Panama Papers again so I’m kind of worked up.

-Bill

The way the Fed disperses funds is to top down. By big bamks.

Why not use regional banks as their means to an end?

This top down approach is similar to the Soviet Union five year plans.

Lol, Soviet 5 year plans were more myth than reality. The Fed serves the banks that came into power after the Civil War. They are shareholders. There is nothing top down. You serve your clients.

Vague’s description of how the Fed works, how money works, and how debt works is enlightening. He is good at explaining. Yet I also get the sense that he is offering “wholesale” political economy while Taibbi is offering “retail” political economy. Notice the last several paragraphs in which Vague repeatedly agrees with Taibbi’s observations and recommendations.

Nevertheless, it is for these detailed explanations of the political economy that I come here to Naked Capitalism. Thanks for posting this discussin.

This is why we must put another class in power. The money changers must be cut out of the system. One national public bank/post office and no more. Only then can our efforts not be done in vane again, again.

This is what comes to mind when Vague’s prescriptions are tagged as “banker’s remedies”.

“we need to note that much of the Fed’s trillions in credit market support were not a giveaway, but instead loans provided to support to those markets through its money creation powers that were calculated to be repaid over a reasonably short period”

I guess this includes the 4 plus trillion the Fed carried on its balance sheet for the decade after 08-09 and the 2 trillion more added in last couple weeks?

“Contrary to economic orthodoxy, higher debt levels don’t cause rates to go up, they cause rates to go down.”

they go down cause the Fed subsidizes bad debt driving down the price of good debt.

“Now because we have a tremendous amount of under-utilized resources, in the form of idle people and businesses,”

And here in lies the rub, from an environmental perspective, without a qualitative value of what this means, that is simply spending money to get any and all economic activity, is death at this point. Can we print another planet?

I’ve never understood the MMT stuff, people entranced by the knowledge money is simply created, always has been always will be. We live in a bank-debt money society, in which we’ve unfortunately given the banks the majority of money creation power. If the government comes in regularly to buy up bank debt, there’s no difference between “private” and “public” debt. Debt matters, it constrains political freedom, and in the end in a bank debt money system in which there is no longer any accounting, through any mechanism, the currency will fail – bet on it.

The banks do not get the “majority of money creation power.” Money is created by the government which spends it into the economy including through the banks’ ability to create money through loans.

When it comes to Treasuries, just exactly whose debt are we talking about. Whose bond? The public seems to pay for it coming and going – we give our full faith and credit to our currency even when it is worth 10 cents on the dollar – so we are often paying 10 times what it is worth; we offer our taxes as payment in any situation; we have no usury laws; we have no bankruptcy laws; and then we have to cough it all up again when we take out a loan and pledge our last drop of blood as collateral – we pay that interest and blood money directly to the banksters. Etc. There’s gotta be some equity in this pile of crap.

Do I have it right that the Fed, that bank owned by the TBTFs, gets the government money, and then “spends it into the economy” (minus their commissions, fees, bonuses, etc.) by making loans?

Loans come in categories. How many “loan dollars” go to multinational corporations or as borrowing to leverage Casino “investments,” versus to small businesses who might make stuff and deliver it, or to the ever shrinking number of individuals who qualify under the ever-shifting guidelines of “mortgage lenders” who as I understand it “borrow” at close to zero interest, the money they “lend” to us mopes at a large multiple of their “cost of borrowing?” And how about credit card “loans,” average rate today reported at 16.14% for reasonably good credit, and full-on loan-shark rates of 36%? Not so very long ago, charging that kind of “interest” was a serious criminal offense, though with all that money the “lenders” have figured out how to accumulate, they can buy legitimacy for their ripoffs by paying bribes (a kind of loan, with the office as the collateral and the “friendly” legislation as the interest) to the people who “represent us.”

So we the people who make the real money, through the Treasury we loan money to the banks which we effectively pay them to take, as I understand it. And they make loans to parasites and profiteers, to corporations good and bad, and to a shrinking pool of people with mortgages (what we call “homeowners” who in most states do not even hold legal title to “their” property) and to PE and VC who pile debt on the “assets” they acquire before stripping the wealth out of them and disposing of the remains (shedding jobs and debt and taking any pension money as they go) through the bankruptcy processes that are terra incognita to mope debtors and simply not available for relief to people who take on student loans to get an education that in a significant number of cases does not even translate into a job that might allow even keeping up with the interest And “fees” larded onto those government-underwritten loans, let alone pay down the principal.

“Loan” is doing a lot of work, a lot of it very dirty from the standpoint of the mopery…

Of course, I could have it all wrong. So hard to know anything these days.

The Fed is owned/part of government, in particular, the Treasury, since MacAdoo set it up in 1913 and by no other person(s) or institution(s).

In the piece The Use and Abuse of MMT Hudson el al make the critical distinction between deficit spending that ends up on wall street and the deficit spending that ends up on main street.

And Mr. Vague’s notion is that the MMT money goes in at the top, once again and always, and the people at the bottom get to work their way out of debt and give over a portion of the gain on their homes to the Machine. In addition to having to create the REAL wealth that the MMT spigot ultimately draws on to fill the goblets of the filthy rich.

I wonder if he would agree that the notion of “community service” should be applied in something like “the punishment fits the crime” degree for the Banksters and Wall Streeters and VC and PE types that have caused so much death, disease and suffering by their “success…” It’s worth noting that the few Elites who ever do get convicted of those control fraud and other crimes have expensive attorneys and “corrections consultants” to make sure every box on the checklist of “sentencing recommendations” from the Federal corrections people is ticked, so they serve the minimum time, in comfortable facilities, near their families, “with all the amenities” including good health care, food, a roof, and reductions of time served “for good behavior.” Or, in the current case, they get let out early because they should not, “in justice,” be exposed to the plague, like people who are nailed for “lower class” crimes.

Who would have known that the current abbreviation “VC” would end being shorthand for a far worse enemy than the “VC” I was sent to make war on in 1967?

Yes! That piece was great, and provides an interesting contrast to this interview.

What good is public knowledge of MMT if all the power is concentrated with the few? We still can’t have M4A- “how are we going to pay for it” they will still say after shamelessly pumping trillions into Wall Street. It’s truly depressing that all the eager reading and optomistic agreement with MMT leaves me with the inevitable conclusion:

No power = no resources. And we are left with Thuycides from the 5th Century B.C.: “The strong do what they will, the weak suffer what they must.”

Thuycides from the 5th Century B.C, ya well that was in the context of never ending war with Sparta and it’s allies. Nothing strong about asking people to vacate a walled city, promise them safe haven and murder them all. Beware of Greeks bearing quotes. Funny though it was the plague and massive stupidity at Sicily that did in Athens, et al.. We got our plague and we got our stupidity – trump. So history repeats as tragedy.

” …. the notion of “community service” should be applied in something like “the punishment fits the crime” degree for the Banksters and Wall Streeters and VC and PE types that have caused so much death, disease and suffering by their “success…” It’s worth noting that the few Elites who ever do get convicted of those control fraud and other crimes have expensive attorneys and “corrections consultants” to make sure every box on the checklist of “sentencing recommendations” from the Federal corrections people is ticked, so they serve the minimum time, in comfortable facilities, near their families, “with all the amenities” including good health care, food, a roof, and reductions of time served “for good behavior.”

JT, I happened to catch a few minutes of a Judge Judy episode yesterday … my spouse, in our isolation, has become addicted to daytime TV … and was struck again by how the defendants are mostly, as my grandma would say, “gormless.” Making them such easy targets for mocking, lecturing and dismissing.

I propose a new series: Judge Judy, but with the defendants plucked from the august ranks of corporate board rooms, hedge fund and venture capital heads, Select Senate committees. Actors would play their roles, obviously, following scripts based on true life events. Sentences could be imposed based on audience feedback, maybe even call-ins from the at-home watchers.

Vague did not say how much of US GDP is from the FIRE sector compared to the real economy. The former, where the highest risk is, gets bailed out and investors saved, while the latter, the real economy, bears the burden of stabilizing things. Even at that elements of the real economy–the large corporate part–finds stock buy-backs more appealing than investing in production. Then, small businesses and workers get saddled with austerity while banks and hedge funds keeping blowing bubbles. The FIRE sector contributes less than nothing.

Taibbi responds to this post:

https://taibbi.substack.com/p/a-quick-note-in-response-to-naked

Looks right to me. Our governments’ answers to Question 2 up to now have been almost totally a mess.

Thanks for the link.

From my email at 4:25 pm, Taibbi has replied on Substack for those interested. Edit: See above.

Vague’s logic seems flawed and inconsistent:

But he says elsewhere that the Fed as LENDER of last resort expects to be paid back. These loans are in private sector pockets only temporarily. If spent on salaries and wages, it does end up in people’s pockets, but eventually the loan gets paid off or the company goes bankrupt and those employees get laid off.

The key here, it seems to me, is that FED and Treasury actions are just stop gaps, unless the loans to turn to grants (as they do in some cases in the CARES Act). Everyone is just hoping everyone will get paid back. Its like lending a life-preserver rather than just tossing it unconditionally to the drowning person. The owner wants it back in a certain amount of time, even if rescue can’t arrive in time.

Also, and maybe more importantly, FED “spending” (or more accurately, FED open market operations) means that banks end up receiving the money. Now, banks are raising lending standards, e.g. for mortgages, and are starting to curtail credit as they usually do in downturns. So what good is that? Now the Fed wants to inject money directly into hedge funds. These financial firms are all “private sector” but don’t have the connotations of worthiness of most businesses.

I’d be more comfortable with all of this if I thought Powell and Mnuchin had a plan, and understood the risks they are taking in our behalf, but they are just hand-waving. No wonder the CARES Act allows them to keep all of their decisions completely under wraps!

Excellent and interesting take. Yet, I find it hard to square Mr. Vague’s assertion that “no profligate growth in new loans or bad debt, the things required to create a conventional banking crisis” has occurred since the last collapse in 2007/8. Why then is the Federal Reserve frantically ploughing oceans of new credit into the banking system? Certainly not for fun. If it is private debt and unemployment that is the issue, as Mr. Vague asserts, then there is no reason to cut checks to any but individuals, and leave the banks out of it.

Mr. Vague also disagrees with Mr. Taibbi’s assertion that the Fed’s “bailout looks like forever,” but looking at the Federal Reserve’s balance sheet since it first began Quantitative Easing hands the prize to Mr. Taibbi. Its holdings went from about $800 million of U.S. Treasuries, traditional holdings used to influence its short rate, to over $4.3 trillion post-2007. When it finally moved to “normalize” this bloat, reducing its holdings to around $3.6 trillion by last year and raising its rate from 0% in baby steps to a high of 2.25%, it soon had to begin cutting again by last July. By September, the Fed moved to intervene in the repo markets which were showing severe stress. Now the balance sheet has been ramped back up to $6.1 trillion, a $1.9 trillion increase in just the last four weeks. So the bailout – and QE was (and is) certainly a bailout of the banking system — was never unwound and never will be, unless the banking system wants to find out what the real cost to borrow capital truly is.