Yves here. Hubert Horan shows how the airline industry is in far more serious trouble than the business and financial press has begun to acknowledge.

Hubert is a bit too polite in talking about “the industry narrative”. The executives of the US majors are engaged in looting. They are peddling clearly bogus forecasts in order to hold off an inevitable and costly restructuring as long as possible. The motive is to preserve their pay packages and jobs, at the cost of employees and taxpayers and other innocent bystanders.

By Hubert Horan, who has 40 years of experience in the management and regulation of transportation companies (primarily airlines). Horan currently has no financial links with any airlines or other industry participants

More Awful Results for the Industry in July

In late July the big four US carriers announced 2ndquarter GAAP net losses of $13.2 billion, or $8.5 billion if adjusted for special items.

Any remaining hopes that the 2ndquarter would produce the beginnings of a traffic rebound were dashed by the huge post-Memorial Day spike in virus cases. July volumes through TSA checkpoints remains 75% below 2019 levels. But earnings reports highlighted that the revenue collapse is even worse. 2Q operating revenue at Southwest declined 83% year over year, while American, United and Delta declined 86-88%. This was slightly cushioned by smaller drops in cargo and ancillary revenue; Delta’s passenger revenue had declined 94%.

IATA, the worldwide industry trade association, reported that international traffic in June was down 97% year-over year, while purely domestic traffic was down “only” 68%. [1] Thus carriers with a heavy focus on international business travel (Delta, Lufthansa, Cathay Pacific) were facing much more severe problems than operators with historically strong positions in large domestic markets (Southwest, various Asian carriers).

Capacity cuts in Latin America, Africa and the Middle East are similar to those in North America, while 42% of Asian capacity is operating, thanks to large domestic markets in China and Japan. Despite virus impacts less awful than in the US, hopes for a steady rebound in intra-EU traffic have been dashed, as countries continue to see bans on cross-border travel (such as the reinstated ban on UK-Spain travel) as a critical to efforts to prevent new outbreaks. [2]

At this writing there is no evidence that Congress will extend the large taxpayer subsidies established in March under the CARES Act. Even the much more generous House Democratic proposals failed to provide any additional payroll protection for airline employees. Major layoffs and capacity cuts are widely expected in October when initial CARES provisions expire. Very few countries have followed the US approach of subsidizing existing airline owners. In those countries major carriers have either gone bankrupt or have been nationalized.

Everyone’s Recovery Forecasts Have Consistently Ignored Economic Evidence

The narrative that a strong V-shaped demand recovery would begin this summer has dominated industry discussions of the crisis. “Most experts in the air transport industry agree that recovery may take a year to 18 months to reach pre-crisis traffic levels and the industry may not record pre-Covid-19 traffic volumes again before the end of 2021,” [3] Under this narrative, taxpayer bailout money provided a critical stopgap until the traffic rebound was underway.

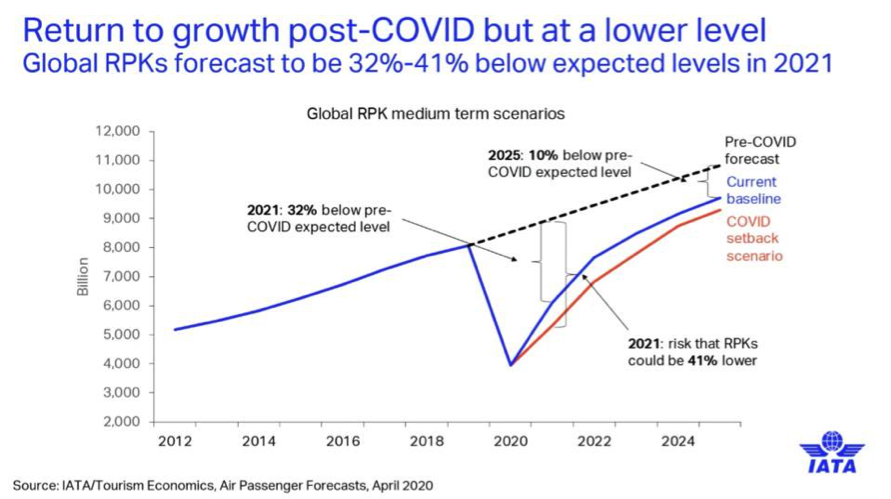

Other forecasts, such as the IATA forecast below, started with a similarly robust V-shaped summer demand rebound, but suggested that it would take a couple more years to fully restore 2019 market conditions.

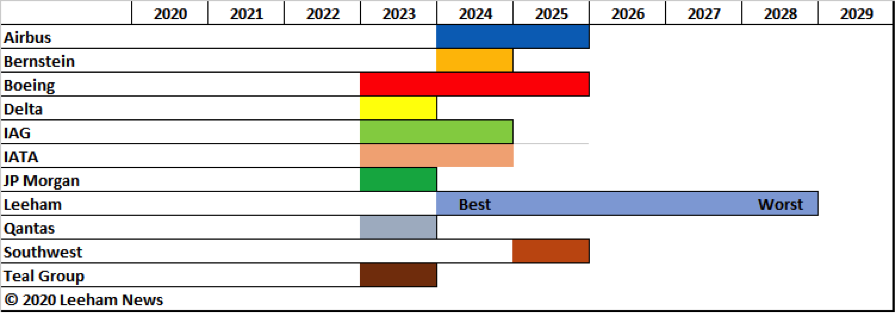

A somewhat more pessimistic view, from Leeham Group (an aircraft fleet consultancy) used the table below to illustrate that the only difference between forecasts by the vast majority of airlines, manufacturers and financial analysts was whether industry demand growth would fully recover to historical levels before 2024 or soon thereafter. [4] Everyone bought into the narrative that the critical drivers of airline travel would be functioning normally by the end of this year. Everyone accepted that there would be serious short-term financial pain but insisted that underlying fundamentals were completely sound and airline viability is not an issue. The only question was how long the exogenous recessionary impacts of the initial economic disruption would delay the return of 100% normalcy.

The Industry Narrative: Please Ignore the Iceberg We’ve Just Hit

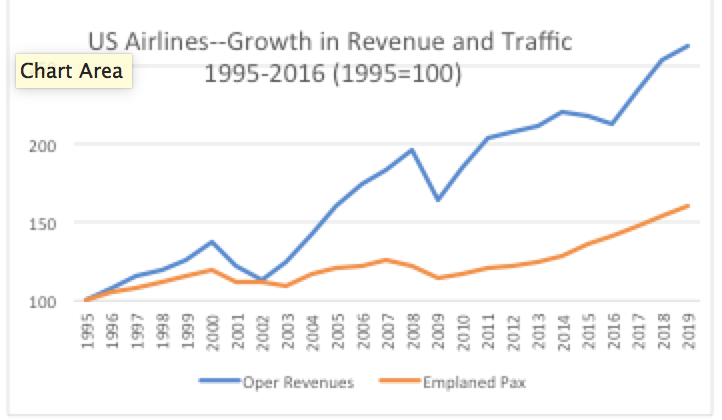

But all of these forecasts ignore obvious evidence that virus’ impact is fundamentally different and orders of magnitude greater than any previous aviation crisis. As shown in the graph below, total US airline traffic declined only 6% during the post-dot-com era recession and only 9% following the 2008 financial crisis. Revenue declined a bit more (19% and 17%) due to lower fares. [5]

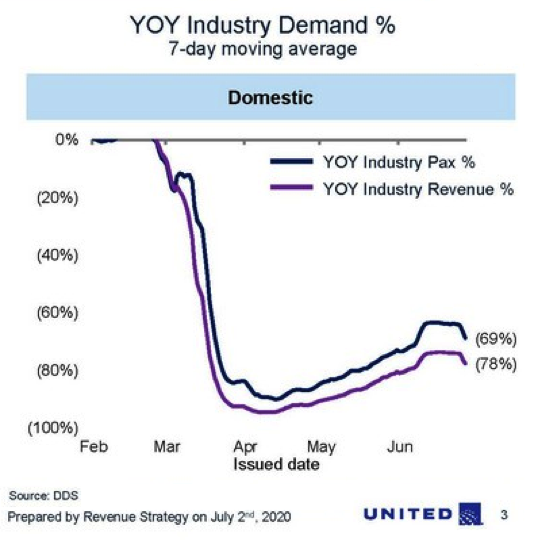

Past demand declines look nothing like the current situation, as the graph United filed with the SEC clearly shows—a graph that would look even worse if international demand was included [6]

With the current demand collapse (roughly 75% traffic volume, 85% revenue) the industry has struck an iceberg and the damage may keep the ship from ever getting back to port in one piece. But the industry’s narrative ludicrously claims that we are just seeing the same kind of engine room problems we saw in 2000 and 2008, that thus the coronavirus recovery will look just like the recovery from those single digit traffic drops. Iceberg strikes don’t always sink ships, especially if action is quickly taken to limit structural damage. But the narrative asserts airlines haven’t been anywhere near any icebergs, and thus there’s no need to think about the possibility that this iceberg strike might threaten the integrity of the ship.

Because the industry storyline insists there is no need to ask whether airline fundamentals are still sound, forecasters appear to have actively ignored evidence showing the collapse of the key drivers of demand, especially international and corporate travel. In the 2000 and 2008 downturns the underlying willingness to take these trips was undiminished although the recessions kept companies from buying quite as many airplane tickets as they might have. In 2020, business people (along with Dr. Anthony Fauci) do not believe flying is safe, and cannot cross international borders (and have little desire to do so). They are embracing substitutes like videoconferencing. And worse for the airline industry, they have figured out that a lot of pre-pandemic travel may not have been worth the cost and hassle.

It was clear by the end of April that efforts to stop the spread of virus had failed, and thus any subsequent forecast based on a robust V-shaped summer rebound of corporate and international demand was delusional. [7] The underlying willingness to travel will not return until a vaccine has been proven to be highly effective, has been administered to tens of millions of people, and the risk of major new waves of infection has been eliminated, or alternatively, treatments can greatly reduce Covid-19 severity and damage become widely available. This will not happen anytime soon, and at that point airline demand recovery will likely face other huge obstacles, such as deeper, longer-lasting coronavirus driven declines in economic activity, much higher airline fares, and reductions in global trade.

The Airline Ship Is Taking on Huge Amount of Water

The 2000 post-dot-com era recession cut US airline traffic by 6% and revenue by 19%, but this forced airlines operating 75% of industry capacity into bankruptcy. [8] This makes the industry’s efforts to convince people that a 75-85% collapse poses no threat to the viability of today’s major airlines especially challenging.

A recent study that attempted to present apples-to-apples data calculated that the cash flow drain of the big four US airlines in the second quarter was $168 million per day, or $15.4 billion per quarter. [9] That cash drain is the water flooding into the hole of the industry’s ship created by the iceberg.

It is structurally impossible for airlines to match these catastrophic revenue declines with comparable expense cuts, and there is no way that these airlines can suddenly improve cash flow by $15.4 billion per quarter. Operating expenses — which do not include major cost items such aircraft lease payments or contractually committed CAPEX purchases — fell only 68% at United and 57% at Southwest. Airlines can avoid certain purely variable expenses (fuel, landing fees, sales commissions, credit card fees) but many critical expenses (fleet, IT, airport facilities, maintenance bases) are locked-in over the medium term, and must be paid even if most of the fleet is grounded.

These airlines understand the financial data and are pursuing increasingly desperate measures to reduce the hemorrhaging of cash. As described in last month’s post, they have been trying to raise cash by claiming that the frequent flyer programs that are integral parts of their marketing and revenue management systems are actually independent business that could be spun off. [10] American (with Goldman Sachs) just secured a $1.2 billion loan (@10.75%) collateralized by slots and by intellectual property, including its brand name and the “aa.com” domain name. [11]

Trapped by Its Desire to Protect Executives and Shareholders, the Industry Can Do Nothing but Rearrange the Deckchairs

As described in the first article in this series two months ago [12] there was always an alternative that could have plugged the hole in the ship and prevented it from sinking. If airlines filed for bankruptcy protection as soon as it became obvious the virus could not be rapidly contained, they could have halted huge wasteful cash drains. Bankruptcy is painful and difficult but would have eliminated all the expenses related to unsustainable operations, and all the payments on unsustainable debt and fleet obligations. Moving quickly would have maximized the long-term value of the companies and maximized the recovery available for employees and creditors.

Instead, these airlines gambled that there was some way to preserve current equity holders’ control of the company. This narrative was constructed to “explain” why there were no risks of bankruptcy, despite a revenue collapse dramatically larger than ones that recently sent 75% of the industry into bankruptcy. This gamble depended on all of the most optimistic scenarios coming true — rapid virus suppression and vaccine distribution, a robust summer 2020 revenue rebound, no damage to underlying corporate and international demand, and continuing taxpayer subsidies.

The senior managers of these major carriers deliberately, consciously choose to not deal with any of the real problems caused by the iceberg in the hope that their creative story-telling could distract everyone from all the financial evidence until a powerful turnaround magically appeared. But this choice painted the airline industry into a fatal corner. While the hull of the ship continued to flood, management had to take increasing desperate actions to preserve their fiction and could do nothing substantive but rearrange the proverbial deckchairs.

None of these efforts can possibly revive corporate/international demand or generate positive cash flow. Recent liquidity raises might create the temporary appearance that the danger of running out of cash is not imminent.

But that cash will be burned unproductively, will make airline capital structure problems even worse as well as making future restructuring much more difficult. Airlines have limited themselves to voluntary early retirement programs that will be very expensive and will not come anywhere close to aligning labor costs with the reduced revenue potential. The airlines cannot ask Congress for additional taxpayer payroll subsidies because the required conditions (no layoffs, capacity guarantees) would make the cash drain much worse.

In pursuing the extremely remote possibility that all airline equity could be salvaged, the airline narrative created a time bomb that could create far more damage than the bankruptcy option they rejected. No matter how bad the financial situation gets, it will be extraordinarily difficult for these airlines to suddenly admit they’d been deliberately misleading everyone all along, and now really need bankruptcy protection. And by the way, this bankruptcy process will be substantially more painful than if we’d filed in the spring.

The market capitalization of US airlines has fallen in half since the beginning of the year. [13] That it has not fallen further illustrates the success of the industry’s storytelling. But at some point investors, employees and Congress will soon realize that no robust rebound is coming, and that the loan repayment, job protections and severance payments, and service levels they’d been promised aren’t going to happen. As those realizations dawn, stock prices will likely collapse, the airlines will lose their limited remaining access to capital markets, and to any goodwill from unions, customers and politicians.

When Will the Timebomb Go Off?

If the industry continues to deny financial reality and cling to its narrative claims, the timebomb might not go off until the weakest link collapses. Since the beginning of the crisis, the widespread presumption is that American was the most financially vulnerable US carrier, as it had the weakest cash flow, and most debt, and that presumption is probably still correct.

Southwest is clearly the least vulnerable, as it has the strongest balance sheet and the least exposure to the markets that have collapsed the most. Delta had the greatest liquidity pre-crisis, but its cash flow has been hurt the worst by the loss of high-yielding corporate and international traffic. United also has huge corporate/international exposure but appears to have done the most sober analysis of the crisis and has made more effort to pare costs.

But this has created a game of musical chairs that is unlikely to work out well for anyone. The current strategy at United, Delta and Southwest seems to be simply to hope that American is the one left standing the first time the music stops. But a messy American collapse is unlikely to restore positive cash flow for the others. Unless a major vaccine breakthrough has occurred, it is more likely to set off (or increase the damage) from the narrative timebomb. An American bankruptcy filing won’t solve the industry’s huge overcapacity problem but will dramatically highlight that all carriers have been facing the same problems and that all of the claims these carriers have been making about their sound fundamentals have been total nonsense.

And as mentioned previously in this series, this musical chairs game is likely to be a disaster for consumers and the many cities and industries that depend on efficient airline service. Any semblance of competitive balance will quickly collapse and investors will be demanding massive capacity cuts and price increases. No one in Washington will try (or have the competence) to oversee a broader industry restructuring process, and the unmanaged process will be ugly and highly wasteful.

____________

[1] IATA Air Passenger Market Analysis June 2020

[2] Centre for Aviation, “UK hurdles to Spain travel raise fears for European aviation recovery” 28 July 2020

[3] Angela Gittens, Director General of Airports Council International World, quoted in “Passenger traffic may only recover end-2021” Flight Global, 2 April 2020

[4] Judson Rollins, “An economic crisis on top of a medical one: Why airline traffic won’t fully recover until the mid-late 2020s” Leeham News 13 July 2020

[5] US DOT Form 41 data. Revenue declined more than traffic because (given fleet obligations) it made more sense for airlines to cut prices to fill otherwise empty seats. The (2000) post-dot-com-era recession was a major crisis because the US industry had foolishly overexpanded in the late 90s, making it more difficult to get supply and demand back in line. Impacts on airlines outside the US were much smaller in 2000 while the 2008 recession affected airlines globally. Revenues grew much faster than traffic after 2004 because of massive reductions in industry competition (especially in longhaul intercontinental markets) that increased airline pricing power.

[6] United 8-K filed 2 July 2020.

[7] Leeham’s worst case is the only forecast that acknowledges the serious impact of aversion to the health risks of flying and the likely persistence of international border closings. But no forecasts address that recovering from an 75% traffic collapse is radically different from recovering from 6-9% declines or that problems of this magnitude raise serious doubts about industry viability

[8] USAirways was under chapter 11 bankruptcy protection 2002-05, United 2002-06, Delta 2005-07 and Northwest 2005-07

[9] The airlines public cash flow claims have been based on wildly inconsistent definitions of cash flow, and most carriers have not released meaningful data about outstanding refund claims. The $15.4 billion quarterly cash drain is the sum of $5.4bn ($59m/day) at American $4.8bn at Delta ($52m/day), $3.7 at United ($40m/day) and $1.5bn at Southwest ($17m/day). Brett Snyder, Figuring Out How Much Cash the Airlines are Really Burning, Cranky Flyer 30 July 2020.

[10] Hubert Horan: Can Collateralizing Frequent Flyer Programs Help Save the US Airlines?, Naked Capitalism 6 July 2020

[11] Claire Bushey, American Airlines pledges brand and slots to secure $1.2bn loan, Financial Times, 23 July 2020

[12] Hubert Horan: What Will it Take to Save the Airlines?, Naked Capitalism 3 June 2020

[13] Wolf Richter, No V-Shaped Recovery for Airlines. Ticket Sales Slide Again., Wolfstreet, 8 Jul 2020.

I don’t think there is a ban on UK-Spain travel. The UK has instituted a 14-day quarantine on all those returning from Spain.

To most practical purposes, it has the same effect as a ban. Load on the restored flights for most european carriers is IIRC around 50%. That’s deadly to pretty much all airlines I believe.

I don’t disagree. But “ban” has a specific meaning.

IIRC, 2/3 of US airports are served by a single carrier. So any of the big carriers going into bankruptcy would create service deserts.

Gee, it can be added to the food, banking, hospital, and job deserts that too many people live in.

‘The senior managers of these major carriers deliberately, consciously choose to not deal with any of the real problems caused by the iceberg in the hope that their creative story-telling could distract everyone from all the financial evidence until a powerful turnaround magically appeared.’

Maybe what they were really hoping was for the government to bail them all out. Trump can try to order kids back to school and order workers to go back to virus-laden workplaces but he cannot order people to go fly by airplane. So the demand for seats will just not be there like it was back at the beginning of the year. I wonder if people will start to get nostalgic for airports once more and looking forward to once more being felt up by a TSA agents? Naw!

I just got an offer from Frontier Airlines. They offered to fly me anywhere in the system for $11. Yes, eleven bucks. It costs me $20 to get the airport via Uber. I have probably taken my last airplane ride. Can’t really say that I am going to miss taking off my shoes to get in line so I can stand in another line, the wanton flight cancellations, surly employees, the TSA groping me, and the airplane fare pricing lottery. Adios Airlines.

edmondo…. “Adios Airlines.”

You betcha and me, too. I made my last ever flight several years ago to say bye to my 90 year old Dad, pre-pandemic I told my family, “I will never fly again.” I am sympathetic to those people who must fly for work or who can only travel by airline to get somewhere….. but how much is actual need vs optional consumption?

Frontier still hasn’t returned my fare for a flight they cancelled. They owe me over $200 from an early

April flight. Guess I’ll never see that money again.

Stay away from them.

I flew cross country a year ago on Southwest, my first flight in about fifteen years. I was pleasantly surprised. The experience wasn’t good, but it wasn’t horrific. The one interaction I had with an employee was fine. I had my eleven year old daughter, who had never flown, with me. I was concerned that we might be separated on the plane, and sweet talked the person at the gate into letting us board in the family group, which really is for kids younger than that. I have no complaints, and came out of it willing to do it again, should the situation arise. That being said, I know from past experience how very very much it sucks when things go wrong. I got lucky.

Perhaps the most interesting thing about the last few months has been the realization that the vast majority of airline travel is optional and in many cases will barely be missed. Unlike all humans who lived before the 1960s, we have grown up in an era where air travel was plentiful and cheap, leading to the subconscious assumption, I think, that it was Vital To Life As We Know It.

In fact, the ability to jet off to a conference, meeting, or weekend vacation has turned out to be something of a frill, and recent imporvements in data networks and software have gotten us to the point where a remote presence is usually fine as well as much cheaper, faster, less tiring, and allowing people to sleep in their own bed.

Who knew?

Meanwhile the arctic ocean is looking at a blue water event or so close as to make one next year a dead certainty. This is a few orders of magnitude more catastrophic than Covid 19 .. as in macro-life extinction by 2050.

But why stop there, why not throw in a super volcanic eruption, another Carrington event and a major asteroid strike?

The gods must be angry.

An equally serious question is what happens to all the airline / aircraft related debt? By my estimate there is over $50 billion in ABS and EETC securitization on issue. This was a major source of finance, mostly purchased by pensions and insurance companies for duration. And, of course it is all safe as it has the right ratings and has high quality collateral.

what is that collateral worth today?

Quoting Michael Hudson: “Debts that can’t be repaid, won’t be.”

Source: https://michael-hudson.com/2012/04/debts-that-cant-be-paid-wont-be/

Whatabout unsecured debt, aka travel vouchers issued after flight cancellations? Be fun when those get dishonoured post bankrupty.

“$50 billion in (debt)…..”

A rounding error in the multi-trillion (dollar) notional global debt pasture………

The comparison that must be made is to the Too Big To Fail Banks. The airlines have failed to strap a large enough bomb to their chest and walked into Congress ready to blow up the world like the banks did in 2008 so they will (thankfully) fail to get bailed out forever.

It’s past time to take the TBTF banks behind the woodshed and put them out of our misery.

No where do I see mentioned in Hubert Horan’s article the impact of state and city edicts regarding quarantine for returning travelers. My best friend’s son just came to visit him from Massachusetts last weekend before the state’s required 14 day quarantine for travel to all but a handful of states. My friend’s son said there were no more than 20 people on the flight to Chicago. The City of Chicago also has quarantine rules in place for residents returning from 22 states and Puerto Rico. They may not catch you on the highways, but deplaning passengers will be caught up in the sweep. Too many states are struggling to keep their Covid cases down to allow airline travel to gum up the works.

That’s certainly true…at work, they’re requiring anyone who travels anywhere by air to quarantine for 14 days before being allowed back into the office. I’d have to check, but this might apply to immediate family members as well.

I don’t know about Mass, but I am told enforcement is unserious. When you get off the plane, all you have to do is bat your baby blues and say of course you are quarantining. They can’t require you to install an app. If you want to be super careful, leave your smartphone in one place and get a burner phone to use during the quarantine period. They don’t have the manpower to run people down and prove they’ve violated.

Plus the edicts would not withstand Constitutional challenge if they were to try to fine anyone. States can’t restrict interstate commerce.

Fake deregulation and landing slots and exclusive use gate leases…mass bankruptcy will kill the fake dereg scam and the scramble might get Donald Burr off his sailboat in St Pete Harbor and turn stpete/clearwater intl into the next Newark terminal C/North terminal. Amazing all the real estate geniuses who “made” Miami Beach “forget” without the people’s express weekend flights from NYC those million dollar art deco doghouses might still be welfare hotels…

Legacy control of the slots and gates will prevent a mass of airline bk filings…a bit anti trust…but anti trust has always really meant anti citizen…so no reason to expect the clowns that bee will fold and actually panic ..

Contrast with Air New Zealand, who explicitly said at a fairly early stage that they expect to emerge from the crisis as a much smaller airline focused mostly on domestic routes. It’s still been a painful experience for them, as well as their customers, shareholders and employees, but at least denial isn’t added to their list of problems.

File early, avoid the rush..

“Virgin Atlantic files for bankruptcy”

http://www.theguardian.com/business/2020/aug/04/virgin-atlantic-files-for-bankruptcy-as-covid-continues-to-hurt-airlines

I would submit that it is not just the airline industry that is in denial but the entire US economy.

Without an effective response to get the virus under control the economy will never recover. And I see no plan in the works to do so. Fast accurate testing, follow-up contact tracing, effective quarantining? –it’s just not happening. The feds have given up and city and state governments simply don’t have the budget or capacity to effectively do so. We are reduced to mask wearing while hoping for a vaccine or effective treatment to get us out of this mess. Good luck waiting.

In the meantime, Congress and the White House can’t decide on how to cope with 30 million unemployed, millions without health-care coverage, and a tsunami of evictions and foreclosures in the offing, and, oh yes, 300 million guns in private hands. However, Congress did defeat the proposals to cut the Defense budget by 10% and prevent a partial withdrawal of troops from Afghanistan and Germany–so there”s that.