Yves here. Delinquencies on conventional mortgages (Fannie and Freddie, which constitute the overwhelming majority of mortgage loans) are at 2012 levels, which is elevated but not crisis level. Nevertheless, Wolf is correct to point out that the rise is unprecedented and strongly suggests that things will get markedly worse before they get better.

Many of Wolf’s readers marveled at how the grim mortgage numbers were at odds with robust homebuilding (which Wolf had highlighted via a Bloomberg screenshot and readers confirmed) and major renovations. Chalk it up to a two-tier economy. I wish I had time to look at the average mortgage size for the delinquencies. It’s not hard to imagine that they skew towards smaller mortgages, which suggests homes in less desirable communities. Put it another way: if you had a home you couldn’t afford to keep in a hot market, now would be the time to sell.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

The mortgage delinquency-and-forbearance mess keeps getting messier – in record-setting ways. At the same time, the record-low mortgage rates continue to push certain other segments of the housing industry toward ever greater exuberance. That contradiction became humorously obvious on the Bloomberg News Economics front page, where side-by-side these two headlines appeared:

The overall delinquency rate for mortgages on one-to-four-unit residential properties soared by nearly 4 percentage points (386 basis points) during the second quarter, and by June 30 reached 8.22% (seasonally adjusted), the highest in nine years, according to the Mortgage Bankers Association’s National Delinquency Survey.

This nearly 4-percentage point jump in the overall delinquency rate was the largest in the history of MBA’s survey going back to 1979.

Delinquencies started soaring in April. A month ago, CoreLogic had reported that the percentage of mortgages entering the early stages of delinquencies — from 0 days to 30 days delinquent — had spiked phenomenally in April beyond all prior records. What we’re seeing now is that many of these mortgages are becoming more seriously delinquent. This shows up in the stages of delinquencies, according to the MBA today. At the end of June:

- The 30-day delinquency rate fell by 33 basis points to 2.34%

- The 60-day delinquency rate rose by 138 basis points to 2.15%, the highest since the survey began in 1979.

- The 90-day delinquency rate jumped by 279 basis points to 3.72%, the highest since Q3 2010

The delinquency rate of FHA mortgages jumped by nearly 6 percentage points (596 basis points), the biggest jump in survey history (since 1979), to a delinquency rate of 15.65%, the highest delinquency rate in survey history.

The delinquency rate of VA mortgages jumped by 340 basis points to 8.05%, the highest since Q3 2009.

The delinquency rate of conventional mortgages jumped by 352 basis points, to 6.68%, the highest rate since Q2 2012.

Delinquency rates here include mortgages that were already at least one month delinquent before they entered into a forbearance program. So these mortgages are still delinquent, and the borrower has stopped making payments before entering into forbearance, but the lender has agreed to not pursue its legal rights for the agreed-upon period of forbearance.

Instead of the borrower either catching up, or the mortgage going into foreclosure, the mortgage is put on ice during forbearance. The borrower doesn’t need to make payments. And the lender, after putting the delinquent mortgage into forbearance, may no longer consider the mortgage delinquent, and may therefore still show the mortgages as “performing,” and may still show interest income from it, though no one is making payments.

There are now 4.2 million mortgages in forbearance, according to estimates by the MBA. Meaning 4.2 million homeowners have stopped making payments, in addition to the homeowners that have stopped making payments but are not in forbearance programs.

The delinquency rates here do not include mortgages that have undertaken the final steps: moving into foreclosure. But the current trend for lenders is to move mortgages into forbearance and put them on ice for as long as possible – “extend and pretend” – rather than foreclosing on the property.

The states with the biggest increases in delinquency rates at the end of June compared to the end of March were:

- New Jersey: +628 basis points

- Nevada: +600 basis points

- New York: +575 basis points

- Florida: +569 basis points

- Hawaii: +525 basis points

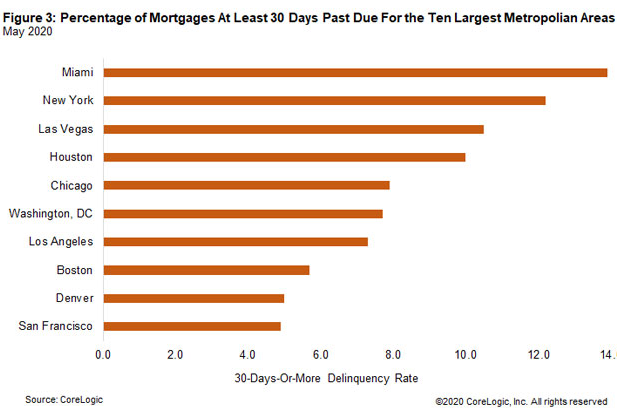

Last week, CoreLogic released a report that showed the 30-plus day delinquency rates in the 10 largest metropolitan statistical areas through May. So this lags by one month the MBA’s report, but provides insights by metros. These delinquency rates at the end of May ranged from 4.9% for the San Francisco metro, to 13.9% for the Miami metro. This data also includes mortgages that were delinquent before they entered forbearance (chart via CoreLogic):

Other smaller metros got hit hard too, with the sharpest increases in metros that are dependent on tourism – such as Kahului, HI, and Las Vegas, NV – and metros in the oil patch – such as Odessa, TX. And Houston, in terms of an oil-patch metro with a massive delinquency problem, is already on the list above, number 4 in the chart, with a rate of just around 10%, just below Las Vegas.

This mess playing out in the mortgage market has been largely swept under the rug of widespread, government-supported forbearance programs – to where no one really knows what will happen to those mortgages when these forbearance programs end. And the exuberance in other parts of the real estate industry, such as with homebuilders, and even with mortgage brokers and mortgage lenders that arrange refi and purchase mortgages, is a contradiction to what is going on with these swept-under-rug delinquencies that will eventually come to a head.

New homebuilding skews to the exurb-suburban Sun Belt/rocky mountain belt. So it’s absolutely possible to have a two-tier market of dumpster fires and lumber shortages.

Big question is does 2020 kill homeownership for a big chunk of 25’s-40’s for the next 5-10 years.

Err…isn’t home ownership dead for that cohort anyway? Pandemic aside, it was a bad place already.

The other problem is so much of localities are funded through property taxes. Countless communities were going to eventually run into this problem especially as more and more retirees look to fund their stay in the home and can’t unload houses.

Somebody’s going to own the home, and owe the property taxes, whether it’s the current owner or a new buyer or the bank. So the question for municipalities is whether those owners can pay.

When it’s Blackrock,they’ll buy the council to set taxes where they want.

My Colombian mobster almost client was shocked at how cheap it is here to buy elected officials.

“Big Question is does 2020 kill homeownership for a big chunk of 25’s-40’s for the next 5-10 years.”

That’s not even a question. There’s been 2 major financial events that have crushed peoples career prospects and job opportunities. Pair this with the rising cost of housing in available labor markets and of course the rate of homeownership is going to plummet. The only people who will be able to afford homes in the places where people work are current land owners.

I bet you see a huge spike in 2nd-3rd homeownership and a decline in first time buyers in the next 5-10 years. Which is going to put another huge weight on the financial growth of people the ages 25-40 right now.

The inventory of SFH in San Francisco increased by 96% YoY in July.

The tech companies have said they can work from home indefinitely. They have booked it to Idaho etc. and are selling.

Can’t say that I blame them.

On a personal note, one of my college friends started a tech company with coworkers he met at the phone company. They sold it to Cisco Systems for $25 million.

He later told me that one of his goals in starting the company was to provide jobs in …

… Michigan.

Yes, he went on business trips to Silicon Valley, lots of them, but he wanted no part of that lifestyle. He and his wife still live in …

… Michigan.

I just 30 year fixed rate refi at 2.5% (2.61% APR) . Of course, if I live so long as to pay it off, I’ll be in the running for the oldest person alive. No doubt, rising prices on food, health insurance premiums and the like will soak up the savings from my lower monthly mortgage payment. Now, if I can just stay out of a nursing home…..

Now, if I can just stay out of a nursing home…..

Every time they threaten to put me in a nursing home, I show them my assets. I’ll die at home.

I doubt the building boom is financed by FHA mortgagees.

FHA mortgages generally serve the poorer home owners.

Although strictly FHA would be a reasonable argument, it is all the Ginnie Mae components which definitely prop up the new home building environment since it includes USDA rural home financing…and you would be shocked…shocked…at how the USDA maps are gamed to include suburbia as “USDA rural”…certainly here in the tamp Bay area especially…

How does this not end in a housing crash that makes 2007-2009 look like a picnic? Yeah, you can make the argument that the higher end hoods full of PMC remote workers will be fine in the short term, but if every other house in the next burb over is a foreclosure those effects will reverberate throughout the market eventually.

FWIW we’re selling our place in a popular / hot Denver suburb and moving full time to the mountains. Getting out while the getting is good, scheduled to close next Friday.

I purchased my 1 bedroom house in March, 2006 in south Minneapolis @ $169,900. My fiancé and I have been talking with a realtor friend about selling. Realtor brought a friend in for a private showing who offered $170,000 ($100 more than the purchase price in 2006).

At the CPI inflation rate from 2006 – the house price would be $220,236 (or like a $50,000 bath @ $170,000). Comparable’s in the neighborhood go from $150,000 – $215,000. This house was a lame, hacked, flipped house in 2006, with 4 layers of flooring on top of the original hardwoods. I refinished the hardwoods, added a bunch of custom tile, opened up the floor layout, refinished the bath and kitchen, built a custom greenhouse and added 20 fruit trees and 200 species of plants to the lot-and-a-half corner lot (we harvested 500 peaches this year). It is now a comfortable, beautiful, entirely unique living space.

So clearly bankers and banks never paid for the Credit Bubble of 2003-2008, but I am still paying for it (I knew the market was inflated in 2006, I was simply ignorant about the securitization shenanigans on Wall Street until after the market collapsed)(I worked in a Wells Fargo Chop Shop in 2012, “helping” package mortgage loans in foreclosure to sell to the Fed for 100 cents on the dollar). Meanwhile my Wells Fargo mortgage is late this month because I am a self-employed builder/remodeler, and one of my clients uses a Wells Fargo payment service to pay my invoices. Wells Fargo says the turn-around time is 3-5 days. It generally takes 8-14 days. It has been 8 days. I know they are deliberately sitting on my money, making money off my money, while I need that money to pay them for this house.

Democrats and Republicans and their crony bankers can burn in [family blog].

I had WFB for 22 years before I smartened up and left that abusive financial relationship. Went to a small bank for my checking/savings and have a couple of credit unions for mortgage, savings, credit card and auto loan. Best thing I ever did. I am no longer supporting by way of relationship, drug money laundering, foreclosure fraud, debit/credit manipulation games to purposefully overdraw the client, or force-placed insurance schemes. I am sorry you are in this boat. And, yes, they are deliberately sitting on your money. Make no mistake about that.

and, one of the largest creators of the fracking oil and gas bubble.

Ok, I already regret the severity of that last sentence of mine. So much seems crapified and corrupt, and sometimes my anger about it gets away from me which is no excuse. Online is already such an absolutist space, so deliberately divided and siloed, I am not justified necessarily to contribute to the nastiness and pathology of it.

I am very blessed. I have much gratitude. I am very happy to be alive.

With your description of how you have added value to your home, and how nice it seems to be as a productive living space, I am curious as to why you are thinking of selling?

In any case, as you apparently have the skills to refurbish houses, you are apparently in a much more secure place than many people these days.

My father owns 80 vacant acres in a relatively remote place where we could expand the food forest we have here out to several acres, plus use the timber in the woods to build some fine timber frame structures. My fiancé is an arborist and with our combined skills, such a remote place seems to be about right for the next year or so at least.

As for building skills, they weren’t much use from 2008-2012 insofar as an income. But yeah, I have long said, what matters going forward is less money and more skills and community. That said, I’m broke, work seems to be drying up a bit, and a brace of cash seems better than a mortgage right now.

Severity? … of the last sentence in your comment? Online may be an absolutist space, deliberately divided and siloed, but I don’t think you’ve made much contribution to the nastiness and pathology of it. I believe you have a very good reason for being angry and such nastiness and pathology as your last sentence contains hardly bears concern.

I’m just reminding myself, too much anger without much of an outlet leads, at least for me, to self-abuse. As a people it can lead to mob mentality, as in, undefined destruction. I prefer to be more thoughtful about my anger so I can channel it more intently, less about condemning whole cohorts of people absolutely.

Sorry you have to put up with that. In Australia, instant bank transfers have been a feature for about two years. Am about to go and private buy a used Merc today and will transfer $8500 from my phone banking app to his bank account. Money in his account instantly.

The banking system in the US seems broken. I haven’t had to use a checking account for about 30 years. The only cash I use is to hire labor around my house.

btw, our 1962 house on concrete pillars, also had several layers of lino and carpet over hardwood floors. Ours is something they call black bean around here and would have been a seconds pack back in 62 as it contained the sap and the hard wood. Sanded and polished, they are beautiful. Like you, I only hope to recoup some of the costs in the renovation when we sell.

Don’t vote is my suggestion to all this November

The money did not show up yesterday, so we are on day 9. Clearly they will blame Covid-19, however this was no different last year before the pandemic. Now that the market has hit new highs I practically expect not to see that money until it plateaus or has a few day correction.

The leadership of said bank too, and the financial industry at large, seems to be all in for Biden/Harris. I’m torn between voting for Biden just so we might not have to deal with All Things Trump All The Time anymore; voting for Trump because I despise Clintonite neoliberalism with every fiber of my being, and not voting because 2020 is like an anti-choice/no-choice.

I will vote green, hoping they will reach 5%.

Same here. Enough with the corporatist duopoly parties.

+2, and thank you both.

The conjunction of those headlines gets me shaking my head and wondering. Does anyone know where I could find the numbers on new mortgages created over the last few years, broken down by months if that’s possible? I’ve done a search myself but the best I could find was yearly and only and stopped before the GFC. Is there anything going on like before the GFC collapse wherein the issuers of the mortgages didn’t care if they would ever be paid off because they were only going to hold them long enough to slice them up and then jam the parts back together before unloading them at a profit?

CFPB: Origination activity

A belated thank you! Much more useful than anything I had been able to find on my own.