The CalPERS board would do well to heed two folk sayings as CalPERS staff is scrambling to put itself in charge of a board campaign, led by State Controller Betty Yee, to reassert the board’s authority over staff. One is “A politician is someone who tries to get in front of a mob and call it a parade.” In this case, CalPERS staff is trying to vitiate this board initiative by putting itself in charge of not just the agenda for discussion, but even the content of proposals.

Since when does it make any sense to put the problem, which in this case is CalPERS executives who have operated for years as if they are accountable to no one, in charge of coming up with solutions? And CalPERS staff is still insubordinate. As we’ll see below, the staff agendized fundamental governance issues, that Controller Betty Yee asked to be scheduled for the whole board to discuss on September 16 in the Board of Administration meeting. Staff instead has put Yee’s items on the agenda for September 15, for a board committee that Yee does not sit on.

As we recounted, CalPERS CEO Marcie Frost was so brazen as to claim at a “retiree roundtable” that the concerns that Controller Betty had stated in the press and at the start of the August 17 special board meeting had been addressed in that closed session.

Putting aside the problem that Frost’s statement was tantamount to saying that CalPERS had yet again violated the Bagley-Keene Open Meeting Act,1 it would have been impossible to have satisfied Yee in the August 17 secret meeting. In her attempt to intervene then, before Board President Henry Jones cut her off and ended the open part of the meeting, Yee had asked when her items would be put on the agenda for a public discussion.

It should have been no surprise that Yee fired back, the very same day, with a letter to Jones requesting that the board have “an open discussion about the governance and oversight of CalPERS” at its September 16 meeting including:

…the delegation of the CEO, reporting structure of the CIO to the Board, and an expanded meeting calendar and composition of the Investment Committee to ensure appropriate Board oversight.

Board member Margaret Brown sent in her own letter to Jones the next day, reiterating Yee’s requests and adding one more: “Delegation of Investment Authority.”

We’ve been pointing out for years that the board has put itself in a dangerous position by ceding authority to staff and not engaging in even basic oversight.2 Let us not forget that important beneficiary groups are also in revolt. One of the biggest retiree groups, Retired Public Employees’ Association of California, has called for Henry Jones resignation. We’ll discuss the gauntlet thrown by the influential California State University Emeritus and Retired Faculty and Staff Association tomorrow.

So what has CalPERS done? Rather than risk Yee going into an Elizabeth Warren level “plenty of blood and teeth left on the floor” response at the September board meeting, CalPERS has rapidly backtracked from Marcie Frost’s attempt at “Nothing to see here, move along.”

CalPERS told Pension & Investments on Friday September 5 that “…the items requested by Ms. Yee will be added to the open session agenda sometime next week.” Since the board agenda and supporting materials are normally uploaded to the CalPERS site ten days before a board session, and made available to the board a day or so before that, CalPERS admitted it was improvising.

But even the rougher than usual agenda shows that CalPERS staff intends to retain control by presenting documents at the meeting. As anyone who has been in a transactional business knows, “He who controls the documents controls the deal.”

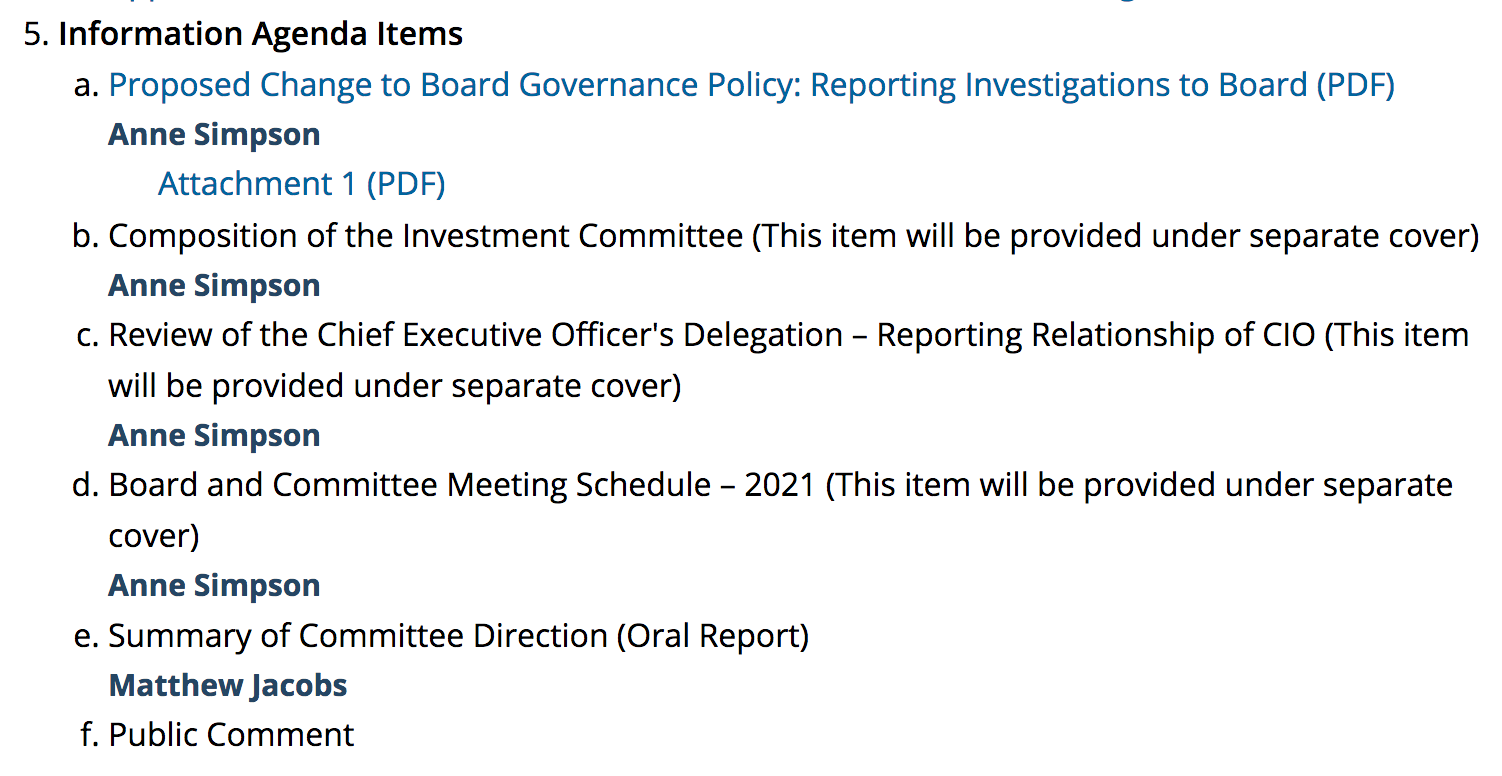

From the agenda for the Board Governance Committee for September 15 (and recall that Henry Jones has chosen not to make Yee a member of that committee):

Notice that the CalPERS staff does have its ducks in a row on the first item, “Reporting Investigations to the Board”. That’s an admission that the board impermissibly discussed this topic in the August closed session and that Frost believed that giving the board this bone would placate Yee. Whoops.

However, as we indicated at the top, unless the board firmly asserts its authority, the staff is certain to maneuver what little discussion there is towards cosmetic changes. They are already laying the groundwork to have no debate at all by classifying all of these items as “Information Agenda” which means CalPERS intends to have a one-way communication. Even “Information Consent” requires a vote, but the format is to have no vote and no follow up action. If there were to be a vote, there would have to be public comments on every item, and you can see it is set only at the end, for the great unwashed public to vent to no avail.

You can see the scheme to concede only minimal changes with the one document the CalPERS staff has published, on reporting investigations to the board. Staff believes there is no reason to notify the board if the Managing Investment Director of Private Equity were being under review for misconduct.

And with two of Frost’s Three Stooges, Henry Jones and Rob Feckner, on the seven-member Board Governance Committee, the staff already has a leg up.

At a minimum, the board needs to take control of the policy reforms, even if it would take more time to gather information, such as looking at the governance regimes of better functioning public pension funds, like CalSTRS and the better Canadian public pensions.

CalPERS board members should know better by now than to trust staff. The other fitting folk story is the fable of the frog and the scorpion:

A scorpion asks a frog to ferry him across a river. The frog fears that the scorpion will sting him. The scorpion reasons that if it did so, both would drown. The frog decides to carry the scorpion. Partway across the river, the scorpion stings the frog, insuring that both of them die.

The frog cries out, “Why did you sting me?”

The scorpion replies, “Because it is my nature.”

The history of troubled organizations is that turnaround efforts usually fail until enough new key executives take the helm to steer a new course. The odds that CalPERS’ top staffers are willing to, let alone capable of, making fundamental changes in how they operate is vanishingly small.

_______

1 First, CalPERS had not agendized the issues that Yee wanted discussed. Second, even if CalPERS had, these topics could not legally be relegated to a secret deliberation.

2 Recall that not only are CalPERS board members jointly and severally liable, but CalPERS liability self-insurance for them established a criminal conflict of interest. As reader David in Santa Cruz explained:

The key here is that the California Government Code recognizes the “moral hazard” inherent in allowing fiduciaries to be insured against breaching their duties. CalPERS as an organization can insure itself against breaches of fiduciary duty by members of the board, but only if the insurer has recourse against the fiduciaries themselves.

Of course, nothing is stopping the individual board members from the purchase of such insurance on their own account — but as you can imagine it would be prohibitively expensive due to the inherent “moral hazard” that would have to be underwritten and reserved. Not. Gonna. Happen.

California Government Code 7511(a) A public retirement system may purchase insurance for its fiduciaries or for itself to cover liability or losses occurring by reason of the act or omission of a fiduciary, if the insurance permits recourse by the insurer against the fiduciary in the case of a breach of a fiduciary obligation by the fiduciary.

It appears to finally be dawning on some of the board members that they are personally the sole fiduciaries for the trust, and that delegating to obviously unqualified, conflicted, and incompetent staff is not going to be a viable defense to a lawsuit alleging breach of fiduciary duty and loss of trust assets.

The Three Stooges — Feckner, Jones, and Taylor who together have been holding exclusive meetings with Frost — are in a pickle, because they and Frost most likely have compromising information on each other.

If they finally fire Frost, Frost may become a disgruntled ex-employee and for once may become a truth teller, informing the public of misdeeds by the Three Stooges. But if they don’t fire Frost, who is drowning in her misguided obsessions to manage perceptions without paying heed to reality, the Stooges appear negligent, even derelict in their responsibilities as Board members.

Except for Feckner who was a Board member when the CalPERS CEO Buenrostro was jailed for bribery and other nefarious deeds, at CalPERS the actors change, but the story repeats — the CalPERS beat goes on

And the saga continues…

I’m convinced that there is a book in here somewhere, sometime down the road when it all comes to a head and gets resolved.

Or, at the very least, one heckuva Harvard Business School case study.

> there is a book in here somewhere

Or perhaps a movie

I have been thinking about this myself. I don’t know how you would simplify the aspects of the story that need to be simplified to make it ‘work’, both narratively as well as commercially. I think Adam McKay would probably be the best suited for it, given that part of his style in ‘The Big Short’ and ‘Vice’ is bluntly didactic (but generally humorous and fun) asides to camera. Maybe Iannucci or the team that works on Succession (there’s some professional overlap between all these creative teams). It’s also such a broad story that spans several years as well, it’s hard to know how you would distill that into a single film – you might need a series or a one-off miniseries.

I’ve also thought Yves would be a good guest to have on Useful Idiots to talk about it (obviously I have no idea if that idea appeals to her or not), not just because it’s a crazy story, but because it might be a good opportunity to extrapolate on what the CalPERS case is emblematic of in the American finance industry generally, if anything.

Thats an excellent idea about Useful Idiots. And given the California connection Joe Rogan would be even better. This really is the sort of saga than only a long form documentary or interview could even begin to do justice.

I mentioned Useful Idiots because I know that Taibbi and Yves seem to be on friendly/cordial terms (recalling an exchange of posts between them on NC and his substack a few months ago)

The opening scene could be Marcie Frost’s HS graduation ceremony.

Taibbi and Halper could add a fifth category, “Isn’t that CALPERS?”. Or expand their “moments” commentary to include “CALPERS moments”.

—

I confess to being a bit disappointed that Taibbi does not seem to have made the effort to understand MMT and appears to regard it to be unreasonable.

I could see it working as a sitcom – one of the kind where the protagonist is up to some mischief or other and has to resort to increasingly desperate antics to keep it secret. I’m thinking something like a US version of Blackadder (Stephen Fry or Hugh Laurie in genially oblivious mode would be perfect as board members) but not sure what the equivalent would be.

;-)

https://youtu.be/VwcpOithag0

cool, thanks for this!

Suggested title. CalPERS CaPERS

The problem with a book is if you label it “fiction” it is just entertainment.

If you label in “non-fiction” no one would believe it and you become the disgruntled dissident.

A movie “based on real events” may be the best option.

Rats! I was going to say that “there is a great comedy film to be made about the CalPERS saga. Maybe even a TV series along the lines of “Yes Minister”.” but it looks like Lambert stole a march on me.

You know, it must be a sweet deal working as Staff at CalPERS. So long as you do what a cabal of Board members say, you won’t be sacked and cut loose into the middle of a pandemic-slash-pandemic. Better yet, when it all comes unstuck, it is Board members that will be on the hook for any responsibility, not you. With no insurance of any kind to protect them, it will be their necks on the chopping block.

Of course if they decide to investigate Staff member’s part in the legal s*** storm that will be flying, they can always say that they were just following orders. And if it gets really messy, they can step forward and say ‘Wait! Wait! I am ready to turn State’s evidence for the prosecutor. And I have copies of computer files that I can bring along to show where the bodies are buried!’

Pro tip for any CalPERS Staff members reading the last bit. Yes, turn over the copies of all those files to save yourself. But always keep your own personal copies on ice somewhere out of their reach. People who trust FBI investigators and California Attorney General investigators would have holes in their heads. Perhaps literally.

Someone should remind Calpers staff of the old saying ‘when you are in a hole, stop digging’.

I’m really baffled that so many individual Board members don’t seem to realise that they are making themselves personally extremely vulnerable financially and legally. I’d expect even the most casual member of the board of a sports club or parish committee or building co-op to be conscious of their personal liability when making decisions, let alone one of the biggest pension funds in the world. I can only assume these people are chosen deliberately for their obliviousness. Which leads to the question of who is really pulling the strings behind all of this.

Tune in tomorrow for the next exciting episode of, “For Whom CalPERS Churns”.

The CalPERS board and staff perform in a cult-like manner, inside a reality distortion field, wrapped in an enigmatic blanket of asbestos.

Glad to see Yves and Yee on the case!

Another old folk saying that applies to CalPERS’ staff intransigence:

“Beware the anger of a patient man.”

Thanks for your continued reporting on CalPERS, PE, and pensions.

The Board doesn’t have anything to worry about as long as Matt and Marcie have their back!

Do they?

Private lawsuits by disgruntled beneficiaries.

‘Standing’ to file a damages law suit in the US is strict in defining who has ‘standing’ and on what grounds they have ‘standing’ to bring a case. However, legalities aside….

A political revolt by the beneficiaries and the local govt agencies left on the hook for retirement funds that were squandered by Marcie et al is another matter all together. Politics is less about pro forma rules and more about voters’ ire. ‘Beware the anger of patient men.’ Shorter: if the political heat turns up in Sacramento then Marcie and Matt may well find their sinecures cut short.

The level of disrespect and insubordination shown by the refusal to agendize the State Controller’s August 10 written demand for a public discussion of the CEO and General Counsel’s management failures is breathtaking. To offer what they should have been doing in the first place as a “new” policy is perverse insolence.

To be caught-out lying and then then place the issues raised before a “Board Governance” committee on which the State Controller is not a member is an intolerable level of impertinence unjustified by the clear incompetence and lack of qualifications of these staffers. Yes, there is a board governance issue, but it was raised by the retirees. The Controller’s litany of issues relate to staff performance, and should properly before that committee — or better, the full board.

As we see as Yves peels back each layer of this stinking onion, Donald Trump has nothing on Frost and a Jacobs when it comes to chutzpah.

At this point we can hope that law enforcement (if it applies to calpers at all) has been monitoring communications from calpers and knows where these board members are planning to flee to after the the bandini hits the ventilator. Where are their luxury retirement homes located? Where are their bank accounts, who is laundering their money for foreign banks, etc…

Or are they immune as they appear to be?

Or is it that California knows what Calpers has been doing and is both terrified and complicit?

Some people are making a lot of money on Calpers bets with insider knowledge. How high does this go in the state hierarchy? Is insider trading illegal for the board and staff, or has it been deemed legal like congress when they write law benefitting only themselves, as they do pretty often.

It all stinks badly and we don’t know where the dead fish is yet.

No, No, the board has NOTHING TO WORRY ABOUT.

That’s as sure as Hillary’s win in 2016.