Recall that in the press reporting on l’affaire Meng, CalPERS in its spin to the press was remarkably open how it intended to bury the matter and not inform the board that its highest-paid officer might have violated the California Political Reform Act.1 From Bloomberg on August 8:

But she [Frost} planned to discipline him — either by cutting his incentive pay or possibly by placing a formal letter into his file.

Institutional Investor confirmed that Meng also believed that his case had been settled before the press uproar…and recall again that since the board had not been informed, it almost certainly implies that the plan was to bury the problem. From Institutional Investor:

It was actually in April that the disclosure issues first came to light internally at CalPERS, when a compliance team flagged a violation: a $70,000 investment in shares of Blackstone Group, which Meng owned at the same time the pension fund made new investments in the firm, according to a Bloomberg report. A former colleague of Meng’s tells Institutional Investor that the then-CIO told this person at the time that an internal investigation had been done and that the issue was resolved.

Needless to say, keeping the board in the dark is a well-established pattern at CalPERS.

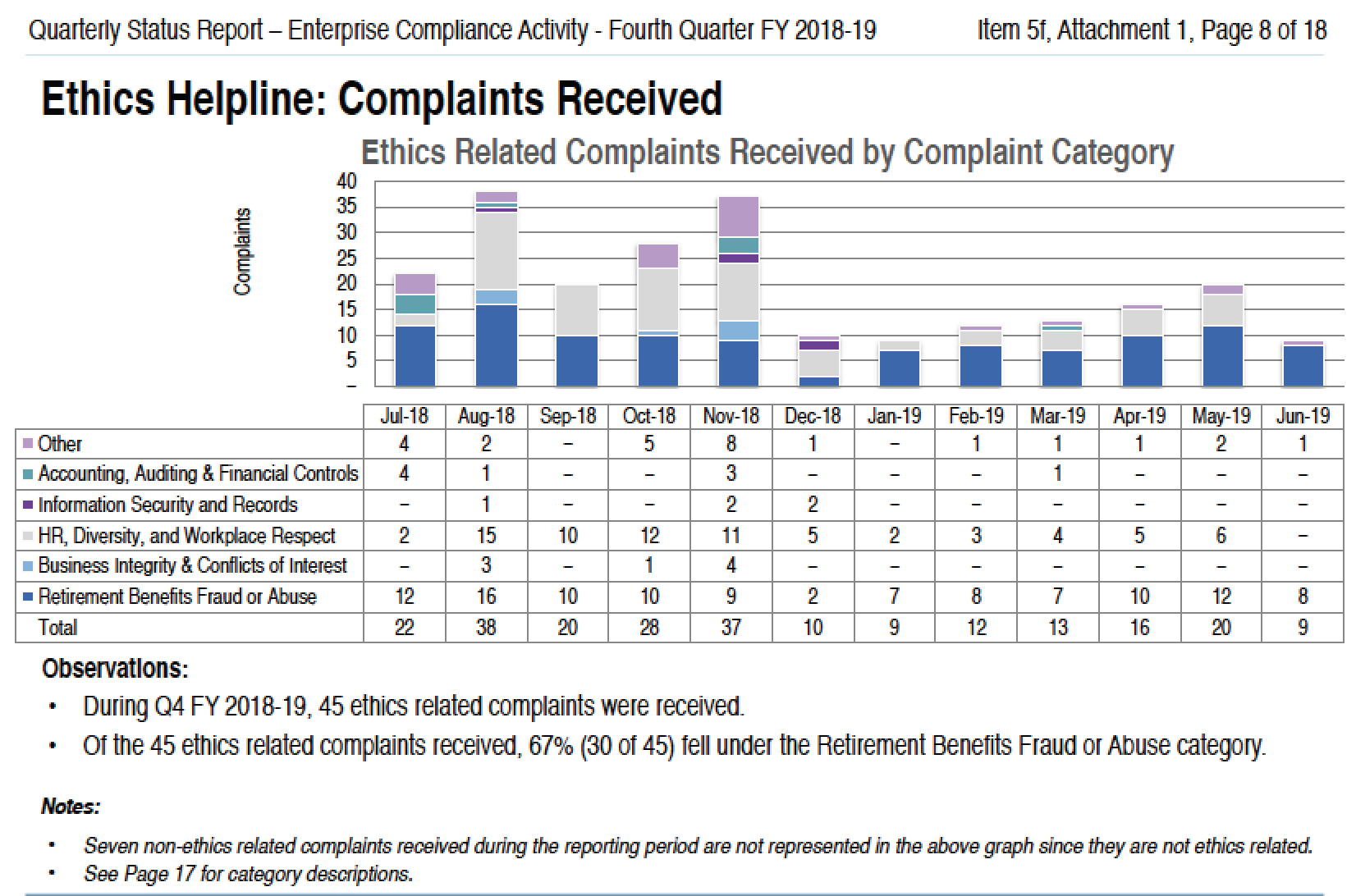

While CalPERS does give quarterly compliance reports to the Risk & Audit Committee, if you look at the document, you can see, as the table below illustrates, they are entirely about process and keep the board in the dark about the substance and seriousness of allegations. This example comes from a 2019 report, but if you look at more recent quarterly compliance reports, they all follow the same format:

Note that in the footnote, CalPERS staff directs the board’s attention to the number of complaints, which gives you no clue about that the matters are or more important, there severity. And highlighting that most alerts are about benefits fraud has the effect of flattering the staff, since it implies that most abuses are outside parties trying to take advantage of CalPERS, and not problems within CalPERS. The board would have no way of knowing it there had been an allegation of something as serious as embezzlement, kickbacks, or a rape from this report.

A final, and obvious problem is the unseriousness of the complaints hotline. A basic rule of compliance is that you don’t design an oversight process to report to people who may be part of the problem. Inherently deficient processes like that lead to JP Morgan London Whale and Wells Fargo fake accounts scandal type outcomes. No one interested in career advancement who had an ounce of common sense would ever report a serious violation to this sort of complaint line unless they were afraid they were going to be scapegoated.

If CalPERS actually cared about having an effective complaint process, the hotline, erm, “helpline” would go to the board, say via an outside consultant engaged by a law firm in case CalPERS might feel the need to take legal action. Instead, if you go to the Ethics Helpline page, even the name makes clear that it’s compliance theater. Ethics help? Like helping called redefine their ethics so they don’t see misconduct as a problem? Or like “I’m from the IT Department and I’m here to help,” which a client of mine, a top Chief Information Officer2 put in the same category as “Of course I’ll love you in the morning.”

Yes, there’s an outside consultant, EthicsPoint, Inc., who handles the abuse alerts, but since it reports to staff, who is CalPERS trying to kid?

Moreover, CalPERS makes clear that it might not be such a good idea to complain, with its “Think twice” warning:

And no assurance anything will happen:

![]()

The proof here is that no one at CalPERS reported Meng’s conflicts even though they were evident as of when he filed his “starting office” Form 700 on January 31, 2019. One of the reasons for failures to report, in addition to well-warranted cynicism, is despite all the handwaving about the measures EthicsPoint takes to keep reports confidential, any serious allegations of financial impropriety could be made with enough detail to be taking seriously only by individuals with access to information, meaning it wouldn’t be hard to make an informed guess as to who the filing party was.

In case you had any doubt, the compliance reports and the obviously defective complaints process offer further proof that CalPERS board isn’t interested in doing its job of minding a $400 billion store.

_____

1 Meng did not fall afoul of Government Code 1090, which is a criminal conflict of interest, due to his income being so high that he fell into the exemption in 1091.5:

1091.5. (a) An officer or employee shall not be deemed to be interested in a contract if his or her interest is any of the following:

(1) The ownership of less than 3 percent of the shares of a corporation for profit, provided that the total annual income to him or her from dividends, including the value of stock dividends, from the corporation does not exceed 5 percent of his or her total annual income, and any other payments made to him or her by the corporation do not exceed 5 percent of his or her total annual income.

2 This is not an exaggeration. This client at the time was running the largest network in the world except for the Internet itself.

Ahhh. My daily fix of Yves reporting on CalPERS misbehavior has been administered.

Now, I’ll sleep well.

Aahhh, this must be the first installment of ‘We will have a heavy dose of CalPERS through and including next week’ that Yves mentioned yesterday. OK then. Can always do with a good laugh.

You would think that Staff keeping stuff from the Board is a fire-able offense but I suspect that the Board wants to keep it this way with a Three Monkeys approach to any unpalatable information as in a ‘See No Evil, Hear No Evil, Speak No Evil’ methodology. If things blow up they can then say that they were never told about this. I suspect that the format of the quarterly compliance report is proof of this.

Looking at the helpline data I do wonder who was so foolish as to actually put their neck on the line with an organization that has a proven track record of stomping on truth-tellers. It would be like one of these guys-

https://www.youtube.com/watch?v=HLITQXRH70M

I sometimes wonder if the final aim of the CalPERS Board is to mess up CalPERS so bad, that the Californian government would be receptive to selling out the whole organization to Wall Street and make themselves a quick buck. Then maybe the Board could be given a finder’s fee will California gets a big mozza of cash in one hit. Don’t know if it is possible but it would explain a lot.

This is actually a very good point re board, it could be that they belive “see no evil, hear no evil” would protect them. I’m not so sure, as any damages would be a civil case..

But the board’s liability insurance is no good! See:

https://www.nakedcapitalism.com/2018/11/calpers-self-dealing-board-staff-grift-calpers-expense-via-grossly-underpriced-liability-waiver-fiduciary-self-insurance-policy-invalid-face-due-lack-reserves.html

And some board members have significant net worth. Rob Feckner, for instance, comes from an old California family and has land in Napa which is worth at least a few million.

Yup. But we have seen that most of the board doesn’t want (or can) understand even relatively simple issues, and I do not believe most, if any of them, know how much they are exposed (except Brown, who can easily show she tried her hardest, so would be safe).

It seems weird to me to both simultaneously have a captive Board, and yet still keep them in the dark on crucial matters. The whole point I would have thought of having a pet Board is that you can pass through all sorts of bad news through them for rubber-stamping, but when the poop hits the fan you can say ‘hey, remember that Board meeting in November last year? You voted for this, just look at Appendix 3.2B, page 143, it says it very clearly’.

But it seems Calpers management isn’t even competent enough to pass on the potential blame for things going wrong to its own stooges. In a way, Marcie’s ineptness might actually be protecting the Board from its own laziness.

See my comment above – this is actually IMO the worst for both. Board cannot, legally, drop its responsibilities, so is still massively exposed (The board cannot say “don’t tell me what you do, just do it”).

I’m not legal expert in these, but I think it’s actually much harder to go after management in any case, except for corruption/fraud etc. In which case the board agreement might not really save them either (well, depends. If board knows about fraud, it’s not a fraud anymore, although it can still be misappopriation since CP is not a private company. But I’m not sure who would be defendant in that case.).

Yes, you have it right. The law that governs CalPERS (the 1200 page Public Employees Retirement Law) doesn’t even recognize the existence of CalPERS the organization. The board and only the board is responsible. As JJ Jelincic likes to put it, you can delegate your authority but you cannot delegate your responsibility.

It seems weird to me to both simultaneously have a captive Board, and yet still keep them in the dark on crucial matters.

“Plausible deniability” worked for Pres. Reagan re: Iran-Contra. Of course, relative national nobodies on a state oversight board are unlikely to be given the same latitude if pressed. The Sgt. Schultz “I know nothing” defense isn’t likely to relieve them of their legal responsibilties. ;)

Any whistleblower line which is not operated by an independent (and I mean independent) company is useless. And, TBH, because the independent company is paid for by the likely subject of a whistleblower, it’s really really hard to establish they are independent – short of creating a non-renewable long term contract.

So, I opine, in reality both internal (board) and external (independent firm) controls will only work if there is a will to make them work and this seems to be lacking at CalPERS with few exceptions (and quite possibly in many other funds so CalPERS might be the rule, not exceptional on this) and this will should arise from fear to legal complaints. They must feel pretty safe as if they can run away without harm. What I am trying to point out is that fund managers must sense there is not functional regulatory control that could hurt them.

Susan, why the nom de plum? It’s an open ‘secret’ and it leads me to wonder.

Furthermore, please speculate regarding why don’t Californians seem to care about CalPERS? Heck, I don’t reside there and I care about what seems like financial shenanigans writ large hurting the body politic. Anyway, good job with making a dry subject interesting! Why aren’t you up for a Pulitzer?

‘Susan, why the nom de plum?’

We could tell you. But then we would have to kill you. Nothing personal mind.

John, California is a one party state run by the SF political machine.

One electoral district is 5 miles wide and 242 miles long…

It’s also a bit inbred, Gavin Newsome is Nancy Pelosi’s nephew.

Take a look at the relationships between the Getty Family (Getty oil), the Browns ( Jerry and Pat), the Pelosi’s and the Newsome family.

CalPers is actually better run and less corrupt than many parts of California Government.

The relationship of Pelosi / Newsom is not as aunt-nephew and they are not genetically related.

https://www.factcheck.org/2019/11/social-posts-distort-facts-on-political-relationships/

“In other words, Pelosi’s brother-in-law was the uncle (through marriage) of Gavin Newsom. But Barbara Newsom and Ron Pelosi divorced decades ago, in 1977, and Barbara Newsom died in 2008.”

The CA state Democratic controlled government may be a harbinger of the behavior of the hoped for new Democratic President Biden/Harris, new Democratic controlled US Senate and US House.

But the Democratic supporters already know the fall-back position, the Democrats WANT to do the right things, but are prevented by evil Republicans, Russians, Chinese, or US oligarchs.

The fall back position has worked well to keep Obama’s so-called legacy intact.

Psychological research studies have repeatedly and consistently found that the same writing sample, when attributed to a male name, gets scored higher than when attributed to a female name. Hence George Sand and George Eliot and J.K. Rowling, as well as many less well known cases.

Psychological research also has found that once someone has formed a positive impression of a person, it is surprisingly immune to later negative information.

And the Yves most people have heard of were at the top of their fields: Yves Montand and Yves Saint Laurent.

Plus it’s a pretty awesome multi-level pun

Yes, thanks for noticing!

Historically I think the idea was to avoid any kind of argument from authority (either for or against) and let the articles stand or fall on their own merit. It’s not all that uncommon in the blogging world. There’s also a long history of female authors taking male pen names, society unfortunately being what it is.

It became harder to maintain when ‘Econned’ came out and there were interviews for TV and radio, and it’s been an open secret since then as you say. I think it’s mostly for historical consistency at this point, and also symbolic of one of the NC values, namely that you should evaluate articles on the quality of their argument and supporting evidence rather than on the reputation of their author.

In the event that any Board members read this post I thought I’d provide a translation, all those big words can be confusing.

Staff to Board “Here, hold the bag, I’ll be right back”.

That ethics report is wild. That’s a lot of complaints. And the staff’s note that most of them are about outside parties only begs the question, what about the rest of them? At the VERY least, wouldn’t the board want to know something more about the 9 complaints relating to “accounting, auditing, and financial controls”? And given the large number of complaints in the “HR, Diversity, and Workplace Respect” category (48 in 4 months!) I’d think somebody would ask wtf that’s about. And it just kills me to think that someone was paid actual money to write that footnote about “non-ethics related complaints” being “not ethics related.” Who are these clowns?

That is quite a bit of slippery wording in that Status Report. Apparently, they want me to believe that the following states are exist concurrently –

– HR, Diversity, and Workplace Respect complaints are close enough in substance to an ethics complaint (in general) to merit its own category in the helpline while

– The non-ethics related complaints (as far as CalPERS defines them) are also so far removed from anything related to ethics and ethical behavior that they CAN’T be lumped into the ‘Other’ category (did someone call to report a dog owner who didn’t promptly scoop up some leavings?)

Not to say that HR, Diversity, and Workplace Respect complaints should be disregarded (and the sheer number of them! hot damn!), but that category of complaint wouldn’t normally seem like an ethical concern. Who knows.

The fact that they removed seven complaints, and seem to have squishy categories and distinctions seems to leave an easy open for manipulation. If they wanted to do it right, they would just have a generalized Complaint Hotline, or one for fraud, waste, and abuse, staffed by an outside company (the ACFE offers this as a paid service, and have a big stake in keeping their reputation clean). By having a generalized complaint hotline, they would pick up more noise, sure, but callers also wouldn’t necessarily self select because their complaint wasn’t related to an ethical issue.

Wide net and all.

A final, and obvious problem is the unseriousness of the complaints hotline. A basic rule of compliance is that you don’t design an oversight process to report to people who may be part of the problem. Inherently deficient processes like that lead to JP Morgan London Whale and Wells Fargo fake accounts scandal type outcomes. No one interested in career advancement who had an ounce of common sense would ever report a serious violation to this sort of complaint line….

Indeed. My uni set up something similar for faculty/staff, a supposedly anonymous ethics failures reporting process. Academics can be terribly naive about the real world, and some of my cohorts did file serious ethics complaints against admin’s ethically questionable actions. I warned them off, trying to explain that if the admin set it up and set it up to report results to admin they’d be risking their careers to report through that channel. My warning was brushed aside. “It’s anonymous!” I was told. (And I have a bridge to sell.) Within 2 years of lodging the complaints, all the people I knew that lodged serious and substantive ethics complains found themselves dismissed from uni employment. These were senior and respected academics with a long record of accomplishments who were let go. They were not habitual complainers. They filed serious ethics complaints. The uni’s answer? Get rid of the faculty and staff who complain. Problem solved.

CalPERS ethics reporting setup sounds like a sort of ‘early warning’ system for staff to focus PR work toward bubbling issues, not to clean up any real problems.

Thanks for your continued reporting on CalPERS, PE, and pensions.

On Friday at 7pacific JJ Jelincic will join Redwood Community Radio (kmud.org) for an hour to talk about the mess at CalPERS. Call in questions welcome starting half way through.

Excellent reporting — and equally excellent comments. It should be clear by now that California is completely lacking in any sort of functioning regulatory control.

The problem with keeping a ginormous $400 billion-dollar pot of money in a nasty little backwater town like Sacramento is that in a state that has been sustained since its inception by waves of manias from the 1849 Gold Rush, through the 1990’s Tech Bubble, the mid-2000’s subprime bank and real estate collapses, down to today’s mass unemployment from gig-work “app” scams, every hustler wants to wet their beak on CalPERS.

The sad truth is that the worst of the looting happened during the “new economic paradigm” of the Tech Bubble, when public employers took a “contribution holiday” while letting benefit promises creep up. When the bubble burst, the then-governor was replaced by a fake super-hero, and in the ensuing chaos billions in CalPERS funds were skimmed-off by connected ex-board members and their cronies of all political persuasions.

Interest compounds, but losses compound more. CalPERS now sees itself as a massive PR machine, their sole mission covering-up decades of financial mis-management and political graft. The board and staff act as if they have complete impunity.

Follow the Money…