Yves here. I have a soft spot for stories that debunk conventional narratives, and we already have quite a few on Covid-19. UserFriendly sent one from Curbed a few days back that we ran in Links: No, the Pandemic Is Not Emptying Out America’s Cities. This story from The City is a variant on that theme: even one of the cities that Curbed singled out as having Covid-19 exodus, New York City, isn’t seeing much in rent relief. Of course, that may be “yet” given the eviction freeze plus how long the process normally takes.

The article does concede that some neighborhoods are seeing higher vacancies, but they are the more affluent ones in Manhattan….which are the places members of the press frequent.

By Rachel Holliday Smith. Originally published at THE CITY on September 10, 2020

People in Corona, Queens, walk along Roosevelt Avenue, Sept. 1, 2020. Ben Fractenberg/THE CITY

In some parts of the city, rents have dropped since the COVID-19 crisis began. But for neighborhoods that felt the effects of the coronavirus most, listed prices have risen slightly, according to a new analysis.

The annual rental report by the apartment-listings site StreetEasy paints a very different price picture between the neighborhoods with the lowest coronavirus infection rates — primarily wealthier neighborhoods in Manhattan and Brooklyn — and the hardest-hit areas, mostly in Queens and The Bronx.

Between February and July of this year, rents fell by 1.9% in the zip codes with the lowest COVID-19 rates in the city, like Battery Park City, Greenwich Village and Tribeca, according to the report, comprised of market-rate listing data.

However, in the neighborhoods with the highest rates of COVID-19, per city health department data — East Elmhurst, Corona and Jackson Heights topped the list — advertised rents have climbed a bit in the same time period, rising 0.3%.

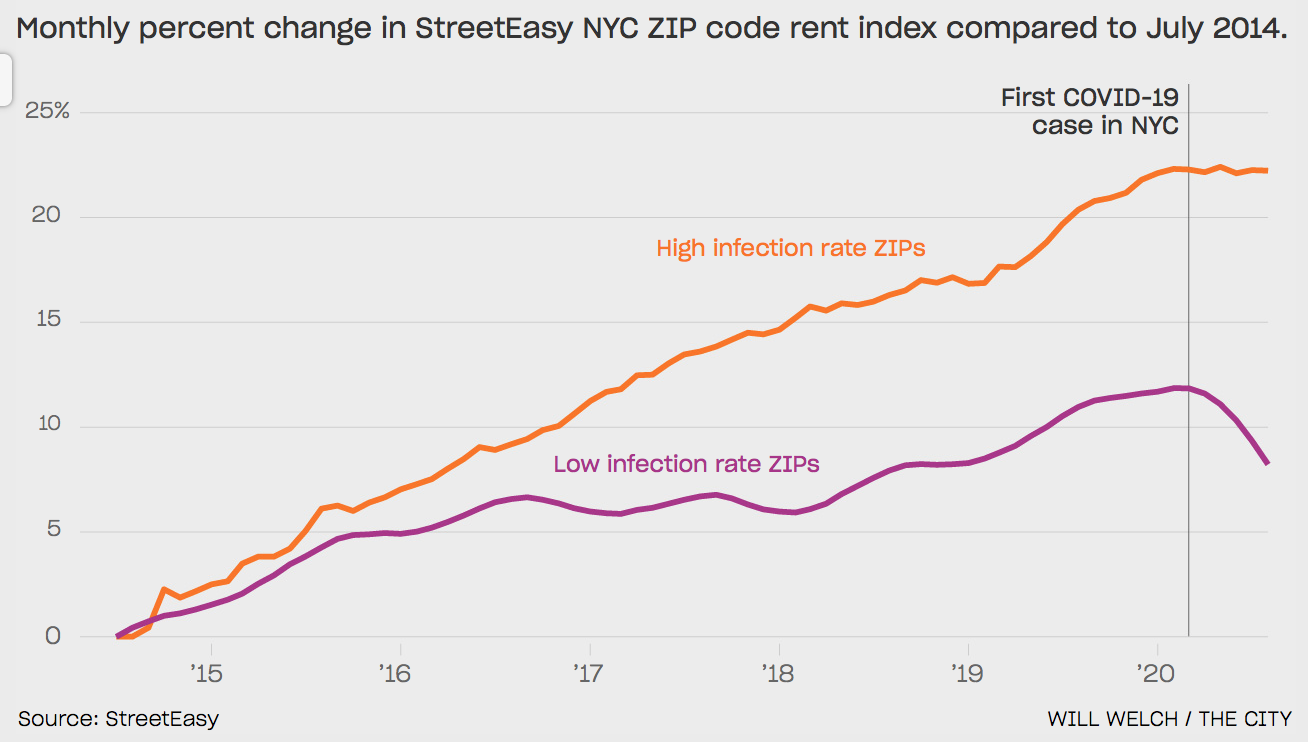

Listed rents have dropped more in NYC ZIP codes with low COVID-19 infection rates

The findings contradict the claim that there’s an “exodus out of the city,” said Nancy Wu, an economist at StreetEasy.

“That’s specific to Manhattan, and a lot of these Manhattan-esque neighborhoods,” she said. Elsewhere in the city, “it’s a very different picture.”

Eviction Fears Loom Large

The StreetEast report released Thursday analyzed six years of rental data in the five boroughs through July of 2020, comparing ZIP codes with the highest tested rates of COVID-19 per 100,000 people since the start of the pandemic with those with the lowest.

Each pool of least- and most-affected neighborhoods was defined by StreetEasy by adding up top and bottom ZIP codes with the highest and lowest infection rates until they had 1 million people in each category.

Over that period, listed rents in the most virus-affected neighborhood rose by 22.1% while the least-affected areas saw advertised prices rise only 10% over the same period.

Some of the trend is attributable to the fact that, generally, areas with lower median rents tend to see price growth at rates faster than higher-priced neighborhoods, Wu noted — because “there’s more demand for affordable properties as other places get more expensive.”

But it also points to a confluence of factors and “housing stressors” that overlap in the communities that have experienced high COVID-19 rates, said Barika Williams, executive director at the Association for Neighborhood & Housing Development, a consortium of nonprofit development groups.

An apartment building in Manhattan’s Chinatown, Sept. 2, 2020. Ben Fractenberg/THE CTY

Among the factors: overcrowding, a high share of families paying a large share of income on rent, and a concentration of essential workers.

“What we’re seeing in the lower-income households and families — especially our immigrant communities, especially our Black and brown community — is that people are really staying put, trying to ride it out [and] having this month-to-month anxiety of, will I or won’t I be evicted?” Williams said.

The NYU Furman Center, which collaborated with StreetEasy on the report, also found the areas hardest-hit by the coronavirus are home to more immigrants and Black and Hispanic New Yorkers, and amass more evictions filings, than other parts of the city.

Oksana Mironova, a policy analyst at the anti-poverty research and advocacy group Community Service Society, noted that the StreetEasy data is limited.

That’s because it’s based on market-rate listings and does not include many types of housing such as illegally subdivided apartments, any unit rented by word of mouth, and subsidized apartments, including public housing.

But the report does confirm what Mironova said she has suspected for some time: Those who had few housing options before the pandemic are under even more pressure now.

“If you have a bad living situation, if you have an abusive landlord … you end up having to put up with negative living conditions. And I think all of that is probably getting amplified under COVID,” she said.

At the same time, higher-income people have more choice within the market, including “the option to leave,” she added.

‘Incredibly Frustrating’

In the wealthier parts of the city, residents seem to be exercising that option.

New data from real estate giant Douglas Elliman found the Manhattan vacancy rate had climbed to over 5% as of August, a first in the real estate company’s report. The median rental price in the borough dropped 3.9% since August 2019.

Williams of ANHD, however, warned against using Manhattan trends as a stand-in for the housing story in the rest of the city. To do so ensures people elsewhere are “rendered invisible,” she said.

“When you see this narrative of everybody is leaving the city, and rents are dropping … and you live in a community where people aren’t leaving, people are trying to figure out how to make things work day to day, where there’s very little affordable housing and you don’t have a whole lot of options to go anywhere else if you wanted to — it’s incredibly frustrating,” she said.

“What we’re perpetuating is this narrative of what is happening in predominantly white, wealthy neighborhoods is the story of New York,” she added. “And that’s just not true.”

This story was originally published by THE CITY, an independent, nonprofit news organization dedicated to hard-hitting reporting that serves the people of New York.

A key point in the article is a looming eviction crisis. That has been forestalled through a variety of legal programs. If a high percentage of renters in these neighborhoods are evicted it will certainly impact rent prices, relocations, and vacancies. It may just be a much longer lag to see these changes in parts of the city where people can’t leave for a host of reasons.

I think that’s right – but as the above points out, it’s hard to get accurate data on non-market housing, which is likely a good chunk of units in areas Covid hit hardest. I imagine a lot of renters in Central Queens have probably undergone some kind of illegal eviction especially if they’re undocumented, there’s a language barrier, or they’re renting an illegal sublet/basement apartment that can be easily filled by another “essential worker” who has cash coming in. It’s helpful to keep in mind that this is the bottom of the market and landlords can still charge relatively high rents regardless of vacancy because the target demographic can’t afford to move and there’s simply nowhere else to go.

The NYS unemployment insurance money plus the $600/week federal input would have allowed many rents to be paid through July. That has ended though and NYS unemployment is only 50% of wages with a max benefit of about $500/week. The fed money has ended. There may be a bit of reprieve with the $300/week disaster money. But I expect evictions and empty apartments to be available once NYC moratoriums end and their process can get under way.

You can’t do restaurant work, janitor, or delivery serves from home. So, if employed, these families don’t have the option of leaving town and retaining their job, unlike the wealthier areas where the white collar workers can work anywhere there is a VPN connection.

So it makes sense that apartments for people who make over median wage would have higher availability as they can just leave, at least temporarily (6 months+). If somebody had an expiring lease and they could work from their parents house in upstate NY or the midwest, many probably left town if they could work from home.

I believe it is too early to come to any definite conclusion.

I am not sure when it will be possible to see anything definite but trying to list the steps involved might help:

1. A decision to move has to be made. It is a big decision and big decisions take time. From the initial thought that moving might be a good idea until it has been decided that a move should be made can take time. The time it would take to decide whether to move or not is individual, it is anyones guess how long the median time might be before a decision has been made. Complicating factors may or may not be related to the size of the household. My guess is weeks if not months will be needed to decide.

2. Once the decision has been made then the next step might be preparing for the move – finding a new place, getting rid of the old, planning the move etc. Complicating factors may or may not be related to the size of the household. My guess is that weeks if not months will be needed for the preparations.

& many people find moving to be very stressful and might want to postpone and delay their move until they see how it works for the first people who moved. Learning by other peoples mistakes, seeing their successes and/or failures

Maybe the data indicates something, maybe not. My personal opinion is that it is too early to tell, my belief is that if work from home will be here to stay (and it is not yet certain) then yes at least some people (5-10%, maybe more and maybe less) will move to places they feel more at home.

I was browsing Zillow for cheap studios in New York the other day and some of the discounts in affluent areas are astounding. Prior to covid it was hard to find many studios for $1500 in the whole city, let alone Manhattan. Flash forward to today, and Manhattan is covered with studios between 1500-1800, which were a rarity mere months ago. Most of these are clustered in the mid and upper east side and especially Tudor City.

In general, it seems like rents have dropped far more than 4% in some areas particular if you consider concessions. Offering one free month of rent is akin to an 8% drop. Lots of buildings in downtown Brooklyn and LIC are offering 2 months free on a 1 year lease as they’re still leasing up.

The article said but not clearly enough that the rent cuts are in Manhattan, and not the outer boroughs, and then in the “affluent” areas. The Upper East Side east of Second has been a bargain for a very long time, but I think when they talk about the cheaper parts of Manhattan, that would be the Lower East Side, Chinatown, Hell’s Kitchen.

I agree the concessions are significant but they are designed to be one year only! I was in NYC since the early 1980s and the only time the rental market was soft 2 years running (and then it was more like 18 months) was in the early 1990s recession. But prices didn’t appreciate all that much after it was over. Point is that unless a landlord comes from an old RE family, these conditions are outside their historical memory and there is some denial as to how much worse things could get.

My (uptown Manhattan–not affluent) building has a rash of vacancies that are not getting new tenants. The scuttlebutt is that mgt. wants to keep them vacant, but that doesn’t really make sense. I suspect there is no demand for now.

One area that’s been strangely absent from the news is also the state of the Chicago condominium market. Goldman Sachs pulled financing for the 74-story 1000 South Michigan Tower and construction halted in June. In the North Loop there are 15 months of inventory on the market versus 4-6. A lot of new luxury buildings have recently come online like One Bennett Park and Wanda Vista and are struggling to sell out. Even Trump Tower, built in 2009, has several studio units going for <$200k.

Now imagine if this was the case with New York’s condo market. Most of the focus has been on multimillion dollar units like a One Manhattan Square, but the strategy is to simply take these units offline as “shadow inventory.” I haven’t heard of a single instance of construction actually stopping on any project and a lot of building permits are still being issued – even for hotels.

We live in a half-horse college town in southern Mississippi.

The information I get from several mainly younger people is that rents have stuck in place for now. The University is re-opening for “business,” and the college renters are back, though we see no “enthusiasm” on that front. Loud partys, a staple of the opening weeks of the semester, are few and far between this year.

One woman I speak with who works managing a college oriented watering hole says that demand is artificially depressed by local ordinances. She mentions just trying to cover expenses for the outlet as her main worry. Several “disposable income” type eateries closed early on in the Pandemic and look to have been permanently shuttered. One mid sized seafood place has had it’s kitchen machinery removed. (I happened to be passing by the rear of the place and saw the moving truck being loaded.) A medium sized bank branch near the campus has just been razed. No signs of rebuilding preparations yet. Two smaller, “neighbourhood” grocery stores, one a Winn Dixie outlet, are being shuttered.

I don’t have the vitamin store owner’s input any more, (I was a customer, not a personal acquaintance,) but I have noticed the lack of new storefronts opening. If there are any new businesses opening up around here, they are running well below the radar.

One of our neighbours who does remodeling work is very busy. One of his workers, a very personable twenty something, is renting the house next door, which was empty but well maintained by the son of the woman who used to live there. The young man said that he lived about thirty miles away and took the opportunity to rent the house cheaply to eliminate the daily commute. Ed says that he gave the young man a “big break” in the rent to have someone reliable in the house to “keep an eye on it.” (Having some income to cover the roughly one hundred dollars a month property tax on the dwelling must help too.) I wonder how many such “deals” are going on under the table right now.

There is a fairly large number of originally PMC type punters who bought houses to fix up and flip or rent out who must have been caught short by the disruptions of the Pandemic. Not having deep pockets like the commercial concerns will be a strong incentive to “make the best of it” and do deals like my neighbour has. As the bar manager put it; “We’re in survival mode right now.”

The 800 pound gorilla in this room is the Pandemic Second Wave coming up this fall and winter.

We are not sanguine about a vaccine. The process is obviously being rushed for political purposes. One thing I did learn in my years in construction is that; “The faster you go, the slower you get.”

Stay safe in these Interesting Times!

Thanks for mentioning the loud student parties, ambrit. I’m just not seeing or hearing them in my neighborhood, which is 1.5 miles away from the University of Arizona.

As for the fixer-upper and rent-it-out market, that still seems to be generating some activity. But I can’t help thinking that the combination of this pandemic and the precipitous drop in the birth rate that started happening in 2007 will not bode well for the long-term health of the student housing market.

I also believe that the future of “going to college” will look a lot like this:

https://nau.edu/online/

I’m personally acquainted with two people who went to NAU Online. One got a bachelor’s degree and the other got a master’s. Both spoke highly of their NAU experience.

Me again. Although those loud off-campus parties aren’t harshing the mellow of the neighborhood surrounding the Arizona Slim Ranch, they are a problem elsewhere. Link:

https://www.kgun9.com/news/coronavirus/covid-19-uarizona-may-tighten-restrictions-of-dorms-frats-and-sororities

Key passage from this news story:

“Dr. Robbins [president of the University of Arizona] says most students who are infected conceded they went to large off-campus parties. He says the university is working with Tucson Police to shut down off-campus gatherings that break COVID restrictions.”

Yes to the “official” response. Perhaps it is because someone in the University nomenklatura can read and think, the University is pushing masks and ‘social distancing’ very hard here.

As for the local coppers shutting down loud parties, well, their past performance is none too good. With other “problems” arising due to the Dreaded Pathogen I can see less, not more, crowd control initiatives on that front.

Oh, any further information about the ‘We Work’ situation?

Well, funny you should ask about the WeWork situation.

As mentioned in my previous comments, I was a member of a now-defunct Tucson coworking space. Place shut down a year ago.

And, one would think, a pandemic would absolutely be wreaking havoc on such places. But I’m hearing of a new one opening.

Will I join, er, sign a lease? Nope. Nowadays, I work from a very pleasant home studio. With zero commute time. I especially enjoy that aspect.

In addition to my work, I am a neighborhood association officer. Took the position in January, thinking that I’d be dealing with area complaints about street lights and potholes. Hardy-har-har. If anything, I’m like a psychiatrist for quite a few of my neighbors.

I do hope that you keep to Jung and Freud for your ‘Neighborhood Treatment Program’ and not Wilhelm Reich.

I’m big on just letting people vent.

Face it, a lot of people are having a tough time right now. The simple act of being heard can make a huge difference. That’s what I’m trying to do.

Props to you, Slim. That’s a valuable service. Back when I was a young ‘n with a paper route, I was the de facto visiting psychiatrist for a number of people, mostly elderly widows. Fortunately we’ve eliminated all that nasty face to face communication (long before CoViD) and replaced it with measured, civil, enlightening discussions online.

That’s a public service in and of itself.

Modern society has been steered towards atomization for decades now. So many no longer have extended support cadres. You do us all a service when you help just one.

List prices haven’t dropped much, but there are move-in “incentives” everywhere, so the rent reductions are real, even if the sticker prices are the same.

No management company wants to be seen slashing rents and no real estate blog wants to be seen as bearish on real estate.

Also worth pointing out that the inventory of vacant 3 and 4 bedroom apartments is unusually large, supporting the notion that some percentage of affluent families have moved out.

My own building is now 40% vacant and the building across the street is now probably half empty. Yet there are still dozens of huge residential construction projects underway.

There is a PC repair guy who lives in NYC. He has a video channel (mainly about electronics repair) but recently he has been biking around the city looking at some of the astoundingly over-priced buildings and bits of real estate.

He does a nice snarky commentary to accompany the videos….here’s a link to just one….https://youtu.be/XwDtv1HzrJE

Lifelong Manhattan resident here, with adult children living in Queens (Astoria) and the Bronx (Marble Hill).

Lower Manhattan is silent at night, comparable to the cricket-hearing quiet following 9/11, though this has been the case for six months, unlike 2001. At the end of May, there were two or more moving vans on very block in the West Village, with everything headed outbound. I’m curious to see how long it takes to rent the first-floor apartment in my building, whose previous tenant just moved to Portland, Maine. In years past, it would have been rented before they moved out.

Street life in Queens and the Bronx is close to normal, with everyone still masked up. Lots of shuttered storefronts – my daughter’s favorite local food store shut during the lockdown, re-opened, and is now closed for good – but the bars in Astoria seem to be doing well at the moment.

There is a terrible reckoning in store for Manhattan – in many ways “deserved,” though it will be the poor and working class that will suffer the most – which was consciously turned into a playground for the uber-rich, tourists and the lumpen-bourgeouisie. Having no connection to the city beyond hedonistic consumption, many of these people have disappeared, taking their spending with them, and exposing the aggressive, hollow superficiality that took over most of Manhattan, and much of the rest of the city.

Having lived through the “bad old days” of the ’70’s and ’80’s (when hyper-gentrification took root), it seems that the city is racing toward deprivation and austerity that last time took decades to play out.

It’s going to be a dark, brutal fall and winter here.

Stay safe and get that rooftop garden going!

As I have noted before, if you are a landlord with a commercial mortgage, more common in more urban areas, then you typically have a 5 year lease with a balloon payment at the end, and need to refinance.

If you drop rents, the bank will drop the property value, and refuse the refinancing, and foreclose.

Thus, an empty apartment is better than a full one at a lower rent for the land lord, and rents are VERY sticky.

You may, however see all sorts of signing bonuses for leases.

So, as with much else, the problem lies with the banks.

When ‘things’ collapse on the financial front, it looks like the fall will be massive.

As ambrit says, the banks are a problem, but just step back and admire the Blood Squid in action:

The landlord, aka the sucker, gets a “loan” from the socially acceptable crime family. He precedes to “buy” some rental property, or really to rent it from the bank himself, to get the income streams from the disposables. The economy tanks, so the “owner” of the rental properties loses the income streams from the dispossessed. This causes him to become dispossessed himself, while the Blood Squid gets the property back, plus whatever its value, less the amount of the loan not paid. Really though the missing money could be said to be a payment to the landlord for managing the bank’s property. Meanwhile, the homeless, who often still have jobs and want a place to live, remain homeless.

This is one effed up, yet beautifully parasitical, system of ruination.

So there’s a strong incentive for owners of retail property to have vacant storefronts instead of lowering rents, correct? This explains a lot. I would have thought it sensible to have retail space occupied at lower rents than vacant at higher rents, if only because vacant property cost more to maintain and insure (I’ve been told).

How long can the vacant storefront scenario go on before other realities kick in? What about property taxes, for example? and when you do eventually use property as collateral for a loan, wouldn’t an underwriter be concerned by high vacancies, which would red-flag an over-valuation of the property?

My point is this: I just don’t see any medium-to-long term advantage for owners preferring vacancies to lower rents, unless the short-term IS the point.

You identified a major problem with ‘moderne’ business methods with your last statement.

As many here say, it will continue until it doesn’t.

One of my sisters lives in Liberty, and works Downtown. She has hinted at resuming her concealed carry habit this last year. She is not a bloodthirsty type, just worried about local conditions.

The “short-termism” of the media is astounding. Everyday I read headlines about unemployment “easing” or the “recovery” when we are still in the midst of an unprecedented crisis, maybe not even half way through. Same goes for urban property markets. NYC is in serious trouble. There are more open listings for apartments in my formerly “hot” Brooklyn neighborhood than ever before. This will only increase as it gets colder and the street dining and park socializing go dark. As the tax base moves away and services continue to decline (the trash situation is already abysmal), anyone with the means will leave. We are sadly looking to leave ourselves. Our glorified studio was rented with the understanding we would both be commuting daily, and we have no interest in signing a new lease (which are nearly impossible to get out of in NYC even after you’d be month to month in any other city, another factor at play here). It may take another year+, but NY and every other major city are in for another bout of 70s/80s decline, barring a miraculous vaccine and the full return of office life. I seriously pity those who took out a NY sized mortgage with their savings. Of course, the international investors and 1% had it coming.

Dumb Question? The Ellmann report about 5% vacancy in Manhattan areas: At what point or overall prevalence does crossing the 5% threshold ABROGATE the rent control/stabilization laws ENTIRELY?

There’s been some discussion of this and I can’t quite recall the specifics, but I believe politicians have signalled that they will try to keep the laws in place and find a workaround.

https://therealdeal.com/2020/08/20/why-rent-stabilization-will-never-end-in-new-york/