Having an exciting night with the power cutting in and out due to Zeta isn’t conducive to concentrating. And was not conducive to searching either, since we eventually lost our Internet connection. So apologies for this post being thin. Nevertheless, let us turn to another solid Wall Street Journal article on Covid’s considerable damage to the economy.

Yesterday, we discussed a critically important issue that both Presidential candidates are pointedly ignoring: that once Trump eviction moratorium expires in January, unless Something Is Done, 30 to 40 million people are set to be thrown out of their dwellings. Some may be able to crash with relatives or live on friend’s couches, but a significant percentage will wind up homeless, a visible explosion in distress that the US will not have suffered since the Great Depression.

Today, the Journal probes another looming disaster stemming from the reluctance of either party to step up and spend enough, in this case, to salvage state and municipal budgets. Finger-pointing at the Republicans for their refusal, in the recent failed rescue talks, to include funding for state and local governments doesn’t properly apportion blame. A stimulus package, even if it denied additional funding to these bodies, would have still given them some help by boosting the incomes of citizens and businesses. That would have meant higher sales and income tax revenues than in the “no stimulus till at best March” mess we are in now.

Remember that state and local governments have already cut headcounts. That’s only going to continue as the budget black holes get larger. Lower employment doesn’t just mean reduced services; it’s another part of the deflationary downdraft, since the lost incomes and spending of those government workers intensifies the funding stress.

The ugly overview, from the Journal:

Nationwide, the U.S. state budget shortfall from 2020 through 2022 could amount to about $434 billion, according to data from Moody’s Analytics, the economic analysis arm of Moody’s Corp. The estimates assume no additional fiscal stimulus from Washington, further coronavirus-fueled restrictions on business and travel, and extra costs for Medicaid amid high unemployment.

That’s greater than the 2019 K-12 education budget for every state combined, or more than twice the amount spent that year on state roads and other transportation infrastructure, according to the National Association of State Budget Officers.

States have established “rainy day” funds so they can ride out revenue shortfalls, since most are not allowed to borrow for general budget needs. However, these reserves were never envisages as needing to contend with a Covid-level deluge. And on top of that, some states hadn’t fully replenished them after dipping into them after the financial crisis. Again from the Journal:

States are dependent on taxes for revenue—sales and income taxes make up more than 60% of the revenue states collect for general operating funds, according to the Urban Institute. Both types of taxes have been crushed by historic job losses and the steepest decline in consumer spending in six decades….

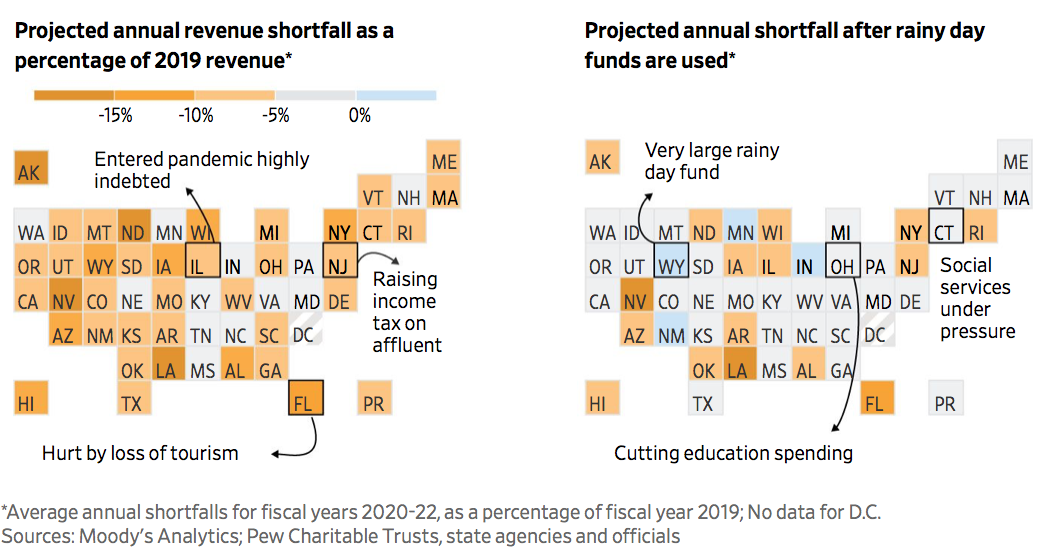

States that earn big chunks of their revenue from hard-hit industries are hurting. Americans are commuting and traveling far less, and oil prices have tumbled, hitting energy industries in Texas, Oklahoma and Alaska. Tourism has dropped in Florida, Nevada and Hawaii, and casino closures hurt Rhode Island, New York and Illinois.

Hawaii, for example, is expecting fewer than half the visitors it took in last year in 2020, and state officials forecast its general fund revenues won’t recover to pre-pandemic levels until its 2025 fiscal year….

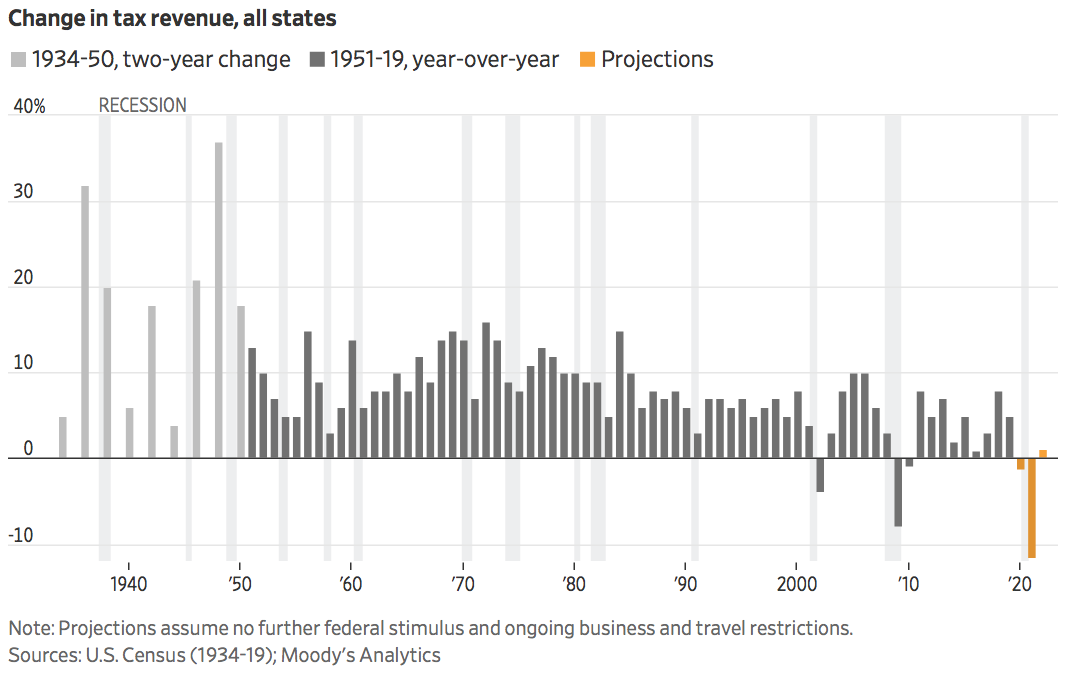

A nationwide decline in combined state revenue has happened after only two events in 90 years: following the Sept. 11, 2001, attacks and in the aftermath of the 2008 financial crisis.

Annual state revenue fell following the Sept. 11 attacks and the bursting of the dot-com bubble around that time, but recovered within a year. During the recession that followed the 2008 crisis, state government revenue fell 9% over two years, according to Census Bureau data.

This time the shortfall could reach 13% over two years, according to Moody’s Analytics projections.

You can see how many states are in bad shape even after applying their full reserves to try to achieve 2019 revenue levels:

The Journal doesn’t say what Moody’s assumptions about Covid are, but an aside about “the recent uptick in Covid cases” suggests that the rating agency built in a winter increase but not much more. So lockdowns and/or Covid restrictions extending well into 2021 do not seem to be part of the baseline scenario. That means the downside could be considerably worse than Moody’s anticipates now.

Brookings comes to higher levels of cumulative budget shortfalls, admittedly by looking both at state and local governments. From last month:

As in other economic downturns, the pandemic has reduced state and local revenues, but this time is different. Declines in income tax revenues are likely to be smaller than projections based on historical experience because employment losses have been unusually concentrated on low-wage workers (who pay less income taxes than higher-wage workers), the stock market has held up so far (sustaining taxes on capital gains), and the federal government has increased and expanded unemployment insurance benefits and grants to business, which will shore up taxable income. On the other hand, declines in sales and other taxes and fees are larger than historical experience would suggest, because consumption has fallen so sharply and people are staying home—meaning that revenues from taxes and fees on hotels, tolls, airports, and motor fuel have plummeted.

We project that state and local government revenues will decline $155 billion in 2020, $167 billion in 2021, and $145 billion in 2022—about 5.5 percent, 5.7 percent, and 4.7 percent, respectively—excluding the declines in fees to hospitals and higher education. Including those fees to hospitals and higher education would bring these totals to $188 billion, $189 billion, and $167 billion.

While federal aid to state and local governments this year has exceeded projected revenue losses, that aid is only one-time, and state and local governments are expected to face shortfalls for many years. Without promises of further aid, these governments are likely to cut spending now to prepare for future imbalances. Furthermore, state and local governments are at the forefront of the response to the pandemic in their communities and will likely need to increase their typical spending to provide crucial public health services and help communities adapt to social distancing guidelines. One lesson from the years following the Great Recession is that cutbacks by state and local government can be a substantial restraint on the vigor of the economic recovery, and so ensuring that state and local governments have enough funding is important both for ensuring that needed services are provided and that the economic recovery is as robust as possible.

Brookings doesn’t mention the impact of pension obligations on this picture. It matter because super low interest rates are punitive to long-term investors, and for some states, like Illinois and California, the obligations are backed by state guarantees (their only route for cutting commitments appears to be a Constitutional amendment, which needless to say is a high bar). And even if it might be possible to reduce existing pension obligations in other states, it would likely take a bankruptcy process, which has never been used by a state government. And that’s before you get to the impact on retirees of having income they relied upon cut. The Journal discusses Illinois, whose Supreme Court overturned legislation to cut pension obligations:

Illinois, with the worst finances of any state, has been banking on billions in federal funding. The state has a $230 billion pension liability after years of putting off payments, according to an estimate by Moody’s Investors Service, and faces an additional $8 billion backlog of unpaid bills.

Since the pandemic, Illinois’s total retirement and debt liabilities are on track to make up 45% of the state’s gross domestic product by June 2021, up from 35% in 2019, according to Moody’s Investors Service.

Illinois was one of only two borrowers to tap loans offered from the Federal Reserve as part of the aid packages. New York’s Metropolitan Transportation Authority was the other.

Illinois issued $1.2 billion in notes, but the funds are expensive, with an interest rate about 10 times the level typical in the market. The state has said it could borrow more. A spokeswoman for the state didn’t respond to requests for comment.

Connecticut has acute pension pain too, for different reasons:

Much of Connecticut’s liability stems from state efforts to shoulder the burden of its aging cities and towns. Almost a third of its total debt is local teacher pension and retiree health-benefit obligations, Moody’s Investors Service said, much of it from the 1990s, when officials skimped on retirement payments.

Two years ago, the state backstopped debt issued by its capital city of Hartford, which was warning it could declare bankruptcy.

The state’s hospitality and leisure jobs were down by about half at the height of the shutdowns, according to the Boston Fed, and were still down by about a quarter in August, despite a partial recovery. The state’s total unemployment rate was 9.5% in August.

The flurry of home buying as people fled New York City for Connecticut towns has had limited revenue benefits. The state’s tax collections from real-estate sales surged to a 10-year high of $47 million in August, according to the state revenue services department, but total collections from April through August remain below where they were the past two years.

While the chart above shows that Connecticut isn’t in terrible shape when you factor in their rainy day fund, the Journal points out that the state is facing high demand for social services, particularly due to its high drug abuse rate, and in-state providers that rely on state funding are worried about their 2020 budgets.

In other words, this is yet another place where Covid is already biting and is primed to get worse if infection rates continue to be high in 2021 and isn’t tamed that year.

Yves – not sure if you saw, but the MTA also announced that they are tapping the Federal Reserve’s Municipal Liquidity Facility for $2.9 billion – effectively maxing out what they are able to borrow under the facility. The facility formally closes on December 31, 2020 and it looks doubtful that it will be renewed. It will be interesting to see the state of the muni market in leading up to the closing date.

https://www.bondbuyer.com/news/new-york-mta-to-tap-fed-program-to-the-max

Thank you. I’m glad that someone is finally trying to figure out where the shortfalls will be. States have kicked the can on budgets but there’s whole months before the end of the FY that are at zero.

The other hidden cost is for localities and townships and boroughs. Many are relying on Earned Income Taxes and so will also see a hit, particularly in “one industry towns” that might rely on tourism for many jobs. My guess is the hit will be mixed given that the PUA and PPP kicked in.

Defund Congress. Now. Those useless twats.

Susan, most of the Congress are twits.

The State of Georgia required all state agencies– including the University System, which is why I’m aware of it– to cut fiscal 2021 budgets (our fiscal year 2021 started 7/1/2020) by, I believe it ended up being 10% right off the top. I wonder if these budget cuts were reflected in Moody’s assessment?

Defund the police ON STEROIDS.

Also defund fire departments, EMTs, hospitals, schools, roads, trash, you name it.

Let’s just be frank, it’s defund any remaining public good. The stuff that used to be the BACKBONE of our society, and what makes our country great.

You want to really WRECK America? You want to put Wall St and the corporations in charge? This is how you do it. Defund the legitimate local governments that are responsible to their people, and watch that power vacuum be filled by mega-corps and billionaire owned rent-a-cops.

This is not your country anymore – you just pay rent. And the rent is going nowhere but up.

Well don’t worry about police budgets. I’m sure those will be the LAST thing to get cut.

time to stop upgrading fire apparatus at the current pace. our town has 5 ladder trucks and ZERO hi-rise buildings

stop basing retirement benefits on base + OT. $90K + health care for a 20 year stint as a corrections officer?

Sitting here in Chicago I will watch the desperate budget battles for both Illinois and Chicago closely.

My father is a retired teacher in the Teachers Retirement System of Illinois. He has long suspected when push comes to shove the pension checks will be “delayed” – a polite fiction to explain why the pension fund can’t pay.

The situation in Illinois is aggravated by the automatic 3% COLA for all pensioners. I have to think there will be some kind of taxpayer revolt over this issue, if all other state services are cut back. I don’t see a legal path yet, but it is coming.

Additional Illinois details:

Many state pensioners retire in their 50s, many with full pension benefits.

.

The average career pensioner – retired after Jan. 1, 2013, with 30 years of service or more – receives $66,800 in annual pension benefits and will collect over $2 million in total benefits over the course of retirement.

Good for them – they EARNED it. Everybody should aspire to have such retirement, and work to create more jobs with good benefits.

Instead you would like to what? Further wipe out the American middle class? Make an example out of hard working Americans? Isn’t that why Trump was elected? To bring back good jobs to America?

Aren’t we working to Make America Great Again?

Or was it a lie?

it was a lie.

after he caught the car, the ptb settled on a good reason to tacitly accept trump in the white house: he’s the judas goat.

the question is, whether or not he’s accomplished(sic) all that they require of him, before being led off into the desert to expiate the sins of the PTB.

if there’s further damage like this to do, he’ll win next tuesday.

if the damage done is sufficient, he won’t.

we’ve been sacrificed.

get your seed orders in now.

Did they earn a 3% COLA forever?

They bargained for it, I grant you. But the bargainers for the state were either financially ignorant or on the take.

If a government representative makes an irresponsible promise, there should be a way to revise the promise.

Damn right. The employees bargained for the pension benefits, deferred in lieu of wage increases, and now they’re being demonized because Americans have been fed this steady bilge of greedy government employees. Taxpayers should instead direct their anger at a system that increasingly makes a dignified retirement a mirage. Read recently how Social Security, increasingly the only source of retirement income for more and more seniors, will likely need to cut benefits due to COVID-related job losses. The “Granny Needs to Die for the Dow” crowd spoke openly what long simmered beneath the surface.

wife, after dealing with a ton of not-her-fault bulls^&t from her university, then a ton of definitely not-her-fault bulls^&t from the state certification agency’s hired goons, finally became a real teacher, at her alma mater, in her home town.

7 years later, she gets terminal cancer. 2 years after that, covid collapses the civilisation…and all the secrets about how crappy everything really is are front page news(yet still spun this way and that).

now, since she must be online only, she’s talking more and more about retiring.

because Being There is a large part of the non-monetary compensation.

I’ve never expected things like social security to actually be there when i reached the age(although SSI was finally there when i needed a hip, it just took 6+ years)

i’ve also never expected her retirement to actually be there as promised.

i’m not savvy enough to go and scrutinise TRA’s pension books.

i expect that what they thought were “sound investments” a year ago, no longer look all that sound.

add in the state and local budget cuts that are almost definitely forthcoming, and it looks pretty dire.

my distrust of all these things is well known by her and everyone else close to me…and largely ignored and eyerolled.

as with all the previous gut feelings/intuitions….or simple awareness of obvious trendlines,lol…I hope fervently that i’m wrong.(rarely am, though, which can be a curse)

her retirement talk is possibly due to feelings of hurt from the recent kerfuffel regarding sending our freshman back to the superspreader school….we’ll see.

irregardless, this sort of thing is a giant plank in my platform of reasons for pursuing all that autarky/emersonian self reliance/jeffersonian yeomanhood-thing i’m always on about.

we will get by.

millions of others, however, won’t.

to blithely admonish that “well, them teachurs shuldna been so greedy” is stupid and hateful, and evidence of being profoundly ignorant of how the world really works.

who benefits from state and local government collapse?

or from millions remaining jobless?

or millions getting tossed on the street, during winter, and during a frelling pandemic?

or millions losing their “employer provided” health insurance during this crazy time?

who’s interests does all that serve?

“They’re trying to wash us away…”

https://www.youtube.com/watch?v=MGs2iLoDUYE

the current crises could have been an opportunity to at the very least examine our numerous and contradictory unexamined assumptions…about practically every aspect of what we still pine for as “Normal”.

instead, the divisionary strategy of “our betters” has worked better than im sure even they hoped it would, and we’re throwing feces at each other, while the bosses get their cull accomplished.

we’re walking right into it.

A better metric for assessing pensions would be the median amount. The average pension in state government is usually inflated by higher-up officials who have gamed the system. (Lots of overtime in their last three years of service.)

Boy is that ever true. See the following for officials who get bloated salaries and large pensions:

https://www.forbes.com/sites/adamandrzejewski/2018/10/26/illinois-100000-club-94000-six-figure-public-employees-and-retirees-cost-taxpayers-12b/?sh=620dd1f3481a

Many states and municipalities over-promised pensions and other goodies. The federal government should not bail them out, unless and until these retirement benefits are slashed to affordable levels.

Oh yeah? Those were teacher union negotiated pensions, and other pay and benefits were foregone in exchange for negotiating those pensions. Funds were set up to guarantee these pensions, from which successive Illinois governors stole, and stole, and stole …

And now you want Illinois teachers to eat the loss?

Actually, I’m fine with getting rid of all of this stuff (starting with all police pensions) – in favor of 100% Universal Basic Income, Education, and Health Care.

I’m ALL in favor of NO MORE BAIL OUTS. But let’s not go after the penny ante stuff.

Wall St firms got $14 TRILLION for the 2008 BAIL OUTS, and has received over $36 TRILLION since that time.

Corporations are legal constructs which can to go bankrupt. There are laws, courts and procedures to follow for the process. People, especially people that EARNED a pension performing a required civic function also “go bankrupt”, but this also means they go homeless and starve.

Yep… stabilizing state budgets would be less than they tossed at the stock market back when the COVID crisis started. It would be less than what they tossed at the 500 Billion slush fund that they gave Trump to doll out. It would be less than what is tossed down the drain for national defense every year.

But the pensioners are the evil ones… *eye roll*

Are you equally offended by the corporate tax breaks that went to stock buybacks?

now would be a good time to cut the police budget, no more tear gas.

Any data on muni yields being discussed anywhere? It just occurred to me that the market probably doesn’t see a problem.

What are muni spreads looking like?

Just a bit of a rundown on muni etf’s

SUB iShares Short-Term National Muni Bond : up since before covid

RVNU Xtrackers Municipal Infrastructure Revenue Bond ETF : about the same range as before covid

NYF iShares New York Muni Bond ETF :about the same as before covid also

All of them took a big dive and then quick rise after the initial covid sell off

So we will break the safety nets and what remains of the welfare state. Any remaining public goods that aren’t stapled down will be sold off because we can’t “pay for it.”

After the CARES Act and the nuthingburgers from the last 7 months, are we really that surprised that we haven’t deviated from the established path? Unfortunately we’re still only in tragedy zone. We need an actual crisis where the elites get to feel pain too.

The money paid on pensions goes to corporations via sales. Sales, on which the corporations make profits, which flow to the rich. If the pension money is crushed, so are the corporations (Walmart et al), and the rich lose income. It appears that retirees, corporations and the wealthy all benefit from pensions.

Corporation operate with fixed and variable costs. Cut their income and the fixed costs mostly remain, and the profit disappears. (See Sears and JC Penny for examples).

Or do I completely misunderstand how money flows?

Crush pensions, and damage the economy.?

Do the Powers That Be, really do want another 100 million “useless eaters” dead quickly?

First, this scream Starve the Beast.

Second, listen to ppl from various places across the country & then tell me Detroit is going to get financial help over Utah. I’m saying the current racism across this country will not allow bailouts of govt. heck, in Michigan the racism wouldn’t allow the state to bail out Detroit in 2008, blaming that bankruptcy on corrupt minority politicians for the collapse of the city, not the abandonment of ppl and jobs from the city.

Further, you can see with the virus just how it will play out. A town of 400 ppl in the middle of a Texas desert will have just as much voice as Detroit (“we aren’t sick, we aren’t dying, let Detroit open up, it’s not our problem if ppl die, it’s their own fault”). Our political pundits will find small towns that aren’t suffering financially like others. They will interview the townsfolk who will say how their hard work and small town values are what have made the town financially successful. But only thru further digging, it is found that 75% of the citizens live on govt assistance or employed with govt jobs (defense industry). But too late in the court of public opinion.

Now Wall Street can go in & buy up public assets for pennies on the dollar, thus completing the full privatization of state & local govts. But of course transferring any losses to govt.