America’s slow motion public pension crisis illustrates how the US has become a “can’t do” nation, one that would rather pretend that real problems don’t exist or at best pretend that bandaid-on-gunshot-wound-level solutions will work. As Glen said in comments on yesterday’s links:

I’m listening to Fauci’s interview on Meet The Press and he is discussing the possible collapse of the American health care system in localities where the hospitals get overloaded, nursing homes get infected, and the overworked/sick health care workers are overwhelmed. And what does Chuck Todd propose as a potential solution? “Can you get the President to mention wearing a mask?” Are you {family blogging} kidding me?

This whole phenomenon of a pandemic reminds one of massive wild fires/climate change and our national response to this emergency. What response you say? EXACTLY! We now have massive wild fires every year. We have flooding in Florida. We have power systems being turned off when it gets windy. Yet, we knew this was coming, and DID NOTHING…

So we are at another inflection point. The pandemic is pointing out more than ever that our health care system is failing. And this is no fault of the people actually doing the work, they are quite literally being worked to death. The obvious solution is to do what the rest of the civilized world did long ago, a Medicare For All based system. This is the time. If we do not do it now, we will never do it.

And back to where we are – there is a vaccine and everything will go back to “normal”. Yeah, been there, done that. For our healthcare system – THIS IS NOW NORMAL.

It’s no secret that most US public pension funds are underfunded, some severely so. It’s is also no secret that the underfunding is set to become much worse as a result of Covid-19 wrecking state and municipal budgets via depressing taxes and fees while increasing pressure on the spending side. It’s already difficult to get these employers to make higher pension contributions to make up for past underfunding. It will be the course of least resistance to continue to put off making real headway in these shortfalls.

A recent paper by Ingo Walter, professor emeritus at NYU Stern and Clive Lipshitz of Tradewind Interstate Advisors provides a deep dive into the so-called Canadian pension fund model and contrasts the process and results with those of the biggest US public pension funds. We’ve embedded their analysis below.

Most investment professionals know that Canadian public pension funds are well regarded. What is less widely recognized is that Canadian pension funds recognized that they had a funding crisis in the making and made major reforms in the 1990s. Accordingly, both in their paper and in a MarketWatch op-ed, the authors argue that the Canadian reforms can and should provide the US with a roadmap for getting out of its mess. However, one of the reasons yours truly has not said much about Canadian pensions before is that too many constituencies in the US feel they will lose if any “reforms” take place, even though upholding the status quo is destructive.

So we’ll make up for this lapse today so that readers can appreciate that US public pension funds are not a hopeless problem, except that the people with seats at the table are making it so by insisting that nothing fundamental needs to change.

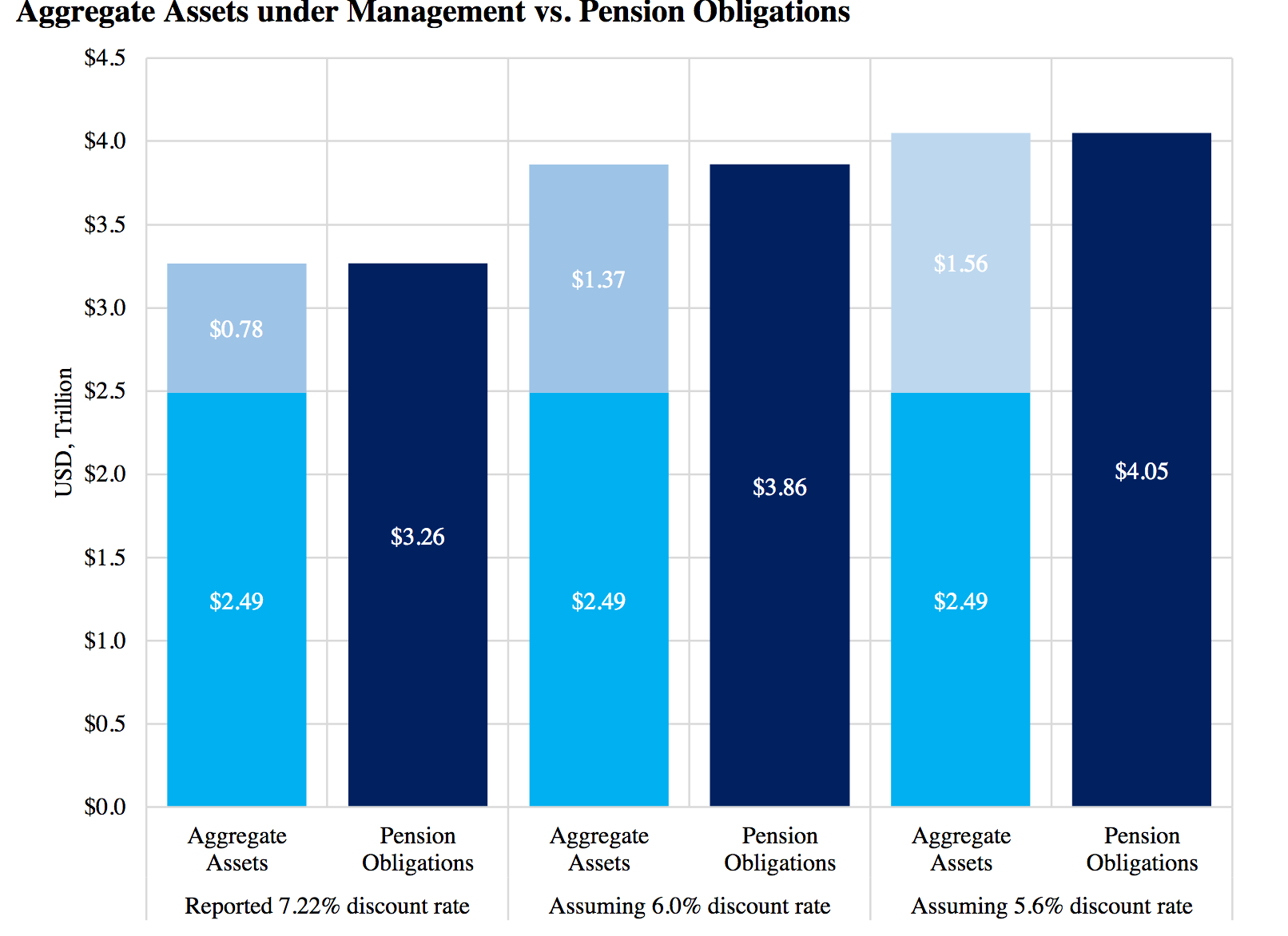

While it’s easy to tout caliber of Canadian pension fund management and regulation, the proof is in the pudding of their results. Unlike their American counterparts, Canadian pension funds are either fully funded or have surpluses despite using more conservative return assumptions. As you can see below, if you were to apply Canadian return assumptions to the universe of the biggest US pension funds, comprising roughly 1/2 of total public pension fund assets, you can see how much bigger the underfunding hole (the light blue bars) becomes when you go from the average return assumption used in the US, 7.22%, to the average Canadian return assumption, 5.6%. The unfunded amount jumps from $780 billion to $1.56 trillion.

If you think that’s scary, have a look at the Fed’s take on public pension funds. The central bank uses bond discount rates which are lower than the “expected returns” that all US and most Canadian pension funds use. Lower discount rates make the pension fund future obligations bigger in present value terms. That is why CalPERS, for instance, is so desperately clinging to the ludicrous idea that it can earn a 7% return, year in, year out. Settling on a level it could conceivably achieve would result in its reported liabilities rising. That would result in it admitting to being more underfunded than it has pretended to be, which in turn would mean higher CalPERS charges to employers like the state and municipal entities that are part of the system. The Fed pegs comes up with public pension liabilities across all US pension funds (not just the biggest used in the study) at $8.9 trillion, with the unfunded portion at $4.3 trillion. That’s a funded ratio of only 51%.

Canadian pensions are also true long-term investors. Even though their use of estimated returns as their discount rate is arguably problematic, they are much more concerned about matching the profile of their expected liabilities than Americans are:

Exhibit 20 shows the average asset allocation of pension funds in the two countries. Canadian plans have larger fixed income portfolios (27.4% compared with 23.4% in the U.S.) and more real asset exposure (25.0% compared with 9.8% in the U.S.). They are fully funded at reported discount rates which are lower than those in the U.S. Their primary focus is on matching assets to long-duration liabilities and generating yield to address cash flow deficits.

Again unlike American, Canadian pension funds make direct investments in real estate and infrastructure, rather than paying fees to pricey middlemen. As we pointed out, real estate fund managers harvest any excess return for themselves. From a post earlier this year:

…the sort of private real estate funds that investors like CalPERS patronize have to compete with corporate buyers and REITs, with an additional layer of fund manager fees. The result [according to Richard Ennis in a paper in the authoritative Journal of Portfolio Management]:

During the last two decades, private-market real estate underperformed REITs by a wide margin. In a 2019 study, CEM Benchmarking determined that institutional portfolios of private-market real estate, including core and non-core properties, underperformed listed real estate by 2.8% a year between 1998 and 2017. With comparable volatility (adjusted for return smoothing), REITs achieved much better risk-adjusted performance than private-market real estate over the 20-year period, with a Sharpe ratio of 0.44 compared with 0.33 for private real estate.

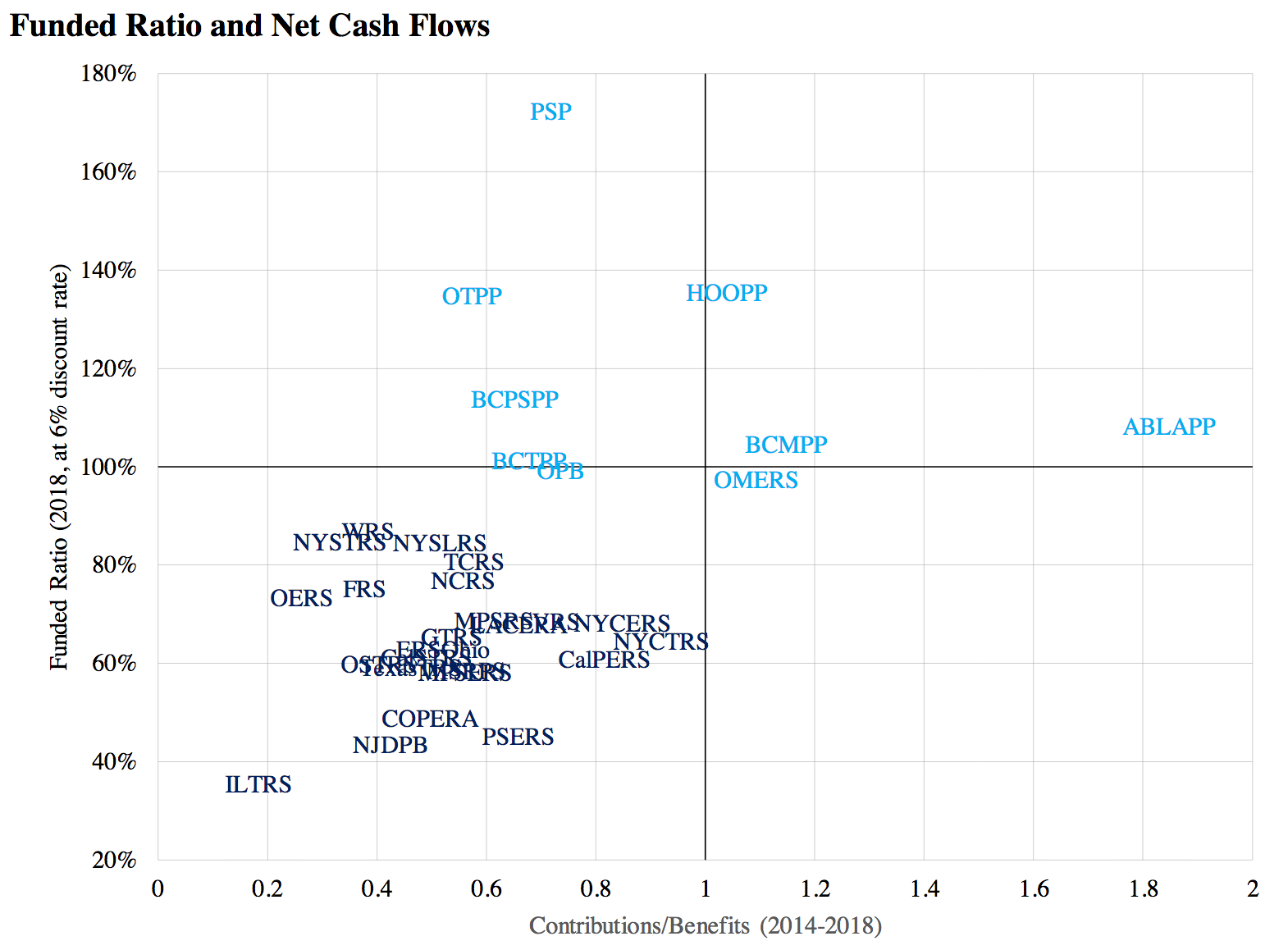

A less obvious, but fundamental impediment, is that US pension funds need to do two things at the same time which in combination are virtually unattainable: generate enough cash flow to meet payouts (US pensions are paying out more than they are getting in in new contributions) and generate capital gains to reduce their underfunding holes. The names in black are American funds and the ones in blue, Canadian:

Exhibit 19 also illustrates the key challenge facing U.S. public pension plans. There is simply no investment strategy that can enable them both to earn enough yield to fund their benefit payments (x-axis)136while at the same time generating capital appreciation to restore their funded status (y-axis). This shows why addressing pension funding exclusively or primarily through the lens of investment management is not a viable solution.

Canadian funds also use more portfolio leverage than US funds, but the authors don’t state where this puts them in terms of overall risk, given that US funds have higher public and private equity exposure than Canadian pension funds.

A critical difference for Canada versus the US was that the adoption of more realistic return assumptions meant bigger annual fund contributions. In Canada, that burden was more equally split between employers and employees than here:

The burden of funding contributions is shared approximately equally between employees and employers in Canada. In the U.S., it is skewed heavily towards plan sponsors (i.e. the taxpayer), with plan members funding only one-third of total contributions.

The authors summarized the Canadian reforms in their MarketWatch piece:

First, actuaries were engaged to correctly value funding gaps which were made whole. In some provinces, taxpayers fully absorbed the cost of these gaps. In others, workers agreed to participate equally in bearing the cost.

Second, plans were reformulated under joint sponsorship of employer and employee interests. This gave employees a strong voice in determining the level of their benefits. It moderated that voice with the recognition of a shared burden for ensuring long-term plan sustainability: a seat at the table in return for skin in the game.

Third, the new legal structure led to more conservative funding models. Canadian pensions are designed conservatively. Contributions from members and employers cover about 80% of benefits in Canada compared with 55% in the U.S. While employer contributions are similar in the two countries, Canadian employees pay more into their pension systems relative to future benefits than do their peers in the U.S.

Fourth, Canadian governments established sophisticated arms-length investment offices to manage pension assets. In the case of smaller plans, portfolios were pooled for more efficient management.

Fifth, pensions were oriented to investing with the objective of asset-liability matching. Today, they on average target 5.6% returns, compared with 7.2% in U.S. Despite this, Canadian pensions outperform those in the U.S.

Canadians prefer longer-duration assets such as directly-held real estate, toll roads and port facilities to generate the cash flows needed to pay promised benefits. They allocate a quarter of their portfolios to such “real assets,” compared to 10% in the U.S.

American public employee pensions tend to favor equity-risk strategies, since they need to “shoot for the stars” to achieve their challenging investment argets. Public and private equity and hedge funds comprise 60% of U.S. pension portfolios but only 41% of Canadian portfolios.

When done well, this strategy bears fruit. When not – or when markets do not oblige – the downside becomes substantial.

That sounds all well and good, until you look at their 15 point version in the paper. That’s when you see, as they say in Maine, that you can’t get there from here. They start with:

The first lesson is the realization and acceptance among key constituencies that meaningful change is needed.

Help me. If you use the Canadian discount rate, the underfunding of US public pension funds is as big as all student loans outstanding, and if you use the Fed estimates, it’s nearly three times that large. Yet do public pensions command anywhere near the level of attention that student loans do?

And it isn’t as if it’s because no one is yet feeling pain. States and cities are already feeling budget pressure due to the need to pay more and more to cover the pension funding hole. They are very much opposed to paying more now, even if it will reduce damage and potential legal train wrecks later.

Nor are unions and other plan participants as concerned as they should be. All you need to do is look at the treatment of former CalPERS board member JJ Jelincic and current CalPERS board member Margaret Brown. The ferocity, persistence, and often childishness of the campaigns against them reveal that their prudent and mild questions about how the funds are invested says that doing basic fiduciary oversight is seen as an existential threat. How could such a topsy-turvy position make any sense? Only if on some level you recognized that institutional claims about returns wouldn’t stand up to scrutiny, so no one can be allowed to pull back any curtains.

Why would it be rational for fund trustees to defend underfunding? Because they are in alliance with the pols who assume the con won’t blow up on their watch.

The authors invoke Illinois’ deeply underfunded pensions as a warning, but they are drawing the wrong lesson. The Illinois Supreme Court in 2015 overturned legislation to cut pension obligations, based on a strongly-worded Constitutional guarantee that was passed when the Illinois pensions were already meaningfully underfunded. From a recap in Forbes:

The decision asserts, in short, that the delegates knew full well that pensions were not properly funded, and intentionally made the choice to guarantee pensions by means of obliging future generations to pay, no matter what, rather than funding them as they are accrued.

In other words, the only way to deal with the underfunding is either to have taxpayers ante up or pass a Constitutional amendment. How likely do you think the latter is?

California has Constitutional guarantees that have also held up to court challenges. Even Kentucky Retirement Systems, which is only 13% funded and projected to run out of dough in 2027, was still found by the Kentucky Supreme Court not to be at imminent risk of non-payment, and hence the plaintiffs had not been harmed. The court also argued that even if the fund ran out of money, the state had made a solemn promise to pay the pensions. The Kentucky Supreme Court invoked a recent US Supreme Court ruling, Thole v. US Bank. As summarized by Paul Weiss:

In Thole, the U.S. Supreme Court ruled that such defined-benefit plan participants lack Article III standing to sue the plan’s fiduciaries based on losses to the plan that do not result in individual financial injury. The Thole petitioners lacked such an injury because, regardless of the alleged losses to the plan, they remained legally and contractually entitled to receive the same monthly payments in the future.

Needless to say, while legally tidy, in practice, the results are Alice in Wonderland-ish: pensioners can’t sue to stop obvious pension train wrecks until they’ve actually been stiffed. By then, it would clearly be too late to do much more than fight over scraps.

So the parties with someone to lose, namely beneficiaries and taxpayers, can’t find good legal routes in most states to storm the battlements and force changes before things get worse. And the public pension/public union hating right wing is probably delighted about their powerlessness, since the worse things get before they come unglued, the more damage it does to the image of governments and unions.

In addition, point 3 of the 15 point list amounts to “Assume a Canadian can opener”:

Strong leadership backed by an effective civil service

Change does not occur spontaneously. In each of our Canadian examples, a strong leader emerged to shepherd the necessary change. This was someone with the analytical ability to envision a viable end-state, the credibility to bring all stakeholders to the table, and a willingness to expend the political capital needed to convince each to give something up inorder to benefit everyone. Such people must rise to prominence in the U.S. states and municipalities facing ongoing pension challenges. At the same time, reform in Canada was enabled by very strong technocrats in civil service roles in the provincial and federal treasuries. Canada’s smaller population and sharing of ideas between these experts allowed for cross-fertilization of best practices and explains the relatively similar series of reforms adopted across the country.

It would be better if I were wrong, but six plus years of arm-wrestling with CalPERS to move the pension fund towards better governance and more transparency have shown how deeply invested the incumbents are in this bad status quo. And they have plenty of hired hands to apply porcine maquillage, or perhaps more accurately, perfume a corpse.

00 Canada public pensions paper

The problem here in the US is our politicians will never agree to a solution which might cause short term pain to them and admit that the path that we’ve been on should be changed.

“Just say no to all ponzi schemes” including those sold to you by the elite.

Speaking of Illinois…

I wouldn’t bet against a constitutional amendment to stiff the teachers* and state employees. They’re a tiny fraction of the population and as we have seen in election after election, play to the pocketbook and you have a good chance of winning.

(*)My brother-in-law is retired from the UofI. He started there at 18 in the physical plant and worked there for 42 years. He’s only ever worked there and the UofI doesn’t participate in social security or medicare. He is completely dependent on the state for his retirement, healthcare and long-term care. We have an ADU because I am guessing at least one of my siblings will end up homeless in old age.

So it’s actually worse than portrayed even here.

Your viewpoint is biased. Here is a game that is played by many public employee unions around the country:

They willingly go along with underfunding because it provides additional funds for pay raises. If state and municipal governments more fully funded pension obligations that would leave less money available for employee pay raises and other benefits. Knowing full well that they can go to court if their pensions are cut due to underfunding they have their cake and eat it too. Across much of this country public employee pensions are far too generous, especially for police, fire, and school administrators. Nobody should qualify for a substantial pension at 50 years of age.

If my memory is correct, Canadian pension funds invest a lot in public-private partnerships, either directly as sponsors or through infrastructure funds. I believe that these are many of the “directly-held real estate, toll roads and port facilities” mentioned in the article. I wonder about the connection between the growth of PPP and the improvement in the public pension financing.

There’s one additional (not preferable) way to deal with state and local pension issues–bankruptcy. Localities are already permitted to declare bankruptcy, and Congress could also permit states to do the same.

Interestingly, in black letter law terms, localities (separately incorporated cities, towns, villages, etc.) are corporations formed by the several states to administer governance in specified areas. In other words, the bankruptcy code already allows state-created corporations to independently declare bankruptcy, provided they have been granted the power to pursue bankruptcy by the state, so it would not be too much of a legal stretch to let the states themselves also declare bankruptcy under the Code.

There’s another wrinkle though. The bankruptcy process may entail a serious surrender of state sovereignty to the federal judiciary. My guess is that, at a minimum, a state legislature must pass a law, and the state executive must sign it, before any state could proceed under the Bankruptcy Code.

On the other hand, under the Supremacy Clause, a bankruptcy court’s orders supersede any state or local rule (including state constitutional rules) limiting pension adjustment or reduction. This single fact is why I suspect bankruptcy will, at least in some cases, be the only available “solution”–it’s easier to pass laws than amend a state constitution.

Illinois can’t declare bankruptcy (per its constitution)

Here’s a link to a piece I published on how to extend Chapter 9 to the States. https://thehill.com/opinion/finance/497329-the-sky-is-not-falling-chapter-9-can-help-rescue-and-secure-state-and-local It in turn builds on an earlier piece. https://muninetguide.com/creating-sustainable-public-pensions/

If I understand the intent of the post it is to a) define the problem with certainty and b) create awareness that something needs to be done, now or c) ‘we the people: by, of, & for are worthless. Bankruptcies would help but not in way described, the idea is to provide money to people via pensions not legally absolve responsibility. A change in US §11, that would put pension funds first in terms of asset class claims, (while we also amend the code to allow the discharge of student loans) and all chapters would be a start. Adam Smith never imagined (cause he wrote about it) that capitalism would become a murder contract.

Stockton declared bankruptcy and despite a favorable ruling, the city agreed to pay all the pensions in its bankruptcy plan. It may be that terminating the plan, which is what a BK would do, allows CalPERS to declare a termination charge to the departing entity. Those assume no future investment profits, which is consistent with them having exited the plan. Putting that vastly larger amount in a BK filing as the amount owed could leave the city no better off, since any haircut would be off a much bigger figure.

I am living as a survivor on my husband’s state pension. The old contract was: work for the government for lower pay than private market in exchange for a government pension, paid vacation, and sick leave. Who decided to void that contract? Now that nobody has a real job, everyone is looking at the government job security with great envy if not hatred. Retirees living on government pensions contribute usually all of their pension right back into a state’s economy. Pensioners spend their money locally. States have wasted so much money on bribing corporations to set up business in their state without paying taxes. These corporations leave the state as soon the tax breaks end. That wasted money could have easily funded pension obligations.

A look at the 25 largest public pension funds as detailed in the article reveals that the funding discrepancies are wildly divergent, e.g., New York and Wisconsin are around 100%, while New Jersey and Illinois are at an alarming 50 and 40%, respectively. Even in my state, Texas Teacher Retirement is at 77% funded, while the much smaller Texas District and County Employee Retirement (TCDRS) is at 89 or 92% funded, depending on how you count it. I’m guessing a lot of the smaller pension funds, as mentioned by Yves regarding the Fed report, are in much bigger trouble. I seem to remember the Fed realizing that its’ low interest rate policies are hurting the pensions, since fixed income investments earn very little interest.

I think it is important to recognize that pension funds are a bipartisan issue. Well run funds are found in both Democratic and Republican led states while some of the worst basket cases are also found in Democratic and Republican led states. It is one of the few bi-partisan issues left, despite Mitch McConnell’s protestations about bailing out Blue state pension funds. His own Kentucky is competing with some of the worst-run states.

My sense for a long time is that many progressive minded Americans oppose the “Canadian” model as it is seen as “privatizing” Social Security in that the Canada Pension Plan which is more akin to US Social Security than the various pension plans covering government employees, assets are now invested in private sector capital markets instead of non tradeable govt debt like the US Social Security and Medicare trust funds are. On the otherhand, when US “conservatives” talk about privatizing US Social Security they are really talking about individually directed private accounts akin to Roth IRA’s that easy pickings for Wall Street “sharks” not a system where govt employed portfolio managers manage the system’s portfolio assets on a systemwide basis.

The US “progressive” view I think would also argue that there is was no need for the reforms to CPP or the Canadian Federal Govt employee pension system called the PSPP as Canada issues it’s own currency and can print basically as much money as needed to fulfill it’s obligations to plan beneficiaries.

Printing money can work for the federal pension system. It doesn’t work for state/province or local systems since they can’t print money to pay for them, unlike federal governments. Although fintech would say they should just create their own crypto-currency and use that to pay for their liabilities.

Covid to the rescue!

Kill off half the population over the age of 65 and the numbers will look much, much better.

Well, I’m with you, Tom. I’ve been considering the upside to Covid since spring. Then Ives suggested I take into account the long haulers. The virus will be adding to the numbers of permanently disabled and they are not over 65. They’re probably in their prime earning years. Those of us lucky enough to have retirement funds are looking at maybe a life expectancy of 80-85, drawing down those accounts for 15-20 years. The disabled will be applying for funds a lot earlier and for a lot longer. And all this will occur in a shrinking job market.

As my husband just put it, ‘ it’s all fun and games until the music stops and you don’t have a chair’.

I notice in the article more than one mention of the Canadian plans being more conservatively managed. The article describes how U.S. plans set goals for returns that cannot be met. However, I’d say that the reason that the U.S. plans engage in these fantasies is that the defined-contribution benefit plan is designed to inflate the U.S. stock market. So you have millions of middle-class people propping up Wall Street with their retirement money.

I’m so old I recall my immigrant relatives (and their kids, my parents’ generation) walking over to the savings & loan with their envelopes of dollar bills, which went into savings accounts that paid 5.25 percent interest–a rate that meant that long-held accounts built up enough cushion so that they could indeed retire (with Social Security and, likely, a union pension). Yet banks now pay interest rates that are near zero on accounts–so all of these savings are looking for some instrument that promises earnings at more than, ohhhh, 2 percent.

It also crosses my mind that the mishandling of these pension plans is a not-so-stealthy tactic to bankrupt states. The entire country is now run like the scenario that brought us Amtrak–and I am an admirer of Amtrak but not of how the railroads were allowed to destroy and abandon passenger service.

“Can’t-do America.” The metaphor has been around for a while. Duncan Black at Eschaton uses it often. We all have to bw ready to use it more often. It is a metaphor and a diagnosis–at a time when people are still caterwauling about having to put on a mask.

As always is the case, both sides latch onto their position that the other side is at fault when the reality is both sides are to blame. Politicians lavish benefits on state/.gov pensions(and paper over the underfunding) as they know this voting block can undermine their reelection chances. The employees press for big pensions and stack their retirements by increasing their hours in the last years of employment to gain bigger pensions.

Why would it be rational for fund trustees to defend underfunding? Because they are in alliance with the pols who assume the con won’t blow up on their watch.

Imagine this Revealing Article resonates with many following the NC.

That Kentucky is really in a fix with its 13% funded Pension—a fact that was public and voiced during the Teachers Strike and past Election, but without consequence.

imo, we are a Nation in need of Shock Therapy at FULL power. The grift is everywhere you look with your eyes open.

Kinda hard to do that when the MSM keeps the sedative flowing.

Newsom is owned by the State employees. That’s what makes us a one-party state. He’s hoping for a Biden Bailout because the taxpayers are getting smarter. They are turning down the bond issues that are disguised as “For the Children” but really go to Pension Bailouts. Over 80,000 State Employees have pensions of 100k or more. Many in the 200-300k range. I know two retired fire dept guys making over 14k a month. The highest CALPERS pensioner is Curtis Ishii at over $418,600 a year.

oh really?I thought the bond issues were the result of prop 13 restricting the state from getting money the old fashioned way. Also, if newsome were in fact owned by state employees then why is he silent on CalPERS?

I am a CA state taxpayer, so I am foreseeing future liability for CALPERS pensions coming to my doorstep.

But, the belief that the typical CALPERS pensioner receives a large pension is belied by the information below:

From https://news.calpers.ca.gov/5-fast-facts-about-calpers-pensions/

>The average pension for all service retirees is $37,008 per year, while a new retiree who retired in fiscal year 2018-19 receives $41,556 per year.

>Overall 61% of all CalPERS service retirees receive less than $3,000 a month. And only 4.1% of CalPERS service retirees receive pensions of $100,000 per year or more; they are usually executives who hold seats in either city or county offices, or are physicians, or senior managers for police and fire departments.

>Unlike the private sector, about 33% of CalPERS retirees don’t coordinate with Social Security for benefits. Their CalPERS pension may be their sole source of retirement income.

Note only 4.1% of CalPERS retirees receive pensions of $100K or more AND some CALPers pensioners may not receive Social Security to supplement their pensions.

There is more information at https://www.calpers.ca.gov/docs/forms-publications/facts-pension-retirement.pdf

This has the CALPERS pension distribution at

4.1% at 9K/month or more

9.8% at 6K to 9K

24.8% at 3K to 6K

61.2% at 0 to 3K

While there have been headlines about officials grabbing/attempting to grab high CALPERS pensions

(see City of Bell scandal), it appears that the typical CALPERS retiree is not “living large”.

.

Your figures are highly misleading because they include part time workers – those who qualify for reduced pensions. The typical police officer retires with a pension in excess of $100K. Transit agencies in CA vie for the title of best paid across the country, and have it written in the union contracts. In the SF Bay Area everyone knows how very well paid BART employees are, and how generous are their pensions. A BART janitor made news for pulling in an additional $200K in one year due to overtime pay.

It’s the Bay Area. The cost of living there has exploded so much that $400K is now considered “middle class.” The average BART salary is between $70,000 to $90,000 per annum which, while in most places might be pretty darn good, in the Bay, it’s barely scraping by. Your “one guy” earning $200K is probably an extreme outlier but you write it in passive aggressive terms to subtly imply that all BART employees are earning 6 figure incomes and living high on the hog. A rule of thumb I learned from my parents in my youth was “if it’s on the news, it’s probably exceedingly rare.” Besides, have you ever paid taxes on overtime income? I seriously doubt he saw even half of that $200k. But considering how little janitors make in general, it was probably far better than what he’s used to.

When it all crashed and burned in 2008, Goldman Sachs blithely said it was doing “god’s work” and began organizing syndicated investments for African ventures that paid 8%. That good old magic number. I’d submit that not even the massive continent of Africa could get the US out of its hole. Mostly because we insisted on digging it deeper. The round table come-to-jesus discussion we need to have goes much deeper than our pension fund debacle. It goes to the heart of our delusional economy. Rocks and vested hard places. Illinois can’t declare bankruptcy but it can and just did borrow massively from the US Treasury (or the Fed – I can’t keep track of the shell game). Janet Yellen is gonna open the floodgates like Gandalf. And every state will follow Illinois, I’d bet. It’s instructive to realize that California, and Illinois and many other big, rich and flat-broke states have, up to now, had economies as big as most countries. Chalk it up to neoliberal defiance and denial. So now finally, maybe, we’ll get our act together. The US Treasury, imo, has been planning to just “print” the money and take care of our former foolishness in one big effort. And here it is. Student loans, M4A, state bankruptcies, pension shortfalls, fix all the infra and do it green. And, oh yes, if Biden manages to hang on to his “win” we will fund the military like never before. I’m just hoping most of that is green too.

About investment choices – life insurers match investments with long-lived liabilities with the priority being to ensure that funds are there when claims need to be made. Maybe it has changed but that used to mean very little equity investment, and generally stiff reserve requirements for equity and equity like investments like real estate. 20 years ago it was understood that pensions were digging themselves into holes by overestimating returns and underestimating investments needed.

Yep. When sober men and women ran pension funds and state leges fulfilled their financial contribution obligations, that’s how it worked.

And then… In my state, sometime during the 1990’s when the stock market was going up,up,up, the state lege decided it could stop its required annual contributions to the state PERS retirement system and let the “magic” of the stock market take care of funding its share of the costs, letting stock market investment returns to the PERS system make up its missing contribution. The lege then used the tax “savings” to cut state income taxes. Seemed to work like magic. Until it didn’t.

The dot com bubble crash in 2000-2001 should have been the warning that tax breaks paid for by under funding the PERS system, on the assumption that the stock market would make everything jake, was misguided. By 2001, the state lege was hooked on the appearance of what looked like free money and easy budgeting. Just keep the PERS system investing and the stock market fairy will return to shower the PERS system with money. Except, it didn’t. The FED keeping fixed incomeTreasury interest rates artificially low for years now hasn’t helped.

Thanks to NC for your continued reporting on CalPERS, pensions, and PE.

Many states regulate their life and property insurance providers much more heavily than their pension funds. Most states have quite powerful insurance commissioners supported by actuaries etc. It is one of the reasons that insurance companies will back away from high risk arears in many states, because they are not allowed to set up Ponzi schemes that will collapse after a disaster.

The financial issues of the French Anciene Regime brought the world the French Revolution. Just saying…

One of the reasons France had its financial issues that led to the French Revolution was its military and financial support the American Revolution. The opportunity to use Americans to tweak the British nose was too compelling. Without the American Revolution, the French Revolution may not have happened at all. https://en.wikipedia.org/wiki/France_in_the_American_Revolutionary_War#:~:text=Because%20the%20French%20involvement%20in,debt%20to%20about%203.315%20billion.

For decades, CA politicians have been bought and paid for my CA government unions. Government union members heavily fund and campaign for the Democratic politicians running Sacramento, who in return give government workers ever more, a win-win for the insiders with power and lose-lose for everyone else

CA government unions always demand more, never give an inch. Why? Because they can. Taxpayers have no say and are left with the bill. CA is a state that is run for the govt unions, where taxpayers are told to shut up and pay up

The CA plan is for the Dems to rule DC, crank the printing press, and bailout CA from the mess of their own creation.

I have lived in both Canada and the US. A fundamental difference between the two countries is that Canadians believe government can and should be effective while Americans believe government is unlikely to be effective and it is irrelevant if it is or not.

So once Canadians understand that there is a fundamental challenge to something important and that government should play a role, there is an expectation that government will do reform to successfully reposition the challenge for the future. Americans simply don’t think about it at all and assume that everything will be good.

So Canadian healthcare provides universal coverage for most important services and is constantly being tweaked to improve itself. There is a lot of latitude province-by-province to resolve unique challenges, but the fundamental support is present across the country. The US passed the ACA along with the hodgepodge of Medicare and Medicaid. Then it keeps shooting at them to kill them. So the US ends up with more expensive and more complex systems that don’t work as well. Why should public pension funds or infrastructure be any different?

BTW – Canada is now taking steps to make sure that the Trump plan to buy Canadian prescription drugs at lower negotiated prices won’t result in shortages of those drugs for Canadians. I am sure the drug companies will be very supportive of this as they would prefer to sell Americans much higher priced drugs in the US. https://www.reuters.com/article/usa-healthcare-canada/canada-blocks-bulk-exports-of-some-prescription-drugs-in-response-to-trump-import-plan-idUSKBN2880RJ

This might be a naive question, but could CalPERS loan the money to, say Caltrans, the HSRA, and other infrastructure agencies to get projects moving (and boost employment) while also having long term investments in infrastructure? Or would such an approach require facilitation through some sort of public bank, like a “Bank of California?”

The short version is CalPERS can lend directly, but infrastructure financing is very complex, so CalPERS would need to develop/hire the needed skills.

Thanks! Of course, there is nothing to stop CalPERS from developing/hiring the needed skills, other than the current crop of pols who are, at best, not interested because they think everything is hunky dory or, at worst, stand to profit from all of CalPERS’s risky investments.

I suggest New York State as ground zero for reform. It’s one of two states whose pension funds are controlled by a sole fiduciary. So theoretically all it would take is a new comptroller to start cleaning things up.

Yes, and theoretically all it would take is another corrupt new comptroller to screw things up even worse

As with most things, the caliber and integrity of the individuals is more important than the system they operate in. DiNaploi has done a good job and NYS voters have had a lot of faith in him. So far he appears to havel ived up to it. These are the types of positions, like state Secretaries of State, that are usually below the radar screen but rely on having people of bedrock integrity as we are observing in the current election.

You are barking up the wrong tree. The NY State and Local Retirement System is 97.4% funded, and NY Teachers, 100.9% funded.

Would MMT advocates prefer a divestment from pension assets (leaving that to private sector pensions), and making public pensions a money-creation-backed/funded guarantee?

I’ve always viewed the public pensions crisis as fake/manufactured – a result of choosing to structure pensions in their current way (where the funding crisis is real within those constraints) – when the reality is that the funding pot for pensions, is the entire governments spending ability (if we want it to be and make that happen…), not merely the pension funds assets/financials.

I understand the need to argue within the constraints of the current system, though. This point of view is not much use until MMT is dominant in policymaking.

So, state pension funds have made promises they can’t keep. Can the Feds solve the problem for them, along with Social Security’s own funding problem, using MMT magic? Or will they have to run their own catfood commissions?

I’m not sure, particularly because, in the US, public pension funds are managed by states and not the Feds (the SSA being a notable exception). Since states cannot create their own currency and rely on the Fed for currency, they would not be able to make public pensions “money-creation-backed/funded guarantees” as you said.

I agree with you that the public pension crisis is manufactured. I suspect the end game is to destroy them as part of the neoliberal plot to destroy all remaining aspects of the public sphere and what better way to destroy them than to get rich off of risky bets until the system comes crashing down. Then those same people who got rich off the risks will run around screaming “see! I told you public pensions were a bad idea!” No, funding them with high risk investments was the bad idea, but try convincing the public, who now has to bail them out, of that. If we had pols who actually cared, they’d go after the PE crowd and make them cough of the dough to fix them, but I don’t see that happening anytime ever.

I would like to see MMT be the dominant policy but I’m not holding my breath on that either. Too many people stuck in the gold standard era, even people who were born after that era ended are stuck on it because all their Econ profs and mentors were stuck on it.

Having the Federal government bail out of state pension funds doesn’t seem all that much different legally from bailing out a Goldman Sachs or an AIG. If MMT’ers are so enamored with using money creation for solving unemployment and student debt, why not solve this too?

Below Exhibit 19 we have:

I think the ending should say “Canadian” rather than “US” pension funds.

Will fix, thanks!

I think it would help if CalPERS was required to produce quarterly reports showing their funded status (assets vs. liabilities), just like every publicly traded company is required to produce quarterly reports (10-Q) showing their assets vs. liabilities.

With only annual reports being required, and with the annual reports being delayed for more than 5 months after the end of the fiscal year, and even then only showing the funded status as of the beginning of the year rather than the end of the year, the most recent funded status currently available shows 70.2% for June 30, 2018, which is an appalling 29 months ago.

I’m down with that. As a beneficiary, I’d weigh in also. I doubt they’ll listen to me. Most pols have a “I know better than you” attitude and would likely give some variation of “you’ll be fine because your pension is guaranteed.” They can’t fathom that I might not actually want to burden my fellow taxpayer with their reckless handling of the fund. But requiring quarterly reports might be a step in the right direction. And penalties for not providing them on time.

The 2019-2020 annual report is available today. It shows the funded status as of 6/30/2019 (yes, hot off the press but with stale data from 1.5 years ago) at 70.2%, exactly the same percentage as 6/30/2018, although the unfunded amount in dollars has grown $8B to $158B from $150B in that period.

https://www.calpers.ca.gov/docs/forms-publications/cafr-2020.pdf#page=134