Yves here. For those with the means (or the good fortune to live in countries with adequate safety nets), hunkering down with Covid has eliminated or reduced spending on personal services, travel, and entertainment. One of my road warrior friends who made a point of making sure her conference schedule allowed her to see opera in Vienna and theater in London says she doesn’t miss the travel and that pretty much everyone who used to go on these junkets has worked out that they were big time and money sinks. This article describes similar changes in not just habits but also preferences among consumers, at least in Europe. If nothing else, it’s allowed introverts to stay home and not be apologetic.

However, a countervailing data point is that a friend still in Manhattan just dropped off a big load of dry cleaning. The manager said they were busy, which seems surprising given that all those people not going to offices are supposedly hanging out in sweats. He said that clients were still dressing up at home to be festive and spilling wine on themselves as before.

Mind you, I’m not endorsing the Mellonite view in this article, particularly since if the authors were to adhere to it, airlines would be close to the front of the line of companies that would be allowed to fail. While there is an economic cost in preserving enterprises that have questionable futures given Covid’s restructuring of the economy, the flip side is that some countries have decided to allow inefficient sectors to survive to preserve employment. Japan’s retail sector, with small shops in many urban neighborhoods, is a textbook example.

And let us not kid ourselves that a lot of the restructuring that is going on isn’t even remotely related to efficiency but preserving the pay and perks of the top brass. Look at colleges and universities, where in some cases entire departments and programs are being shuttered, yet senior level administrator jobs are untouched.

By Alexander Hodbod, Counsellor to ECB Representative to the Supervisory Board, ECB; Cars Hommes, Professor of Economic Dynamics at CeNDEF, Amsterdam School of Economics, University of Amsterdam; Stefanie J. Huber, Assistant Professor, Amsterdam School of Economics, University of Amsterdam; and Isabelle Salle, Principal Researcher, Bank of Canada. Originally published at VoxEU

The profound and protracted experience of the COVID-19 crisis may fundamentally change consumer preferences. This column reveals how a representative consumer survey in five EU countries indicates that many consumers do not miss certain goods and services they have cut down on since the COVID-19 outbreak. It concludes that fiscal policy must recognise that some firms will become obsolete in the altered post-COVID-19 environment. To achieve a swift recovery, these obsolete firms must be allowed to fail fast so that resources can be reallocated to more efficient uses.

From the outset of the COVID-19 crisis, there has been a rich debate on the appropriate fiscal response. Soon after the crisis began, analysts quickly diagnosed the huge consequences it would entail for the macroeconomy (e.g. McKibbin et al. 2020, Gopinath 2020). Major negative impacts would arise from both the demand and supply side (Brinca et al. 2020). The economics profession strongly encouraged governments to swiftly pursue aggressive fiscal expansion to help keep employers afloat and to maintain household solvency (e.g. Gourinchas 2020, Goldberg 2020). Governments across the developed world have heeded this advice, introducing unprecedented broad-based support measures such as furlough schemes, loan moratoria, and outright subsidies for struggling firms. These economy-wide responses allowed those sectors of the economy impacted by social-distancing measures a chance to survive the initial COVID-19 shock. However, as the duration and the extent of the crisis are becoming clear, governments must ask themselves how to hone their continuing support to the economy to transition to the post-COVID-19 equilibrium.

In particular, the longer the crisis lasts and the more profound the experience of it is, the higher the chances that the post-COVID-19 economy will look fundamentally different from what preceded it. If consumer preferences have fundamentally shifted in response to the COVID-19 experience, some firms and potentially some entire sectors will become obsolete. Fiscally bailing out such obsolete firms on an ongoing basis will, in the long run, merely create unsustainable ‘zombies’ and mismatch unemployment. Concerns about zombification are also growing due to the current extreme liquidity that exists in debt markets and the associated corporate debt overhang that is building up (Jordá et al. 2020).

Our recent paper (Hodbod et al. 2020) seeks to provide insight into how different the post-COVID-19 equilibrium might be from what preceded it by using a cross-country survey of five European countries. In line with existing recent country-specific studies looking at France (Bounie et al. 2020), Spain (Carvalho et al. 2020), the US (Coibion et al. 2020), South Korea (Kim et al. 2020), and the Netherlands (Golec et al. 2020), we observe major consumption drops across sectors since the COVID-19 outbreak. We contribute to this related descriptive literature by analysing the data on households’ self-reported reasons for their consumption shifts. Thus we provide initial evidence on the nature of the COVID-19 demand shock and on how durable the reported consumption shifts could turn out in the post-COVID-19 environment.

Sector-Specific Shifts in Consumer Preferences

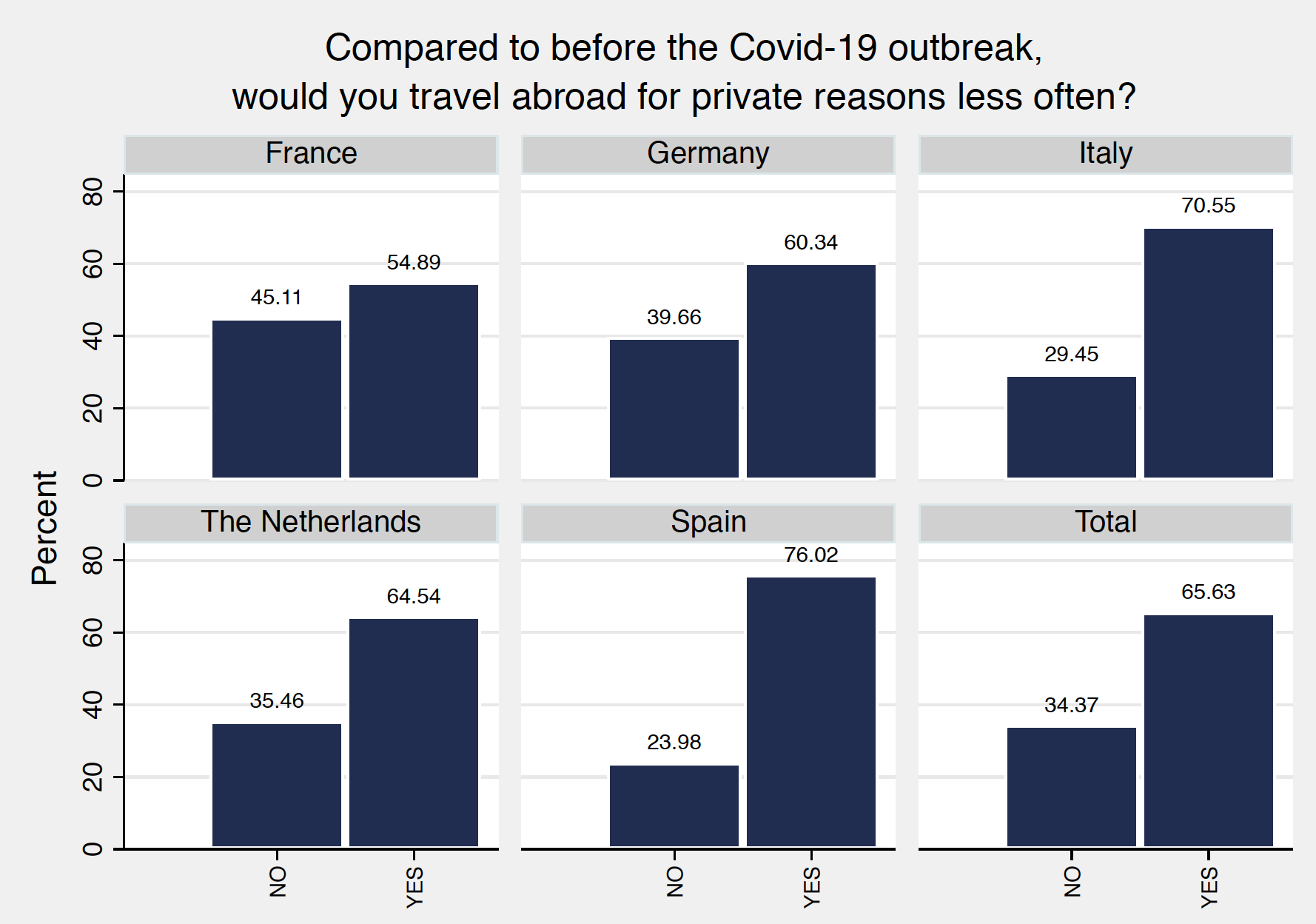

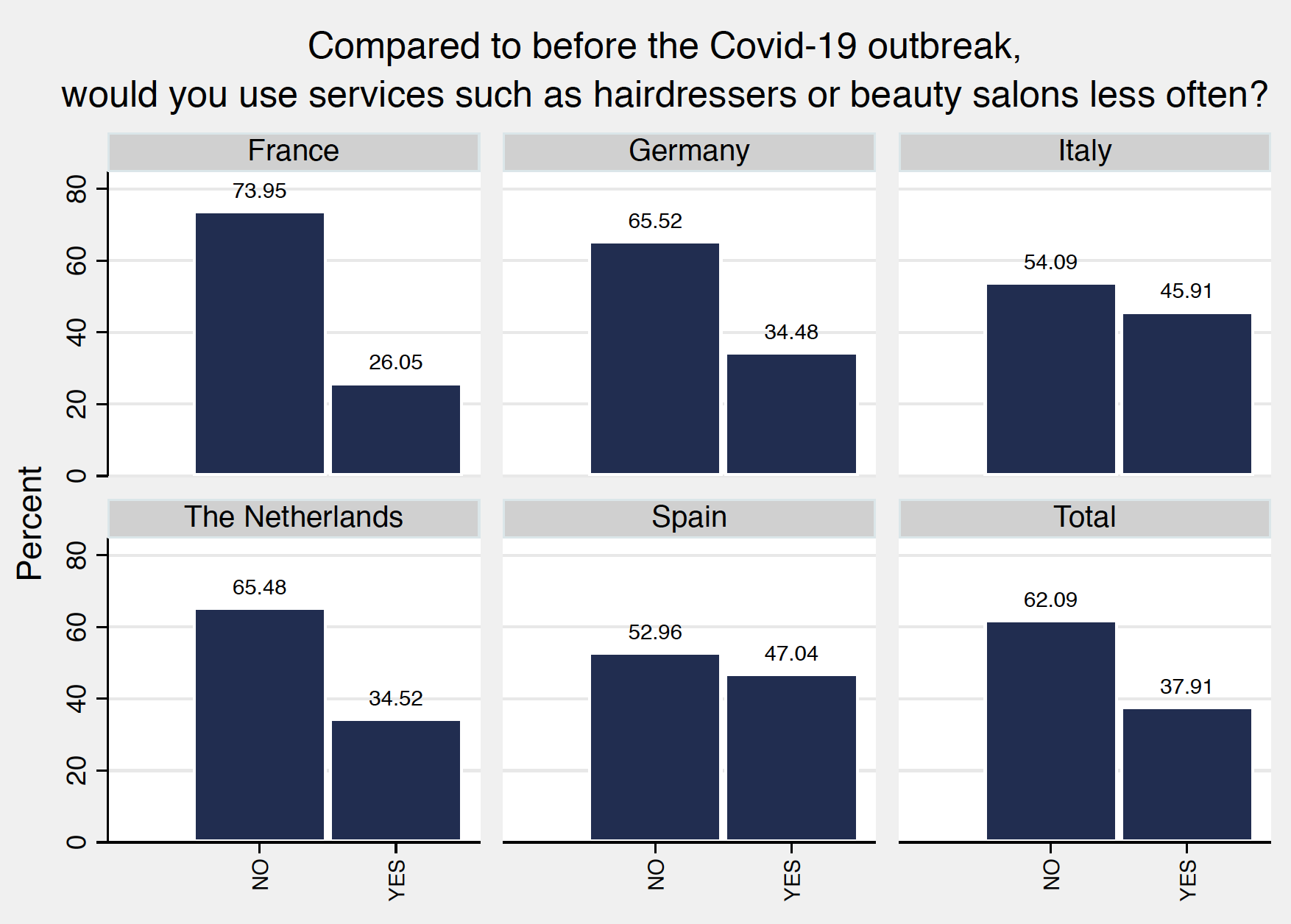

A sample of 1,500 representative households per country was surveyed in France, Germany, Italy, the Netherlands, and Spain. We collected the data after the first lockdown experience in July 2020, at a point when those initial restrictions were completely lifted. The survey asked households how their current consumption compares to before the COVID-19 outbreak for five key sectors (tourism, hospitality, services, retail, and public transport). We find that a substantial fraction of households decreased their consumption across all sectors, with the largest drops in Spain and Italy. Overall, tourism was the most negatively impacted sector (66%), followed by public transport (58%), hospitality (55%), retail (46%), and services (38%) (see Figure 1).

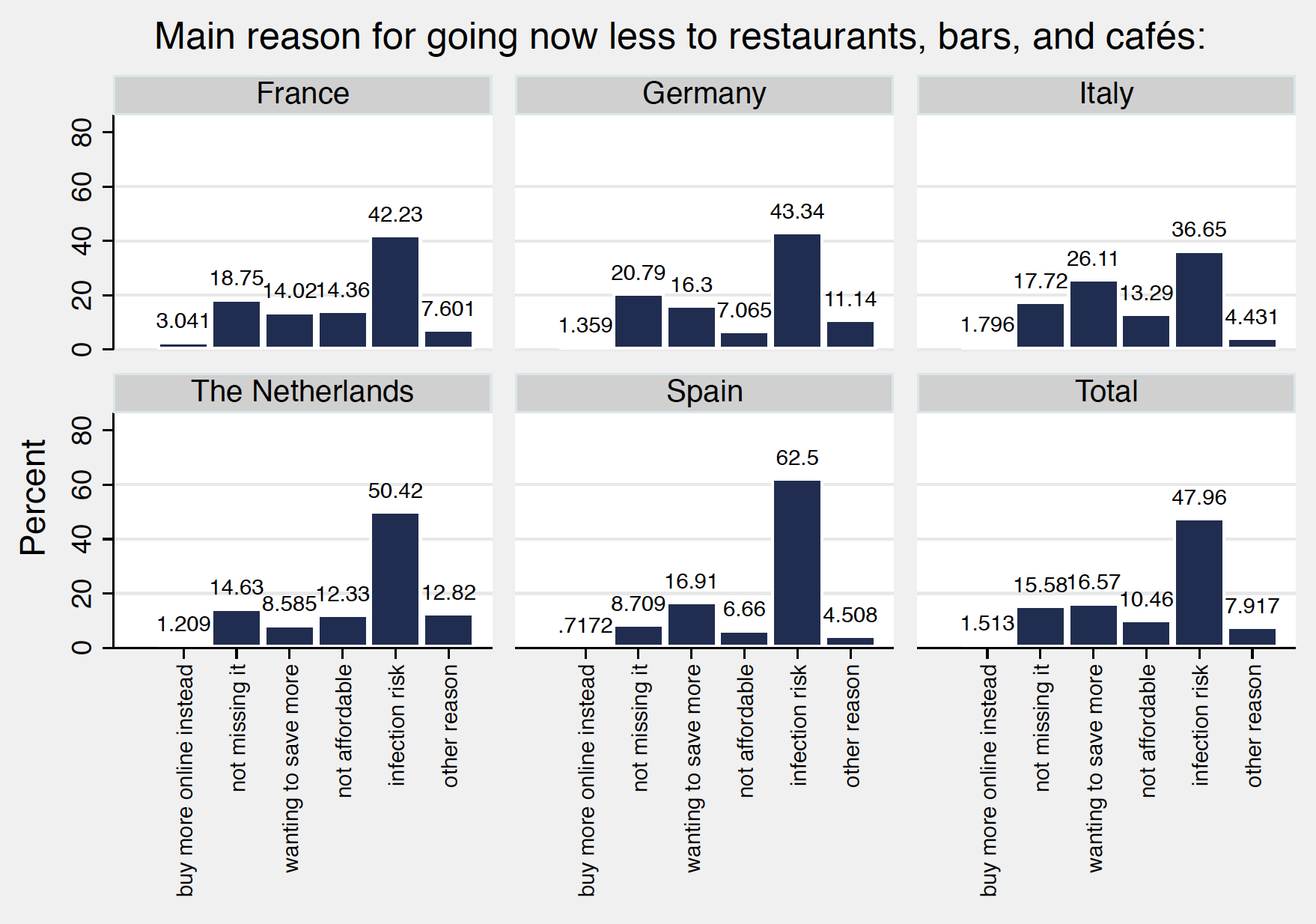

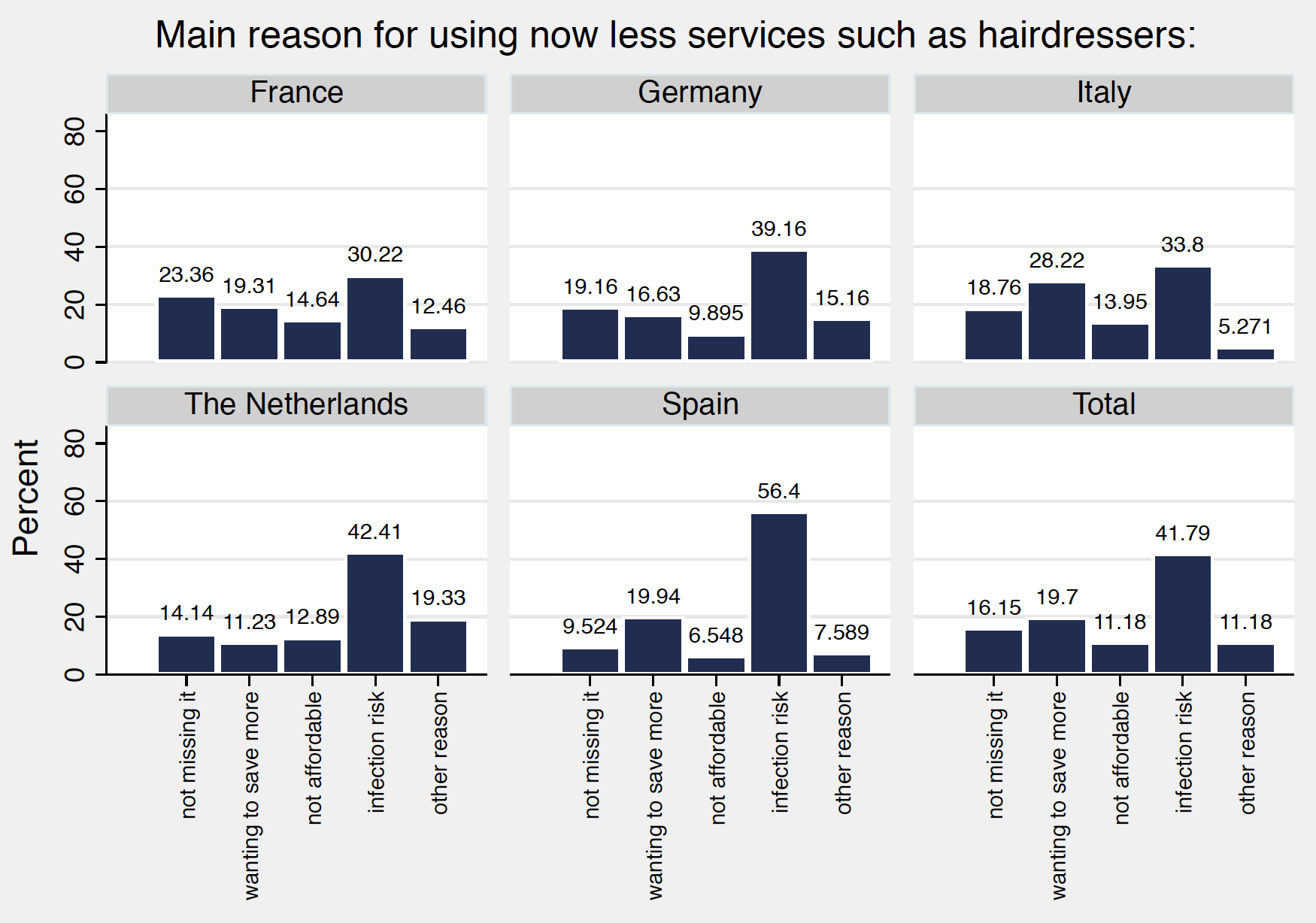

Households were specifically asked to state the primary reason for their consumption changes. We focused on five self-reported drivers of consumption changes: (1) financial constraints, (2) worry of infection risk, (3) a lack of confidence in the future that induces a rise in precautionary savings, (4) substitution to online alternatives, or (5) permanent shifts in taste and preferences arising from the lockdown experience. This design allows us to reveal the underlying drivers for reported consumption changes and thereby to shed light on the nature of the COVID-19 demand shock. Are we merely experiencing a transitory income shock? Or a shock to consumer confidence? Or is the COVID-19 experience a game-changer, creating permanent changes in consumer preferences?

Figure 1 Fraction of households that consume less compared to before the COVID-19 outbreak (selected sectors)

Signs of Substantial Long-Term Structural Consumption Preference Changes

Lockdowns and travel restrictions were lifted in the countries during the time of the survey. Figure 1 shows that, despite this, a large fraction of households report reducing their consumption compared to before the COVID-19 outbreak. Analysing respondents’ feedback on their underlying motivation for changing consumption habits shows that a substantial fraction of households report what seems to be a durable shift in preferences. In France, Germany, and the Netherlands, “the realisation of not missing it” is the second biggest explanatory factor that respondents cite to explain their reduced consumption.1

Households’ permanent preference shifts are particularly observed in the services sector (such as hairdressers) and the hospitality industry (i.e. restaurants). For example, the fraction of households that realized that they do not miss services such as hairdressers amounts to 23% in France, 19% in Germany and Italy, 14% in the Netherlands, and 10% in Spain. At the same time, the fraction of households that realised that they do not miss going to restaurants amounts to 19% in France, 21% in Germany, 18% in Italy, 15% in the Netherlands, and 9% in Spain (Figure 2).

Slightly behind the fraction of respondents that don’t miss consuming the products and services in question, another substantial fraction cite precautionary saving motives. This saving motive is the second most cited reason for reduced consumption in Italy and Spain, and the third most popular in France, Germany, and the Netherlands. Within this segment of respondents, one may speculate that underlying permanent preference shifts could be taking place. Amongst those having chosen to forego certain consumption goods and services for an elongated period, a proportion may end up shifting their consumption patterns permanently as they adapt to living without them.

Beyond the question of how much households are consuming, one must also reflect upon how they are making their purchases. For instance, amongst respondents indicating a reduction in their shopping at malls and other stores, a significant number report that this was due to substitution into online alternatives. The fraction of households reporting online substitution as the main reason for shopping less in malls and other stores is highest in France with 16% and lowest in Germany with 9%. As the crisis becomes prolonged, consumers may become accustomed to this new way of consumption, which could lead to a long-term shift in the retail sector away from high-street shops.

Figure 2 Reasons for consumption reduction (selected sectors)

The Crucial Factor: Personal Experience with COVID-19 Infections and the Severity of the Health Crisis

On an aggregate level, the fraction of households reporting to be reducing their consumption compared to before the COVID-19 outbreak is highly correlated with the number of deaths per million of the population and personal infection experience during the preceding lockdown. We exploit the heterogeneous severity of the health crisis across the five countries surveyed to investigate what drives households’ reduced consumption in each sector. Using probit regression models, we find that gender is the only socioeconomic household characteristic that is consistently and significantly associated with consumption changes. Standard socioeconomic household characteristics such as income, age, employment status, and education play a negligible role. Instead, behavioural factors such as macroeconomic expectations (pessimism) and psychological factors (such as worries and fear) are powerful explanatory factors underlying households’ consumption drops in all sectors. These behavioural factors are highly correlated with the severity of the health crisis and with personal experiences of COVID-19 infections within respondents’ family and friend networks.

Honing Fiscal Policy to Prepare for the Post-COVID Era

Despite the recent positive vaccine news, it remains clear that the risk of infection will unfortunately remain with us still for quite some time. Nonetheless, governments must begin to plot a policy pathway out of the crisis and towards a new post-COVID equilibrium. Our results suggest two conclusions that policymakers should keep in mind to ease this transition.

First, our indicators of long-term shifts in consumer preferences should serve as a warning against maintaining broad-based horizontal fiscal support to firms for an extended period. Given the scale of the shock and the profundity of the experience, some fundamental changes to consumer preferences are likely. The shift to a post-COVID equilibrium will therefore require some obsolete firms to leave the market, allowing resources to be reallocated into new sectors that better reflect consumer demand.

Second, until the health crisis is over, governments should avoid seeing their dual objectives of protecting citizens from virus risk and preserving economic prosperity as a trade-off. Our results instead suggest that governments should see controlling infection risk as a prerequisite to preserving economic prosperity.

Authors’ note: The views expressed here are our own and do not represent those of the ECB, the Eurosystem, or the Bank of Canada.

See original post for references

He said that clients were still dressing up at home to be festive and spilling wine on themselves as before.

So I pretty much only drink red wine, and I have this – dare I say it – wine colored shirt, and people say, “Oh, your wearing your red shirt.” And I say, “No, its a white shirt”

I wonder how much that statement captures people socializing behind closed doors in defiance of lockdown edicts.

Here in Tucson, those gatherings are called Underground Parties. The tell is when you see people knocking on the door of a house, and when the door opens, the LOUD music blasts out.

I haven’t darkened the door of a dry cleaner in months. My wine consumption, on the other hand, is as robust as ever.

I’ve heard the quip that business travel will remain suppressed indefinitely, but I would argue it will rebound as quickly as is possible. In the world of sales there is real value of meeting people. While I agree that it will take time to rebound, it’s a true competitive advantage to be in front of clients. Though at the rate we’re going, it’s hard to predict when that travelling future will be.

Regarding dry cleaning, I have colleagues who dress up for Zoom. They put on work clothes to create a work routine and also drive home a work life balance. Taking off those work clothes signals it’s time to turn off the laptop and stop checking the phone. I’ve heard that some people even simulate a commute by building walks into their morning and afternoon times, again to better define work/life balance.

Yes, I believe sales will be a big driver. Its one of those parts of the business where if you feel or are seen to not be persuing all avenues to get the sale then you will get roasted if the sales dont happen or are lower than wanted. So if you can go meet people, there will be pressure TO go meet people.

But that doesn’t mean the prospect will take the call! After a year plus of sales meetings on Zoom, why the much greater intrusion of having them literally in your face?

True, sales travel will be the most likely to return. There is an advantage to being in front of your customer.

However, will your customers want you face-to-face in front of them to the same degree they did before?

And, there is a lot of business travel that is not sales. Will companies send the same number of people to conferences and tradeshows? Will companies realize that international trips are extremely time consuming and expensive relative to what gets accomplished?

Having travelled a lot for business, pre covid we have struggled to convince clients to pay for business flights where its less than 12 hours. Having been forced into other options for the last year and at least next (as africa etc will be the last to be vaccinated) clients will want to avoid paying for hotel/flight/feed etc. So whilst there will be some return those relying on the business traveller (hotel/restaurants/car rental/taxi/flights) will only see a portion of it return and we tend to the more profitable ones. I dont miss not having platinum status etc as i get to spend more time at home. It will differ regionally. ie the bounce back maybe more in the states where a plane is like a bus or train like Europe, but other areas will more likely keep virtual. The same applies to the commuter who prefers wfh, the sandwich shops etc will likely see a long term drop off, do i need to purchase the newspaper at the station or the devices people use on the train etc. Do we still need expensive rail projects now into places like london. ie infrastructure spending, should be more geared to to having good connections. Housing spending will evolve. A one bed flat or apartment no longer suffice for those working from home. In asia (eg singapore) when you buy an apartment there is the maid annex (ie live in), will we now see places designed with the home office as a key selling point.

Not sure if this is an outlier, but the CEO of the investment bank Moelis & Co. last week told Bloomberg:

“We all woke up and said, ‘Wow, you mean we could have done this without flying 20 hours and drafting a document in a room together?’ This is a moment of enlightenment.”

I think most of his employees are non-sales business travelers.

Even for non-sales, I find it essential for my entire team to meet physically, maybe once a year is enough. But there is too much hidden on video-conferencing, chat, and email.

The physical meeting is kind of like an inoculation against misunderstandings in the rest of the year, because we can fill in the unspoken/unwritten gaps that are hidden in a non-physical situation.

One of my local colleagues is a Zoom fashionista. Dress-up clothes. Makeup. Jewelry. I mean, she goes all out.

Me? Let’s just say that every day is dress casual day at the Arizona Slim Ranch. And that includes my Zoom time.

When I first started teleworking in 2012, I would actually get in my car and take a quick drive to grab a cup of coffee, just to simulate the commute and be mentally ready for work. After a few months, I no longer needed it, but the concept of those routines were important at the time. interesting how the brain works.

I honestly don’t know if people will stop eating out as a habit – anecdotally, people I know are chomping at the bit to go out again to their favourite restaurants and pubs. Younger people especially. Although I suspect that high quality takeouts will surge – quite a lot of people seem to have developed a habit of ordering in (or collecting from) one of their favourite restaurants on a Friday or Saturday night. My local food pub does some very nice ‘heat at home’ dishes. It still works out cheaper as you can avoid pub prices for wine or beer, but then again, perhaps that will mean they’ll have to adjust their costs upwards.

For travel, again I think there is a lot of pent up demand. Some of it is postponed trips – I know many people now who haven’t seen their family abroad for a year and are desperate to go, especially those with elderly parents or grandchildren in other countries. Once the vaccine is rolled out, I suspect there will be a big pick up in that type of travel. I think though that habits may well change for regular travel – I suspect it will be some time before people take multiple breaks a year, not least because it will be a while before cheap flights return. Certainly here in Ireland, the price of hotel breaks has dropped very significantly, and I think because of that far more people will take a domestic holiday – maybe one longer one over the summer, rather than multiple trips. I certainly hope that they will not go back to school foreign trips (the first wave of Covid in Ireland was overwhelmingly brought in by teenagers returning from school ski trips to Austria/Italy, the second wave was from those who insisted on going to Spain for their summer break – something like 60% of the current Irish wave is from a Spanish strain of the virus).

I wonder if people will also reconsider the cost of travel. There is a boom right now in home improvements, almost entirely funded by money from peoples cancelled breaks. People may decide now they’d rather invest in their homes and take fewer trips away.

I think the big changes will be in work and office. People will return to offices, but it will be a different pattern of work. I think we’ll see a pattern of 1-3 days in the office, the rest at home – partly because companies will save on office rents, partly because staff will insist on it. I think that change is quite fundamental, and it is the death of a myriad of industries associated with supporting office workers, from sandwich bars to hotels to conference facilities and so on.

“There is a boom right now in home improvements…”

I had planned a bunch of home improvements but I am not comfortable having workers in my house right now.

On eating out… the problem is that it’s the smaller, individual, interesting restaurants that will never reopen because the families that run them have given up.

The good news is that the odd little businesses (think spare parts for 100 year old Singer sewing machines) can thrive online.

I think that the writer has the right hypothesis (secular spending shift) but needs to also look at geography.

IMO, the real story is that noticeable % of people will be moving one’s primary home from southeast London, NYC, San Francisco to Cornwall, Florida, Austin, etc.

IMO, much of consumption is status-signalling. People live in SF because they’re bosses do or their social network—even if they never go to an art gallery or prefer steak and burgers to 3-starred Michelin food.

Covid broke the dam and gave high status people an excuse to leave SF, NYC. And unlike the 70’s or 80’s, Austin TX, Florida, etc. have the cultural and services infrastructure (eg, restaurants, hospitals, etc.) that the top 5% of consumers want.

and naturally their underlings and others who like nicer weather will follow.

Poor Cornwall. What did it do to deserve those people?

Said Slim, who is Cornish American, and believe you me, my ancestors weren’t well off. Uh-uh. That’s why they had to leave Cornwall in the late 1800s.

The empire brought in cheaper tin from Malaysia and that broke the back of the local mining industry, and, by extension, the Cornish economy. It has never recovered.

I am concerned about this trend affecting the board game industry.

It has been booming the past two decades but for a few years before 2020 prices of sets had started to balloon. There are several reasons for this but the two main ones appear to be consolidation (Hasbro is fast on its way to become the monopoly) and complexity. Small and large publishers now released bigger sets with more components, and average base set prices have increased from $40 to $60, with more and more around $100. The average board game enthusiast will spend even more as expansions are released to augment the base game. It is very much the “block buster” business model, that usually means creativity declines as sequels and reboots dominate (e.g. Arkham Horror is on it’s 3rd edition).

Board gaming is a social activity, but now most players have become used to low digital subscriptions or once-off payments to play their favorite games online.

Speaking personally, I have stopped buying physical sets and my subscriptions and digital purchases for 2020 have been 14% of what I normally spend in a year.

If other enthusiasts have adapted a similar shift, and I don’t see how they haven’t, then the industry is looking at an estimated 80% decline in revenues.

Like what we are seeing in retail and restaurants, it will likely be the independent publishers that vanish, the small to medium companies that give this industry it’s diversity and vitality.

Yes, the pandemic will eventually end, but it will have gone on long enough to change this hobby.

Apologies for not noticing that [family blog] auto-correct prefers “it’s” to “its”.

I’m concerned about something similar happening in the miniatures games industry. Beginning to feel like the bigger games like Warhammer 40k will have a lot less competition in a few years.

Articles like this are why I predict a resurgence of Dr. Guillotine’s device some day. Talk about being totally blind to the reality of the 99%, for whom a night at the opera in Vienna – even on the company’s dime – represents groceries for a week!

Don’t you get it, the 99% are not the people buying from Amazon, they ‘are’ Amazon. E.g. the drivers and warehouse workers! They are the lady at the checkout register, the greeter at the door, and the one tallying people in and out of Walmart.

As for the future, if we evade things getting so bad we have a replay of 1790s France, then I predict things will go back to normal surprisingly quickly. The point being people will resume going out to eat by August (theaters in Vienna included).

However, I will further predict masks will remain part of western culture much like it is in the orient before the pandemic. As for office work, companies will recalculate how much people really need to be around, but I suspect bosses will prefer to see people and thus, commercial office real estate will largely recover (although recall it was facing a swoon before this). The point being, warehouse space won’t get cheaper but offices will. And strip malls will be as busy as before because Amazon doesn’t affect beauty saloons, pizza delivery, and pool halls like large mall traffic patterns are affecting Macy’s and Kohl’s (despite their bucks).

In short, I predict we settle into a new normal recognizably derived from the normal of two years prior because people are creatures of habit. Folks, we’re talking about long established habits of shopping and going out and about. So just as in the 2 Corinthians 4: 17-18 where the Bible speaks regarding troubles . . . this too shall pass.

I went to VoxEU that originally published this and caught this endnote.

“Unsurprisingly, the most often cited reason for consumption reduction is the infection risk, while financial constraints are the least often reported reason across all sectors and countries.”

I was looking for more demographic info about the people polled. I could already tell by the questions/answers about vacationing that this was an elite subset being polled. And also have to consider they included Europeans who have a more robust safety net provided by their countries.

Good observation. My finances haven’t changed (retired), but two late 50s children’s jobs are gone for the foreseeable future. They’re self-sufficient now but can’t sustain it until social security age, plus they are losing their best years to build retirement. I wonder how many out there have the same concern.

Living in the US, makes it difficult for me to appreciate the value of this post’s view of how different post Corona “equilibrium might be from what preceded it by using a cross-country survey of five European countries.” Besides — in a US context — regarding the post Corona “equilibrium” through the lens of “sector-specific shifts in consumer preferences” seems not only cold-blooded but myopic. It may be a little premature to speculate about the post Corona world given how little we still know about how that world might congeal — especially in the US. Rather than discussing a shift in sector-specific consumer preferences I fear Americans will experience a fundamental change in their way of life.

I believe some of the shapes of a post Corona US appear clearer than others. I believe the US is undergoing a deliberate re-structuring of Government, the economy, employment, and living patterns. There are two aspects of the post Corona world in the US — the changes as a consequence of the Corona pandemic which are difficult to foresee, but also the chances fostered by the CARES Act, and probably by some more goodies tucked into the most recent doorstop funding bill that included funding for a very little Corona relief. I fear the post Corona “equilibrium” in the US will manifest the demise of many kinds of small and medium scale enterprise; massive consolidation of the existing Big Money enterprises funded by the US Government; severely crippled Local and State Governments; greatly deminished and degraded Government services — services like schools and mass transit; unemployment, homelessness, hunger, misery on an unimaginable scale. I assume the authors of this post are concerned about the inefficiency of what they term “mismatch unemployment”. I can only wonder what employment match they can dream up for the unemployed in the US.

The authors of this post need to immigrate to the US, where most of their dreams of creative destruction can come true before their eyes. They can see resources reallocated to more efficient uses — if ‘efficient’ means whatever use or lack of use the Market declares efficient. They can visit the American heartlands and see the wondrous efficiencies the Market has already achieved, or walk the streets of downtown to enjoy the many Corona shuttered shops for lease. In the US they can see waves of drifting homeless human ‘zombies’, zombie encampments, and perhaps worry about their debt-overhangs. But I trust they won’t be too disappointed that in the US the Market seems to have decided zombie Corporations are not a bad thing as long as they can produce rich compensation for their management.

To achieve a swift recovery, these obsolete firms must be allowed to fail fast so that resources can be reallocated to more efficient uses.

Bland technocratese…

In the charts provided, (hairdressers? really? They’ll bounce back has no one heard of “covid hair” it’s wild and crazy, but you’re not likely to leave it that way…) risk of infection outpaces everything, and when risk decreases, usage will increase proportionately, but ymmv…)

Slightly behind the fraction of respondents that don’t miss consuming the products and services in question, another substantial fraction cite precautionary saving motives.

and when the saving motivation is gone? Is this guy an economist?Ok, now bear with me for these three sentences…

1.)”…another substantial fraction cite precautionary saving motives. This saving motive is the second most cited reason for reduced consumption in Italy and Spain, and the third most popular in France, Germany, and the Netherlands. Within this segment of respondents, one may speculate that underlying permanent preference shifts could be taking place.

2.) “Amongst those having chosen to forego certain consumption goods and services for an elongated period, a proportion may end up shifting their consumption patterns permanently as they adapt to living without them.”

3.) The shift to a post-COVID equilibrium will therefore require some obsolete firms to leave the market, allowing resources to be reallocated into new sectors that better reflect consumer demand. um… And the example is, once again, hair dressers?

Point 3 is doing some heavy lifting there, and rhymes with “talking his hook” whatever that might be…

and then, SMH, he closes with this which compared to the stated conclusion that sectors will become obsolete seems completely out of left field and is a pretty obvious given…

Our results instead suggest that governments should see controlling infection risk as a prerequisite to preserving economic prosperity.

To my cynical mind it seems like an article pimping for amazon/uber and tech platforms, without mentioning them as that would give away the game.

I’ll admit to going into the article triggered by this claim…

The economics profession strongly encouraged governments to swiftly pursue aggressive fiscal expansion to help keep employers afloat and to maintain household solvency (e.g. Gourinchas 2020, Goldberg 2020) yeah… Right, as we used to say in ratchesta’ back in the day…

Interestingly, here in California the panic has caused every handgun store within 100 miles of me to sell out of stock. During the first lockdown the lines were usually out the door, now you have to call and reserve your place in advance and pay cash/check/debit only. This includes “online” sales, wherein the dealer agrees to accept an firearm you purchased online for a fee. Ammunition was bought out by hoarders months ago, so now most stores are limiting sales to 1-2 boxes per household (based on driver’s license) per week. Even the local Dick’s and Big 5 are selling out, now they’re down to odd caliber rifles and overpriced .22lr lookalikes (fake Mp5s, fake M1s, etc).

With so many new handgun owners, there’s going to be more demands to get rid of gun control. Right now the mandatory 10-day wait and proposed 1-gun-per-month rules are in the crosshairs as those are the most onerous for consumers. Things will change for the same reasons the War On Drugs is receding: more people are suddenly caught inside the red tape, and any additional sense of security wrought by putting people into jail over it is declining. It’d be about time, with BLM as big as it is and with their demands to defund the police in general (which more unhinged people have called for in regards to the BATF).

And on the flip side, I’m seeing CBD oil sponsor pray-ins on the TV. The only reason gun stores haven’t jumped on this is because of the obvious legal problems in using a firearm while intoxicated on a controlled substance. Eventually this will fall and so will the rest. If evangelicals can be convinced to take (legalized) drug money then so can people who traditionally oppose firearm ownership.

I feel fairly confident that I will never eat at a restaurant again. The thought of the people and their spit, germs, etc all over the place has me so grossed out that I would never enjoy myself. Plus, while it stinks to have to come up with different meals every day/night, on the *rare* occasion that we get take out (usually a pizza), I find that we all end up with stomach aches after we eat take out food. Maybe our bodies (particularly my 7 year old daughter) is not used to the preservatives (read: c**p) in commercial food? I cook only limited stuff but it’s all from good sources (high quality olive oil, imported Italian pasta, etc.).

As well, I will never join a gym again (I really never did, but toyed with the idea because winters in the north east are rough). My stationary bike and walks outside suffice. I do miss the yoga studio, though. But that’s easy enough to get my fix at home.

Hairdressers – I miss that. But do I need to go more than 2x/year? Nope.

And while I’m not saving a ton more money (food prices are astronomical), it does feel good to be sensible and thoughtful about my money in these uncertain times. And I think we are in for a lifetime of uncertain times after this craziness.

So, yeah, coming from someone who has been blessed through this all (still working, albeit stressed to the max with a young child remote learning), I can afford to do these things but will not resume pre-pandemic consumption for a wide variety of reasons.

I believe the sentiments you express in your comment speak for a large number of others. I worry for what it all means for the future. I am trying to visualize the future and figure out how events play out but what I see grows ever darker.

It will be a very different world. Folks are thinking they’ll wake up on Jan 1 and yay! 2020 is over!

The economy as we know it is over. I feel very certain on this. It’s going to be painful for a lot of people.