It’s hardly a secret that Deutsche Bank has become a standout in the universe of badly managed big banks. But thanks to news flow overwhelm, we’ve been slow to write up an important suit, Rosenfeld v. Achleitner that lays out the misconduct over the last decade and is out to ding the executives and directors, or more accurately, their very fat D&O policies, for the abuses (Paul Achleitner is Deutche’s long-standing and very connected chairman of the board). We’ve embedded both the original complaint and the brief in opposition to the defendants’ Motion to Dismiss. The text of the later filing isn’t that long; the big page count comes from inclusion of all the exhibits.

Rosenfeld v. Achleitner follows broadly the same legal strategy as a set of filings against a series of European corporate governance train wrecks, including Bayer, Volkswagen, UBS and Credit Suisse: it’s hauling their top brass into New York court to ‘splain themselves. As you can see from the filing below, “foreign” corporations, as in foreign to that jurisdiction, are regularly and successfully sued. From a legal perspective, a German company is no more foreign to New York than Bank of America, a Delaware corporation.

As you’ll see from the more recent filing, a key issue is procedure versus substance. Deutsche Bank is governed by German law. However, the plaintiffs argue that by issuing shares in the US and having a substantial base of American shareholders, having large banking operations in the US that are subject to US regulatory supervision, Deutsche just like Bank of America can be hauled into New York court.

The plaintiffs are filing a derivative action, which means rather than suing the board and executives in their capacity as shareholders (which the shareholders’ agreement would require them to avail themselves of cronyistic German courts) but derivatively, as in acting on behalf of the corporation to sue individuals who have violated their legally-defined duties to the corporation. To sue derivatively, the plaintiffs must satisfy at least one test of “demand futility,” that a majority of the directors were incapable of making an independent decision to bring suit against the alleged bad actors because 1. they were not impartial (aka they were part of the problem), 2. they didn’t inform themselves when they should have (they played ostrich), or 3. the behavior was so heinous “on its face that it could not have been the product of sound business judgment.” Deutsche’s rap sheet is so long it’s not hard to think the judge will deem the plaintiffs to have met at least one standard.

Assuming the plaintiffs meet the New York procedural requirements, the substantive arguments use German law, particularly the German Stock Corporation Act (Exhibit A in the voluminous October filing) as the basis for causes of action. As we explained last year in a post on a filing against Bayer’s executives, directors and its investment bankers Credit Suisse and Bank of America, German law is shareholder-friendly, which makes it a potent weapon if you can get into a court prepared to enforce it. The abstract from a 2015 article by Gerhard Wagner, Officers’ and Directors’ Liability Under German Law: A Potemkin Village:

The liability regime for officers and directors of German companies combines strict and lenient elements. Officers and directors are liable for simple negligence, they bear the burden of proof for establishing diligent conduct, and they are liable for unlimited damages. These elements are worrisome for the reason that managers are confronted with the full downside risk of the enterprise even though they do not internalize the benefits of the corporate venture. This overly strict regime is balanced by other features of the regime, namely comprehensive insurance and systematic under-enforcement. Even though the authority to enforce claims against the management is divided between three different actors – the supervisory board, the shareholders assembly, and individual shareholders – enforcement has remained the exception. Furthermore, under the current system of Directors’ and Officers’ (D&O) liability insurance, board members do not feel the bite of liability as they are protected by an insurance cover that is contracted and paid for by the corporation. Thus, the current German system may combine the worst of two worlds, i.e., the threat of personal liability for excessively high amounts of damages in exceptional cases, and the practical irrelevance of the liability regime in run-of-the-mill cases.

Notice here the low bar for misconduct: simple negligence, plus the managers and board members bear the burden of proof that they behaved well! So the linchpin of these cases is getting a non-captured court to measure corporate conduct against these standards.

The original complaint depicts the D&O policy deep pockets as evidence of misconduct (emphasis original):

Many of the potential defendants pocketed millions and millions in bonuses due to their conduct that damaged Deutsche Bank and are very wealthy. The Supervisors and Managers are covered by a multihundred- million-dollar D&O insurance policy purchased and paid for with Deutsche Bank’s corporate funds — not their funds. The policy belongs to Deutsche Bank, not them. That policy is a corporate asset that can and ought to be realized upon (to help compensate Deutsche Bank for the damage they caused it due to their wrongdoing and lack of due care and prudence).

215. Large directors and officers liability insurance policies customarily include what is called an “insured versus insured” exclusion, intended to exclude from the insurance coverage claims by one insured, i.e., the corporation, against another insured, i.e., a corporate supervisor or manager or employee. Thus, were the company insured under such a policy, to bring the claims asserted herein, the insurance company would, based on this exclusion, decline coverage to pay the damages to the company. Purchasing this type of insurance where the premiums measure in the millions and are paid by the company is, in itself, a breach of the supervisors and managers’ duties of due care and prudence as policies without those exclusions are available and could have been purchased. The presence of “insured versus insured” exclusions in the directors & officers liability policies means that this derivative lawsuit — which does not fall within any such exclusion — is the best available legal vehicle to realize on this corporate asset, for the benefit of the corporation, which has after all paid 100% of the premiums.

Among its many sins, Deutsche is fabulously undercapitalized on the parent level and its US operation was alone among the banks the Fed oversees in failing stress tests in 2015, 2016, 2017, and 2018, earning it the designation of “troubled/problem bank.” Deutsche has paid more in US fines in the past decade than and other financial firm. The sanctioned conduct includes money laundering, Libor fixing, multiple types of mortgage abuses, and violating the Foreign Corrupt Practices Act by bribing officials in Russia, China, and Saudi Arabia. Even worse, it controls and IT systems are so shoddy that a former CIO described his job as “airplanes into the sky, watching them crash and then trying to learn from the mistakes.”

Deutsche Bank’s original sin was thinking that as German’s most important bank and a major European “universal” bank (engaged in retail banking, corporate lending, and securities trading) that it had the chops to compete with US investment banks that had become global players. It didn’t help that Deutsche tried building its investment banking empire on the shaky foundation of Bankers Trust, a miscreant it bought on the cheap after a Federal prosecution for escheating funds.

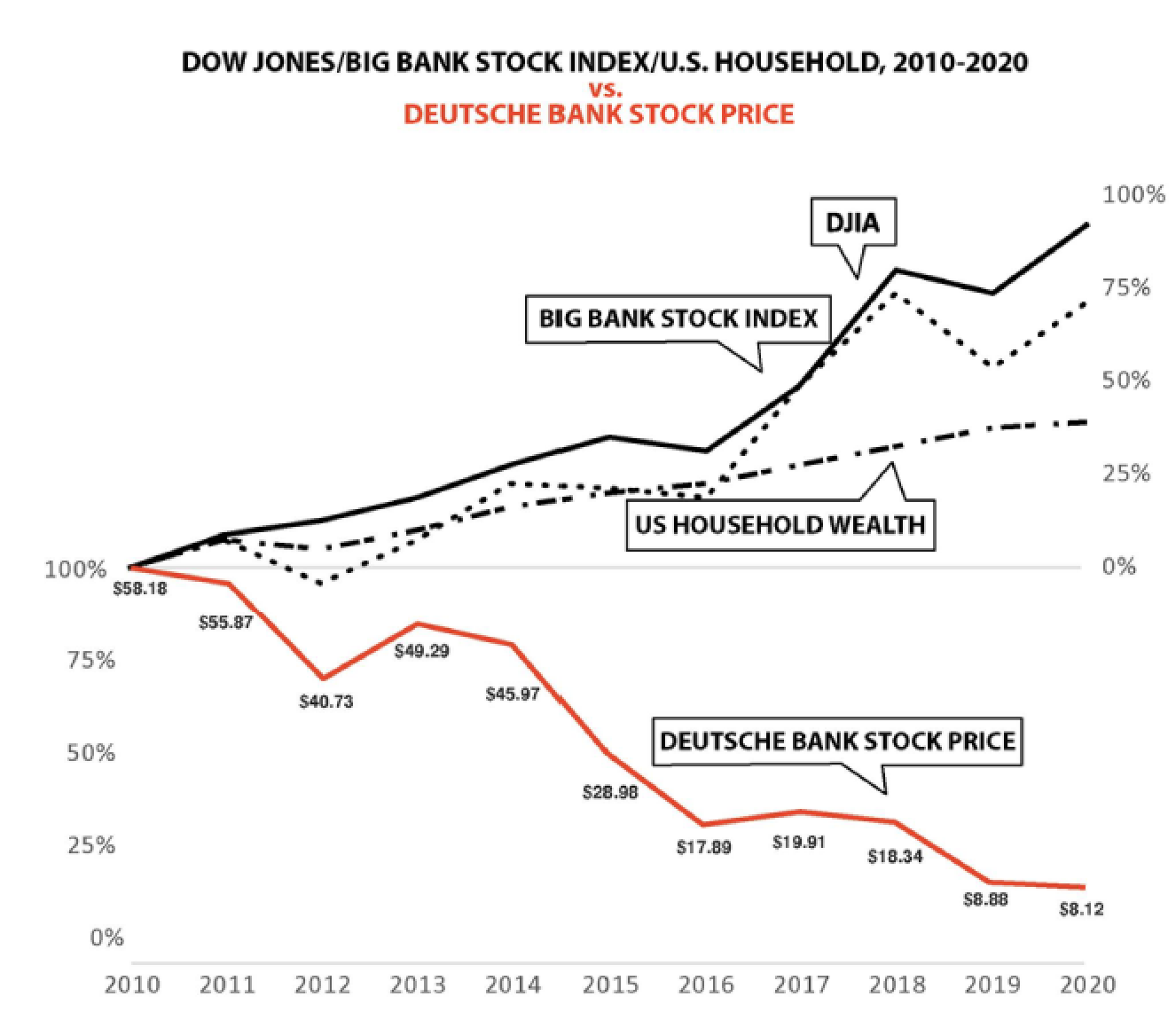

Even though big banks all over the world were caught out in the crisis for having poor risk management and too little capital, most shaped up at least somewhat afterwards. For instance, the FDIC forced America’s biggest problem bank Citigroup, which was facing calls to be nationalized in early 2009, to downsize considerably. By contrast, under Paul Achleitner, Deutsche went from bad to worse:

The initial complaint makes for lively reading because it quotes liberally from the extensive, and often excoriating, press coverage of Deutsche’s colossal ineptitude and criminality. For instance:

Deutsche Bank’s stock reached a post financial crisis high of $60 per share in 2011, giving Deutsche Bank a market capitalization of over $70 billion.

Today, however, Deutsche Bank is on deathwatch. Its finances are gravely impaired and its long-term survival in doubt. A share of its common stock sells for the price of a pack of cigarettes. Alone among its peers, during the strong economic recovery and unprecedented “bull markets” that followed the financial crisis, the Bank has shocked the financial world — and enraged its shareholders/owners — as it has become the most dysfunctional, chaotic, investigated, sued, fined and punished bank of its size in history. Due to the misconduct of the Individual Defendants, it has paid over $18 billion in penalties and settlements. Yet it remains engulfed in several ongoing criminal and other regulatory investigations. The Bank has reported large revenue declines and billions in losses over the past five years. It has completely eliminated its dividend. It just reported a 2019 $6 billion loss — its fourth multi-billion-dollar loss in the last five years and was forced to undertake a huge restructuring, i.e., shrinkage, firing almost 25,000 employees, in an effort to survive. Many of its top executives have been ousted, while pocketing millions in bonuses and “face saving” exit payments even though they were pushed out for their misconduct and breach of duties to the Bank.

if you simply dip into the impressively well-documented original filing, you’ll see the many examples of self-serving management conduct. For instance, after Cerberus bought 3% of Deutsche’s stock (not enough to yet pose a serious activist threat), Deutsche took the bizarre step of hiring Cerberus to act as an advisor to management after it fired CEO John Cryan in 2018, presumably a time when the bank felt vulnerable. Cerberus has zero expertise in the management of international banks; if this gig were at all serious, McKinsey would have been the go-to name.

Yet Cerberus apparently didn’t get that it was supposed to stay bought, or maybe the consulting fees weren’t high enough to achieve that end. A year later, the Financial Times reported that Cerberus was calling for Achleitner’s removal. Not surprisingly, the consulting deal was quickly terminated.

Another unsavory chapter was the ouster of board member and chairman of the integrity committee Georg Thoma. From the filing, quoting Handelsblatt:

The senior-most overseer at Deutsche Bank is Paul Achleitner. He chairs the supervisory board, the panel that sets major policy and hires and fires top managers. But one his colleagues has been making waves for asking the really tough questions: Georg Thoma, who heads the supervisory board’s “integrity” committee, which is responsible for internal investigations into the bank’s long list of scandals.

But instead of clearing the air at Deutsche Bank, Mr. Thoma’s relentless legal questioning — especially of Mr. Achleitner’s role in the handling of an investigation into an interest rate manipulations scandal that eventually cost the bank $2.5 billion — has set off a bitter dispute at Germany’s largest bank. Several board members have attacked Mr. Thoma in public statements and in internal emails, which Handelsblatt has seen in excerpted form….

Deutsche Bank certainly knew it was getting a meticulous overseer with a reputation for rectitude

when in 20133 it appointed Mr. Thoma, a Frankfurt-based partner at U.S. law firm Shearman & Sterling

LLP and one of Germany’s top corporate mergers & acquisitions lawyers, to its supervisory board….At Deutsche Bank, which has been mired for years in scandal, Mr. Thoma is now apparently making

enemies by doing exactly what Mr. Achleitner appointed him to do when he asked him to chair its “integrity” committee, a panel that was supposed to shed light on the bank’s dark, costly dealings…“He is going too far in demanding wider and wider investigations, and deploying more and

more lawyers,” Mr. Herling told the Frankfurter Allgemeine Sonntagszeitung, the Sunday newspaper.

Several top managers have made similar statements.

The bank first stymied Thoma’s efforts to have a truly independent investigation, then pushed him out.

There’s plenty more where that came from. The causes of action start on pdf page 162 (numbered text page 152) of the original compliant.

Finally, the legal team on this filing includes the attorneys on the Bayer complaint we wrote up earlier, plus some new names. The lead attorney is again Clifford Roberts of Roberts & Roberts, a boutique New York firm specializing in complex corporate litigation. Famed criminal defense lawyer Benjamin Branfman is also on board. Michelle Lerach’s firm Bottinni & Bottinni appears again, and as before, the similarity of the writing style of this filing to the Kentucky Retirement System case Mayberry v. KKR (more informal, more narrative, and much more factual backup than the norm) says the Lerachs are providing a lot of the muscle. The additions are WeissLaw, a New York firm, and John Pierce of Themis, a DC firm.

If you want a break from the news grind, these documents both contain a great deal of crafty lawyering, as well as a compelling account of a continuing governance train wreck. And if the plaintiffs make headway, it will cause a great deal of heartburn in European boardrooms, and could force unpleasant changes in the pricing and terms of D&O insurance. Keep your fingers crossed.

00 Rosenfeld v. Achleitner March 2020 complaint00 (2020-10-23) Conformed Opposition Papers - Brief and Affirmations Combined

There is another lawsuit in which the Judge’s son was murdered last year & etc. Etc. ::

https://www.globenewswire.com/news-release/2020/07/16/2063666/0/en/DEUTSCHE-BANK-DEADLINE-ALERT-Faruqi-Faruqi-LLP-Encourages-Investors-Who-Suffered-Losses-Exceeding-250-000-In-Deutsche-Bank-Aktiengesellschaft-To-Contact-The-Firm.html

The lawsuit has been filed in the U.S. District Court for the District of New Jersey on behalf of all those who purchased Deutsche Bank securities between November 7, 2017 and July 6, 2020 (the “Class Period”). The case, Karimi v. Deutsche Bank Aktiengesellschaft et al., No. 20-cv-08978 was filed on July 15, 2020, and has been assigned to Judge Esther Salas.

” s the best available legal vehicle to realize on this corporate a

sset, for the benefit of the corporation, which has after all paid 100% of the premiums.”

There is a carriage return after “corporate”, paragraph numbered 215, that should not be there.

Thanks. Actually a misplaced blockquote….gah.

This is a very important lawsuit and the lawyering is quite brilliant.

It cannot be understated how rotten corporate culture has become in Germany. I know a gentleman, now 80 years old, who was a top manager at a large concern in Germany from 1970 until his retirement 15 years ago. I had a discussion with him one evening about this problem. It clearly filled him with sadness.

His generation had grown up in the ashes of Nazi hubris, in a divided and occupied country, surrounded by millions of desperate flüchtlings from the lost provinces and colonies to the east. His generation was both frugal and humble. The West Geman legal system was simply a benevolent guide for a culture that stressed honor and personal responsibility.

Then came reunification. A new generation of Germans came to be defined by arrogance, and this combined with the naked greed and shameless connivance of newcomers raised in the länder of the former DDR. A legal and business culture designed for the frugal and honorable generation of the West German wirtschaftswunder were no match for this new generation.

If I recall correctly, the West Germans took the East Germans to the cleaners and treated them as second class citizens in many cases. Are you saying that the East Germans corrupted the West? I may be reading you wrong, and if so I apologize.

Perhaps subtlety is lost in a brief comment.

What my German friends tell me, and what I have personally experienced visiting post-reunification Germany, is that the generation of Wessis who came of age after reunification are spoiled and arrogant — in a word, entitled. Germany was Made Great Again. They treat everyone as second-class citizens, especially the Ossis.

But the Ossis have not been passive victims. Life in the DDR taught them to be jealously greedy and shamelessly conniving, as I have personally experienced. Their abuse by arrogant Wessis only served to feed their own sense of post-socialist entitlement.

The legal frameworks of the former Bundesrepublik have proven inadequate to rein-in a generation that doesn’t have the concept of personal and national honor that served the Wirtschaftswunder generation so well.

Or so I’ve been told…

Thank you for this great reply. I am glad I responded now. I lived in Germany at the time of reunification, but left soon after, so it is always a source of interest for me.

Complaint was amended in May 2020; operative amended complaint here (I hope; works for me): https://iapps.courts.state.ny.us/nyscef/ViewDocument?docIndex=/_PLUS_j7nxCesl7a0Lu6QBkCjA==.

Or look up here: https://iapps.courts.state.ny.us/nyscef/CaseSearch.

Thanks but I as a matter of history I like to look at the original complaint. And the latest filing is mainly a legal brief/rebuttal to the standing issues. But I agree it would have been better to link to the more current complaint as well.

The “insured versus insured” concept mentioned here seems to me to have some similarities with the idea incorporated into the Federal Tort Claims Act (and state-law equivalents) that citizens should often, if not isually, not be permitted to sue the government — at least for money damages — because if plaintiffs win, they and the rest of We the People would be the ones paying the penalties for the government. Is this a plausible comparison?

Whether the insured vs. insured exclusion in the insurance policies applies to a derivative lawsuit of this nature is an interesting question. As you noted, in a derivative lawsuit, it is the corporation suing, although the individuals bringing the lawsuit are not those usually in control of the corporation. If I were the insurance company, its certainly a point I would be looking at closely.

One of the poster children of Wall Street behavior over a long time period. As a layman I hope there is no settlement, the plaintiffs successfully pierce the corporate veil, and that the pricing and terms of D&O insurance are materially modified to make the behavior that has led to this lawsuit prohibitively costly at the individual level. Better yet if it were to be a catalyst for reinstatement of the Glass-Steagall Act in the U.S.