Yves here. While the level of stock market leverage, in the form of margin borrowing, isn’t quite at the level of the eve of the financial crisis, it’s still getting to warning signal levels. Recall that the financial crisis was not even remotely a stock market crisis; it was a derivatives crisis. Even though the unwinding of the housing bubble by itself would have hit the economy hard, almost certainly worse than the nasty (but short) recession of the early 1990s, it was derivatives that produced leverage on top of the housing market borrowing, above all on the weakest subprime debt, and the implosion produced the conflagration of September 2008, after three acute phase where the officialdom only papered over the symptom.

In other words, the stock market leverage that Wolf chronicles below isn’t sufficient in scale or type to cause a financial crisis. But it is symptomatic of far too much liquidity washing through the financial system. Experts talked about the “wall of liquidity” in the year before the crisis entered its first acute phase, in July 2007. I’ve not yet heard of the sort of leverage on leverage that set up the last blowup occurring now, but that doesn’t mean that it isn’t starting to happen.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

In the current craze that encompasses everything from sneakers and NFTs to stocks, where valuations don’t matter because of widespread certainty that valuations will be even greater in a few days, and where folks are chasing lottery-type returns, supported by the Fed’s interest rate repression and $3 trillion in asset purchases, and by the government’s trillions of dollars of handouts and bailouts – well, in this perfect world, there is a fly in the ointment: Vast amounts of leverage, including stock market leverage.

Margin debt – the amount that individuals and institutions borrow against their stock holdings as tracked by FINRA at its member brokerage firms – is just one indication of stock market leverage. But FINRA reports it monthly. Other types of stock market leverage are not reported at all, or are disclosed only piecemeal in SEC filings by brokers and banks that lend to their clients against their portfolios, such as Securities-Based Loans (SBLs). No one knows how much total stock market leverage there is. But margin debt shows the trend.

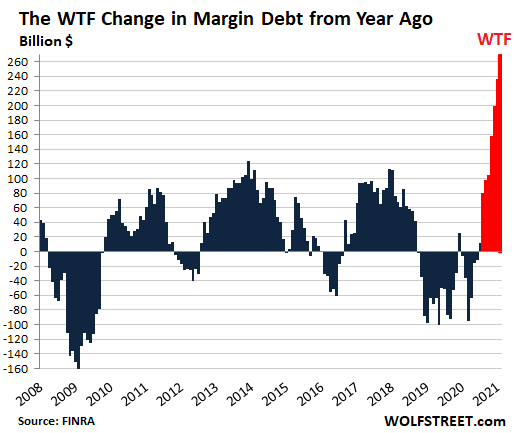

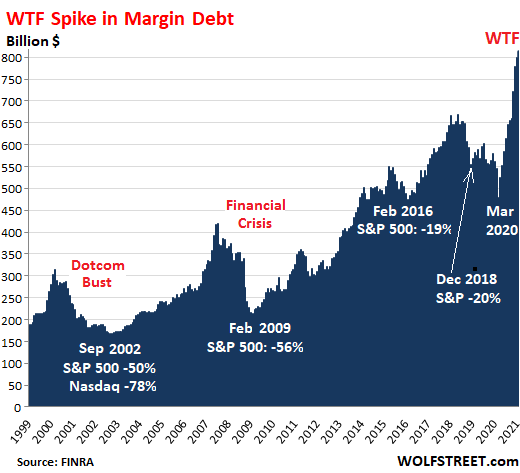

In February, margin debt jumped by another $15 billion to $813 billion, according to FINRA. Over the past four months, margin debt has soared by $154 billion, a historic surge to historic highs. Compared to February last year, margin debt has skyrocketed by $269 billion, or by nearly 50%, for another WTF sign that the zoo has gone nuts:

But margin debt is not cheap, especially smaller amounts. For example, Fidelity charges 8.325% on margin balances of less than $25,000 – in an environment where banks, money market accounts, and Treasury bills pay near 0%. Margin debt gets cheaper for larger balances, an encouragement to borrow more. For margin debt of $1 million or more, the interest rate at Fidelity drops to 4.0%

“Whether you need extra money for a short-term financing need or buying more securities, a margin loan may help you get the money you need,” Fidelity says on its website. In other words, take out a margin loan to buy a car or much needed bitcoin or NFTs.

Every broker has its own margin interest rate schedule. Morgan Stanley charges 7.75% for margin balances below $100,000, compared to Fidelity’s 6.875% for balances between $50,000 and $99,999. For margin balances over $50 million, Morgan Stanley charges 3.375%.

And it’s risky leverage for the borrower. It seems like risk-free leverage when stocks go up, but when your stocks do the unheard-of and tank below a certain level, your broker will ask you to put more cash into your account or sell stocks into the tanking market, whereby you then join the legions of forced sellers.

In the past, a big surge in margin balances tended to precede history-making stock market declines:

Over the two-decade period of the chart, the long-term changes in the dollar amounts are less important since the purchasing power of the dollar with regards to stocks has dropped.

But short-term, the changes show what is happening to margin debt in the run-up before the sell-off, and what is happening during the sell-off when margin requirements turn investors into legions of forced sellers.

Leverage is the great accelerator of stock prices, on the way up, and on the way down. Purchasing stocks with borrowed money creates buying pressure, and prices rise, and rising prices increase the margin balances a portfolio can support, and this encourages more stock-buying on margin.

On the other hand, selling stocks to deal with margin calls adds more selling pressure to an already declining market. The more prices fall, the more selling pressure there is from frazzled forced sellers trying to deal with margin requirements.

Then at some magic point, margin debt has been reduced enough, and its contribution to the selling pressure fades.

The historic surge in margin balances in recent months is another indicator of how hyper-speculative and blindly courageous the mega-bubble has become. All kinds of new theories are being proffered why fundamentals and valuations are meaningless, and why prices of all assets will shoot to the moon, no matter what.

These theories smacked into the bloodletting in Treasury bonds and high-grade corporate bonds with longer maturities, as long-term yields have been marching higher for months, which I discuss in my podcast…. THE WOLF STREET REPORT: Market Manias Galore, But Long-Term Interest Rates Smell a Rat

Hmm. What to make of this. Buy puts in stocks that have gained 30% since 12/31/2020?

Just remember that “the Market Can Remain Irrational Longer Than You Can Remain Solvent”.

If you wish to make money, analyse the situation, come up with something that any sane or sensible person would do, and do the opposite.

Or rely on the much more effective expedient of already having loads of money.

What if you would rather make sense than make money? What do you do then?

What if you don’t believe the sensible and sane people are at all sensible or sane?

What is missing is any real examination of the question of causation over correlation. When real estate prices are high, you are going to see higher real estate debt vs. when prices are low, because you can borrow less against your assets. Margins in brokerage accounts are limited under Treasury rules to a multiple of the account value, so if stocks tank 30%, overnight margins shrink as well. There is no doubt that the amount of margin debt increases as equity markets go up, and shrinks when markets go down, but that belies the question of cause and effect. Stocks are at a historic high, and so unsurprisingly, margin loans are too. While there is no doubt that margin loans create money to buy equities, thereby pushing equities higher and allowing for greater margin loans, and the reverse is true in a downturn, there remains a chicken/egg problem.

In addition, given the nature of futures contracts, you can get significantly more leverage trading stock futures than you can ever get from trading equities in a brokerage account, it would seem that simply looking at margin debt does not necessarily capture anything like the risk from excessive leverage in markets. When one thing blows up, it generally triggers a correlated price movement in other asset classes as people sell to make margin calls (for example). In sum, what is missing from this article is any examination of causation versus correlation, and any attempt to look holistically at other forms of leverage in financial markets, from futures contracts to options markets, to place brokerage margin loans in context. Instead, we get chicken little making the obvious point that people borrow more money when the assets they are borrowing against are worth more than when they are worth less. One could even argue that perhaps Treasury Rules that mechanically limit margin loans to the value of equities are counterproductive and increase instability in financial markets by prompting sell offs.

You don’t have a strong argument here. The real estate comparison is spurious. You don’t have margin calls in real estate, plus real estate interest is tax deductible, so leveraging real estate to pay down other debt is a sound move.

And it is simply false that the level of margin debt is kinda-sorts consistent over time. This is serious Making Shit Up territory. Margin debt has very reliably risen as a percentage of total market cap in frothy markets.

Trading futures is a sucker’s game. 70% of the futures traders lose money. That’s why you seldom see retail there. They get screwed on execution too.

Interesting observations but the article is still ultimately unsatisfying because it doesn’t propose a mechanism for the bursting of the bubble as per the Keynes quote cited by Thomas P.

Certainly if interest rates rise enough the bubble will burst, but over the last decade the Fed has not allowed this to happen. It seems to me the most interesting question is what will lead the Fed to change its strategy and push interest rates higher. Evidently inflation in house prices and financial assets aren’t enough.

Presumably it will require a significant rise in the general price level, especially of wages. Is such a rise likely? I don’t see that, at least for now. Unions have been decimated and offshoring continues. Where will workers get the power to get wage raises out of their bosses? Alternatively will it be higher rents to Big Capital in healthcare and Silicon Valley? Or is the Fed waiting for a booming economy to offset the effects of higher interest rates to some extent?

I think part of the point, albeit not addressed explicitly, is that increased leverage increases instability by amplifying small events into systemic ones.

Yes, I agree, but that is always the case with leverage. The more interesting question is what will spark a sell-off. I live in Canada. During the aftermath of the financial crisis circa 2009-10 colleagues were predicting a crash in the housing market. I didn’t see anything that would trigger it, nor any serious underlying issues, so I disagreed. Prices plateaued for a bit then continued their upward trend. Still no crash in Canada more than 10 years later, quite the contrary.

A major correction needs a reason. What is it? Sure one will happen one day but WHEN and WHY are the big questions.

A prof I knew used to say sure one day capitalism will end but if it’s not for 500 years how is that relevant for us today? As long as corporate profits are significant and debt service is manageable and the Fed is supporting financial markets what exactly will trigger a serious sell-off?

> A major correction needs a reason. What is it?

Corporate debt.

A trade war with China could trigger a crash, to take one example.

OTOH, I think some at the top are very happy about the instability since it makes reforming the system hard. If you don’t want change, having a system that comes crashing down if you try to change it has it’s advantages, since no one wants get get the blame for a crash that hurts everyone.

Perhaps it will be one of Rumsfeld’s unknown unknowns which finally bursts the bubble.

to be an insufferable pedant, nominal y-axis (margin debt) over 20+ years only paints 1/3 of the picture.

margin debt/aggregated market cap would be a better chart

My anecdotal evidence, trading group chat I’m in has a lot of the younger Robinhood account types who have taken on margin and don’t really understand it. Got to hear the exaltations and lamentations with GameStop. Robinhood’s issues were mostly margin related, a warning shot over the bow.

In general, there has been a lot of new money coming in. Some excess stimulus, some stuck at home working so extra time. Definitively most of them have no real understanding of risk and/or margin use. Their knowledgebase is small.

The little correction we’ve gone through recently has quieted down a lot of the younger traders. Some I know went through margin calls, others if they did, didn’t say so, but have not posted much recently. I’m now curious to see how this next round of stimulus flows affects the chatter.

Re: potential “pins” for bursting margin bubbles. The Fed can quietly approach broker-dealers to remind them that margin requirements, whether initial or maintenance, are floors not ceilings, and can be raised unilaterally by the broker-dealer. “Floor” means 50%, say, of account value for retail clients is the most they can borrow to finance trades. This is how the Fed can encourage tighter credit in security finance without publicly raising the official Reg T margin rate. They have done this before and I hope will do it again. And then there are the significantly higher levels of margin debt (relative to value) supplied to some professional traders, who are exceptionally quick to liquidate when trends begin to change. Last March was just a practice round.

fed is the problem now, not the solution

To clarify previous comments on margin. The minimum margin requirement can also be viewed as the amount of personal equity the client must supply. So 50% minimum initial margin means the account holder must fund 50% of the value of the purchase. The broker-dealer has the authority to require 60%, or any other number (< 100%) it chooses. Near the end of the tech bubble, some bds were requiring 100% funding, i.e., refusing to loan to clients.

the unemployed are betting their expected $1400 stimulus checks in hopes of striking it rich…

I’ve also heard mentioned from time to time that credit spreads remain historically narrow (the premium charged for junk for example over the risk free treasury rate.) That’s another sign, if I understand the point that too much cash chasing investments leads investors to chase risk to get something in return. Not suggesting this risks another GFC, but could lead to amplified losses when things start going south.