Silly me! Here I thought the main reason for funneling so much money into higher education via what has become lax student loan screening was patronage. Academics and administrators have a strong tendency to vote Democratic. So a debt-fueled expansion of colleges and universities could only help Team Dem.

But in finance, bad accounting regularly drives bad outcomes and that looks to the far more immediate cause for the expansion in student loans, and the resulting escalation in higher education costs.

Another example of this type of dynamic is the global financial crisis. As we explained long-form in ECONNED, many banks adopted accounting practices that allowed them to use credit default swaps to remove CDOs from their balance sheets for accounting purposes. Traders had the entire theoretical future profits from this so-called negative basis trade booked in the current year. This resulted in Eurobanks as well as some US securities firms to (at best) be indifferent to CDO risk and at worst, aggressively increase their CDO holdings. This mechanism was a significant reason that systemically important and fragile firms like AIG and the monolines wrote so many CDS, and the reason so many systemically important financial firms wound up holding CDOs on their balance sheets. Yes, the implosion of the US and other Anglosphere housing markets would have produced a nasty downturn. But as documented, the use of CDOs kept the subprime party going way longer than it should have, drove demand to the worst mortgages, and resulted in the financial system nearly failing in September 2008.

A much less convoluted mechanism encouraged the Federal government again and again to expand its student loan programs, even when that implied extending credit to more and more marginal borrowers (remember a creditworthy borrower can be made not so but having them take on excessive debt). As the Wall Street Journal explained, a change in government accounting standards in the 1990s allowed the Federal government to book anticipated student loan profits and reduce Federal debt requirements.1 As the Journal explains:

Before then [1990], the budget treated student loans as an expense. If the government lent $1 billion, the deficit rose by that amount, absent offsetting measures.

The law changed in 1990 to incorporate expected future repayments. Suddenly, loans became a potential source of profits, by assuming that most borrowers would repay with interest. This created an incentive for Congress to expand student lending. Doing so would increase access to higher education either at no cost to the government or with a gain in federal revenue, at least on paper.

Keep track of the dates. See how quickly changes that weren’t in the interest of helping students from non-affluent households afford an education kicked in:

Changes in 1992 made loans available for the first time to students from upper-income households, and provided that interest would start accumulating while borrowers were still in school, instead of after graduation. Congress also lifted a ceiling on how much parents could borrow for their children.

In 1993 the government introduced “Income-contingent” loans, under which monthly repayments were set as a share of borrowers’ income instead of fixed, and repayment could be spread over 25 years instead of 10.

This encouraged bigger loans. Congress and the Obama administration later expanded these kinds of loans. In all, the changes, by making nonpayment of student loans seem less likely, were justified as preventing losses from student lending.

Let’s stop for a second and see how the “income contingent” loans have actually performed. From BankRate last month:

A new National Consumer Law Center (NCLC) report found that while 8 million Americans are currently enrolled in income-driven repayment plans for student loans, only 32 borrowers have received the forgiveness promised by the program.

The income-driven repayment program, implemented more than 25 years ago, was intended to bring borrowers student loan relief by basing monthly payments on one’s current income and family size, then forgiving any remaining debt after 20 to 25 years of payments. The NCLC report, however, highlights just how hard it is to access the benefits of the program.

The federal income-driven repayment program has existed in some form since 1995, designed to get borrowers completely debt-free after 20 to 25 years. However, the program is optional, and it appears that many borrowers either weren’t aware of the program at its inception or were otherwise steered away. According to the report, 2 million federal student loan borrowers have been in repayment for 20 years and still owe undergraduate student loan debt — 2 million borrowers who, if they were enrolled in IDR plans, should have seen their debt wiped away by now. Instead, only 32 borrowers have seen student loan forgiveness through the program.

The BankRate article goes on to explain that the inability of borrowers to achieve loan discharge is mismanagement by the Department of Education and loan servicers. But one has to question that this incompetence is an accident. Both the DoE and servicers have incentives to keep borrowers paying even if their student loan balances are required to be wiped out. The servicers get servicing and other fees and the DoE keeps showing profits on the loans.2

Back to the Journal:

One instance of how accounting drove policy came in 2005 with Grad Plus, a program that removed limits on how much graduate students could borrow. It was included in a sweeping law designed to reduce the federal budget deficit, which had become a concern in both parties as the nation spent on wars in Iraq and Afghanistan and as baby-boomer retirement was set to raise Social Security and healthcare outlays.

A key motive for letting graduate students borrow unlimited amounts was to use the projected profits from such lending to reduce federal deficits, said two congressional aides who helped draft the legislation.

In other words, the policy aims of advancing students’ education (however you choose to define that) was becoming hostage to budget aims of generating more interest income.

Overly-optimistic assumptions and too generous lending leads to a world of hurt. Student loans are just another of many examples. Start with failure to complete a program:

Almost 40% of borrowers with student loan debt didn't finish their degree. Now, they face the worst of both worlds: all of the debt and no degree.

Canceling student loan debt will make a world of difference for them. #CancelStudentDebt

— Rep. Alma Adams (@RepAdams) February 9, 2021

Now admittedly, these students presumably are less indebeted on average by not having completed their studies. But they didn’t get any income bump, and they took time off from working, in addition to having borrowed to help fund their schooling.

Some have tried to minimize the sorry non-completion rate since it’s based on a six-year timeframe. They contend the students might still finish their degrees. However, those students have to pay interest and principal when they cease studying. So they face real costs of what looks like a bad decision immediately. They may face additional costs if they attempt to restart in finding out soe of their older course work might be deemed out of date, requiring re-dos. By contrast, the hand-waivers don’t muster any data to show how many go back to school and successfully complete their program.

Some reader may think we’ve buried the Journal’s lede, which is about the magnitude of coming losses from the student loan binge. We anticipate that most of you are well aware that this sort of outcome is baked in. Wolf Richter and less often yours truly (and others) have been providing updates on student loan delinquency rates. They rapidly become sobering once you adjust the denominator for the number of students who are required to pay (as in no longer in school) as opposed to total borrowers (the ones currently enrolled have their payments deferred).

An earlier story in the Wall Street Journal reported on an internal study by the Department of Education in 2019 that projected student loan program losses at $435 billion, vastly in excess of the CBO’s estimate in the same year of $31 billion in losses. Wolf did a fine job of recapping that story:

The Department of Education, fearing that government staff had underestimated the losses on student loans, brought in FI Consulting to build a computer model for a much more detailed analysis. And it brought in Deloitte to review the model.

The study found that most of the losses are already baked into the cake through the income-based repayment and loan-forgiveness plans, which see to it that effectively many loans do not get paid back in full before the remainder is forgiven.

Only a small number of borrowers owe a gigantic part of the student loans: 7% of all federal student-loan borrowers, mostly those that went to graduate school, piled up $500 billion of student loans – meaning these 7% of borrowers owe 37% of the federal student debt, according to a report by Moody’s dated January 2020. Each of them owes more than $100,000…

But student-loan forgiveness is already the rule through income-based repayment plans, which allow borrowers to make monthly payments of only 10% of a special income measure composed of gross income minus 150% of the federal poverty limit. And the remaining balances are then forgiven after 10, 20, or 25 years, depending on the program.

Borrowers in income-based repayment programs will repay only 51% of their balances on average, while borrowers in other plans will repay 80% of their balances, according to the analysis by the Department of Education.

The idea – particularly for borrowers with huge debts, such as former graduate students – is to drag repayment out as far as possible, and make it as slow as possible, and to pay the least amount possible, and then have the rest forgiven. Students with smaller balances too use this strategy to avoid default and minimize payments.

This is in part responsible for the surge in student loan balances, according to Moody’s; as new loans are being added, old loans are simply not being repaid.

The current Wall Street Journal story paints the expected losses picture a bit darker.

Betty DeVos called Jamie Dimon to recommend someone who could help review DoE data, since losses were coming in higher than forecasted. Former JP Morgan exec Jeff Courtney performed a separate study. From the Journal:

…over three decades, Congress, various administrations and federal watchdogs had systematically made the student loan program look profitable when in fact defaults were becoming more likely.

The result, he found, was a growing gap between what the books said and what the loans were actually worth, requiring cash infusions from the Treasury to the Education Department long after budgets had been approved and fiscal years had ended, and potentially hundreds of billions in losses.

The federal budget assumes the government will recover 96 cents of every dollar borrowers default on. That sounded high to Mr. Courtney because in the private sector 20 cents would be more appropriate for defaulted consumer loans that aren’t backed by an asset.

He asked Education Department budget officials how they calculated that number. They told him that when borrowers default, the government often puts them into new loans. These pay off the old loans, and this is considered a recovery, even though in many cases the borrowers haven’t repaid anything and default on the new loans as well.

Yves here. That old trick is called, “A rolling loan gathers no loss. Back to the Journal:

In reality, the government is likely to recover just 51% to 63% of defaulted amounts, according to Mr. Courtney’s forecast in a 144-page report of his findings…

According to his report a year later, students who took out federal loans in the 1990s had repaid, on average, 105% of the original balance a decade later, including interest. Since 2006, they had repaid an average of just 73% of their original balance after a decade.

He looked into why government projections seemed so far off. One thing he found was that Education Department budget officials didn’t look at basics such as borrowers’ credit scores to estimate the likelihood they would repay. Not checking credit would be unthinkable in the private sector.

The incoming Biden administration shut down Courtney’s forecasting effort, which brought in FI Consulting and then had the models reviewed by Deloitte, depicting it as politically driven and based on flawed data. But while his approach may indeed have had problems, it’s not as if the current approach is sound. Back to the Journal:

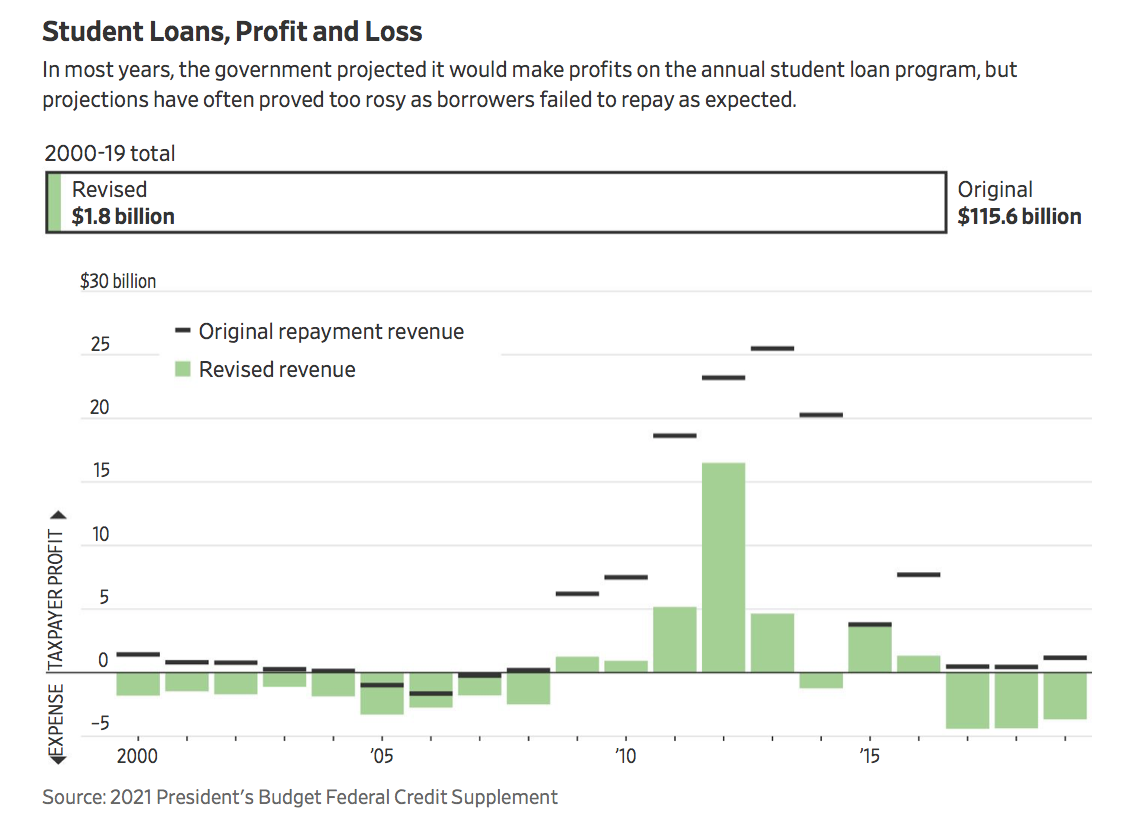

The assumption that all this student lending would mean growing profits for the federal government and savings for taxpayers has been consistently off the mark.

The federal government extended $1.3 trillion in student loans from 2002 through 2017. On paper, these would earn it a $112 billion in profit.

But student repayment plummeted. In response, the government revised the projected profit down 36%, to $71.5 billion. The revision would have been bigger except for the fall in interest rates that let the U.S. borrow inexpensively to fund loans.

The phenomenon is worsening in recent years. For the fiscal year ended September 2013, the government projected it would earn 20 cents on each dollar of new student loans. For fiscal 2019, it projected it would lose 4 cents on each dollar of new loans, federal records show.

Congress approves the student loan program each year, doing so based on a profit assumption. Then, in subsequent years, it revises those profit estimates based on the repayments that actually arrive.

If repayments come in lower than expectations—as has happened successively in recent years—the Treasury Department fills the gap with cash infusions to the Education Department.

This process takes place outside of the budget review and outside of congressional oversight. Ever-larger cash infusions from the Treasury have been needed.

This is a rancid mix: financialization along with off-the-books fudges. And Biden has decide to go full steam ahead. Recognizing all those losses would undermine the Administration’s spending plans.

But as lending experts know, not recognizing losses does not make them go away. Indeed, that response usually makes the downside worse.

____

1 Take that, MMT skeptics! Here the Feds have been treating non-existent revenues as real to lower borrowing needs…which of course means the difference between accounting revenues and cash revenues had to be made up somehow….by the Feds simply writing checks, or as the MMT crowd likes to say, “net spending”.

2 If you think this sort of thing doesn’t happen regularly, by design, you are smoking something strong. During the foreclosure crisis, activists found regular cases where the servicer had foreclosed on a home and then sold it, as confirmed by dates of sale at the relevant courthouse….but would show the property as an asset of the trust for months after the sale. Why? They could keep charging property management and other fees against the cash they held before they distributed it.

Would it be fair to say that the explosion in college education costs has been attributable to the non-discharge-ability of student loans combined with the guaranteed backing of those loans. Anotherwords – their is no effective curb regarding the amount that colleges can charge for education. – Government backed private business…. forgot what that is called.

As for the servicers…… they really are the ones that take the cream off the note

No, as you can see from this post, the considerable expansion pre-dates the 2005 bankruptcy law reforms. That’s why I stressed following the timeline. College education costs were rising in the 1980s faster than inflation and started increasing even faster in the 1990s.

The article contends that the 2005 Grad Plus expansion was part of the Deficit Reduction Act of 2005:

https://en.wikipedia.org/wiki/Deficit_Reduction_Act_of_2005

So the 2005 bankruptcy “reforms” were part of this picture but far from the driver.

Moreover, the fact that the Feds keep having to refi the loans so as not to declare them in default (and do what exactly?) says many aren’t performing despite the fact that they can’t be discharged.

“there is no effective curb regarding the amount that colleges can charge for education.”

I think this actually might be the case. According to a related post:

“Student-loan balances on the government’s financial statement skyrocketed from $147 billion in 2009 to $1.37 trillion at the beginning of 2020, despite the 11% decline in student enrollment since 2011.”

This suggests that between 2009 and 2020 creditors lent 932% more to finance a university education, despite a probable enrollment decline over the same time period. Or during this time period fewer students were made to pay exponentially higher education costs.

The figures are cumulative. Since students aren’t repaying debts anymore and rather rolling them over, the increase simply stems from adding and no longer subtracting debts that get paid off

That would mean almost no one (in the U.S.) has made payments to reduce the principal balance of their student debt for the last 11 years. I’m not sure the current situation is that bad – yet.

This is working as planned, a rent extract program amongst the finest. Collusion between universities and the feds to create a generation that was lied to (get a degree, your path to riches!), misled (well, you didn’t get a degree, but it’s not our fault that you weren’t clever enough to do so), abused (not our fault that you took on all that debt) and trapped in a never-ending cycle of debt servicing without debt repayment. If you are evil enough, it’s a great way to enrich yourself at the cost of others.

Of course, it’s the result of a corrupted system: but none dare say that. It’s not merely rancid: it’s the smell of deep corruption. It will only get better when people turn their back on higher education and force universities away from this aggressive, harmful business plan. Meh.

I had no idea about the 1990 change in projected revenue. If the government counts loans on the asset side of the balance sheet, the way banks do (which is how I’m reading Yves’s post), the fate of student loan borrowers is sealed: not a chance that the government forgives student loans and write off assets. Especially when there’s no chance of discharging that debt in bankruptcy.

Why would the feds write off these loans if they can guarantee repayment through the courts? The feds have an infinite timeline and guaranteed repayment strategies.

The only way to stop this would be legislation (lol) or rent strike by students.

The law changed in 1990 to incorporate expected future repayments. Suddenly, loans became a potential source of profits, by assuming that most borrowers would repay with interest. This created an incentive for Congress to expand student lending. Doing so would increase access to higher education either at no cost to the government or with a gain in federal revenue, at least on paper. wsj

Then note that US Treasury Bonds, if sold at negative yields, receive the interest, as well as principal, up front and are risk-free revenue in that regard, unlike student loans.

So if we wish to encourage Federal spending for the general welfare, negative interest and yields on inherently risk-free US sovereign debt are the way to go since they change a revenue drain to a revenue source.

Of course this will offend those used to welfare proportional to account balance and, in some cases, excusably so, so we should expand welfare proportional to need or at least in a manner that does not violate equal protection under the law, to compensate.