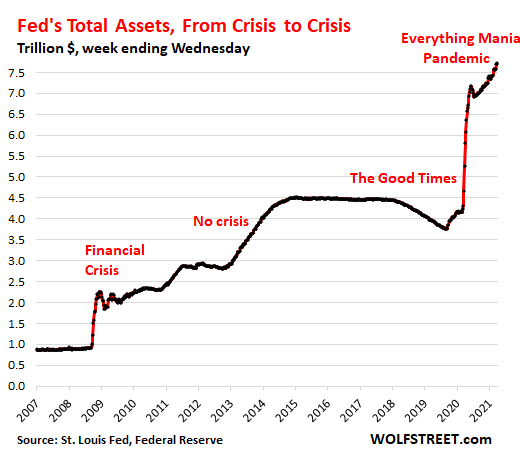

Yves here. Even though I did not agree with a lot of what the Fed did during and after the crisis (at a minimum, institutions that needed Fed assistance, like Citi, or did nasty stuff, like Citi and everyone else, should have had their boards replaced and execs in the units that did Bad Shit forced out), I did understand their reasoning. Like Wolf, I’m at a loss now.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

The Fed has shut down or put on ice nearly the entire alphabet soup of bailout programs designed to prop up the markets during their tantrum a year ago, including the Special Purpose Vehicles (SPVs) that bought corporate bonds, corporate bond ETFs, commercial mortgage-backed securities, asset-backed securities, municipal bonds, etc. Its repos faded into nothing last summer. And foreign central bank dollar swaps have nearly zeroed out.

What the Fed is still buying are large amounts of Treasury securities and residential MBS, though no one can figure out why the Fed is still buying them, given the crazy Everything Mania in the markets.

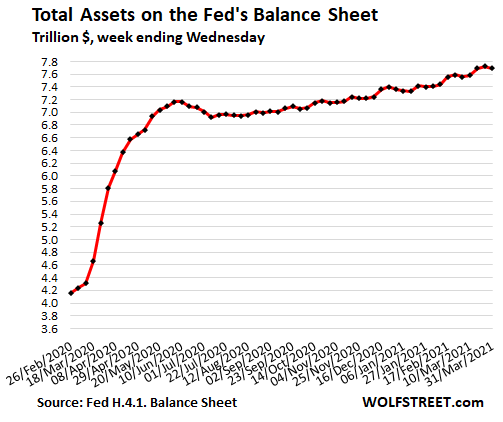

But for the week, total assets on the Fed’s weekly balance sheet through Wednesday, March 31, fell by $31 billion from the record level in the prior week, to $7.69 trillion. Over the past 13 months of this miracle money-printing show, the Fed has added $3.5 trillion in assets to its balance sheet:

One of the purposes of QE is to force down long-term interest rates and long-term mortgage rates. But long-term Treasury yields started rising last summer. The 10-year Treasury has more than tripled since then and closed today at 1.72%. Mortgage rates started rising in early January. Bond prices fall as yields rise, and the crybabies on Wall Street want the Fed to do something about those rising long-term yields and the bloodbath they have created in the prices of long-term Treasury securities and high-grade corporate bonds.

But instead, the Fed has said in monotonous uniformity that rising long-term yields despite $120 billion of QE a month are a welcome sign of rising inflation expectations and a growing economy:

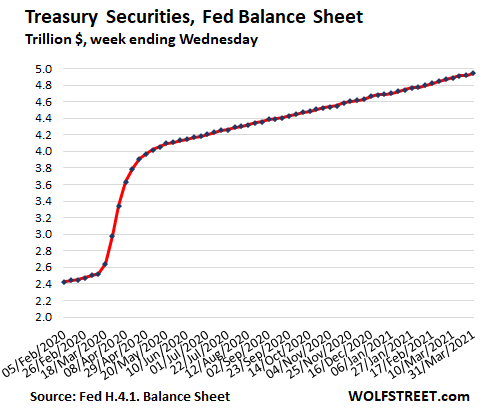

Purchases of Treasury Securities Purr Along, $4.94 Trillion

After the initial blast a year ago, the Fed has continued to add around $80 billion a month in Treasury securities to its balance sheet, bringing the 13-month total addition to $2.47 trillion, which more than doubled its Treasury holdings over the period to $4.94 trillion:

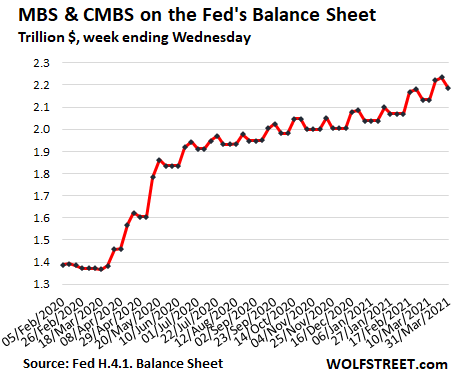

MBS Zigzag Higher, but for the Week Drop by $50 Billion to $2.18 Trillion

Holders of mortgage-backed securities receive pass-through principal payments as the underlying mortgages are paid down or are paid off. The Fed buys MBS in the “To Be Announced” (TBA) market to replace the pass-through principal payments and to increase its balance. But trades in the TBA market take months to settle, and timing differences create the zig-zags.

The pace of the increase of the balance has steepened a little this year as pass-through principal payments slowed down due to the slowdown in mortgage refis caused by rising mortgage rates.

CMBS Bailout Program Is Shut Down

This $2.18 trillion of MBS include the Fed’s purchases of commercial mortgage-backed securities, a program it announced during the crisis. It was going to be a huge program, according to media hoopla. But in effect, it purchased only $10 billion of CMBS, mostly during April and May last year. This program is now shut down, and the Fed has ceased buying CMBS as of last week. Principal payments that the Fed receives will reduce the balance going forward.

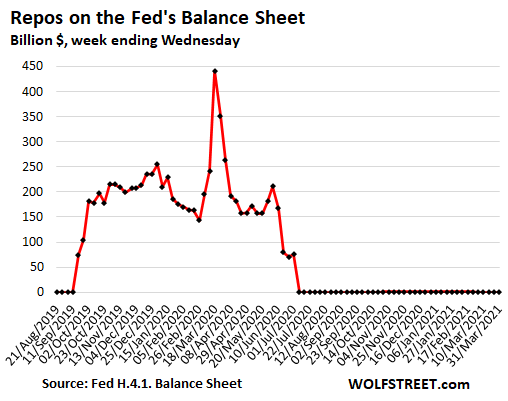

Repos (Repurchase Agreements) Remain at Zero

The Fed continues to offer repos, but after it had raised the bid rate last June, making its repos unattractive, there have been no takers. The remaining repos matured and were unwound last summer:

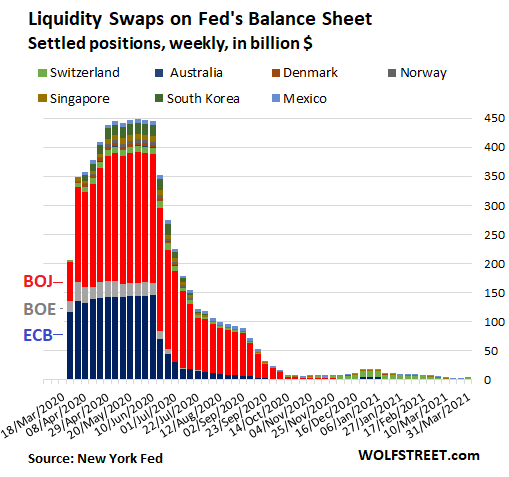

Central-Bank Liquidity-Swaps Are Phased Out

The Fed offered dollars to 14 other central banks in exchange for their currency. Nearly all these “central bank liquidity swaps” matured and were unwound. Just $2.5 billion remain, split between the ECB, the Swiss National Bank, and the Bank of Mexico – down from $450 billion during the peak:

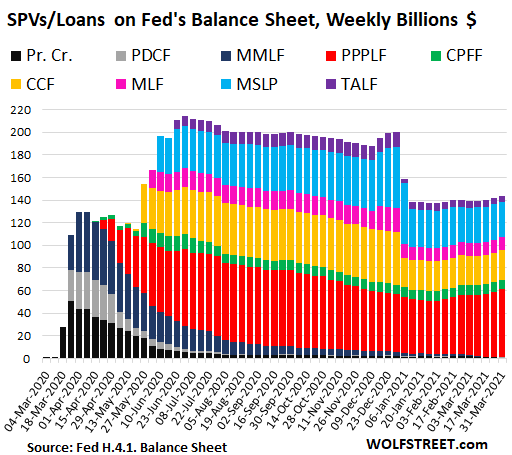

All SPVs Except PPP Facility on Ice, at $144 Billion

The Fed created these Special Purpose Vehicles (SPVs) as legal entities that can buy assets that the Fed is not allowed to buy otherwise, such as corporate bonds, junk bonds, bond ETFs including junk bond ETFs, auto-loan backed securities, municipal bonds, corporate paper, etc. The Fed lent to the SPVs, and the Treasury Department provided equity funding that would take the first loss.

These SPVs are now on ice and have expired with exception of the PPP liquidity facility (red), which the Fed extended for another three months through June. It buys PPP loans from banks and is the only SPV that is growing. All others are either frozen or declining:

Might try a very wild guess here. Obviously the economy is being reconfigured but to what end is unclear. And if it is unclear financially, then the reason for it may be political. If the Fed is closing down all those programs and agencies, could it be that the reason is that they are being run by Trump appointees which the Dems want to end. And if it has proven so hard to remove the Board of Governors of the United States Postal Service, then perhaps the people running those agencies (assuming they are Trump Appointees/friendlies too) might be equally hard to remove. Thus it might be easier to wind up those alphabet agencies to replace them with a more Dem friendly agency or agencies later on. And if the Fed is still buying large amounts of Treasury securities & residential MBSs, this might be cover to show the market that “they are doing something” while they complete their plans. All this is just wild speculation of course.

@The Rev Kev

April 3, 2021 at 6:53 am

——-

I think you misunderstand the nature of that alphabet soup of “facilities” in the last graph. Those are not agencies or bureaucracies, there are no employees or managers. They are just bookkeeping entities that are used to purchase different types of securities, including some that the Fed is normally prohibited from buying (as noted in the post). They are probably set up as some kind of separate legal entity that is a wholly-owned subsidiary of the Fed, or some such arrangement.

BrianM, below, has some good ideas about why the Fed may be doing this.

I can think of three reasons, not all of which I have total confidence in:

– the economy is recovering so ’emergency’ measures are not needed.

– monetary policy can’t do everything and beyond a certain point maybe ineffective – if current measures are seen as beyond that then stop them

– fiscal measures will do more work, making monetary actions redundant

I’d like to think that the third will be true, but calling victory seems somewhat premature!

Sometimes I feel like I’m so deep into left field that I’m in the bleachers. I understood, and supported the Fed’s moves early in the pandemic/recession to prevent a financial meltdown. But, long-term easy money and the absorption of risks has led to asset bubbles in stocks and non-commercial real estate, while crushing the incentive to save for those outside of the elite. I mean, what does a 6 mo. CD pay now? 0.2%! I do not understand why the effects of monetary policy on inequality are not more frequently considered. Yes, economic growth is lax, but as the pandemic subsides and government spending increases, as is happening now, the potential for economic growth is excellent. To me, this suggests that it is high time for the Fed to tighten. While I have no problem with the Fed holding US government paper, I think it should unwind most of its other assets over time as well. It is time to wean.

I don’t understand this any better than the rest, but wonder if the Fed buying treasuries is supposed to prop up that market?

Are Russian/Chinese efforts to create a new, non-dollar dominated world having some results?

I firmly believe that Powell (and Yellen) believe they have to do something radical to get the US out of the massive debt deflation syndrome the economy is in. They see/think the “pent up demand” from the COVID crisis as a potential springboard for achieving some rip-roaring price inflation throughout the economy. Thus the QE, ongoing purchase of bonds/MBS and of course support of the big (excessive by any definition) COVID bill. Now infrastructure which I believe they hope to ultimately ram through like COVID.

The problem of course with this approach is that wages (across the spectrum) have to follow or we will have even worse social problems than current. A rise to $15 min. wage would help their plans but it will be a short lived gain as prices will simply run higher to a new equilibrium that will put these new “higher paid” low wage workers back where they started from.

We are in for a very turbulent time and I think there is equal probability that something really bad is going to come of all of this. Ultimately, something bad will definitely come from where the US has positioned itself in the world. Just a matter of when.

What debt deflation, the only deflation I see is the purchasing power of my dollars, they buy les and less every day. Can you name smth that has come down in price those last three decades?

Anyone doing grocery shopping , or going to Home depot can attest that prices are exploding and not by 5 or 10 % but rather 30 to 50%.

Don’t get me started on asset or home prices, and why is Fed still buying 40billion a month of MBS, they already own more than 20% of the residential market, are they going to own everything?

Fed has gone rogue and is acting like a crime syndicate.

pull the Fed out and you’ll see debt deflation

I tried Michael Hudson: J is for Junk Economics, which defines the term, but somehow … :

I guess we commonly use “deflation” as though it only meant price deflation — while really it’s more general. You use deflation to describe the reduced buying power of your dollars, when that’s price-inflation along with being buying-power-deflation.

Maybe Fisher was talking about the deflation — i.e. reduction or collapse — of activity, and useful work, and production throughout the entire economy, brought on by diverting present money to service old debts.

Maybe Fisher was talking about the deflation — i.e. reduction or collapse — of activity, and useful work, and production throughout the entire economy, brought on by diverting present money to service old debts.

Correct. That’s what Fisher was talking about.

Sorry, meant to say ‘debt stagnation’ or something of the sort. Basically, we are up to our eyeballs in debt across all spectrums. Interest rates can’t go much lower (they’ve used that up). So we’ve run out of using debt as way to juice growth.

The only plausible way to reduce the debt is through inflation. And you are right, inflation has been high and even higher now. But they want to goose it even further and try and get wages up to reduce the real debt levels.

If they want to get wages up, they aren’t trying very hard.

Markets are not rational because Human beings are not rational.

We are rationalizing animals rather than rational animals and according to sales 101 primarily motivated by fear and greed..

I’ll call a top to the everything bubble, by the end of June 2021

Salesforce tower, Jafri and Beeple, Tesla’s stock price and inclusion in the S&P 500 ( Talk about crapification!)…lots of indications we’re there or very close.

And I have profound faith the the Biden Administration will manage to screw up something important in a very visible way, soon.

Imagine what would happen to Tesla’s stock price if Elon Musk were struck in the head with a 10 Lb chunk of blue ice falling from the sky and killed while walking to his car tomorrow morning.

His demise could just as easily occur driving his Tesla on autopilot.

(When the auto industry goes full EV with government support, Tesla’s unit production is unlikely to keep pace and the price of its stock will fall.)

“His demise could just as easily occur driving his Tesla on autopilot.”

I am loathe to admit it, but this would satisfy me immensely. Not wishing this on anyone, but…

Is this not at least functionally debt monetization? The Fed creates a huge amount of USD’s and injects them into our economy. The Pandemic winds down and the economy takes off roaring ’20’s style. What’s not to like other than a bit more inflation? What’s the downside otherwise of the Fed holding $10T or more of Treasuries on its balance sheet?

The proper business of the Federal Reserve as guardian of the money is to provide it a constant value. The United States would take a long stride forward if the Federal Reserve would do no more than figuratively to set up that computer readout on the desk of its chairman and bend all its efforts to holding the indicator steady. Professor Milton Friedman, chief critic of the Federal Reserve, made this point repeatedly, and it is difficult to add much to his arguments. Never in its entire history had the Federal Reserve taken as its sole duty the stabilization of the value of the dollar. Instead it meddled with controlling interest rates, financing the government, producing economic growth, providing jobs, dampening booms, and reversing recessions. All of these may well be the business of the government, but not of the money guardians.

No, that is absolutely not the Fed’s mandate. Having a low to moderate level of inflation is much better for banks and for labor, and the Fed’s dual mandate is to preserve the soundness of banks and to promote full employment. Its post Volcker fixation with crushing inflation is a violation of its second mandate.

And Friedman’s monetary theories were decisively disproven in monetarist experiments in the US and UK in the early 1980s. Contrary to what Friedman insisted was the case, money supply changes bore absolutely no relationship to any macroeconomic variable.

I thought the Fed mandate was defined in the 1978 Humphrey-Hawkins legislation.

Using that criteria, they have utterly failed, no?

No, it was first defined when the Fed was chartered, in 1913. Then the emphasis was on safety and soundness of the banking system and an “elastic” currency, to use the jargon of the day, which was low inflation but avoiding deflation.

The Federal Reserve Act clarified the Fed’s mandates, but the idea the it was responsible for full employment goes back further:

https://www.richmondfed.org/-/media/richmondfedorg/publications/research/economic_brief/2011/pdf/eb_11-12.pdf

This essay is consistent with my understanding. that having the Fed also seek to achieve full employment dates back to 1946.

Friedman made a lot of clever arguments and claims that make some sense theoretically. But nearly all testable claims have been refuted by those damned empirical data

What was it, 6000% wrong when he made a personal bet on FX based on his assumptions …

Never played the markets again ….

Well, that was why he invented “long and variable lags.” There was no correlation between policy changes and the results he wanted. His theoretical results were so intuitive, so attractive, so desirable, that it did not matter that they required assumptions that were totally unrealistic. “All models are wrong.” It doesn’t matter if a model makes no sense as long as it produces the right results. The same as the Austrian School, empirical results are not to be trusted, only the theoretical results based on reason.

How does Milton Friedman find his way out of a dark cavern? ‘Assume a lightbulb’

Driving down interest rates helps some (spenders) and hurts others (savers). Historically, cheap credit bends the economy towards financial speculation and away from value (production of real things).

Why should savers get a risk-free return greater than ZERO percent? Doesn’t that constitute welfare proportional to account balance? A violation of equal protection under the law?

Otoh, equal fiat distributions to all citizens do not violate equal protection under the law.

One good thing about Covid is that it has established the efficiency and popularity of fiat distributions to citizens.

I’ll add that MMT proposes a permanent ZIRP.

ever hear of a thing called the 10 yr treasury note?

It appears to me that Mr. Market ratifies, during economic crisis, what ethical considerations dictate all the time.

But hey, to be against welfare proportional to account balance is NOT to be against welfare according to need or pensions or against equal fiat distributions to all citizens but to be against welfare for the rich.

Low rates make buying cars and homes easier. Probably two of the middle class’ largest and economically important purchases.

You forgot to add…

“The Fed creates a huge amount of USD’s and injects them into our economy. ” [and then a large chunk of those USDs go straight to rest of the world to pay for BMWs, tube socks, produce, petroleum, electronics, etc.]

Pumping all this USD into the global economy is like spraying a flamethrower on your roof to remove an ice dam on the roof—little room for error. Inflation hurts the bottom 50% a lot, lot, lot more than the top 10%.

Only if the US suddenly buys more BMWs and tube socks.

Has there been an big increase of the US trade deficit since 2019?

Mainly the influx of fed dollars has been used to pay more securities, stocks, etc. it seems. E.g. the Fed buys mortgage backed securities (MBS) for 1.x trillion since last year. That is financial money which now seeks new investment opportunities, which explains why the stock market is up in a recession, not spending money.

While the money is also buying Beemers probably, it mostly goes back into the casino aka markets, and it shouldn’t drive up hoi polloi prices.

So the usual things like houses will inflate as they did the last decades while nothing else happens with inflation (e.g. food, clothes, etc) than did last few years.

The money that is actually used to spend for consumer goods, etc. is the stimulus money, the $600 and 1400 checks, the program for all kinds of corporations including e.g. airlines so they can pay their employees, at least some of them, instead of going bankrupt. That is however mainly to compensate for losses incurred, so it would not stimulate inflation but keep the corporations artificially alive but on live support. They don’t rush and buy more stuff from China like tube socks than usual with this money.

“The Good Times”?

Just a shout out to Wolf for all the hard work he puts in to make these things as clear to us as possible. I truly appreciate it brother.

amen & the active involvement of the NC Team in the comments :-)

Interesting that most of the latest increase in the size of the Fed’s balance sheet began with the collapse in the stock market indexes from February 19 – March 23, 2020. Under its “Quantitative Easing” (QE) policy, the Fed has bought US Treasuries and US government agency securities that participants in the financial markets were already bidding up in price. This has had the effect of further suppressing interest rates below where they otherwise would have been, thereby maintaining short-term US Treasury yields below the rate of inflation and supporting the prices of stocks, corporate bonds and real estate.

But “Economic stimulus”?… I think history shows QE is not. So the question arises: Why not?… and a possible answer to that question is that the other side of the accounting entry for the Fed’s Treasury and Agency purchases under QE: “Bank reserves” – is not ‘money’ in any meaningful sense and doesn’t directly impact the real economy unless borrowers borrow and the banks create credit that’s used for productive purposes.

We’ve had “Quantitative Easing” for well over a decade now. The tangible benefits of this policy in terms of fostering real economic activity have been minimal despite the outsized financial gains enjoyed by participants engaged in speculations in the financial and real estate markets. Who knew that the runway would occasionally receive fresh foam “as needed” over the ensuing twelve years after the GFC with foreseeable systemic effects?…

What happens to the mortgage market when the pandemic mortgage payments forbearance ends?

As we’ve seen 2009, it’s not important what happens to the borrowers, only what happens to the companies holding them.

Since the biggest mortgage holder is apparently the Fed now, it’s probably not such a big deal anymore: they can absorb any loss.

Convincing people that inflated asset prices represent real wealth is the easy bit.

Maintaining that belief is the hard bit.

At the end of the 1920s, the US was a ponzi scheme of inflated asset prices.

The use of neoclassical economics, and the belief in free markets, made them think that inflated asset prices represented real wealth.

1929 – Wakey, wakey time

The use of neoclassical economics, and the belief in free markets, made them think that inflated asset prices represented real wealth, but it didn’t.

It didn’t then, and it doesn’t now.

This generation would never believe in the markets again, but a new generation came along that didn’t have those painful memories.

We got going again in the 1980s, pumping up real estate and stock market valuations.

The stock market crashed in 1987 and the first wave of real estate bubbles had burst by the early 1990s.

In 1994, John Kenneth Galbraith wrote “A Short History of Financial Euphoria”.

“In London, tourists going down the Thames to the Tower will extend their journey to encompass the Canary Wharf development, perhaps the most awesome recent example of speculative dementia.”

Real estate was always going to be difficult, but they started thinking how they could keep other asset prices inflated and the first “Greenspan put” came into play.

Real estate – the wealth is there and then it’s gone.

1990s – UK, US (S&L), Canada (Toronto), Scandinavia, Japan, Philippines, Thailand

2000s – Iceland, Dubai, US (2008), Vietnam

2010s – Ireland, Spain, Greece, India

Get ready to put Australia, Canada, Norway, Sweden and Hong Kong on the list.

It wasn’t real wealth, just a ponzi scheme of inflated asset prices.

You just can’t keep these bubbles inflated.

Convincing people that inflated asset prices represent real wealth is the easy bit.

Maintaining that belief is the hard bit.

They have been doing very well, but you can’t hide the truth forever.

By preventing natural corrections they have inadvertently made things much worse.

This nice Chinese chap tried to warn the Americans the US stock markets was at 1929 levels at Davos 2018.

https://www.youtube.com/watch?v=1WOs6S0VrlA

When it does correct, it’s going to be very painful.