Yves here. This post “unambiguously” demonstrates that lax monetary policy, also known as ZIRP or negative real interest rates, boosts inequality by increasing the total share of income going to top cohorts. While we’ve seen plenty of corroborating data, like how much richer our billionaire lords and masters have become under Covid, it’s important to see this finding proven out in Denmark, when European stock markets haven’t been as bubbly as ours.

By Asger Lau Andersen, Associate Professor of Economics, University of Copenhagen, Niels Johannesen, Professor of Economics, University of Copenhagen, Mia Jørgensen, PhD student, Copenhagen University, and José-Luis Peydró, ICREA Professor of Economics at UPF, Barcelona GSE; Research Professor and Research Associate, CREI; and CEPR Research Fellow. Originally published at VoxEU

Who gains – and by how much – when central banks soften their monetary policy regime is a key policy question. This column discusses new evidence on the distributional effects of monetary policy based on detailed administrative household-level data. The authors show that the gains from lower policy rates exhibit a steep income gradient, with the increases in income, wealth, and consumption modest at the bottom of the income distribution and highest at the top.

Monetary policy is an important tool for stabilising the economy. This was especially evident during and after the 2008-2009 global crisis (Cui and Sterk 2018), with some market commentators even arguing that monetary policy has become ‘the only game in town’ (El-Erian 2016). In the context of the current Covid-19 crisis, central banks have again played an important role (e.g. European Parliament 2021).

While monetary policy is generally designed to affect economic aggregates, the distribution of gains and losses matters for several reasons. First, it shapes the effect on aggregate demand because households differ systematically with respect to the marginal propensity to consume (Kaplan et al. 2018). Second, the revived interest in income inequality (Milanovic 2016) and wealth inequality (Saez and Zucman 2014) have sparked an important debate about how monetary policy affects these phenomena. This question has also attracted significant attention from policymakers, with some arguing that softer monetary policy reduces inequality because it primarily helps lower-skilled workers find jobs (Draghi 2016). But others have emphasised that the well-to-do also benefit through increasing asset prices, meaning the net effect on inequality is ambiguous (Bernanke 2015).

In a recent study, we analyse the distributional effects of monetary policy on income, wealth and consumption (Andersen et al. 2020). Our main data source is individual-level tax records for the entire population of Denmark, with detailed information about income and balance sheets for the period 1987-2014. This equates to more than 70 million individual-year observations. In the tax records, we observe all major components of households’ disposable income (e.g. salaries, dividends, and interest expenses) as well as the main balance sheet components (e.g. housing, stocks and debt). We combine the tax records with other administrative data sources, most importantly an auto register with information on car purchases – an important component of durable consumption.

The goal of the study is to estimate how a decrease in the policy rate affects households at each position of the income distribution. A key empirical challenge is that the Danish policy rate may be endogenous to local economic conditions. We address this challenge by exploiting the long-standing commitment of the Danish monetary authorities to exchange rate stability (which implies that Denmark has effectively imported its monetary policy stance from Frankfurt for 35 years). When the ECB changes its leading interest rate, the Danish Central bank typically changes its rate on the same day to restore the interest rate differential that is consistent with a fixed exchange rate. This introduces a source of exogenous variation in the Danish policy rate that we exploit for identification. Concretely, we use changes in the ECB policy rate as an instrument for changes in the Danish policy rate, while controlling exhaustively for the macroeconomic environment, for cross-border spillovers, and for secular trends in inequality.

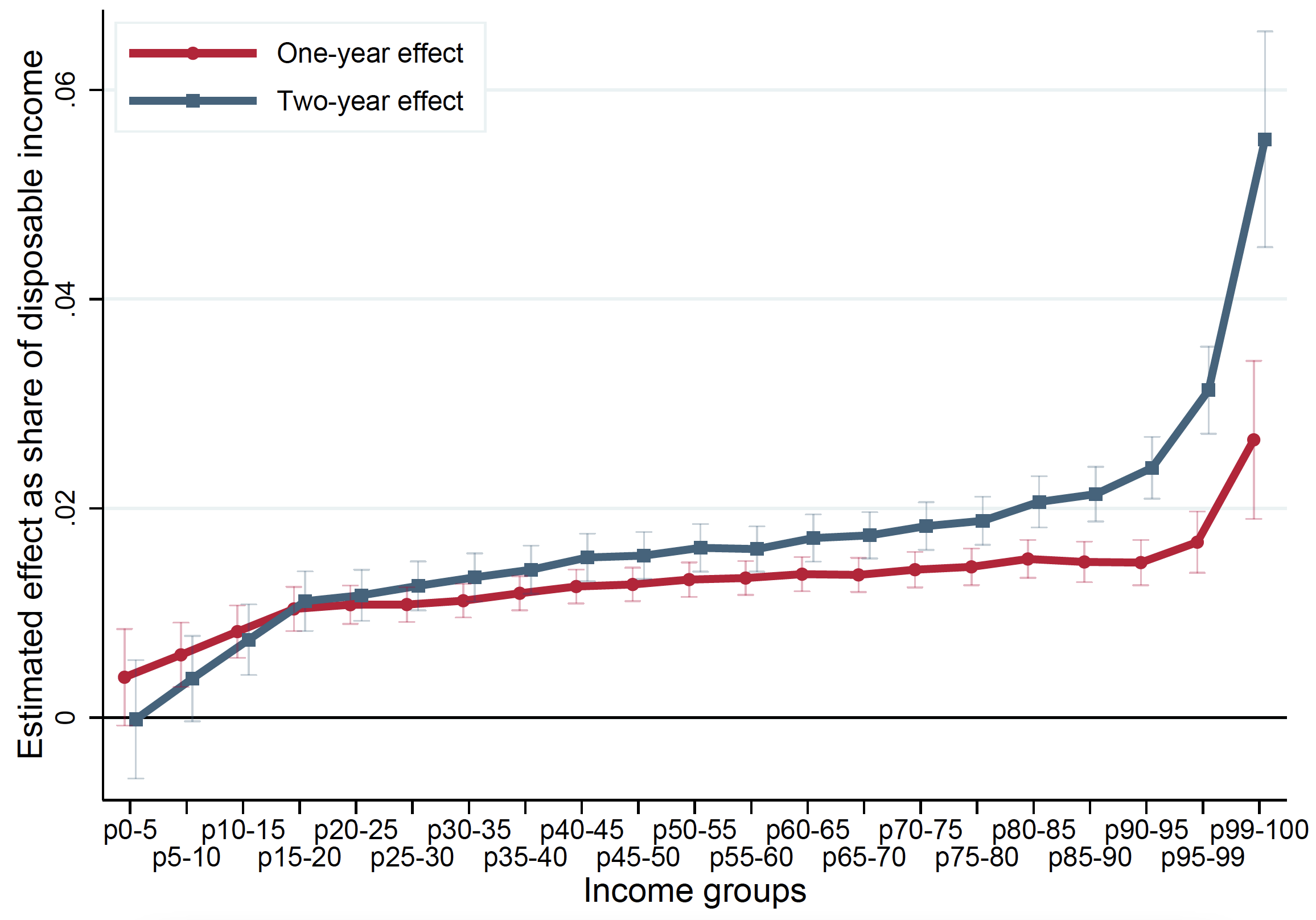

Our first set of results concern the effects of monetary policy on disposable income. We show that softer monetary policy increases disposable income at all income levels, but that the gains are highly heterogeneous and monotonically increasing in the income level. As shown in Figure 1, a decrease in the policy rate of one percentage point raises disposable income by less than 0.5% at the bottom of the income distribution, by around 1.5% at the median income level, and by more than 5% for the top 1% over a two-year horizon.

Figure 1

We identify the key economic channels underlying this result by considering each component of disposable income separately. Consistent with theory and the perception of policymakers (e.g. Draghi 2016), softer monetary policy has the largest effect on salary income at relatively low income levels, reflecting a sizeable increase in employment for this group. But most other components of disposable income (e.g. gains in the form of higher business income, higher stock market income, and lower interest expenses) contribute to a positive income gradient.

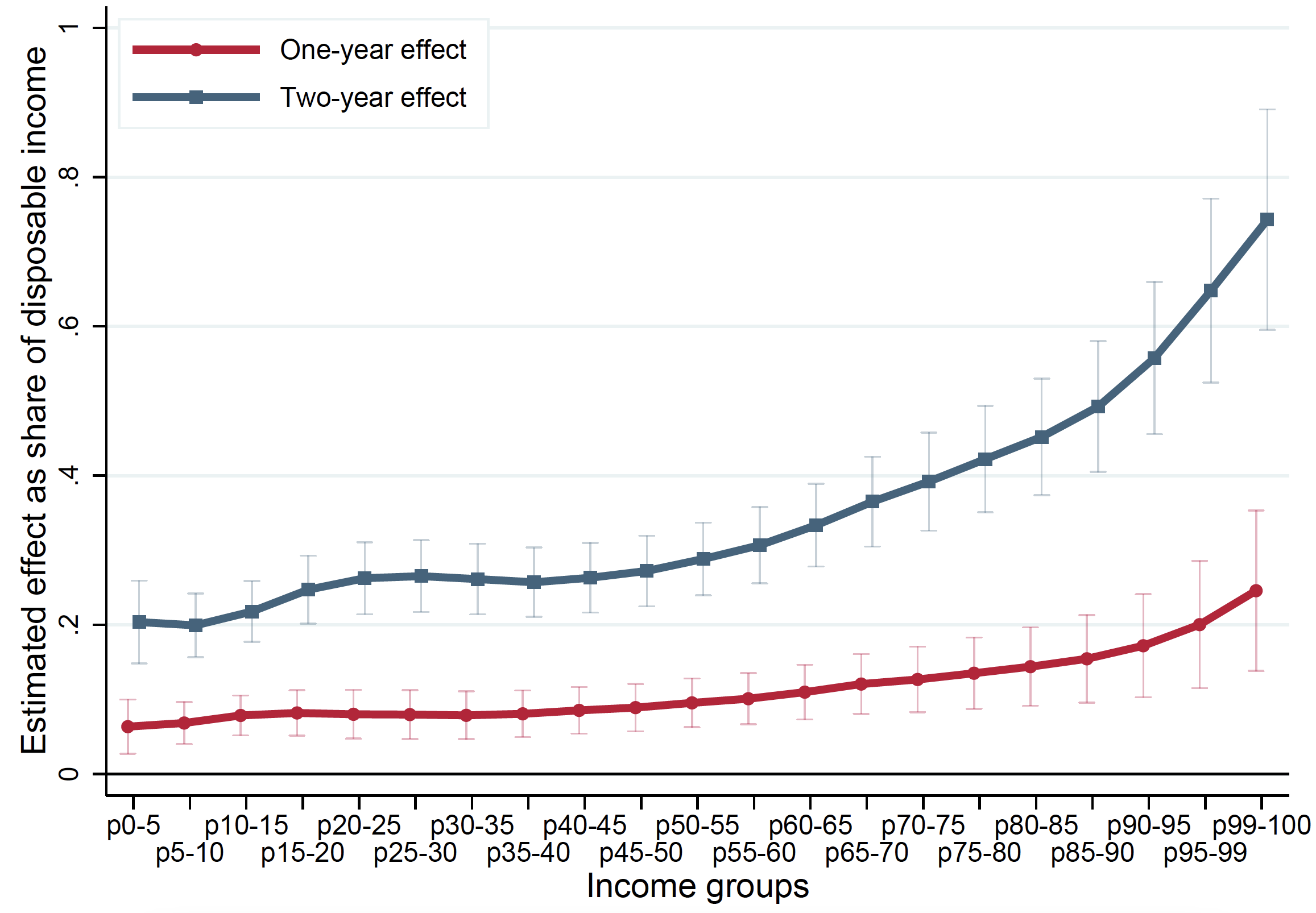

Our second set of results concerns the effects of monetary policy on asset values through changes in property prices and stock prices. We document that softer monetary policy creates capital gains for all income groups, but with a pronounced positive income gradient. As shown in Figure 2, a decrease in the policy rate of one percentage point increases asset values by around 20% of disposable income at the bottom of the income distribution and by around 75% of disposable income at the top over a two-year horizon (implying asset returns on housing and stocks of 6-8%). This suggests that the effects of softer monetary policy through appreciation of assets are generally much larger than the effects through higher disposable income. The income gradient largely reflects that households at higher income levels hold more assets relative to their disposable income, and, to a lesser extent, that the asset returns created by monetary policy are higher.

Figure 2

We also study the distributional effects of monetary policy on consumption and wealth accumulation. The intertemporal budget constraint requires that the gains created by softer monetary policy, whether in the form of disposable income or capital gains, must be either consumed or added to the household’s wealth. But by changing market interest rates, monetary policy also changes the trade-off between consumption and savings more broadly, as captured by the intertemporal elasticity of substitution. The results indicate that the consumption and wealth gains of softer monetary policy are both highly unequally distributed.

Theoretically, debt matters directly for exposure to several channels of monetary policy and may further shape consumption responses to the extent that it represents a financial constraint. We show empirically that household debt plays an important role in the transmission of monetary policy. Within income groups, we show that the estimated effects of monetary policy tend to increase monotonically with ex ante leverage. Within groups with similar leverage, the income gradient is generally weaker than in the full sample. Nevertheless, significant heterogeneity remains even after accounting for leverage. Notably, the top-1% stands out with larger gains from softer monetary policy than any other income group at each level of leverage.

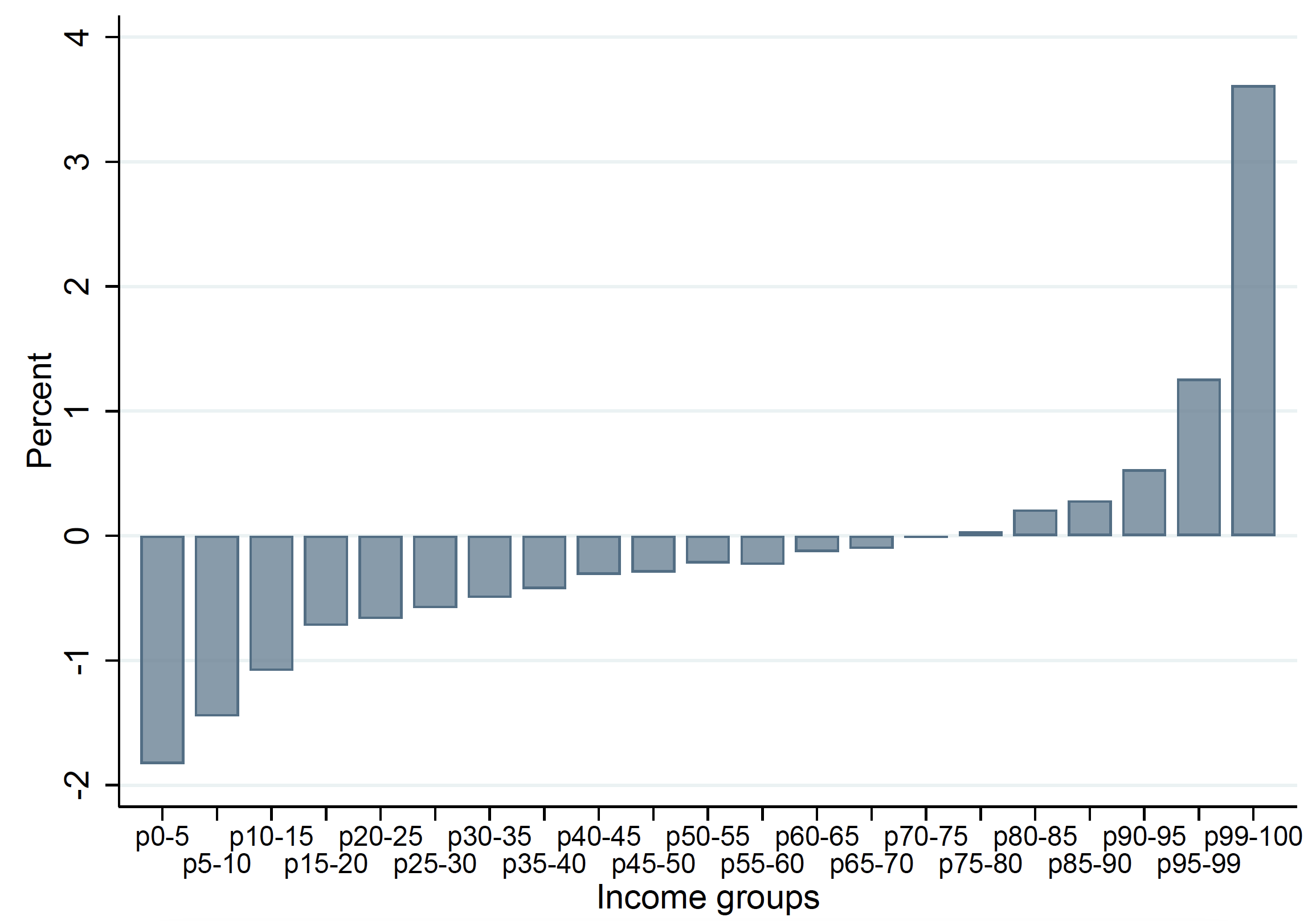

Finally, to relate our findings to the broader body of existing research on inequality (e.g. Piketty 2014), we undertake a simulation exercise that summarises the distributional implications of our estimates. The results suggest that softer monetary policy unambiguously increases income inequality by raising the income shares at the top of the income distribution and lowering them at the bottom. As shown in Figure 3, accounting for direct as well as indirect channels, reducing the policy rate by one percentage point raises the share of aggregate disposable income for the top-1% by around 3.5% over a two-year horizon and lowers it by almost 2% for the bottom income group.

Figure 3

See original post for references

When one adds in the impact of middle class homeowners paying off the restrictive to well being debts such as student loans with cash out refis it becomes clear that those people are the morality firewall protecting the rich (good people pay off their engineered to create poverty debts) giving the looting that is low interest rate policy justification beyond simply shoveling money to rich people, which is what it is. In my circle of friends those who kept their houses through the GFC have been handed 100’s of thousands of real dollars not available to us lessers, we’re just much lessers now.

“But others have emphasised that the well-to-do also benefit through increasing asset prices, meaning the net effect on inequality is ambiguous (Bernanke 2015)”

It’s not ambiguous unless you need it to be…

“…some arguing that softer monetary policy reduces inequality because it primarily helps lower-skilled workers find jobs (Draghi 2016).”

And the lack of ambiguity can clearly be a path to success.

Tax it. Provide excellent social services and safety nets and consumer and environmental protections. Codify it with Rights legislation. Give all rivers their Rights. Listen to the rich when they asked to be taxed. Crazy. Redistribute money in a myriad of ways. Pour it into environmental cleanup. The nice thing that neoliberalism did was provide an explosion of money. It raced past science and technology and sociology; money went critical mass. Leaving devastation in its wake, yes. For all to see. And the good thing? Money is no longer the problem – inequality is.

I wonder how much of the wealth accruing to the top 1% due to lax monetary policy is actually vapor created by asset inflation, that will disappear in the next downturn.

Good question. Alas, I fear it’s not as much as you might hope. While a lot of us would would experience significant schadenfreude at seeing some one-percenters brought back down to earth by a market crash, we’d also discover that a lot of the ultra-rich had diversified. Like scooping up real estate they don’t need and turning it all into rental properties. Or buying up several competing companies and forming a monopoly. There are all sorts of “wealth preservation tactics” that can be employed to keep the ultra-rich really rich. Almost none of them benefit Joe and Jane Public.

In my opinion, ZIRP has been one of the greatest public policy disasters of the 21st century. Truly a terrible idea.

I wonder if Bezos source of wealth is from beating his meat or Jerome’s money gusher for billionaires.

I think this can be something of a source of confusion for MMT advocates to get straight, because the “natural rate of interest is zero” within an MMT framework. In some ways, what we have now is the worst of both worlds – ZIRP or near-zero interest rates when we are relying on interest rates and QE as the economic stabilisers (rather than a job guarantee).

ZIRP on its own is increasing inequality, fuelling asset price bubbles, and leading to insane speculation (especially in the tech sector), without any sense of reigning in high finance and directing money to more productive causes. Injecting money in ways concentrated at the top, as opposed to having more muscular fiscal (rather than monetary) policy as what we seek to sort out our economic malaises.

In a way we are halfway to MMT, with basically zero flexibility on a ZIRP taken as read, without the core counterbalancing measure of that more robust fiscal policy.

At least this is how I see it but smarter people are invited to disagree.

Yep. When it comes to fiscal and monetary policy, seems not to matter a whit given the way “the system” has been built and gamed. From the Riches perspective, tight or loose fiscal or monetary = “heads I win, tails you mopes lose, suckers!”

Quelle surprise! Central bank owned by banks owned by the richest few, operating via laws and regulations emplaced by corrupt (NC definition) government, will always and everywhere produce inward and upward transfer and concentration of wealth. With occasional burps of oh, say, $1400 or so, to cut the top off the burgeoning rage of the looted class.

No Jubilee for you, mopes! But I, your corporate overlord, can not only escape my debts via bankruptcy, but steal your pensions and demolish your polity at the same time!

Looking at Arrhenius and subsequent observers, http://sites.apam.columbia.edu/courses/apph4903-2015/Arrhenius_and_Global_Warming.pdf , none of this may matter since it may well be that the enviro processes are already well into a runaway Venusification of the planet. Such is the conclusion of an actual scientist working in the area that I used to work with at the US EPA.

I recall a sci fi dystopia story from many decades ago — rich folks get life extension treatments that let them live several hundred ears. Their predation on the planet has racked up a “Soylent Green” level of destruction. The mopes know they are living on a doomed (Venus-aborning) planet. Some of them get together and start killing off the rich folks, to deny them the pleasures those rich folks continue to indulge themselves in as the biosphere cooks itself from retained infrared under the permanent CO2-methane-H2O cloud cover.

One could only hope…

As to the hopeful notion that the next crash would burn off the “asset value” bubble, you can bet that the 0.1% and the next few ranks down will have immunized themselves against this problem. They’ve accomplished this many times already, most recently a couple of trillion in the Covid collapse, both wealth transfers from the MMT storehouse and real estate bubble and theft of RE (homes) as mopes fall off the train…

note to incipient mopes…

Always listen to the geezer that can properly use both “lose” and “loose” in one sentence!

The zero natural rate of interest is the real (after inflation) rate. The central message of MMT is that fiscal deficits can be monetized (not by zirp, but by currency creation) up to the point where inflation becomes an issue. In a country where constraints from foreign sovereign debt holders is small, and where r>g, there is room for job creating investment in infrastructure.

> where r>g

Really?

A couple of observations. First off, as JTMcPhee perceptively notes: while low interest rates evidently favour the top of the income and wealth distributions (as clearly outlined in the study referenced in the article) this does NOT prove that high interest rates don’t also favour the top of the income and wealth distribution. It’s more likely that the monetary policy game is rigged either way — as Mosler points out, it’s the already wealthy that disproportionately receive the interest payments:

https://gimms.org.uk/wp-content/uploads/2019/02/Central-Bank-Interest-Rate-Policy-Mosler-Armstrong.pdf

Second, I posit that it is fiscal policy rather than monetary policy which is the correct tool with which to attack inequality both because the latter appears to favour the rich regardless of its settings, and because the former can be targeted towards the lower end of the income and wealth distribution.

Of course, plutocracy and oligarchy having already infested our democracy, the challenge lies in getting political actors to recognize the importance of fighting inequality in the first place, and then getting them to recognize the primacy of fiscal policy over monetary policy in the teeth of a barrage of think tank/media propaganda and obfuscation on the payroll of “our betters.”

Unfortunately, Gilens and Page’s “Testing Theories of American Politics: Elites, Interest Groups, and Average Citizens” suggests that this will be an uphill struggle indeed:

https://scholar.princeton.edu/sites/default/files/mgilens/files/gilens_and_page_2014_-testing_theories_of_american_politics.doc.pdf

Powell should be arrested for treason.

Forcing inflation during a depression is reprehensible.

Print money for the ultra wealthy and force the bottom 99% to pay more for it.

Not that this will be news to anyone here, but there is also the second order effect that

low interest rates

=> reach for yield by insurance cos, pension funds and endowments

=> assets flow into private equity

=> monopolistic mergers and race to the bottom cost cutting.

Rinse and repeat for a few generations and the precariat is magically transformed into a real underclass.

Because the playingfield is completely not level. Pickity’s observation that capital accrues at a higher rate than the economy is key.

https://www.connectingdots.one/winner-takes-all-or-why-the-playing-field-is-so-slanted/

Piketty’s theory is bunk. His only source is land records in France.

Nothing can grow faster than the rate of GDP on a sustained basis. Trees do not grow to the sky. If this were true, capital would have become all of GDP a long time ago.

Are monetary conditions soft for people who, sadly, rely on payday loans & credit cards?

QE is just financial repression.

I don’t suppose it occurs that HOW interest rates are produced is important? That privileges for the banks and welfare for the rich aren’t the way to go in that regard?

As Keynes pointed out in the 1930s, monetary policy is unable to solves some of these problems. The Fed has been fighting the war for decades with the only tool it has specifically because the other government agencies refuse to do their part. These other government agencies who have decided on huge tax cuts, disinvestment in the USA’s productive capacity, privatization of essential utilities, financialization of our economy, and deregulation, have been working at cross-purposes to the Fed. Not only is monetary policy alone unable to solve these problems, but monetary policy fighting against fiscal policy is a sure recipe for disaster.