Lambert: Herd animals.

By Yuriy Gorodnichenko, Quantedge Presidential Professor, Department of Economics, University of California – Berkeley, Tho Pham, Lecturer in Economics, University of Reading, and Oleksandr Talavera, Professor of Financial Economics, University of Birmingham. Originally published at VoxEU.

While the effectiveness of central bank’s verbal communication is well documented, little is known about the effectiveness of communication via non-verbal channels. This column discusses vocal features of Federal Open Market Committee communication and examines the impacts on financial markets. The results suggest that tone of voice can contain distinct information not captured in the texts of press conferences. A positive voice tone can lead to higher share prices and decreases in volatility, highlighting the importance of voice control for central bank communication.

In a famous analysis, Mehrabian (1971) posited a 7-55-38 rule of communication: words convey 7% of a message, body language (gestures, facial expressions, etc.) accounts for 55%, and tone delivers 38%. While the debate on exact percentages for each channel is far from settled, it is clear that effective communication has to rely on more than just the text. Central banks have been increasingly relying on communication-based tools (e.g. forward guidance) to manage the public’s expectations, but do central bankers utilise communication to its full potential?

It has been widely documented that the content and text sentiment of statements, minutes, and transcripts can move financial markets (e.g. Hansen and McMahon 2016, Hansen et al. 2018). However, little is known about the effects of central bankers’ non-verbal communication. In a recent study (Gorodnichenko et al. 2021), we develop a novel deep learning model to quantify tone (vocal emotions) embedded in the answers given by Federal Reserve (Fed) chairs during Federal Open Market Committee (FOMC) press conferences over the period 2011 to June 2019. In other words, we move beyond text analysis and study how policy messages are voiced. We then examine whether emotions in voice tone can move financial markets.

Vocal and Verbal Features of Monetary Policy Communication

Building on recent research on voice recognition and speech emotion, we develop a neural network algorithm to classify the emotions embedded in the answers during FOMC press conferences. Specifically, we split a given press conference into audio segments corresponding to each question raised during the event and the response of the speaker. The split audios are then run through a machine learning procedure which is trained to recognise emotions from voice variations. Each answer is rated in terms of three emotions: positive (happy or pleasantly surprised emotions), negative (sad or angry emotions), and neutral. For a given press conference, the aggregate voice tone is then measured as the ratio of the difference between the positive answers and the negative answers to the total number of positive and negative answers.

On average, Ben Bernanke had more positive emotions in his voice than Janet Yellen, who in turn had generally more positive emotions in her voice than Jerome Powell. Bernanke had five Q&A sessions with only positive emotions in his voice. In contrast, Jerome Powell had five Q&A sessions with only negative emotions. Janet Yellen’s sessions always had a mix of positive and negative emotions. Moreover, there is a considerable within-speaker variation in the tone, with Jerome Powell exhibiting the largest variation.

We also employ a dictionary-based approach similar to Neuhierl and Weber (2019) to classify the text of statements and press conference transcripts into hawkish versus dovish sentiment. The sentiment of texts during the terms of Bernanke and Yellen appeared to be more dovish than Powell’s, which likely reflects that policy rate increases dominated during Powell’s period in our sample. The within-speaker variation in the text sentiment is broadly similar across the Fed chairs. Additionally, the variation in text sentiment during Q&A sessions is larger than the variation in the text sentiment for statements and remarks, which is likely a result of the less scripted nature of Q&A sessions relative to other communication types.

Co-movement in Voice, Word, and Policy Actions

Although one might think that text and voice should be highly congruent, we find that the relationship between these two channels of communication is more nuanced. Specifically, the positive messages conveyed in the voice tone are associated with more dovish texts, but this relationship is fairly weak. In fact, it is not uncommon to observe dovish texts and negative tonality. Similarly, there is only a weak correlation between the variation in tone and actual policy shocks identified as in Swanson (2020): a shock to the policy rate (FFR shock), a forward guidance (FG) shock, or an asset purchase (AP) shock. However, there is a stronger correlation between voice tone and the stage of the policy cycle measured by the shadow rate (Wu and Xia 2016). In short, the tone of Q&A responses may generate variation in policy communication that is unrelated to the Fed’s actions and verbal communication.

Fed Chairs’ Voice Tone and Financial Markets

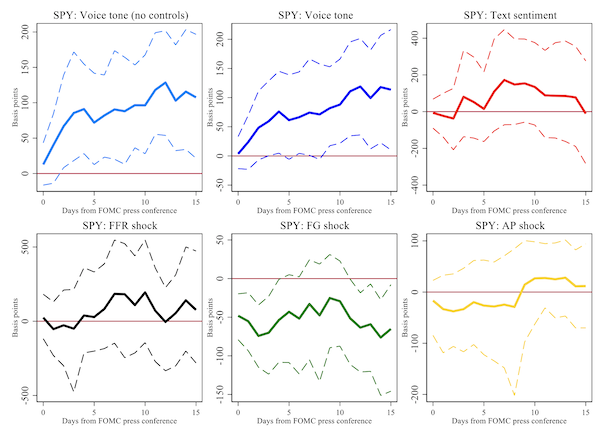

Using local Jordà (2005) projections, we show that a more positive voice tone leads to an increase in share prices (Figure 1). Specifically, the contemporaneous response of the stock market is weak and not significant statistically. Over time, the response builds up and after five days, the return on SPY ETF reaches approximately 100 basis points for a unit increase in voice tone. Importantly, the magnitude of the stock market response to a unit decrease in voice tone is approximately equal to the response we observe after a one-standard-deviation forward-guidance shock. Thus, the variation in voice tone has economically significant effects on the stock market.

Figure 1 Response of SPY ETF (S&P 500) to policy actions and messages.

Notes: The figure reports estimated slope coefficients for policy communication/actions. Dashed lines show 90% bootstrap confidence intervals. FFR, FG, and AP shocks are normalised to have unit variance.

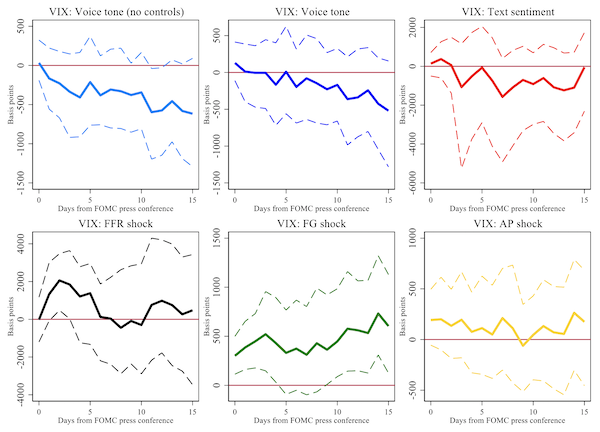

Further examination suggests that a positive voice tone tends to decrease current and anticipated volatility (Figure 2), which is consistent with the notion that central banks can shape uncertainty about future economic conditions (Hansen et al. 2019). A more positive tone also leads to a reduction in investors’ expectation about interest rate risk.

Figure 2 Response of VIX (CBOE volatility index) to policy actions and messages.

Notes: The figure reports estimated slope coefficients for policy communication/actions. Dashed lines show 90% bootstrap confidence intervals. FFR, FG, and AP shocks are normalised to have unit variance.

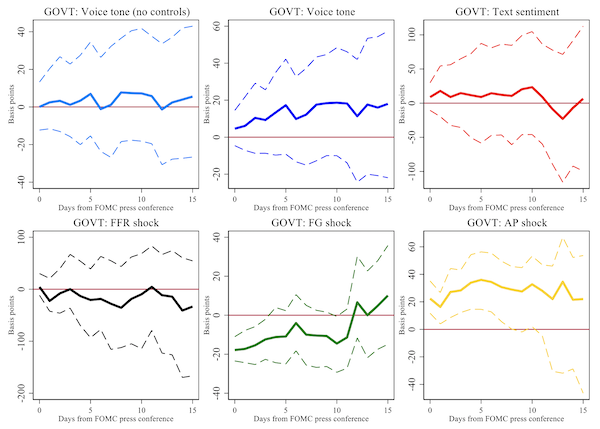

In contrast to the strong responses of the stock market, bond market tends to take few vocal cues from the Fed chairs (Figure 3). This finding is consistent with Cieslak and Pang (2020) or Ehrmann and Talmi (2020), who document that bond market reaction to Fed communications is weak. By examining the response of the spread between nominal and inflation-indexed government bonds, we find that a more positive voice tone leads to lower expected inflation after five to ten days. One may conjecture that positive tone plays a signalling role: a happy tone of the Fed chair indicates satisfaction with future inflation dynamics.

Figure 3 Response of LQD ETF (corporate debt) to policy actions and messages.

Notes: The figure reports estimated slope coefficients for policy communication/actions. Dashed lines show 90% bootstrap confidence intervals. FFR, FG, and AP shocks are normalised to have unit variance.

Why Does Voice Tone Matter?

Overall, our findings show that just as the actions of the Fed move financial markets so too does the vocal aspect of FOMC press conferences. One potential explanation is that due to asymmetric information between the public and the central bank, market participants tend to look for more information through the aspects which are not explicitly ‘scripted’ such as the voice tone or body language of the Fed chair. These non-verbal elements of communication can signal the Fed’s perspective on current/future economic outlook and/or the course of future monetary policy. In fact, it is not uncommon that investors and media watch/listen to the FOMC press conference, analyse the chair’s voice, and attempt to interpret what it (i.e. the voice tone/emotion) means. In other words, the press and financial market investors appear to pay attention to the non-verbal communication.

Although future work should dig deeper into understanding nuances of using voice to communicate policy, our results clearly have important policy implications. How messages are said appears to be potentially as important as what is in the messages. This does not make the job of central bankers easier and possibly adds another qualification (voice control) to the job requirement. However, this could be a prerequisite for anybody interested in using a public arena for policy communication. Indeed, to paraphrase Ronald Reagan, how can a Fed chair not be an actor?

Shorter…

When you’re running a con, it’s important for he rubes to not be in on all the information given out, while you want others who are in on the con to be able to suss the message.

“One potential explanation is that due to asymmetric information between the public and the central bank, market participants tend to look for more information through the aspects which are not explicitly ‘scripted’ such as the voice tone or body language of the Fed chair.”

Well said. It’s a faith based system and if people lose faith in their gods the whole thing would tumble.

Telling article. Setting aside the issues of whether Fed buying trillions of dollars of US Treasuries and government-guaranteed MBS, negative real interest rates, and repeatedly encouraging massive increases in debt and related speculation-driven asset price bubbles is either sound public policy or consistent with the Fed’s dual mandate, communication is essentially all they’ve got. Increased Bank Reserves, which is the other side of the enormous QE, are inert unless activated by the banks; and loans as a percentage of deposits are in a long-term decline. The reality is that money is tight. Significant control now lies with the large transnational banks that set rates in the global eurodollar system, which is likely one of the reasons the Fed and BOE have been pushing for replacement of LIBOR with SOFR.

The writers ask, “Why does voice tone matter?” We’ve been in an economic malaise since the 2008 financial crisis, and it’s become clear the central bankers don’t have a policy solution that works for anyone but Wall Street, the 0.3 Percent, corporate executives with stock options, and the speculative investor class.

Bernays, met Bernanke.

Oh, you already know each other? have been working together for a couple of generations?

Good to know.

I ran into this little article in a random walk through Greenspan searches: https://www.cepr.net/documents/publications/dereg-timeline-2009-07.pdf Lays out the history of how the wealthy gutted the regulatory structures that once upon a time gave the mopes a small chance of not being looted.

Greenspan: what a rat he was — and then to have the cojones to sort of apologize with one of those “Mistakes were made” nopologies, https://slate.com/human-interest/2014/11/sorry-not-sorry-non-apology-fauxpology-unpology-and-other-names-for-hollow-apologies.html May he rot in the seventh level of Hades. And some think Jerome Powell is walking the same path: https://thehill.com/opinion/finance/547987-jerome-powell-risks-alan-greenspans-fate

Non-verbal communication indeed. An upraised middle finger to all of them.

I believe Greenspan got exactly the result he wanted. For reputation-saving purposes, he pretended to think he had “overlooked” something and pretended to feel “apologetic” about it.

About ” tone of voice” communication . . . . I remember watching Bernanke on CSPAN a couple of times talking to Congress. I remember sometime before the 2008 crash ( I don’t remember how much before), that when Bernanke was asked in the hearing something about the state of things and stuff, that his voice began cracking with fear before he got control of himself and his voice and told the Congress hearing-meisters how good things were, how safe, and how in-control the Fed was.

And I remember thinking, Bernanke wasn’t going to be afraid of any old Congressman or even a whole Congress full of them. He must have “seen” something very big and very bad slowly approaching from over the horizon and it scared him. But I of course would have had no idea what it could be. Just that he saw “something”.

I claim that to be a true memory.

Hahahahahaaa! This is great! Having just gone through Rhetoric of Economics coursework, this both resonates and extrapolates. If the rhetoric of macroeconomic policy matters, then it stands to reason that the manner of delivery of such rhetoric does as well. I’ve taken a shine to the movie “Tinker Tailor Soldier Spy” during the pandemic. I watch it several times a week and I find it so superbly acted – Gary Oldman, John Hurt and Mark Strong particularly as Smiley, Control and Jim Prideaux respectively. The script, save for a few incongruous bits, allows the actors to deliver convincing performances. The old bard is proven right yet again – all the world’s a stage! FOMC members are indeed actors – twice times over, as agents/participants and as thespians! Toward this end, I have sought to blunt the agita that usually accompanies my online discourse by imagining myself speaking about #MMT or Econ in general as Gary Oldman’s George Smiley might … ;-) Hoping this will turn out to be a more convincing approach.

I work in aerospace. If aerospace engineering was such a sorry a$$ joke as this crap, airplanes would fall out of the sky every day.

How these people EVER convinced the rest of the world that they should control the systems of finance that rule for world is beyond me.

> In a famous analysis, Mehrabian (1971) posited a 7-55-38 rule of communication: words convey 7% of a message, body language (gestures, facial expressions, etc.) accounts for 55%, and tone delivers 38%.

I close my eyes and listen. That takes away over half of the misdirection the talker intends to harm me with. Then I can see right through the rest of the bullshit.

For instance, it used to drive me nuts to watch Obama, rotating his head side to side on some weird eliptical neck pivot, but once I eliminated that it all made syrupy vacuous nonsense.

I am reminded of the public address recordings used to soothe and disperse any agitated groups in Huxley’s Brave New World — accompanied, naturally, by a judicious dose of aerosolized Soma.