Yves here. We picked up on the observation of the Financial Times’ John Dizard many years ago: that the shale industry would continue to engage in fundamentally unprofitable drilling as long as operators could borrow money, and that would continue for quite a while. The day of reckoning has finally arrived.

By Justin Mikulka, a freelance investigative journalist with a degree in Civil and Environmental Engineering from Cornell University. Originally published at DeSmog Blog

Image: Fossil fuel oil well. Credit: CL Baker. CC BY 2.0

“Drill, baby, drill is gone forever.”

That was the recent assessment of Saudi Prince Abdulaziz bin Salman of the American oil industry’s future potential. As Saudi Arabia’s energy minister, Prince Abdulaziz is one of the most influential voices in the global oil markets. Fortune termed it a “bold taunt,” and a warning to U.S. frackers to not increase oil production.

The response by the U.S. producers — to shut up and take it — quietly confirms this reality. Shale oil’s era of growth appears to be over. The reason is that even as global oil demand and prices rise, the economics of the shale oil business model continue to not work. The U.S. shale industry has lost hundreds of billions of dollars in the past decade producing oil and selling it for less than it cost to produce.

This was possible because despite the losses, investors kept giving the industry money. But now investors appear to have grown tired of losing money on U.S. shale companies and new lending to the industry has dropped dramatically.

As reported this month by The Wall Street Journal, “capital markets showed little interest in funding expansive new drilling campaigns” for the U.S. shale industry. Shaia Hosseinzadeh, a partner at investment firm OnyxPoint Global Management LP, told The Journal that the problem facing fracking companies is that “they can’t access cheap capital any longer.”

Without new infusions of money, the industry can’t drill for more oil, and that is why the Saudis feel confident taunting the U.S. oil industry. Prince Abdulaziz’s confidence is based in the financial realities of U.S. shale.

As oil industry analyst Robert Clarke of Wood MacKenzie recently told the Financial Times, “If there ever was a time to drill [shale] oil, now is a great time. … But why would you change the recipe? Not drilling is working in their favour.”

New Normal for U.S. Oil Industry

What’s happening with the U.S. shale industry in this high price oil environment is unusual. Oil is typically a very predictable boom-and-bust business: When prices go up, oil drillers produce as much as they can, and when prices go down they stop.

But for American drillers right now, the money isn’t there because investors no longer are willing to lend to frackers based on promises of future profits that have yet to materialize for the industry. In July 2020, accounting firm DeLoitte released a report stating that, “The U.S. shale industry registered net negative free cash flows of $300 billion, impaired more than $450 billion of invested capital, and saw more than 190 bankruptcies since 2010” — supporting the claim that the industry has peaked without ever making money.

Investors have taken notice, including the private equity industry that has invested heavily in the fracking boom. Dan Pickering, head of energy investment firm Pickering Energy Partners, highlighted how private equity has lost interest in further investment in the shale industry in his keynote presentation at Hart Energy’s annual Energy Capital Conference in June.

According to Pickering, despite the industry’s inability to make profits, in 2016 private equity started 122 new oil and gas companies. In 2017 private equity backed 132 new companies. This is compared to private equity backing 16 companies in 2020 and just four new companies this year.

‘Capital Destruction Machines’ Need Capital

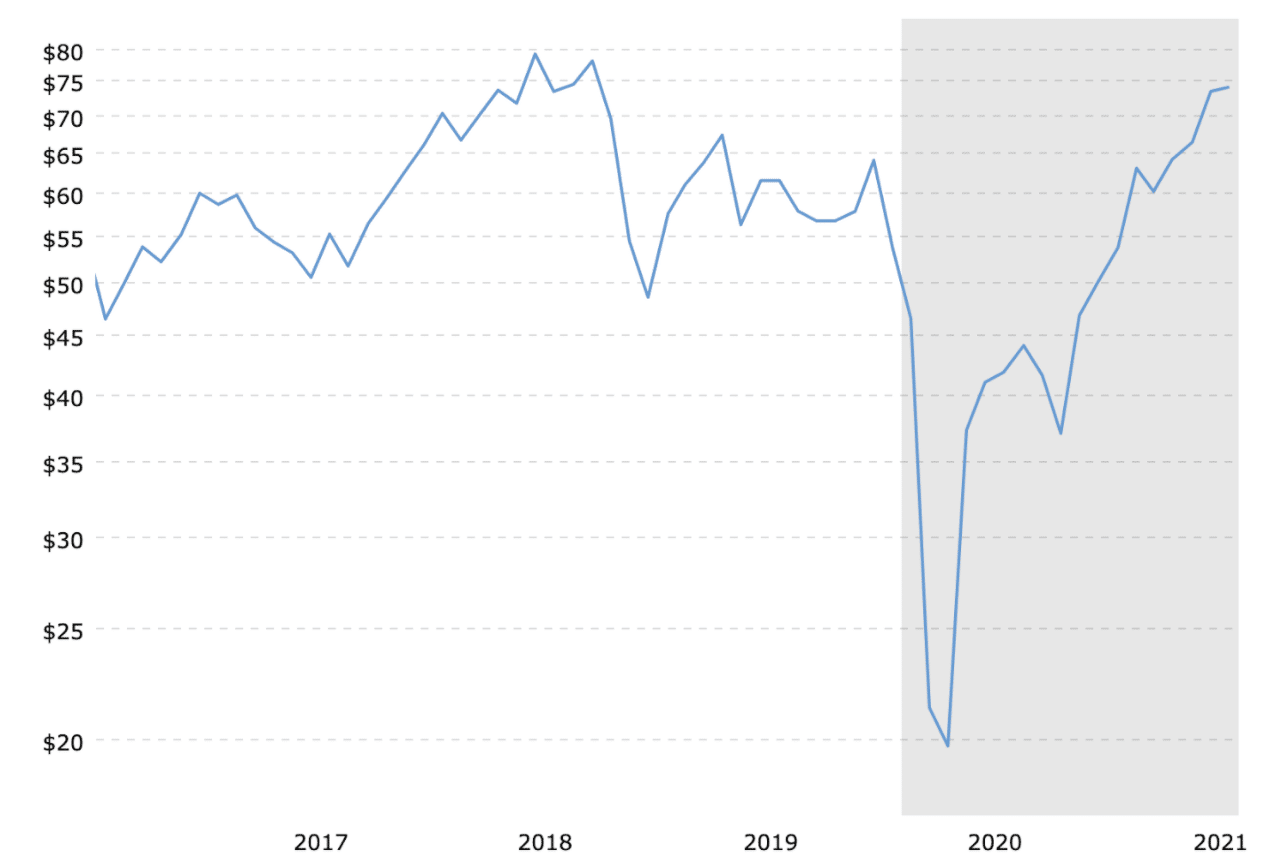

The U.S. shale industry has been accurately described as being composed of “capital destruction machines”. The hundreds of billions in losses the industry has accumulated in the past decade prove that it’s true. With few investors willing to provide new capital to feed the machine, the only option is not drilling, even though prices are the highest they have been in years, at nearly $75 per barrel.

Capital Destruction Machine –> good band name https://t.co/fDWTgmhA69

— Catherine Traywick (@ctraywick) May 10, 2019

Oil prices briefly reached $75 a barrel in 2018 but haven’t been consistently higher than that since 2014.

According to the shale oil industry, these prices are well above what is needed to make a profit. But the industry isn’t drilling, and in areas like the Bakken shale play in North Dakota, production is actually falling.

In March of 2020, Lynne Helms, the director of North Dakota’s Department of Mineral Resources, made an optimistic forecast for shale oil production out of the state’s portion of the Bakken formation, a 200,000-square-mile shale oil deposit underneath Montana and North Dakota in the U.S., and Saskatchewan and Manitoba in Canada.

“We’ve looked at a large number of price scenarios and none of them take us below 1 million barrels a day in the next four or five years,” Helms explained in a webinar, according to Bloomberg.

And yet, with prices above $70 a barrel, Bakken production is not increasing. The current rate of just above one million barrels a day is down 26 percent from the 2019 peak of almost 1.5 million barrels per day.

As DeSmog has recently documented, the challenges facing this region’s oil producers mean that “Bakken’s best days are a thing of the past.”

But it isn’t just the Bakken. Investors are not interested in losing more money on any U.S. shale. The latest survey of oil and gas companies by the Federal Reserve Bank of Dallas makes that very clear: “We have relationships with approximately 400 institutional investors and close relationships with 100. Approximately one is willing to give new capital to oil and gas investment. The story is the same for public companies and international exploration.”

Without that money, drillers can’t drill.

DeSmog asked petroleum geologist Art Berman for his opinion on why the U.S. shale industry is choosing not to expand production amid the current high prices for oil. “I believe that the main factor behind somewhat limited drilling by the tight oil industry is lack of outside capital,” Bermain stated via email.

Shale Industry Limited By Financial Constraints

The shale industry — known for misleading investors — is taking credit for restraint to explain the lack of new drilling. This argument was reflected in the recent Wall Street Journal headline, “American Frackers Show Restraint as Oil Tops $70.” This is misleading because it implies that the frackers are choosing to not drill when the current financial reality doesn’t offer them that choice. The industry is facing a very real financial constraint that is the result of investors’ decisions, not the will of those within the industry.

But the reality is that investors are fleeing the sector, and are unlikely to return.

In early June, at Hart Energy’s annual Energy Capital Conference in Houston, there was a panel discussion on the state of bank lending to oil companies, moderated by Steve Toon, editor for industry publication Oil and Gas Investor. Toon closed the session with a simple question: “Do you think there is enough capital available in today’s market to grow production in the U.S.?”

“I don’t think there’s enough capital available right now to grow production, much less even replace depletion,” was the response from Steve Kennedy, executive vice president and head of energy banking at Amegy Bank.

“Not today. But there will be. As prices go up, capital will be attracted to the industry,” said Buddy Clark, a partner at Energy Practice Group, Haynes and Boone. “If oil companies are making money, the banks want to be there.”

Some estimates are that the U.S. shale industry has lost half a trillion dollars of investor money during the U.S. fracking boom. That is the amount of money required to fund the capital destruction machines that produced oil above and beyond what the industry was able to earn and re-invest from selling oil. There is very little chance the industry will ever make that money back.

The history of market booms is full of claims that “this time is different,” that normal market economics no longer apply. This was certainly the case in the U.S. housing boom that caused the Great Recession. As DeSmog explained in 2018, these booms are driven by U.S. monetary policy which allows them to go on for much longer than would seem reasonable.

From that perspective, the U.S. shale oil boom has been pretty standard. However, like the dot-com boom of the 1990s and the housing boom of the 2000s, eventually investors tire of losing money, and the old rules of investing — where investors expect to get a return on their investments — become attractive once again.

The U.S. shale oil boom seems to have reached that moment. This isn’t the outcome the industry and its supporters promised to investors. The reality that the industry has never made money is finally sinking in.

The US shale industry has been like the Freddy Krueger of the American landscape. No matter how many times it looked like it had been killed off, it was back again. Hopefully this will finally die now that all the stupid money has dried up but this is not the end. This is merely the beginning. There is going to have to be an almighty reckoning with how much damage and destruction has been done to the American landscape and here I am talking about water & soil contamination, health care costs, habitat destruction, repair of public infrastructure and services (if it can be afforded), and economic depression in former fracking areas. I am here to say that eventually that this will run into the trillions and that some damage cannot be undone. How do you replace contaminated aquifers for example?

Wall Street made out like bandits with the fracking industry but don’t think that they will be anywhere to be seen when the cleanup bills arrive. Their buddies in DC will make sure of that. I am given to understand that fracking really kicked of with the 2005 Energy Policy Act which made fracking exempt from requirements of the 1974 Safe Drinking Water Act. This sounds like some of Cheney’s doing here. And the reason that it was made except was that fracking pollutes underground water sources with a toxic brew of chemicals. What were some of these chemicals? Don’t know. That’s propriety information that. Will those toxic chemicals migrate up to the top soils? Myself – don’t know. All I know is that there is the devil to pay and him out to lunch. Here is an article taking about some of the costs incurred-

https://environmentamerica.org/sites/environment/files/exp/reports/costs_of_fracking.html

they left off the list various ancillary costs…like sand.

i live on an ancient beach, from when texas had an inland sea, and the place where i’m sitting would have been 10-100 feet underwater(now 1680′ above sea level)

one of the reasons mom chose this area was that there was no timber, oil, rail or anything else that the Machine could want…but the realtor only mentioned in passing, and after the fact, that we sold sand at the time to Saudi Arabia.

the big hill just to my north is composed entirely of granite derived beach sand…which turns out is perfect for propping open oil/gas bearing rock strata.

the mining of this sand is open pit, involves a whole lot of groundwater, and fills the air for miles around with very fine and sharp particulate matter/dust.

it also gives everyone working at the mine silicosis…even with the protective gear(which wasn’t enforced until recently….because, as we’ve learned lately, Masks are not Manly)

a couple of miles around the old voca, texas sand plants is devoid of birds and insects, and that portion of the san saba river has few fish…the whole area is eery in it’s utter silence.

so i’m very pleased that the permian is no longer in play, and that fracking has finally….and hopefully…run it’s course.

i just hope that this sand is not any good for concrete.

“Masks are not manly”. Indeed.

My grandfather worked in a fertiliser factory (in Ireland, 1970s/80s). The men were supposed to wear masks into one of the more dangerous and dusty parts of the plant. He didn’t (apparently they were just too sweaty and humid to bear). His lungs were destroyed to about 20% or 30% capacity, which put strain on his heart, giving him angina. Got a few thousand compo which he used to buy his house, but small compensation for angina, getting a minor heart attack every 2 or 3 days.

Working without a mask when you should wear one = very bad idea.

Great to see the shale shenanigans finally come to an end, hopefully.

Yep reverend, the uncounted costs of repair, well capping, reacconditioning and the costs of what cannot be repaired or mended are important. Those bills won’t likely be passed to the investors (the drivers of the drill baby drill craziness). We can add also the costs of added climate change through fracking activities, both the products themselves and the leaks from wells. Then we can add the opportunity cost of not dedicating those investments in other energy alternatives with potential to reduce emissions, the so called ‘bullshit renewable” sources. The spirit of such investments is so different!.In one hand you were investing in a finite resource that is rapidly depleting, much faster that conventional oil, with no multiplication effect and simple prayers on margins for profit. On the other hand you have technologies that may have lots of limitations but any improvement even if by small incremental gains would have a amplification effect that makes more sense from the point of view of investors in the long run. The lesson here is that when there is will to do so lot’s of money can be poured into certain activities no matter the losses. Why not doing it with investments that make better sense from the point of view of long term sustainability?

Thanks for making this point. There really is a fundamental difference between extractive investments/technologies and those that create something useful for the future.

I can’t recall the name of the book, but one economic historian went through past bubbles and pointed out that some just wasted resources (Dutch tulips, South Seas), some created infrastructure for the future (mid 19th Century railway mania), some were mixed (the first internet bubble) and others were actively distructive. We seem to be doing more and more of the latter. A stupid bubble in solar or wind would at least let us leap over some technological and infrastructural barriers.

1.5 million barrels of oil (a day) is the equivalent of 645000 tons of CO2. The yearly emissions for 36000 Americans. More than the entire country of Belize emits in a year. And they never even made money.

So that means it takes 16 years of harm for a market to correct itself (for reasons other than the damage).

I’m beginning to wonder if the profit motive is an unalloyed good.

Wonder no more. When the term “profit” changed from describing a single economic agent’s subsistence wage (like a peddlar’s in the 18th Century) to camouflaging economic rent siphoned off to absentee owners (via dividends), the profit motive became a ruthless, unthinking machine that would render the Earth uninhabitable if that’s what it takes to feed the profit motive. [Again, I call on those better schooled than I, such as graduates of the University of Denver’s Master’s program (where my academic mentor Robert E. Prasch studied), to weigh in here.]

How much of is it because the fracking industry and their political allies are wary of losing/angering more of the Republican-leaning base that are farmers and other rural residents?

Seems like the lack of cheap money is the barrier to the “I’m Be Gone/You’ll Be Gone” way.

Long-term loss of potable water and arable land for short term gain that mostly went to out-of-town people…

This is just an opinion w/o data that I am aware of to support…but the Fed’s recently found heroin like addition to QE and ZIRP have greased the wheels for the “The U.S. shale industry has lost hundreds of billions of dollars in the past decade producing oil and selling it for less than it cost to produce.”

The current US Fed policy of eternal QE and ZIRP have created massive dislocations, distortions, mal-investments in capital and investment and causing damage to society – like promoting climate change in a truly fantastical way. And reducing our standard of living.

Why should the Big Boys care about losing “hundreds of billions” when the Fed is injecting of free $120 billion/month towards their “investments” ? And that’s just the QE part.

Since QE is merely an asset swap (exchanging reserves for bonds, or vice versa), which is always and inherently an even exchange, I’m not understanding how this can be framed as a “free $120 billion/month”.

And since ZIRP prevents free interest income from being earned by the wealthy, I’m again not seeing how that can be so terribly damaging to society. (How ZIRP can cause climate change is beyond me.)

The next problem as these companies go bankrupt is all of the wells they abandoned now have to be capped and at the expense of the local governments and thus citizens. The low bonds posted will probably not cover the costs. Just another way to socialize the oil drillers losses. Drillers truely are snake oil sellers but investors never seem to learn. Take a google maps or earth tour of the Balkans or North Texas as well as New Mexico to see the pox they have created on the surface of the earth and now just walk away from. The produced water ponds and tanks and injeçtion wells are all a part of it too.

Losses are still losses, even if you could borrow at low rates.

My father-in-law is a high tech oil and water prospector in W Texas (since the late 70s). Due to recent health problems he’ll never work again so his kids have been trying to untangle the Gordian knot of his finances. Turns out the business hasn’t made any money off of wells since 2014, surviving on consultancy fees and debt. The family lawyer helpfully explained that the best way to think about the oil business is that it’s basically just gambling. Some people get addicted and they’ll go to great lengths to stay in the game. My father-in-law hasn’t paid his accountant since 2005 (running tally up to $170k), but in 2011 and 2013 he shelled out a combined $90k to take all his kids and their families on vacation. Microcosm of the whole industry.

Do different links in the supply chain show different profit margins – like the actual fracking margins vs the margins on the market after refinement?

I only ask because, like the oil industry would book profits in Panama using foreign flaged ships. Correct me if I am wrong but I think it worked like this — Buyers of oil would pay – for example – 20 a barrel – put it on board a flagged ship and sell it at a port with refineries at 60 a barrel – the 40 a barrel profit was booked in Panama or some other tax free zone and the refiner had their refined product profits squeezed by the over-price they paid for those barrels.

So my question is – is this same type of play used to dip into the investors pockets while booking profits elsewhere – so the insiders make the cash in the deals? Overseas? Dark markets?

For so many reasons detailed by this blog over the years, I have always viewed fracking as a potent symbol of modern man’s utter insanity. America’s fracking movement was one of many plot points that woke me up to the unbelievable greed and shortsightedness of our elites. Everything about it is insane.

“Only when the last tree is felled and the last fish is caught will you realize you can’t eat money.”

– Cree saying

The movie “Gasland” nailed it and that was about 10 years ago.

Fracking will have consequences for the health of US citizens for decades to come.

Oy! And yet “Bakken production is not increasing. The current rate of just above one million barrels a day”. A million barrels a day, and that’s not counting the other, albeit smaller, fields. We are so so doomed. It’s in the 80s (F) in Scotland today. In 2030 will it be in the 100s? (40C)? Doomed.

“Good riddance to bad rubbish!”

Yeoman’s service again to this Family Blog for providing all the analysis along the way. Still remember that article about sellers paying buyers to take oil off their hands. Ludicrous from start to finish.

I can only hope the Biden Administration doesn’t step in to give the industry a lifeline. It is pretty easy to claim “strategic importance” to get subsidies flowing in.