Yves here. This story serves to illustrate the incoherence of US policy, or more accurately, the incoherence of policies designed to pretend that addressing climate change is a no-pain proposition. We can either reduce energy use radically, which means lowering consumption (and war-making), or in short order, we’ll have lots of disruptions and shortages due to fires, floods, extreme storms, and lower harvests. So the US ought to welcome higher oil prices as a crude (no pun intended) carbon tax. But that would represent a 180. Suburban sprawl, extended supply chains, and our new normal of home deliveries all depend on cheap energy.

Needless to say, there’s even more of a disconnect in the Biden infrastructure bill, with the sops to oil and gas industry incumbents belying “Green New Deal”/Paris Accord posturing.

I’m old enough to remember that during the 1970s oil crisis, there were many efforts to cut energy use, from every other day gas access (depending on whether your license plate ended in an odd or even number), corporations generally following the exhortation to set summer thermometers at 77, and more use of ride-sharing (the grassroots kind). Warren Mosler has a persuasive analysis that shows that inflation started to fall in 1979 just after oil prices peaked; his charts make the case that the Fed driving interest rates to the moon and the resulting steep recession were unnecessary save to further weaken labor bargaining power. As we wrote in 2019:

Some experts, such as Warren Mosler, point out that the underlying inflationary trends were dissipating even before Volcker launched his money jihad, as shown by oil prices peaking in 1979. Recall that Volcker became Fed chairman in 1979 and started implementing the “Volcker shock” of constraining money supply in March 1980. Thus there is a case to be made that inflation would have abated, particularly since the key practice that had helped reinforce it, widespread formal and informal cost of living adjustments, had been abandoned or weakened.

High energy prices aren’t just unpopular, they are destabilizing. Economists have argued that gas at the pump rising to over $4.00 a gallon was a trigger for the financial crisis.1 In a similar vein, a persuasive analysis by Normura showed that the countries that had Arab Spring uprisings also had a high percentage of their populations unable to support themselves due to recent increases in food and fuel costs. The Gillet Jaunes protests were triggered by planned energy taxes; the protestors were low wage workers in rural areas particularly exposed due to being truckers/drivers or having long commutes by car.

Angolosphere economies, with their neoliberal “hate the poors” reflexes, are terrible at delivering relief to low income households, which is one way to distribute the burden of higher oil costs more equitably. Not only do we seem unable even to devise and implement such programs, but on the rare occasions when they get done, they rarely hand out dough quickly, and they are often burdened with elaborate means-testing.

By Alex Kimani, a veteran finance writer, investor, engineer and researcher for Safehaven.com. Originally published at OilPrice

President Joe Biden has lately sought to soothe fears that rising inflation could hurt the U.S. recovery and undermine his $4-trillion spending plans. This comes after U.S. inflation for the month of June accelerated to the fastest clip since 2008, as the economy continues to recover following the Covid-19 related lockdowns. According to the Labor Department, the consumer price index (CPI) climbed 5.4% Y/Y in the month of June. That’s about twice the average rate over the past decade. Biden has something else to worry about: Rising oil prices.

The administration will feel a little jittery about high oil and gasoline prices because of the risk they pose to Democrats’ future political ambitions. It’s a well-known fact that gas prices have an outsized impact on the consumer psyche. Gas prices currently sit at $3.18 per gallon nationally, a full dollar higher than prices last year.

Indeed, this is not lost on Republicans, who have seized the moment andblame Biden for rising gas prices.

Investors should, however, worry about rising oil prices not only because of the role that oil has historically played in dictating inflation trends but also because Wall Street is no longer enthusiastic about oil and gas stocks–which could, ironically, lead to even higher inflation.

Oil prices and inflation are connected in a cause-and-effect relationship. As oil prices climb, inflation tends to follow in the same direction higher. On the other hand, inflation tends to fall in tandem with falling oil prices. That’s the case because oil is a major input in the economy, and if input costs rise, so should the cost of end products.

Falling Oil Investments

Though less frequently discussed seriously compared to Peak Oil Demand, Peak Oil Supply remains a distinct possibility over the next couple of years, mainly due to serious underinvestments in oil and gas.

In the past, supply-side “peak oil” theories mostly turned out to be wrong mainly because their proponents invariably underestimated the enormity of yet-to-be-discovered resources. In more recent years, demand-side “peak oil” theory has always managed to overestimate the ability of renewable energy sources and electric vehicles to displace fossil fuels.

Then, of course, few could have foretold the explosive growth of U.S. shale that added 13 million barrels per day to global supply from just 1-2 million b/d in the space of just a decade.

It’s ironic that the shale crisis is likely to be responsible for triggering Peak Oil Supply.

In an excellent op/ed, vice chairman of IHS Markit Dan Yergin observes that it’s almost inevitable that shale output will go in reverse and decline thanks to drastic cutbacks in investment and only later recover at a slow pace. Shale oil wells decline at an exceptionally fast clip and therefore require constant drilling to replenish the lost supply.

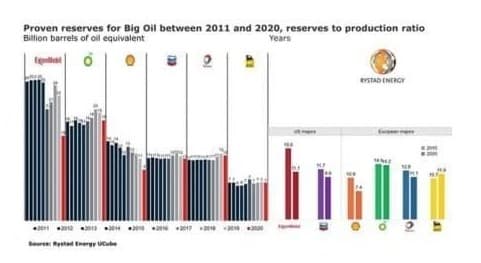

Indeed, Norway-based energy consultancy Rystad Energy recently warned that Big Oil could see its proven reserves run out in less than 15 years, thanks to produced volumes not being fully replaced with new discoveries.

According to Rystad, proven oil and gas reserves by the so-called Big Oil companies, namely ExxonMobil, BP Plc. (NYSE:BP), Shell (NYSE:RDS.A),Chevron (NYSE:CVX), Total (NYSE:TOT), and Eni S.p.A (NYSE:E) are all falling, as produced volumes are not being fully replaced with new discoveries.

Source: Oil and Gas Journal

Last year alone, massive impairment charges saw Big Oil’s proven reserves drop by 13 billion boe, good for ~15% of its stock levels in the ground, last year. Rystad now says that the remaining reserves are set to run out in less than 15 years unless Big Oil makes more commercial discoveries quickly.

The main culprit: Rapidly shrinking exploration investments.

Global oil and gas companies cut their capex by a staggering 34% in 2020 in response to shrinking demand and investors growing weary of persistently poor returns by the sector.

The trend shows no signs of moderating: First quarter discoveries totaled 1.2 billion boe, the lowest in 7 years with successful wildcats only yielding modest-sized finds as per Rystad.

ExxonMobil, whose proven reserves shrank by 7 billion boe in 2020, or 30%, from 2019 levels, was the worst hit after major reductions in Canadian oil sands and US shale gas properties.

Shell, meanwhile, saw its proven reserves fall by 20% to 9 billion boe last year; Chevron lost 2 billion boe of proven reserves due to impairment charges while BP lost 1 boe. Only Total and Eni have avoided reductions in proven reserves over the past decade.

Yet, policy changes by Biden’s administration, as well as fever-pitch climate activism, are likely to make it really hard for Big Oil to go back to its trigger-happy drilling days, meaning U.S. shale could really struggle to return to its halcyon days.

Clark Williams-Derry, energy finance analyst at the Institute for Energy Economics and Financial Analysis (IEEFA) has warned that there’s a “tremendous degree” of investor skepticism regarding the business models of oil and gas firms, thanks to the deepening climate crisis and the urgent need to pivot away from fossil fuels. Indeed, Williams-Derry says the market kind of likes it when oil companies shrink and aren’t going all out into new production but instead use the extra cash generated from improved commodity prices to pay down debt and reward investors.

Unfortunately, this trend is very likely to lead to a major oil supply squeeze down the line, high oil prices, and high inflation.

_____

1 We beg to differ since the subprime market started going into crisis in late 2006 and the first three acute phases happened before the oil/gas price spike. Chapter 9 of ECONNED explains in detail why the crisis was a derivatives crisis; a mere housing crisis would not have nearly wiped out the financial system.

I think there is a crucial point here which is not often understood fully, but the massive over investment in shale and other forms of oil and gas in the last decade and a half could result in a very severe drop in supply at some point in the coming decade. There is plenty of oil and gas out there to anyone with the capital to get it, but these wells do not have a long lifespan – once the capital supply is cut off, the oil no longer flows. And it seems that belatedly Wall Street has realised that putting money into it is no longer a safe or sensible bet. Its not just shale, btw, that has lost lots of money, back in the early 00’s Shell and BP and others lost a lot of money betting on off-shore gas wells that turned out to be just too expensive in a world floating in fracked gas and gas from Russia and Qatar.

The ‘big’ wells that are left to tap are off-shore – mostly the pre-salts of the Atlantic fringes – but the oil majors don’t seem to have the willingness or cash to develop them, its too high risk for them to invest in wells that will take a decade or more to flow. From their point of view, a shortage of oil is good news, they can reap a big profit over a short term. It seems very unlikely that the traditional sources of oil and gas – the Middle East, the US and Russia, are capable of producing much more. Its possible they are already in significant decline.

So while it would be good news for the planet if oil prices were to spike, its terrible news for the world economy if it happens so suddenly that we can’t adopt our energy systems in time. The technology is there for a rapid transition to something else, but it can’t be done overnight, and it won’t be cheap. The longer we put off a transition, the more expensive it will be.

Unfortunately, in the absence of leadership from our elected leaders, we are very much in the hands of whoever makes the decisions over where the oceans of capital floating around the world gets invested.

Alberta stands ready to fill those production holes. Nobody wants the dirty oil, except when gasoline hits, lets say USD $6 to $8 per gallon and it;s a quarter thousand every few days to fill the tank of a 6500 lb pickup truck or Escalade transporting a single person 80 miles round trip per day to take a seat in the office performing a bullshit jawb,

Then the tears flow, screams are heard and polititians can’t sign deals for a slew of XL pipelines fast enough.

Never mind that there is less than a century of livable air to breathe, and eclownomists assume technology in the form of functioning carbon capture saves the day.

Oil sands are significant for North American supplies, but globally are a peripheral player with little capacity to be expanded much more, except perhaps in Venezuela. It also can’t push the price of oil too low as the cost of production is around $60 a barrel last time I looked. Its always hard to predict with these things but it does seem that the industry has lost too much money on oil sands in the past to make them confident about investing much more in them. You need consistent high prices over a very long period to make it viable, and already the most of the easiest to access oil sands have been worked.

I really wish when talking about high-production cost oil like the tar sands, prices would be quoted in units of energy rather than dollars.

i.e., it costs 5000 kWh per bbl to produce oil from tar sands, vs 50kWh to just keep on pulling it from a Saudi field. Note that I just made those numbers up for illustration purposes only. They’re complete fiction but you get the point.

I suspect a lot of lightbulbs would come on when people realize that it costs more in net energy terms to produce Alberta oil than the amount of energy you get out of it. We’d be better off leaving it in the ground.

Note – I probably should have written “costs almost as much in net energy terms” vs. costs more. Here is an article I found from 2013 that explains why tar sands don’t make much sense in terms of EROI, and that was 8 years ago. I doubt the situation is any better now, quite possibly worse when you include transport and refining costs.

https://insideclimatenews.org/news/19022013/oil-sands-mining-tar-sands-alberta-canada-energy-return-on-investment-eroi-natural-gas-in-situ-dilbit-bitumen/

Really good points

and

contemporary social structures require the petroleum products, so they will be produced at any price, valued in joules or otherwise, EROI be damned. I should say, produced as long as contemporary high energy society isn’t in meltdown.

Maybe as an infrastructure encore, the Biden administration could subsidize (nationalize) the frackers. I think I would bet on it.

There is always a bull market somewhere, or sometime.

Once CO2 concentration gets too high outdoors, hermetically sealed malls will make a comeback.

The point is even if shale were to stop cold, there is way moar than we can possibly burn just in Alberta.

I am surprised at the extreme confidence level of financial markets. There are so many seized bearings, wobbly spindles and smoking belts, the thing is running on inertia and FED bucks now.

Just in time, is now “when will we get our shipment, three weeeeks are you effing kidding me”, for all and at the same time replaced by we gotta order way moar material than we need just to be sure we can supply our customers. The exaggerated demand impulse that imparts to the system means ramp up production.

How long before everybody figures out they ordered too much?

China closing a huge port due to one covid case, am I right? In racing that’s like hitting the wall before you get spun up into the fence.

Interesting message from China. They are not going to tolerate this thing running wild like it does almost everywhere else.

It’s not just the tar sands. US fracted gas has never made a profit as per wallstreet.com. that has documented these huge loses. Investors are just tired of losing money. And that is before one takes into account the so-called externalities that are destroying the biosphere. The governments of the world have been stonewalled by the fossil fuel industry while the world continues to heat. It’s criminal.

It is the entire modern paradigm. Successful enterprises need to follow the rules of business, which are the rules of capitalism. Good management is rewarded, it hasn’t mattered whether those profits are from exploiting the environment, polluting it, cheating on taxes, bribing governments for subsidies, etc. It has just been accepted. And growing populations have been one of the driving forces, excuses. But that is over. So none of the old patchwork and duct tape fixes even apply. Nor does the concept of “inflation”. It’s pretty hard to get nothing to inflate. And that’s what we’ve got. Nothing but liquidity provided by central banks just to keep commerce alive. The problem with not admitting to all this is that we can neither tighten our belts nor grow our way out. So we are effectively admitting we are out of ideas. So velvet revolution here we come. Because we still need oil to facilitate the best industrial practices to create a sustainable economy. We can’t do it without oil. That means not just our usual subsidizing of the oil industry, it really means nationalizing oil. Globally. So oil needs to be controlled both at the national and global level. It need to be rationed for best purposes to achieve our goal and in the meantime we all need to become local. Local jobs. Local resources. Local cooperation. The only reason we can say this now is because the oil industry will undoubtedly go under and call it quits for lack of profit anyway. It can’t drill and it can’t sell. It is an impossible situation.

And remember that local currency backed by the local taxing authority is perfectly legal, last time I checked. On a local level. Resources that will need to come from outside the local community will still have to be paid for in dollars I’d think. Possibly crypto but how do you figure that exchange?

They’re going to drill where all of that ice is melting.

Same with Russia.

There’s probably lots of coal, gas and oil in Greenland. All we have to do is melt all the ice off of it so that it becomes accessible for drilling and mining. Same for Baffin Island and Ellesmere Island.

And think of all the coal, gas and oil in Antarctica once we can get all the ice melted off of that.

As John McCain put it, Russia is just a gas station (economically). That could be good or bad – it doesn’t have a hyper capitalist economy that needs to be slowly lowered back to reality but it’s still got a lot to worry about. A population of maybe 150 million people to mobilize and feed and support. But if nobody’s buying arctic gas, Russia will pull back.

The various anti-Russia sanctions have forced the Russians to diversify their economy to a more broadbased mutli-internal-inputs model. It has been de facto “protectionism” imposed from without. But it shows what a country can achieve with protectionism.

It is a lesson which our Free Trade Traitor establishment will obscure as long and as hard as they possibly can.

Tundras are 7200 pounds and their V8 power plants get 14 mpg average They are very prevalent here in Texas. At $50k+, the payment is more that the mortgage on my first home 25 years ago. You will not see these behemoths in Yokohama, that’s for sure..

Our “elected” leaders have probably decided that it just isn’t a problem for them. As with 2008, they can just let another chunk of the population get thrown into poverty without it being any threat to the system. In other times this might lead to a revolution, but modern tech makes it pretty easy to keep everything locked down.

Renewables can not replace oil and gas. Nuclear is not wanted. What will happen?

No, renewables cannot fully replace oil and gas. You need a solution to the base load problem.

Tell all these low income people who can barely scrape together $3000 for a deposit on an $8000 used car (I now know a few) to eat EVs. Remember that nearly half the households in the US would have difficulty paying for a $400 emergency expense. There’s a reason only 3% of the cars in the US are EVs. Given the income distribution in the US, I don’t see EVs coming soon enough to make a difference.

Base load problem meaning what, exactly? Are my 4 children examples of the base load problem?

Here’s a definition of “Baseload” with a link to NRDC (Natural Resources Defense Council), website. NRDC is an NGO advocating for environmental protection and ecological awareness.

Hah, everybody I know, including myself is in that poors category. I bought an electric bike instead of a car, but I can’t live off a bike very well. I admit, I’m trying to design a heavy duty bike trailer with a pop top, one that if I’m sleeping inside might prevent someone from knifing me.

bill clinton was warned that free trade would lead to massive increases in the burning of fossil fuels. he ignored it or made some idiotic tech will take care of it blubberings.

just think, we catch fish here, raise chickens here, then fly them to china where they are processed under horrendous human and environmental conditions, then fly the results back here. so that parasites can make a few pennies more a pound off of the sale of that production.

when dell bragged that they had over 4000 suppliers all over the world. bill clinton held them up as something to be proud of, and we should all emulate dell.

just think of all of that burning of fossil fuels just so dell could save a few more pennies in the production of their computers.

Replacing cars with mass public transit is an easier solution — rail and buses use far less energy. There would be a lot of whining out west where people depend heavily on cars presently, but wouldn’t it be an easier and more environmentally friendly solution than increased oil production?

Yesterday’s discussion of railroads was interesting — although railroad infrastructure may have been overbuilt in the 19th century it would be nice if some of those lines were still in existence now. At one time many small towns were well-served by rail for both freight and passenger travel.

But the car industry?! The independence and freedom?!

Road transport – including buses* – apparently comprised 15% of global emissions in 2018, and transport overall only accounted for 21%.

https://ourworldindata.org/co2-emissions-from-transport

Obviously, something else needs to go, and go in a big way to make a sizeable impact on CO2 emissions. Something not as relatively easy as switching to EVs and rail transport.

* Superficially excluding my exceptionally surprising dying Midwest city. Many buses are hydrogen fuel cell powered here, although that typically involves fossil fuel consumption at some point(s) along the production line.

You must not live in America. “Mass public transit” does not work where there is no mass. I could give you a long form explanation why it’s a non-starter in Birmingham, with Jefferson County having about 650,000 total inhabitants.

And for one of many examples, what about grocery shopping? Deliveries to home just shifts car use to delivery van use.

Electric/gas hybrid cars are the only solution in America. Driving distances and culture dismiss any other transportation solution.

In low density suburban areas, for the most part the only quick and cost effective solution for public transport is dedicated high intensity bus lanes. The Dutch have clever systems whereby buses can access suburban housing estates off highways via dedicated protected slip roads (these occasionally confound tourists who try to use them and find their cars impaled on the automatic bollards). This means, of course, taking lanes off private cars.

But there is still of course the ‘last mile’ problem and the cultural aversion in the US and other countries to public transport. In some countries they’ve invested heavily in high quality buses with good wifi etc., to persuade more monied commuters to give up their cars. Others are investing in app based ‘pick up’ systems that can automatically adjust routes according to demand.

But even then, its not even close to a complete solution. Even in Holland or Denmark or Japan, there is a core percentage of people who you will not prise out of their cars with any number of incentives or disincentives.

Nuclear is not wanted. James Trigg

No nukes! No nukes!

What will happen is China and other countries will push on with nuclear power and the US will eventually follow.

China does not have a large nuclear power program in comparison to its overall energy needs.

It has dabbled with a lot of different designs (pretty much every one on the market) over the past 3 decades and has more or less settled on a varient of the US APC1000 (the Hualong One) to be the main reactor for future use. The current offical target is under 8% of electricty generation to be nuclear by 2035. Its just too expensive for them, and mostly unsuitable for inland sites because of floods/droughts.

This is replicated in most countries – France, Japan, Russia, South Korea and India are scaling back or delaying investments due to high costs and the failure of the Gen IV designs to achieve anything close to what they promised. Only a major breakthrough in design or costs will change this, and despite decades of promise, there is nothing all that promising likely to emerge for at least a decade.

Plus many dont want hydro power, a proven renewable.

Most of the hydro power plants are in the west, where its a bit dry.

…the Oroville Dam stopped producing electricity last week

As warming continues it’s only a matter of time before shrinking glaciers and less snowfall fail to supply enough irrigation as well as power production. Half of WA state depends heavily on irrigated crops and most of the state depends on hydro-generated electricity.

“unable to support themselves due to recent increases in food and fuel costs”

But is this not a chicken and egg situation? Where there’s no good public transport, one has to rely on private transportation.

Arab countries are not famous for their public infra.

While France has some good trains, but I don’t think outside of the train coverage the public transport is that great for the rural areas – based on my cycling years back, happy to be corrected.

So you have lifestyles (I don’t like that word, as it implies choice, where there may be none really), that _require_ gas, while at the same time we want to reduce it.

Hence we need to address the causes really, but that’s not going to be easy either.

Reality is, people will have to change their behaviour – voluntarily, or not. But we’d make the change fair and equitable, because at the moment (as shown by the WFH stuff), it’d not be.

As I recall from the Nomura analysis, “fuel” was mainly for within the house, not petrol for a car.

My daughter has been living in France (relocated from London) and we vacationed in Loire-Atlantique pre COVID. I saw far more new highway construction going on in peripheral areas than almost anywhere in the US. It also seemed that big box retail on the periphery of smaller cities did a huge business. While some regional railroad lines were being rebuilt and getting new rolling stock, they are very marginal for most users. I didn’t see a whole lot of public transport in smaller cities or towns.

With her relocation, they have to buy a car. France subsidizes PHEVs to basically even out the cost to equal gasoline only vehicles. But many models were recently unavailable due to demand and lack of chips.

Everyone is buying band aids to keep sprawl alive…

Why this obsession with trains? Even in Europe more people use long distance busses at less than half the cost of trains and they go almost everywhere Check out the Eurobus website for travel all over Europe and the excellent OuiBus service originating in France. I use both of them when I’m in Europe.

And what buses, better than first class on US airplanes. The seats can slide further apart on rails once the bus starts rolling, NO BOOM BOXES, full wifi plus a toilet down the stairs and a stop every three or four hours at a modern truck stop with better food than you find in most American resturants. With the usual airport problems, anything below 400 miles is as fast as the plane.

Also in France it is common to book a ride share in a private car going to roughly where you want to go; try BlaBlaCar… and meet the real French.

One wonders if things like that could be rolled out in those parts of the US which are as densely populated as France.

But the buses are slow and don’t have a desk or a dining car.

Only half in jest – I can get to the office in London in two hours with a table to work at and silver service breakfast by train. It would be four hours by bus, because the top speed is half the train and the city centre stops en route are congested. For professionals, the train is much better value for the money than buses. Trains also move many more passengers than buses per service so on busy routes they make sense operationally and environmentally.

Why can’t we have both? Long distance coaches for price sensitive, time insensitive passengers, trains for the self important White Rabbits? And local buses for both when they get there.

France typically has excellent transport between and within major cities. Most smaller cities have reasonably good transport infrastructures, but then mostly in the town centres. On the other hand, if you live in the provinces, then getting to work, taking the children to the zoo, visiting relatives in the next town or even going to buy a new fridge-freezer, effectively requires a car. This is not an accident – investment has been moved towards high-speed travel for the wealthier for decades now. It was this that really set off the Gilets jaunes – people who relied on their cars just to get to work were suddenly told that they were hazarding the future of the earth by driving, and would have to pay more to help fund the “ecological transition.” The problem hasn’t gone away.

I wonder if economic analysts these days are using an obsolete model. I feel a huge disconnect. https://www.yanisvaroufakis.eu/2021/07/05/techno-feudalism-is-taking-over-project-syndicate-op-ed/

re deliveries – deliveries can be more efficient, if they replace driving to/from shops en-masse. But it’s “depends” type of thing, so one would have to really see the numbers to compare.

Yes, there is no consensus on this, there are too many variables at work. A key issue apparently is whether frozen food is involved as the energy use in keeping food cold during home delivery is very high. The ‘last mile’ question is as always a major issue with energy use.

It is not obvious that freezers should be less efficient in a vehicle than at the shop/warehouse or the destination. Indeed, surplus engine heat could drive a freezer circuit. And, if active refrigeration is too energy hungry, some sort of passive insulated box with a phase change material that is cooled at the depot might work.

‘a lot of industrial production is also close to the coast, such as oil refineries and chemical plants near New Orleans.’

All the capital investing in building all those facilities must have been paid back years if not decades ago. So you would think that they would start investing in either moving those facilities or hardening them to the coming changes but they do not seem to be doing so. I suspect that they are waiting for the day that Uncle Sugar will pay all the costs & expenses for them to ‘build back better’ – and probably after some future disaster. The only way to break this impasse if so hit them in the subsidy that makes their stand viable at all – their insurance. If their insurance policies could be jacked up to a horrendous rate until they actually did something to mitigate their present and future problem, then this might force them to actually do something. It would concentrate some minds wonderfully if insurance companies could tell some corporations that in ten years time, that they will not sell any insurance on a facility that is particularly vulnerable. But this would suggest a government willing to lean on insurance companies to do so which at the moment is not going to happen.

Insurance companies need a place to invest their massive pile too. High oil prices are good for insurance investments. There are no “better angels” in the grifting class, they’re all intertwined and won’t/can’t do the right thing, or talk anybody else into doing the right thing.

Enjoyed the post, thank you. I am skeptical on one small point in the commentary, regarding home deliveries. If a delivery truck has 100 parcels on it, that could represent a substantial number of private car trips not taken to local stores. The goods might also go directly from a warehouse to homes, rather than being trucked from the warehouse to retail stores, and then picked up by people in private cars. All this very well may be bad for retail stores, and bad for walkable/bikeable communities for those of us who think that is important, but I am not sure it represents a net increase in energy use or even traffic. This is a hypothesis, would be interesting to see some numbers.

“because oil is a major input in the economy”

Um, THE major input? Like 95million barrels per day input?

This article seems to me confused. It seems on the one hand to presume that oil is super abundant still, and the only thing standing in the way of low oil prices and the flooding of the market is investment in new discoveries, while presuming that new discoveries won’t come because climate action, thus high prices and high inflation are the new norm.

It seems to me that the only way one could presume that oil remains abundant is the idea that the arctic, Antarctica and Greenland are totally abundant with oil, and we will get there to exploit it as soon as the world is hot enough to melt the ice caps. Because like, we are going to need that oil to build a renewable consumer eternal war society, right?

That is btw how I know most climate activism is BS. Because first, saving the world wasn’t really a thing so much as long as it was habitat destruction and species extinction other than human, and the supposed Green Renewable society is merely less carbon dependent (presumably) but otherwise just as consumer rapacious, habitat destroying, species other than human extinct-ing?

Yves refers to ” the incoherence of US policy, or more accurately, the incoherence of policies designed to pretend that addressing climate change is a no-pain proposition. ”

We should move the analysis back one step, and look again at the premise that we have an emergency requiring immediate drastic measures at any and all costs.

Steve Koonin recently published an entire book questioning that premise. Koonin served as Undersecretary for Science in Obama’s Department of Energy. Probably not the world’s greatest climatologist, but I’m pretty sure he knows at least as much about the use and misuse of computer models as anybody in the climate tribe.

I’d like to know (a) what’s wrong with his analysis, and (b) where would I find a serious cost-benefit analysis that justifies crapifying the electric grid in the name of electrifying personal transport.

Koonin is a crank, his arguments have long been addressed and taken apart by proper scientists. He is given a platform on the WSJ for the reason other Koch funded cranks are given a platform there.

How were you able to figure out what the Obama Administration overlooked – that “Koonin is a crank”? Somebody told you? You’ve put up a few short pieces by climateers that are long on ad hominem snark, but pretty light on direct analysis of the points that Koonin is making. Heavy on rhetoric, short on science.

The “proper scientist” you cite – Mark Boslough – goes on about Koonin’s alleged biases, while giving free rein to biases of his own. In his account of the APS red team exercise – after deploying the discredited 97% trope – he describes the consensus team as “three scientists”. And well he should – we’re talking Ben Santer of Lawrence Livermore, Isaac Held of Princeton/NOAA, and Bill Collins of Lawrence Berkely. The other side in Boslough’s rhetoric don’t get to be “scientists”. They’re only “contrarians” – or maybe, like the late Fred Singer, ” a prominent denier”. That would be the likes of Richard Lindzen of MIT, or Judith Curry (Earth and Atmospheric Science, Georgia Tech).

You can’t do justice to the problem if you’re going to wave away Koonin’s arguments on the say-so of the people he’s questioning.

The reason the argument is worth our time is that IMO we really don’t need an energy policy pratfall out of this Administration. At present we have only one party remotely capable of governing in the US, and handing the government back to the Trumps is a much more real and present danger than climate apocalypse stories based on obsolete scenarios.

PS – Hadn’t seen the Pierrehumbert piece from back in 2014. Some interesting stuff in there along with the arm-waving. Thanks.

I am not a scientist. I am just an amateur science buff.

I do see the same heatup, meltoff of various ice-features, more raindump-waterbomb events here and there which other people also see.

I see that the “warmists” began predicting these things would happen some decades ago, and I see these things happening the way the “warmists” predicted. That makes me think that the “warmists” have a reality-based theory of climate response to surfacesphere heat-trapping.

Your “arguments” and the names you drop seem like a velcro decoy tarbaby set up by the side of the road to trick people into wasting their time with.

I am reminded of something President Lyndon Johnson once said. ” I may not know much, but I know the difference between chicken salad and chicken shit.”

You offer us a great big heaping helping of chicken shit salad and invite us to spend our precious time sorting out the chicken salad from the chicken shit. As a mere amateur science buff, I have better things to do with my time and attention and brainwidth.

So here’s a gold star for you, and a pat on the back. You’ve answered the call, you’re at one with the righteous – a true and sincere believer.

And that’s for the best.

Wouldn’t want you to stretch the old brainwidth. It might hurt.

Awwww . . .

https://images.search.yahoo.com/search/images?p=trollface+you+mad+images&fr=sfp&imgurl=https%3A%2F%2Fi0.wp.com%2Fi.pinimg.com%2Foriginals%2Fe5%2F94%2Fd3%2Fe594d3609981c978974ada48780b9892.jpg&guccounter=1#id=7&iurl=https%3A%2F%2Fres.cloudinary.com%2Fteepublic%2Fimage%2Fprivate%2Fs–SUbkF4tR–%2Ft_Resized%2520Artwork%2Fc_fit%2Cg_north_west%2Ch_954%2Cw_954%2Fco_ffffff%2Ce_outline%3A48%2Fco_ffffff%2Ce_outline%3Ainner_fill%3A48%2Fco_ffffff%2Ce_outline%3A48%2Fco_ffffff%2Ce_outline%3Ainner_fill%3A48%2Fco_bbbbbb%2Ce_outline%3A3%3A1000%2Fc_mpad%2Cg_center%2Ch_1260%2Cw_1260%2Fb_rgb%3Aeeeeee%2Ft_watermark_lock%2Fc_limit%2Cf_jpg%2Ch_630%2Cq_90%2Cw_630%2Fv1569582766%2Fproduction%2Fdesigns%2F6116230_0.jpg&action=click

You must be feeling lonely and rejected. You brought us a whole bowl of your best chickenshit salad and nobody wants to eat it. Awwww . . .

Yves talks about the 1970s, and it is odd that there was an energy consciousness then that, in retrospect, seems greater than now when the problem is not only about gas prices but also the threat of climate disaster. Perhaps an oil shock is needed to “concentrate the mind” of those soccer moms in their Suburbans and lawn care freelancers in their huge trucks. But the political courage to do the right thing on this, or anything, seems entirely absent in our current political parties. Th 70s turned into the “me decade” and the 20th into the me century–at least so far. Hard to see a way out but a start would be for the PR food fight at the top to come to an end.

People are so, so, so easily bought. SO easily bought. They have the moral fiber of apple juice and will easily persuade themselves they can’t afford anything else. They are probably right about that.

Just make it less expensive to do the right thing and you’ll see the selfishness drain away. It isn’t the population that is the problem. It is the people making money off of all the busted behavior that are preventing common sense legislation from being enacted.

Related:

Since moving to Truck Country Oregon, I’ve learned that newer diesel pickups cannot be driven AT ALL right after being started! They must be allowed to idle for at least five minutes (ten would be better) before driving away. I mean, with vehicles being designed this way now, I really don’t see how our fossil fuel consumption will ever go anywhere but up. /s

Remote starters are quite obnoxious. They have their place, but not much of the lower 48.

Drilling increased under Obama, Trump and now Biden who has given more than 2,000 oil leases, will drill in Alaska’s North Slope, Dinosaur National park and support line 3 pipeline to transport tar sands crude.

Obama’s sttaement to big oil “Under my administration, America is producing more oil today than at any time in the last eight years,” he said in a speech promising to increase pipeline capacity to flood the world with even more fossil fuels.

“Over the last three years, I’ve directed my administration to open up millions of acres for gas and oil exploration across 23 different states. We’re opening up more than 75% of our potential oil resources offshore. We’ve quadrupled the number of operating rigs to a record high. We’ve added enough new oil and gas pipeline to encircle the Earth and then some. So we are drilling all over the place – right now.” https://www.theguardian.com/commentisfree/2021/aug/10/obama-climate-crisis-democrats-fossil-fuels

Now Biden is increasing drilling https://www.theguardian.com/commentisfree/2021/aug/13/joe-biden-spending-plans-inflation-debt-fears-misplaced

Same as Trump and Bush. There is policy continuity whether a democrat or republican president is in office. All this will the world burns