Yves here. An old economists’ saying: “If you must forecast, forecast often.” So feel free to take this prognostication with a fistful of salt. Nevertheless, your humble blogger believe, and less gloom and doom oriented correspondents similarly intuit that if Biden doesn’t get a pretty big spending bill passed, the economy will start to sputter. The floundering around getting his ever-shrinking package passed is frazzling the Confidence Fairy.

And what happens if the US suffers a winter Covid surge? That would represent not just a direct hit to the economy (presumably a pullback on travel, going to restaurants and bars; with reduced hospital capacity, lockdowns are possible) but a further blow to confidence. Serious Covid outbreaks would show that the officialdom was again unable to contain the disease….and might finally shatter the undue reverence for the vaccines.

By Alex Bryson, Professor of Quantitative Social Science, Social Research Institute, UCL and David Blanchflower, Bruce V. Rauner Professor of Economics, Dartmouth College. Originally published at VoxEU

Economic downturns are not as unpredictable as we once thought. There is mounting evidence that the expectations of consumers, workers and employers predict economic downturns, sometimes 12 to 18 months ahead. But we live in exceptional times. The COVID-19 pandemic and its aftermath have sown doubt and uncertainty among consumers and producers and may do so for some time to come. So what’s the economic prognosis? this column argues that expectations data for the US suggest the country is entering recession about now.

With the mass rollout of COVID-19 vaccinations and the attendant decline in COVID-related deaths in most advanced economies, and with many economic indices turning positive, it looks like most economies are on the road to recovery although the data paint a confusing picture.

For example, in the spring of 2020, wage growth jumped sharply at the same time unemployment was rising. This was in both the US and the UK. Since then, unemployment has been falling while wage growth remains high. This implies the wage curve slopes up, which seems unlikely. But other metrics are telling a different story, most notably those capturing consumer and business sentiment.

Two series – from The Conference Board on business conditions, employment and income six months hence, and from the University of Michigan on the financial situation in a year and business conditions a year and five years hence – tell the same story: sentiment peaked in spring or early summer. And it has been falling precipitously since (Blanchflower and Bryson 2021a). This is true for the US as a whole and for the eight largest states for which The Conference Board collect data.

Why does this matter? Well, the rate of decline in these sentiment indices is of the same magnitude we saw back in 2007, before the Great Recession (Blanchflower and Bryson 2021b,c). We call it the 10-point rule. When the indices drop by at least 10 points, this is an early warning signal for a recession.

We test this proposition for the US over the period 1978 to September 2021 and show that consumer expectations about future economic trends are highly predictive of economic downturns 6-18 months ahead, thus providing an early-warning system for the economy (Blanchflower and Bryson 2021a).

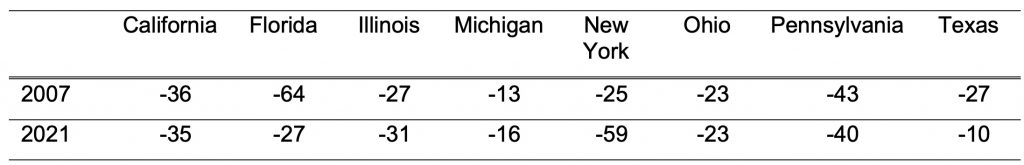

Table 1 The Conference Board expectations data in the eight biggest US states, 2007 and 2021

The first row of the table shows the drop in The Conference Board expectations data in the eight biggest states from the spring peak in 2007 to December 2007, the date called by the NBER Business Cycle Dating Committee as the start of the Great Recession.

The second row reports the falls in 2021 from the spring peaks to September 2021.

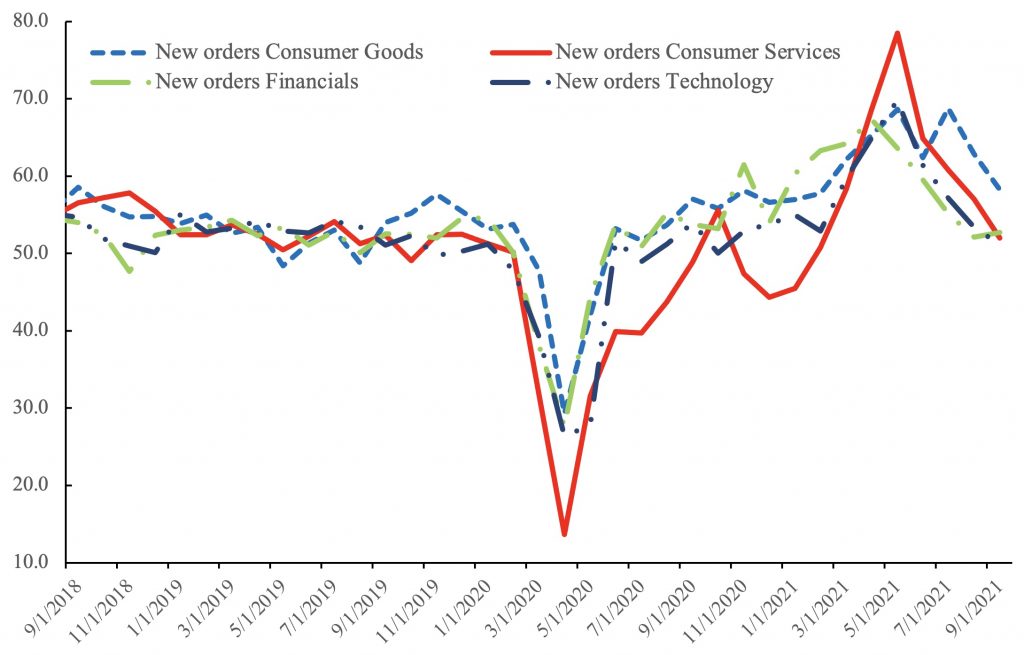

These aren’t the only data flashing red. The US PMI New Orders data are also trending down as Figure 1 shows for four consumer facing sectors.

Figure 1 US PMI new orders, September 2018 – September 2021

On the other hand, if a recession were imminent, we would expect to see an increase in the unemployment rate – our rule of thumb is a 0.3 percentage point upturn in consecutive months – and declining employment. This is not what is happening.

That’s because the economic situation in 2021 is exceptional. Unprecedented direct government intervention in the labour market through furlough-type arrangements has enabled employment rates and unemployment rates to recover quickly from the huge downturn in 2020.

So, what is going on? The answer appears to lie in the exceptional nature of the COVID-19-induced shock to the economy. It has been both an economic shock and a health shock, and one with the potential to derail the economy again over the coming months. In spite of improvements in traditional labour market indicators, declining consumer expectations about the future of the economy are likely linked to COVID-19-related fears and anxieties.

This is borne out by a recent The Conference Board survey indicating that 42% of workers are worried about returning to the workplace for fear of contracting COVID-19, a substantial increase from June 2021 when only 24% expressed this concern (The Conference Board 2021).

The increased level of anxiety among workers is potentially justified because, as we showed in a recent study analysing the US Census Bureau’s Household Pulse Survey, workers were substantially more likely to contract COVID-19 than non-workers, despite having a higher probability of being vaccinated (Blanchflower and Bryson 2021d). Being at work or commuting to it increases the risk of infection. Such concerns have been exacerbated by the appearance of the Delta variant of the virus.

Rising anxiety and worry are not confined to workers. Evidence from the US Census Bureau’s bi-weekly Household Pulse Surveys suggests a consistent increase in anxiety and worry since June 2021.

We suspect that fears linked to COVID-19 will continue to affect the real economy and consumer expectations about an imminent economic downturn. This is a bold call not consistent with consensus; only time will tell if we are right. However, equivalent falls in these data in 2007 were an early indicator of recession, missed at the time by policymakers and economists.

It is possible that these data are giving a false steer. However, missing the declines in these variables in 2007 proved fatal. It is our hope such mistakes will not be repeated this time around. These qualitative data trends need to be taken seriously.

See original post for references

Who would want to order anything that might end up sitting on a container ship for the next six months?

Black Friday in October, seems the plan is “Sell what we got, quick” if the shelves are going to be empty, lets have them empty now rather than after Thanksgiving?

Was shopping for some laptops, the first such purchases in maybe 6 months, nothing but page after page of “This item on back-order”, no promises as to delivery date.

Lucked out finding a couple of really good refurbished machines locally, snatched them suckers!

It’s been impossible to buy any new desktops/laptops since well before this supply chain stuff started coming up. I was in the market a year ago and it was impossible because of bitcoin miners* snatching up all the video cards and the already extant chip shortage. Tough time right now for enthusiast PC consumers.

*I hate bitcoin miners. I will hate them for as long as I live.

Imo better to hate those that allow this to continue. The miners are just looking for a way to make a few bucks in a tough economy.

I hate the bitcoin miners because of their role in massive carbon skyflooding. And if they bought up certain video cards and chips, they diddit to perpetrate yet more carbon skyflooding.

If this shortage prevented the bitcoin miners from getting all the video cards and chips they could use, that means this shortage is forcing the bitcoin miners to perpetrate less carbon skyflooding than they wish they could.

If so, that would be a bright shiny silver lining to this shortage.

Yes, I asked my favorite salesman what else I could expect to wait for, and he said “graphics cards for sure!”

I’ve been buying refurbished Lenovo desktops for about three years because I was sure of the reliability, having purchased the same exact machines brand new.

Then about a year ago it seemed everyone figured out same thing and those refurbished machines got more rare and more expensive.

Raspberry Pi.

yes!

Framework do it yourself model Don’t know if they’re readily available, but it may be the last one you ever have to buy,

I have one and I’m pleasantly surprised how well it works for general home computing. Inexpensive and readily available… so far.

But then again I’m very comfortable with a Linux OS for home use and have little need for MS Office products when I have LibreOffice, podcast and mp3 applications, etc.

So buying stocks at their all-time highs might not be a good idea?

Not giving any advice here, but the powers that be seem keen on protecting the stock market since it’s owned mostly by rich people.

As they say, if you can’t beat them, join them.

Re the rich, I thought it was, “If you can’t eat them, join them.”

Ugh! Most of them have bad taste.

I’m not selling until Nancy Pelosi does.

Here’s one list that could be useful:

https://www.yahoo.com/now/nancy-pelosi-stock-portfolio-10-133549340.html

The OpenSecrets website is pretty fun too.

Exactly. It may fall and THEN what?

It’s been shown over and over again that a recession alone doesn’t equal lower stock market.

The artificially high prices of NIMBY real estate and other artificially high priced assets are related.

So I bet everybody’s over-priced home that they keep the stock fantasy floating longer.

US rentering a recession? Well then the Federal Reserve better hurry up and cut internet rates and do QE. Oh, wait…

A good predictor is when the Fed Reserve inverts the yield curve (raises their fed funds rate above the 10Y yield) https://fred.stlouisfed.org/graph/?g=I4UE

Nah, the old saying goes, “An inverted yield curve has predicted nine out of the last five recessions.”

Your really going to kick me in the pants, not that I don’t like it, but wow people really confuse numbers of the symbology that what they represent and over look all the other factors … duh commodity hangovers …

Shoot me now …

Those hangovers can go on in perpetuity. There’s nothing to stop the party. Until the Fed Reserve decides it’s time for the party to come to an end.

Until then, keep climbing that wall of worry. And guess what, there’s no worry. Because the Federal Reserve telegraphs it’s tell well in advance.

Ultimately its a political issue acerbated by doctrinaire ideological friction e.g. stimulus/reconciliation bill and not what the Fed does within its limited scope and at the end of the day its always a distribution problem and not one of currency form.

It just seems some think if they used a currency form that is limited everything would be fixed, yet nothing in the historical record supports this view. I suggest that better understanding of social factors is more important and especially contracts e.g. it proceeds money in any form IMO.

Sorta in line with recent anthro posts on NC along with various view around risk and how to evaluate it outside some ideological dogma.

If we’re talking the 2s and 10s, I’d agree. I’m specifically graphing the Fed Funds rate (3mo) vs the 10y. It’s the best predictor I’ve come across.

We often talk about the Fed Reserve taking their punch bowl away. How do you define that? I define that as the Fed Reserve raising their Fed Funds rate above the 10Y yield, by about 25 basis points or so.

I am sure that there will soon be calls for more austerity from members of both parties, including Biden as we enter this latest recession as that is basically the neoliberal answer to everything when it comes to the economic issues faced by the peasantry.

In fact, Manchin and the rest of the Democratic austerians might use it as an excuse to water-down the spending bill even more with Biden’s blessing.

As soon as the stock market drops 30%, heck maybe less than that, members of both parties will find religion and abandon austerity. It happens like clockwork.

And meanwhile, the Federal Reserve will definitely ramp up it’s spending of handing out free money to it’s rich friends (QE). So forward looking of Congress to authorize the Fed to freely and casually spend money off book (never adds a single penny to the “deficit”) in a way no one calls it what it is – government spending – for the benefit of asset owners. Ignore the Fed’s presently saying it will taper. That will change drastically. It will use any slowdown as an excuse for a big increase in spending money to hand out to the rich.

Cassandra here – when the collapse of industrial society comes, as it will, the term ‘recession’ will be a quaint byword.

I may be wrong but QE is a compositional change. Not one that injects new so-called ‘free money’ into the system. QE may support asset prices because the FED is buying bonds, but this is NOT increasing the aggregate amount of money in the system.

A compositional change will result in inflation in some things and deflation in others. Are we seeing deflation somewhere? And is that deflation proportional to the inflation we’ve been seeing in asset prices.

Welcome to the Biden/Harris Depression.

That may not be fair, but that’s how it will be perceived.