Yves here. The problem with the current price rises is that (as hard as it is to believe) a lot of it really truly is transitory, due to over-optimized supply chains falling apart due to Covid. But that “transitory” could easily last a couple of years more, which is too long to feel transitory to most mere mortals who lack unlimited funds. However, if oil prices stay high compared to the pre-Covid normal, energy price increases will work their way through the economy. Some of the food price rises are due to supply chain issues, but another driver is climate change, and that is here to stay.

Note that none of the factors above can be alleviated by the Fed increasing interest rates.

By Wolf Richter. Originally published at Wolf Street

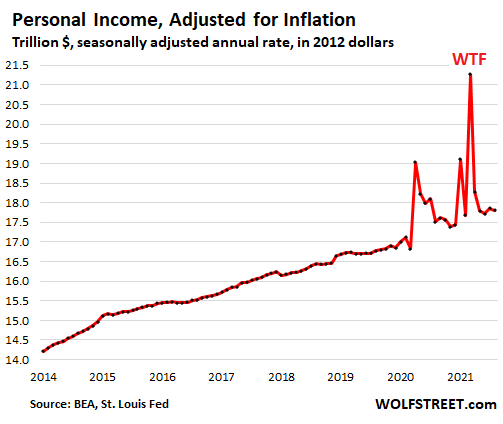

Before taking inflation into account, personal income from all sources – from wages, interest, dividends, rental income, transfer payments such as unemployment compensation, stimulus checks, and Social Security benefits, etc. – rose by 0.2% in August from July.

But after taking inflation into account, it’s uglier: Inflation-adjusted – or “real” – personal income fell by 0.2% in August from July, to an annual rate of $17.8 trillion (in 2012 dollars), according to the Bureau of Economic Analysis on Friday.

The spikes in the chart were produced by the three waves of stimulus payments and other piles of funds that were handed out by the government; they created the biggest distortions in consumer income and spending ever. What’s now left behind is the worst bout of inflation in 30 years, that is eating into income:

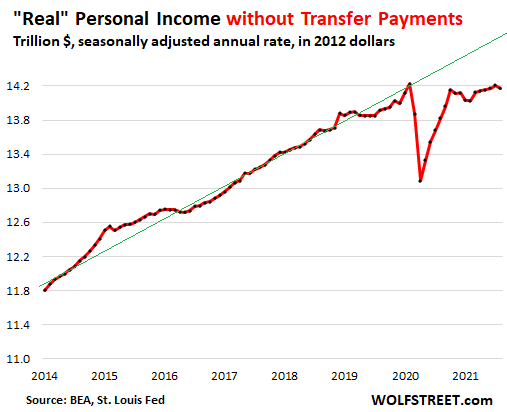

“Real” personal income without transfer payments fell by 0.3%in August and fell below the pre-pandemic level of February 2020, to an annual rate of $14.17 trillion (in 2012 dollars).

This is personal income from labor, interest, dividends, rental property, etc. but without transfer payments from the government, such as unemployment benefits, stimulus checks, Social Security benefits, welfare benefits, etc.

It should have grown as more people got jobs, and wages increased for many jobs. The green line shows the pre-pandemic trend. It’s tough getting beaten up by the worst bout of inflation in 30 years:

On the spending front:

- Consumers still spent heroic amounts on goods, but inflation is taking a serious bite out of their “real” spending.

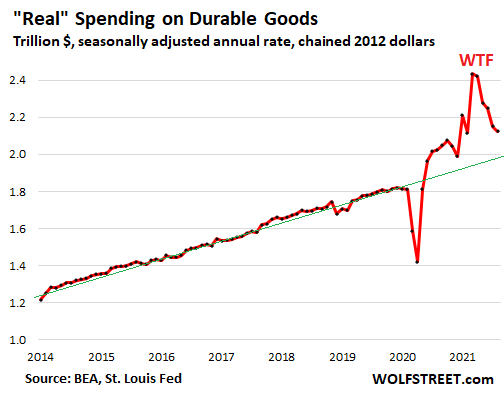

- “Real” spending on durable goods continues to drop from the stimmie-spike, largely due to auto sales, which plunged in recent months due to the collapse in auto inventories.

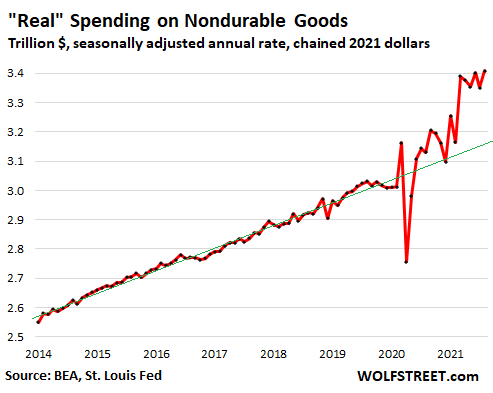

- “Real” spending on nondurable goods ticked up to a record of dizzying magnitude, still powered by working from home, which shifted spending to the supermarket.

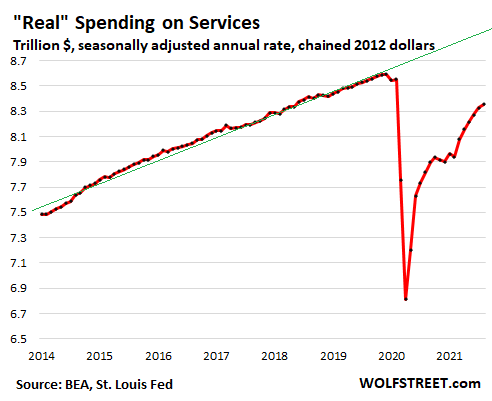

- “Real” spending on services was well below pre-pandemic levels, in part perhaps due to eviction moratoriums and mortgage forbearance; rents and the interest on loans are part of spending on services.

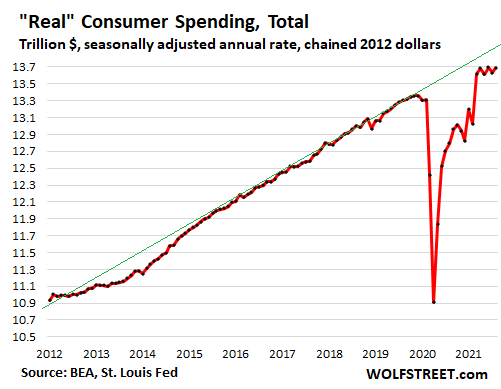

Before inflation, consumer spending jumped 0.8% for the month to an annual rate of $15.9 trillion.

After inflation, consumer spending rose 0.4% for the month, to an annual rate of $14.2 trillion, but only undoing the drop in July, and has remained in the same narrow range since October 2020.

These are still huge amounts that consumers spent, and consumers are still flush with money from the myriad of pandemic-era fiscal and monetary stimulus, from forgivable PPP loans to stock market gains, and they’re still spending bravely. The green line shows the pre-pandemic trend. It’s tough to outspend this type of inflation:

“Real” spending on durable goods dropped another 1.3% in August from July, the fifth month in a row of declines from the breath-taking stimmie-inflated levels in March and April. But spending levels, even after inflation, remain far above the pre-pandemic levels (green line).

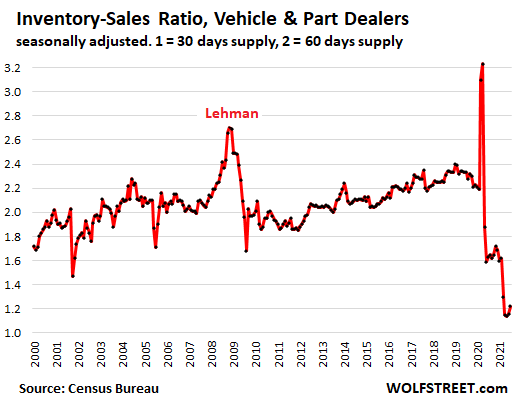

A big contributor to the drop in durable goods spending is the plunge in spending on new vehicles in recent months, as inventories on dealer lots have collapsed and there isn’t much left to spend your money on (more in a moment):

Auto sales normally account for over 20% of total retail sales and dominate spending on durable goods. But new vehicle sales plunged 23% in August compared to August 2019, as dealers ran out of inventory. Auto dealers jacked up their prices in response, and people jostled for position and paid over sticker to score popular trucks and SUVs:

“Real” spending on nondurable goods jumped by 1.7% in August from July to a new record annual rate of $3.41 trillion (in 2012 dollars), a heroically high amount and far above the pre-pandemic trend line (green). This category is dominated by food and energy, including gasoline, but also includes household goods of the type sold in supermarkets that were among the winners of the shift to working from home:

“Real” spending on services ticked up 0.3% for the month but remains 2.2% below February 2020, and far below the pre-pandemic trend line (green). At an annual rate of $8.35 trillion (in 2012 dollars), real spending on services is where it had first been in June 2018.

Services accounted for only 61% of total spending in August; before the pandemic, it accounted for about 65% of total spending. During the pandemic, spending shifted from certain types of services (such as travel and entertainment events and healthcare) to goods.

Rents and the interest portion of loan payments also fall into this category of spending on services. Given that the eviction moratoriums were still in place in August, and that 1.6 million mortgages were still in forbearance at the end of August, and that $1.6 trillion in student loans were still in forbearance, part of the decline in spending on services was caused by many consumers not making their rent and loan payments.

This situation with unpaid rents and interest is an example of how the massive and wide-ranging pandemic-era programs have side effects that skew spending in bizarre ways.

Just one comment, the FED can solve the problem by raising interest rates in the way that Volcker stopped the problem by killing the economy stone dead. 15% should do nicely.

Raising it 25 basis points above the 10year yield is sufficient to take the punch bowl away and bring the party to an end. Back when Volcker did it, the 10year yield was a lot higher.

The $trillionPlatinum coin + ending the debt ceiling charade + digital currency and the US will have defaulted to MMT without calling it MMT.

Exactly. MMT implemented without conceding the argument.

Oh cars. I recently had the misfortune of having to buy one, having traded in city living for rural America because pandemic. This was early July. I was told at the dealer that cars were flying off the lot almost literally. And there was a bear that would come occasionally and jump into one of the trucks on the lot, a show much enjoyed by the sales staff.

In any case, the used car I managed to get had just come in the previous day and I bought it that day. More than I anticipated, but prices have been crazy. The online inventory had shown about 10 cars in my price range, but they only had two on the lot when I arrived. The corporate inventory database couldn’t keep up with facts on the ground.

This is as the pandemic really began to ramp up again, and I was the only one wearing a mask. By the middle of July when I finally picked up my car (bank financing has gotten annoying apparently in the past 5 years) the dealership had instituted a mask policy for its employees.

(Battery died 10 days later; Apparently they don’t check for this in their 200+ point inspection as part of the extended warranty…?)

I got a ride from a family member and the sales agent tried to buy it from us, if we were interested in selling it…

Stay safe!

Is there anything in life that is not transitory?

Its all relative, a 100 year life span can be quite long for a human being, yet at the scale of the universe is nothing. Printing trillions of dollars without a corresponding increase in the supply of goods and services and expecting the prices to remain the same, you got to be a central banker to believe it.

Then the rationale provided for it, transitory, transitory for longer, persistent transitory and finally frustrating that inflation is not coming down is more akin with the justifications that an emotional schoolboy would give rather than the leader of the most important institution in the world.

Have we really gone that far down the drain that our elite is bereft of all values of virtue, and courage to do the right thing for the public interest rather than self dealing to enrich themselves?

Why are Fed officials front running their own decisions to trade in the stock market?

How many millions does a man need before its enough?

Then when I think of Tolstoi’s short piece “How much land does a man need” I see that its impossible to change human nature, we are doomed.

Sorry to say, but “noblesse oblige” died in the trenches of Flanders.

Today, we are, to paraphrase the ex-popular saying, “A nation of lions led by snakes.” (With apologies to serpents everywhere.)

>>>Printing trillions of dollars without a corresponding increase in the supply of goods and services and expecting the prices to remain the same, you got to be a central banker to believe it.

During one of rants earlier this week, I pointed out that even with money there is nothing good to buy in items like clothes and furniture.

What is notable about those items (or houses) is that much of what we used to make them with we still have plenty off. Rare earths

stolenimported from the Congo is not needed to make walls or pants. I mean the quality of the available wood has declined especially in teak or has stopped being available like rosewood, but good enough wood is still there. And there is plenty of cotton for clothes. However, the junk available to buy is just that, junk. There is also a shortage of housing, especially well built housing, and furniture, and clothes and…We have millions poorly sheltered, if at all, with all of them needing work, clothes, furniture, homes, educations, medical care and with our infrastructure falling down. We already have much of the physical resources needed to fix all that, including trillions of dollars. There are still people around who know how to build and teach. Our tech base is decaying, but it is not gone. Yet, the only thing that gets done is insanity like the buying and storing away of the housing that already exist, driving more people, most of them employed, onto the streets.

According to the amount of need for goods and services with the vast amount of cash, the decent supply of raw materials, and the continuing existence of an educated, skilled workforce (for now) we should have a booming economy and we don’t. We do have substandard clothes, furniture, white goods, tools, and housing. We have a shortage of everything, yet I don’t see it being fixed anytime soon, but more money is still effectively being printed.

Yes, I know that this has turned into another rant instead of the short comment I was going to type, but the insanity is mind breaking, and I guess this is a way for me to get my mind around it.

How much land does an Amishman need? Are the Amish doomed?

In today’s Guardian Matt Stoller has an article about the causes of the supply chain disruptions. While covid is a factor, it is not the only factor. Since the 1970s our policies have allowed power to be concentrated in the hands of monopolists and private equity financiers. Lax antitrust, deregulation of basic industries like shipping, railroads and disinvestment in productive industries, and trade policies emphasizing finance over manufacturing have led to a fragile supply chain. Stoller gives specific examples. We observe what Hudson views as the parasite killing the host. Finance grows at the expense of the real economy of goods and services which is being hollowed out by debt deflation.

Worth a read.

https://www.theguardian.com/commentisfree/2021/oct/01/america-supply-chain-shortages

As an mining engineer working in Zambia some 20 yeas ago we had the following posted in our offices.

Just in time delivery.

Just too late.

Disaster.

To be honest, I still can’t get over the price of meat. Every time we have an economic problem, prices go up and packaging goes down. And it is not transitory! Also, at Wally World, I notice that the more expensive products are never missing from the shelves (particularly in the dog food aisle).

I got 9¢ on my lowly savings last quarter. Saving for my property tax in Fevruary. Money already borrowed. Food costs aee up. Sinking here.

Then, there’s all the deficit hawks blaming government spending.

Their solution is austerity. If can’t address supply, address the demand by crushing the economy and people’s incomes