Yves here. I don’t agree with Wolf’s “monstrously overstimulated” thesis, as in inflation being due to too much spending, as opposed to too many fragile supply chains breaking and producers and retailers thus being willing and able to charge more for smaller amounts of product. And despite economists using words like “transitory”, we could stay in this mess for quite a while. But the point about jobs and the number of workers who haven’t come back to work is very important and not enough discussed.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

Record GDP, record consumer spending, record private investment, but the number of workers accomplishing these feats is down by 4.7 million.

The jobs report’s two components – the survey of 60,000 households and the survey of 697,000 individual worksites – came back together today, after having diverged in September in a way that had caused a lot of premature hand-wringing about the labor market.

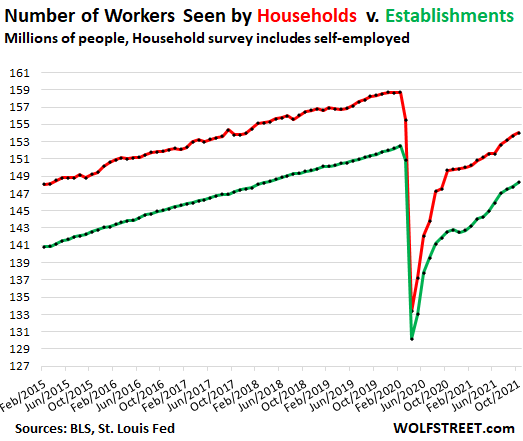

Households reported that the number of people working, including the self-employed, rose by 359,000 in October after having jumped by 526,000 in September, and by 509,000 in August, for a total of 1.39 million over those three months, according to the Bureau of Labor Statistics today. This is still down by 4.7 million people from February 2020 (red line).

Employers reported that they added 531,000 employees to their payrolls in October. This includes governments, but they shed jobs for the second month in a row. Over the past three months, including large upward revisions for August and September, payrolls grew by 1.33 million employees. This is still down by 4.2 million people from February 2020 (green line):

Something Big Has Changed.

As jobs have struggled to bounce back, and remain well below pre-pandemic levels, the economy overall, as measured by real GDP, surpassed its pre-pandemic record in Q2 2021. Consumer spending surpassed its pre-pandemic record in Q1 2021. Private investment in buildings, equipment, and the like started setting new records in Q4 last year. Retail spending, which is part of consumer spending but doesn’t include services, has been blowing out every record all year.

But the number of people actually working to accomplish these feats is down by 4.7 million. Let that sink in for a moment.

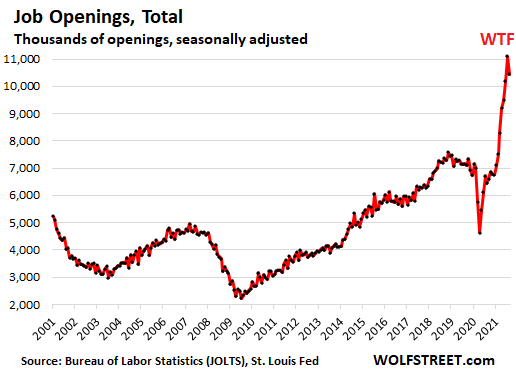

That’s the weird phenomenon: The economy has been monstrously over-stimulated to get consumers, businesses, and governments to spend record amounts of money, and it is creating lots of spending that counts in GDP, and it’s creating lots of job opportunities. But millions of people, for whatever reasons, have chosen not to rejoin the labor force, triggering widespread shortages of labor, materials, and components.

The Labor Force Phenomenon

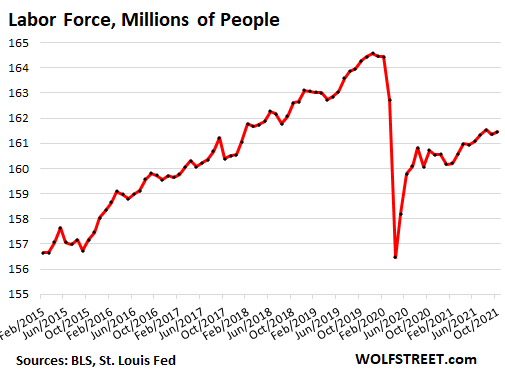

The “labor force” consists of people who are working or who are actively looking for a job in the four weeks prior to the survey of households and are available to work. Many people are still not looking for a job for whatever reason – many decided to retire or are temporarily resting on their stock-market-crypto-housing gains, while others can’t find affordable daycare centers, etc. If they’re not actively looking for a job, they’re not included in the labor force.

So there were 6.0 million people who said they’d like to have job someday but weren’t actively looking for a job or were unavailable to take a job during the four-week period prior to the survey and therefore didn’t count as part of the labor force. There are always a lot of people in this category, but this was still nearly 1 million higher than in February 2020.

The labor force has increased very little over the past 12 months, after initially bouncing back sharply from the collapse in April last year. In October, it barely ticked up and only partially reversed the decline of September, and it remains down by 3.1 million people from December 2019 – among the amazingly askew post-pandemic-boom charts that show that something big has changed in society:

This squished-down labor force, combined with a smaller number of people actively looking for a job (the officially unemployed), caused the headline unemployment rate to drop to 4.6%.

The labor force that is still short by 3.1 million people, the labor shortages that employers are complaining about, and the record spike in unfilled job openings that employers are trying to fill — all tell different aspects of the same story:

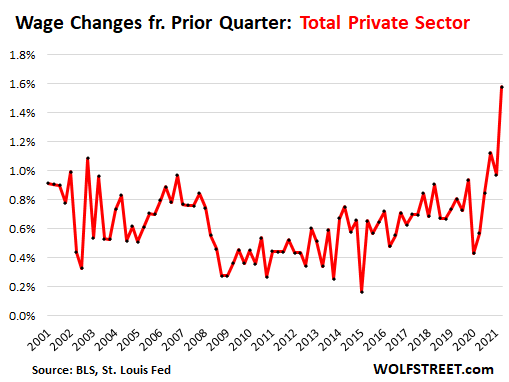

Employers have been raising wages to attract people, confident that they can pass on the costs from those wage increases to their customers, which has triggered the largest wage increases across all industries in two decades…

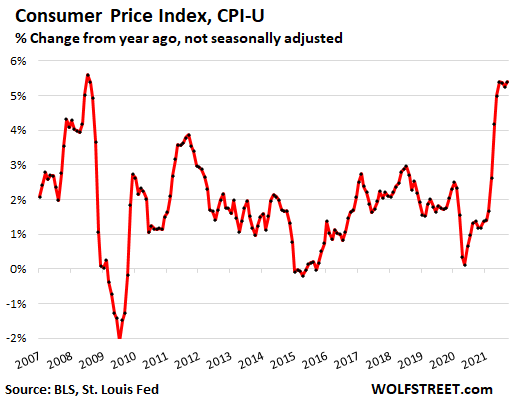

…and the worst consumer price inflation since 2008 and 1991:

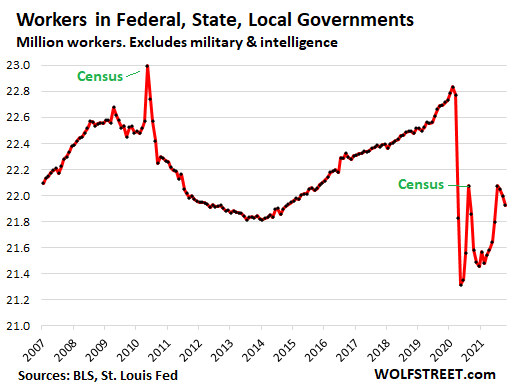

Employment in federal, state, and local governments fell for the second month in a row, in October by 73,000 workers. At 21.9 million, government employment was down by 909,000 workers from where it had been before the pandemic.

Federal government employment during the pandemic has remained roughly steady outside of the spike during the Census. In October, employment ticked down by 3,000 to 2.88 million.

Employment at state and local governments plunged early on during the pandemic and started to bounce back. But that bounce stalled in August and has reversed some since then.

State governments shed 25,000 jobs in October, most of them in education. After two months of declines, jobs are now down to 5.03 million. Local governments shed 45,000 jobs, almost all of them in education, the second month in a row of declines, now down to 14.01 million:

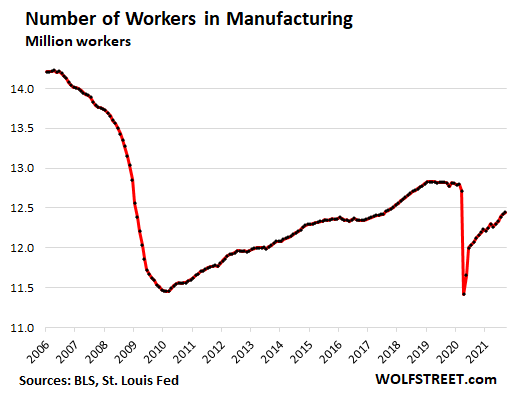

Employment in manufacturing rose by 60,000 workers – including by 28,000 in the auto industry – to 12.5 million jobs. Payrolls were still down by 270,000 employees, or by 2.1%, from February 2020, as manufacturers are screaming about shortages of materials, components, and labor that prevent them from meeting demand for their products:

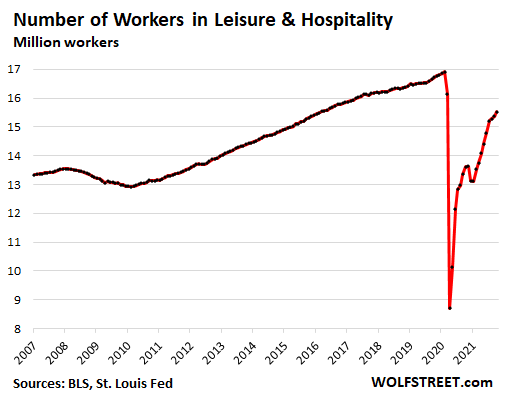

Employment in the leisure and hospitality industry jumped by 164,000 jobs in October, as restaurants, bars, hotels, and casinos were offering higher pay and, in many cases, improved schedules in their efforts to attract workers. Some people that used to work in that industry have moved on when the industry shut down. Employment was still down by 1.38 million from the peak in February 2020:

Employment in Construction rose by 44,000, to 7.5 million workers, even as construction companies were struggling with shortages of all kinds of materials that stalled projects and produced a record number of unfinished houses. Employment in the sector was still down by 150,000 from February 2020.

Wolf was banging on a few weeks back about how federal unemployment benefits were the reason why people weren’t returning to the workforce. Not the pandemic, not the child tax credit, not self-employment, not seasonal employment, not work conditions, not anything else but the indignity of the state paying people “not to work.”

Now that that particular moralizing narrative doesn’t seem to make sense anymore, he’s dropped it like a hot potato, and now opines on how precarious self-employment is.

As good as Wolf is for making graphs, and sifting through the data, he’s also brilliant at framing the data.

There is another big reason why fewer work:

Fed inflated assets. Let’s call it Unemployment Benefits For The Rich, Or Welfare For The Rich.

That “investments” (stocks, real estate) have zoomed to the moon due to the Fed policy of giving trillions of free money to it’s rich friends to purchase them, is as powerful incentive to not work that I can think of.

Wolf: “Private investment in buildings, equipment, and the like started setting new records in Q4 last year.”

My take is ‘one of those things is not like the other’. As timbers says, that’s the FIRE sector.

@timbers: Yup. Why bother working when your Fed-inflated 401k account earns more than you do?

I’ve coined a word for Welfare For The Rich.

Richfare.

So far, no one has been interested in it. But I will offer it again from time to time.

I think you mean Unfare

Or Wealthfare

Different words for it can be launched and tried and see if any go viral. We do need a name for it.

I think I remember once that Ralph Nader invented the phrase ” welfare for the wealthy”. So perhaps . . . wealthyfare?

Yep Wolf likes the “people are getting Government payments so why should they work” narrative.

His first chart explains it all. That delta of 3 million in the labor force can easily be explained by retirees, deaths, lack of immigrants, and two income families becoming one income because of school precarity/child care.

I fully expect the immigration drums to start really pounding soon.

I would like to see a breakdown of those potential workers that are not seeking work by age.

In the last month, as vaccine mandates have set in, I have had two people decide to retire early.

Then, my neighbor, who has been with BAE for 25 yrs decided she has had enough and she and her husband are selling their home in Norther VA and moving to St. Augustine FL. Gonna pay cash for a house with the proceeds from the home here. Asked her what she plans to do. She told me that she and her husband are looking at starting a small business and in the meantime she will do some part time consulting work but that is really all they need.

My guess, based on what I am seeing, is that a lot of people are just deciding to change their lifestyle plans and adjust to something less competitive and that will allow them to stay remote and work less.

My suspicion is that a lot of people in their late 40’s and 50’s, with kids that are out of the house, are deciding to downsize, simplify and spend more time doing what they like, walk away from the corporate rat race and the stress of climbing a ladder. The cost/benefit does not work for them anymore. For those that still need some income, they will do consulting work or other part time work.

Trade off the 4,000 sq ft home in DC, the BMW, for a 1,200 sq ft condo/townhouse and a jeep in FL, AL or TN. Consult remotely 20 hrs a week and get Obamacare til you qualify for Medicare.

I tend to agree with your comments, in broad terms. Those in a good to solid financial position may never find a better time to sell their home. Moving to a southern or southwest state will likely reduce the tax burden. Hat tip to a Federal Reserve policy for unintended outcomes.

Trading down offers advantages, and being remote capable means that most career or lifer professional employees have options.

“Consult remotely 20 hrs a week and get Obamacare…”

That’ll just about pay for the Obamacare.

As long as you don’t need any actual medical care.

Wonder about Medicare at 60’s prospects. If eligible workers had the option, the stampede out the doors would be bison-like. Not to mention a benefit pool goosed with younger, often healthier retirees’ contributions.

I would also like to see a breakdown by age. For example, I see many articles about people retiring early because of the covid pandemic, but I took the opposite tack.

I was eleigible for retirement a couple of years ago, but due to the pandemic I chose to keep working. The reason was simple. Since travel was greatly restricted I figure why bother retiring? I live in a smaller town (smaller crowds), make a decent salary, and I couldn’t easily go anywhere as safely as staying put. Plus, I was able to avoid the workplace and work remotely (for the most part). So, I might as well keep working and making money towards the time when a decent retirement lifestyle would be easier to deal with.

I wonder how many people around my age took what I feel to be a relatively rational position?

Labor force data by age is available: https://data.bls.gov/PDQWeb/ln

>I was eligible for retirement a couple of years ago, but due to the pandemic I chose to keep working.

Good luck, JCC. I hope it works out for you. Being in a position to decide for yourself whether or when to retire seems to be more and more of a luxury nowadays. However, even those in such a fortunate situation would do well to heed the following words of wisdom:

‘Always remember that every year you continue to work after the time when you could retire is not automatically added on to the end of your life.’

I coincidentally have been working on 2 different research projects for work and have run across 2 surprising data points that probably feed into your idea which I agree with. One project has revealed a surprising number of people who have part-time and “side” gigs. The other project involves small and very small businesses. I haven’t tallied the percentage yet but I was shocked by the number of people who said their biggest unexpected business benefit of 2021 was the ability to quit their day job to focus entirely on their business. People are definitely adjusting their lives and for many it involves less work.

“temporarily resting on their stock-market-crypto-housing gains”

There are two types of gains: unrealized and realized.

Is there any type of comprehensive data on realized gains?

That’s quite different from watching the bid up on markets and assuming everyine is making out like a bandit.

Crypto has been especially turbulent.

My buddy owns a couple houses here, and watched his very successful sightseeing tour business go to nothing during Covid when Sequoia NP was closed, and then resumed at about 20% of his old sales pre-Covid on account of only being able to do private tours versus the old business model of a dozen complete strangers in a vehicle for a half day or all day tour.

Now the KNP Fire has closed Sequoia NP for probably 4-6 months, so out of business once again.

He told me about trying to get a HELOC on his real estate and based on his earnings being practically nothing in 2020 and this year where he garnered 1/6th of what he made in 2019, no dice.

On the upside he does own a number of used 8 and 15 passenger vans which have appreciated mightily and he could turn a tidy profit over what was paid for them years ago, but if he was to sell he’d be out of business for good.

Yep, plenty of people holding assets that they can’t or won’t sell.

And for every crypto and meme stock success story, plenty more have gotten caught @ss out in the chase.

Good point–good luck cashing out 8 billion dollars in Shiba Inu Coin

https://decrypt.co/70344/dogecoin-knockoff-puts-8-billion-in-ethereum-founder-buterins-wallet

WTF?

It’s theoretically a market. Reduce the profit share. Increase the wage share of total income.

That ratio has steadily skewed towards profit, which has seen record year after record year since the Carter Administration. Trends that can’t go on forever won’t, the race to the bottom is in the final dash.

i am all for more money for workers, but we must reverse the reasons why we cannot have better wages, working conditions and retirements.

but we cannot reform, till we reverse nafta billy clintons disastrous polices. pay workers more under free trade, and a lot of that money flows offshore creating even more inflation, and less investment in innovation and production in america.

TARIFFS are a hedge against inflation, and promote high wages and investment inside america

tariffs arent a hedge against inflation, they increase prices (aka inflation) they dont stop it

Could it be that people are in fact working but are basically off the grid? That they are working for cash in hand and in places where you do not have to register? I have no idea of the size of America’s black economy but I bet that it is large.

This is not sarcasm or intended as off the cuff. Yep and yep, most likely the market for cash exchanges is pretty strong. Most likely, been trending that way since the 2nd term of President Obama.

Not be a complete cynic, but the state and federal tax forms are onerous and in fact odious. And every source of income for an American is taxed, including earnings made 100% overseas.

Sidebar. See the rancor around the proposed tracking of bank / financial institutions for individuals. Someone in the Treasury thinks aggregating for $10,000 is the marker for “wealthy tax cheats”. I’ve no idea where this proposal stands in the whatever its now called house bill.

If that sort of thing passes, then people who were doing business in cash will do as much as possible business in barter ( and maybe in alternative currencies like Ithaca Hours and so forth), even if that causes them to make less actual “money” . . . . as a sort of live-action protest over the years to come.

It will also drive more people to produce more at home. Which can more easily be done in a detached house and yard than in a barracks apartment cubicle. Which will make people in detached houses even more attached to their detached subsistence doomsteads, and more resistant to any plans broached to drive them out of their suburban doomstead neighborhoods and into multi-story urban barrack dwelling-blocks.

Such persecutionist “transaction-scrutiny” laws will drive Americans towards a new birth of Peasantism.

lol.

late to the thread….but almost frelling precient on the part about neopeasantism…like the archdruid said, years ago:”crash now and avoid the rush”.

and Black Markets are not just for dope any more.

i’ve been a black market farmer for a long time, now…because i am excluded from the “white market”(?) by the regs and insurance and “industry standards” and officially enforced cartellism(like milk and eggs) as well as the almost universal in group/out group dynamics of the above board ag market.

i’ll never make more than property tax like this,lol…but then again, i’m not really operating a bidness…like the bluebell ice cream commercials:we “eat all we can and sell the rest”…when we’re not just giving it away, that is.

friend of mine is an evengelist for raw milk…raised her kids on it, and will prosteltise to anyone about the benefits.

she even went so far as to get certified by state of texas, under their newish rejiggering of milk rules(creating space for small raw milk producers)

but she can’t legally sell it anywhere except “on farm”.

no grocer will touch it.

so she meets her customers in literal alleyways and on dirt roads…even in the truck parking spot after hours by the lone grocery store, itself.

milk(and eggs and meat) are, of course, different than tomatoes or squash…much more risk of food-borne illness, etc…still…

and it is the same with tomatoes and squash…our one grocer won’t buy local.

except for locally produced wine.

so one of my very favorite books, “Five Acres and Independence” has been rendered moot…not by the Great God Market, but by greedy people with a hand on the steering wheel.

of course it’s not really possible for BLS or whomever to get reliable numbers on a Black Market…by definition.

so anecdata it is,lol.

we should do a thread on that, and collate observations from far and wide.

i, for one, would be very interested in the results.

I’d bet that it’s more widespread than ever, right now.

if we were to do such a thread, it should be on a very-easy-to-find post. We would have to decide by perception and intuition which post would be easy to find, so people could go there and report their anecdata from the field on this or similar neopeasant production topics.

> … every source of income for an American is taxed, including earnings made 100% overseas.

Well, yes and no. If you are recognised by the IRS as an expat, you still have to report income earned overseas but you are not taxed on the first $107K.

And you probably won’t have much more to report if you are just an employee somewhere, because it’ll be next to impossible to get a bank account for your salary to go into. It really will be totally impossible to have a retirement plan or just invest any spare cash because of insane US legislation.

Of course everything is different if you have a couple of million floating around!

Yep I realized later on that was a bit exaggerated. I don’t know exactly the tax laws front to back for overseas earnings. So I appreciate that you’ve added a clarification.

If the economy continue to grow despite having fewer workers than pre-pandemic, that would seem to blow a big hole in the argument that we need loads of immigrants to keep the economy growing.

Child/elder care, or lack thereof, is a contributing factor that the author didn’t mention.

Yeah the ‘overstimulated economy’ in the headline sounded very hawkish as if Mr Richter being a bloody ultra-liberal type. May be some ultra-liberal blood runs through his veins.

(I don’t know if adding the adjective ‘bloody’ goes far beyond politeness requirements or if it is understood as colloquial) This is influence of Ian Rankin novels indeed.

The English (unless that’s just an assumption) have so over used the term, bloody, that it is pretty tame at this point, on both sides of the Atlantic for that matter though not used that often in American English. It is somewhat of a hackneyed form of emphasis often peppered throughout every sentence giving off more color than substance. Over here, we use, f*****g in much the same way but the term remains outside of polite language.

Just my take on it.

That said, I don’t think Americans have a patent on turning a rich human experience into something offensive to express frustration.

Over the past 40 years or so, annual labor productivity gains average about 2 percent per year. That means next year, we’ll need 2% fewer workers to produce the same amount of goods and services we created this year.

If you calculate the effect of 2% annual labor productivity increase over, say, 23 years, you discover that in 23 years, it’ll only take 50 workers to produce the same output that 100 workers produced this year.

Every 23 years, we need 50% fewer workers to produce what we need and want.

Do you wonder why we need so much gov’t stimulus, transfer payments, employment programs like DoD, etc.?

Without transfer payments, things would be much worse. Those transfer payments are what’s enabling households to buy all that production. Wages alone aren’t sufficient.

Why does our economic policy emphasize debt? No income required to buy production. Charge it.

Why are interest rates low? So free money can be created, and dispensed across the economy.

>Every 23 years, we need 50% fewer workers to produce what we need and want.

This assumes no population growth.

U.S. annual pop growth rate 0.59 and declining.

Versus 2% labor productivity rate.

Good point tho. There are offsetting factors.

But the fundamental point I made, which is that labor is rapidly being factored out of the production equation, stands.

Please rebut.

I agree with the rest of your comment–the gains from productivity have been strictly going to the 1 percent over the past 4 decades rather then workers. I just felt it was worth noting in absolute numbers we generally still need more workers, even if the Participation rate can (and should due to climate change) go down

well at current rate of population de growth, we may find out how Japan works. they are at the point that there is no growth at all, and that it wont be long that there wont be many left. China is much different really (left over from that one child per couple law). and ‘productivity; has been growing, its just doing what it normally does

I am 72, on a fixed income and just below the FPL. I got the J&J jab (zero reaction, thank you very much). I go three places in my 23 year old car (10 gallons lasts me two months) and I always mask up. 1 – the Library (with my cataracts I can’t read so I watch videos, though with my impaired hearing I cannot always understand the dialogue, and sometimes cannot even read the subtitles), 2 – the liquor store for brandy (I walk or take the bus if I am already loaded) – and 3 – the food CoOp. So far, #3 has the greatest inflation of prices. I expect to be drinking more and eating less. The expected 5.9% SS increase next year will not cover the difference, as the CPI does include energy or food.

oops

If you are in the USA, Medicare/Medicaid covers cataract surgery.

https://medicare.com/coverage/medicare-cover-cataract-surgery/

Thank you GF, yes I knew that, but you are kind. I have Medicare/Medicaid/QMB. I spent two sessions with an Ophthalmologist recently who predicted I would have it done when I could no longer drive. I’m getting close to that as I can barely distinguish (in the day, I rarely drive at night) what a stop light is indicating. Cataract surgery scares the hell out of me, even though I seek service from the major University Health System in Michigan. They are great! But still, I am a wimp.…

Those people I know who have had it done were all really happy with it and it is no longer a new technology so (I assume) much safer now.

But I completely understand being scared anyway. I’m a member of that club.

Thsnk you Brooklin Bridge, I will take that to heart.

My mom had cataract surgery years ago. She’s 79, with a litany of health problems, but vision isn’t one of them. She’s actually got close to 20/20 vision.

Go for the surgery. They usually do one eye, then wait for it to recover before doing the other one.

Thank you JohnnyGL, I take all of these kind replies to heart.

Mark Cuban put out a tweet a couple of days ago. He said “4% of people in the USA have quit their jobs because of Crypto gains, and the vast majority made under 50k. ”

Despite what you may think of Mark Cuban, we might be approaching what people in the future will call the Powell’s Dilemma. If everyone’s rich, who’s left to work? Crypto, stocks, beanie babies, etc, etc. It won’t be long before all sorts of stuff will be inflated. Looks like Utopia is near.

50k is no where near enough to retire on. Those people will be back in the labor force in the not too distant future.

When actual rich people start withdrwing their crypto gains in numbers I suspect it will tank the market just like it did the tulip market

If you’ve paid off your mortgage and autos and have little debt, it’s enough to retire on.

but unless your mortgage is really low (good luck with that), and you own your car, and you can get on Medicare (if you try COBRA, you will be unpleasantly surprised how much health care is (even if you are healthy). and of course if you own your own house, you will have to pay property taxes, and sales taxes. 50,000 will go very quickly, and unless your are already able to get SSN, then you will have no money at all (other than 401k, etc), and that will have last how long? never mind having to pay for food (today’s prices are driven more by farmers not being able to get food to market), oil prices will keep going up (since that takes tankers…and truckers to get it where its gong). and then there is all sort of other insurance (car,house, etc) which wont go lower much at all (odd how the cost of lumber sky rocketed this year….and the price cars and parts is going up too…never mind getting some one to work on either…we spent about 5 months trying to get some repairs around our house done…..havent had to go a car repair place yet…..but i doubt that will be much better

English can be so vague sometime. It could be he meant that the vast majority made less than 50K through Crypto trading or the vast majority used to make less than 50K in their day jobs.

Withdrawing Crypto to book gains? That’s so last century. Everyone knows you can take out loans against your crypto holding like this dude: https://www.wsj.com/articles/crypto-fans-borrow-to-buy-homes-carsand-more-crypto-11631266200

Remember the mortgage crisis? Hopefully the crypto one will be bigger.

I think a lot workers leaving the work force are people who learned during shut down that their job didn’t actually pay for the expense of working.

Let’s see, child care, auto, auto insurance, gas, auto repairs, buying takeout cause you are too tired to cook, uniform for job.

And after all that,, you still are treated like expendable crap.

People likely found that cutting those expenses (sell the second car) and cooking at home left them ahead of where they were while working. And even if you were little behind, there’s the joy of telling the boss to stuff it when he calls you back. That’s unadulterated pleasure.

Plus I’m sure there is a lot of work in the black economy. I should know, I live there myself.

THIS So Much!

Way back around 1990 the NYT did a study of an “average” dual income professional couple in the New York Tri-State area. If one spouse quit their job and stayed home, yes, their income was halved. But…

Progressive taxation rates means their Federal and State tax loads were more than halved.

Childcare expenses were eliminated.

Transportation/commuting expenses were halved.

Less ordering out/eating out/processed foods.

Less dry cleaning/work wardrobe expenses.

And more. When all was done and tallied up, halving a second income netted only $85 per year!

While this is true, it does put an undue future burden on the person who decides to stay home. No social security wages, no 401k savings, and no buffer if the sole worker loses their job for any period of time for any reason. Returning to the workplace when the time is right can be very difficult too. My wife and I went through years of this sort of not getting ahead on two salaries due to child care expenses being so high in our area, but while we spent nearly every dollar earned, we were saving into 401ks and both accruing SS benefits.

While not perfect sample size the Wall Street types I speak and hear from are furious. While they profess to be socially progressive, they aren’t, they too a person want any nascent labor movement crushed and crushed now. They are part of the donor class and are seriously worried about anything that could cut into corporate margins and the gravy train they have been riding for the last few decades.

These are the same people who voted Obama and were relieved when he took care of them and screwed Main Street. They worry Biden will help Main Street and want Build Back Better killed, despite having no idea what is in it. They want the remainder of the social safety net torn up so the lazy masses get back to work.

You can’t make this up.

yea afraid so. after all they have exported as much production as they could (in some cases…..not so smart for the US….they sold a plant under Clinton, to a buyer from over seas…but that buyer couldnt move any of the equipment over seas…until GWB was in office….at which it went over seas too…what they produced was permanent magnets…used in all sorts of products…..which now have issues with supply…since the plant and equipment ended up in ….China).

I like reading WolfStreet, especially when I don’t agree with Wolf’s interpretations. He has a PoV that seems to be pretty rare nowadays, with so many people becoming ideological & polarized about economics.

As for the current economy, I’ve been thinking about it more, and I suspect we’ve passed the point there’s any one single cause (and thus, a single solution). I agree that most of the current inflation is likely due to structural, supply issues (dislocation of workers, supply chain nodes going down, etc.)

However, I’m starting to think Wolf may be right that the monetary stimulus is directly involved through one vector: housing. It’s not just that the prices themselves are going up, but all the easy credit sloshing around gives particularly well-connected people a lot of options to play Monopoly with real real estate. And I expect almost none of those speculative / rent-seeking games help the average worker find affordable housing in a convenient location.

The really interesting one though is oil / gasoline. Even though it’s not brutally high yet, I wonder if that’s where America’s in for way more trouble than it realizes. Why? Because I’m starting to suspect it’s geopolitical. It looks like OPEC+ called our bluff that we could keep dumping capital down fracking wells to cap the price of crude. And at this point, after years of mindlessly waffling on their worst policies while maligning them domestically, I’m wondering if the Saudis are as happy as anyone to stick the knife in.

In short, what if some of this inflation isn’t just a bad reboot of Tommy Boy, but the first act of Oil Embargo 2: Electric Boogaloo?

What I see in my SE Michigan neighborhood is that property asking prices have peeked and are now falling back.

Seeing the same thing here in Tucson. Also seeing increases in the number of houses for sale. Many look like they had been rentals.

some of the price of oil….is because its harder to transport than most other products (and it didnt really help that big oil stopped looking for new supplies for a few years. consider that the choices for transporting it…is by ship, pipeline, and trucks. the last one has issues with lack of truckers. that have the skills needed to do that. considering that a gas truck maybe transporting 10,000 or gallons of gas…you really dont want them to now what they are doing the resulting explosion could be really painful. and tankers are also harder to find (many were pulled back when oil crashed…like it always has happened), then there has been more than a few pipelines…that had ruptures…since they werent kept to the standards required…

and cant forget than when the market crashed….a lot of the fracking wells were shutdown….cause demand was low….like last year…

one of the things i think we might learn,,,,is that disruption of a supply chain….is really painful…. and costly.. and will take a long time to resolve…

And no one is mentioning credit cards. Everybody is talking about the money that the govt “prints out of thin air.” What about the “money” banks create out of “thin air”? Some stats are showing credit card usage and balances rising.

During the “Teens” of this century I ran up my credit cards. Bad move! I spent the last 5 years paying them down to nothing (April 2021). Since April, I have now been using my cards strictly on a pay-as-you-go basis to gain points. As an example, even though I have the money to pay the cable bill, I run it through a bank card. I receive my points and then immediately pay the balance.

If every one does this we would expect to see a decrease in credit card usage into the beginning of this year. Then an increase which may stagnate in the year to come. Let’s see what happens.

banks have been creating money for a very long time…used to be loans….the CC…but those are old news….now they seem to want in on Crypto, which to them looks like it will a lot money out of thin air….or out of wall street

No, you can’t create money with crypto. It is personal property, not a currency. But banks are looking at a lot of fees and margin from the skim from converting it into money.

I still can hardly believe the way the u.s. government pumped up the price of stocks and housing. I have been out of the stock market for some time now — ever since the prices on stocks diverged so far from what had once been their fundamentals. The sudden up-tick in housing prices and rents mystifies me — even taking into account the unimaginable amounts of almost free money the Fed made available for speculations by the FIRE sector. Large numbers of renters and home owners face the end to eviction and foreclosure moratoriums and a possible upsurge in the Corona pandemic looms, some time in the future.

But — “Consumer spending surpassed its pre-pandemic record in Q1 2021. Private investment in buildings, equipment, and the like started setting new records in Q4 last year. Retail spending, which is part of consumer spending but doesn’t include services, has been blowing out every record all year.”

Wages are up a little, up less I think than the prices for too many of the things I need. Who are the consumers spending record amounts and what are they buying? Retail spending is blowing out records all year? I do not see that on my Main Street … Amazon? Are drugs included as part of retail spending? Is everyone buying a larger television? What is going on. The numbers and measures for the economy do not match the impression I have from my limited excursions outside my apartment. Am I that far out of touch? — or are the numbers reported for the u.s. economy that far out of touch?

Trillions were sent out indiscriminately to people who didnt lose income during the Covid then the most egregious thing was the PPP with another trillion sent to businesses that didnt need it but took it and it is now being forgiven by the government. All you have to do is fill some paperwork saying that money was used for payroll and it will be forgiven. Dont start me on the airline companies who spend billions buying back their shares and got a full taxpayer bailout.

At some point one has to ask, if money is so freely spread around , why bother working?

If consumers who were used to paying a slave-wage price are suddenly paying a fair-wage price, are they experiencing inflation? Or are they paying the fair price involved in other peoples’ decent survival?

Maybe people who don’t want to pay a fair-wage price for anything, don’t deserve to have anything.

Retired four months early from cush university “IT” job – Mac tech, certified to repair Apple laptops. Universities that have extremely profitable Apple Campus Stores must have someone like me on staff to facilitate warranty, extended warranty and out of warranty repairs or Apple won’t let them sell their hardware. Did I say “extremely profitable”?

Old hippie who went PMC to do the house/marriage/family thing, then stumbled into IT via Apple Macintosh computer sales and service. Calling this the “Clang! Honk! Tweet!” economy after my old friends The Fabulous Furry Freak Brothers:

https://comixguru.blogspot.com/2004/08/clang-honk-tweet.html

After decades of military contractors, upper education, privatized healthcare and pharmaceuticals practicing it, and now with shortages of goods and workers due to the pandemic and just-in-time logistics collapse; the best description of this economy is unmentionable by corporate media — “profiteering”.

There are some other possible reasons people are not working that I don’t see discussed much. First, how many companies went out of business during the pandemic and never returned? Second, how many people were working for those companies and were limited in ability to find local employment because they did not want to move to a new location (maybe because of family or spousal employment)? Third, there have been a lot of anecdotes about people moving back to live with their parents during the pandemic, job or no job. How many of those people are still living with their parents and do not have a job? Fourth, some people pulled their kids from school and have still not returned them to school. How many teaching jobs has that affected? Fifth, how many police left their jobs due to the increased hazard of being sued or otherwise held to the law? What are they doing now? Sixth, while there is a lot of talk of people retiring early, who actually retired? Police for example can retire at a fairly young age, so may have had a greater incentive to do so. What other professions tend to retire early? How many medical workers burnt out? While it is interesting to see employment by sector or age, what is more interesting is finding out specifically where those 3 million people are now and what their circumstances are. Has no one done a large randomly sampled survey of the USA? Seems like that is the only way to get past all the mystery and speculation.

People are actually trying to move toward Keynes’s long ago predicted 15 hour work week?

More power to them! Let’s collectively choose hours of family time over cubic inches of car engines, diagonal inches of TVs, and square feet of housing.