Yves here. Wolf is correct in his depiction of the effects of Covid economic policy, even if he is a bit off base as to the causes. One wag said something like: “White collar employees got to stay home while low-income workers brought them stuff.” Super low interest rates, which is what the Fed likes to use in crises because fast and easy, benefitted the rich, particularly leveraged speculators (private equity, real estate, hedge funds) and not much ordinary folks. At the same time, officials have adopted a “Let ‘er rip” Covid policy even when making some gestures otherwise. That results in supply chain disruptions which increase prices, particularly of essentials like food. The fact that bad weather (often credibly climate change driven) is also goosing ag prices does not help.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

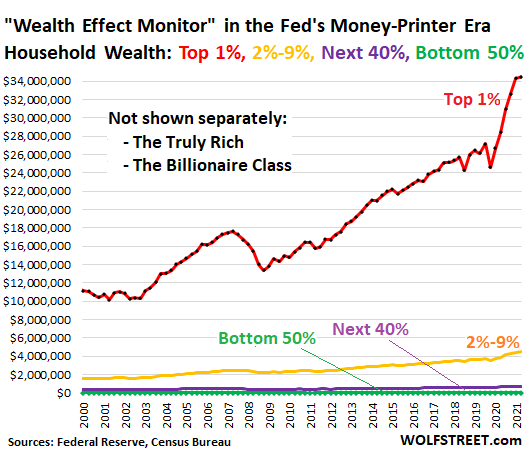

My “Wealth Effect Monitor” uses the data that the Fed releases quarterly about the wealth of households. The Fed, after having released the overall data for the third quarter earlier in December, has now released the detailed data by wealth category for the “1%,” the “2% to 9%,” the “next 40%” (the top 10% to 50%) and the “bottom 50%.”

Wealth here is defined as assets minus debts. The wealth of the 1% ($43.9 trillion, according to the Fed) is owned by 1% of the population. The wealth of the “bottom 50%” (only $3.4 trillion) gets split across half the population. My Wealth Effect Monitor takes this a step further and tracks the wealth of the average household in each category.

The average wealth in the 1% category ticked up by only $121,000 in Q3 from Q2, after skyrocketing over the prior five quarters, to $34,478,000 per household (red line). In the bottom 50% category, the average wealth ticked up by $6,800 $53,600 (green line). And get this: About half of that “wealth” at the bottom 50% is the value of consumer durable goods such as cars, appliances, etc. Even the top 2% to 9% (yellow), have been totally left behind by the explosion of wealth at the 1%:

Note the immense increase in the wealth for the 1% households, following the Fed’s money-printing scheme and interest rate repression in March 2020.

A household is defined by the Census Bureau as the people living at one address, whether they’re a three-generation family or five roommates or a single person. In the third quarter, there were 127.4 million households in the US, per Census estimates.

Those top 1% households were the primary beneficiaries of the Fed’s policies during the pandemic. And they have hugely benefited since the Financial Crisis. They benefit the most when the Fed prints money (QE), which is designed to inflate asset prices, which benefits those that hold the most assets the most. This is not a secret. It’s the official policy of the Fed and the desired outcome of these official policies is officially called the “Wealth Effect.”

Billionaires Got More Billions, Half of Americans Got Peanuts

The Fed doesn’t provide separate data on the truly rich (the 0.01%) and the Billionaire Class, a distinct class in American society whose members often get named in the media with specific titles that have “billionaire” in them. They’re the prime beneficiaries of the Fed’s monetary policies.

According to the Bloomberg Billionaires Index, the top 30 US billionaires are worth a total of $2.23 trillion. On average, that amounts to a wealth of $74.5 billion per billionaire among the top 30 richest US billionaires. Three months ago, each of the top 30 US billionaires at the time was worth on average $69.2 billion. So, over the three-month period, the average billionaire among the top 30 US billionaires each gained $5.3 billion in wealth.

But the bottom 50% households, that huge mass of Americans, on average gained just $6,900 in wealth over the third quarter. And the wealth disparity between the top billionaires and the bottom 50% exploded.

You can kill someone with reckless usage of percentages. If I give a homeless person $5, and he already has $5 in his pocket, I increased his wealth by 100%. But he still is homeless and still doesn’t have any wealth. Percentage increases are touted as a way to show that the wealth at the bottom increased, when in fact, it increased by only peanuts because the bottom 50% have so little and even a big percentage increase is still nearly nothing, compared to the billionaire class.

Over the past quarter, the average wealth of the top 30 US billionaires increased by 7.6%, according to the Bloomberg Billionaire Index. This amounts to an increase of $5.3 billion per billionaire. This is a huge amount of money for one person to gain due to inflated asset prices in one quarter.

The average wealth at the bottom 50% increased by 14% during the quarter. But this amounts to only $6,900, further blowing out the wealth disparity between them and the billionaires by the billions per household!

Within each category of wealth, the range of wealth is huge. The top 1% range from those who’re just run-of-the-mill wealthy to those who’re worth tens of billions of dollars. The bottom 50% range from the desperately poor to those who’re comfortable with a modest house, a small 401k, and some durable goods, and weighed down by lots of debt.

Fed Goes All in on Wealth Disparity as Solution to the Pandemic

Since March 2020, the Fed printed $4.8 trillion and repressed short-term interest rates to near-zero, for the sole purpose of inflating asset prices massively in order to enrich the asset holders massively. The Fed has long clung to the doctrine that making the already rich vastly richer by printing money and repressing interest rates creates economic activity.

This doctrine is called the Wealth Effect, and it has produced the greatest economic injustice committed in recent US history.

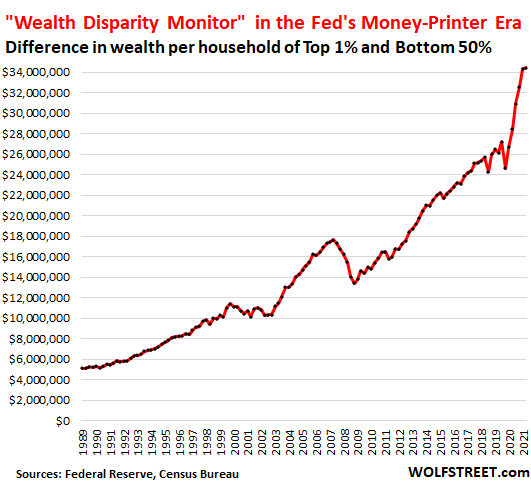

My “Wealth Disparity Monitor” (chart below) tracks that economic injustice by showing the difference in wealth between the top 1% and the bottom 50%, using the Fed’s own data, on a per household basis.

Back in 1990, the wealth disparity between the average bottom 50% household and the average top 1% household was $5 million. By Q3, 2021, that wealth disparity ballooned by nearly 600% to $34.4 million.

This is a great way for a handful of people at the Fed to tear up a whole society. Conversely, a big market downturn, with asset prices returning to where they were a few years ago, would repair some of the damage these horrendous policies have done to American society.

The Fed Makes the Rich Richer, the Bottom 50% Pay for It Via Inflation

The Fed’s policies are designed to create asset price inflation. Asset holders get richer. That’s the purpose. The more they have, the more they get from this asset price inflation.

The bottom 50% have nearly nothing in terms of assets – for example, they held on average only $4,077 in stocks per household in Q3 – and they get shafted. This has been the case for decades, but during the pandemic, the Fed embarked on a historic money printing binge, and the results in terms of this ridiculous wealth disparity are now everywhere.

But for the bottom 50%, this historic money-printing binge has now created the worst inflation in 40 years. Inflation means the dollar loses purchasing power. But for the bottom 50%, their labor, which is denominated in dollars, loses purchasing power in terms of housing, food, cars, etc. And so the bottom 50% get to tighten their belt to pay for the Wealth Effect.

What’s gone wrong?

We have forgotten what real wealth creation is.

Capitalism is all about hard work, drive and ambition.

Only joking.

It’s all about sitting on your backside and reaping the rewards from ever rising asset prices.

Making money and creating wealth are two different things, but we forgot.

Why did they abandon neoclassical economics last time?

The wealth evaporation event of 1929 finally brought them to their senses.

They needed to find out what real wealth was.

It took them a long time to disentangle the hopelessly confused thinking of neoclassical economics in the 1930s.

This is when they invented GDP.

The real wealth creation in the economy is measured by GDP.

Real wealth creation involves real work, producing new goods and services in the economy.

That’s where the real wealth in the economy lies.

They used to think rising asset prices were creating wealth, but after 1929 they realised this was not the case.

They needed to find out where real wealth was created in the economy and they invented GDP.

This is why GDP is the thing we want to grow; it is the real wealth being created in the economy.

“Real wealth creation involves real work, producing new goods and services in the economy.”

True however we let the Chinese do that now. You know – Don’t get your hands dirty.

Agree! Stock market wealth functions as fiat currency, fiat investments, and the only tax-deductible gambling game.

For the first time in my adult life, I don’t own enough “vacant real estate” to plant a veggie garden. I am limited to a small hydroponic garden.

one of the first things FDR did was to impose tariffs, truman fought the free traders who tried to turn Gatt into a nafta billy clinton W.T.O. type of trading system, the W.T.O. is a classic example of fascism, truman won.

ike SAID HE WOULD NOT OVER TURN THE NEW DEAL, AND HE WOULD NOT OVER TURN TRUMANS GATT. then ike taxed the s##t out of the rich, and increased unionization.

nafta billy clinton said it was about time to do away with trumans triumph for democratic control, and we ended up with the fascist W.T.O.

nafta billy clinton said we cannot live by the new deal, and he wiped most of it away, and we got this way today because of nafta billy clintons disastrous policies.

those disastrous polices were the almost complete want list of the mount perlerin society, and looneytoonterianism

Are permanent zero percent interest rates a good thing or a bad thing? What’s NC’s commentariat take on this?

Amongst people who agree that wealth inequality is completely out of control and is leading us towards societal breakdown, there seem be quite a difference of opinion about low interest rates.

Wolf Richter here seems clearly against, arguing that QE is inflating the asset bubble – hard to go against that. As far as major MMT voices go, I think Steve Keen also argued against them (I might be misremembering or misrepresenting his position here), and on the opposite side, one of Warren Mosler’s proposal is to make the zero rate policy permanent.

I’m really confused by this, instinctively it seems to me that QE/lower rates have given governments the world over some fiscal space, which is a good thing, it means more ability to help people, even if inapt/unwilling governments aren’t actually doing that. And even if QE wasn’t even needed in the first place: whatever fiscal stimulus was done “thanks” to QE could have been done through simple deficit spending.

On the other hand, the divide between people owning assets (basically stocks and one/multiple houses) and people not having any asset has become completely ridiculous. It makes the rich even richer and more powerful and even less willing to let go of the current system. Class mobility has gone from an actual thing during the post war period, to a marketing fairy tale during the neoliberal/reagan years to now being a bitter joke.

Every asset bubble cheapens the value of work, which is exactly the opposite of what we should be doing right now.

Anyway, I might be wrong on that but where I’m currently at is that the real crime hasn’t been zero interest rate policy or QE, but it has been central banks sending asset prices sky high by buying stocks and bonds during the pandemic. That’s a direct use of state power to prop up and protect private wealth – ie the thing the LEAST in need of state protection right now.

Or the problem in the first place, as Michael Hudson has repeatedly been arguing, it that we let banks lend for asset speculation rather than for socially productive aims. And letting bankers do that kind of lending with permanent low interest rates is a bad thing on steroid, it just makes the problem that much worse.

The MMT argument for zero interest rates depends on using a floor on labor prices, aka a job guarantee, as the alternative for managing the economy. That is why MMT advocates generally favor a job guarantee. It is not central to MMT analysis, but MMT does lead to recognizing that interest rates are a poor tool for that purpose, and if you reject that, you have to propose something else.

We do price supports, buying surplus soybeans and cheese, why not labor?

As I asked that, I realized “Labor discipline” is the answer. (That’s the message that you had better take whatever crappy job is on offer, or suffer the indignities of poverty, even homelessness and starvation…and if you’re extra ornery, we’ll put you in a cage.)

Meanwhile (thx to Mike Norman) Biden’s Agenda Is on Its Death Bed Because the Interests of the Rich and Poor Are Irreconcilable. To keep the poor content, or at least distracted, we’ll continue to have media dominated by “fake news.”

The problem with lies is not only that they’re unethical, it’s that they tend to deceive even the liars who start to believe their own BS.

So…a country of the deluded led by the deluded is what to expect. Why else would a transparent phony like Trump be hailed as a savior when he called out fake news?

i do not think many ex-voting for democrats deplorable(blue collar work with their hands FDR democrats)voted for trump as their savior.

trump simply told the truth, nafta billy clintons free trade policies destroyed their standard of living, took their jobs, homes, wealth, pensions, and funneled them into the pockets of nafta billy clintons wall street, and the chinese communist party.

now working people have become radicalized, and empty suit hollowman obama, and now nafta joe biden are bailing out nafta billy clintons disastrous polices.

so how are you going to get those voters back?

>>>That’s the message that you had better take whatever crappy job is on offer, or suffer the indignities of poverty, even homelessness and starvation…and if you’re extra ornery, we’ll put you in a cage.)

This is a partial explanation for the strikes and new unions; in California, a lot of the employed live in their vehicles or rent a room. They are essentially homeless already. Then there’s the overloaded food banks. “Labor Discipline” is becoming an oxymoron if having a job or three doesn’t prevent poverty, hunger, and homeless. However, I guess those who have the whips are used to saying that the beatings will continue until morale improves and it work.

“Are permanent zero percent interest rates a good thing or a bad thing? What’s NC’s commentariat take on this?” ……… Keep in mind we don’t have zero interest rates but deeply negative interest rates maybe about -10 or -15% once you factor in inflation.

Recommended reading for an MMT perspective: The Interest/Price Spiral (Thx again to Mike Norman)

As always, its not about the money creation, its about where the money goes (and how we decide that). If we leveraged the Treasury to create new money to do productive work like rebuilding infrastructure and creating sustainable energy solutions, you’d see a general boom in society like we haven’t since the New Deal. Instead we leverage new money creation to let rich people and corporations buy up assets through finance.

In short: the answer is political (as always) and not some neo-classical math function having to do with the money supply.

Zero percent interest rates. This is “no cost” money. But you have to ask yourself who gets access to the cash. Is it the guy humping the pizza to your door, or the guy who just fixed your sink? Is it the Uni student next door who just took out a tuition loan…the orderly taking care of people in the old-folks home…your bus driver? A relatively small and privileged class of people is allowed access to hoard of cash. So, if you do even a crude class analysis as Wolf has done, it is clear that Plutocrat Boutique Bank is not in business to benefit your well being.

Yes, and Wolf likes to point out, the wealthy and corporations can and do borrow for next to nothing, the average Joe or Jill pays 18% on their credit cards. I was going to respond to AJ above too:

Or by “disrupting” industries using wealthy investor’s money to subsidize money losing businesses (Uber is a great example). There’s so much investment capital out there looking for somewhere to go, it can’t go to Treasuries because there’s no money to be made there, so it goes into VC because that’s a well-paved path, even though most of that work is useless and even destructive to the economy, labor, etc.

Central banks’ intervention through negative real interest rates and QE is bad as it extends the central bank put policy that helps primarily those taking the most (and sometimes excessive) risks at the expense of those who are not willing or able to take as much risk. In a way central banks are creating a chicken game economy, where the ultimate winners are those willing to risk it all and ultimate losers those who are not (as they will have to compensate to the winners through the negative interest rates after the bubble has burst).

Central bank does not need to repress the rates for the government – it can easily lend at 5% rates as in the end it will direct the interest revenue to the government anyway (as such the net cost for direct lending is 0%). In that way the credit risk could easily fluctuate and thus remove the central bank put. This still does leaves the door open for the government to take too much debt in longer term (as it has no negative feedback through higher interest rates) that could result in the destruction of those not willing to take risk (through destroying the purchasing power of the currency).

The evil in this story is the central bank’s goal to achieve a 2% inflation no matter what as otherwise the world seems to end in their minds. Most of the interest rate repression and QE in major central banks is for that purpose (there is little economical need). And there is little hope of that repression to end as the demographics creates a headwind, previous bubbles have brought forward too much consumption leaving less for now, inflation numbers do not include housing costs correctly and the application of hedonic adjustments are probably bringing the value downwards creating a situation difficult to reach a 2% inflation number.

I think the proposal for permanent ZIRP policy is an acknowledgment that fiscal policy, NOT monetary policy, is the correct avenue through which to address distributional problems.

In this sense, the ongoing squabbling over whether lower or higher interest rates are better for the poor is a distraction (quite possibly purposeful) from the required fiscal policy adjustments that would be necessary to actually address the problem.

I’m just finishing Stephanie Kelton’s 2020 book on the deficit, and am wondering what she now thinks about the inflation situation.

Somewhere I saw her mention of a study by one of the Fed’s regional banks that found that the spending under Biden had a very small effect on inflation. That supply chain problems and the pandemic are to blame.

So I wonder what she is now recommending.

The MMT description of how things work makes a lot of sense.

Where it fails is in the prescription that it can reduce inflation by raising taxes without taking into account the realities of our gridlocked government and entrenched lobbied interests.

With some stretch of imagination one can say that the covid stimulus was some form of applied MMT in practice. We have a lot of inflation to the point where it even shows in the biased official stats and without arguing if its due to supply or demand, good luck stopping it by raising taxes.

But in an ideal world and in theory a lot of things make sense.

I’d disagree. Dr. Kelton cites a Cato study of 56 hyperinflations throughout human history. How many were initiated by a “Central bank run amok” (her words)? Answer: zero. In every case, a shortage of goods, often coupled with a balance of payments problem kicked off the inflation, not too much money printing.

So…Zimbabwe expelled the colonial farmers and redistributed their land to native, who were not able to produce as much food. That shortage led them to try to import food, producing the hyperinflation.

In Weimar, the French were angered the defeated Germans weren’t paying reparations on time–in this case telephone poles–so they invaded the German industrial heartland, and shut down that industry. The shortage of goods, and the balance of payments problem posed by the WWI reparations led to the hyperinflation.

In the U.S, peak oil (pre-fracking) was 1971. When the Arabs employed the “oil weapon” in 1973, it was the first time the U.S. wasn’t able to produce its way out of that shortage. The price of oil–$1.75/bbl in 1971–quadrupled overnight, peaking at $42/bbl in 1982 when Alaska’s North Slope production came online. That shortage of a critical commodity led to the inflation of the ’70s. Warren Mosler says the inflation abated because Carter deregulated natural gas (oil producers won’t drill if the product won’t pay for the production), not because Volker raised the Fed Funds rate.

Anyway, the current inflation is likely the product of a) supply chain shortages, and b) monopoly pricing. … or at least that’s my best guess.

Anyway, tax rises are always problematic. The increase in prices because of shortage could amount to the same thing. Michael Hudson is fond of saying low real estate taxes mean a) real property price inflation, and b) banks making bigger loans as a consequence. I just recently heard Warren Mosler propose a federal real estate tax, presumably for just that reason. (and…Surprise! California’s Prop 13 made property *less* affordable by lowering taxes, making more money available to pay those mortgages.)

I’d disagree. Chickens and eggs. I guarantee that if you double the money supply overnight you will have an immediate shortage of goods the next day.

The current inflation has multiple causes and money printing is one of them. Cantillon postulated that the inflation starts in the parts of the economy that are closest to the money spigot and it spreads from there. So it starts in stocks, bonds and real estate and is now spreading.

MMTs contention that it can control inflation through taxation is totally fallacious. Having taxed, it will of course spend, and so on and so on and so on. Once printed the money simply goes from bank account to bank account to bank account and liquidity builds in the system.

Pretty soon you have so much money sloshing around that the banks can’t use the stuff and threaten to stop taking deposits or impose a negative rate on deposits. So the Fed steps in and offers reverse repos so that the banks get a minimum few pips and keep accepting deposits to hold the system together. How much is the overnight reverse repo tally now: about 1.65 trillion and rising!

Parking the funds with the Fed through reverse repos also fails to properly sterilize the freshly minted money, which can be pulled out at call. As the proportion of cash in the economy rises relative to goods and hard assets its value falls. Eventually it doesn’t make sense to hold it and hyperinflation is the result. Hold onto your hats!

Weird.

I thought if you had twice as many chickens you’d get twice as many eggs, roughly based on the nutrition available to the chickens, and conversely if you have twice as many eggs you’d get twice as many chickens. it’s based on resource constraints, the MMT…

The fed has been flooding the market with “cash”, as you call it, for a long decade although it’s not really cash…the trump stimulus was cash. It’s only a problem for you when the assets need to be made liquid in order to have actual cash go to actual resource, say labor for instance, now all of a sudden it’s OMGinflationhowyougonnapayforit?!!!

Weird indeed.

Chickens and eggs, as in which comes first!

Most “cash” today is electronic, rather than coins and notes. So the Fed’s QE cash is no different to Trump or Biden stimulus cash. It is one and the same. For appearances, rather than deal direct, Treasury issues bonds to the market and the Fed then buys the bonds from the market and pays for them with newly minted electronic cash. Rinse and repeat. The net result is cash in Treasury’s account with the Fed, which Don and Joe can fling around with gay abandon coz it’s free.

Just because you can get away with printing for a while, even a long while, does not mean you can do it forever. Nassim Taleb called it something like “the Turkey fallacy”. Every day everything seems just fine, and then it’s Thanksgiving. It’s the contrast between the short run and the long run. You can get away with all sorts of crap in the short run, but in the long run it will bite you. It’s called complacency, but it’s a big fat tail risk. The entire history of our civilization tells us it ends badly, but ignore that if you will. Don’t look up!

A few weeks back, Fed Chairmen Powell said to the affect the Fed’s job was to keep financial markets happy. Never mind stuff like laws etc.

That’s been true for a long time for sure and of course the Fed is servicing powerful interests (and servicing themselves, too) many of whom happen to friends and associates of Federal Reserve Folk, but some noticed that statement and were surprised that he just flat out said it.

Interesting article yesterday in Politico yesterday about Thomas Hoenig, retired president of Fed in Kansas City. For years he was the lone dissenter against the Feds 0% interest rate policy. https://www.politico.com/news/magazine/2021/12/28/inflation-interest-rates-thomas-hoenig-federal-reserve-526177. He predicted that, “While Hoenig was concerned about inflation, that isn’t what solely what drove him to lodge his string of dissents. The historical record shows that Hoenig was worried primarily that the Fed was taking a risky path that would deepen income inequality, stoke dangerous asset bubbles and enrich the biggest banks over everyone else. He also warned that it would suck the Fed into a money-printing quagmire that the central bank would not be able to escape without destabilizing the entire financial system. ” I guess he was right on all counts.

This was really good. Although, I found this little bit of mild hagiography kind of strange:

“Hoenig has a stubborn streak when it comes to such decision, and it traces back to his long history of working with serious numbers. During his childhood in Fort Madison, Iowa, Hoenig spent his holiday breaks working at his dad’s small plumbing shop. Hoenig was sent to the back room with a clipboard so he could record the inventory of plumbing parts. If he made a mistake, his dad could find himself short of supplies. After graduating high school, Hoenig served as an artillery officer in Vietnam, where he calculated the firing range of mortar shells to ensure they landed near enemy positions rather than on his fellow U.S. soldiers. Hoenig’s upbringing taught him that getting numbers right was a deadly serious job. And he felt a sense of duty to get it right. When he enlisted to fight in Vietnam, he had explained the decision in simple terms to his sister, Kathleen Kelley.”

almost the only economists that you find have any sense at all have some experience in “applied” economics.

because they are keenly aware that their decisions are affecting the real world and what people actually get to do.

one blessing for me is that my econ. prof was, for many years, a practicing applied economist with a local school district.

he still taught us loanable funds and marginal theory and all that crud but he tempered a lot of what he taught by always focusing on “the real”.

too bad that curricula neatly avoids all history, and marxist analysis but it was just the required basic ed.

My cynical (realistic?) view of class divisions in the US:

Those with sufficient assets to purchase one or more senators

Those who can purchase one or more congress critters

Those with sufficient liquid assets to hire a really good law firm for an extended litigation

Those with sufficient liquid assets to live for a year without additional income

The rest of us

Any suggestions for names for those divisions?

Delta SkyMiles Medallion Status Levels:

Diamond

Platinum

Gold

Silver

and for the rest of us: putty.

Well, this article contains two of my biggest peeves … LOL

Firstly, the euphemism “printing money”, which I loathe; and secondly, what I consider to be the lame take that “money printer go brrr” has a lot to do with our current pandemic-shock inflation.

If I were in the mood for digging, I’d search Wolf’s own site and see what he was saying during the years after the #GFC, when, despite all the QE in the world, the Fed couldn’t get it up – inflation, that is. Instead, I just did custom date restricted search on Google – January 2009 to December 2017 – asking the question “why can’t fed get inflation up to 2%”? Here are a couple results of interest:

Why Does the Fed Care about Inflation? [via the Cleveland Fed, 2012]

Excerpt:

” A number of central banks from all over the world have inflation objectives, and many of them also target an inflation rate of about 2 percent. Inflation rates around these levels are often associated with good economic performance: a higher inflation rate could prevent the public from making accurate longer-term economic and financial decisions and may entail a variety of costs as described above, while a lower rate might make it harder to prevent the economy from falling into deflation should economic conditions become weak.”

Yep, back then, on the heels of the financial crisis, the Fed was concerned about the economy sinking backward, a.k.a. disinflation/deflation.

—

Why central banks are not hitting their 2% inflation target [via The Guardian, 2017]

Excerpt:

“Because stronger demand means less slack in product and labour markets, the recent growth acceleration in the advanced economies would be expected to bring with it a pickup in inflation. Yet core inflation has fallen in the US this year and remains stubbornly low in Europe and Japan. This creates a dilemma for major central banks – beginning with the US Federal Reserve and the European Central Bank – attempting to phase out unconventional monetary policies: they have secured higher growth, but are still not hitting their target of a 2% annual inflation rate.

One possible explanation for the mysterious combination of stronger growth and low inflation is that, in addition to stronger aggregate demand, developed economies have been experiencing positive supply shocks.

Such shocks may come in many forms. Globalisation keeps cheap goods and services flowing from China and other emerging markets. Weaker unions and workers’ reduced bargaining power have flattened out the Phillips curve, with low structural unemployment producing little wage inflation. Oil and commodity prices are low or declining. And technological innovations, starting with a new internet revolution, are reducing the costs of goods and services.”

—

Wolf is right about the inequality made greater by soaking banks with trillions in reserves, but that’s just the top end. The bottom end is lowered bargaining power of labour and globalization shifting low cost production to China.

Now, when you introduce the pandemic, what happens? Well, you lose your cheap, Chinese supply chain for one. In addition, the cartel, despite an overall abundance of oil from all sources, decides to squeeze the world by keeping prices high, so you lose that aspect of the low-inflation equation. Next, production is down, because of lost workers or lockdowns, and maybe in some places, you have to pay more to workers who do show up. All inflationary to costs which will be passed on to the end consumers, but none of it has to do with the earlier QE morass.

So overall, I think people pointing to QE a.k.a. the Fed’s money printing as the ultimate reason for the inflation we are experiencing now have got it wrong. It’s as if they’ve been waiting for an opportunity since QE began to shout “Eureka!”, and the pandemic has finally delivered. However, central banks all over the globe were struggling before the pandemic to get inflation above 2%. The #MMT side of the house was not surprised, by the way, for one simple reason: most of the QE money never entered the real economy. It never got into the hands of the underpaid working stiffs, so there was little chance for demand driven inflation to happen. Instead, we got localized inflation in 1%-dominated markets like Silicon Valley real estate.

As I understand it, inflation can be many faceted: inflation can be in wages (which corporations don’t like) or inflation in asset prices (which corporations and banks love). Right now we are having another kind of inflation: of prices for food and other essentials. Some people profit from wage inflation; other people profit from asset inflation and some people suffer from food and essential goods inflation.

Excellent analysis! Thank you.

People talk about inflation like its some specific thing, but noone can quite define what it is. We try to quantify it through certain measures like CPI. However, what normal people experience are price changes, so I think it would be better to just talk about “price increases” rather than inflation. Thinking about it as just price increases also allows us to properly include medical expenses, asset prices, wages, etc. as well as just the prices of consumer goods that CPI measures. Price increases are good for the seller and bad for the buyer (ceteris paribus). Rising home prices are great for blue-collar folks that bought their homes 20-30 years ago or more, but bad for younger people looking to purchase their first home. Workers like when wages go up but employers hate it.

At risk of repeating myself too many times, it’s all political. There is not a neo-classical economic function that works independently of man-made laws, regulation, and corruption. If there was, it’s more likely to be the gold rule. That is, he who has the gold makes the rules.

The unnerving quality of an inflation is that no one knows anything for sure; how much his money is overvalued, how much of his prosperity is illusory, how much of his work is useless and would not even exist in conditions of stability. All standards are lost.

If there is any lesson to be learned from a study of inflations, it is that one never knows where he is in the midst of it, but he certainly is not where he appears to be.

Everyone loves an early inflation.

The effects at the beginning of an inflation are all good.

There is steepened money expansion, rising government spending, increased government budget deficits, booming stock markets, and spectacular general prosperity, all in the midst of temporarily stable prices.

Everyone benefits, and no one pays.

That is the early part of the cycle.

In the later inflation, on the other hand, the effects are all bad. The government may steadily increase the money inflation in order to stave off the later effects, but the later effects patiently wait. In the terminal inflation, there is faltering prosperity, tightness of money, falling stock markets, rising taxes, still larger government deficits, and still roaring money expansion, now accompanied by soaring prices and ineffectiveness of all traditional remedies.

Everyone pays and no one benefits.

That is the full cycle of every inflation.

As always, the inflation which comes later is blamed on every sort of extraneous event that happened to coincide in time with the later emergence of the hidden inflation. It is reminiscent of the difficulty primitive peoples are said to have perceiving the causal connection between last night’s ecstasy and next year’s childbirth.

Inflation is a policy choice because the government always has the theoretical ability to draw a line and say, “No farther!” But it is those “crises and catastrophes” that would ensue that lead everyone to believe that inflation is less bad than the alternative.

If there are no wage increases then you don’t have a cycle of inflation.

Increased volatile price fluctuations is not inflation.

Inflation, very simply put, is the natural consequence of the bidding up of wages and prices in an economy. Attempts to quantify a single broad statistic for inflation, as well-intentioned as they are, will always fall short, because of the vast differences in goods, markets and other exogenous shock inputs like climate change (which Yves pointed out in her preface).

“However, what normal people experience are price changes, so I think it would be better to just talk about “price increases” rather than inflation.”

This is price volatility. And yes, what the Fed is really concerned about beyond just the inflation target, is price stability. In other words, to your point, if you go to the grocery today and buy a dozen eggs for $1.00, you don’t want to go in week’s time and pay $1.50 for the same product. Here is the detailed CPI-U table [via Bureau Of Labor Statistics – BLS]. #YMMV depending on what you consume and how much.

“Price increases are good for the seller and bad for the buyer (ceteris paribus). Rising home prices are great for blue-collar folks that bought their homes 20-30 years ago or more, but bad for younger people looking to purchase their first home. Workers like when wages go up but employers hate it.”

Neither of those examples is entirely elastic – i.e. they don’t adhere to assumptions of supply and demand, because of things like monopoly, oligopoly and collusion. One subtext of asset inflation was Wall Street’s entrance in the home rental market – essentially buying up distressed properties after the #GFC and keeping rental prices high. There is overall a housing glut in the US, but the lack of affordable public housing in the US essentially perpetuates inflation in highly prized markets. In 2015, Apple, Google, Intel & Adobe agreed to pay out $415M to settle a lawsuit which accused them of colluding to keep salaries at a certain level and not to poach each other. The problem is political to the degree that much of this is a consequence of corporate overreach into, and capture of US economic policy.

The problem is that “inflation” has been acute in categories that matter: energy, food, cars.

Energy cost rises have absolutely nothing to do with the Fed. It’s demand being whipsawed by Covid and producers not being able to respond quickly enough and retailers gouging to a degree.

Food is considerably due to weather-related poor harvests and Covid impact on supply chains

Cars are due to chip shortages and again a Covid whipsaw.

These are all totally out of the Fed’s purview and despite having considerable importance to inflation measures (fuel cost rises propagate through all other cost), they have squat to do with the monetary stories about inflation.

These are all totally out of the Fed’s purview and despite having considerable importance to inflation measures (fuel cost rises propagate through all other cost), they have squat to do with the monetary stories about inflation.

#Concur … been falling on deaf ears of most with whom I engage outside of this family blog.

I got an 18% rent increase starting January here in SoCal. I have been looking for a cheaper accommodation but places that were going for max $1800 a year ago are at minimum $2500 and there is very little product out there. So no choice but to pay the higher price.

If the asset whose price is inflated is real estate, obviously the owners must try to extract inflated rents from it — money has to go somewhere and do something. To some extent rich people’s money and poor people’s money are different, but real estate is a crossover point where rich people’s money, which is largely fictional, has been leaking into the realm of poor people’s money, which is related to labor and material goods, driving prices (including rents, etc., upward. That pulls up other prices in the poor people’s economy. If it were not for rent stabilization (I live in New York) my rent would probably be at least doubled. And I guess I’d be living in my car, or a tent in the woods, if I could find any woods.

Price of oil is over determined. But it does have a correlation against the strength of the dollar, which the Fed is a definite factor in.

That said, that correlation seems to have broken the beginning of this year. https://fred.stlouisfed.org/graph/?g=Frpl

Central banks do have an impact on the categories of energy, food, cars. First, central banks’ (and governments’) actions have increased business activity / consumption and thus gave increased the demand for those products. If they hadn’t, then due to lower demand, there would not be (such) an increase in prices. Second, central banks’ actions impact the pass-through effect – during normal times an increase of an item’s price means less money is available for other items and that should limit price increases, in current situation with increasing money supply (and cheap loan money) there are less such restraints, which allows the prices more freely to rise.

This is bad faith argumentation, as well as inaccurate.

I explained why the Fed has absolutely nothing to do with the current inflation in energy, food and cars.

You attempt to shift the ground of the argument by making claims about what is generally true, which even if accurate is irrelevant to now.

Monetary experiments in the Reagan/Thatcher era established incontrovertibly that money supply changes do not influence ANY macroeconomic variable.

And Keynes explained why putting money on sale does not increase economic activity. Businessmen (save in categories where the cost of money is their biggest cost like financial services) do not run out and expand because interest rates dropped. They expand because they see opportunity. Look at how there was secular stagnation for years after the crisis even with super cheap money and QE.

You are basically trying to sell the loanable funds fallacy, which was decisively debunked decades ago, but neoclassical economists keep dragging that corpse around.

I seem to have a different opinion whether Fed’s (and other central banks’) actions can impact / have impacted the current price increases in energy, food and cars. Fed’s actions have strengthened the economy, increased the expectations that everything will improve going forward making markets bubblicious and creating a FOMO feeling. Bidding wars take place in such environments. While the Fed has not caused the limitations in supply, then it has created the environment, where everybody is looking to find the next bubble. And if there are news about supply issues, then there is a wave of buying interest driving the prices upwards (this applies to energy and food, which are traded on the markets). In weaker markets / economy I think this would not happen (at least not that much). The other side of this is consumers’ ability / willingness to pay for the higher price. If Fed had not intervened in the markets that much, then I think people’s ability / willingness to pay would be lower and thus price increases would be lower. So in aggregate, I think the same news (supply limitations) would have a different size of impact on the prices depending on the strength of the economy / markets (which are affected by Fed).

I wish there were parallel universes so we could test it out if Fed’s action do have an impact or not.

No, your entire premise is incorrect. What stimulates the economy is net spending, as in Federal deficits. Putting money on sale via cheap interest rates do not strengthen the economy. Remember the near decade of secular stagnation after the crisis with the Fed having super accommodative monetary policy and QE? Or Japan, which has had massive monetary stimulus yet has been stuck in borderline deflation?

What stimulated the economy was the massive Covid spending programs. That was an Administration/Congress drill, not the Fed.

Agreed with both Chris and Yves on the major points. My biggest pet peeve when having this discussion with people are the definitions. The word “inflation” has a purely negative context and most people have never heard of the term “deflation” which is usually a bigger problem than inflation.

Talking about “fluctuating prices” either up or down gets rid of the negative connotation and allows people to (hopefully) see both sides. Also, the common wisdom is that inflation is “always a monetary phenomenon” meaning that its always caused by “printing money”. Talking about price increases instead helps bypass that automatic system 1 response and encourages more critical thinking as to what is causing prices to change.

As Yves points out, most price increases in consumer goods are driven by the supply side (price of oil, logistics issues) rather than the demand side. However asset price inflation (housing, crypto currency, startups) has mostly been driven by cheap and easy money available to those who already have it. But in this society we typically look at rising house and stock prices as good things. I don’t see Wall Street complaining about rising stock price.

Don’t high RE prices affect us muppets trying to survive in a shitty suburb of LA?

To me it also looks like there has been a noticeable increase in blatant rent seeking behaviour to go with a side of inflation. Thanks to supply shortages, it’s hard to find reasonably – ie, near MSRP – priced computer parts.

The more obvious ones are car dealers though. I currently have the misfortune to look for a new car for my wife. Yes, in most cases it’s a discretionary purchase, although in this case I have most of her current car’s engine apart right now and it’s looking a little less than discretionary. I’m seeing “market value adjustments” that in some cases are over 50% for some of the more desirable vehicles. Sometimes I’m surprised when they only add 30%. Used vehicles aren’t much better, there are similar adjustments to vehicles that are 1-2 years old.

Given how indebted the average American consumer is and how regularly a lot of them change vehicles, and vehicles being the second biggest purchase most people make, I suspect this is going to get really ugly pretty soon.

I don’t expect this to show up in the inflation measurements though, either.

> . . . although in this case I have most of her current car’s engine apart right now and it’s looking a little less than discretionary.

Timing chain skipped a few teeth? If so forget about replacing that engine, because the next one will have the same point of failure.

Pardon my advice, and I know she won’t like it, but to avoid the whole insanity of current late model new and used car prices get something about fifteen to twenty years old with some life left in it for a few thousand bucks and use it till the price fever abates. I prefer motors with timing belts rather than chains. Some maintenance required but they last a lot longer than timing chain motors, is my experience.

The buck you don’t have to spend is way moar valuable than the one you do. As good an inflation fighting tactic as any.

Mostly general wear and tear, although I’m also finding some suggestions that I’m not overly impressed with the workmanship of the people I paid to maintain it. Oh well.

Right now we’re definitely looking at older vehicles for the reasons you mention if I can’t manage to repair this one again. Being in the Rust Belt limits how old one can go before it becomes something between a liability and a Flintstone Mobile, though.

The top 1% are not causing consumer inflation because they don’t spend as much as 10% of their accumulated currency and assets into the consumer market.

A billionaire buys another Rolls or corporate jet or mansion, it doesn’t inflate my expenses. Why should I care. Because I can’t afford a Tesla? I could but I hate driving. Why should I care if you have 2 Teslas?

You are quite correct. Kajillionaire spending is not causing inflation, they spend a miniscule portion of their hoarded treasure.

The command/control economy of the monopolist socialists at the top of this glorious ponzi scheme is causing inflation.

Profit Uber Alles!

A person I know, working in a dodgy industry, has made out like a bandit in Bitcoin and is turning into a real estate tycoon. Three years ago he had a dodgy job, and a tiny apartment.

A couple I know, who have good government middle-management jobs, cannot buy a small house in the area where they own an apartment. In late 2019, a very average house on an average block was about $850 K. The same house now would be $1.7 mil.

As a non-economist I can see that the real value of money has plummeted. A dollar now buys half of what it bought in housing in 2019.

If you take the cost base as housing, then wage earners are now working for 50% of what they were 2 years ago. This is hidden by the CPI, which is designed to hide the true cost of living. Wages in my area appear to be flatlining according to the CPI, but in fact their value has plummeted if you look at the full list of items people need to live (food, transport, furnishings and electronic, aannnd…. housing).

Just looking back at “inflation”. It always sucked wealth away from the middle class. I’d submit it is the business model of the US: To go to war and run up enormous debt (WW1, WW2, Korea, Vietnam, the first Middle East; the Second Middle East). Every time we always resolved the debt at the expense of the middle class. After WW1, we had the Roaring Twenties – it was Calvin Coolidge who overstimulated the economy to pay for the war. Then the hangover (the Great Depression). Then in order to get out of the depression and to break up the British Empire in the name of Free Trade we did WW2. Which devastated the very economies we were counting on to create our free trade bonanza (the Europeans, especially France, England and Germany). So in order to get back some of our war-time “investment” and jump start a new global free trade economy we spent zillions to rehabilitate Europe and push our way into trading with their old colonial interests; we had our big snit over the Chinese Revolution of 1949 and did our best to secure half of Korea and all of Taiwan; and then of course our almost 30 years of intervention and war in Vietnam… followed by stagflation that, surprise, surprise, took more war to keep the business model going. This time in the Middle East – wars 1 and 2. And now after another 20 years of massive military expenses we are once again faced with inflation. The war profiteers are not losing money. Nor are the big corporations. Only the middle class. Inflation really is the business plan. It’s pretty clear to me that the one potentially best cure for inflation would be to end war. Give the military a new mandate to green the planet and protect it. Establish control over neoliberal financialization and privatization. And do direct sovereign spending for our societal entitlements – which should be entitlements in the legal sense – they should be law. aka M4A; a jobs guarantee and etc. Inflation is just a word we use to fudge what is really happening. We can probably only get rid of “inflation” by ending our national military adventures.

In the introduction to this posting, Yves Smith notes that Fed crisis-response policy has the side effect of exacerbating the distribution of wealth:

I concur. Wolf Richter, however, goes much farther out on a rhetorical limb, arguing that exacerbation of the distribution of wealth is the objective of Fed policy. He writes:

This is all very hyperbolic and tendentious. In the first place, there’s nothing “official” about the term “wealth effect.” It’s a macroeconomic concept that’s been around for a long time. It was an old concept even when I was in graduate school forty years ago. In an earlier Wolf Street posting Richter quotes the National Bureau of Economic Research:

Is the wealth effect theoretically valid (within the scope of orthodox economics)? Has its empirical validity in predicting consumption and investment spending been historically demonstrated? I’ll leave those questions to the specialists.

Is the wealth effect one factor that the Fed takes into consideration in making predictions about the macroeconomy? Yes, as references to past statements by Bernanke and Yellin in the other Wolf Street posting confirm.

But is the wealth effect the dominant factor in Fed decision-making? Almost certainly not. Even a casual reading of those statements from Fed officials makes clear that they view asset prices in the context of the dual mandate.

I very much appreciate the chart which Richter generates from his Wealth Effect Monitor. It’s one of the most striking ways of illustrating the increasingly unequal distribution of wealth in the U.S. in recent decades. I’m all for confiscating the wealth of the top one percent. Let’s discuss concrete ways of doing that.

However, even granting that the Federal Reserve is part of the executive committee of the ruling class, I don’t think it’s accurate to suggest that exacerbating that inequality is the explicit purpose and main objective of Fed policy. That’s way too simplistic a view of how the capitalist state works.

Fed Chairman Ben Bernanke explaining the benefits of rising asset prices to the real economy during a press conference in September 2013.

“…The tools we have involve affecting financial asset prices and those are the tools of monetary policy. There are a number of different channels – mortgage rates, I mentioned corporate bond rates, but also prices of various assets, like for example the prices of homes. To the extent that home prices begin to rise, consumers will feel wealthier, they’ll feel more disposed to spend. If house prices are rising people may be more willing to buy homes because they think that they will make a better return on that purchase. So house prices is one vehicle.

Stock prices, many people own stocks directly or indirectly. The issue here is whether or not improving asset prices generally will make people more willing to spend. One of the main concerns that firms have is there is not enough demand, there’s not enough people coming and demanding their products. If people feel that their financial situation is better because their 401(k) looks better for whatever reason, or their house is worth more, they are more willing to go out and provide the demand…”

This is the last hurrah, for the really rich dynasties.

They know the demographics and deflation will persist for another century. So, let her rip!

To prevent this from recurring, we need building societies and smaller corporations with full transparency. All large transactions checked for laundering. Capitalism is about families, not corporations.

capitalism is about capitalists.

i would hope and pray, for your family’s sake and yours, that you don’t run your family like a business even if you’re forced to run your family finances like one.

imagine charging everyone rent and locking out the child who brought home bad grades one term. and judging all social relations by how much “value” is provided.

i think they have a word for that and there’s a more polite and less polite version of that word, but i won’t be using either of them here.

Nothing will change so long as Americans believe these five lies:

1. The federal “debt” is too high (It isn’t even “debt,” and it isn’t too high.)

2. The federal government can’t afford Medicare for all, Social Security for All, housing for all, college for all, or food for all. (The federal government can afford anything.)

3. Federal spending causes inflation. (It doesn’t. Inflation is caused by shortages of key goods and services, i.e. food, energy, computer chips, labor, shipping. In fact, federal spending cures inflation when it facilitates obtaining the scarce items)

4. If the government provides the necessities, the poor won’t work. (The “starve ’em ’til they slave” system works only for the rich. People always will work to improve their situation, whatever that situation may be.)

5. Federal taxes fund federal spending, (Unlike state & local government taxes, federal taxes fund nothing. In fact, federal tax dollars are destroyed upon receipt by the Treasury. That is why no one can say how much money the Treasury has. It has infinite dollars.)

Does it matter what Americans believe? I suppose a certain amount of effort is spent on propaganda, but it’s pretty low-quality propaganda and those who spend it can probably get it cheap.

>>>Does it matter what Americans believe? I suppose a certain amount of effort is spent on propaganda, but it’s pretty low-quality propaganda and those who spend it can probably get it cheap.

Oh, my. One of my berserk buttons. Pardon me, I need to bang my head on my keyboard again.

With respect, I have a question. And I am not trying to troll, insult, or mock.

Why is it that a hundred and fifty years ago Americans were more socially conservative, but more diverse, as well as more economically liberal, even leftist than today despite there being a more even and broad range of views then there is today?

Accounting, of course, for there being an extremely different society then, which makes straight comparisons harder. For instance, the major parties of today are nothing like the parties of just 60 years ago.

It is not accidental that Americans, as well as other like the British act unwisely especially when given a choice between whatever is the latest version of Charybdis and Scylla that the elites have created for our “choosing.” Untold billions of dollars have been spent over more than a century in the United States as well as very long term planning along with the creating, funding, and manipulation of private police, think-tanks, advertisers, politicians, political parties, and education especially higher education; it has been a thing since the American Grangers, the Socialists, the Progressives, and the first powerful Union Movement in the United States.

There is all the flying fecal matter, say better lies, put out by our “new” media. Followed by the hollowing out of education.

There is COINTELPRO, which “officially” was shut down in 1971. I give that the same credence I give to Jeff Epstein having committing suicide and Lee Harvey Oswald acting all by his lonesome in the Kennedy Assassination.

Before that, McCarthyism, the Red Scare, and HUAC (House Un-American Activities Committee) with driving out of society anyone deemed a communist, followed by socialists, anyone who was a leftist, and finally anyone too liberal. All based on their very elastic criteria and not anyone else’s.

Before that, the Mont Pelerin Society, which was directly used to created the ideology of the Chicago Boys and extremely Right-wing Libertarianism or maybe better said modern Neoliberalism, was one of their creations, in the 1940s.

Before that, the original thinkers of neoliberalism started their project right after the First World War. Around the same time, there was the Palmer Raids, which were at least loosely connected to the Creel Committee.

Finally, before them, there were the Robber Barons, who often controlled the newspapers, and their private armies with the occasional assistance of the American army, plus their control of the various local governments to corrupt the legal system, to demonize and destroy the union movement as well as the communists and socialists, which they tried for decades.

So, let’s say since at least the 1890s, probably the 1870s, to destroy the American Left as well as to corrupt any honest conservative organizations and social institutions, which seemed more common the further you go back in history. When everything from the local church to bowling league all start sounding and acting the same, there is probably some money behind it. Much like with our modern nonprofits or NGOs.

Our ignorance has been deliberately manufactured and imposed on us. I am an American, with decades of education and decades afterwards of reading with an emphasis on history especially American. Would you like to know when I really found out about the Tulsa Massacre of 1921? With its possible thousand plus casualties, probably hundreds dead, and the destruction of the entire Black financial and business district in a fairly large American city? It is an important part of history. Around a decade ago. It only took over thirty years as an adult.

Being a perpetual browser of books and documentaries, I think I saw some throwaway lines in a few places, usually on page hundred something: bla bla hah, bla, Tulsa something, bla, bla bla bla, wa hah wa. Never any expansion or elucidation. I think I just assumed it was just the same as all the other race riots, massacres, burnings, and lynchings only not as bad as some during the Red Summer. Same old, same old horror as all the other decades of American history. And I just lumped in with all the other evils of the Nadir. Of course, Red Summer is often unknown being generally not taught in schools. I just had to find out on my own.

Of course, the town records and the newspaper editions on the massacre and burning are strangely missing. They also don’t where the bodies are, despite witnesses saying there is at least one mass grave. Evidence showing a few hundred people died, but hardly anybodies. That takes effort.

Just like how the dead of the San Francisco Fire and Earthquake changed from a few hundred to several thousand. I remember thinking even as a child reading my textbook, which said only a few hundred died, and thinking that is rather light. I have walked over much of the destroyed area and it is fairly large. What was the city then was even more densely populated than now. Yet, the official rebuilding committee successfully got accepted official casualty numbers some one tenth of the true count, which they knew at the time. It was for business. Fortunately for them, much of the city had become a crematorium. They did not want businesses to leave or not come to the city. So they lied, and eighty years later, I am puzzle about the official count of dead and injured I am reading in my textbook.

Most people are not stupid. They are human, which means they learn from society what is real, true, and of value. Their ignorance is manufactured and being ignorant can make you stupid. Change the institutions especially those of learning and of religion and eventually you will change society much closer into what you want it to be; this is what the people in power know and have known for generations in the United States. Sometimes it is easy to get people to buy those cancer stick. Other times it takes constant money and effort to destroy an entire political wing of a society and replace it with an Orwellian system of lies, distortions, and a money worshiping ideology. To worship that boot on ones face.

Look at graph 1.

It’s not just the underclass and working class that is getting shafted — given that the growth in real wealth is much lower than financial wealth, and thus the financial wealth is purely political power, it’s the 99%, including the “officer” class.

By officer class, I mean the PMC narrowly defined, plus everyone else that is basically the same thing: military officers, pastors + priests, civil servants of all types, engineers, plus the managers, PhDs, MDs, JDs, plus our friendly neighborhood journalists and blogger-hosts (who’s Hudson other than a card-carrying member of the officer class?), and so on — the folks who run society for the 1%. In fact, I bet if we looked at the curve logorithmically, we’d see that the relative rate of growth is pretty close across the 99%.

All change has been because enough of the officer class buys in to pivot the system (usually involving the other 90% making it clear to them) — and the failure of changes have been because that’s not taken enough into account. And it’s tough, because as long as someone is hungrier than you, less powerful, that’s usually enough, and thus the ability of the 1% to leverage us against each other.

In the same way that the various disciplining measures (race, sex, etc), have been the pivot that the 1% have used to keep everyone else in line and disciplining each other (yes, you’re going to have to swallow wokeness if you actually want the discipline to end — everyone needs to positively stop buying in to the discipline and not merely stop believing personally, like fine Pauline Christians who are equal only in church).

And of course, what we’ve seen happen to the working class aristocracy (the middle-class, American style), will happen to that 9% as well, since it’s really a question of relative power. The consequences will be obvious — they already are when ball-headed oligarchs send themselves to space rather than

putting technocrats in charge who could do something useful with space.

That graph is critical if there’s a hope of getting off the crazy train before it hits the wall. Graeber (another officer) was right — it’s the 99% trying to save themselves, if they can clear the delusions from their eyes before Thwaites comes tumbling down on all of us.

>>>That graph is critical if there’s a hope of getting off the crazy train before it hits the wall.

That means pushing aside fear and forcing themselves to think, plan, and then act instead of emote, babble, and react, but so far the Elites’ using fear induced stupidity for profit and control is doing good.