By Winta Beyene, PhD student in Finance, University of Zurich and Swiss Finance Institute, Manthos Delis

Professor of Financial Economics, Montpellier Business School, Kathrin de Greiff, PhD candidate in Banking and Finance, University of Zurich and Swiss Finance Institute, Steven Ongena, Professor in Banking, University of Zurich, the Swiss Finance Institute, KU Leuven and NTNU; Research Fellow, CEPR. Originally published at VoxEU.

One of the concerns in the debate on climate change is whether financial flows contribute to the reduction of emissions. This column looks at the role bond market-based and bank-based debt plays in the allocation of resources to fossil fuel in the context of the risk of stranded assets. The authors show that banks continue to provide financing to fossil fuel firms that the bond market would not finance as long as they do not price the risk of stranded assets. In this setting, stranded assets risks may have shifted to large banks.

In the ongoing debate on the need for a transition towards a decarbonised economy and the actions that should be undertaken by central banks, financial authorities, and governments, the role of bank and bond market financing is of paramount importance. Financiers could play an important role in terms of channelling funds away from fossil fuels and polluting types of activities and investing in greener activities (Caselli et al. 2021). However, fossil fuels still dominate energy investments, and particularly, banks still show unwavering interest in fossil fuel projects (e.g. RAN 2020, Pinchot and Christianson 2019, Delis et al. 2018). A major concern in the transition to low-carbon energy provision, therefore, is to steer investments away from fossil fuels.

In light of this, there is a real risk that large investments in fossil fuel companies will decrease in value and result in bad loans when climate policies finally tighten (Löyttyniemi 2021). Stranded asset risk – the risk related to the re-evaluation of carbon-intensive assets as a result of this transition away from a carbon economy – needs to be reflected in the fossil fuel firms’ cost of debt to compensate for the increased risk of default.

In a recent paper (Beyene et al. 2021), we examine the potentially different roles of market-based versus bank-based credit in the allocation of resources to fossil fuels. We do so by investigating fossil fuel firms’ cost of corporate bond financing versus syndicated bank loan financing, and the consequent composition of these two debt types along these fossil fuel firms’ risk of seeing part of their assets stranded. Following the observation that bank financing on average has not decreased with stricter climate policies, we investigate the question of whether stranded assets risk is increasingly concentrated in a few large exposures for some large banks?

Our dataset consists of corporate bonds and syndicated bank loans issued from 2007 to 2017 by firms that have had access to both markets during that period. Fossil fuel firms’ risk of stranded assets is proxied with the variable ‘Climate Policy Exposure’, which is constructed as the product of a country’s climate policy stringency and the relative amount of reserves a firm has in this country. The relative reserves of firms we hand-collect from firms balance sheets, and to measure a country’s climate policy stringency we use mainly the Climate Change Policy Index (CCPI) by Germanwatch (Burck et al. 2016). Large energy companies are going to have reserves in different countries, and these reserves are going to be exposed to differential climate policy stringency, which is what Climate Policy Exposure captures. While the finance literature on the topic of carbon emissions-related risks has largely been focused on firm-level emissions, focusing on fossil fuel firms’ holdings of fossil fuel reserves, and the risk stemming from this, is closer to the root of the problem. Much of the global stock of carbon emissions can be traced to a small set of largely fossil fuel companies (Ilhan et al. 2020).

The analysis is carried out in four parts. First, we look at the pricing of stranded assets risk of fossil fuel firms by the corporate bond market and by banks. We find that newly issued corporate bonds in the fossil fuel industry have higher yields than syndicated bank loans, and with increasing climate policy exposure, bond markets earn a higher premium relative to the syndicated bank loan-implied credit spread. Second, we show that fossil fuel firms shift from issuing bonds to obtaining bank loans as their stranded asset risk exposure increases. Third, we show that bond-to-bank substitution is unlikely to arise from differences between banks that underwrite corporate bonds and banks that underwrite syndicated bank loans, and ultimately from a resulting difference in the quality of borrower. For this, we collect information on lead manager banks, combine the loan and bond subsamples, and construct a dataset in which the same banks are observed to engage in corporate bonds and in syndicated bank loans as lead manager in order to control for the underwriter. Fourth, we look at whether bank characteristics related to bank size may influence banks’ reaction to stranded asset risk impulses in terms of lending and risk-taking. We find that across all syndicated loans, large banks acting as lead managers charge a lower all-in spread drawn than small banks do, and consequently there is a migration towards the very largest lead manager banks along fossil fuel firms’ Climate Policy Exposure.

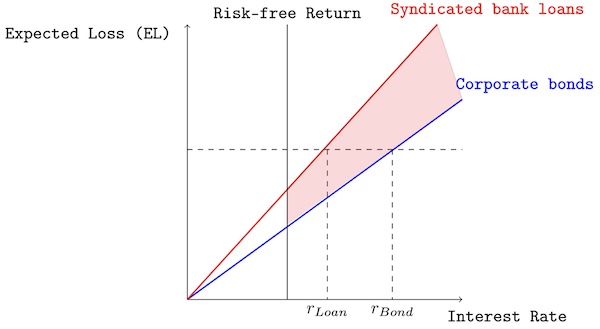

Figure 1 Credit allocation towards fossil fuel

Figure 1 is an illustration of some parameters of fossil fuel debt and summarises our findings. We assume that an increase in Climate Policy Exposure implies an increase in the expected loss. Hence, to cover the expected loss on a debt, the lender needs to apply a higher interest rate. We conclude from our findings, however, that for at least large banks, the expected gains from an increased investment today may in some ways still compensate for the expected loss due to the risk of stranded assets. Therefore, while the corporate bond market requires rBond, which accounts for firms’ risk of stranded assets to some extent, banks require only rLoan. Consequently, this differential in the pricing of the risk of stranded assets implies that banks continue to finance the fossil fuel projects that the corporate bond market would not, as visualised by the red area. The same figure can be applied to illustrate the migration of stranded asset risk towards big banks within the banking sector.

The level of fossil fuel financing from the world’s largest banks remained in 2020 higher than in 2016, the year immediately following the adoption of the Paris Agreement (RAN 2020). Our findings add to the limited literature on the impact of stranded asset risk on firms’ (bank) funding cost and provide empirical evidence for this narrative that there is a migration of fossil fuel stranded assets risk away from markets and towards (large) banks. On the subject of stranded assets risk and debt, our paper provides the following new insights:

- Market discipline, on its own, seems to be more effective in driving bondholders, rather than banks, to price the negative externalities associated with the risk of stranded assets.

- The ability of large banks to hold large exposures to firms with stranded asset risks may prevent the steering of investments away from fossil fuels.

- A substitution mechanism between bond and bank financing, or even within the banking industry, could potentially mitigate the capital constraints on fossil fuel firms imposed by the bond market or some more ‘environmentally friendly’ banks.

All very good if you accept that the transition to a non-fossil fuel-based economy will actually happen in an orderly and planned way. It seems to me, however, that the reality of our energy-fueled economy is that current fossil energy use cannot be sustainably replaced – the energy content of the billions of barrels of oil we consume, the result of millions of years of carbon sequestration which we are releasing into the atmosphere in the blink of an eye, cannot be replaced by windmills and hydro power. There must be massive reductions in energy usage and that necessarily entails massive changes in how we live as humans.

But the transition will be resisted at every turn – the gilets jaunes in France, for example, as serious as their manifestations were, are just a small indicator of the chaos to come when energy prices necessarily rise to the point that private automobiles revert to being available to the rich only. And replacing gas-powered cars with electric is a physical impossibility without massive increases to electrical grid capacities. Perhaps a nuclear power plant per 250k population might do it but the investment required is stratospheric not to mention the required political will not in evidence.

My conclusion? The world oil oligopoly will continue its activities for as long as they can – the transition will largely be unplanned and chaotic. Add to this the effects of climate change and the human migrations which are already resulting and will only grow; chaos and conflict are inevitable.

So yes there will be stranded bank assets – but that will be just another side effect of the chaos to come. The global South is SOL and the global north better prepare to defend the barricades pdq.

divadad – I understand your opinion, however, you are arriving at it via linear thinking. Paradym changes, like fossil fuel to renewables, are one of the examples where the changes move exponentially with a very steep curve that usually surprises most analysts – for a reference check out http://www.rethinkX.com. The report called Rethinking Humanity – very well researched by VERY credible people with a 10-year track record of demonstrating this change and correctly predicting it and how it has been happening over the past 10 years and is not ready to accelerate. The biggest problem is that we have started at least 2 decades late, given what the science told us from the #1 Climate lab in the world at that time – the EXXON lab.

“By year-end 2021, ExxonMobil anticipates reduced flaring volumes across its Permian Basin operations by more than 75% compared to 2019. The company plans to eliminate all routine flaring in the Permian by year-end 2022, in support of the World Bank’s Zero Routine Flaring initiative. The company is also securing alternative natural gas delivery points across the basin to minimize non-routine flaring.”

With higher oil prices, oil majors have the cash flow to meet the renewable challenge head on and blunt some political opposition.

Board changes at Exxon seem to be having a positive effect. European majors are talking green energy up also.

If you don’t see the mark in the crowd…

I didn’t quite understand the various levels of financial underwriting in this article, but the logic of looking at the market this way was almost reassuring. Not that it won’t all hit the fan fairly soon, but that there is serious planning going on. I’m always most impressed by what these studies leave unsaid. The underlying point that I read is that large syndicated banks are now financing the oil industry at reasonable rates. This means that oil is recognized as a critical resource; nobody wants to impoverish the industry so it goes out of business and, most importantly, if big financiers are on board with this so are their respective governments. Ergo the ultimate underwriter for energy to see us through our transition is… us. Sovereign nations and groups of sovereign nations together. That sounds pretty good. It is as close to admitting that oil/gas will be “nationalized” and rationed and is starting to be structured so it can easily be nationalized as I have seen. Imagine the worst chaos of having to buy out individual private bondholders. (Think 2008.) One question that remains is how will shareholders be handled? Maybe it won’t come to that. Since even utilities have shareholders.