Yves here. Readers have likely worked out that your humble blogger is not all that excited about the perturbations of the equity market, particularly since even after the Fed (by accident or design) has let some air out of the bubble, stocks are still way way overvalued by historical standards. Which does not bar them from becoming even more overvalued!

In other words, wake me when NFTs crash. That would be a sign of real blood on the streets.

But the press is a bit worked up about the pain in the tech sector, hence the update.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

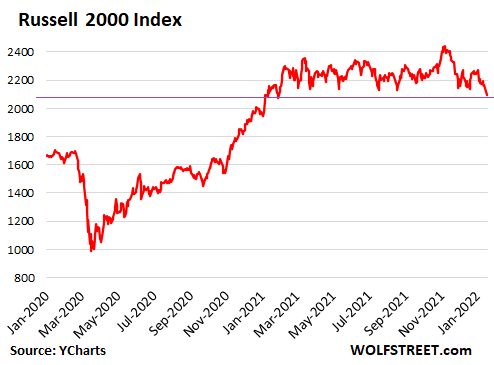

The Russell 2000 Index, which tracks 2,000 small-cap stocks, dropped 3.1% on Tuesday, to 2,096, down 6.6% year-to-date, down 1.3% from where it had been a year ago, and back where it had been on January 7, 2021. The index has whittled down its gain from its pre-pandemic peak of August 31, 2018, to 20.5%.

But that’s on the mild side of the spectrum (stock data via YCharts):

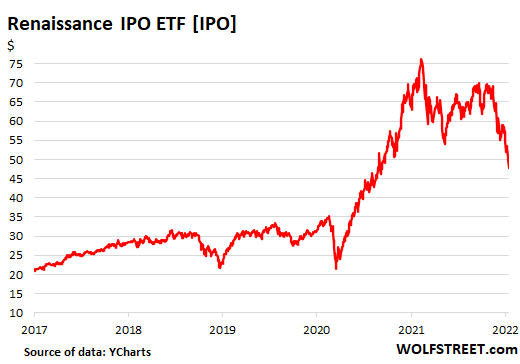

This is another aspect of how the stock market has been falling apart beneath the surface, in line with the wholesale collapse of IPO stocks, SPACs, and trackers of the most-hyped stocks, such as the ARK Innovation ETF.

The Renaissance IPO index [IPO], which tracks stocks that went public over the past couple of years, after a blistering spike that started in March 2020 and ended in February 12, 2021, has now plunged by 37.7% from that high, to the lowest level since September 11, 2020, with lots of air remaining below it (stock data via YCharts):

The top components Renaissance IPO index and their collapse in percent from their highs:

- Moderna [MRNA]: -62%

- Snowflake [SNOW]: -29%

- Uber [UBER]: -40%

- Cloudflare [NET]: -57%

- Zoom Video [ZM]: -73%

- CrowdStrike [CRWD]: -42%

- Datadog [DDOG]: -34%

- Coinbase [COIN]: -48%

- Palantir [PLTR]: -66%

- BioNTech [BNTX]: -63%

Among the notable IPO stocks beyond the top 10 of the Renaissance IPO Index, with the collapse in percent from their highs:

- Airbnb [ABNB]: -28%

- Peloton [PTON]: -82%

- Carvana [CVNA]: -57%

- Chewy [CHWY]: -64%

- Squarespace [SQSP]: -56%

- DoorDash [DASH]: -50%

- DraftKings [DKNG]: -70%

- Unity Software [U]: -43%

And some notable housing-related companies, and the collapse in percent from their highs:

- Zillow [ZG]: -75%

- Redfin [RDFN]: -68%

- Compass [COMP]: -63%

- Rocket Cos. [RKT]: -70%

- Lemonade [LMND]: -81%

And our space SPAC:

- Virgin Galactic [SPCE]: -85%

Our glorious EV SPACs have gotten wiped out wholesale. Here are some of the most prominent ones:

- Lordstown Motors [RIDE]: -90%

- Nikola [NKLA]: -90%

- Lucid [LCID]: -40%

- Rivian [RIVN]: -59%

- Faraday Future Intelligent Electric [FFIE]: -75%

- Workhorse [WKHS]: -91%

Even the online dating SPAC when online dating is hot:

- Bumble [BMBL]: -63%

Fake-meat producer Beyond Meat, which IPOed in April 2019, today landed below its first-day close:

- Beyond Meat [BYND]: -67%

Some of these winners are tracked by the ARK Innovation ETF [ARKK], which attempts to track “disruptive innovation,” which it defines as a “technologically enabled new product or service that potentially changes the way the world works” or at least it changed the way people’s money got disappeared:

- Ark Innovation ETF [ARKK]: -52%

Shades of the year 2000 in tech. Remember Global Crossing, Worldcom, AOL? Me neither. So much froth in valuation now as then, but then in 2000 there were viable investment alternatives. Hell, cash paid 4+%.

Yup. For some strange reason, I am reminded of the Q1 2000.

Wolf saying that the stock market is “falling apart under the surface” is too doomer for me. This is just classic winners rotating. Financial stocks are likely make a comeback with rising rates and energy/commodities with inflation going.

Not a big deal that freaking draftkings, the online gambling site, is falling.

Point taken, but the Russell 2000 is a much broader index, indicating smaller companies, — those that may not have the amount of pricing power of the big guys, have probably peaked and may be headed for a long downturn.

Big turning points are always hard to spot, and they take a while to unfold and only become clear in hindsight. Plus, in bull markets, there’s always lots of minor reversals before breaking out to new highs.

I take Wolf’s point that there’s the potential for this to be the start of a bigger downturn, but it’s just not clear.

Wolf has been calling for economic catastrophe daily for years, though. I like reading his stuff but his “Housing Bubble 2” header has been on his site for a decade. It would take another 50% dive for the Russel 2000 to get back to 2020 levels, which just isn’t much of a crash if you weren’t Robin Hooding your way into buying AMC or whatever.

Only time will tell, but I’m also wary of calls about the sky falling. This long overdue correction in QQQ related stuff certainly isn’t making me change strategies.

2000 is a lot of companies.

Normall, don’t 40% of the Russel 2000 companies have zero or negative earnings?

There are many reports of distress among long short hedge funds. If some commentators are to be believed the herd is getting culled.

Speaking of 2001’ish characteristics, I anecdotally heard from a coworker that she occasionally gambles on these sites, but only when they offer a promotion that pretty much ensures she won’t lose any money either way.

Interesting. I’d be curious to see similar charts for crypto and NFTs and also an indicator of how much money is in those things compared to say the Russell 2000

I think cryptocurrency in broad terms had a sad face since Q3 of last year. Not that I’m troubled about any of it, whether rising or falling.

Bitcoin this am is quoted about 41,900 to 42,000. Can’t recall where the price maxed at in 2021

Bitcoin was at $69k a few months ago.

I think events in Kazakhstan greatly influenced the price as of late.

Mayor Adams is going to see his paycheck keep dropping every month from here on out, hopefully.

I would be surprised if that is how his arrangement works. I figure his pay is in $, converted to bitcoin each payday. He can then sell it the next day, or even the same day, so price risk is minimal, unless he wants it, in which case bully for him. Happy to stand corrected if anyone knows the actual terms, but to me it looks like the whole pay in bitcoin thing is pure unadulterated bs optics, like so many other things today.

Clearly this is an emergency situation. The Fed better hurry up and resume the Quantitative Easing it hasn’t ended yet. 3-5 rate hikes in 2022? Uh hah that’ll happen. Yesterday’s emergency measures are today’s Standard Operating Procedures. The rich must be coddled and so they will be. After all averaged out inflation is under 2%.

There’s even talk that after the rate hikes and the end of tapering they think they can actually run down the balance sheet! I can’t remember the last time I heard anything more fantastical than that!

I thought NFTs we’re all about money laundering because you can effectively buy something from yourself. No bottom of the market there.

The Fed is tightening monetary policy via 3, possibly 4 different methods:

1. tapering Q.E. which means they will reduce their monthly bond purchases

2. reducing their balance sheet which means selling off their inventory of bonds

3. raising short term interest rates

4. possibly shortening the time between rates hikes

5. all of this in front of a slowing economy with DC fiscal reductions

There is no way to fight CPI inflation that will not also impact financial asset inflation.

I would not be surprised if the broad market falls 25% to 60% from highs.

Might all the newfangled financial acronyms and the like merely provide cover for Dow Jonestown when the whip comes down on the DJIA as it eventually must?

I can see it now, Cryptos plunging-which rocked market confidence elsewhere, when the ARKK then started sinking, etc.

Free associating here, but this looks a lot like Godzilla versus Mothra. Since the Stock Market, (genuflects towards N’Yawk,) is pretty much fully disconnected from ‘Main Street,’ the net effect of all these financial gyrations is of no discernable benefit to the Public. However, as putatively pusillanimous, pandemoniacal pundits opine, when Godzilla fights Mothra, Tokyo, where all the ‘ordinary’ people live, ALWAYS gets flattened.

As the Trade Federation leaders in a Star Wars film are wont to say: https://www.youtube.com/watch?v=vYk7m6Nu1Do

i remember the dim wit nafta billy clinton used to start many of his speeches with his glasses of course at the end of his nose, seeming to suggest he was a heavy weight in understanding economics.

his speeches almost always started with the stock market is up, then his concentrated look all over the room, suggesting heavy drama. the dim wit used to extol world com and enron.

https://www.wsws.org/en/articles/1999/11/bank-n01.html

“Kenneth Guenther, executive vice president of Independent Community Bankers of America, an association of small rural banks which opposed the bill, warned, “This is going to begin a wave of major mergers and acquisitions in the financial-services industry. We’re moving to an oligopolistic situation.”

“Threat to financial stability

“The proposed deregulation will increase the degree of monopolization in finance and worsen the position of consumers in relation to creditors. Even more significant is its impact on the overall stability of US and world capitalism. The bill ties the banking system and the insurance industry even more directly to the volatile US stock market, virtually guaranteeing that any significant plunge on Wall Street will have an immediate and catastrophic impact throughout the US financial system.”

and it went on and on with this moron!

Just one more reason why we really don’t want war with China – China is the only thing keeping the stock market up, besides QE.

I’ve been following Real Estate in Sonoma County since 2004 and there is no economic basis for today’s prices, this is particularly true of country properties of one acre or more.

Those prices are fear based and it’s a GTFO of Dodge rather than FOMO market.

The same is true in OC, CA.

However if you price RE by monthly loan payments mortgage payments one gets a better cash flow with the record low interest rates.

California is challenging (I quip for want of a better description). Sacramento, erstwhile city of trees, has paved paradise resulting in an unrecognizable city. From what I’ve gathered, there’s been a massive influx from the San Francisco Bay area where their sales there go a long way. Similarly, desert home prices are driven up by new second homes and it seems (anecdotally) folks leaving Los Angeles. In the past 20 years, the same dance around “affordable housing” has been discussed, and either summarily dismissed or dismissed after futile discussions in the three areas I’ve lived in CA and WA state.

and as long as we free trade, rents and housing will keep on going up. it got so bad in canada, they floated a moratorium on house sales to foreigners.

and the dim wit is still a free trader,

https://www.blogto.com/real-estate-toronto/2021/08/trudeau-housing-ban-foreign-home-buyers-canada/

rents are soaring under nafta billy clintons free trade, driving millions into poverty and homelessness.

https://www.yahoo.com/finance/m/63448269-26e3-3bc3-8cb5-6f5275aa14fb/u-s-rents-are-soaring-3.html

nafta billy clintons chinese communist party accounts for 25% of the real estate investments in america, driving housing prices rent through the roofs

remember, smith, lincoln and keynes predicted that our money would come back to america in the form of massive price hikes and bubbles

are free traders unintentional pawns of the destruction of america, or willing participants?

https://www.silverdoctors.com/headlines/world-news/china-pwns-us-how-the-chinese-are-buying-up-america/

Silver Doctors

News

Live Market Prices

SD Exclusive

China “Pwns” Us: How the Chinese Are Buying Up America

October 21, 2020 11929

Oh my, my…

Come hell or high water these bags will be delivered. They have seen the promised land of how high they can convince people to buy.

Re: NFTs

https://www.bloomberg.com/news/articles/2022-01-14/nft-investors-owe-billions-in-taxes-as-u-s-officials-crack-down

Apologies if this has already been posted, but I think the end might be coming. Not that some other scam isn’t coming to take its place, but I’m just so tired of cryptobros (almost exclusively dudes; I’ve seen very few women in that scene, weirdly enough – maybe they just have more sense as a whole) and the damn dirty apes. I do take some issue with the $44B number Bloomberg uses; by comparison, projected US smartphone market for 2021 according to this (just a random Duck search) is $73B. I don’t think the Bloomberg piece is counting the ways the Ape Dummies will sell to themselves to hike up the price.

I love the idea of these people getting hit with normal income tax rates for something they know isn’t worth a damn, and trying to justify their much lower valuations without having the entire scheme topple down on them.

At least in the tulip mania people got tulips. With NFTs, SPACs and the ever-expanding everything bubble it certainly feels like we’re entering the final phase of something. Can’t say exactly what will happen when given the govt’s forever plan to keep shoveling trillion dollar bailouts at the system but it seems to get less mileage each time. Gotta invade Russia and China soon or these boys won’t have anywhere left to loot.

That last is a joke. The US military won’t stand a chance. Maybe the western banking elites will finally realize the only way to not lose is to nuke everyone.

This also has to be remembered:

With much gusto (and bots), the phrase “buy the dip” was popularized…especially among novice traders.

Nobody bothered to tell them this was HALF the full phrase.

Anyone who’s been around for a time knows the full phrase of action: “Buy the dip, sell the rip…”

Let’s see if it’s learned in the next few months…

What is real wealth creation?

“Errrrrrrr ……. that’s a hard one” the economists

Neoclassical economists have always excelled in creating wealth of the evaporating kind.

At the end of the 1920s, the US was a ponzi scheme of inflated asset prices.

The use of neoclassical economics, and the belief in free markets, made them think that inflated asset prices represented real wealth.

1929 – Wakey, wakey

The use of neoclassical economics, and the belief in free markets, made them think that inflated asset prices represented real wealth, but it didn’t.

It didn’t then, and it doesn’t now.

In the 1930s, they worked out what had inflated the stock market to such ridiculous levels in 1929.

1) Share buybacks

2) The use of bank credit for margin lending.

The lessons that were learned after 1929 were gradually forgotten.

The US stock market is doing really well with share buybacks and margin lending driving prices ever higher.

A former US congressman has been looking at the data.

https://www.youtube.com/watch?v=7zu3SgXx3q4

He is a bit worried, hardly surprising really.

“Those who cannot learn from history are doomed to repeat it”

Cor blimey!

Free market thinkers have taken intellectual laxity to a whole new level.

paul wellstone the great anti-free trade senator was most likely rubbed out by free traders

nafta billy clinton: “China will open its markets to American products from wheat to cars to consulting services, and our companies will be far more able to sell goods without moving factories or investments there.”

nafta billy clinton: free trade with China as “a hundred-to-nothing deal for America when it comes to the economic consequences.”

nafta billy clintons Secretary of State Madeleine Albright said, “Economically, America gives nothing in this deal. All we agree to do is maintain the same open markets and policies toward the Chinese products(here is what the criminally incompetent nafta democrat said)that have already expanded choices and lowered prices for U.S. consumers.”

Gene Sperling, Director of the National Economic Council under President Clinton (and again in the Obama/Biden Administration), said China’s market opening to the U.S. was a bonanza. “The agreement we negotiated with China is a one-way deal.” YES IT WAS NAFTA TRAITOR!

denying the poor medical care free traders are responsible for this, The U.S. had no face masks, ventilators and limited hospital gowns in the middle of the worst pandemic since the Spanish Flu. They are mostly made in China.

the protecting the poor with tariffs Trump Administration basically told the WTO to go pound sand.

starving the poor free trader nafta joe biden resurrected nafta billy clintons fascist W.T.O., SENDING PRICES ON THE POOR THROUGH THE STRATOSPHERE!

Sep 18, 2020,11:34am EDT|2,633 views

This Is The Vote That Changed China Forever

Kenneth Rapoza

Kenneth RapozaSenior Contributor

The early neoclassical economists took the rentiers out of economics.

What could possibly go wrong?

The interests of the rentiers and capitalists are opposed with free trade.

The UK knew how free trade worked in the 19th century, before neoclassical economics.

How did the UK prepare to compete in a free trade world in the 19th century?

They had an Empire to get in cheap raw materials; there were no regulations and no taxes on employees.

It was all about the cost of living, and they needed to get that down so they could pay internationally competitive wages.

UK labour would cost the same as labour anywhere else in the world.

Disposable income = wages – (taxes + the cost of living)

Employees get their money from wages and the employers pay the cost of living through wages, reducing profit.

Ricardo supported the Repeal of the Corn Laws to get the price of bread down.

They housed workers in slums to get housing costs down.

Employers could then pay internationally competitive wages and were ready to compete in a free trade world.

That’s the idea.

You level the playing field first; then you engage in free trade.

The interests of the capitalists and rentiers are opposed with free trade.

This nearly split the Tory Party in the 19th century over the Repeal of the Corn Laws.

The rentiers gains push up the cost of living.

The landowners wanted to get a high price for their crops, so they could make more money.

The capitalists want a low cost of living as they have to pay that in wages.

The capitalists wanted cheap bread, as that was the staple food of the working class, and they would be paying for it through wages.

Of course, that’s why it’s so expensive to get anything done in the West.

It’s our high cost of living.

Disposable income = wages – (taxes + the cost of living)

Employees get their money from wages and the employers pay the cost of living through wages, reducing profit.

High housing costs have to be paid in wages, reducing profit.

The playing field was tilted against the West with free trade due to our high cost of living

The early neoclassical economists had removed the rentiers from economics so we didn’t realise.

actually demand for goods and services is wage driven. so our high standard of living, drove those profits. remove the wages, you remove the profits and now the capitalists rely on the federal reserve to prop them up.

hardly sustainable.

so if you have to destroy your standard of living to compete, its called a race to the bottom.

so who is gonna buy all of this stuff if wages do not cover consumption?

its self liquidating.

so we should not be to worried about competing. we should be worried about production and the wages to support that production.

we should buy what we have to, and sell what we can, and as in the past, 90% or more of our GDP came from internal consumption.

china figured it out, they desperately try it, yet cannot get over the hump that to have a self sustaining middle class, you actually have to provide the atmosphere for that.

they cannot get past that fact because they would have to give up that corporate cash cow called free trade.

I’m never very concerned about the stock market. It might as well be a child’s toy. The thing that freaks me out is aggressive value exploitation. Done by the creation of a lot of totally frivolous crap and the frenzy that is created by unequal distribution and the fear of losing out. Because we do not attend to actual basics – the true value of the things in our world – we manage to turn everything into an enterprise that creates profits from money. And devastates the environment and civilizations. So all this “disruptive innovation” and the stumbling IPOs don’t represent anything beneficial. It’s just pump and dump. If we had a stock market that valued “sustainable innovation” it would be a different thing altogether. And we’d have a good high-tech industry focused on recycling and reclamation as well. Until we have that, imo, the “stock market” is just another garbage dump.

What does the father of modern economics say?

“But the rate of profit does not, like rent and wages, rise with the prosperity and fall with the declension of the society. On the contrary, it is naturally low in rich and high in poor countries, and it is always highest in the countries which are going fastest to ruin.” Adam Smith, classical economist

Exactly the opposite of today’s thinking, what does he mean?

When rates of profit are high, capitalism is cannibalising itself by:

1) Not engaging in long term investment for the future

2) Paying insufficient wages to maintain demand for its products and services

Today’s problems with growth and demand.

Amazon didn’t suck its profits out as dividends and look how big it’s grown (not so good on the wages).

Where does the idea of maximising profit actually come from?

in fact the high rates of profit are from canibalization of the wests corporations and wealth. the fed props them up for now.

self liquidating.

its painfully obvious what a disaster bill clintons free trade really is: by getting rid of those bolt 2 things together deplorable goobers America can’t build anymore

millions of manufacturing jobs have been lost over the past 2 decades under bill clintons free trade: The production networks that once sustained so much process knowledge have disappeared along with the car factories.

bill clinton and al gore relished the facts that america was losing its factories, and told the deplorable goobers, it was good for them.

to get bill clinton, why you could say any free trader to understand that low-margin goods, are fundamentally valuable. the free traders would be wise to drop their dismissive attitude towards manufacturing as a “commoditized” activity and treat it as being as valuable as R&D work. And corporate America should start viewing workers not purely as costs to be slashed, but as practitioners keeping alive knowledge essential to the production process.

and quite calling the backbone of america, those bolt two things together deplorables that want to work at ford. they are practitioners keeping alive knowledge essential to the production process.

we are going to reverse bill clintons disastrous free trade, one way or another: localization requirements and cultivation of a deep labor pool could help rebuild the American industrial base.

This crisis, though, should have made abundantly clear how urgent the task is. we must protect now.

https://www.bloomberg.com/opinion/articles/2020-05-07/why-american-manufacturing-can-t-handle-the-coronavirus?srnd=opinion

Technology & Ideas

Why America Can Make Semiconductors But Not Swabs

U.S. factories are as productive as ever but they’ve lost the process knowledge needed to retool quickly in a crisis.

By Dan Wang

May 7, 2020, 5:30 PM CDT

The loss of manufacturing workers has had a broader impact than most Americans realize.

What about the companies that make missiles, bombs and drones?

Did he have a chart for them?

Always up…always. Except of course when it comes down on someones head.