Yves here. A whole bunch of things are now conspiring against housing and stock market bulls. Bears always have great reasoning but general optimism bias nearly always carries the day. But nearly always is not always, and securities and investments don’t fare well in higher interest rate environments.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

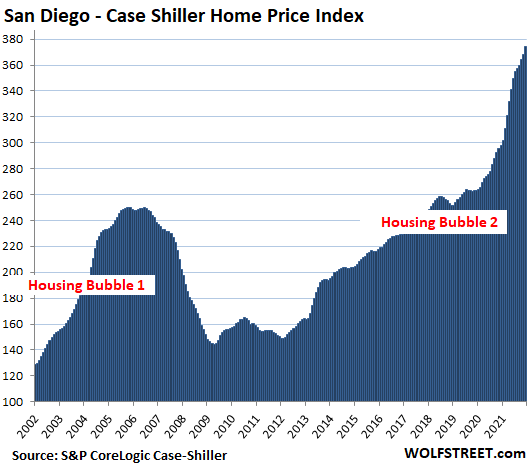

The Magic Number in 2018 was around 4.8%. In 2006, it was around 6%. But with today’s super-inflated home prices? Here are the signs.

The average weekly contract interest rate for 30-year fixed-rate mortgages with conforming loan balances rose to 4.06 percent for the week ended February 18, the second week in a row above 4%, and the highest since July 2019, according to the Mortgage Bankers Association today. The average rate for FHA-backed 30-year fixed-rate mortgages increased to 4.09%.

So where is the magic number beyond which this super-inflated housing market starts to feel the pressure of higher mortgage rates?

But mortgage rates remain ridiculously low, in face of CPI inflation that has shot to 7.5% and is still being fueled by the Fed’s ongoing interest rate repression and QE – which makes this the most reckless Fed ever.

The “Magic Number” in 2018

In the fall of 2018, as mortgage rates headed toward 5%, the housing market was beginning to wheeze, and stocks were spiraling down. The magic number at the time appears to have been about 4.8%, and when mortgage rates moved above it in September, all heck started breaking loose.

After the S&P 500 had dropped about 20% by December 24, 2018, and with the housing market weakening, Fed Chair Powell caved under Trump’s daily hammering and did the now infamous U-Turn.

However, back then in early 2019, inflation was below the Fed’s target, as measured by its yard stick “core PCE,” at 1.6%, and that provided Powell a fig leaf.

Now inflation is the worst in 40 years and spiraling higher, and “core PCE” inflation is 2.5 times the Fed’s target. It’s now inflation that is hammering Powell on a daily basis – him who’d made a fool of himself calling this monster he’d unleashed “temporary” when everyone already knew that it would spiral higher.

So where is the magic number this time beyond which the housing market starts to feel the pressure?

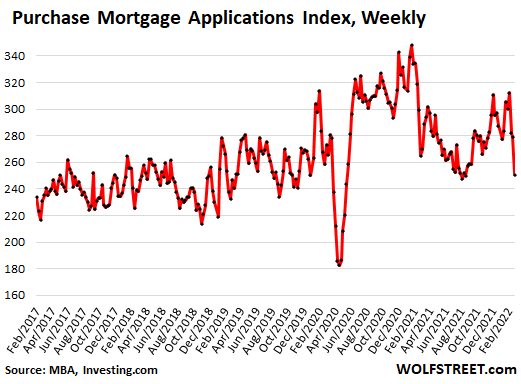

Mortgage applications to purchase a home have dropped sharply for three weeks in a row, coinciding with the surge in mortgage rates, and in the week ended February 18 reached lows briefly kissed in August 2021, and then during the lockdown, to enter the lower part of the range in 2019. The MBA’s index for purchase mortgage applications has now dropped by 28% from the January 2021 pandemic highs (data via Investing.com):

The “Magic Number” in 2006.

Not shown in the chart: Back during the peak of Housing Bubble 1, in January 2005, the MBA’s Purchase Mortgage Index had maxed out at 500 – twice today’s level – before it collapsed.

At that time, the Fed was in the middle of its rate-hike cycle, taking the federal funds rate from 1.0% in June 2004 to ultimately 5.25% by July 2006, which pushed the average 30-year fixed mortgage rate to 6.4%, at which time the housing market ever so slowly began to collapse.

The Nasdaq started heading lower in the summer of 2007, and little by little all heck broke loose in a global manner, punctuated by the collapse of Lehman in September 2008.

Higher mortgage rates, when home prices are already sky-high, are very tough on housing markets. And higher interest rates in general are tough on stocks.

So where was the magic number back then? Obviously 6.4% for the 30-year fixed mortgage rate, at those Housing Bubble 1 prices, was beyond the magic number.

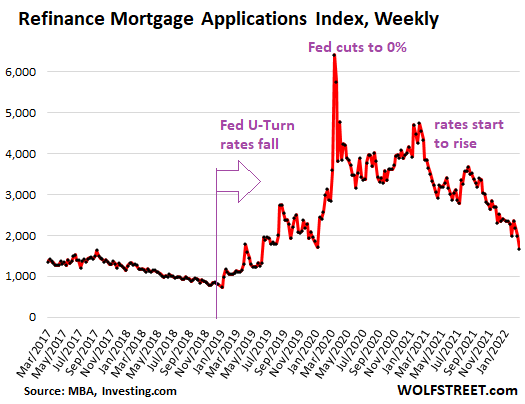

Refi mortgage applications plunge

Rising mortgage rates means that households are putting refinancing their mortgages on the back burner. This happens despite the historic explosion of home prices that brings with it a lot of home equity that could be drawn out via cash-out refis.

The MBA’s Refinance Mortgage Applications Index has now plunged to the lowest level since June 2019 and is down by 74% from the pandemic highs – and mortgage rates have just started rising and are still ridiculously low, given that CPI inflation has surged to 7.5% (data via Investing.com):

The Magic Number now.

First-time home buyers, facing these higher mortgage rates and sky-high prices, have already pulled back from this ridiculous Fed-inflated market, as investors and cash buyers have piled into the market.

In January, first-time buyers dropped to just 27% of total home purchases, down from 30% in December, and down from 34% in all of 2021, according the National Association of Realtors.

Going forward, “some moderate-income buyers who barely qualified for a mortgage when interest rates were lower will now be unable to afford a mortgage,” the NAR said.

With each increase in home prices, and with each increase in mortgage rates, more layers of potential buyers get wiped off the table. At first no one notices, but then the layers are starting to accumulate, and at some point, the regular buyers – such as first-time buyers – are starting to thin out. And that’s what we’re now seeing.

At first, cash buyers and investors may be able to make up the difference. And that’s what happened during Housing Bubble 1, which was in part driven by investors, who then become the core of the mortgage crisis when they walked away from multiple properties at once.

Individual investors or second-home buyers piled into the market, accounting for 22% of home purchases in January, up from 17% in December and up from 15% in January last year, according to the NAR.

All-cash purchases jumped to 27% of home purchases in January, up from 23% in December and up from 19% in January 2021, according to the NAR.

But in January, mortgage rates were still in the 3.5% to 3.7% range, well below the 4% line. And already, visible layers of first-time buyers started to get pushed out of the market that has been artificially inflated by the Fed’s reckless monetary policies, and that now faces rising but still artificially low mortgage rates.

So it looks like the Magic Number now for the average 30-year fixed mortgage rate is a little north of 4%, a level when the layers of potential buyers, such as first time buyers, are disappearing from the market. This is already happening.

For now, as last time, over-enthusiastic investors are making up the difference, but if we’ve learned anything from the debacle 15 years ago, it’s that this investor enthusiasm too will fade in these ridiculously over-inflated markets when interest rates rise in face of spiking home prices as in the Most Splendid Housing Bubbles In America:

I wish Wolf would start his y axis at 0 on his graphs.

It’s interesting reading the history and considering how long it takes for these effects to play out – years! Peak in Jan 2005, to Lehman’s in sept 2008. And many people had recognized the bubbleness and waste before 2005 I’m sure, though probably few whose income depended on believing otherwise. It’s a good reminder to have patience, and recognize that unsustainable things will end, though on their own timeline.

It’s not just Mortgage rates, it’s gas prices.

And Ukraine.

Now the vaccine mess.

Markets are cyclical and based on emotion, this has been a very long up cycle and most recent buyers have been pushing their limits to “Afford” buying a home, betting on appreciation to bail them out when they sell.

When confidence wanes people back away from buying big ticket items and a home is the biggest investment most people make.

.

Even a 5% mortgage, is better than paying rent right now. You used to be able to rent a detached house with a yard for what they are charging for a semi-decent one bedroom condo on the ground floor… talking $1800/month; and by used to I mean 3 years ago. It’s as if they want riots; yet Americans are remarkably well behaved! Perhaps their culture of self-sufficiency causes them to blame themselves for their misfortune. I wonder where the suicide rates are at?

As I keep mentioning there is currently a huge expansion of housing, and rental space in particular, here. Blackrock and similar behind it? I can’t see where all these new residents are going to come from unless apts will be given to the homeless (not as many here as in other places). Perhaps capitalism and not just the Chinese into building empty cities?

I have a theory (i.e., uneducated guess) that these modern luxury apartment developers don’t care whether they have tenants or not. They are building the apartments for their investment value (appreciation) plus all of the tax write-offs. The fewer tenants you have, the more you can write off and carry over.

Is this a possibility, anyone?

Anecdotal to this regional information, I research in the past 12 months how one noted home builder cut corners and could potentially wreck the completed homes with shoddy construction and incomplete plumbing. The stories were pretty atrocious, but centered elsewhere in SC and also Ohio.

It is always hard to suggest with foresight what the next few years hold. I have a growing suspicion in the next 2 to 3 years that supply will exceed the demand and pricing will come down. A mortgage at 5.0% interest looks much different than a comparable mortgage at 3.0% interest.

Sounds to me like the real rates are continuing to fall then. Why would we think this will be bad for home prices? Might be bad for first time homebuyers, but private equity and investors will step in. 30 yr treasuries are paying under 3 percent — a guaranteed loss (probably significant loss) of real equity.

Until we get a Paul Volcker 2.0 who jacks up rates above inflation I don’t see a reversal in prices

“It’s now inflation that is hammering Powell on a daily basis – him who’d made a fool of himself calling this monster he’d unleashed “temporary” when everyone already knew that it would spiral higher.”

Umm…no on “the everybody knew” element. We’ve only been dealing with endemic deflation trends for two decades now, due to all-time highs in wealth inequality plus downtrending birth rates plus tech-led deflation and garden variety class oppression. As soon as the poors finish spending the last of their crumbs dropped from the table, we’ll get back to the status quo ante.

We have had massive immigration. Much of it is off the books but as soon as they have babies they are locked into the US, as a practical matter. They will buy houses. My housekeeper, for example, has many relatives coming into the US and she has bought a house in the high desert. The relatives, and her adult kids, fill the house and their combined earnings cover much if not all of the mortgage. This is up in Victorville. My housekeeper lives in with us so she makes the drive once per week from Brentwood.

Can we also talk about the non-existent savings rates?

For me, this is a crime in a country that parades around spouting off about capital, capitalism, and markets. ZIRP is akin to another 1000 paper cuts for a middle class already disable by wage stagnation, hyperinflation in healthcare/higher education costs, and loss of unionized bargaining for the majority of middle class Americans.

It used to be 12-15 years ago, one could get 2% or 3% on their liquid money and the market was a place to enter when increasingly risk. But over this period, investors have been bullied into equities or home buying properties because there are really no options available that make sense.

And then, we see what’s happening all over the world — and then we get it (in Lambert fashion) – they are trying to kill us.

The country has 3 products essentially, a housing bubble of immense proportions, a military run amok, and the ability to conjure up what is essential hyperinflationary amounts of money.

We can’t ever let these pursuits wither on the vine, which is why so many used homes have been bought up by Wall*Street in not only propping up the market, but making it seem viable and strong.

When it eventually craters, the hole will probably be visible from the Moon…

A fourth product is celebrities, and you could include influencers along with them.

Our next president/congress will have a plant to fix this. Just like the ones we voted in previously.

While letting the Fed run amok.

Sad sack Bill here. [waves]

Housing prices can’t continue to go up forever, can they? I say that because I’ve been renting my housing for the past decade. I almost bought a house in 2017 but I got cold feet at the last minute. I thought the market was due for a correction back then AND IT HAS ONLY GONE UP 50% SINCE THEN. I could have bought the house I was living in in 2017 for $325,000, but I thought that was way too much for a home that needed so much work. Now Zillow says it’s worth $544,000 now. It’s absolutely crazy.

Meanwhile the builders are not keeping up with demand, which I believe is intentional. They also cater to nicer, bigger homes. OUR HOUSES ARE TOO BIG!

I’ve thought about buying a house this summer by beg, borrowing, and stealing to find downpayment money, but I’d still be in PMI or high interest rate territory, and I’m even more convinced that ever (even though it looks like I’m wrong) that the market is going to pop.

How will this be solved?

Alas, this situation will be resolved with guillotines in the Town Square. And a lot of violence in the streets.

Neoclassical economists have always excelled in creating wealth of the evaporating kind

At the end of the 1920s, the US was a ponzi scheme of inflated asset prices.

The use of neoclassical economics, and the belief in free markets, made them think that inflated asset prices represented real wealth.

1929 – Wakey, wakey

The wealth evaporation event of 1929 finally brought them to their senses.

They needed to find out what real wealth was.

It took them a long time to disentangle the hopelessly confused thinking of neoclassical economics in the 1930s.

This is when they invented GDP.

The real wealth creation in the economy is measured by GDP.

Real wealth creation involves real work, producing new goods and services in the economy.

That’s where the real wealth in the economy lies.

They used to think rising asset prices were creating wealth, but after 1929 they realised this was not the case.

They needed to find out where real wealth was created in the economy and they invented GDP.

This is why GDP is the thing we want to grow; it is the real wealth being created in the economy.

Real wealth doesn’t have a nasty habit of evaporating again.

We want to roll back the New Deal.

Are you going to fix the problems in what preceded it?

No, we’ll just make the same mistakes again.

What can you do?

The attractive, new ideology of neoliberalsm, was the Trojan Horse that delivered the payload of dodgy old, 1920’s neoclassical economics to global policymakers

Under the bright, shiny, new wrapper of neoliberalism is dodgy, old, 1920’s neoclassical economics, and it’s still got its old problems, e.g. neoclassical economists excel in creating wealth of the evaporating kind

Neoclassical economics has still got its old problems; we just forgot what they were

Relying on price signals from the markets.

“Everything is getting better and better look at the stock market” the 1920’s believer in free markets

Oh dear.

In the 1930s, they were wondering what had gone wrong with their free market beliefs and worked out what had happened.

What had inflated the stock market to such ridiculous levels in 1929?

1) Share buybacks

2) The use of bank credit for margin lending.

The US stock market is doing really well with share buybacks and margin lending driving prices ever higher.

A former US congressman has been looking at the data.

https://www.youtube.com/watch?v=7zu3SgXx3q4

He is a bit worried, hardly surprising really.

The economics of globalisation has always had an Achilles’ heel.

The 1920s roared with debt based consumption and speculation until it all tipped over into the debt deflation of the Great Depression. No one realised the problems that were building up in the economy as they used an economics that doesn’t look at debt, neoclassical economics.

Not considering private debt is the Achilles’ heel of neoclassical economics.

What could possibly go wrong?

The inevitable.

1929 and 2008 stick out like sore thumbs.

https://www.youtube.com/watch?v=vAStZJCKmbU&list=PLmtuEaMvhDZZQLxg24CAiFgZYldtoCR-R&index=6

At 18 mins.

In 2008 the Queen visited the revered economists of the LSE and said “If these things were so large, how come everyone missed it?”

It’s that neoclassical economics they use Ma’am, it doesn’t consider private debt.

……. etc ……..