Yves here. From time to time, readers chide us for lacking the patience to spell out the proper name of economics profession’s imitation Nobel Prize. J.R. Swenson is particularly annoyed by this practice and is highlighting some of the (sadly still few) instances within the discipline of pushing back against the brand appropriation.

To highlight additional points: Trying to imbue economics with the luster of more rigorous disciplines is a political exercise. Remember that after World War II, economists became the only social scientists with a seat at the policy table. The USSR had gone from a peasant society to a major industrial power in barely over a generation. Many Western leaders recognized that would have been impossible in a free enterprise system. Economists were seen as the experts who could help governments adopt policies to enable market systems to keep up with centrally planned ones. (More careful studies of the USSR have concluded that central planning actually worked pretty well initially, but then the middle manager bureaucrats started gaming targets and hiding output to assure they’d meet their plans).

More specifically, the fake Nobel Prize in economics has strongly favored adherents to the Chicago School of Economics’ neoliberal dogma. So it has served to act as an enforcer of conservative, capital-backing, anti-labor policies.

The Nobel Foundation haf bleated about the Swedish Riksbank hijacking of their name, but clearly gave up.

By J.R. Swenson, formerly a consultant, teacher and project manager in math, computing, and database research

Despite the obvious counter-incentives, it’s time to ask the cadre of professional economists and some others to admit to a bit of self- aggrandizement, namely by claiming to win a Nobel Prize. We’ll encourage a few economists who have won the yearly prize in economics awarded at the Nobel ceremony each December in Stockholm to fess up to the fact that there are no Nobel Prizes for economics and perhaps even that economics is not a science. We’ll use a number of published remarks by various economists and some physical evidence< The Prize

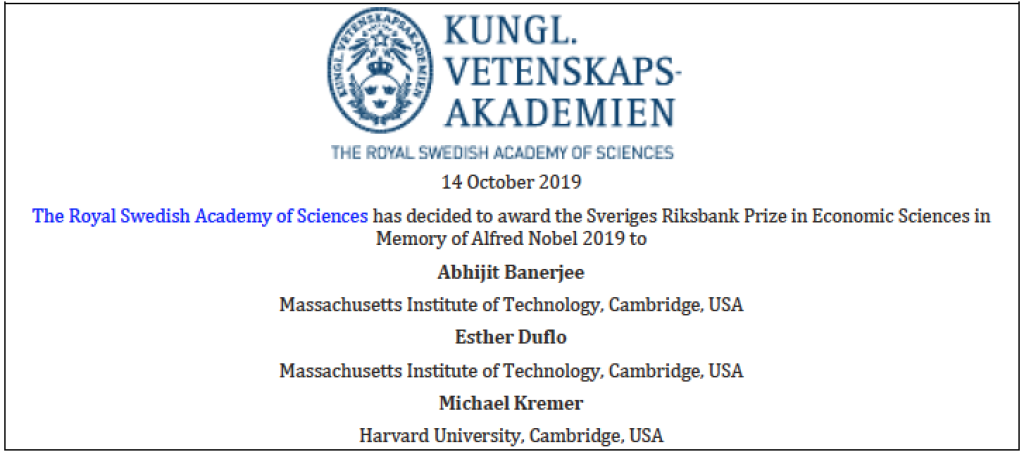

Let’s consider some details regarding the prize. The correct name of the prize (in Swedish) is:

Sveriges Riksbanks pris i ekonomisk vetenskap till Alfred Nobels minne

An English translation of this is:

The Swedish Riksbank Prize in Economic Sciences in the Memory of Alfred Nobel

Notice that the prize is from “The Swedish Riksbank” aka The Swedish Central Bank which is the Swedish equivalent of the US Federal Reserve, except it formally reports to the Swedish legislature. It is NOT from the Will of Alfred Nobel.

There is another point which may be quibbled about and that is the translation of vetenskap. As with translations in general, there is another English word other than “science” that is deemed to be a valid translation and that is “scholarship.” I will deal with the claim that economics is not a science later

So why do the media, economists, and others refer to this prize incorrectly? A colleague suggested the idea of “leveraging a brand.” Another way to look at this is that applying a “label” also carries with it the aura or halo of that label.

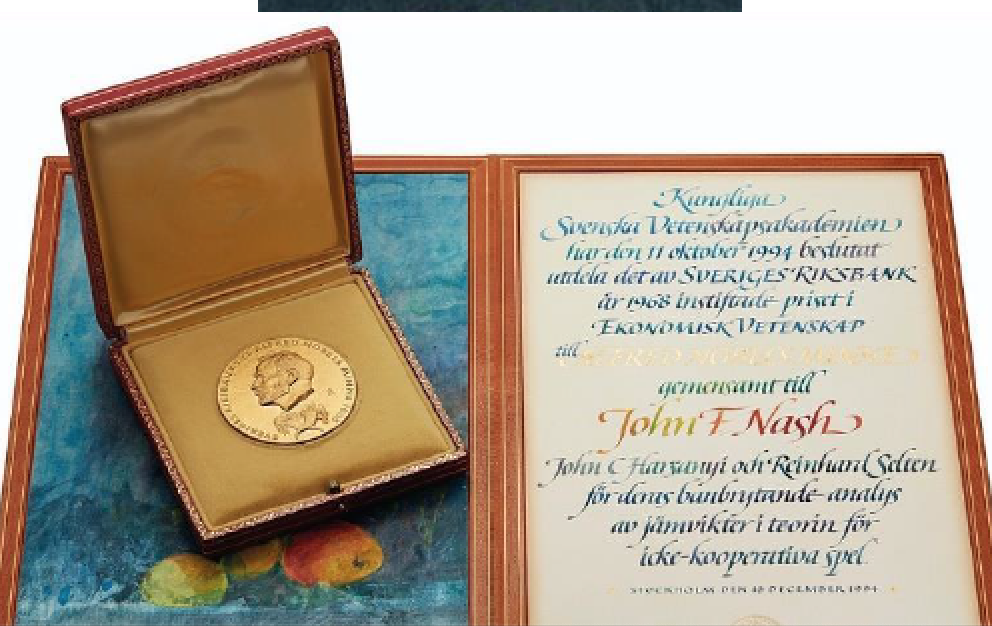

This point was made by Dan Kahneman, a famous psychologist who actually won this prize in 2002. He suggested this in his book Thinking Fast and Slow 2011 (Farrar, Straus and Giroux) Most economists don’t protest the incorrect naming because they can bask in the glow of the words “Nobel Prize.” Journalists and book publishers also like this aura. Isn’t it curious that a famous psychologist and a famous mathematician, John Nash (1994) also won this prize in “economics?” In my opinion both deserve as many prizes as they can garner for their accomplishments.

The Correct Name

It is instructive also to read the 2019 Annual Review from the Nobel Foundation to learn that it never refers to a “Nobel Prize in Economics” but always uses the longer title involving the Swedish Riksbank.

This document is large and is not attached here.

Finally, the Nobel Foundation describes the many names used during the 60 or so years of is existence when discussing this prize. “Nobel Prize” is not one of them.

To directly show that “Nobel Prize” is an incorrect name, I insert below three images that should be examined that provide real evidence as to why the phrase “Nobel Prize” is inappropriate. First, those words do not appear on the Certificate or Medal received by the winners. This claim is verified by actually looking at the image of the medal and Certificate awarded to John Nash. I have made the image of the latter as large as possible so that the writing on the Certificate is visible. Furthermore, the phrase “Nobel Prize” does not appear on the announcement of the recent winners of the economics prize. The top image is the announcement.

Background

When the prize was created by a group of Swedish bankers in 1967 and first awarded in 1968, there was political conflict in Sweden regarding the orientation of economic work in that country. I will not attempt to give the history as it is well told in the first 4 chapters of The Nobel Factor 2014 (Princeton Univ Press) written by economic historians, Avner Offer and Gabriel Söderberg. The prize was created for political purposes. This was not the behind the creation of the real Nobel Prizes.

Given the near-universal use of the incorrect name for the Swedish Riksbank award, it was courageous for the President of M.I.T., Dr L. Rafael Reif, who wrote an email to Alumni lauding the two 2019 winners who are M. I. T. faculty. (copied below) To my knowledge this was one of the few public announcements that used the correct name of the prize except in two places However, soon after I found two other publications associated with M.I.T using the words “Nobel Prize”: Technology Review (March 2, 2020) and Spectrum (Spring 2020). Unfortunately, there are two places within President Reif’s email that do use the phrase “Nobel” or “Nobel Prize.”

In response to the article in Technology Review, I composed a long note and mailed it to them sometime in late March or early April. I have not received even an acknowledgment that they received it, which is disappointing.

Why Isn’t Economics a Science?

To argue that economics is not a science encourages deep discussions as to just what is meant by the word “science.” This is an old discussion. It was taken up by Karl Popper in his book The Logic of Scientific Discovery published first published in German in 1934, then in English in 1959. (It is available on-line.) Popper discusses his fundamental idea that unless a theory is falsifiable, it cannot qualify as “scientific.” From Wikipedia:

Popper argues that science should adopt a methodology based on falsifiability, because no number of experiments can ever prove a theory, but a reproducible experiment or observation can refute one. According to Popper: “non-reproducible single occurrences are of no significance to science. Thus a few stray basic statements contradicting a theory will hardly induce us to reject it as falsified. We shall take it as falsified only if we discover a reproducible effect which refutes the theory.” Popper argues that science should adopt a methodology based on “an asymmetry between verifiability and falsifiability; an asymmetry which results from the logical form of universal statements. For these are never derivable from singular statements, but can be contradicted by singular statements.The New Paradigm for Financial Markets, 2008 (PublicAffairs), George Soros extends Popper’s idea with the idea of “reflexivity.”

Soros continues his theme in great detail in Fallibility, Reflexivity, and the Human Uncertainty Principle (Jnl of Economic Methodology, January 13, 2014). The book and article point out that when human participants involve themselves in economic activity e.g., trading in markets, bargaining, saving, etc., they are affecting the very system that they are pretending are objectively real, stable, perfectly known, etc. by virtue of some theory and not subject to ignorance, misunderstanding, emotion, etc. on their part or on the part of other actors at the same time. (Note that humans are assumed to not influence scientific discoveries.)

Also, economics is often portrayed as deterministic involving perfectly rational actors with complete knowledge who don’t make mistakes, are not emotional and possess complete knowledge. Economic theories often assume that markets are perfectly efficient, completely understood, and subject to deterministic theories that can be mathematically modelled.

These assumption are made for the purpose of permitting simplification of the current model. They is being steadily eroded by economists such as Professor R. J. Thaler, the winner of the prize in 2017 who wrote the book Misbehaving 2015 (WW Norton), a book extolling the idea that economic activity is fraught with ignorance, emotion, and fallibility.

If economics were a science, the winners of the prizes would hardly be constantly arguing about one another’s theories. They would be capable of making accurate predictions. The following quote from the lecture of Friedrich Hayek upon winning the economics prize in 1974 is another mark against “economics as a science”:

It seems to me that this failure of the economists to guide policy more successfully is closely connected with their propensity to imitate as closely as possible the procedures of the brilliantly successful physical sciences – an attempt which in our field may lead to outright error.

Hayek goes on to discuss reasons and examples of why the paradigm of science (in Popper’s sense) is inappropriate for economics.

Closing<

Consider these tidbits from web searches:

The Sveriges Riksbank Prize in Economic Nobel the Nobel Prize in Economics, is a prize awarded each year for outstanding contributions in the field of economics. … The amount of money awarded to the economics laureates prizes.

https://www.britannica.com/topic/Winners-of-the-Nobel-Prize-for-Economics-1856936

Notre Dame historian Philip Mirowski has found evidence that the economics award grew out of Swedish domestic politics. According to Mirowski, in the 1960s, the Bank of Sweden was trying to free itself from government oversight and become independent. One way to do that was to frame economics as purely scientific, rather than political — in which case, government interference could only hurt the bank. Having a Nobel Prize boosted economics’ scientific street cred. And Mirowski isn’t the only academic who is skeptical of whether there should be a Nobel-associated economics prize. Friedrich von Hayek, who won the award in 1974, used his Nobel Banquet speech to critique the prize.3 “The Nobel Prize confers on an individual an authority which in economics no man ought to possess,” Hayek said. He worried that the prize would influence journalists, the public and politicians to accept certain theories as gospel — and enshrine them in law — without understanding that those ideas have a different level of uncertainty than, say, gravity or the mechanics of a human knee.

https://fivethirtyeight.com/features/the-economics-nobel-isnt-really-a-nobel/

This link also triggers a great 10 minute Youtube presentation that mentions Offer and Söderberg.

I also commend the reader to refer to “Nobel” Prizes for Nonsense :

In 1968 the Central Bank of Sweden, Sveriges Riksbank, instituted the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel. The long-winded title gives the impression that the award is a Nobel Prize alongside those for Peace, Physics, Chemistry, Medicine and Literature. It is not, though by practice (imitation and aspiration?) it is announced at the same time.

In 1999 Barbara Bergmann, a prominent US economist, explained the “contributions” of recent winners:

The prize frequently occasions embarrassment, since we have to explain to the public what the achievement of the newest laureate is. That achievement is usually…a totally made-up, simplified representation of some process we all know takes place. People snickered when they heard that James Buchanan’s prize was for telling us that politicians and bureaucrats act in their own interests, Robert Lucas’s was for telling us that people do the best they can in doping out what to do, and Franco Modigliani’s was for telling us that people save and spend their savings at different times in their lives.

Referring specifically to Robert Fogel, who in 1993 won for demonstrating the economic “rationality” of slavery, and to Gary Becker for the insight that the subordinate role of women in the labor force is optimizing behavior (1992), Bergmann wrote: “Fogel’s and Becker’s awards were not just in bad taste. Those prizes honored work that distilled complicated and sometimes painful phenomena into simplistic representations of cheeringly optimal processes.”

The “contributions” of Buchanan, Lucas, et al. seem seminal compared to later ones. In 1997 Myron Scholes and Robert C. Merton garnered the Sveriges Riksbank Prize for their breakthroughs in the theory of capital markets (“break” being singularly appropriate). Using their contributions to science they helped create in 1994 a scheme for high-stakes speculation, Long-Term Capital Management (LTCM). In one of those outcomes a critic couldn’t make up, the scheme of the laureates went spectacularly bust in 1998, losing $4.6 billion. To my knowledge, no one at Sveriges Riksbank expressed embarrassment, much less an apology. [From page 16 in Economics of the 1%: How Mainstream Economics Serves the Rich, Obscures Reality and Distorts Policy. (2014). Anthem Press by John Weeks]

And finally, from the concluding chapter of Capital in the Twenty-First Century by Thomas Piketty:

I see economics as a subdiscipline of the social sciences…. I dislike the expression “economic science” which strikes me as terribly arrogant because it suggests that economics has attained a higher scientific status than the other social sciences.

It is not the purpose of social science research to produce mathematical certainties that can substitute for open, democratic debate in which all shades of opinion are represented

As far as I can tell, the phrase ‘Nobel Prize’ occurs nowhere in his book.

Epilogue

I have failed above in one respect for which I must apologize. All the preceding has been clearly motivated by the book The Nobel Factor written by Gabriel Söderberg and Avner Offer.

In my opinion, however, the most thought-provoking portion of the book is its last chapter, Conclusion – Like Physics or Like Literature. I wish that I could simply copy it here. One observation seems worth noting: mathematics is not a science and simply adopting mathematics does not turn an endeavour into science.

_____________________

A copy of and announcement email from the President Reif of M.I.T:

From: President L. Rafael Reif <leadershipnews@mit.edu> Sent: Monday, October 14, 2019 6:35 AM To: blackiebernard@alum.mit.edu blackiebernard@alum.mit.edu

Subject: Economics Nobel for Profs. Abhijit Banerjee and Esther Duflo PhD ’99 To the members of the MIT community, Good morning!

I am delighted to share the news that Abhijit Banerjee, the Ford Foundation International Professor of Economics, and Esther Duflo PhD ’99, the Abdul Latif Jameel Professor of Poverty Alleviation and Development Economics, have just been awarded the 2019 Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel.

As co-directors of MIT’s Abdul Latif Jameel Poverty Action Lab, they share this honor with Michael Kremer of Harvard for their transformative work on the economics of poverty alleviation.

As Professor Duflo emphasized in an interview this morning, the essence of their work is to make sure that the global fight against poverty is based on scientific evidence, so that policymakers have a systematic way to understand which interventions work, which do not and why. By providing an experimental basis for development economics, they have both transformed their field and profoundly changed how governments and agencies around the world intervene to help people in poverty – a proud example of MIT’s commitment to bring knowledge to bear on the world’s great challenges.

You can read more about the impact of their work here.

(http://news.mit.edu/2019/esther- duflo-abhijit-banerjee-win-2019-nobel-prize-economics-1014)

We join with the Economics department in celebrating this extraordinary honor for Professors Duflo and Banerjee and their Harvard colleague. MIT Economics faculty have been awarded the Nobel on five previous occasions. This morning’s announcement serves as an inspiring reminder of the department’s wide influence and groundbreaking ideas.

With admiration, L. Rafael Reif

MASSACHUSETTS INSTITUTE OF TECHNOLOGY 77 MASSACHUSETTS AVE, W98-300 | CAMBRIDGE, MA 02139

I have said this before a few times and it was well received. A good way to make this fraud plain would be to bestow a Naked Capitalism Prize in Economic Sciences in Memory of Alfred Nobel. No money necessarily, but the acceptance speech could be on Zoom and get a big audience. The short version would be “Naked Capitalism’s Nobel Prize in Economics.”

If I may, I would like to nominate the late political economist George Carlin. Maybe Merle Hazard can stir up a tune to support George.

Does the Commentariat get to vote? Mine goes to Michael Hudson.

It seems that the “uneducated” among us can tell that economics is not a “science”. Just like political science ,isn’t one. They are more akin to the “schtik” of a con artist. good useful insights in there somewhere, but with variable intent of the teller; wholly different outcomes are “certain”.

And even if the nobel prize in economics isn’t “real”….so?

isn’t it fetishizing all these different professional organizations,and the academic industrial complex , that co-exists with them.

The world turns, these groups aggrandize themselves. Big deal.

The con goes a lot deeper than that.

And it is costing us the world

Thank you, Yves.

The descendants of Nobel are equally upset and have campaigned against what they see is a neo liberal campaign by the Swedish business establishment, not just the central bank, but the Wallenberg family’s network of investments, too.

Interesting piece. Various observations from working in applied economics and with mathematical psychologists that tie in with points made here. Regarding prediction and reproducibility. Totally agree and that’s why I don’t rate most winners of this prize. McFadden is IMHO an exception: he got his for accurately marrying observed transport decision data to the conditional logit model (for which he got the credit, but see below) and hence predicted demand for the BART in SF, CA incredibly accurately under a load of different possible scenarios and in particular the design etc chosen to be built validated his predictions.

However, back then a psychologist would never be considered – R Duncan Luce and his then PhD student Tony Marley had already done the math for this model but they gained much less fame (where policy makers are concerned anyway) because they parameterised it in a way that was less easily formulated as a regression model and (perhaps more insidiously) made it clear that the model was a model of an individual human and that it BY DEFINITION incorporated the assumption that a human isn’t rational under various circumstances and that such “rules” like preference transitivity are often garbage. It was this “allowance for errors” that made discrete choice modelling so successful in prediction across several fields, once the “siloisation” in academia began to break down. To be fair, McFadden did acknowledge Luce in his “nobel” lecture but Marley arguably did a LOT of the work. Declaration of interest – I had the honour of working with Marley for years and just checked up and sadly found his obituary from last year. Luce died 10 years ago.

Ironically, and I feel I can say this now Tony has passed, an alleged joke among the top mathematical psychologists about Kahneman when the “nobel” committee finally allowed it to go to a psychologist is that they wanted to give it to Tversky but there was a slight problem….he had died. Kahneman’s and Tversky’s Prospect Theory was being widely discredited in well designed experiments just as I was leaving academia anyway so that’s all moot. I guess the thread underlying a lot of my thoughts on the subject is that much of economics should be moved into Schools of Divinity. It’s a bunch of stuff you’re just supposed to believe which is untestable or based on beliefs that are just demonstrably false according to hard historical and anthropological evidence. But I guess I’m biased and now increasingly the old man shouting at clouds….

Not that long ago the teaching of economics was within the philosophy department. The great 19th century economist Thorstein Veblen had trouble getting a job because he lacked courses in theology. If the moderator will allow, I have pasted in something I wrote several years ago that is apropo to the topic.

As a faith-based system, modern economic science has had to ignore, or explain away, occurrences in real life that are not compatible with the known certainties of the faith. This happened in the Middle Ages when astronomy, medicine and physics were based on Church doctrine. Today, modern economic science is trying to explain away, or simply ignore, a number of inconvenient facts that threaten the revealed faith. In no particular order these include a belief that a Free Market exists, that economic growth (measured in money) is essential, that natural resources are not limited, that government services are more efficiently provided by private enterprises, that environmental protection is harmful to national prosperity, that restrictions on the freedom of financial transactions impedes economic growth (again measured in money), that economic efficiency equates to a social benefit, and that capitalism and democracy are somehow linked.

Along with the conversion of economics into a Science, the word “political” is no longer used to describe the subject matter. Does this mean that political concerns are no longer within the scope of economic thought? Far from it. Whereas political systems were once seen as means to establish a beneficial type of economic system, the dominance of orthodox economics has resulted in an almost total agreement as to the role of political systems. The proper role of politics is to stand back and get out of the way of economic activity. Instead of governments, through the political process, directing economic activity it is the financial sector, through the wise men who interpret the mysteries of the Science of Economics, that are directing government policies that affect our daily lives. Just as the Medieval Church was able to ignore the realities of the physical world, the new Church of Economics is ignoring the environmental and social realities that are more apparent in our daily lives every day

Wow great post, thanks. Makes me feel a little less alone when I point out political and quasi-religious “articles of faith” that are taken as read in modern economics.

Friend suggested to me that I volunteer to be a mentor to UK kids from disadvantaged backgrounds to help them get better grades and “navigate the perilous path in getting into Oxbridge”. I checked the current “A level” economics syllabus for UK which is biggest factor in influencing this. Just as awful as it was in my day, 30+ years ago. Told friend “thanks but I’m actually handicapping these poor sods if I help them get good at this – morally I couldn’t do it, it’s teaching them sociopathy”.

When I was doing undergrad economics in the 1980’s there was a widely circulated Economist article based on research indicating that after one year of a basic economics course, the students tested lower on scores for empathy than any other students. I recall a lecturer mentioning it in a second year class and the entire lecture hall laughed. I suppose you would call that confirmation.

Yep. I could add shocking stuff but I’d get into trouble.

You should write it all down but with firm instructions for it not to be published until after your death. Give future historians something to chew over for a “flavour” of the times. :)

Given long covid and the fact writing is one of the few things I can do (albeit with frequent breaks when brain fog is too bad) I’ve been tempted….

But ultimately there are plenty of folk on site like this who can do similar “reveals” better than me so I’m probably going to return to a predominantly “passive observer” of events….. Have had dodgy ticker from birth and since I’ve already published my “magnum opus” I’m content to watch from the sidelines more often – NC is a big part of my reading :)

The issues of reproducibility and falsifiability are all over the social “sciences”.

Yet sadly their influence grows year by year, as they provide ample justification for those in power to keep doing their thing.

The most glaring example right now is that economic prize winning claim that global warming can be counteracted with a few more AC units.

I agree wholeheartedly about the fraudulent ‘passing-off’ of the economics prize as a Nobel prize. As for the word ‘vetenskap’, this could perhaps literally be translated as knowledge creation, in relation to the Swedish verb ‘veta’, to know, and ‘skapa’ to create, hence perhaps the use of scholarship rather than science in the humanities.

A classic on this topic with nice additional information.

http://exiledonline.com/the-nobel-prize-in-economics-there-is-no-nobel-prize-in-economics/

Prize winner Milton Friedman was something of a fabulist. His Permanent Income Theory is designed to explain why anti-recessionary tax cuts can’t work. And according to James Forder, he created a myth in his “Nobel” acceptance speech:

“In his Nobel lecture, Friedman built on his earlier argument for a ‘‘natural rate of unemployment’’ by painting a picture of an economics profession which, as a result of foolish mistakes, had accepted the Phillips curve as offering a lasting trade-off between inflation and unemployment, and was thereby led to advocate a policy of inflation. It is argued here that, in fact, the orthodox economists of the time often did not accept Phillips’ analysis; almost no one made the mistakes in question; and very few advocated inflation on bases vulnerable to Friedman’s theoretical criticisms.” James Forder, “Friedman’s Nobel Lecture and the Phillips Curve Myth,” J. of the History of Economic Thought, v. 32, n. 1, 9/2010, 344.

But even he had described Markowitz’s [another awardee] dissertation work in finance as outside economics: “It’s not economics; it’s not mathematics; it’s not business. It is something different. It’s finance.”

::applause::

There is never a bad time to re-up this topic. It’s one of the cornerstones of neoliberal macroeconomic misanthropy. This odious insiders’ club of science-penis-envy ne’er-do-well’s are indeed co-opting a brand that is, to be completely honest, otherwise tarnished anyway – see the Nobel “Peace” Prize, for example. Again, one of the reasons NC is so important is because of its commitment to airing heterodox economic voices, and shining a light of this sort of sleight-of-hand.

Bravo!

There are other famous awards: Fields medal (mathematicians under 40), Pulitzer Prize (journalism), Booker Prize (“awarded each year for the best novel written in English and published in the United Kingdom or Ireland”).

Of course, if the Swedes had named it the “Scrooge McDuck Prize in Economic Science” they might have had an expensive fight with the Disney Corporation.

Sir Arthur Eddington defined science as ‘the attempt to place into order the facts of experience.’ Based on this definition, I don’t see scarcity-based, political economics or psychology or mathematics (pi) as categories for improving our rational behavior, nor for a better understanding of Nature. I would bet that we’d be far better off if natural principles could somehow unify these areas in the way that they do for chemistry, physics, etc. In not being natural, we continue to risk our lives.

The difference between a science and a pseudo or semi-science is that a science can afford to make fun of itself. Even statisticians regularly make fun of their profession; economists do so less often.

See https://improbable.com/ig/winners/, home of the Ig Nobel Prize and the Annals of Improbable Research. Don’t forget its predecessor, the Journal of Irreproducable Results.

Note the presence of a well known economist in the picture on the Ig Nobel site. So the profession isn’t entirely lacking in a sense of humor.

Great post. Thank you. So, being a bit…um…silly here, I get the idea the not-the-Nobel Prize was designed as “prize” for economists who justified neo-classical economics in the late 1960s, aka the Milton Friedman economic cover story for TINA economics. ( too harsh?) / ;)

I found the 10 minute video referenced in the original post’s link to 538. Very good explanation, imo. Hope it’s OK to repost the link to that video here.

https://www.youtube.com/watch?v=dLtEo8lplwg

The most glaring thing about the so called Nobel prize in Economics is the dominance of a school of economics in its awards, above 50%, over decades since its establishment.

One more short comment: several years ago I ran across a thin book by Gertrude Stein titled Money. It is from her ¨A rose is a rose is a rose¨ phase, but has a number of interesting comments. One of my favorites is her observation regarding taxes (and other things) that Money is collected odd and spent even. She points out that there is a Qualitative difference between Money spent and Money collected.

Thank you for this post, Yves. Way interesting. The quotes by Barbara Bergman were wonderful. Even v. Hayek. And the quote from Picketty sounds a lot like the opinions Fukuyama was expressing in his interview that (Picketty:) “It is not the purpose of social science research to produce mathematical certainties that can substitute for open, democratic debate in which all shades of opinion are represented.” As Fukuyama was lamenting that neoliberal economic policies precluded actual democracy. One thing to consider is that all the vested pigheads in Congress have been given the means to prevent any form of progress they perceive, paranoid or not, to be ultimately against their own secular interests. That is one problem with our “democracy”. Both democracy and economics are imprisoned by vested interests.