Before those of you who are in “I’ve got mine” mode about the widely anticipated announcement that Biden will be forgiving $10,000 of student loans for every borrower making less than $125,000 a year: your humble blogger has for many many years advocated debt relief along with fundamental reforms of the student loan program.

This Biden scheme doesn’t even rise to the level of a band-aid over a gunshot wound. It leaves the system that has grotesquely inflated the cost of higher education. For any child not born of affluent parents (or say getting a very hefty scholarship), the choice is foregoing college or taking on a lot of debt. Long gone are the days when kids could earn enough to go to a pretty to very good state school by working over the summer. Why not direct less money to debt relief, particularly as we’ll discuss soon, it is mainly a subsidy to the better-off, and start giving more Federal support to state colleges and universities?

And this grotesque system, of loading up young people with debt even before they’ve made key life decisions, like where to live, whether to get married and have kids, has created a new rentier class, in the form of a greatly enlarged and overpaid cohort of administrators…who have a very strong propensity to vote Democrat. So Biden has kept the subsidies to this voter block very much intact by refusing to do anything about out of control, unsupervised lending.

Remember: nothing, not a single thing, is being demanded of banks who made questionable student loans or the schools who gave students unrealistic information about their future earning prospects. One would think it would be a no-brainer to impose automatic penalties on lenders and schools whose borrowers had delinquency rates over a certain level, and inspected the next tier and imposed fines for bad practices.

So what are we going to do, keep throwing money at a bloated, elitist higher educational complex, and then pretend that this isn’t as grotesque a system as it appears to be by large scale writeoffs every decade or so? Doesn’t the magnitude of the debt cancellation say the time is overdue for root and branch reform? But oh noes, can’t break those rice bowls.

Or how about, as we and many other proposed, having student loans be dischargable in bankruptcy, as they were before the 2005 bankruptcy “reform” that Biden, as Senator from MBNA (a major credit card lender) helped push through? Businesses that make bad decisions get to restructure their debts and carry on. Individuals who have a run of bad luck (big medical bills, job loss, divorce) can also either write off their debts or enter into a court-supervised repayment plan…except for student debt. It’s perverse to have this one type of lending be carved out as sacrosanct.

Even though the Biden scheme is means-tested, it isn’t all that much, with the result that the program mainly benefits higher-income borrowers. Biden is expected to announce debt relief of up to $10,000 to borrowers earning up to $125,000, as well as extending the debt payment freeze that started in March 2020 another four months.

One can take the cynical view that capping the amount of debt cancellation was designed to favor more affluent borowers. For starters, the relief could have been means tested more strictly, with the $10,000 stopping at $80,000, and allowing even higher loan cancellation amounts to lower income borrowers. Instead, as the Tokenist notes:

For several months, Democratic lawmakers, labor leaders, and civil rights organizations have pressured the White House to cancel more than $10,000 in student debt. They allege that black or lower-income students are disproportionately carrying greater debt loads. The model estimates that households in the top 60% of the US income distribution would get between 69% and 73% of any debt forgiveness….

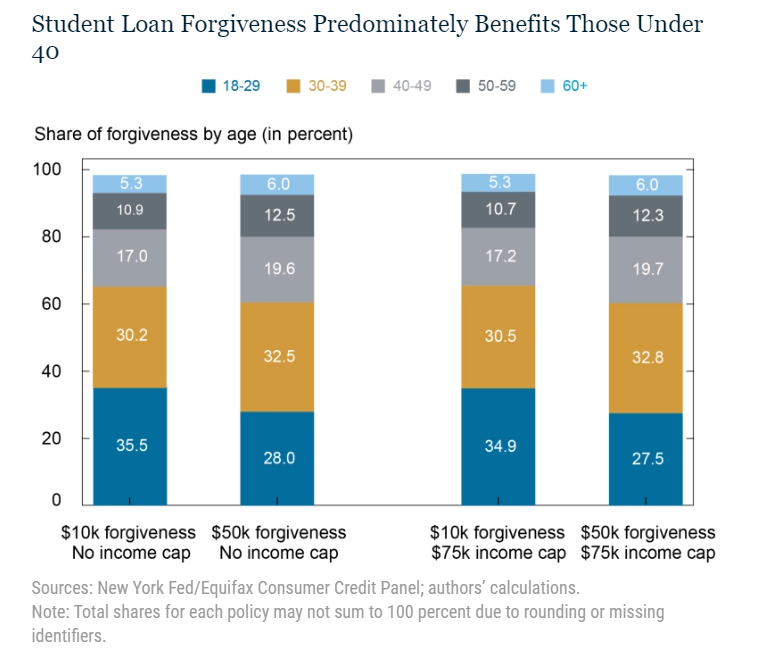

According to the New York Federal Reserve, Americans aged 25 to 34 are most likely to have student debt. The chart above also shows that only 57% of student loan debt is held by borrowers under 40, although 67% are under that age. This indicates that individuals with higher balances are more likely to be older.

How about the politics? This measure sure looks like it intended to boost Democratic party fortunes in the runup to the midterms. But how much of a difference will it make? The college-educated skew to Democrats already. Conversely, the young tend not to be big on turning out to vote at midterms. If they do, the trigger is more likely to be abortions, particularly in “purple” states where attorney general, district attorney, and state legislature elections will be seen as important.

Some Republicans argue that the debt cancellation could trigger a backlash; a contact in Ohio say that non-college educated workers in Youngstown see this as a reminder than their needs don’t count. A new CNBC poll found that 30% of voters believe student debt should never be forgiven. We’ve seen some of our readers get very upset because they did pay off their student loans in full and don’t see the justification for selective relief.

But one widely believed canard is that this debt break will be inflationary. The aforementioned CNBC poll found that 59% were concerned. If student borrowers were paying on a current basis, that could be the case. But remember, what matters most for inflation is what happens in the next 6-12 months, since the Fed is determined to kill the economy stone cold dead and may succeed. And even if not, we’ve shown how this inflation is not the result of too much demand, but supply factors like high energy prices, supply chain breaks, and many workers still staying out of the labor market.

Remember, student loan borrowers have had their payments on hold since March 2020. So this payment cancellation will not add to their present spending power, but prevent a charge from resuming. And if the Biden Administration hadn’t cancelled some debt, it would likely have extended the payment moratorium longer or ended it gradually.

If we have protracted inflation, and it looks like too much demand is becoming a driver, then yes, this debt break could make a difference. But those conditions are not now operative and they may not become operative.

In the meantime, the politics bear watching. Republicans will try to stoke jealousy. And they might succeed.

Almost… …Clintonian in its vapid symbolism, no?

How can they possibly expect anyone to take this seriously?

Just enough to disappoint those it claims to help and anger those who feel it’s a handout. The Dems have really perfected this into an art form.

It’s a big tent!

This.

Always this with the Dems.

Like the promised $2000 pandemic relief checks that were lowered to $1200… Skinflint Dems, nickel and diming you to death! They deserve to lose, but citizens don’t deserve the alternative.

There were 5 candidates on the president election ballot in California. We need to stop lying to ourselves and have some courage.

Makes me glad I went to college in Canada and dropped out after one year. Felt like a scam having to keep loading myself with debt (even Canadian college was somewhat pricy as an American abroad) and I was too poor to keep digging that hole.

“So what are we going to do, keep throwing money at a bloated, elitist higher educational complex, and then pretend that this isn’t as grotesque a system?”

This whole article got me thinking about an incredible blog post from The Last Psychologist a decade ago called “Hipsters on Food Stamps”. Reread it and it’s still spot on and incredible insight into the psychology of this mess (and profane but hilarious). Hard to pick a pull quote, especially since the epic closing statement is less than family blog friendly, but this one sums up a bit of it:

“All the system had to do, starting around 1965, is not incentivize this madness. If there were not guaranteed student loans, up to any amount, available equally across majors and across colleges, independent of skills or promise or societal need, none of this would have happened. Easy money got us into this mess, and easy money will keep us sailing until we go right off the edge of the map.”

It’s a three-part post but worth a read for anyone looking for an interesting insight into the psychology behind our systemic reasoning for these kinds of means-tested less-than-half-measures and the PMC role in it all. Note: some crass language and themes but all done to aptly express the ideas in a blunt and memorable way!

Part 1

https://thelastpsychiatrist.com/2012/11/hipsters_on_food_stamps.html

Part 2

https://thelastpsychiatrist.com/2012/11/hipsters_on_food_stamps_part_2.html

Part 3

https://thelastpsychiatrist.com/2012/12/product_review_panasonic_pt_ax.html

It makes me realize how insanely lucky I was to go to a world-class state college that was cheap enough that work-study plus summer jobs was enough money to pay tuition and live a starving student existence. By the time I went to Harvard for graduate school twenty years later, I could afford to pay full freight.

Most people aren’t that lucky, and most of the ones that are don’t realize how lucky they are.

This is wrong.

“Live a starving student existence”

This is an important point no one is making: the rising cost of housing rent, particularly in college towns, also affects affordability. Even tuition-free college would still exclude a lot of potential students who could not afford to live near their desired college. Nowadays the starving student existence would also have to be a homeless student existence. We need a revolution or a total collapse and rebuilding.

Yup, “investors” buying up the student ghetto then a mix of slightly gentrified houses or former section 8 cinder block units with multiple tenants and cars over the lawn, and tear-downs replaced with “luxury flats” in the new “hot” area.

The local state university is one of the cheapest in the state. IIRC, a year of tuition costs about $6,500. A year of dorm room and board costs … about $6,500. At least first year students are required to live in the dorms with a meal plan (reasonable, but expensive).

At most universities the student housing is technically a separate venture and is for profit / self-sustaining. But student loans can be applied to paying these organizations. University housing has been so badly managed at many universities that they can’t afford upgrades, while they cry that if the dorms aren’t nice enough no students will choose to go in debt for their university. So it’s either Wall Street bond funding or the new thing: partnering with private corps that build new dorms on land leased from the university. The university gets the building in 50-70 years, the corp gets the money before handing over a building that needs to be demolished. The university contractually guarantees occupancy/revenue and must make up any short falls (yeah, Covid was problematic).

My local uni has one, I once called it “the super 8 on campus” in front of the university foundation CEO and he got real mad at me.

Not to beat it to death, but when I attended U of Missouri starting in 1966, the semester tuition was 250 dollars. Anyone who had graduated from a Missouri high school was eligible to attend. The freshman attrition rate was around 50%. I seccond Yves comment about better funding for state schools, but higher standards would also help – with the side beneffit of producing graduates who know how to write and string two thoughts together.

It use to be that under California Master Plan for Higher Education My parents entirely and myself partially went to college under California’s Master Plan, which is effectively, although not officially dead. It has been since about 2000. Funding for K-12 education has cut enough so that it is only very partially as good as pre Proposition 13 or 1978 unless you look at upper class neighborhoods or good, but very expensive, private academies like the Marin Academy; add the concurrent cuts to the community, state, and university college systems with the increasing tuition (officially “fees”), books, housing, and the requirement for laptops and cellphones and the reduction in aid especially for grants with the increasing costs of living never matched by income’s increases. I can also say that eligibility for aid has also been tightened so that while it is available on paper, it is often denied in practice, or at least an increasing amount of it.

Also, the difference between public and private aid especially with grants have become stronger when it comes to qualifying for SNAP, SSDI, SDI, and any other aid with the possibility of being prosecuted for “fraud” or more likely having benefits cut off and financial penalties imposed as well as income taxes. This is true if you only use it to go to school instead of buying cocaine because somehow there is a difference between public and private aid. Or something. If someone gives you the money for an education, have lawyers look at it real well.

Further, the ability to add another degree is limited by newish limitations on the number of extra degrees that will be covered for life. Got a bachelors twenty years ago and want to get another one in a different field? You can probably just drop dead. No retraining, re-education, or more learning for you.

Aside from some limited circumstances, unless you are willing to take those non-dischargeable student loans or belong to a upper, upper “middle” class family

with both the wealth and the social connections, you are not getting a bachelors degree.

This was the norm thirty years ago. The problem is that government support and College administration priorities are so changed it is like talking about a different world now.

What about they A/C tech that spent $20K on trade school and $10K on equipment? This is a middle finger to the productive class.

This is particularly galling to me as well. We need trades and we’re treating them like 2nd class citizens.

Remember that when your car breaks, your roof leaks, your toilet floods your house, a utility pole falls in your neighborhood and a crew comes at 3am to restore power and clean up the mess.

I don’t like this public policy choice, but I’d feel better about it if it included guys that spent thousands in tools and work trucks so they could help the rest of us when we most need it.

Anyone who bought a truck before 2019 has seen the value of that asset skyrocket.

A worker who needs his truck to work isnt going to able to realize that gain. What’s he going to do — sell the truck and buy another equally expensive truck? And of course those who need new trucks now are really screwed by that increase in price

Well,Tucson tradesmen tell me that gas/diesel and hardware prices are killing them. Yes they try to pass those on, but their customers are often insulated from the reality of all the driving required. Electricians have standardization in their favor, plumbers less so — they have to sort it out as they penetrate deeper into the problem.

Why wouldn’t trade school debt be covered?

Also, here in Massachusetts you can learn a lot of that at technical high schools and paid apprenticeships.

I propose that the unit of Biden debt relief be called a Corinthian.

Named after one of those infamous debt mills masquerading as so-called colleges. Follow the link to see how many campuses were in that network of fraud.

Now, which debt relief amount to select?

$10,000 for the current, uh, effort, or

$5,800,000,000 for the fraudster version :/

This is needlessly complicated by design, but some of the debt from tuition to for-profit schools has been cancelled or is in the process of being cancelled.

Over $1 billion has been forgiven

It’s trademark jack-ass policy. Any idea how much a nurse practitioner education costs? Certainly, like anything else, a hell of a lot more for a poor person than a rich person!

And what’s $10k for a $200k debt? And even that relative pittance is off limits for someone who made the choice, did the hard work, lived on ramen for a half dozen years, and is now making $125,001 a year?

Allow bankruptcy, fund public education, and put the eligibility gatekeeper caste to work strangling the institutions.

They should get any debt incurred for trade school forgiven. Most of the time trade schools are operated through universities or community colleges and student loans can be applied. So I’m realty, this does (or can) apply to a lot of people with trade certification. The equipment is a business expense that can be depreciated via taxes.

I went to a state college in Pa during the 60’s. I live at home and commuted 10 miles a day to and from school. In my first year tuition was $50 per semester. Books ran about on average $20. You could buy used books for next to nothing. The next year tuition was raised to $75 per semester and stayed the same for my last 3 years. I graduated with a teaching degree and started out for $4200. It took me 20 years before I made $20,000. After 35 years during my last year of teaching I was making $49,000. I had an MA and 39 additional graduate credits. In my entire working life I made a little less than a million dollars. Presently with my pension and SS I make more than I ever made working.Because my teachers pension isn’t taxed by the state I have far more spendable money than I ever had while working. Pretty good for a child of parents without even a high school diploma. When I went to college student loans weren’t available so college graduates could graduate free of debt. Probably the biggest thing that made college so expensive was the availability of student loans. I was the driver for the cost of an education becoming too expensive.

Those who support debt forgiveness, always state the ‘economic benefits’, without examining the benefits of other forms of the use of public funds. I guess it is always preferable to funnel money to ‘deserving’ higher-income brackets and indirectly to ‘deserving’ institutions of ‘higher-learning’.

Like which ones — 50 billion to Ukraine, decade long wars in Afganistan, infinite handouts to the 0.1 percent via monetary policy?

The bar for effectiveness with regards to government spending should be against the prevailing interest rate. If government spending can boost growth by a higher percent than they can borrow at they should do it. And actual GDP growth does a pretty good job of ignoring rentier capitalism where money is just being moved around to administrators or already high income individuals.

Besides how bad it is to use the orwellian “forgiveness” framing, this leaves a lot to be desired.

So if 10k of clemency isn’t a step in the right direction, please, tell us what is?

With the whole finance system successfully having painted higher education into a corner, should we just let the good be the enemy of the perfect?

Additionally, there’s a lot of very weaselly points made in here, points that many of the PMC like to make to prove that there is no alternative (thanks mayo pete). Saying it’s some sort of give away, when the money has obviously already been given away, is false. Trying to hold “the banks” accountable for the bad loans, when these are publicly held contracts (made through brokers) is misleading. The borrowers with extra additional private loans for their ivy league education will likely still be on the hook for them in full (unless Biden really is going to start spending his executive branch budget in the credit markets.) Trying to hand wring about Republican backlash because a poll finds 30% of voters think this debt is immutable is quiet ridiculous. 30% is the resounding number of butthurt Republicans who will never say a government action is good and still want a second Trump term. So how many of them were going to vote for Biden either way?

If you really want to focus on the electoral gamesmanship of this whole thing, it’s much easier to see the 30-40yo cohort is going to be the biggest winner from this, and the Dems will have successfully bribed them to go out to the polls. That cohort will be the ones that suddenly can afford to have a child, or a down payment. Those older people who have paid down most of their loan, and only have a couple grand left on the balance will be able to brag to their boomer parents Biden’s mercy actually gave them financial freedom. Dems will be able to make the case to all of the sub-40yo demo that they need more legislative seats to do even more in the future, including reform the grant and loan programs. Or else, they’ll never see this type of jubilee again. They can make the case that the Kirstens Sinema of the world won’t be the final negotiator to sink this stuff. Whoever is that magical 50th vote will be the new king. Especially in GA with Warnock, he’s been riding hard on this clemency stuff, and if he wants to keep his seat, he needs to make the case the DNC Machine can deliver.

That cohort will be the ones that suddenly can afford to have a child, or a down payment

you’re delusional if you think really think 10 whole thousand dollars is going to make an impact on anyones life outside of those who just got loans so the miracle of compound interest has not had time to work it’s indefatigable magic. Another increment to badger your lessers with. You reveal your partisanship several times throughout your comment. You don’t want the system as it is to change, and you don’t see all of it’s shortcomings because you profit from it. i see this constantly in my daily life. Your claim that 30-40s have been “bribed” really says it all. That’s really what it is. Nothing about this will flip a maga voter. The DNC machine delivers all the time to the socialists at the top who’ve consistently had their assets pumped, not by a measly 10,000, but 100’s of thousands (house values), millions, (the stawk market) and billions (carried interest anyone?)

But yeah, what are “we” supposed to do to get you plebes to vote for a claque of shameless grifters over a clown. At least the clown is funny. Oh and by the by, Trump gave out cash, and brandon owes me 600 bucks.

“You reveal your partisanship several times throughout your comment.”

Fun fact, I’ve never voted for either party.

The fact you think accusing someone of partisanship can discredit them shows how disconnected from reality the discourse is around here all for the chance to lob potshots. Imagine accusing someone who actually believes the earth is millions of years old as being a partisan because they don’t indicate they tow evangelical line for the GOP. You’re just proving Noam Chomsky correct with this absolutely brain dead fallacy, all while the site comment guidelines claim to not permit this stuff.

But yeah, now that we’ve seen Pell Grant recipients are getting 20k chopped off, it’s not unreasonable that someone with a 40k debt and a 250$ monthly payment, getting that chopped in half, might actually convince themself they’re now financially stable enough to have a child soon, or that replacing their unreliable 25yo Nissan would be a good investment and that the bank agrees.

So if 10k of clemency isn’t a step in the right direction, please, tell us what is

Who is us?

30% is the resounding number of butthurt Republicans who will never say a government action is good and still want a second Trump term.

No, that’s not partisan at all… (eyeroll)

Those older people who have paid down most of their loan, and only have a couple grand left on the balance will be able to brag to their boomer parents Biden’s mercy actually gave them financial freedom

This has two parts, one what about the borrowers whose balance keeps increasing, a not insignificant number, and two, bragging about mercy equals partisanship, once again.

Whether or not you like it, partisanship discredits your argument.

A 25 year old Nissan is not only a good investment, it’s a better car than today’s Nissan. Hey, you brought it up.

Back in the “good old days,” college loans were a good way to establish credit. Many of us did just that. We also were encouraged to learn, not become some sort of brainwashed, non-thinking serf.

In the U.S. is it like it is in Canada, where paying off a student loans does nothing for your credit score at all except to not make it worse than if you were still paying the loans? They also cannot be discharged in bankruptcy here, and if you have student loans and are young enough to try to join the military (once an economic lifeboat of last resort), you will be turned down for having the student loans.

Am I the only one who thinks this is pretty great?

Obviously it could have been more and college should be cheap in the first place and means testing is dumb. 100% agree with all of that.

But this is still, I believe, an unprecedented victory, rather than some little neoliberal Obamacare subsidy. What’s remotely similar to this policy? Wiping away 10k dollars of debt represents a HUGE amount of money for me and everyone I know.

Look… I’m not usually out here thanking my masters for the political crumbs they throw my way, like the inflation reduction act or whatever. But 10k erases the remainder of my student loans and is enough to make a huge difference in the lives of the students I teach as they graduate and begin their adult lives.

Today is the culmination of a decade of organizing and agitation, birthed in the assemblies of Occupy Wall Street and raised up through the Debt Collective and Bernie Sanders campaigns. What was unthinkable 10 years ago is about to be a reality, to some degree.

No knock on your otherwise very good and much needed critical analysis. But today is pretty great if you ask me.

My takeaway from Yves’ post — which I agree with — is that needing to do this should de facto tell us the system is broken. It’s the doing this while refusing to fix the system that is hypocritical and the issue. Not that giving money to struggling individuals in our society is a bad thing

Too many beneficiaries of the current regime.

Milo Minderbender would remind that they all get a piece of the action.

Or has Catch-22 been cancelled or taken off syllabi?

It is so hard to tell these days.

“Doing this while refusing to fix the system that is hypocritical and the issue.”

Yes. My niece started college last week. Will she and her classmates be eligible for $10k of debt forgiveness 4 years from now? Will this a new benefit going forward, or will the upcoming debt forgiveness be a one-time deal that mostly benefits people who were lucky enough to graduate in the few years leading up to 2022? I’d honestly like to know, but I doubt I’ll hear an answer. Biden has proven himself an expert can-kicker.

The whole federal student loan program is an utter flaming mess. I consider it one of the most destructive programs ever initiated by the federal government. Biden’s upcoming actions are unlikely to fix it.

My understanding is this will be a one time deal.

My biggest long-term concern is this will serve as a pressure release valve for American’s growing rage over higher education in general and specifically the problem of debt-fueled tuition inflation, buying the system another 10-25 years through immeasurable immiseration.

So… it’s a one-time deal. I truly appreciate your letting me know. Thank you.

Now if I could just figure out if the “one-time deal” aspect makes me happier or more angry. The fact that I’m having trouble making a decision makes Objective Ace’s conclusion even more apparent: The system is broken.

I’m with you. Compare this to other changes that could have been and it’s underwhelming. Compare it to doing nothing and it’s great. Talking point of it only benefiting the wealthy is a bit oversimplified too.

I paid my loans off early for peace of mind and wicked high interest rate. But if I had just let them ride then this measure would net me like $5-10k. But you can’t let something like that make you bitter.

It’s not about fairness. It’s about fixing a problem. This 10k is pissing in the wind. Fix the problem. That’s what these fools were elected to do, remember?

Agree. My wife and I have paid off nearly 100k in student loans. For us, money well spent. I’m going to cheer for those who get some debt relief. Millions of people are going to have a lot less financial anxiety if they do indeed forgive 10k. The last thing my wife and feel about this is anger; this is great.

Well, bless your and Nick’s hearts! And anyone else whose heart is feeling some measure of relief today.

Not to rain on your parade, but history–recent history–suggests you may be counting your chickens before they’re hatched.

I feel I need to remind you that there is / was a loan “forgiveness” program in which many student borrowers participated that did not deliver as promised. Borrowers who took “public service” jobs after graduation and made their monthly payments as agreed for ten years were supposed to have their remaining balances “forgiven.” But when the ten year mark rolled around, all kinds of hell broke loose in the form of “documentation” snafus, and very few actually got what they were promised.

Then there’s the infamous biden “promise” of $2000 that became $1400 if two guys in Georgia got elected.

Not to mention the “Inflation Reduction Act” that doesn’t reduce inflation at all.

I really, really hope you and Nick and everyone else gets what seems to be being promised. It’s just that pulling the rug out from under people after the votes have been cast–because technicalities–has become a time honored democrat tradition.

I’m with you. Here’s another positive: Those with Pell grants can have up to $20K forgiven.

According to the WAPO, this will cost the Feds around $240B, so this is fairly significant. Also according to WAPO, even though most of the debt is in the form of large loan balances, 33% of all debtors have balances less than $10K and another 20% have balances of $10K-$20K. So, this is a big, big deal for a lot of folks.

Perhaps the biggest positive is that this establishes the principle of student loan forgiveness. This is likely just the first installment. Lots of “mini Jubilee’s” will eventually add up. Let’s be patient folks. This country progresses incrementally–too fast for some, too slow for others.

Its pretty easy problem: allow partial or full discharge of Higher Ed loans in bankruptcy based on showing of economic hardship, then leave it to judges to address individual cases. They pretty much force everyone into 11’s now anyways. Maybe make the bankruptcy plan run 10 years for student loans (that seems to be the amortization schedule that the establishment thinks is “fair”). That way, legislatures don’t have to deal with unintended consequences or pick winners and losers.

Further, how about statutory limits on tuition and requiring secondary education institutions limit the % of administrative bloat to qualify for federal aid, since they are getting the benefit of federal money. I would want to limit what they spend on athletics, but that would probably be communism.

The student loan program is primarily a federal subsidy to an undeserving higher education complex. Questions about reckless private lending are rapidly falling by the wayside because the federal juggernaut has become the real problem.

Something around 80% of all outstanding student loans ($1.3 out of $1.59 trillion USD) are direct federal loans, meaning that (as a result of changes under President Obama) the federal government is the lender on the overwhelming majority of student debt. (Recent numbers taken from Wolf Street: https://wolfstreet.com/2022/08/07/are-federal-student-loans-even-loans-from-forbearance-to-forgiveness-to-taxpayer-expense-fairer-solution-allow-bankruptcy/)

The remaining amount is a mixture of Federal Family Educational Loans (“FFEL”) and fully private debt. FFEL debt was issued under a public-private arrangement whereby private financial companies issued loans under certain federally mandated terms and the loans were in turn insured by the federal government in case of default. The FFEL program is now dead but loans under that program still are out there. FFEL loans can be refinanced with the federal government (which of course results in the federal government becoming a lender to the refinancing borrower).

(Side note: It’s generally a good idea for FFEL borrowers to consider this refinancing, as it tends to lower the interest rate while keeping similar borrower protections to the original FFEL loans.)

The massive involvement of the federal government in the issuance of student loans means that a Democratic Party administration will have no interest in correcting the problem. Under the current federal direct loan program (the main issuer of student loans, remember), institutions of higher education, notoriously core Democratic Party constituents, receive significant federal money that is easy to acquire (just add students) and have no direct accountability for how this money is spent (student loans are not grants).

The Biden Administration’s offering selective student debt “relief” smells of buying loyalty among aspiring members of the PMC that were not too “successful” (as that term is usually used today). Federal policies relating to higher education financing (both in terms of loan program and bankruptcy rules) probably are the main reasons for sky high prices. Offering a loan “discount” only to some people implies that the general student borrower population for the last few decades did not overpay, but that is not the case because prices were artificially elevated for all of those borrowers due to bad governmental policy.

My view remains that any debt forgiveness must be tied to direct reforms in pricing. Higher education is an area where direct price controls may even be the best choice because it is a critical national service and the barriers to entry mean that no classically functioning market is even possible. I also agree that some kind of claw back must be implemented for schools where too many students have trouble paying loans–in fact, I would institute such a program on a degree/certificate basis because some individual programs may be financial traps while the school in general has a good reputation. Regardless of the method, however, giving current borrowers a discount doesn’t resolve the problem for next year’s borrowers, etc. And because debt relief has this limitation (unless it’s going to be a regular action every year?), this underlying reality reinforces (to me) the sense that the present relief proposal is just vote buying.

It’s usually Chapter 7 (liquidation) or Chapter 13 (payment plan) for individuals. Chapter 11 for individuals is, to my understanding, something that would only be appropriate for very high net worth individuals.

With that said, I think student loans should not be treated specially in the way you suggest. Chapter 13 is a 5 year payment plan and student loans should get crammed down to fit as well. Recognizing that student loans are, however, an unusual kind of debt–they’re unsecured loans but the item they funds is an intangible thing not subject to resale–some kind of reasonable attempt at payment rule or other similar restriction might be appropriate. Not the historically onerous “undue burden” standard, as actually applied by the courts in all but a few recent cases, but rather some kind of “good faith” rule, perhaps. Unfortunately, this kind of rule is necessary because otherwise some people (inevitably people who stand to earn higher incomes) will game the bankruptcy system.

So what are we going to do, keep throwing money at a bloated, elitist higher educational complex, and then pretend that this isn’t as grotesque a system as it appears to be by large scale writeoffs every decade or so?

Yes.

To the extent that there is any “plan” at all, this is it. And gratuitous, periodic pressure releases like this current “forgiveness,” conveniently synched with “elections,” are a necessary part of keeping it going.

This is the price you pay for maintaining the illusion that a financialized “economy,” that produces nothing yet requires perpetual, exponential “growth,” is viable long term.

This addresses a demographic that has not seen any benefit from government in a long time, so it will be interesting how it is received. Of course it’s incremental and political; everything is. Don’t toss the baby out with the bath water.

Let’s not forget that when college was cheap there was a “crisis of democracy” as the trilateral commission put it. Turns out that when you have people learning about the world and unencumbered by debt – they start trying to change things for the better and of course that’s no good for the ruling class.

Since then an entire system has been created to give virtually everyone a 16 year old should trust an incentive to overload them with loans. From a high school guidance consoler who needs x% college placement to the colleges themselves to banks (to at least trust that they wouldn’t write a bad loan) all while society/peers pushes them toward even more expensive and private schools or makes them feel like a failure.

And now activism as been reduced to a tweet while these kids try to navigate a difficult financial world with 200k in debt and a sociology degree.

“It leaves the system that has grotesquely inflated the cost of higher education”

Bingo

So by guaranteeing student loans and making the debt non-dischargeable a ways back … the cost of College Ed went way up — say…just a conservative figure – 1 – 2 trillion dollars. And now the problem is putting out 10,000 of the debt and GEE Wiz it’s just to much and it’s so unfair that x might get more than y.

What a scam in the first place – inflate the costs beyond reason with a finance tailored bill and then after all the “consumers” money has passed hands into an inflated system….now we are going to use tax dollars to pay a huge portion to the same schmucks who lobbied for the bill.

I do wonder if the money will be paid to banks, or simply erased…

If it costs the budget a bunch then it is to be paid to creditors by Gov – Thats my view of it.

Its like the ACA — it makes it affordable to the consumer by having the Gov pay the difference to health insurers and the whole Financialized Health industry.

Supporting the rent seekers is the major function of our government. Much more important than concern about the quality of health care or education.

Another consideration I have is that intellect is not confined to those with money. We have to be missing many people with ” brains” who are inhibited by cost to forego higher education. This society is poorer for it.

I wonder if the supposed ten grand will be applied to principal or just outstanding “balance.”

From Forbes:

Unless it knocks down the principal, it’s just a temporary hiccup in the brilliant business plan of “earning” money from money you never lent in the first place.

https://www.forbes.com/sites/adamminsky/2021/08/12/for-many-paying-student-loans-doesnt-stop-balances-from-growing-advocate-push-cancellation-as-a-fix/

Almost certainly erased.

President Biden has no general power to compel a private lender to write off part of a loan. He does, however, have arguable powers to readjust (including write down) part of student loans held directly by the federal government. Since federal direct loans are now the overwhelming majority (~80%) of the student loan “market” (see my big post below), the federal government will just partially erase/adjust the obligation.

Now as Katniss asks, I don’t know if this is a principal or balance reduction. Knowing this administration, I suspect it will be the latter.

With that said, I cannot stress enough that student loans are mostly NOT a private bank problem anymore–they are an issue of federal government behavior. I urge everyone to keep that in mind because, as much as the banks deserve criticism and scorn, they aren’t fairly the main target in this one area of student loans.

“He does, however, have arguable powers to readjust (including write down) part of student loans held directly by the federal government. ”

This is the part I don’t get. Isn’t this spending money that hasn’t been appropriated by congress?

Spent yesterday morning at CSU Veterinary Teaching Hospital getting our dog’s pacemaker checked out… again*… via the emergency room, in an end run around the system that would have had us waiting weeks to get an appointment on the schedule of yet another resident cardiologist. Our dog’s heart and lungs were fine; it’s his back that’s bothering him to the point of effecting his breathing.

The cost was $611 of an $865 (80%) upfront deposit on the estimate, just to begin the process of getting him some serious medical attention. I waited for an hour to get that estimate in the Urgent Care room, directly across the hall from the hospital director’s office, while watching the ‘propaganda/marketing channel’ streaming baby animal rescue documentaries (mostly baby raccoons in Nova Scotia), where apparently the entirety of those dedicated teams do that exhausting round-the-clock work out of the goodness of their highly educated and virtuous hearts. Money is never mentioned… or what happens to those cute little trash pandas once they get too big and numerous for their three hots and cot.*

I grumbled about the money and those two chipper young women (emergency medicine resident and a tech from UC Davis) suggested serenely that ‘we should have purchased insurance’ for our dog. I countered with how rescue schnauzers these days almost always came with pre-existing conditions, if the owner bothered to look or take their new furry friend to a veterinarian, and that insurance companies are not charities, they’re in the business of making money and inclined to take a dim view of that breed, while the pet owner is highly likely to be using that insurance early and often, and so the owner was looking from the get-go at higher premiums to the point they may wonder, why bother? Much like health insurance for humans. Were they put off by my argument? Not in the least. They’re in training for spending thousands of other people’s money (carte blanche to their credit cards) without a shred of guilt, in a room where the mark is being softened up by streaming cute baby raccoons attended by highly educated, not yet canonized selfless saints walking the Earth righting wrongs, cross from director’s office who seems to have an ‘open door’ policy. Re: he’s listening and watching.)

Bear with me, I have a point around here somewhere (pats pockets)…

After fifteen years of taking our dogs to that teaching institution I’ve been witness to its slow transformation from humble cheaper alternative to local private practice veterinarians, to CSU cash cow much like the football stadium. I can instantly tell which of the techs/residents before me in consultation took out student loans to be there, and which had their educations paid for in advance (mom and dad, grandparents, trust funds, scholarships, grants).** They would graduate debt free (or an amount so small as to be quickly dispensed with). The two in front of me in the Urgent Care waiting room double-teaming to jack up the bill were in the latter category. When I say ‘jack-up’, I mean making sure that as many departments as possible ‘got a piece of the action’ – billable hours/billable procedures – all well reasoned requests x 4 departments = $611. Oh, and while I made an appointment on the phone for Urgent Care, they still billed through the Emergency Dept. (at the higher rate) to gain the attention of Cardiology (and the cardiologist recommended by the last resident, now teaching at the University of Georgia (and the one before that got hired to teach at Cornell… the last two internists joined specialty veterinary practices).***

Will $10K in debt forgiveness make much of a difference for those students? Most of them don’t need the help, and for rest who borrowed, it’s far too little. They are almost guaranteed jobs when they graduate but will spend decades paying it off and may have incomes too high (just) to qualify for the $10K. Yeah, I knew there was some kinda point to this too long missive.

*I kept wondering if raccoon coats were making a comeback in Nova Scotia. So many little raccoons who would become bigger raccoons, and then released back into the wild to fend for themselves after being raised in captivity?

**Something in their carefree or careworn demeanor. The trust fund babies look fresher and better dressed. I could hear the indebted residents complaining to the techs walking beside them (usually about money) from across the parking lot. The students in the program these days tend to be mostly female and from monied backgrounds. It threw me when I heard the name of the new cardiologist. A male?! Until I heard his last name… ‘ah, that explains it, he’s Chinese.’

***CSU is graduating and then training a lot of future professors for universities who would like a piece of CSU’s action for their own veterinary programs, by marketing the new staff’s college pedigree. Like selling puppies born of an AKC registered mother. It’s all about the breeding, grooming, and training. Thus the medical care at CSU feels increasingly elitist, and the price tag all around for services rendered for both students and owners.

If any California veterinary programs/departments are still creating full or even assistant professors, they’ve been missing the academic tenured position elimination boat for some time! /s Don’t tell their chancellors/presidents!

IMOR, I have a feeling Lexx may be talking about Colorado State. I have heard nothing positive about that place from friends whose animals have been treated there(horror stories) or through having to deal with it myself due to my research field. I got the vibe that it’s just about raking in as much $$ as possible in every way.

I don’t think he’s talking about California. It is very, very hard to get an appointment at UC Davis these days. And they are not jacking up prices or and they are definitely not pushing treatments.

Colorado State University – Veterinary Teaching Hospital.

The veterinary technician was on loan to CSU from the University of California – Davis. Don’t ask me how that works, since I didn’t ask myself.

I’ve never had any student loan debt. I think it should all be wiped from the books because the whole thing is a racket. Take a serious look at public university finances through the journal of higher Ed or similar. Admins have been “running them like a business” for 20+ years now and it shows. For university administrators, running the organization “like a business” essentially means turning them into poorly managed real estate development firms. Most of the organizations are in far worse debt situations than graduating students. It’s papered over by the endowment and property value, but it’s serviced by raking students over the coals. And that only works so long as the student loan cycle can continue.

Reading through the comments I’m sort of surprised there isn’t any recognized analogy to the just forgiven PPP loans. Which were only supposed to pay 1% interest even if they weren’t forgiven. (Were any repaid? I didn’t see that headline). The AC techs and plumbers and electricians likely saw some of that largesse, whether on their own behalf or via their employers.

And I’d submit there is some relevance. The PPP loans propped up some zombie companies and precipitated some outright frauds, just as student loan programs propped up some bloated useless college bureaucracies and some fraudulent degrees. While sustaining some worthwhile enterprises and some deserving students.

And in the face of that all too recent forgiveness it’s hard to see this proposal as anything but a pitiful performative gesture. aka The Democratic Brand (see also kneeling in kente cloth). And true to that brand it will please exactly nobody. I can’t picture the voter who will be motivated by this either way. Another Biden nothing burger.

Its not comparable at all. The PPP loan program was a short-term stimulus in response to COVID lockdowns that shuttered businesses. The government shuts down your business in the name of public health, then hands you money to stay afloat. Student loans are a long-term economic drag, and essentially transfer wealth from a young up and coming generation to the bloated financial industry and the higher education industrial complex. Different cause and different political solution.

I agree, at least in part, with Amateur Socialist. The PPP was rife with fraud, as is the student loan scam. This doesn’t mean PPP was a complete boondoggle, but a large chunk was. The same with student loans that benefit scam outfits such as the ITT Technical Institute. The government will provide large sums of money for programs that ultimately benefit entrenched business interests. For programs that benefit everyday people the government is very miserly.

“Long gone are the days…”

True.

Why is that?

Thanks. And thanks for bringing up the irresponsible lender (with government backstop) angle. Arguably capitalism where “failure is not an option” is not capitalism at all since the capital providers are supposedly being reimbursed for their risk. And it’s certainly not socialism when it’s “from each regardless of their ability to pay.” What it is is a grift.

The craziest thing about student loans is that as committed Neoliberals, we understand that returns are what they are due to risk. So if banks lend money to students that can not be written off in bankruptcy and which the gubberment guarantees, risk is exactly zero so return or interest should be zero. [Its a free lunch to banks.]

If you can’t cancel the debt, there is no reason why ed loans are not interest free or why interest is not cancelled. Further, this probably takes the banks out of the process, making it easier to reach a long-term solution (when the not committed Neoliberals perform emergency surgery in ER).

I love the sheep-like acceptance of the term “loan forgiveness”. Loans aren’t forgiven; they’re transferred from students to the federal government and the taxpayer.

This discussion conflates two issues; what to do with the existing loans and should we allocate government loan “guarantees” based on political power, not objective credit criteria? Three examples:

First, no lender would have given loans to students at these for-profit, on-line schools without government guarantees. But these schools were big businesses locally. Arizona and John McCain come to mind. This isn’t lending it is graft and corruption. I’m allowed to say that. But many art colleges, popular college majors and roughly half the traditionally Black colleges have default rates equal to the default rates of the on-line schools. Is that also graft and corruption?

Second, home loans. During 2008 we discovered both the lending criteria and the acceptance of false loan docs was driven by political decisions to expanding home ownership for “underserved” groups. This was politically motivated underwriting.

An even more troubling example is what was called “redlining”. Redlining is both racial and class-based. For class redlining read Jane Jacobs in “Death and Life of Great American Cities” on the Italian north end of Boston. Race redlining was based on the reality that White neighborhoods turning Black as people from nearby poor neighborhoods moved in had white flight, more rental units, higher population densities, more crime, lower resale values and higher default rates. And the defaults could not be covered by the sale of the properties because values were declining, so lenders made rational financial decisions to not lend there. Anti-redlining laws were passed but could not affect the underlying problem; all they did was force lower lending criteria and more defaults which had to be covered by increasing the interest rates on all borrowers- in other words a money transfer from borrowers with good prospects to ones with bad prospects.

Third, car insurance and credit card issuance. Risks here are usually not racial. In car insurance the risks are correlated with: car type, color and model (gray Toyota good; red Camaro bad), driver age and situation (young male bad; attending college good); arrests for alcohol (bad). For credit cards it is: out of wedlock births, shop-lifting arrests, parental financial history, etc.- basically everything matters. The result of prohibiting the use of some criteria is to give some people “second chances” by transferring the default costs to people who are better credit risks via the high 3% fee.

One may legitimately argue that correlation is not causation and that allowing lenders to use these correlations imposes a cost on individuals for things they did not cause. Eighteen year-old boys make the same argument; why should girls get lower rate? Politically determined criteria always help one person and impose a (usually hidden) tax on other people. So the bottom line is: “Should the government be in the private credit business at all” or should any benefits be “on the books” via direct loans and grants the public can see?

The student loan program is primarily a federal subsidy to an undeserving higher education complex. Questions about reckless private lending are rapidly falling by the wayside because the federal juggernaut has become the real problem.

Something around 80% of all outstanding student loans ($1.3 out of $1.59 trillion USD) are direct federal loans, meaning that (as a result of changes under President Obama) the federal government is the lender on the overwhelming majority of student debt. (Recent numbers taken from Wolf Street: https://wolfstreet.com/2022/08/07/are-federal-student-loans-even-loans-from-forbearance-to-forgiveness-to-taxpayer-expense-fairer-solution-allow-bankruptcy/)

The remaining amount is a mixture of Federal Family Educational Loans (“FFEL”) and fully private debt. FFEL debt was issued under a public-private arrangement whereby private financial companies issued loans under certain federally mandated terms and the loans were in turn insured by the federal government in case of default. The FFEL program is now dead but loans under that program still are out there. FFEL loans can be refinanced with the federal government (which of course results in the federal government becoming a lender to the refinancing borrower).

(Side note: It’s generally a good idea for FFEL borrowers to consider this refinancing, as it tends to lower the interest rate while keeping similar borrower protections to the original FFEL loans.)

The massive involvement of the federal government in the issuance of student loans means that a Democratic Party administration will have no interest in correcting the problem. Under the current federal direct loan program (the main issuer of student loans, remember), institutions of higher education, notoriously core Democratic Party constituents, receive significant federal money that is easy to acquire (just add students) and have no direct accountability for how this money is spent (student loans are not grants).

The Biden Administration’s offering selective student debt “relief” smells of buying loyalty among aspiring members of the PMC that were not too “successful” (as that term is usually used today). Federal policies relating to higher education financing (both in terms of loan program and bankruptcy rules) probably are the main reasons for sky high prices. Offering a loan “discount” only to some people implies that the general student borrower population for the last few decades did not overpay, but that is not the case because prices were artificially elevated.

My view remains that any debt forgiveness must be tied to direct reforms in pricing, and price controls may even be the most appropriate policy in this one area of higher education. I think that some kind of claw back must be implemented for schools where too many students have trouble paying loans–in fact, I would institute such a program on a degree/certificate basis because some individual programs may be financial traps while the school in general has a good reputation. Regardless of the method, however, giving current borrowers a discount doesn’t resolve the problem for next year’s borrowers, etc. And because debt relief has this limitation (unless it’s going to be a regular action every year?), this underlying reality reinforces (to me) the sense that the present relief proposal is just vote buying.

The student load debt relief story was covered in Zero Hedge a day or two ago. Predictably, most of the comments were of the jealousy sort. As Yves has pointed out college education is very pricey these days, with large loans nearly mandatory for students without means. I took loans out to attend college, but the amount was small compared to today because tuition was a fraction of today’s rates. I agree that lenders and schools need to take haircuts if taxpayers are to be on the hook for billions of dollars of student loan debt. The Obama-Biden presidency said no haircuts for banks during the Global Financial Crisis. And it appears that the Biden-Harris presidency will also impose no haircuts. What a great country we live in!

Very cute on the day that Ukraine gets another 3 billion. Priorities are clear.

My cynicism for the win! I had my daughter take out a loan her last year in college to potentially take advantage of this exact scenario.

Even though I “won” (assuming it actually comes through), I’m in agreement with most comments. It’s a bald face bribe which probably isn’t going to change many votes. It doesn’t fix anything. The money could probably do more good spent differently. Total Dem move.

Then again, while $10k-20k is probably not life changing, it is better than a sharp stick in the eye… and definitely better than sending it to Ukraine.

Non-Controversial Solution:

everyone and their dog gets $10,000.

Send Biden a sympathy card. His day is over.

U.S. universities have created a student loan crisis that has saddled generations of Americans with unmanageable debts which they may never be able to repay. While a university education was always expensive, the cost and debt required to finance it has skyrocketed since 2009. According to Wolfstreet:

“Student-loan balances on the government’s financial statement skyrocketed from $147 billion in 2009 to $1.37 trillion at the beginning of 2020, despite the 11% decline in student enrollment since 2011.”

As a consequence, the Department of Education in 2020 reported that they were expecting to lose at least $400 billon, out of $1.37 trillion in student debt they reviewed, because of borrower nonpayment. Two years later, in 2022, student debt has ballooned over 24% higher to $1.7 trillion.

There have been countless articles explaining the unmanageable burden of student debts, including ones that estimate borrowers may need over 100 years to repay their student debts. And so in March 2020, the U.S. federal government took the extraordinary step of pausing all federal student loan payments as part of its COVID relief CARES Act. Think about that for a moment – the U.S. government needed to freeze all payments on one of the largest categories of consumer loans for over two years. This was good in that it helped to temporarily lift the unmanageable burden of student debts, but it also made it impossible to determine the true delinquency and default rates of current student debt ( those numbers are likely now calculated from non-federally funded private student debt which is only 8% of the $1.7 trillion in student debt ).

Universities are designated under our tax code as 501(c)(3) educational organizations, which are exempt from all federal and state income taxes, because they are supposed to be nonprofit businesses that have a mission to inform and educate individuals or the general public. They also don’t pay any property taxes on university land, and can issue tax exempt bonds to fund construction, renovation, and operational costs. This does not include the $50 billion per year the U.S. government pays to universities in federal contracts and research grants. These institutions are eligible for almost every government subsidy and tax loophole imaginable.

All of these privileges do not mean that universities pay most of their front line staff generously. According to a Berkeley study “25 percent of “part-time college faculty” and their families now receive some sort public assistance, such as Medicaid, the Children’s Health Insurance Program, food stamps, cash welfare, or the Earned Income Tax Credit”. The real picture is that only a few illustrious professors, administrators, and university contractors ( famous architects come to mind ) gorge on outsized compensation, while the rest of its staff receives only leftover crumbs.

By far the biggest of all these subsidies is our federal governments willingness to loan trillions of dollars to a universities customers ( students ), without any evaluation of their ability to repay, so these students can pay whatever tuition the university decides is reasonable. It is in this environment of supreme privilege and protection, that tax exempt and supposedly not for profit universities have chosen to shockingly overcharge their students. And because none of these institutions considered the long term consequences of these actions, we are just now starting to realize we are in a student loan crisis. The debt burdens they foisted on all these students will likely hinder our national economic health for several generations. While temporary fixes like student debt relief will just encourage universities to continue these unethical practices.

To give you an idea of what comparable schools cost in different countries, undergrad tuition at Switzerland’s Swiss Federal Institute of Technology ( ETH Zurich ) is $1,300 USD per year, undergrad tuition at Japan’s University of Tokyo is $4,000 USD per year, undergrad tuition at the UK’s University of Oxford is $11,000 USD per year, and undergrad tuition at the USA’s Harvard University is $54,000 per year. Can you spot the outlier?

So forgiving some portion of past student debt is a good start to helping currently indebted students. But if nothing is done to manage university fees, then future student debt will just end up with the same problems.

I recommend we have someone investigate the precise nature of how universities and banks created this student loan crisis, and make suggestions for how we can prevent it from ever happening again.

The USA is the outlier in almost every sector. Health care, MIC, major public works and construction projects, you name it. Many studies have been done analyzing why. We know why. Everyone, probably including you and me–especially if you are part of the PMC (overhead)–are getting some piece of this action. In many organizations, overhead is 3x or more of direct labor. Universities are training the PMC of the future.

While I applaud Biden’s move, I also believe it’s up to each student to figure out how they will excel in some remunerative field that will enable them pay back these loans. Even if their frontal lobes aren’t fully developed, they have parents and friends who can advise them. There needs to be some discipline in this process folks. This is how it works in this country. I’d prefer Switzerland’s approach (as would many commenting here), but we aren’t living in Switzerland.

If we were truly efficient, the U.S. economy would collapse. This is the privilege of living in a country with the dollar as the reserve currency of the world. We can pay ourselves a lot–and charge a lot in almost every sector– and because we can. But, there are indeed distributional consequences. We are also the most unequal country in the world.

I think, on balance, the distributional effects of Biden’s plan seem appropriately skewed to the smaller (probably more frugal) end of the tuition spectrum. It will help kids who attended community/public colleges much more than those who attended Yale.

There’s a limited number of slots in those remunerative fields, so inevitably there will be many who did things right and still failed to secure such a position. There’s no way to know in advance, so it’s a crap shoot. What are parents and friends supposed to do – the prudent advice is not to play at all, but what choice does that leave kids? The higher education complex doesn’t care because it benefits from students as conduits for free money.

Our society benefits from striving and competition, so it should pay for that process of determining winners and losers rather than imposing the costs on the losers.

Sure, there are many systematic problems with higher education, same with many other sectors of our country.

But Congress isn’t about to pass legislation fixing any of them. So while we have numerous problems with our education system that should be addressed, it is currently impossible to address them.

On the other hand, the US President has the power to forgive federal student debts on his own. No legislation is required. Moreover, this power was publicly demonstrated when the previous President decreed that payments would be excused as part of Covid relief.

As a result, tens of millions of student borrowers realized that it was actually possible for the President to take an extra step and forgive their student debt with the wave of his pen. That’s why to focus is on the President forgiving student debt. People know he has the power to do it.

Here, because of our incredibly flawed political system, there are only two options. Either the President forgives student debt, which we all know doesn’t address the problems with our higher education system, or he does nothing.

Given the awful choice, I support doing the something that may actually help some people.

I feel like I have fully lost my mind watching progressive Dems and activists crow about what a major achievement this is. IT IS NOT MAJOR AT ALL! LET’S STOP PRETENDING! And let’s stop obscuring the fact that this piss ass level of means tested cancellation is a choice against a universal debt jubilee, which Brandon has the power to execute with the same stroke of the same pen.

Every single day of my life I feel immensely grateful that I was blessed enough to get scholarships for my undergraduate and graduate degrees; and the modest amount of student loans I took out in grad school (<$20K, so I'd have some money to float on after graduation) were paid off in one fell swoop after I started working a well paying, private sector job.

But my heart breaks for so many of my millennial friends & peers who are saddled with eye watering 6 figure debt! I don't know how they get up in the morning with these enormous debt loads hanging over their heads like a sword of Damocles. These people took on debt to become therapists, public interest lawyers, medical professionals, public health researchers, urban planners, religious scholars/clergy, etc. Universal student debt cancellation is easily one of my top 3 political issues because of how I see my peers struggle. I want nothing more than them to be free of this crushing debt bondage. I feel no regret or jealousy at the idea of their debt getting completely wiped out, though I paid mine off. NONE.

Bravo to Team Dem for double crossing voters by pissing on them while trying to convince them it's rain. Again.

Welfare Programs that help the poor seemed to be viewed with that same cynicism and crying out of racist welfare queen, they are coming to steal our jobs, why should my tax dollars go to support someone in need. And then you have the cops who say they need more funding and special privileges because their job is so dangerous when the statistics point out that they do not rank in the top ten dangerous jobs.

For decades our tax system has been overwhelmingly aimed at welfare for top companies and top income earners but, nary a peep about that welfare to the people who gave jobs away, increased the poor employed, raised the cost of living, turned law enforcement into a standing army …… not one peep

The Republicans don’t have to lift a finger to stoke anger and resentment. The Dems are doing a fine job of it on their own.

Predictably, Summers is raining on the Dems’ parade, according to WAPO. Because: Inflation. Of course!

Perhaps what Summers means is that this will lead to tuition inflation at places like his employer, Harvard.

But there is the inter-generational equity question: is Summers saying we shouldn’t help the kids because their parents (and the Congresses they voted for) lived beyond their means all of their lives, which he probably would say is the real culprit (deficits)? (Which I don’t agree is the real culprit for this inflation by the way.)

On a side note, I read Krugman’s latest Opinion piece yesterday exploring the question of whether there’s any realistic short term alternative to recession as a means of taming inflation. He decides, sorry, “No”. He didn’t even mention the possibility of ending the self-defeating and ineffective policy of Sanctions on Russia! That would be a great way to reduce energy and food inflation, and possibly avoid recession in Europe, Japan and the U.S.. It looks like these recessions are coming. Even ending sanctions now may be too late.

I’m on SSI and have over 50k in student loans. My IBR is $0 because I only get $560 a month. I’m on the Michael Hudson debt repayment plan. lol

This “forgiveness” is a joke and doesn’t help me at all. I just hope that I don’t have to deal with a time tax of paperwork or the IRS or some such BS. What’s ridiculous is that you have to be essentially mostly dead to get forgiveness if you are disabled.

I get that debt forgiveness can be unfair to some people. My state, Louisiana, instituted a free in-state tuition program in 1997. I graduated in 1996 and TOPS wasn’t retroactive.

It does suck that my debt load is higher than that of someone who graduated right behind me, but on the other hand I’m glad that those people don’t have the burden that I do.

There definitely needs to be reform in the student loan financial sector as well, otherwise the problem will just continue.

Also why in the world is there interest on a gov’t loan? Shouldn’t the gov’t invest in its citizens?!

Wouldn’t the forgiven loan amount qualify as

income for federal and state income taxes?

Thanks in advance.

Income of $250,000 represents the top 5% in income spread. In 2019, median income is about $32,000. Also, it is upper middle and middle class parents who have the capability of navigating Pell grant applications. This is a giveaway to approximately the window between 60% to 95% of income, leaving those on the lower tiers of the income ladder a considerable tax bill in the form of inflation – food,energy, rent. Also, a stake in the heart of all the financially responsible who lived in closets, ate beans and worked three jobs to get through school. Also, lower tiers have to relay on the vagaries of public education which is fully invested in a college prep, classical only model, in lieu of strong, career ladder training for positions in tech, health care and finance. It is well established that those in the lower 40% are bright, capable and talented – but they and their families are massively short changed every step of the way – be they black, Islamic, Hispanic, or Caucasian. The tiering is class – not ethnic or religious heritage. A class consistently titled “deplorables” whether they be children, adolescents or adults.

This is very late to the game so probably won’t be read, but I just wanted to say that I graduated from Roosevelt High School in Honolulu in June of 1972 and started at the University of Hawai’i in September, 1972. My resident tuition was $80 for the first semester and books were less than $100. I worked at Dole Cannery over the summer and earned more than enough to pay that, and later worked at JCPenney summers. During the school year I had a pretty cushy, easy job at the UH grad school library and lived at home with my family and took the city bus to and from school and to work. Honolulu had a great bus system and life really seemed pretty easy back then. American out of control greed has really ruined life for our people. Why we haven’t all risen up to overthrow the bastards is truly beyond me. My God, we used to protest in the streets! We didn’t get permits and permission. Of course now you’d probably be shot if you did that. All this passivity I find really depressing.

Probably not shot, just tossed into a private prison to make $0.12 an hour working 10-12 hours a day in prison industries– light assembly or maybe a call center if you’re lucky. You’d get to spend your hard-earned cash on $2.00 ramen at the com, on toiletries and computer/email privileges.

You’d rather be shot.

Go study in Germany. High level education, in many places taught in English and completely free.

A bit late for that. The EU, Germany most of all, is going into a full bore economic crisis. Expect a lot of services to be cut.

Apropos of nothing. Is it just me or is Sagaar Enjeti getting more annoying by the day? To use one of their favorite words that show is becoming more and more cringe by the day.

Too bad we can’t make the universities guarantee the loans – give them some skin in the game.