Since FTX is due to lodge a big filing in bankruptcy court today, which among other things is expected to provide more detail on the unwind, it seems prudent to wait for more scandalous revelations…save for making sure a couple of juicy details already public don’t get lost in the shuffle.

Even though there’s a widespread assumption that Sam Bankman-Fried and his main partners did a whole bunch of things not on the up and up beyond operating a trading business while insisting staff be high on drugs known to blunt inhibitions about risk and then lose boatloads of money on bad wagers and investments, we don’t yet know that for sure.

But turn over a few obvious rocks that do not require expertise in crypto and one finds far too many creepy-crawlies. We described how the shockingly amateurish customer agreement, the so-called Terms of Service, was the investment version of a Nigerian scam letter, designed to sort for marks.

Given that both of Bankman-Fried’s parents were Standford law professors and crypto was a perceived-to-be hot place to be, it would not seem to be hard to find a hot-shot young partner who thought being the general counsel of a rising star firm would be career and wallet enhancing. Or alternatively, a high-flying senior associate as general counsel, with a good Silicon Valley law firm looking over his shoulder.

Nope. Instead FTX hired a lawyer who for a while served as general counsel, then regulatory counsel, whose big resume item was having been general counsel at a major online poker betting firm that collapsed in a cheating scandal. Oh, and said lawyer, Dan Friedberg, was implicated in the misconduct.

Oddly there hasn’t been much uptake of his story.I admit I’m late to it; reader britzklieg pointed it out a few days ago, but as of then, only some poker-oriented Twitter accounts had taken note. Even as of now, only the New York Post1 seems to have written up this angle of the story.

The reason this matters, as anyone who has worked in finance and investments would likely tell you, is that the job of the general counsel is to keep you out of trouble. He is supposed to tell you very bad things will happen if you cross certain line, and care enough about it to threaten to or actually quit if his bosses seem set to do Bad Things despite his stern advice.

Having a general counsel with a clean and credible resume is also normally important in reassuring investors, customers, and lenders. So it’s weirdly par for the course that so many acted like lemmings, assuming that somebody else in the wall of money that for a while flowed towards the FTX empire had done due diligence.

From the New York Post:

The top “regulatory officer” at fallen crypto exchange FTX once served as an attorney for a company that was embroiled in a notorious online poker cheating scandal more than a decade ago — and was caught on tape allegedly aiding the perpetrators of the fraud, according to reports.

Dan Friedberg — a lawyer who was FTX’s chief regulatory officer in the months leading up to its collapse and who also did a stint as its general counsel — also had served as an attorney for UltimateBet, whose collapse was considered one of the largest online gambling scandals in history at the time.

In the alleged scheme — which reportedly claimed actor Ben Affleck among its victims — employees between 2005 and 2008 were accused of using a software exploit dubbed “God mode” to bilk players out of anywhere between $20 million and upwards of $50 million…

The UltimateBet scandal arose after revelations that some of the site’s employees were using the software exploit to peek at online opponents’ cards during hands and bet accordingly.

In 2008, the Kahnawake Gaming Commission, the Canada-based regulatory body that licensed UltimateBet, said it “found clear and convincing evidence” that Russ Hamilton, a UltimateBet co-owner and consultant, “was the main person responsible” for the scam, along with a handful of accomplices.

Friedberg’s involvement surfaced after recordings of his conversations with the poker site’s top brass was leaked to the public in 2013. The recordings were taken during a meeting in early 2008 between Hamilton, Friedberg and other executives and were reportedly leaked by Travis Makar, Hamilton’s longtime assistant. Friedberg was never personally accused of wrongdoing and there is no indication that he was ever even investigated by prosecutors or regulators.

Friedberg can be heard on tape discussing how UltimateBet should respond and handle media inquiries. Friedberg also advised company executives on a strategy to limit payouts to victims by withholding the extent of the scheme.

“I think, for the public, it just has to be, ‘Former consultant to the company took advantage of a server flaw by hacking into the client, unable to identify exactly when,’” Friedberg allegedly said on the tape, dictating a script in a bid to shortchange victims of the fraud.

Friedberg even advised Hamilton to claim he also was a victim of the scandal because “otherwise it’s not going to fly.” He acknowledged on tape that the liquidator for Excapsa, the software firm that owned UltimateBet, had $47 million on hand for potential payouts – but that executives wanted to limit the total to no more than $5 million.

“If we can get it down to five, I’d be happy,” Friedberg added regarding potential payouts….

In its 2008 segment, “60 Minutes” reported that “jurisdictional issues” had prevented any criminal charges from being filed against Hamilton or others implicated in the scandal. The audio tapes revealing Friedberg’s involvement did not surface until years after the Kahnawake Gaming Commission released its findings.

FTX clearly could have gotten someone “better” by conventional standards of “better,” as in relevant background and taint-free. The Post managed to find someone who claimed that having Friedberg aboard would legitimate FTX. That view seems to be an outlier:

Been saying this for a week – EXACT SAME BUSINESS MODEL AS FTX

Dan Friedberg the mastermind of the shell company architecture, the data delete fail safe implosion, and the back door to Alameda. https://t.co/KGNpmJE22f

— Ben Armstrong (@Bitboy_Crypto) November 16, 2022

poker OGs will remember that UltimateBet – where FTX chief regulatory officer Daniel Friedberg was the head lawyer – also tried to get whales to hold large balances on deposit with the promise of 9% APR.

they too were insolvent, and cheating users (insiders could see our cards). pic.twitter.com/vJ6NloWJyG

— Cole South (@ColeSouth) November 17, 2022

A simple google search any time after FTX was founded would have revealed Friedberg’s scandalous history.

You’d be forgiven for wondering if Mr. Friedberg’s “experience” wasn’t a positive in the eyes of @SBF_FTX… pic.twitter.com/Fsvhr6GGqO

— Andy Swan (@AndySwan) November 16, 2022

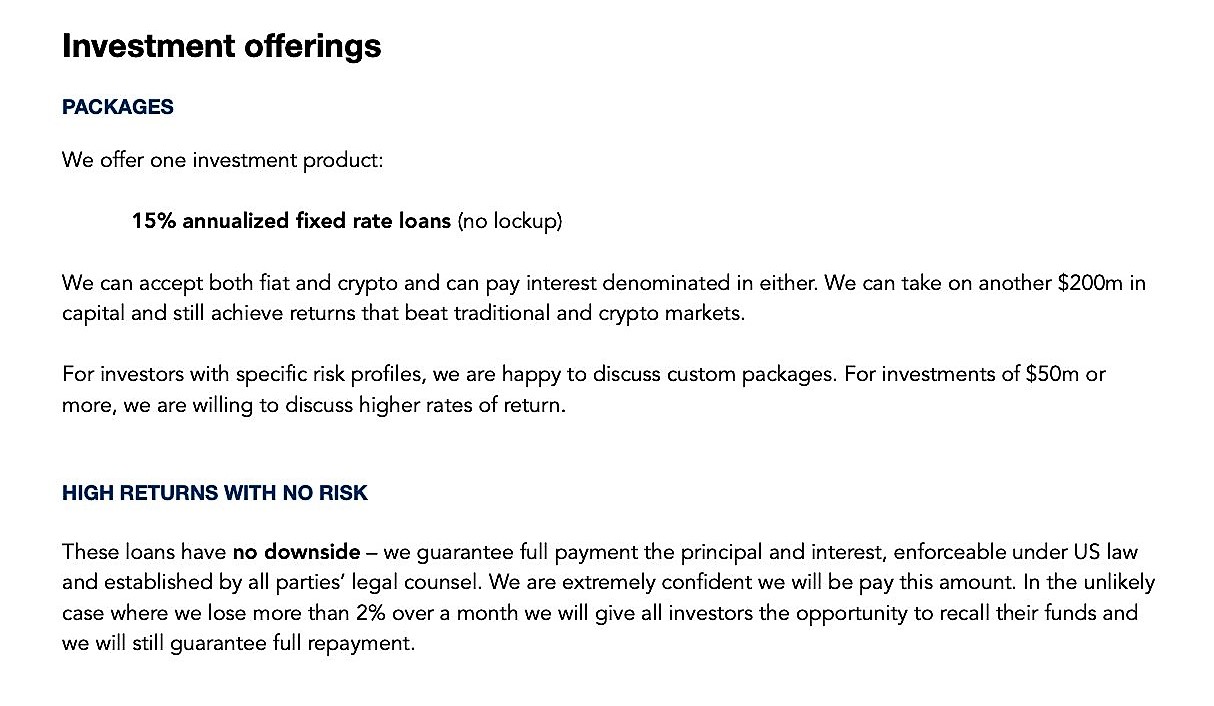

Let’s go back to the guaranteed return bit. I was going to highlight that even before some Twitterati suggested Friedberg might have been the brain behind that FTX ruse.

I had seen some screenshots of FTX promising a 15% no risk return. That is another “Beware, scam ahead!” signpost. But I hadn’t seen any explanation of what role it played or whether it was significant in terms of FTX funding. If it was a meaningful money source for the FTX empire, that pretty much guaranteed that FTX would wind up engaging in Ponzi scheme type behavior. Even hedge funds that are successful over time can have wild swings in returns, like up 85% one year, down 20% the next. Even a merely flat or low return year would lead the FTX maestros to have to fill the shortfall somehow…more money promised they might not be able to meet, like loans? Or covertly borrowing from customers on the over-optimistic assumption that your return hole is temporary.

Ben Hunt nailed down this piece of the puzzle, and it explains a great deal:

SBF was early to the professional crypto trading world (he launched Alameda in 2017), and there were plenty of persistent informational asymmetries in that early market for a smart guy like SBF to skin with a portfolio of systematic quant strategies…..So I think SBF and Alameda probably killed it in 2018 and 2019, but by the time Covid hit, Alameda was just one of many crypto hedge funds competing with each other over an increasingly difficult-to-navigate market.

Here’s the thing, though: Alameda had no outside investors who would know that performance had declined from Magical Money Machine levels to non-magical levels! See, Alameda did not take on outside investors the way that most hedge funds take on outside investors, with an annual management fee (1-2% of the amount invested) and a performance fee (10-30% of the profits) on the capital account established for the investor within a limited partnership vehicle. No, Alameda didn’t take investors (LPs) in their fund at all. Instead, you lent money to Alameda and they promised you at least a 15% annual return on your loan. Also, they promised that you could cancel your loan and get your money back anytime they had even a slightly bad month.

Alameda Research 2018 pitch deck

It’s both a really interesting and really troubling offer! On the one hand, it creates an enormous mystique and reputation as a Magical Money Machine (nope, we’re going to make crazy consistent profits with your money, so much so that we’ll promise at least 15% annual returns, but we’re not going to share more than 15% with you because you’re lucky we’re even talking with you). On the other hand, this IS the recipe for a Ponzi operation (oops, we didn’t cover the 15% this year, but we can cover it with new client loans and some fudged accounting and no one will ever know) and most troubling of all, they are selling themselves as a Magical Money Machine. I mean, if the words “HIGH RETURNS WITH NO RISK” don’t give you the heebie-jeebies as a potential investor (not to mention that this sort of language would be outright illegal for a US-registered or EU-registered investment vehicle) … well, I don’t really know what to tell you. Actually I do know what to tell you. If you ‘invested’ money with Alameda on the basis of this deck, you allowed a MacGuffin to take over your decision making, and all of the bad things that are happening to you now stem from your failure to recognize and control your MacGuffins. I’m sorry, but you should not be responsible for managing other people’s money.

Ultimately, I believe, Alameda became a Ponzi, using new funds to cover the returns they promised on client loans, all while maintaining a reputation as a Magical Money Machine.

Back to the original post. I presumably missed it in all the overwrought coverage, but I have yet to see what the original FTX-Alameda funding sources were. The origin myth is that Alameda made a lot of dough early in proprietary trading and then quit making much/any money. That’s plausible because markets became more efficient. This is such a common story that I’ve had clients have to grapple with this erosion. The usual answer is to go find customers. But FTX and Alameda got lucky in that naive long positions were also very profitable as crypto enthusiasm grew, and the scuttlebutt is that they were leveraged. This part of the story also makes perfect sense, see for instance the Lehman Brothers emerging markets desk which similarly looked like a bunch of geniuses as much of their apparent trading profit was simply riding inventories as these markets went from chaotic to somewhat organized so more investors were willing to take the plunge. Then the 1997 emerging market crisis hit and Lehman nearly went under.

While again this storyline generally hangs together, it’s still curious that a trading firm would go out raising money from retail investors on what was allegedly a large scale when it was by crypto standards an established player. This smacks of being extremely eager to avoid due diligence.

This also fits with the VC and other institutional investors being essentially late stage and thus getting fairly small stakes (the initial bankruptcy filing says no one held more than 2% in any FTX entity). But I am still gobsmacked that several did not get together and get one board member among them.

I imagine we are far from the end of eyepopping FTX stories. Stay tuned.

____

1 The Post has long been good at reporting on hedge fund legal/personnel messes.

The function of crypto in this whole scandal appears to be solely as a kind of legal jedi-mind-trick to get regulators, journalists, judges, etc to look the other way as time-honored financial scams took place. Similar to how Uber and the gig economies real innovation have actually been using “tech” to jedi-mind-trick around established labor law, I suspect these crypto firms are simply using tech-buzz as flack to cover schemes that would have been passe in Ponzi’s time.

Judges continue to be dazzled by bright computer lights.

This seems also to be the function of adult children.

I saw on Twitter this morning that SBF’s parents (the Stanford law professors) bought $121 MILLION in Bahamas property. Matt Stoller shared a tweet about it this morning – being reported on Reuters.com. So the rot even goes to supposedly “upstanding” Stanford lawyers. SBF had his parents stealing from FTX as well!

Been digging around. This from a Nov 16 Protos article:

“Interestingly, while ensconced in his island enterprise, SBF also successfully roped in a regional Caribbean regulator. The Chairman of the autonomous entity the Eastern Caribbean Securities Regulatory Commission (ECSRC), Arthur G.B. Thomas was one of the three directors of FTX Malta, along with SBF and former HSBC exec Jonathan Innes Cheesman. Thomas is from Antigua and Barbuda and also serves as its ambassador to the Czech Republic.

The ECSRC is tasked with licensing persons engaged in securities business, monitoring and supervising the conduct of licensees, promoting investor protection, and maintaining effective compliance and enforcement programs. The Bahamas, however, is not a member of the ECSRC.”

Thomas is listed as Director on this November 2, 2021 SEC filing.

Friedberg’s involvement surfaced after recordings of his conversations with the poker site’s top brass was leaked to the public in 2013. The recordings were taken during a meeting in early 2008 between Hamilton, Friedberg and other executives and were reportedly leaked by Travis Makar, Hamilton’s longtime assistant. Friedberg was never personally accused of wrongdoing and there is no indication that he was ever even investigated by prosecutors or regulators.

….

In its 2008 segment, “60 Minutes” reported that “jurisdictional issues” had prevented any criminal charges from being filed against Hamilton or others implicated in the scandal. The audio tapes revealing Friedberg’s involvement did not surface until years after the Kahnawake Gaming Commission released its findings.

=====================================

“jurisdictional issues” How convenient

Are there time limits on debarring lawyers?

Ultimate Bet? Why is that name familiar? Oh right the general counsel for Bitfinex/Tether Stuart Hoegner used to work for Escapa which owned . . . Ultimate Bet. Small world.

And Tether’s largest customer was FTX. So FTX supposedly sent $36 billion to Tether to use their stable coin instead of just buying $36 billion of t-bills and creating their own stablecoin. Good deal for Tether.

Before Bitfinex and Tether

Stabenow, Boozman, Toomey, Gottheimer, Lummis, Gillibrand, Waters, McHenry and the list goes on of legislative geniuses either introducing crypto bills in congress or deeply involved in them. Nothing has come of it. Meanwhile, the regulatory gray zone of the SEC, CFTC et. al. talked a good game and managed to fine big a** Kim Kardashian for throwing a crypto curve ball.

The scamming interface is allowed to operate essentially unimpeded because the campaign cash keeps rolling in. When the agencies are about to move with a draft proposed regulation they are invited up to the offices of the pols on the Hill and staff instructs them to stand down because “we got this.” When the scam disintegrates everybody plays Alphonse and Gaston. I have had enough, and I’m gonna go register to vote!

Well, there’s the answer there.

If it’s regulations that crypto wants, and so many stupid legislators trying to give it to them, let it be casino/ gambling regulations.

Or just let it burn.

My impression, which may be quite wrong, is that Alameda/FTX were run as a magic circle. FTX was loaning money to Alameda to buy FTX’s own FTT token ($6 billion) and tokens minted by several other SBF-backed projects (Solana, SRM, etc.) to the tune of 3 billion.

So FTX loans money to Alameda that goes out and buys tokens, FTT/Solana increases in value, FTX uses it as a collateral to borrow more money, loan it to Alameda to buy more token, around and around we go. Meanwhile, early investors cash out at inflated prices and leave everyone else holding the bag.

So my impression is that Alameda gave up on actual investing in the last couple of years and mostly served as a vehicle to pump up the prices of selected tokens on FTX and allow SBF and his friends to cash in their founder’s share of these tokens at highly inflated prices.

That is also my understanding too – the funding for these exchanges and hedge funds came from the artificially inflated valuations of these grifters’ own tokens. The valuations get inflated by only releasing a few tokens to the public, which those in the know goose by trading among themselves for ever increasing amounts – I buy for $1, sell to my buddy for $2, who sells it back to me for $3, etc – until the mark walks in and puts down real money. Meanwhile the non-public tokens shoot to the moon, and are then used as collateral for more grifting.

Those articles britzklieg posted on the poker industry’s involvement were very good. Short version – the cryptomuppet got some big money poker players to buy into his crypto enterprise (they were the marks putting down real money in this case). What he neglected to tell those marks was that he had hired Freidman who was basically persona non grata in the industry due to his involvement in the big time online poker scam a decade earlier. Now they know, and they are not a happy bunch.

If I were the crypto muppet, I would be a lot more worried about what those guys might do to me than what law enforcement might.

If Casino is any guide, those Vegas types don’t take kindly to being cheated and SBF might be making the choice between the money or the hammer himself – https://www.youtube.com/watch?v=kGp3PrC1CKI

A couple days ago, in I an article I can’t relocate now I believe discussing SBF’s claimed version of “altruism” and a covid study, that a University in Ontario was involved in the research. And many articles have reported on SBF bilking the Ontario Teacher’s Union pension fund. Wonder what all went down there?

This just keeps getting better!

I love the “15% APR and NO RISK!!!” when treasuries were paying 1% or so.

The perfect product for those who sometimes waited at the wrong stop for the short bus as kids.

And roping in a regulator is traditional,

And somehow, a sh!t-ton of spendable money got shipped to Ukraine, where billions circled back to Dem pols (and maybe select Rep pols too?) while other billions got skimmed off into the ‘wallets’ of a whole rogue’s gallery of Ukies and related skulch. I bet some of that somehow got into the disposable-deniable coffers of certain Alphabet Agencies that originated in the US of A but have branched out “globally.” Some speculation on it all: https://slaynews.com/news/ftx-scandal-exposes-tether-links-cia-drug-cartels-ukraine/

“Another fine mess you’ve gotten me into.” https://www.youtube.com/watch?v=W3qcj2MzPYc

Yeah, I’m wondering if in the spirit of it all I should start taking bets on how long until SBF gets Epsteined.

FTX is the posterboy for the hype.

There’s No Good Reason to Trust Blockchain Technology

Opinion: Cryptocurrencies are useless. Blockchain solutions are frequently much worse than the systems they replace. Here’s why.

https://www.wired.com/story/theres-no-good-reason-to-trust-blockchain-technology/

Ha! “Alameda didn’t take investors (LPs) in their fund at all. Instead, you lent money to Alameda and they promised you at least a 15% annual return on your loan.”

from “Fargo” https://www.youtube.com/watch?v=RM2N1w6t1KM

pass the popcorn please!

Can you say “Moral Hazard?”

The Post reporting appears to piggyback from Steven Stradbrook’s reporting on Coingeek from over two years ago

https://coingeek.com/tether-links-to-questionable-market-makers-yet-another-cause-for-concern/

The money quote about Friedberg and Tether’s “Compliance Officer” Stuart Hoegner who he had coincidentally worked with on the UB/Excapsa gaming scandal:

Hasn’t anybody heard of Google?

Weird scenes inside the numismatrix, man.

It wasn’t really a pyramid scheme, more of an trapezoid scheme of what might be termed ‘check kiting’ back in the day, no?

I find it funny that US government is getting upset with Bahamians seizing whatever FTX assets they could get. I imagine the Bahamian authorities knocked on door of $40 million FTX penthouse with guns drawn and politely asked everything of value get sent to this account now, or SBF and his buddies could to the white collar jail cell suspended over the school of hungry sharks. Or at least that’s what I hope asset seizure should be like when dealing with degenerate a-holes like SBF and his kind.

This seems to go even further connecting dots and going where most surely won’t want to go. I suppose today one can be a conspiracy theorist or a coincidence theorist…

I wonder how many FDIC insured US banks are involved with crypto accounts. Must be a sizeable number for the FDIC to issue this warning. (I’d rather see a bright line. The kind of bright line I did not see in the lead up to the subprime fuse that lit the GFC.)

https://www.fdic.gov/news/financial-institution-letters/2022/fil22016.html

Waiting for the Fed to say “crypto is contained.” / ;)

Coming soon to a crypto digital currency (CBDCs?) near you. / ;) What would Bill Black say?

https://www.amazon.com/Best-Way-Rob-Bank-Own/dp/0292754183

Thanks for the link to the Ben Hunt piece, that was really helpful and a fun read to boot.