Yves here. Mr. Market has been acting as if it can lobby the Fed, that if it drives stock prices up ad gets its commentator fanboys to talk up how everything is or soon will be coming up roses, the central bank will revert to its traditional role of making the world safe for moneybags.

But the Fed has decided that the economy needs to be put on a diet so that it slims down enough to reduce employment. The central bank keeps behaving as if our current inflation is the result of too much demand, as opposed to supply side shortages, particularly of workers, that steeper interest rates will not solve, except by killing activity to the degree that the shortfall-afflicted sectors will have less demand, along with all sorts of innocent bystanders.

As Joseph Stiglitz and Ira Regmi wrote in the overview to a new paper:

The evidence is overwhelming: were there no supply problems, aggregate demand would not be excessive. The inflation we’ve experienced is best understood as resulting from industry-specific problems that many Organisation for Economic Co-operation and Development (OECD) countries are facing. A strong labor market is part of the solution, not the problem.

But the Fed and other orthodox central banks believe that inflation is every and always the result too much demand, which even worse leads workers to seek more pay. So of course crushing labor is the perfect remedy. Never mind that that approach distributes income ad wealth to the already rich.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

On Thursday, the S&P 500 Index dropped 2.5%. Since the Tuesday morning spike, it plunged by 5.0%. The Nasdaq dropped 3.2% today. Since the Tuesday morning spike, it plunged by 6.5%. In Europe, stock indices were deep-red, with the German DAX and the French CAC 40 down over 3% for the day, and down by about 4.4% since the spike on Tuesday.

This comes after the Fed pivoted even more hawkish yesterday, pointing at a peak rate of over 5%, and taking any rate cuts in 2023 off the table, and after the ECB this morning pivoted more hawkish and hiked by 50 basis points into the recession that it now sees, and said that it was “obvious” that there will be a series of 50-basis-point rate hikes despite any recession, and it announced that QT related to bonds would start in March, after it had already started QT related to loans at the prior meeting, which already caused its balance sheet to drop by 9%.

And it comes after the Bank of England today announced a 50-basis-point rate hike even as it sees a recession. And the SNB announced a 50-basis-point rate hike and said that it sold foreign-currency assets. And to not be left behind, the Bank of Mexico announced a 50-basis-point hike. And all of them put more rate hikes on the table.

The ECB is now hiking into a recession, according to its own economic forecast. It expects this recession to be “relatively short-lived and shallow” starting this quarter. But it could get worse, according to ECB president Christine Lagarde, who added at the press conference that “risks to the economic growth outlook are on the downside, especially in the near term.”

It hiked its three policy rates by 50 basis points: the deposit rate to 2.0%; the main refinancing rate to 2.5%, and the marginal lending rate to 2.75%.

Hiking rates into a recession is very hawkish. And it revised up its inflation outlook.

“Interest rates will still have to rise significantly at a steady pace to reach levels that are sufficiently restrictive….” Lagarde said, adding, “It is pretty much obvious” that “steady pace means we should have to raise interest rates at a 50-basis-point pace for a period of time.”

The ECB is grappling with raging inflation: Overall CPI inflation at 10%, with CPI inflation without energy at a record 7.0%, and some Eurozone countries at over 20% and even Germany at 11%. Inflation began soaring in 2021, after years of mega-QE and negative interest rates. And suddenly it’s a huge mess.

QT related to bonds will start in March 2023, it said today, by shedding €15 billion a month in bonds through 2023. The pace of subsequent declines “will be determined over time.” Details will be announced after the February meeting, it said.

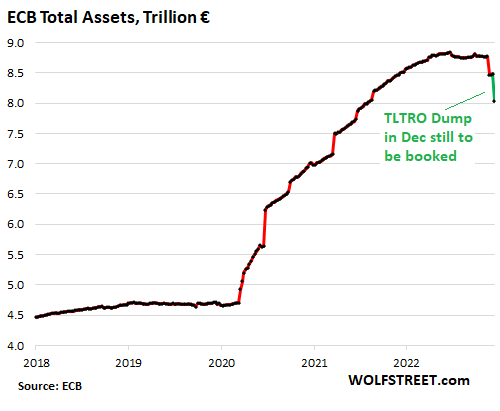

QT related to loans already started at its October meeting to “help address unexpected and extraordinary inflation increases,” as it said at the time. To do so, it made the terms and conditions of its Targeted Longer-Term Refinancing Operations (TLTRO III) less attractive for the banks, which would speed up the banks’ exit from those loans.

These loans have dates at which they can be paid back, and two of those pay-back dates have already passed:

- In November, the banks returned €296 billion to the ECB, which was booked on the ECB’s balance sheet on November 25.

- In December, banks returned €447 billion in loans, which haven’t been booked yet, but will be booked in December.

This TLTRO III unwind was the main factor in reducing its balance sheet by €803 billion, or by 9.1% from the peak in June. The green line is my estimate of the next balance sheet based on the announced €447 billion TLTRO III reduction. Total assets will drop to about €8.03 trillion:

The Bank of England also hiked into a recession, by 50 basis points today, to bring its bank rate to 3.5%. Citing its Monetary Policy Report, it said that “the UK economy was expected to be in recession for a prolonged period and CPI inflation [currently 10.7%] was expected to remain very high in the near term.”

The Swiss National Bank sold foreign currency assets & raised its policy rate by 50 basis points to 1.0%, after its 75-basis-point-hike in September, and its 50-basis-point hike in June, and put further rate hikes on the table. Gone is the negative policy rate of -0.75%.

It’s doing so to counter “increased inflationary pressure and a further spread of inflation.” Inflation in Switzerland was 3.0% in November and “is likely to remain elevated for the time being,” it said.

“We have sold foreign currency in recent months to ensure appropriate monetary conditions. We will also sell foreign currency in the future if this is appropriate from the monetary policy perspective,” SNB head Thomas Jordan said in his remarks. This follows his announcement in June and September that the SNB would do so.

And the SNB has done so. In the second and third quarter, as we know from the SNB’s SEC filings, it unloaded hundreds of thousands of shares of its biggest holdings of US stocks, from Apple, Microsoft, Alphabet, Amazon, and Meta on down. And it has taken massive losses as asset prices in its huge portfolio of foreign-currency-denominated securities have dropped.

The Bank of Mexico hiked by 50 basis points today, to 10.5%, after having hiked by 75 basis points four times in a row, mirroring the Fed. Core inflation in Mexico rose to 8.5%.

The Bank of Mexico started hiking in mid-2021, from 4.0%, nearly a year ahead of the Fed, to stay ahead of the Fed, similar to Brazil and some other central banks. They did this to grapple with inflation at home and to support their currencies against the USD.

Which worked. Over the 18 months of rate hikes, the Mexican peso has strengthened against the USD, while the currencies of the laggards such as the ECB and the Bank of Japan watched their currencies take a drubbing.

The rate hikes are to accommodate the increased need for military personnel. Recruitment is down, saber rattling up.

We are all reverse Keynesians now. Peddle on the foot in good times, slam the breaks in bad times.

Didn’t the Fed do that when Herbert Hoover was President?

Bruning did that for Germany in 1931. That paved the way for The Mushache.

https://www.nber.org/papers/w24106

Abstract:

We study the link between fiscal austerity and Nazi electoral success. Voting data from a thousand districts and a hundred cities for four elections between 1930 and 1933 shows that areas more affected by austerity (spending cuts and tax increases) had relatively higher vote shares for the Nazi party. We also find that the localities with relatively high austerity experienced relatively high suffering (measured by mortality rates) and these areas’ electorates were more likely to vote for the Nazi party. Our findings are robust to a range of specifications including an instrumental variable strategy and a border-pair policy discontinuity design.

1) We don’t have an election coming up

+

2) Donald Trump is not the President anymore

=

Okay to cram down wages

They have done the same thing over the last 40 years despite any political timing. As soon as wages start to creep up they slam the brakes. 1993, 2001, and now. Heck they usually said exactly what they were doing, which was wage suppression.

What does Trump have to do with it?

The beatings administered by the FOMC and FED will continue until morale improves. Or as noted CNBC maven Jim Cramer continues to repeat daily, that Americans need to lose their jobs and moreso after the holidays ( which assumes that managers are not all Mr. Scrooge ).

I want to call into Mr. Cramer on his daily show and just scream in his ear. STFU.

IMO, the next recession will not be kind to bicoastal white collars. See all the mid-level bloat at places like Twitter HQ or Washington Post.

There hasn’t been a recession that truly hit white collars nationwide. Closest is early 1990’s Southern Cal.

Bottom 75% already has had every drop of labor productivity squeezed. and ironically, relatively speaking, the bottom 75% will be somewhat cushioned.

That’s perfectly OK regarding bicoastal white collars. Chuck Schumer said Americans aren’t having enough babies so we need immigration and there have videos of “caravans” of thousands crossing the southern border this last week. My middle of the road to Trump supporting kin in California and Arizona say that’s “old news” “happens everyday.”

Problem solved.

“That happens everyday”

And there is still plenty of immigration to the USA via other borders and channels – people already of working age.

Still, watch the accelerating downward trend for the worker participation rate.

With the tripledemic getting now into full swing, Fed Policy Rates are acting directly on the supply of labor, killing it, while simultaneously trying to reduce the demand for labor.

This is an Ouroboro’s Loop where success is self reinforcing: kill more labor> tighten demand for labor> raise rates> pay more for riskier essential employees> kill more labor> etc.

Seems like the Fed has overstepped their boundaries the past couple of decades. Scary to think what’s going on behind the scenes with that massive 9 trillion dollar balance sheet.

I think the original sin is the easy credit.

I never understood why the fed was so anxious to generate inflation when inflation was sub 2%.

No matter what the fed does there is no relief for the poor, the fed increases the rates the poor lose their jobs and the rich get richer, they slash the rates, the rich asset holders get richer and evth else becomes less affordable for the poor.

It sucks to be poor. And I am becoming one.

Interest rate rises hasten the inevitable recession, do little (if anything) to curb ‘cost-push’ inflation, and cause maximum misery to ordinary folk. The economic errors of politicians and central banks from 2020 (and before) underlying this current inflation crisis will go unpunished (unregulated government borrowing, inefficient awarding of crony Covid contracts, magic money printing, reckless QE policies etc). The myopic US led sanctions, aka Putin’s Price Hike(c), are only part of the problem, albeit an important one.

‘Sanctions inflation’ is not due to rampant consumer demand but rising costs and limited supply elsewhere down the line, often outside the country in question. Restricting the spending power of already cash strapped and cold citizens via the banks taking away what disposable income they still have cannot tame the resultant street prices.

The ‘Mexico argument’ that such rate hikes (temporarily) strengthen a country’s currency / buying power to stave off the worst of supply cost rises, is only valid until other countries follow suit in a vicious ‘zero sum’ currency market until forcing another hike – as Mexico is finding out – locking countries into permanent high interest and unsustainable debt levels. Supply prices don’t fall, they are outside the control of any one country, instead the interest rate hikes themselves add further to the cost of domestic businesses which then have to be passed on, thus the inflationary spiral continues (except now it is endemic not imported).

Some would say don’t touch interest rates for imported cost-push inflation, and let the rises work though the annual cycle. Not the current crop, like Lagarde, however.

Nevertheless endemic inflation will also (eventually) come down, not via interest rate hikes but the recession these hikes will cause – and the more blunt and painful causal mechanism described by the Phillips Curve. And as tax receipts fall and welfare payments rise in the wake of mass unemployment, where’s the money to fund proxy wars? Or is deep recession the agreed point to restart negotiations, at least until next time?