Yves here. Tom Ferguson, Paul Jorgensen, and Jie Chen, who have long been the most meticulous and comprehensive data collectors and analysts of US political donations, have made a first cut on the contributions by Sam Bankman-Fried, his colleagues, and FTX. Note the limitations: some 2022 information has yet to be disclosed; this analysis presently excludes allies like law firms that could have been channels for giving, and omits “dark money” channels which may never come out save discovery in prosecution or disclosure by recipients.

Yet this preliminary tally comes up with a much bigger level of donations than has been previously reported. The analysis also finds that these “core FTX” contributions were very much focused on members of key financial oversight committees that were in a position to advance SBF’s crypto agenda.

By Thomas Ferguson, Research Director, Institute for New Economic Thinking, Professor Emeritus, University of Massachusetts, Boston; Paul Jorgensen. Associate Professor and Director of Environmental Studies, University of Texas Rio Grande Valley; and Jie Chen, University Statistician, University of Massachusetts. Originally published at the Institute for New Economic Thinking website

Late last week, Samuel Bankman-Fried, in the eyes of many our century’s answer to 18th-century fraudster John Law, Charles Ponzi, and the con artists who puffed tulips back in the Dutch Golden Age, allowed that he would be willing to testify before the House Committee on Financial Services. Curiously, for someone usually so eager to jump on stages where he could trumpet his determination to make the world a better place, Mr. Bankman-Fried was far more tentative about the possibility of appearing before the Senate Banking Committee.

That little factoid, reported with no real explanation in the media accounts we saw, suggested to us that a little basic research might be in order. Like everybody else, we were eyeing the astronomical totals of political contributions ascribed to Mr. Bankman-Fried (hereafter SBF), his colleagues, and FTX, the crypto-currency exchange that SBF ran before it filed for bankruptcy. But past experience with mass media and scholarly analyses of campaign finance suggested to us a deep dive into the data would still prove highly instructive.

And so it turns out. In the interests of basic fairness and because so much data from the 2022 election cycle is still being posted on the websites of the Federal Election Commission and the Internal Revenue Service (which reports so-called “527” contributions usually neglected by journalists and scholars), we need to wave a few cautionary yellow flags about what we found.

Note first of all that as yet Mr. Bankman-Fried and his coworkers have not been convicted of anything, though the swiftness with which he and some of his colleagues made themselves scarce within the territorial United States as FTX imploded was striking. Recent comments and Congressional testimony by John J. Ray, the executive who is now presiding over the bankrupt shell of FTX, are also not encouraging. Indeed, coming from someone who helped liquidate Enron and a long line of other financial duds, they are downright chilling: “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.”

We also take to heart warnings from public figures who admit they spent a lot more political money than the press recognized. While his recent public utterances clearly often mix poetry and truth, some of SBF’s statements on this score are noteworthy: “I donated to both parties. I donated about the same amount to both parties this year.” He added that “that was not generally known, because, despite Citizens United [the famous court case widely, if mostly mistakenly, blamed for opening the floodgates to giant waves of money in politics] being literally the highest-profile Supreme Court case of the decade and the thing everyone talks about when they talk about campaign finance, for some reason, in practice, no one could possibly fathom the idea that someone in practice actually gave dark.”[1]

“Dark money,” of course refers to contributions that are laundered through gifts to qualifying charities that are not themselves required to report where the money came from, only whom it went to. Election money analysts, accordingly, can see the money gushing out, but not the invisible spring it really comes from. As we have documented from time to time, Mitch McConnell along with many other politicos, including nowadays many Democrats, are past masters of stuffing campaign piggybanks in this stealthy way.

A passage from one of the indictments of SBF just unsealed underscores the need for wariness and, we would add, far more disclosure:

In furtherance of the conspiracy and to effect the illegal objects thereof, the following overt act, among others, was committed in the Southern District of New York and elsewhere: in or about 2022, SAMUEL BANKMAN-FRIED a/k/a “SBF,” the defendant,and one or more other conspirators agreed to and did make corporate contributions to candidates and committees in the Southern District of New York that were reported in the name of another person.[2]

In other words, the government contends, SBF and colleagues used dummies, too.

Here we can deal only with the on-the-record money. Dark money by definition stays dark unless some Congressional committee demands disclosure of how many of its own members and their colleagues really supped at the trough or prosecutors find the records.

But in the case of SBF and his colleagues, the public totals are quite something, even by the standards of American political finance.

Money in politics today is a Category 5 hurricane. Just when you think you have finally absorbed the worst punch the storm has to offer, some other eddy comes blasting down. We have tried to pull together the many streams of political money from SBF, his senior associates, and all other employees of FTX, together with the executives of Alameda Research, the crypto hedge fund that SBF had co-founded and remained involved with. We include individual donations and PAC contributions, but also the often gigantic 527 transfers reported to the IRS. We counted his brother, but not his parents. We have not looked at law firms that represented SBF or the firms or other possible sources of more money. And we warn readers that the group donated lavishly to think tanks, including the Center for American Progress. It also nourished a stable of former regulators, especially from its preferred regulatory venue, the Commodity Futures Trading Commission, and – secretly – at least one media outlet.

Still, our total is substantially higher than most others reported: over $89 million dollars since 2019, with the bulk of it coming during the 2021-22 political cycle when the campaign to keep crypto clear of federal regulation swung into high gear.

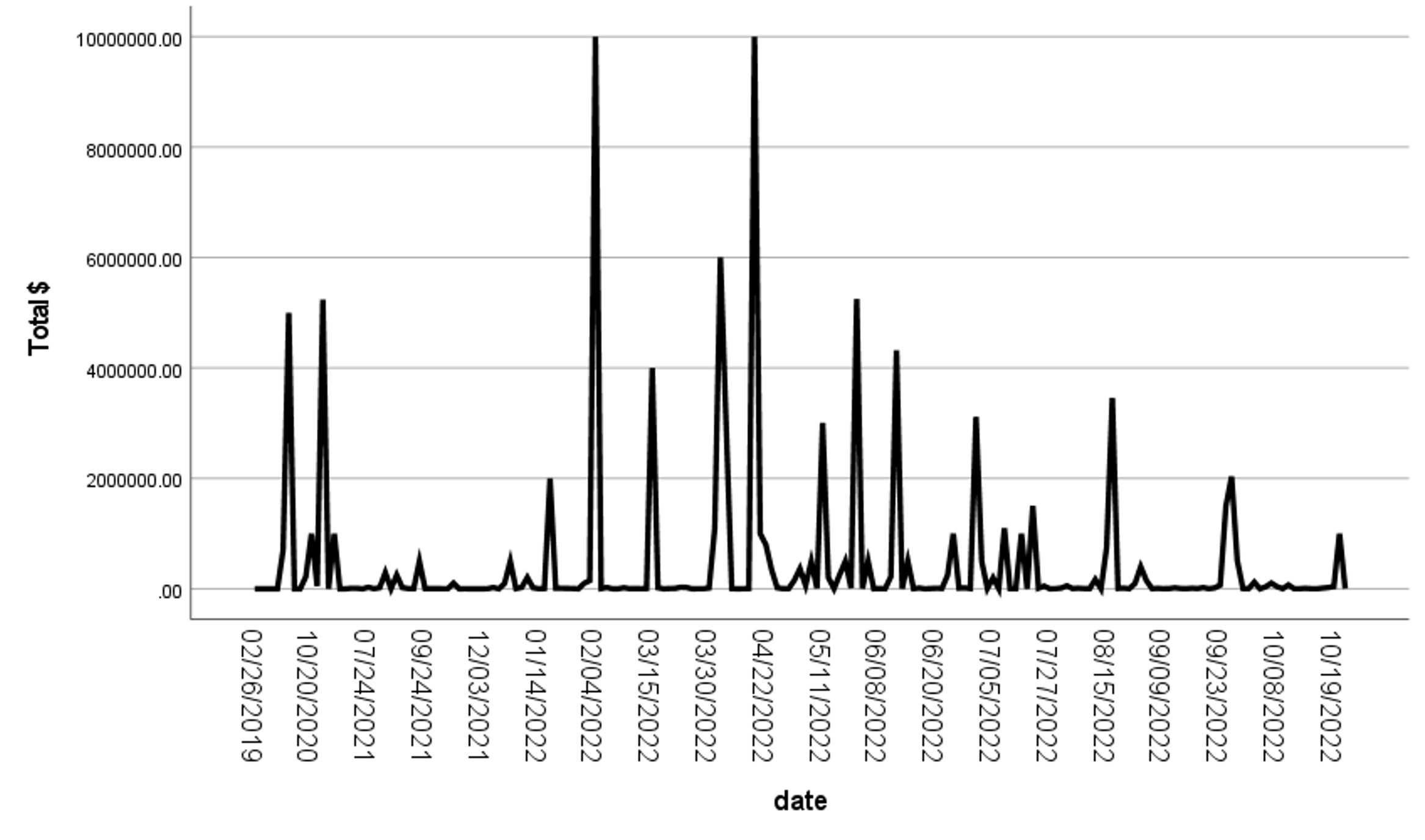

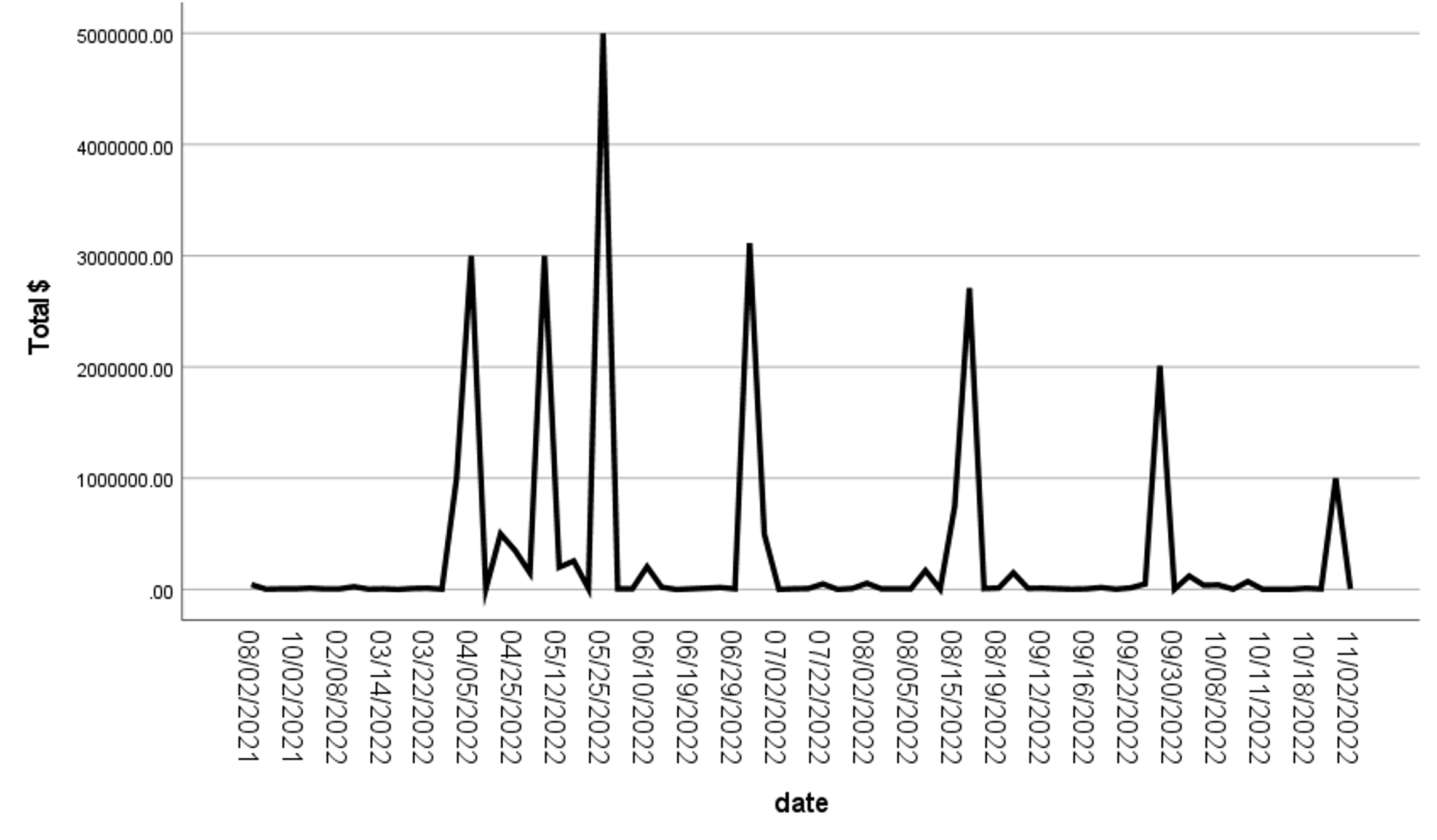

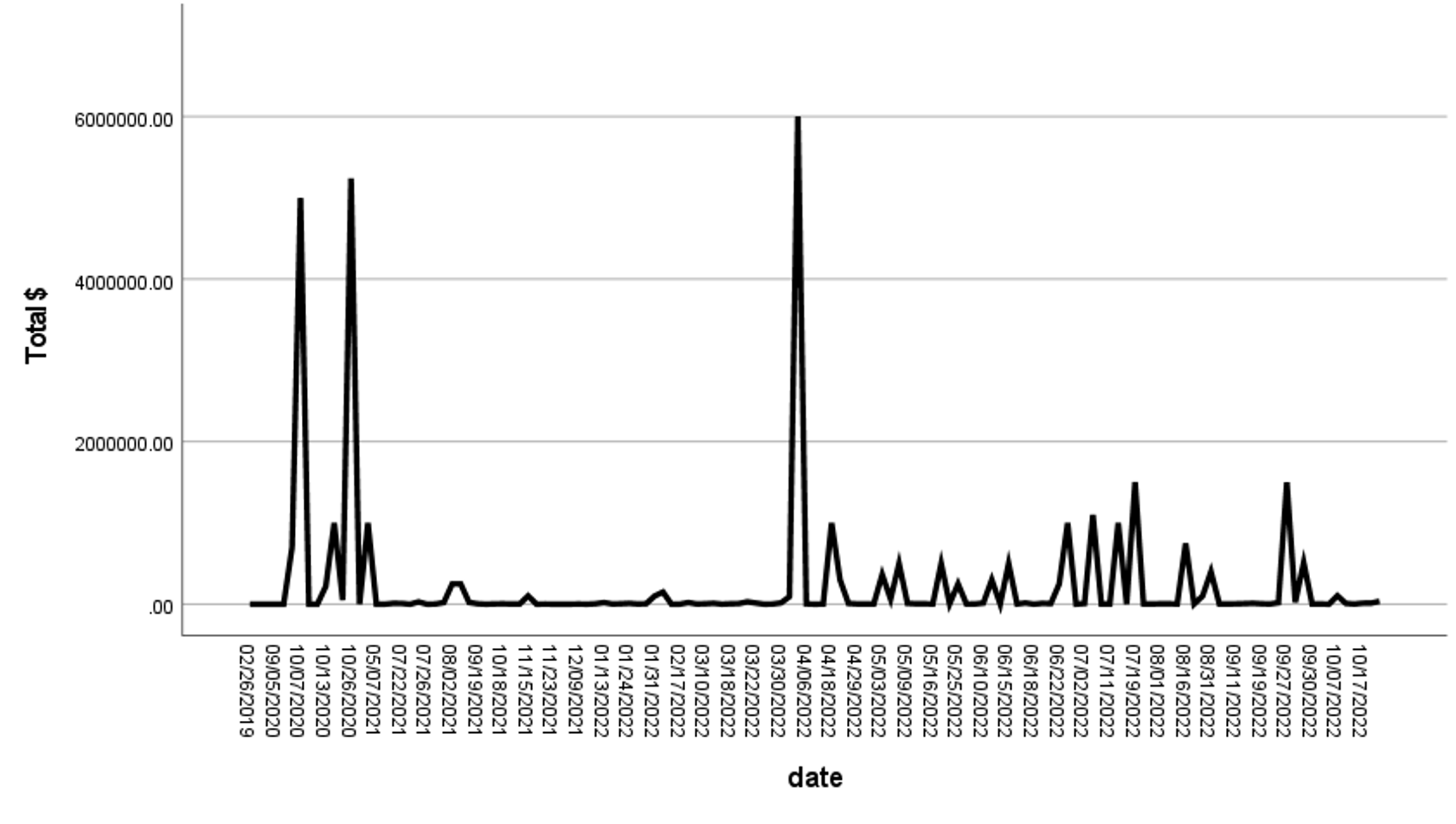

Three graphs clarify some of the issues debated in public. Figure 1 displays the time path of all the contributions we identified; Figures 2 and 3 display total contributions to Republicans and Democrats respectively. Figures 2 and 3 do not quite sum to the totals in Figure 1, since some streams of money could not be clearly pigeonholed in partisan terms. These last mostly represented donations to popular fundraising vehicles within the crypto industry or broader sectors of business that dispense money to politicians of both parties.

Figure 1 – Total Contributions

Figure 2 – Total $ to Republicans

Figure 3 – Total to Democrats

A strong current of Twitter feeds and press clips on the far, far right suggest that FTX was deeply involved with US-Ukrainian relations. So far, very little has come to light about FTX’s foreign subsidiaries or international dealings, save that some investors in the Bahamas were allegedly afforded a special opportunity to withdraw funds after the firm stopped withdrawals by other customers. But details of the public donations and their timing offer virtually no support to suggestions that eastern Europe was much on the mind of SBF and his colleagues. Many 2022 cycle contributions predate the outbreak of the war, though obviously not all do. Nor, though readers will have to take our word for it at least for now, the rivers of political money were not heading toward key foreign policy players in Congress. The FTX group focused on financial regulation. These little piggies were going to market: they wanted to keep crypto lightly regulated while dramatically expanding their field of action.

The alleged progressive tilt of the group’s donations was a smokescreen, as SBF’s confession quoted earlier testifies. The trough was quite bipartisan, even if tilted toward Democrats. The public data show that many Republicans received large sums from the donor group. Election financing vehicles controlled by McConnell, McCarthy, and other Republicans received substantial amounts, as did some very prominent representatives noisily involved in the battle to regulate crypto, such as Representative Tom Emmer (R-MN), Ritchie Torres (D-NY), and Josh Gottheimer (D-NJ). Stories suggesting that the group tilted toward liberal Democrats are also nonsense. That is not true even for SBF alone; his own contributions to Republican groups were substantial, including over $105,000 to Alabama Conservative Fund, the Super PAC supporting the newly elected Katie Britt in June 2022. When he gave to Democrats, the money flowed almost entirely to corporate Democratic groups and centrist Democratic politicians, not AOC or Justice Democrats.

A look at the institutional context clarifies what was really at stake in all this hyperactivity. FTX’s real aim was to put across a drastic rewrite of longstanding regulations governing commodity clearing houses in favor of a new system that would allow it to “offer direct clearing access to margined futures contracts.” This was no detail; it implied a sweeping change in the “structure of the entire futures market” that would vastly increase “the participation of retail speculators in futures markets, which have historically been markets for physical producers and purchases to hedge price risk, almost always by institutional participants who have the financial resources and sophistication to protect themselves.”[3] Or in other words, invite a vast new herd of eager, but inexperienced lambs to run free in the heady world of leveraged derivatives using crypto, alongside very experienced and well-capitalized wolves.

What could possibly go wrong?

Other major exchanges opposed this but warned that if the Commodity Futures Trading Commission allowed FTX to do this they would follow suit. Regulatory legislation on the books gave significant roles to both the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission. But the crypto industry constantly contested the authority of the SEC. It sought to shunt exclusive jurisdiction to the CFTC, which was more than happy to play along.[4] Thus the FTX group (along with many others in the industry) heavily supported representatives of both parties who favored locating regulation in the Commodity Future Trading Commission.

The Agricultural Committees in Congress principally oversee the CFTC, not the Banking committees. So the FTX groups donated heavily to members of those committees, including at least 19 members of the House Agriculture Committee. The ranking member of that committee, Glenn Thompson (R-PA), took in over $61,000 of direct contributions, for example. Other top recipients on the House Agriculture Committee included Josh Harder (D-CA), Salud Carbajal (D-CA), and Angie Craig (D-MN).

Senate Agriculture was a big winner: McConnell ($3,626,100 – you read that right); Democrat Debbie Stabenow, whose former aide chairs the CFTC ($38,200); John Boozman ($33,200), John Thune ($14,200), and Kirsten Gillibrand ($13,700). By comparison, only six members of the Senate Banking Committee received contributions. Jon Tester led the way with a paltry $8,300.[5]

The FTX group did direct some serious money to the House Financial Services Committee: Ann Wagner (R-MO) led the way with $50,000, but not far behind were some of the most vocal critics of the SEC: Ritchie Torres receiving nearly $30,000, Josh Gottheimer collected $16,600, with Tom Emmer garnering $11,600. An unsympathetic observer might thus conclude, in the spirit of the “revealed preference” theory common in modern economics, that that is the reason SBF preferred to talk to the House, but not Senate Banking Committee. In the House, his appearance would have been more like a Christmas visit from Santa.

If all this brings to mind the long, disgraceful battles over derivatives regulation in the nineteen nineties, it should. It is a near carbon copy of that earlier travesty, right down to the vast clamor from the media and think tanks that all but drowns out critics. The industry was on the verge of getting its way when the crypto dominoes started tumbling down, temporarily slowing its momentum.

But the crypto story, if not FTX’s, is really a zombie movie. Despite everything that’s happened, crypto forces in Congress are still pushing to change the rules on exchanges and to allow pension funds to invest in crypto. Borrowing another leaf from the nineties, they are striving to pin the blame on the disaster that’s occurred on the stronger regulator, the SEC, for not acting, even though they spent years trying to block it from doing so. It strikes us, accordingly, that the first item of business ought to be the demand for full disclosure of all political money SBF, his colleagues, and their firms contributed to everyone on the Congressional committees and in the rest of the political system, together with a full accounting of grants to think tanks and researchers. And the second should be drastic changes at the CFTC, which has once again failed to protect the public.

Notes

[1] Bankman-Fried advanced the claim in an interview with Tiffany Fong. The quotations are taken from CNBC. This article draws also from a complaint by the Citizens for Responsibility and Ethics in Washington.

Bankman-Fried went on to add that he concealed the donations “because reporters freak the f—- out if you donate to a Republican because they’re all super liberal. And I didn’t want to have that fight.” “So, I made all the Republican ones dark.” In fact, there was plenty of money to Republicans on the record from both the group as a whole and Bankman-Fried himself, as we show below. Some other comments he has made about his political giving being limited to primaries are equally discordant with the public record; we refrain from a longer discussion.

A few press accounts recognized the bipartisan nature of the campaign. See especially Politico and The American Prospect.

[2] The quotation comes from the indictment presented here. Several other sections deal with political money.

[3] Letter Dennis M. Kelleher, Stephen W. Hall, Jason Grimes, Scott Farnin of Better Markets, Inc. to The Honorable Rostin Behnam, Chairman, Commodity Futures Trading Commission, June 16, 2022.

[4] See, among many sources, the compelling summaries hereand here.

[5] The totals here and below to individual representatives combine cash streaming into a variety of committees they drew on for resources, not simply their individual campaign committees.

Prediction: There will be no prosecution that risks discovery of dark money flows.

So, “contributions” is not the same as “bribes”. Isn’t it? I guess as long as these are annotated somewhere so that might be disclosed by people like Ferguson et al. There is some guy mentioned here with quite a high share of these contributions! Cryptos must indeed be among those “values” worthy to be defended in Ukraine and elsewhere.

There are times when I really want to know what the courses so many of our illustrious judges took were that taught them that bribes and corruption only exist within a clear and limited context where for all intents and purposes the quid and the pro quo are spelled out in writing almost like a contract. All because I really need it explained to me how so much that is clearly a means of pressing undue influence on government officials, elected or otherwise, can be considered so above board that they can eliminate any laws meant to limit or outlaw it. Not that much makes it to them anymore, they have done so much to clear the runways.

The “citizens” “united” will never be defeated. / ;)

(Thank you, Supreme Court.)

Outside of Congress money given to influence someone’s decision is a bribe.

When given to a congress critter to do the same thing, they are donations.

When I do something potentially illegal and criminal, I am investigated by law enforcement and a criminal complaint is filed.

When a congress critter does something similar, it’s an ethics investigation or an ethics violation.

Rules for thee not me.

Now the scramble in Congress to stay behind the curtain and keep the dark money. But why bother? The way Congress votes is evidence enough of to whom they are listening. Hi ho. And so it goes.

In my experience judges are never themselves corrupt despite almost always favoring the more powerful interests. They are people of simple wants and needs. They want to sit with the cool kids wherever they go, and need to hear someone call them “Judge” everyday, even on Sundays. That’s about all they get, but it’s enough.

> Senate Agriculture was a big winner: McConnell ($3,626,100 – you read that right);

McConnell has the highest “value” of them all. The “price” of his venality is greater than all others combined.

————

Apparently the excrementitious Mercedes G Wagon, the Crypto bros preferred method of virtue signalling, are on sale now. A fine example of fake “wealth” boosting demand in all the wrong places, that blows up when exposed.

I cannot even understand the point FOX News is trying to make about SBF donating to dems who are now letting him go free. Maybe the idea that Rs would have forced a reckoning but those slippery corrupt dems were bribed in advance??? Buts, despite hooting about congress wanting to ask questions, I haven’t heard much that says he is a bad guy. Do they say that? I can only handle small bites of FOX.

And even before this we had a pretty clear view of him “donating” on both sides. So FOX knows the idea of him supporting Dems is BS, the idea the Rs wouldn’t take his dirty money is BS.

re: How FTX showering money on both parties to try to paralyze regulators.

That play works for phrma. / ;)

Useful information although we all know that McConnell is sleazy (didn’t his wife play a role in the Clinton deregulation?). It’s the Dems who have been furiously signalling virtue these days including Biden–the boss of those mentioned agencies–whose contributions aren’t mentioned. The Dems still got the greater amount.

Since Congress is bought and the press are bought and the enforcement agencies are bought you have to wonder who will stand in the way of the wrecking ball. To some of us out here in the hinterlands it already feels like things are falling apart.

For yonks now Yves has talked about “prosecution futures’ with the subject of crypto-anything. Well it turns out that it is and isn’t true. In a rational world this would be 100% true and you would expect Sam Bankman-Fried for example going to the slammer. But I think that we are seeing something different. Crypto has been allowed to grow over the past few years in spite of the dangers of fraud connected with it and the Feds have not really hauled it in, even though it could be used for things like funding terrorism. So suppose that the political establishment let it grow because they could see that it could be turned into their own ATM machine when needed and we have seen this happen with FTX funds that went to the Ukraine and were washed back to political parties. And I would add another possible reason why there is no rush to advance this case. Where this post says ‘some investors in the Bahamas were allegedly afforded a special opportunity to withdraw funds’ I would suggest that those weren’t Bahamians doing that. They were agents for powerful, wealthy people that were allowed to pull their own money out while the little guys weren’t. So with their own money safe, why would there be any rush in prosecuting this case?

Thanks for this post, and the comments. BTW, I found Ben McKenzie’s Senate testimony interesting. (Jack Reed’s committee.)

I almost wonder if the rush to arrest SBF was so the Feds could put a big blanket over the entire affair (“sorry we can’t comment on an active investigation”) and manage the damage to those in power by having the facts to influence the preferred narrative.

imagine that…

No, because Federal prosecution will boost private suits (they can piggyback off their work, plus bar for getting past summary judgment lowered by mere fact of indictments, regardless of outcome) and private plaintiffs can also do discovery.

“Indeed, coming from someone who helped liquidate Enron and a long line of other financial duds, they are downright chilling: “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.”

Flags were being waved at Madoff’s operation as far back as the 90s. Madoff got away with actually never making a trade for decades. And think of things like the BCCI banking operation.

And more.

If he hasn’t seen decades of systemic fraud and assorted crimes, his eyes also have been closed.

which should remind that no new regs are needed to prosecute what SBF did… and all the screaming that suggests this is the “worst financial crime evah” is laughable.

The reality that FTX was attempting regulatory capture, and the idea of FTX being “involved with US-Ukrainian relations” are not mutually exclusive as per the idea of dark money flows from the article.

This seems similar to the late 80’s Keating Five scandal ( 4 Democratic Senators (including former astronaut John Glenn) + Repub John McCain).

The political influence game doesn’t go out of style.

https://en.wikipedia.org/wiki/Keating_Five

“Lincoln Savings and Loan collapsed in 1989, at a cost of $3.4 billion to the federal government. Some 23,000 Lincoln bondholders were defrauded and many investors lost their life savings. The substantial political contributions Keating had made to each of the senators, totaling $1.3 million, attracted considerable public and media attention. After a lengthy investigation, the Senate Ethics Committee determined in 1991 that Cranston, DeConcini, and Riegle had substantially and improperly interfered with the FHLBB’s investigation of Lincoln Savings, with Cranston receiving a formal reprimand. Senators Glenn and McCain were cleared of having acted improperly but were criticized for having exercised “poor judgment”. “

exactly…

stern reprimands will be forthcoming

and whatever happened to that FTX compliance lawyer, Daniel Friedberg? he seems to have escaped scrutiny so far despite his previous record…

And Fried’s partner, Gary Wang, who apparently was the programmer who set up FTX (back doors and all). I’ve never even seen a photo of that dude.

> While his recent public utterances clearly often mix poetry and truth

Dry, very dry

In other news, the money SBF gave to the Effective Altruists has been handled in the most effective way to decrease human suffering. By buying not one, but two castles in Europe!

After all, isn’t alleviating castle envy among the altruists themselves the effective altruism? Free from castle envy, they can now concentrate on alleviating suffering, starting with the largest. Which is of course preventing chatbots from becoming evil AI, taking over the world and torturing the uploaded consciousnesses of mankind for eternity.

They are a cult, just like Scientology. And SBF might very well be a true believer, in which case he was in his own mind morally obligated to steal all the money (“earn to give”), and buy the indulgences. After all, as he told the New Yorker this summer, he would donate to prevent “AI risk”, which is what they call the Evil AI takes over future.

Great article and very readable (I particularly liked “These little piggies were going to market”). It all starts to look awfully familiar: politicians and executives profit handsomely, and the losses are pushed onto pension fund beneficiaries and taxpayers when it all comes crashing down (as regards crypto this is very much when and not if).

It does seem like there is some hope of heading it off this time, or at least limiting the damage. The crypto execs are neither as competent nor as well-connected as the banking execs in 2007/8, and seem to have drunk a little too much of their own Kool-Aid. Plausible deniability is part of the game, and if your largest campaign beneficiary turns out to have been running a clown show like FTX and helping themselves to customer funds without regard for pesky things like laws, it’s not a good look. Witness the scramble to memory-hole SBF at present.