The CalPERS long-term care fiasco continues, with the board and staff taking a course of action that increases harm to policyholders by continuing to bleed them rather than put the program in bankruptcy.

For those new to this train wreck, the public comment at the February 14 CalPERS board meeting by policy-holder and certified financial planner Lawrence Grossman provides an introduction. A key bit of background is that state legislation allowed CalPERS to jump on the long-term care insurance bandwagon in the 1990s. Most of these insurance plans have gotten into a world of hurt by underestimating the degree to which proper elder care would extend lifepsans of policy-holders and overestimating the lapse rate (lapsed policies mean the premiums paid by dropouts benefit the remaining policyholders). But CalPERS’ recklessness and incompetence were in a league of its own.

CalPERS not only considerably underpriced its policies compared to commercial competitors, but it made matters worse via giving CalPERS policyholders the options of lifetime benefits (as opposed to fixed dollar benefits) and inflation protection. Inflation protection would seem like an incredible promise for any long-term insurance scheme. Yet the policies were advertised as CalPERS policies, not those of a free-standing “CalPERS Long-Term Care Fund,” as in not backed by CalPERS or the state of California.

It doesn’t look like there will be a happy ending for the over 100,000 CalPERS long-term care policy holders who are represented in the class action lawsuit, Wedding v. CalPERS. That doesn’t mean there’s a good outcome for CalPERS either. However, things should work out for the plaintiffs’ attorneys.

The bone of contention is that CalPERS approved an eye-popping 85% increase in premiums in 2013, hitting only the policies with the most generous payment features. The plaintiffs contend that these increases weren’t permissible and are seeking substantial damages.

The case has been grinding through the California courts since 2013. Judge William Highberger, in his decision from a June 10 trial, explicitly called on the legislature and state government to bail out the long-term care scheme.

Needless to say, this is a highly unusual step for a judge to take in a contract dispute. At a minimum, it signals an expectation that CalPERS will lose and lose big.

But CalPERS losing would be of no benefit to the policyholders as a whole (there could be some reallocation among them). It’s highly unlikely that the state will throw money at CalPERS. Unlike CalPERS’ pensions, the state has no obligation. The long-term care insurance plan was set up to be self-funded. So in a worst-case scenario, and “worst-case” looks all too likely, the relevant plans will be insolvent.

If the case results in a significant money judgment against CalPERS, and the judge’s body language is that that’s a probable outcome, the only place the funds can come from is the long-term care plans themselves. As we’ll discuss, that means that CalPERS would need to bankrupt the long-term care plan or take other measures to deal with their insolvency. Note that CalPERS has just put out a bid opportunity for an outside bankruptcy counsel.

But expect CalPERS to drag things out. Defaulting on this scale would be a huge embarrassment. CEO Marcie Frost and General Counsel Matt Jacobs will do everything they can to try to kick this mess over to successors. The most likely course is for CalPERS to appeal and put off a formal bankruptcy or alternative (a runoff plan?) as long as possible.

Four years later and things are going according to CalPERS’ abusive plan. Even though Judge Highberger clearly rejected CalPERS’ position that it can violate policy terms and raise premiums, CalPERS has continued to increase premiums because the court so far has issued only preliminary decisions. Note these increases are vastly in excess of those implemented by commercial carriers.

By dragging things out and putting through punitive premium increases, CalPERS hopes to accomplish two things:

Have more policy holders die, reducing the number of potential claimants on a too small pot of funds

Having more policy holders lapse, either due to inability to afford the vastly higher premiums or dropping the policy out of the belief that the cost of keeping the policy is too high compared to any payoff.

Notice CalPERS’ abusive approach is succeeding. We wrote of “over 100,000” plaintiffs in the class action suit in 2019. It’s now down to “over 80,000”.

Now to Grossman’s update, starting at 1:10:

President Taylor, members of the Board, good morning, thank you for five minutes.

My name is Lawrence Grossman and I live in Benicia, California. I am here to comment on the CalPERS long-term care insurance crisis.

Permit me to be perfectly frank: If the CalPERS long-term care insurance program had honestly disclosed what it is, I believe that no reasonable person would have bought a policy.

But CalPERS has been extremely dishonest by not disclosing material facts. And it sold about a quarter of a million policies.

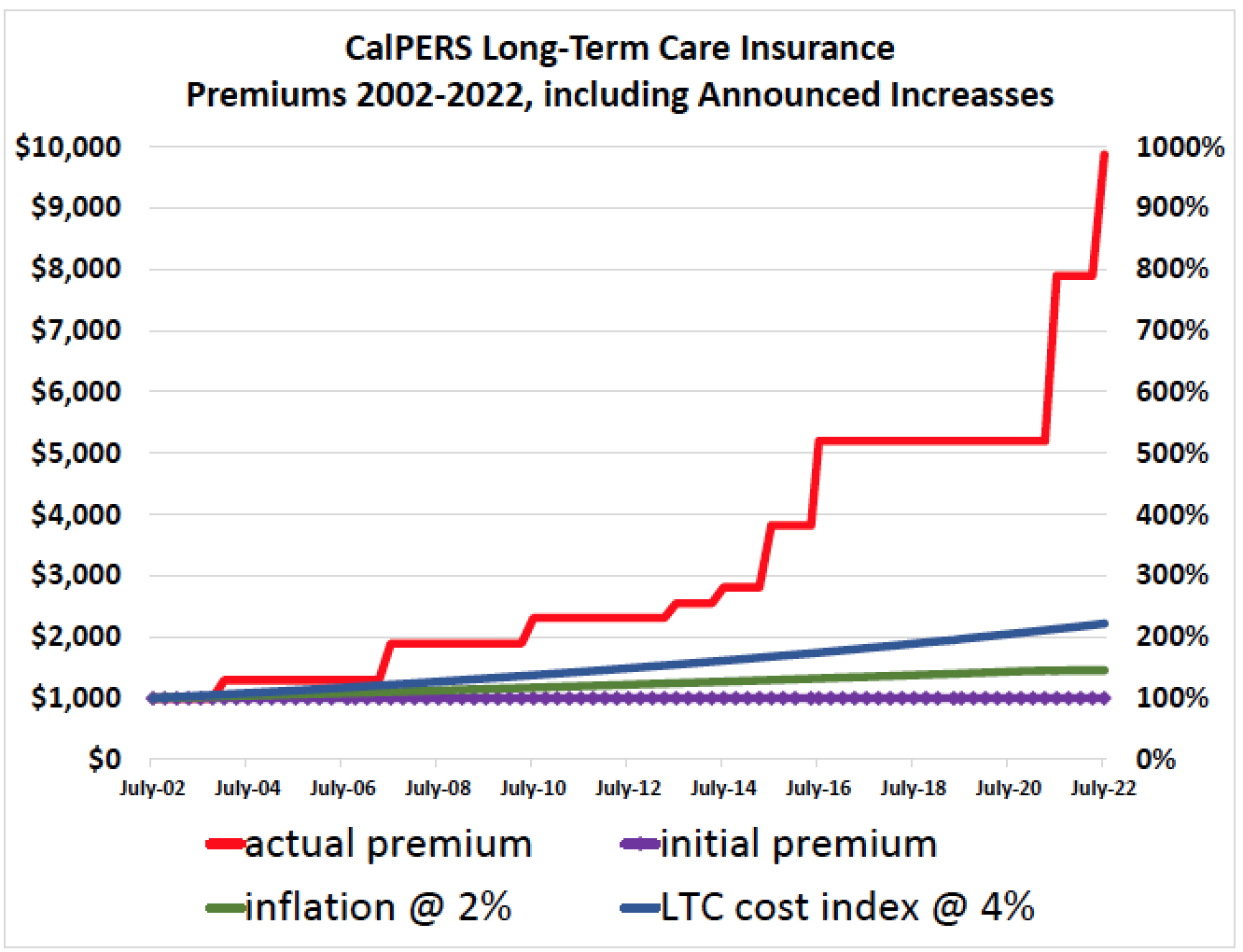

The program has been implemented incompetently and is now a financial disaster, primarily of CalPERS’ creation. Yet CalPERS wants policyholders to pay for its failings and to that end has broken contracts and has risen premiums at times ten fold, as in 100% .

The ongoing class action lawsuit, which this Board has fought for nine years, addresses only part of the problem. There remain earlier and later rate increases which are inconsistent with policy contracts as well as damages caused by deceptive sales practices.

This is why a public audit of the program is necessary.

Likely you noticed that each candidate last year for the CalPERS Board seat that Ms. Walker won emphatically stated during their debate that the CalPERS long-term care program is a “failure” or “debacle”. This Board has denied that, with staff asserting publicly that the CalPERS program has simply experienced problems which all the commercial long-term care insurance companies have experienced. That assertion seems quite inconsistent with the facts and needs to be publicly examined.

CalPERS has failed to follow its enabling legislation which requires it to offer a commercial policy option in the CalPERS program if there is a program at all. But CalPERS decided to ignore the law because, I have been told by former CalPERS Board members, staff asserted that the so-called self-funded option was far superior.

Yet even if one believes the commercial option is less attractive, how was it possible to ignore the law? Why did CalPERS not let consumers choose? CalPERS’ General Counsel was asked that question in writing by a colleague of mine. The General Counsel had an associate respond, who simply wrote that “this is how the long-term care program has always operated and there are no present plans to change it”.

Not offering a commercial long-term care insurance option means that the self-funded option did not have to compete with another policy that CalPERS endorsed. Competition would have let buyers see the crucial differences between a policy subject to Department of Insurance oversight and a self-funded one without oversight.

The self-funded option, I submit, also is dangerously convenient to CalPERS. It means that CalPERS is not subject to Department of Insurance regulation. Undoubtably, the Department of Insurance would not have permitted the 900% premium increases that CalPERS has imposed; the Department of Insurance certainly has not approved such rate increases for any commercial carrier.

As President Biden said recently during his State of the Union address, “Capitalism without competition is not capitalism. It’s extortion. It’s exploitation”. Effectively, that is what we have with the CalPERS long-term care program. We have neither competition nor regulation, just extortion and exploitation.

In just a few months, one of the largest class-action lawsuits in US history will go to trial in Los Angeles, CalPERS versus 80,000 or so of its long-term care policyholders, the remaining ones. CalPERS settling the suit now with policyholders on equitable terms is both necessary and the ethical thing to do. Then CalPERS must turn to the remainder of the long-term care mess. Until it is cleaned up, we aggrieved policyholders are not going away.

And since I have 42 seconds, thank you, permit me a personal comment. I wonder if any of you has spoken with a long-term care policyholder; it is heart-breaking to do so. I have spoken with nearly a hundred policyholders who reached out to me for help after reading my articles about this long-term care CalPERS crisis. Each one believes that they have been cheated by CalPERS and that their financial and physical security during their final days has been stolen by CalPERS. As an eighty-year-old policyholder wrote me: “There is no escaping the conclusion that the people we have totally entrusted to look out for our interests have decided to ride it out, waiting for us to die.”

Of course the board ignored Grossman and went on to the next person on deck for public comments. The current board has no incentive to deal with the plaintiffs in good faith because they have no skin in the game. Only seven former board members are named defendants. No executives are named.

I urge the attorneys pursuing this case to consider amending this case to include current executives and board members as defendants for the additional, willful damage done since the filing of this case by their punitive treatment of the plaintiffs, in defiance of the judge’s repeated rulings about CalPERS’ permitted scope of action. CalPERS’ top brass has relied over-much on self-dealing, underpriced self-insurance rather than third party directors’ and officers’ policies. It is very likely that the perps in the financial torture of aged CalPERS long-term care insureds are flying naked as far as their exposure is concerned. Turning the heat on them could expedite a long-overdue settlement.

Congratulations to CalPERS for making it all the way to early February before their shenanigans are cause for a post on them. This really sounds like CalPERS is trying to have their cake and eat it – while telling the peasants to go die. On one hand, the policies were advertised as CalPERS policies even though they were in fact free-standing polices that were not backed by either CalPERS or the State of California. On the other, they are fighting to defend themselves in court about those policies and are already thinking about putting those policies through bankruptcy and abandon those policy holders. So the question remains – are they CalPERS policies or not. Their behaviour plainly states that they are. And if it walks like a duck and quakes like a duck, it is a duck. As this point they might as well offer those surviving 80,000 policy holders a pack of cat-food in exchange for their original policies as the former is actually worth something. And CalPERS will walk away while the State will say that being a commercial dispute, it has nothing to do with them.

💯 for Rev.

Don’t given them too much credit. There was no Board meeting in January.

I enrolled after the increase that is the subject of the lawsuit. After the gigantic recent premium increase I did some research. Among the things I learned: (1) the legislation has always mandated that CalPERS contract with a provider of LTC insurance; a program solely managed by CalPERS was an allowable additional option. It was never to be a substitute. (2) A few years after inception of the program it commissioned a consultant report. That report told CalPERS that its assumptions on returns on investments and claims were incorrect, that its staff was not competent to run such a program; and advised the advantages of an insurance company running it, not only due to an insurance company’s expertise, but also its ability to draw funds from other insurance products if needed. (3) CalPERS has made exactly the wrong investment decisions over the years. (4) CalPERS kept increasing the relatives and partners eligible to enroll in an effort to “stabilize” the program. There is no one left to add, even if someone were foolish enough to want to join, and CalPERS withheld the material information from prospective new enrollees that the program was unstable.

Thank you for this firsthand report.

/s

they could mitigate the problem by revising the contract further to specify that to be eligible for payment, LTC facilities must implement no protective mitigations to slow the spread of CV in the facility.

Rule #2: Die (faster)

/s

—

TBH, my recent visits to friends at a LTC facility suggest that this may actually already be practically the norm. I offered some N95s to staff; they were declined. The friends accepted them, but don’t use them.

Not meaning to defend CalPERS, but these policies were heavily promoted, oh, about 20 to 25 years ago. My mother and father both purchased policies offered by a Pennsylvania-based company called Penn Treaty.

By the time Mom and Dad actually needed to use those policies, and, yes, they paid through the nose for them, Penn Treaty was being liquidated by the Commonwealth of Pennsylvania. And I have to say that I never had any problem getting Penn Treaty to actually cover my parents.

The problem lies further up the food chain. Ideally, insurance is intended for infrequent events, say, like a tree falling on your roof.

With LTC insurance, just about everyone who bought a policy eventually needed to use it. And that wreaks havoc on the business model of insurance.

They were heavily promoted much more recently. And the basic problem is that CalPERS did not contract with a long-term care insurance provider, notwithstanding statutory requirements. The feds contract out and their program functions. It’s much more than market issues that have created the CalPERS debacle

Slim – I was in the life insurance business about 30 years ago when LTC policies became popular.

The competition was fierce with almost every insurance company trying to get in on the action. Unfortunately, with no experience to fall back on, the actuarial assumptions were way off base. Penn Treaty was far from the only insurer that was liquidated due to bad assumptions.

The false assumptions of lapse rates and lifespan have caused most of the problems. Many more people than expected held on the policies because the benefits were seen to be very valuable and most people knew someone in long term care and how expensive it was. Plus, improving medical care led to folks living longer (once they get that old).

The points you raise were taken into

By the time I enrolled, the initial problematic assessments were well-known.

It’s also worth mentioning that imposing very large rather than incremental rate increases – as CalPERS has done – is a strategy whereby insured persons are encouraged to let their policies lapse. (The practice is well known and has a name that I do not recall.)

One more thing worth noting is that when there was a significant premium increase in the federal program (which is subject to competitive bidding and involves 7-year contracts (the last time I looked) – Congress got involved and held hearings. The silence of the California Legislature is deafening.

I am an attorney and frankly consider myself to have been duped. It was only after I started researching legislative history of the Public Employees’ Long Term Care Insurance Act that I saw that when my enrollment was solicited CalPERS was telling the Legislature that classes of people eligible for enrollment should be expanded, among other reasons, to stabilize the program. The same information was in some (partial) responses CalPERS made to my Public Records Act requests.

People my age (76) now have no other alternatives. We are too old to be insured elsewhere.

It should be noted that this “inflation-protected long-term care” plan is yet another pyramid scheme concocted in the 1990’s by the same SoCal Republican cabal, led by former U.S. Senator and State Governor Pete Wilson, who came up with the public utilities “privatization” fantasy that has led PG&E through multiple bankruptcies and into a manslaughter charge.

When you’re morally bankrupt — and a magical-thinking moron — financial bankruptcy is no big deal.

The phrase “CalPERS continues to behave badly.” reminds me of the first season of Saturday Night Live, when Chevy Chase would always begin each episode of “Weekend Update” with the news that Generalisimo Francisco Franco was still dead. So true that it almost doesn’t even need to be said. Almost.

Despite living in California for two decades I was never a state worker so it’s technically not my problem but I despise powerful incompetence and CalPERS seems to embody this in spades. I truly think they’d put a hit on Yves if they thought they could get away with it. She is their avenging Nemesis, and I can only say “Brava!” to our fearless leader. Yves, keep the incoming fire on to these corrupt, bought bureaucrats who have forgotten for whom they work. My god, we live in squalid times.

PS: Even if CalPERS decided to take Yves out, they’d blow it. If these guys tried to organize a two car funeral procession they’d mess it up; it would cost 10x its budget and they’d loose the body, which would likely turn up in some Private Equity roadshow as an exhibit as some sort of plasticized and dissected ‘human diorama’.

To paraphrase Dean Wormer from the comedy classic Animal House, CalPERS should realize that bloated, unprofitable, and lazy is no way to go through life.

Cheers,

d

Does anybody know why the fact that CalPERS ignored the statutory requirement to offer a commercial plan is not part of the class action? The class’s attorneys could not have been unaware of this fact, yet they chose not to make it part of the suit. I have yet to hear an explanation for this.

for those readers that would like to communicate their views to representatives in sacramento, here is sample language:

Dear_______:

I am writing to request your assistance because I have been gravely damaged by the CalPERS long-term care program that deceptively sold me an inappropriate and fatally-flawed long-term care policy. Here is the issue in sum. I can provide further detailed information if you wish.

Contrary to enabling legislation, CalPERS has operated incompetently the equivalent of a long-term care insurance company since the 1990s. The CalPERS long-term care program has been a massive financial failure and, to balance the books, CalPERS has brazenly broken contracts for decades of hundreds of thousands of insureds and raised premiums 900% and more.

The resulting class action lawsuit started by policyholders against CalPERS nine years ago and which is yet unsettled, if it ever prevails, would be grossly inadequate and inequitable, and moreover address none of the abusive business practices that induced California public employees to buy policies that were extremely risky and deceptively marketed.

The fact that two Superior Court judges have issued in recent years two preliminary rulings in the ongoing suit in support of policyholders charging that calpers breached their contracts, as well as the fact that CalPERS has already agreed to settle the lawsuit by paying $2.7 billion, demonstrate that the CalPERS long-term care program has been operated in a highly irresponsible manner that requires an audit as soon as practicable to determine precisely what happened and how best to provide justice to policyholders who are elderly.

The Joint Legislative Audit Committee, or a similar body, should do that audit. I ask that you take appropriate action to initiate such an audit.

Please let me know how you will proceed with this request.

Sincerely,

YOUR name