Yves here. This post will likely be an eye-opener to many by describing the very large, ongoing subsidies from central banks to banks via payments on bank reserves. And here you were worried about underpriced deposit insurance!

It tries to unpack why central bankers ever could have rationalized such large gimmies, and here one that has grown as central banks increase interest rates to fight inflation. The authors focus on how central bankers (overwhelmingly monetary economists who follow The Gospel According to Milton Friedman) have accepted the bank lobbyist argument that more efficiency is ever and always a good thing, when in fact any efforts to reduce risk come at a cost.

While this argument is sound, let me point out an additional layer: bank regulators have internalized the idea that they should care about bank profits. Up to a point, that’s not crazy; if banks are going to increase their capital levels, it comes from profits or selling new shares or selling some exiting units at a good price. However, in Japan in its heyday, banks were low earners by international standards. The reason was that bank profits were seen as coming at the expense of the productive economy, and therefore were not to get out of hand. The reason the banks all blew up was not much due to this philosophy, but the rapid deregulation forced on them by the US, primarily for the purpose of making the world safer for US investment banks. It was like taking a drayage company, giving them a 747 and telling them they could fly it because they were in the transportation business. A crash was baked in.

By Paul De Grauwe, John Paulson Chair in European Political Economy London School Of Economics And Political Science and Yuemei Ji,Associate Professor University College London. Originally published at VoxEU

Since central banks started their fight against inflation, they have transferred massive amounts of their profits to banks. The authors of this column have suggested that minimum reserve requirements are a valid alternative, but they have met fierce resistance because they are seen as introducing distortions and departures from efficiency. However, the authors argue that successive financial crises have shown there is a trade-off between efficiency and stability. The emphasis of central bankers on using policy tools that do not interfere with market forces comes at the price of less stability and more financial crises.

One legacy of quantitative easing (QE) is that banks have accumulated huge amounts of bank reserves. As a result, the bank reserves market is characterised by a large excess supply. This has kept the money market (interbank) rate stuck at the zero lower bound for many years, until the central banks felt compelled, from early 2022 on, to raise interest rates to fight inflation. Given the excess supply of bank reserves central banks could only perform this feat by raising the rate of remuneration of bank reserves. As a result, this rate of remuneration became the new (not zero) lower bound in the money market (De Grauwe and Ji 2023a, 2023b).

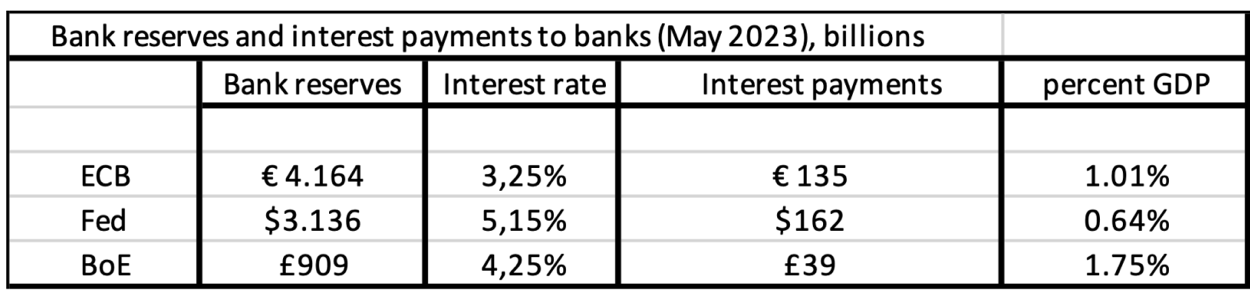

This policy now has created a lot of ‘collateral damage’. Since the stock of bank reserves is extremely high, the central banks now pay out large amounts of interest rate remunerations to banks, which increase with every interest rate hike. We show this in Table 1. This presents the outstanding bank reserves in the euro area, the US, and the UK in May 2023. We also show the interest rates prevailing at that time (second column). The third column presents the total interest payments made by the respective central banks to their domestic banks. The last column expresses these as a percent of GDP.

These are substantial numbers. To give some perspective, these interest payments exceed the seigniorage gains (profits) of modern central banks. For the US, for example, it has been estimated that seigniorage gains are less than 0.5% of GDP (Barro 1982, Cutsinger and Luther 2022). 1 Thus, as a result of their anti-inflationary policies, central banks transfer more than the total seigniorage gains to private banks. An extraordinary outcome of the fight against inflation. This is all the more spectacular as the seigniorage gains of central banks find their origin in the monopoly power granted by governments to central bankers. One would expect that these monopoly profits would then be returned to the government. Instead, they are returned more than fully to private agents.

Table 1

Source: De Grauwe and Ji (2023b), Board of Governors of the Federal Reserve, and ECB.

In our previous publications (De Grauwe and Ji 2023a, 2023b), we argued that the remuneration of bank reserves is not inevitable and that there is an alternative to the current central banks’ operating procedure that would avoid making large profit transfers to private agents. We proposed using a system of two-tier minimum reserve requirements. This consists in freezing part of the existing bank reserves in non-interest bearing deposits, while remunerating the reserves in excess of these minimum requirements. This achieves two things: It allows the transfer of central banks’ profits to private agents to be drastically reduced, and it makes it possible for the central banks to maintain their current operating procedure.

In addition, the existence of non-remunerated minimum reserves makes the transmission of monetary policies to the real economy stronger. In their attempt to restore their profit margin (that is reduced by the existence of non-remunerated minimum reserves), banks will tend to increase the loan rate more than proportionately to the increase in the central bank’s policy rate (remuneration rate). Thus, a given increase of the policy rate is amplified in the loan rate. This also makes it possible for the central bank to have the same impact on the real economy with a lower increase in the policy rate. This in turn may reduce the balance sheet losses of banks when faced with higher interest rates and, in so doing, soften the dilemma central banks face between price stability and financial stability.

We believed that a two-tier system of minimum reserves is a reasonable alternative to the present system that subsidises banks in an exorbitant and unsustainable manner. We found out, however, that this is not generally considered to be reasonable. The resistance of central bankers and many economists (cheered on the sidelines by bankers) to the use of minimum reserve requirements is formidable. 2This led us to ask the question of where this hostility comes from.

The Unpopularity of Minimum Reserve Requirements

Minimum reserve requirements were a standard tool of monetary policy in the past in many industrialised countries. This monetary policy tool is still being used in many emerging countries. However, its use as an active tool of monetary policy has been discontinued in most industrialised countries. Why have minimum reserve requirements become so unpopular among central banks and economists?

Trade-Off Between Efficiency and Stability

The decline in the use of minimum reserve requirements by central bankers was very much the result of a paradigm shift from the 1980s on – a shift that stressed the use of market forces and that frowned upon policy induced distortions. Minimum reserve requirements were seen as introducing important inefficiencies in the financial markets that had negative effects on the optimal allocation of capital. It was often – and is still – interpreted as a form of financial repression that leads to wasteful investment with a negative effect on economic growth (see McKinnon 1972 for an early and influential analysis of this view). The corollary of this view was that in truly free markets (and provided the monetary authorities maintained price stability), the risk of financial crises would be minimal.

This view led to the idea that when minimum reserve requirements are used, they should be remunerated. In doing so, the inefficiencies are minimised. This view was first expressed by Friedman (1960) and led to a literature discussing how the remuneration of minimum reserve requirements would increase the efficiency of the banking system, and by the same token the profits of the banks (Freeman and Haslag 1996, Williamson 2016). It appears that the literature discussing the need to remunerate reserve requirements was exclusively driven by the need to increase efficiency with a total disregard of the need to maintain monetary stability.

How large the cost of the inefficiencies induced by minimum reserve requirements are is an empirical matter. 3 The jury is still out on this (Cuaresma et al. 2019). But clearly there is a trade-off between efficiency and stability of financial markets. The existence of such a trade-off has now been firmly established both theoretically and empirically. On the one hand, there is a large literature documenting how financial liberalisation spurs efficiency and growth (see Levine 1997, Beck and Levine 2004, Bekaert et al. 2005 for both theory and empirical validation). On the other hand, there is an equally large literature showing that financial liberalisations tend to lead to excessive risk taking in financial markets increasing the risk of crises (Stiglitz 2000). As a result, most banking crises in the postwar period have occurred after financial liberalisations (Demirgüç-Kunt and Detragiache 1999, Kroszner et al. 2007, Arregui et al. 2013). The fact that financial liberalisation leads to more efficiency and more instability leads to the conclusion that financial liberalisation leads to a trade-off between efficiency and stability.

By abandoning the use of minimum reserve requirements, central banks also abandoned the use of an instrument of monetary policy whose primary aim is stabilisation of the banking sector and, more generally, the business cycle. Thus, one can also conclude that in the choice between efficiency and stability, central banks chose for efficiency at the detriment of stability.

Historically, central banks tended to use minimum reserve requirements as a tool to achieve greater stability even if this choice led to less efficiency. Central bankers in the past realised that booms and busts, driven by waves of optimism and pessimism, are characteristics of a dynamic capitalistic system. They also knew that banks that create credit and money tend to amplify these movements. During booms euphoric bankers in search of profits create an excessive amount of credit thereby exacerbating the boom. That’s when raising minimum reserves becomes very effective in halting excessive credit creation. During busts, these minimum reserve requirements can be relaxed thereby mitigating the downward movement. Central bankers of the past found out that minimum reserve requirements are effective tools of stabilisation.

This choice in favour of stabilisation made in the past by central bankers also reflected the analysis made by economists. The most extreme example of this was the ‘Chicago Plan’ published by economists of the University of Chicago in 1933 in which they proposed to impose a 100% reserve requirement on banks issuing demand deposits (Simons, et al. 1933). These economists took the view that the link between the payment system and credit creation made the banking system unstable, producing bank runs and crises and thus endangering the stability of the whole economy. In proposing a 100% reserve requirement, they aimed at de-linking money and credit creation. This was the only way, they argued, to avoid destructive banking crises in the future. Clearly, these economists chose stability over efficiency, mainly because history taught them that banking crises are extremely destructive.

A Trade-Off between Liquidity and Profitability

One would have expected that after the banking crisis of 2008 monetary authorities would have taken recourse to minimum reserve requirements as an instrument to stabilise the banking system. They did not. Instead, under Basle III they introduced a new instrument of liquidity control. Banks of a certain size were subjected to a liquidity coverage ratio (LCR) (see BIS (2013). The Basle III agreement defines the assets that qualify as liquid assets to be included in the LCR and calls them ‘high-quality liquid assets’ (HQLA). The problem is that there are just too many HQLAs eligible for liquidity purposes. Not only do bank reserves at the central bank qualify, but also government bonds, certain types of corporate bonds, and even equity. It is striking that many of these assets, even with much imagination, do not qualify as liquidity because their prices in times of crises become extremely uncertain.

We know what happened recently. The Silicon Value Bank had a high LCR as a large part of its assets consisted of long-term government bonds. Yet it was unable to confront large deposit withdrawals. With the increase in interest rates the market value of long-term government bonds had declined significantly. When it was forced to sell these bonds to satisfy deposit withdrawals, the losses incurred on these bonds made the bank insolvent.

It is difficult to understand how regulators designed such a caricature of liquidity management. The common sense dictated that they would reactivate the only sound instrument of liquidity control, i.e. reserve requirements at the central bank. They did not do so, obsessed as they were about not damaging the efficiency (and the profits) of the banking sector. This also seems to be an example of capturing of the regulators by banks that want to have their cake and eat it – they want to have liquidity and make profits. The holdings of truly liquid assets should not be profitable. Here also there is a trade-off – between liquidity and profitability. Assets that are very liquid are not profitable; assets that generate profits are not very liquid.

By remunerating bank reserves, the central banks eliminated the trade-off between liquidity and profitability for the banks. In doing so, they created a land of plenty for the banks. They made it possible for banks to hold highly liquid risk-free assets and make a lot of profits. The rate of remuneration on bank reserves at the Fed (5.15%) is now (May 2023) substantially higher than the yield on 10-year US government securities (3.4%). Also, in the euro area, banks can earn more on their bank reserves (3.25%) than on 10-year German government bonds (2.25%). An extraordinary act of generosity towards bankers, at the expense of taxpayers and the stability of the financial system.

See original post for references

Well, if I played the Lottery and won big-time, the second thing I would do after paying off debts would be to open a Bank.

Off-topic:

I continue to have issues with the We Value Your Privacy (Admiral) cookie-preference pop-up. It appears every single time that I load an NC page, if I check “Reject all”.

Note: I have sent an email about this issue, including my OS and browser details, but have not received a response.

Thank you.

We say in our Policies that we don’t even remotely have the staffing for us to be able to respond to e-mails. But I did tell our ad service and they said it was solved. I will go back to them.

I haven’t had the pop up since it was mentioned a while back, but I also don’t get any ads

Still getting the pop-up. Not expecting you to invest time in fixing this, by the way, Yves, just thought you might like an update, as per Tinky.

(UK reader, Windows Edge user.)

Thanks.

I am using a Mac (which shouldn’t be relevant), and the issue occurs both with Safari and Firefox.

I am based in Europe, which may well be relevant.

>>>It was like taking a drayage company, giving them a 747 and telling them they could fly it because they were in the transportation business. A crash was baked in.

Nice similie.

That the “industrialized” countries follow different rules than the developing seems typical in a cynical way. This fits with all my priors, such as capture of government and the regulation provided by capital.

I had not gotten that memo that reserve requirements were a thing of the past, with Basel III:

“Instead, under Basle III they introduced a new instrument of liquidity control. Banks of a certain size were subjected to a liquidity coverage ratio (LCR) (see BIS (2013).”

The authors conclude: “An extraordinary act of generosity towards bankers, at the expense of taxpayers and the stability of the financial system.”

I know the correct news narrative, of the 3 of 4 largest bank failures ever in the usa banking system (and in the eu, credit suisse wasn’t tiny), in the past few months is, “don’t worry nothing to see here, move along”. It would be interesting to read what the authors think are the stability risks of making the banks be their own regulators. Perhaps we will soon find out.

This article does not do an adequate job of explaining what led particular countries’ central banks to eliminate reserve requirements at particular points in history. I would have at least expected some comparison of the experiences of Canada and the United States, as Canadian banks have long operated without reserve requirements.

Did US Banks find the increase in fed funds rate by 5% profitable? Their assets declined in value, and their liabilities didn’t. Was there a lot of bungling with respect to asset/liability management? Of course. They lost a lot and are amortizing their errors … and deserve the financial consequences.

Owners of banks are losing money…not receiving windfalls.

Just a high level perspective.