Yves here. If the forecast in this article proves to be correct, and the author argues that it’s pretty much baked in, a big fail in US LNG production will produce a lot of collateral damage. The first is for Europe, which bet on LNG and renewables being able to replace the loss of cheap Russian gas. Recall that contrary to quite a few forecasts, Europe got through last winter without obvious bad outcomes due to demand destruction in the form of de-industrialization (an unacknowledged bad outcome), conservation, and a warm winter. Particularly because energy price subsidies are boosting demand, it is not at all obvious that Europe will have such favorable events next winter. At a minimum, scarcer and pricier LNG will make building up inventories more costly. Yes, the article puts the big production drop taking place in six to eight months, and there is presumably a lag between production and delivery. However, the flip side is that market pricing anticipates supply and demand changes, so there are good odds that prices will rise before the shortfall becomes acute.

Biden will be a second casualty. Higher oil prices will propagate through the economy, and if the impact is marked enough, will induce the Fed to not relent on scarce money or even tighten the screws further. Bush the Senior attributed the failure of his re-election bid to the Fed waiting six months longer than it needed to to start easing.

By David Messler, an oilfield veteran, recently retired from a major service company. During his thirty-eight year career he worked on six-continents in field and office assignments. He currently maintains an independent training and consulting practice, and writes on energy related topics. Originally published at OilPrice

- While the EIA and others see U.S. shale production rising through the end of 2024, there are some worrying signs that production may already be slowing.

- The two main drivers of U.S. shale production, DUC withdrawals and the rig count, are in decline while 82% of wells drilled in 2022 were to replace legacy production.

- With analysts already warning of an oil price spike later this year, a dramatic drop in U.S. shale production will add significant upside to any rally.

I have argued in several Oilprice articles, and most recently in February 2023, that the era of increasing output from shale wells did not have much more room to run absent a price signal that caused a huge increase in drilling. A price signal similar to the one the market received with the onset of the Ukraine invasion, that added 153 rigs in U.S. shale plays from January to June of 2022. Instead, as the market adapted to the loss of Russian oil and gas, and worries about the strength of the economy cast doubt on demand, prices began to soften throughout the rest of the year.

As we approach the midpoint of 2023, WTI prices have mostly stayed in a $70-$80 range, continuing a pattern that established itself in late Q-4, 2022. There is nothing in the next few months that will interrupt this pattern, but if we look a little farther out, in the next six to eight months, we can make a case for a transformative drop in U.S. domestic production.

Subtle Changes in the U.S. E&P landscape

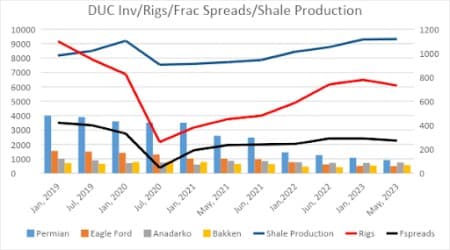

The chart below is a little busy, so we will spend some time decoding it. The multi-colored, vertical bars show changes in the drawdown of Drilled, but Uncompleted (DUC) wells over the last four years. Low oil prices from 2019 through December, of 2021 drove a decline in DUCs from ~4,000 to 1,446, more than 75%. During this period, oil companies desperate for revenue and needing to control costs thanks to oil prices below $70 per barrel, turned to DUCs to maintain output. Post-January 2022, higher oil and gas prices drove a rapid increase in drilling, and attenuated the trend toward DUC activation as the year wore on. From January of 2023, both DUC withdrawals and drilling have declined and shale output has essentially flatlined around 9,300 mm BOPD, according to the monthly EIA-Drilling Productivity Report. The most recent results of which are captured in the graph below, along with rig data from Baker Hughes and frac spread count data from Primary Vision.

One final point I’ll make regarding the graph above, and I will have to ask you to use your imagination as I didn’t graph this, but you will notice the slope of the decline curve for DUCs is largely a mirror image of the increase in production from January of 2021. The takeaway being that DUC withdrawal is responsible for much of the 1.7 mm BOEPD added since Jan-2021.

Drilling doesn’t begin to pick up until June 2021 and it’s not until June 2022 that the rig count-dedicated to oil, rises above 600. The rate at which I estimate is necessary to grow production beyond the natural decline rate, ~40% annually, of shale typically. I discussed this in a recent Oilprice article.

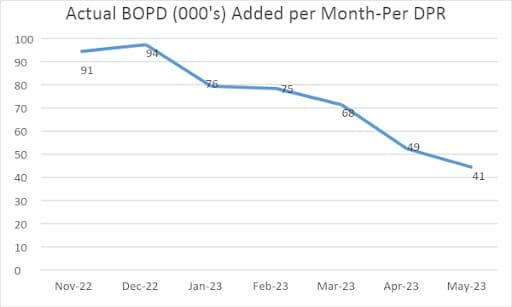

“We have had about 600 oil rigs turning to the right since the middle of last year. Since June 22, we have gone from 8.7 mm to 9.4 mm BOPD in shale output, or about 700K BOPD of increase. That’s less than 58K per month of new production, meaning that about 82% of the ~14K wells drilled in 2022 were to replace legacy production. It only gets worse from here.”

What Happens from Here?

I’ll start with another graph. Beginning in January of 2023, you see a sharp decline in the rate of new oil added per month. This is consistent with the fact that the first DUCs Turned In Line-TIL’d since Jan-21, are watering out as production falls below 50 BOPD, just as the oil-rig count has dropped below 600. This means that the two drivers – DUC withdrawals and an increasing rig count – that have propelled production to post-Covid highs are in retreat, and there is only one outcome possible. Daily shale output is nearing an inflection point and may soon start a rapid decline, that will be impossible to reverse, absent a huge increase in the rate of drilling new wells that cannot be sustained in today’s market.

Your Takeaway

The full effect of this decline in shale output is likely going to occur at the worst possible time if your interests coincide with low to moderate oil prices. Many large banking institutions are warning of a supply deficit later this year which will cause oil prices to spike, as noted in this OilPrice article.

Noteworthy also is the surprise factor for the markets when, and if, my projections bear out. No one is forecasting a decline in shale production at this point, making me something of a heretic. The most recent EIA – Today in Energy forecasts shale production rising to 11 mm BOPD by year-end 2024. We can’t both be right.

It’s not for me to make a determination about final outcomes. The observable trends support my thesis, and that creates an opportunity for investors looking for growth in their portfolios. As noted in the Oilprice article-Goldman Sachs: Oil Markets to Face Crisis in 2024, the energy sector is by far the cheapest of 11 market sectors tracked at a 5.7 PE. The article goes on to say-

“Indeed, the energy sector is the cheapest of all 11 U.S. market sectors, with a current PE ratio of 5.7. In comparison, the next cheapest sector is Basic Materials with a PE valuation of 11.3 while Financials is third cheapest at a PE value of 12.4. For some perspective, the S&P 500 average PE ratio currently sits at 22.2. So, we can see that oil and gas stocks remain dirt cheap even after last year’s massive runup, thanks in large part to years of underperformance.”

That should suggest possibilities in the upstream energy sector to investors willing to look past the day-to-day ups and downs currently being experienced in oil and gas prices. Scarcity exacerbates demand, which is already forecast to be strong, and should be very bullish for oil prices as we move through the year.

This is completely unrelated but I hope NC picked this up, if not – here is the link to the BBC article re libor rigging

https://www.bbc.co.uk/news/business-65635243.amp

as far as i know, most LNG exporters don’t commit to a final investment decision until they have most of the plant output sold under long term contracts…that’s how the Chinese managed to profit from European demand post Ukraine; it was Chinese LNG being loaded in the US Gulf for shipment to Europe, or in some cases LNG already on the way to China U-turning in the Pacific & back thru Panama to deliver the LNG to Europe….the point i’m making is that if we end up with a gas shortage, it won’t be exports that will suffer; they’re already under contract…the shortages will come out of what’s left to heat your house..

for the record, shortages are a ways off: The EIA’s natural gas storage report for the week ending May 12th indicated that the amount of working natural gas held in underground storage in the US increased by 99 billion cubic feet to 2,240 billion cubic feet by the end of the week, which left our natural gas supplies 521 billion cubic feet, or 30.3% above the 1,719 billion cubic feet that were in storage on May 12th of last year, and 340 billion cubic feet, or 17.9% more than the five-year average of 1,900 billion cubic feet of natural gas that were in storage as of the 12th of May over the most recent five years…note, however, that the oft quoted national average obscures the fact that naturals gas supplies are 40.6% below normal for this date in the West, while 32.8% and 29.4% above normal in the East and Midwest regions of the country at the same time….

the west and the Northeast (north of the PA-NY border) will feel it the most—lack of natural gas distribution options (pipelines).

For example Massachusetts imports LNG as pipeline capacity does not meet demand. Good luck charging an electric car if charging networks are rationed to prevent brownouts which is very easy to do given today’s “smart grid” technology.

A plausible scenario in an extended winter cold snap/”polar vortex” scenario.

De Nada. We certainly tried our best? Constitution’s 36″ SAWL was the very last good pipe we saw. QA/QC & environmental considerations were seldom in question. Scores-of-thousands of quick to kick, impossible to plug, soon to be abandoned leaky-ass wells was Biden’s administration’s schtick & I’m really wondering WHERE NYC’s going to get sufficient fracked gas (let alone EU industry) without Rooski imports? Betya, the 2024 general election is gonna be COOL?

These are fracked wells. Production in graced wells declines much faster than in conventional drilled wells. Unless new wells are drilled production is going to decline.

That method always did remind me of a Ponzi scheme where the only way to keep it going is to bring in more production or else the whole thing would fall over. The good news is that as shale production is wound down, that means there it will pollute fewer water tables with toxic, cancerous chemicals

The problem then would be to find any unpolluted water tables to draw from. Second problem is to match usable water sources with usage zones. The old joke about piping Great Lakes water to the West Coast comes to mind.

How about the US rebuilding the SPR reserves? Shouldn’t there be enough demand there to keep prices high?

the SPR reserves largely uses hollows in salt formations. Leave those types of formations unfilled beyond a certain point, and the domes collapse.

Given how DC keeps stumbling into avoidable calamities in every topic, don’t be surprised if DC starts buying oil for the SPR at prices much higher than today’s $70 to $80.

Maybe the Biden administration will not be proven as idiots for releasing *strategic* reserves when oil is $80. Maybe in 2024 oil hits $120 and there is a reckoning. Or maybe the oil market is “saved” by a big recession between now and then.

There is also the trend towards decreasing the percentage of the population that can afford personal transportation. It is a classic micro-economic strategy. To ‘ration’ something, raise the price.

This being the best of all possible neo-liberal paradises; no public transportation is being created to compensate. Rule #2 in all of it’s shining glory. Minus the “go” part of course. Don’t go anywhere to show your fealty to the System. Do it in place.

Thus, allow me to propose a new “Green” Neo-liberal rule #2: “Die.”

Kinda depends upon your idea of personal transportation? Shiny new Diesel RAM, 3yr old PHEV, 15yr old ICE, or scores-of-thousands ebikes, scooters we’re watching yuppie media trying to ban, here in NYC? i3 size BEV with microtubine range extenders seem unpopular & as folks get fed-up with dodging folks’ deliveries & dead-eyed rich kids crippling us on the sidewalks & API pushes the perfectly reasonable fire hazard trope?

It would be nice if scooters and cities co-evolve to become adapted to eachother. Da Kiddz are not going to give up scooters. Give them up for what? Subways in slow decay? Every subway a coughing covid coffin car?

Bicycles? Maybe. I’m too old to predict the tastes and choices of the young.

So . . . make scooters slower and safer for riders and the surrounding people alike. Make the front wheel at least small-bicycle big to eat bumps and potholes without throwing the rider off. Maybe make the standing board shorter and wider. Maybe replace the back wheel with two wheels semi-close together. Maybe put a cargo box above the rear wheel(s) as wide as the standing-on board and several feet tall to be able to put a bunch of stuff in it.

Maybe design the scooters to be unable to go faster than some designated or legislated or ordinanced safe speed. Maybe have combination bike and scooter lanes where possible.

Mind you, my nickname in one gas & oil conglomerate was “Bicycle,” because I’d carry a Jamis Dakar on my 22yr old Nissan (grew up without a car in Pittsburgh, raced a Tange/ Sakae Ringyo in college). I’d NEVER ride on a sidewalk, ESPECIALLY in a huge, crowded city FULL of PASC-debilitated old folks (let alone an 80lb e-bike or Monocycle, 22-40mph, posing or Instagramming my Mindfulness session?) Lots of EXCEEDINGLY precariate folks & ALL essentials NEED e-cycles (I’m seriously invested in Asian equities our betters shorted after Biden got in; that kicked ass right through Trump! Y’know, they’d done VERY well in an open market, filling a niche my yuppie neighbors ignored?)

Yes, e-bikes is another growing thing. Perhaps e-bikes for longer distances and/or heavier uses. And better e-scooters for shorter distances or twisty urban scooterways where an e-bike might or might not fit and fine-grained ability to stop and park almost anywhere.

And at key crucial heavily-used bus stops and subway stops and trolley stops and such, why not have larger parking areas for many e-bikes and e-scooters? Help get more people onto the buses and rails.

I like this analysis. If NG prices increase by next summer this will indeed be bad news for Spain. I think I have commented this before but July and August are peak NG consumption months in Spain (last year well above winter because winter was mild but compare 8.000-9000 GWh monthly by Jul-Aug-Sep with 4.000-5000 GWh in Dec-Jan-Feb last winter). This is in mostly because wind and hydraulic production tend to be lowest in late summer. This year we are having an awful draught so this summer hydraulic will fall precipitously. On the bright side NG reserves are already at high levels (>30.000 GWh ) and significant, as you can see enough to cope with the summer peak.

We will see…

The ‘trogloditas’ in Guadix are beginning to look like the smartest people in the room. Living in those caves gives natural air conditioning.

The BBC: https://www.bbc.com/travel/article/20160811-the-cave-dwellers-of-southern-spain

If the near to very-near future plunges everyone into a forcefield matrix of high to ultra-high prices for various hydrocarbon fuels, those people who have spent the last few years learning to live and/or at least survive on a fraction of the hydrocarbons their neighbors use may well start to look like winners or at least survivors in the eyes of their neighbors.

If they can be humble about it and not braggy or gloaty, they might even find themselves getting asked how they do it. And this would be their opportunity to tell the asker how they do it. But only if asked, And no trying to trick people into asking.

well, here you go:

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCRSTUS1&f=W

this week’s 2,013,000 barrel per day decrease in our overall crude oil inventories was the largest on record, topping the prior November 25, 2022 record by 16,000 barrels per day…

the media missed it cause they don’t look at the SPR withdrawal…