Yves here. Please welcome back Satyajit Das, who has graciously published posts on banking, derivatives, centralized clearing houses, and economic issues, is providing a series on energy needs and the implications of energy transition proposals. As he introduces this exposition:

Abundant and cheap power is one of the foundations of modern civilisation and economies. Current changes in energy markets, perhaps the most significant for a long time, have implications for society in the broadest sense. Energy Destinies is a multi-part series examining the role of energy, demand and supply dynamics, the shift to renewables, the transition, its relationship to emissions and possible pathways. The first part looks at the part played by power in the rise of modern societies and patterns of demand and supply over time.

By Satyajit Das, a former banker and author of numerous works on derivatives and several general titles: Traders, Guns & Money: Knowns and Unknowns in the Dazzling World of Derivatives (2006 and 2010), Extreme Money: The Masters of the Universe and the Cult of Risk (2011), A Banquet of Consequences RELOADED (2021) and Fortune’s Fool: Australia’s Choices (2022)

Energy’s Role In Modern Civilisation and Economies

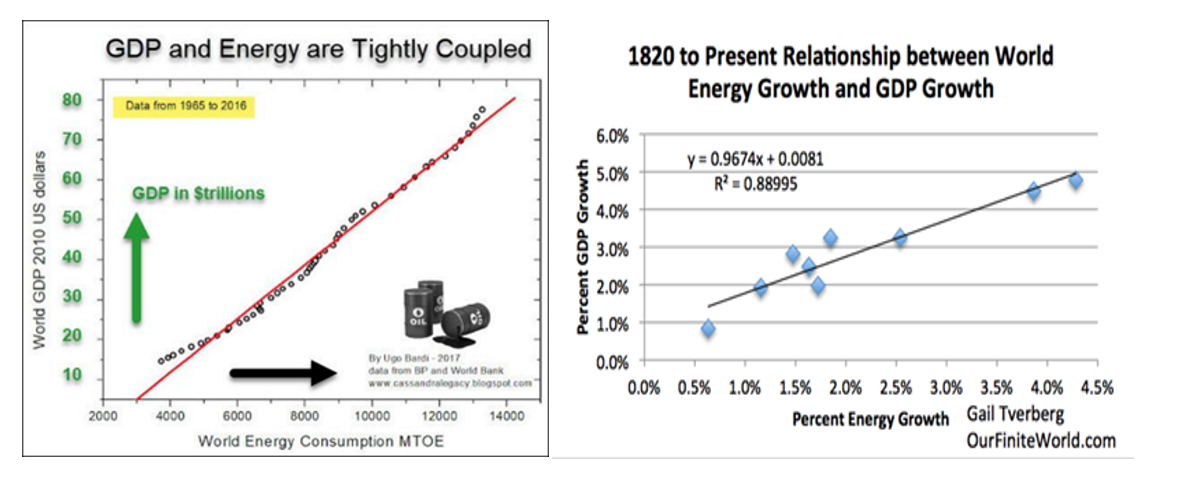

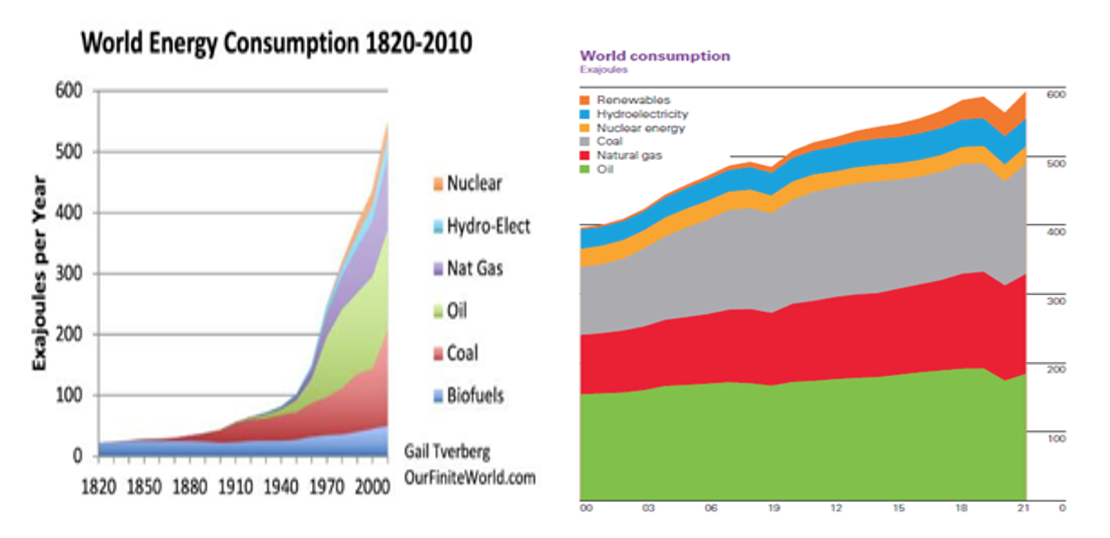

The last two centuries of human history were the ‘age of fossil fuels’. Abundant and cheap energy has revolutionised industry, transportation and lifestyles driving growth and wealth creation. It expanded the scope of human activity to an unparalleled degree. The correlation between oil use, population, growth and living standards is captured in the work of actuary Gail Tverberg and others:

Energy use per capita is increasing. Since 1950, global population has increased by 3.1 times while energy use has increased 6.4 times. The increase in energy use per capita is driven by:

- Increased use by residents of emerging markets who have been traditionally low energy users as incomes rise.

- New uses of energy related to higher living standards, particularly since the second World War.

Uninterrupted supplies of energy on current terms is widely assumed. However, the availability of reasonably priced energy is not assured. In the last half century there have been at least three energy shocks – the oil shocks of 1974 and 1978 and the 2022 Ukraine conflict. All have been relatively short in duration with a rapid reversion to the status quo although the long term repercussions of 2022 is difficult to predict. The more fundamental underlying change under way may not resemble these past shocks in terms of scope and scale.

Sources of Energy Demand

Careful parsing of demand and supply and the underlying physics, chemistry and economics are required to understand the shifts in train.

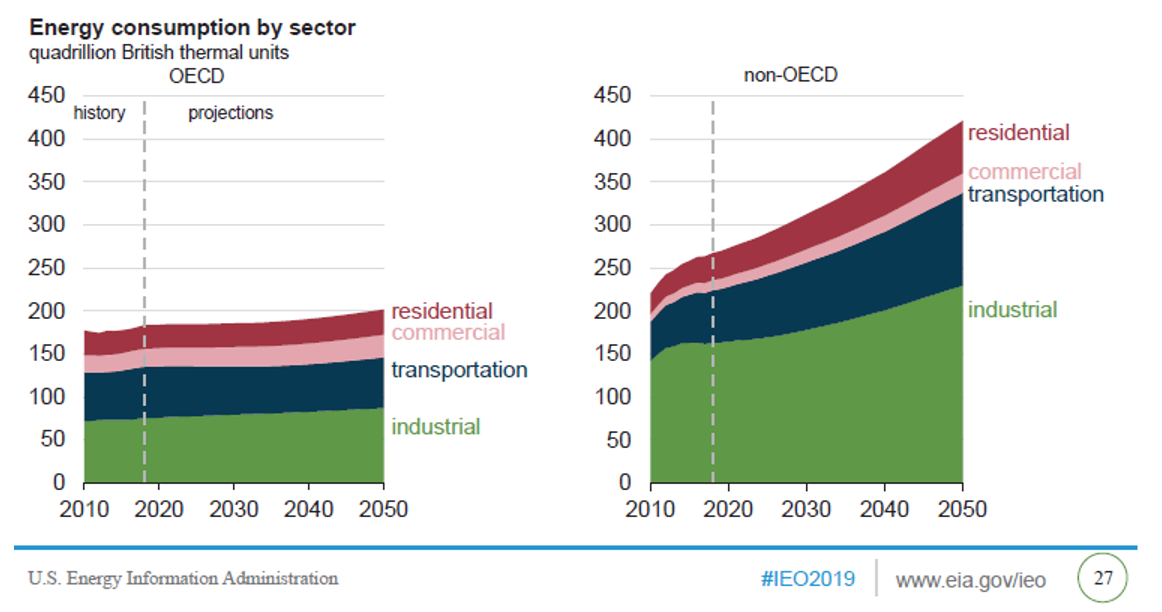

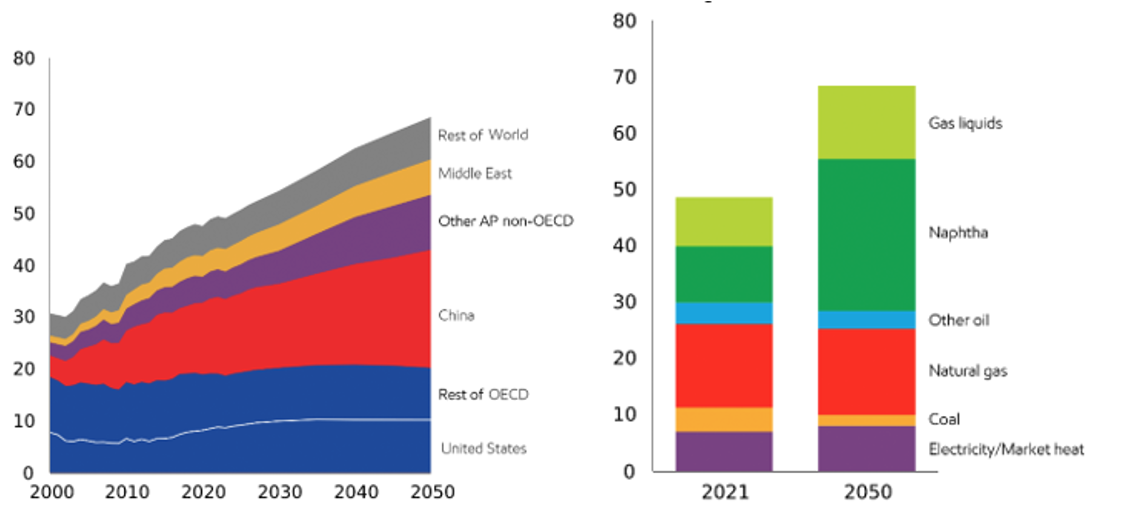

The major users of energy are households and industry. The industrial sector (mining/ refining, manufacturing, agriculture, and construction) constitutes the major energy consumer —more than 50 percent of end-use. Increasingly, much of industrial sector energy use occurs in non-OECD nations.

Power is needed for:

- Lighting

- Climate control (cooling/ heating)

- Powering appliances and machinery

- Transportation

These uses are common to households and industries. There are differences; industrial application focus on operating industrial motors and machinery as well as heavy transportation. Industrial energy intensity, for example to manufacture steel, aluminium or concrete, is also magnitudes greater than that required for normal household use.

Industry also uses fossil fuels as feedstocks (raw materials) for products such as plastics and chemicals, especially ammonia and bitumen type products. It is essential as the base raw material for items such as lubricants. Coal, crude oil or petroleum, natural gas liquids, and natural gas are the primary sources of basic petrochemicals. Around 9–10 percent of global fossil fuel production is used as feedstock.

Plastics require hydrogen and carbon, with the most common production method being extraction of ethylene, propylene, styrene etc from oil. Petrochemicals such as naphtha and other oils refined from crude oil are used as feedstocks for petrochemical crackers that produce the basic building blocks for plastics. Fossil fuels represent currently represent 99 percent of the plastics raw material base. There is a growing interest in the use of biomass as a feedstock. While data is sparse, it is likely that around 4 percent of the world’s fossil fuel resources are used in plastics production.

Oil is used in the production of ammonia as the nitrogen source in agricultural fertilizers. Global ammonia production currently accounts for around 2 percent of total final energy consumption; around 40 percent as feedstock and 60 percent as process energy, mainly for generating heat.

Energy demand is also changing. Data storage and transmission, as well as crypto mining, now consume 1-2 percent of global energy.

Historical Energy Demand

Global demand has increased over time:

It continues to increase, although the rate has slowed over time to 1-2 percent per year. There have been brief interruptions in the early 1980s, and 2009 as a result of financial crises and the 2020 Covid19 pandemic.

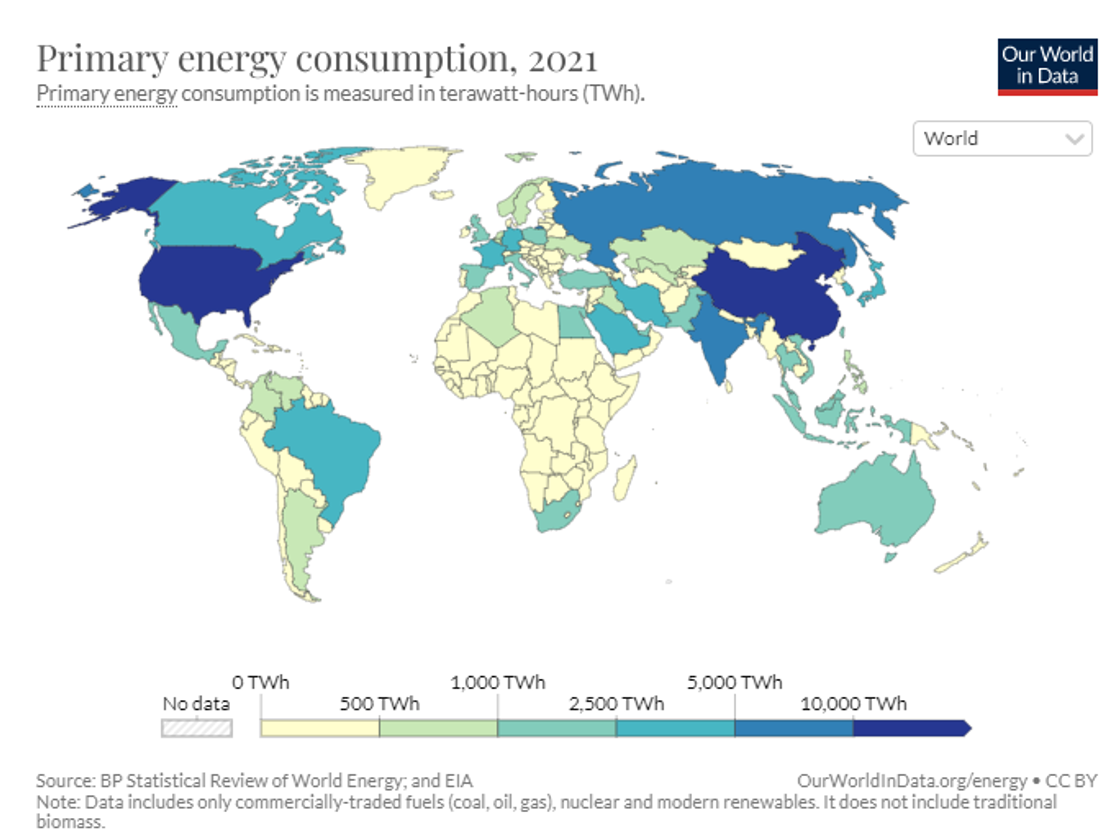

The bulk of energy consumption is in developed countries. Some emerging countries such as China show high levels of consumption driven by advanced economies outsourcing polluting and energy intensive activities to these locations.

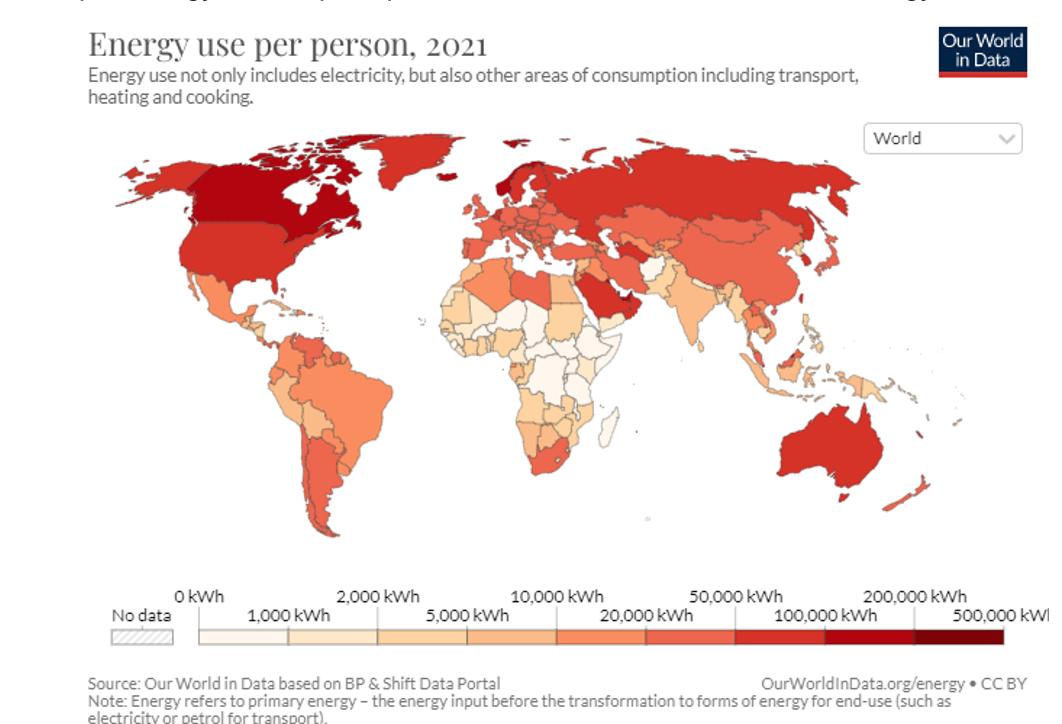

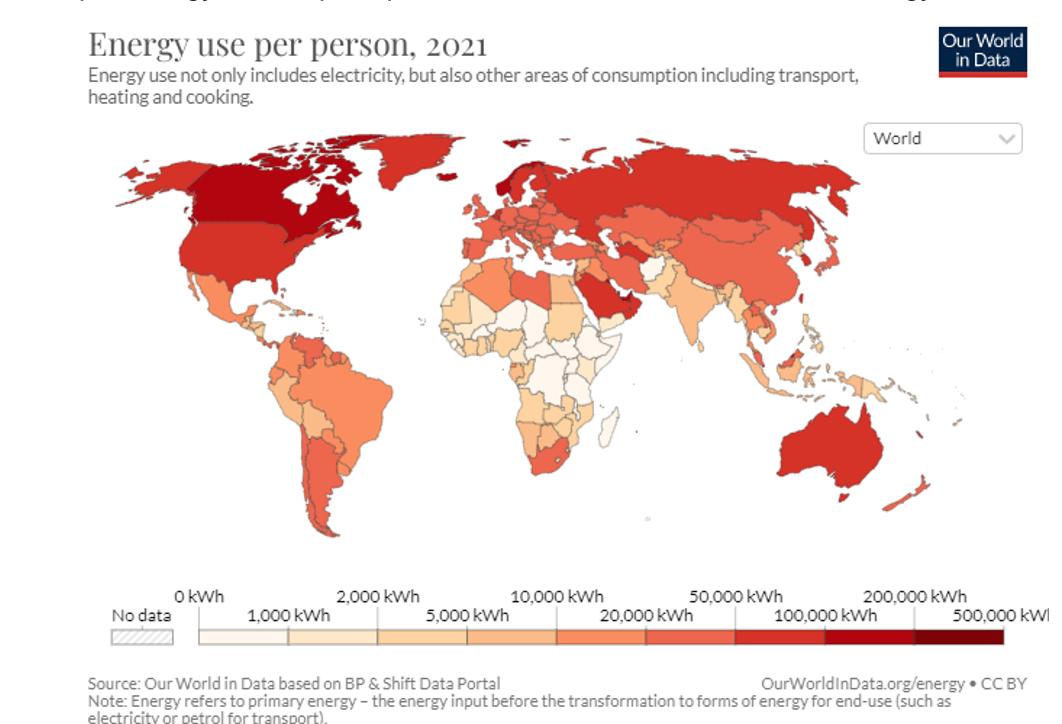

Per capita energy consumption provides a more accurate measure of energy demand.

The largest energy consumers on a per capita include the US, Canada, Iceland, Norway, Australia and Russia as well as Middle East such as Oman, Saudi Arabia and Qatar (in part due to climate and desalination to meet water needs).

The average person in high energy use per capita countries use up to 100 times more than the average person in some of the poorest countries. The true difference is under estimated due to lack of high-quality data for many of the world’s poorest countries. Low income countries use less commercially-traded energy sources instead relying on difficult to quantify traditional biomass – crop residues, wood and other organic matter that is.

Demand has been ameliorated, in part, by increases in energy efficiency. This is uneven with bulk of gains in advanced nations with increases of varying degrees in developing nations.

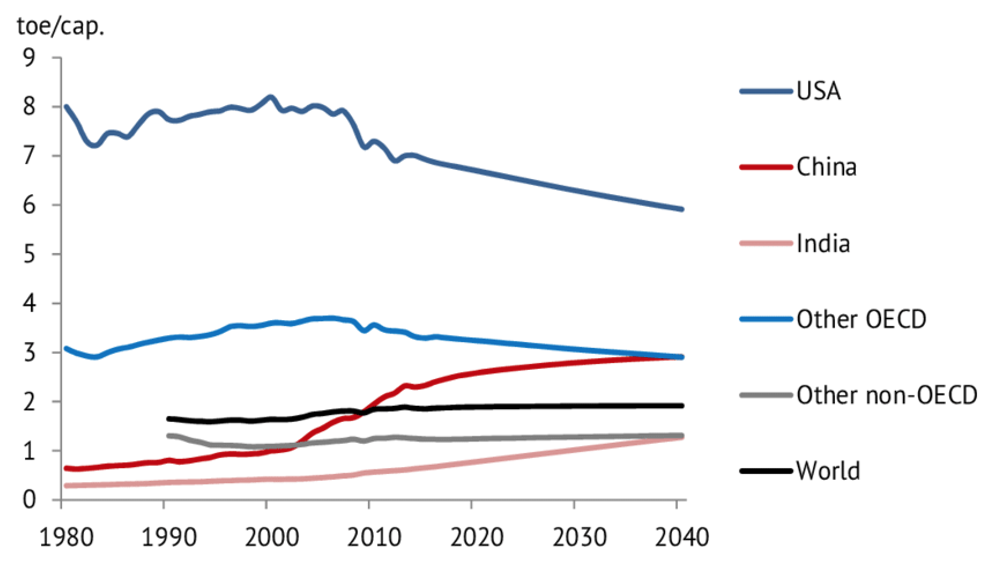

Forecast Energy Demand

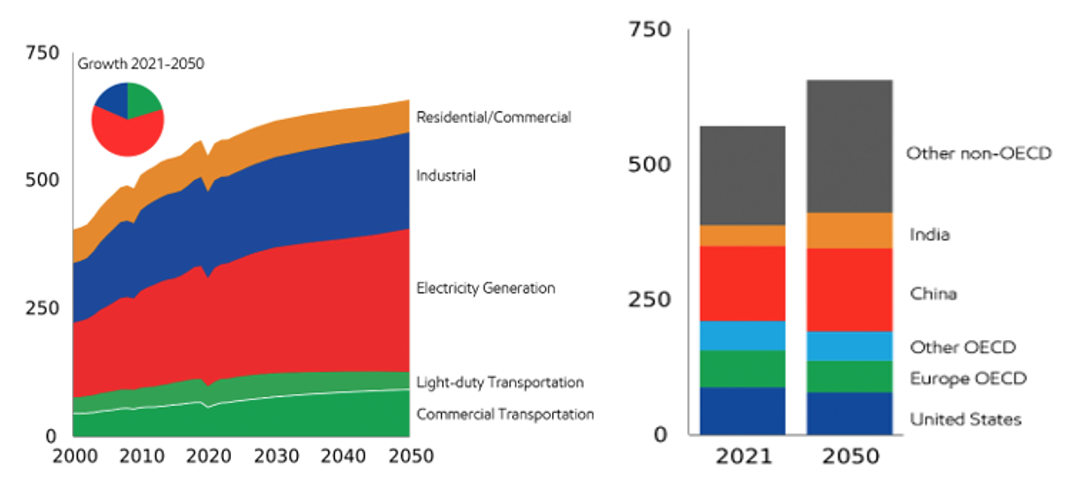

Forecasts of future energy demand vary. S&P forecasts combined residential and commercial energy demand will rise by around 15 percent through to 2050. ExxonMobil projects similar growth.

There is broad agreement on the pattern of increasing energy needs. Much of this growth will be in developing nations. Most of the growth comes from industry underpinned by increases in population and living standards. Energy-intensive manufacturing of such products as chemicals, food and iron and steel is forecast to increase. This is led by activity in China and India. Average worldwide household electricity use is expected to rise by about by 2050.

Overall growth in energy demand (in quadrillions of BTUs (British Thermal Units)) is projected to be as follows:

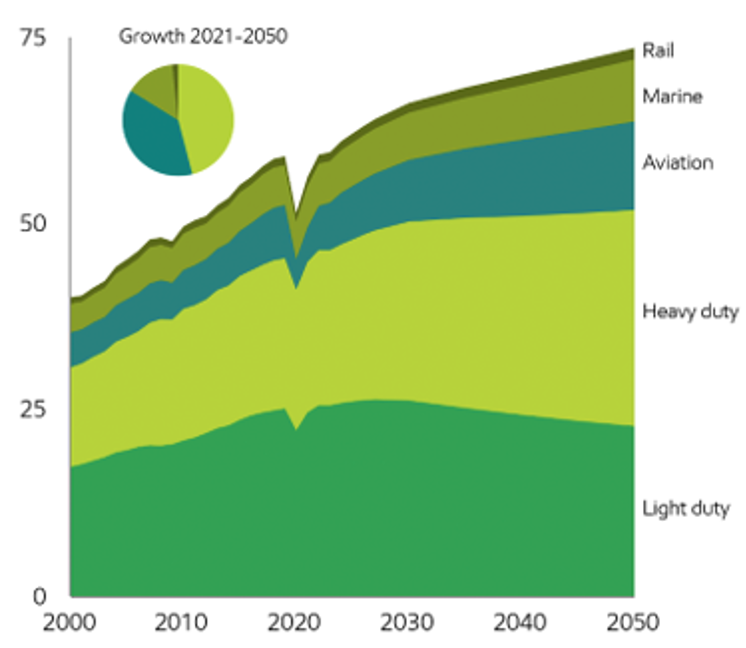

Global transportation demand is expected to grow by 30 percent to 2050. This reflects greater personal vehicle ownership, especially in emerging markets with purchasing power rises, offset in part by higher fuel efficiency and more electric vehicles (“EVs”). Strong commercial transportation (heavy-duty trucking, aviation, marine and rail) energy demand is driven by growth in economic activity and consumption, in particular the increasing middle class consumers in emerging economies.

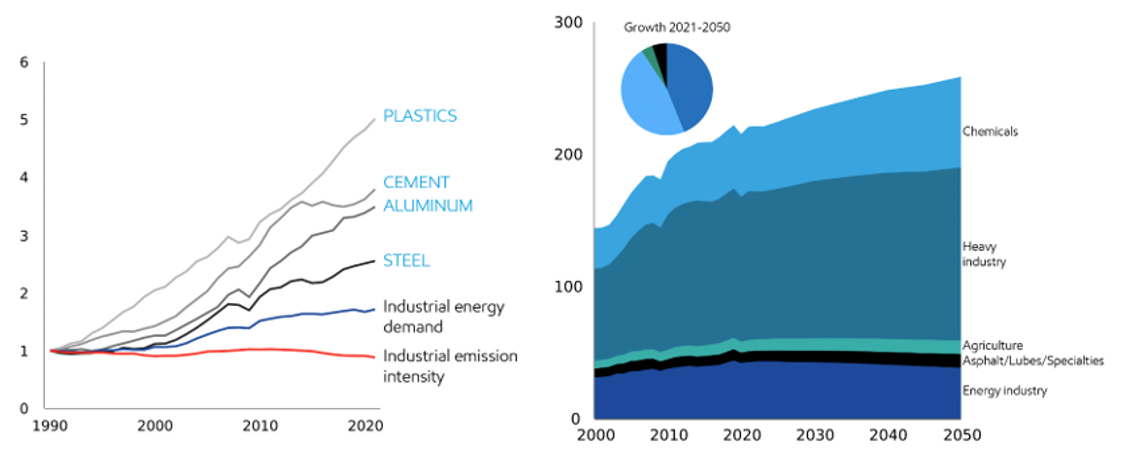

Industrial energy demand will continue its strong rise over recent decades focused around steel (used for large-scale construction, shipping containers, trains and ships), Aluminium (power grids, construction and vehicles), cement (construction) and plastics ( medical supplies, cleaning products, electric vehicles, and household goods).

Demand from heavy industry will, in part, be offset by improvements in energy intensity (the amount of energy used per dollar of overall economic activity). Developed nations will benefit from the shift to service-based economies and predominance of higher-value, energy-efficient industries. Improvments in energy intensity require advances in technology, processes and logistics and their adoption in major manufacturing hubs like China.

There will be strong increases in demand for production of chemicals due to need for fertilizer, cosmetics, textiles and plastics. Much of this will require fossil fuel based feedstocks.

The above focuses on traditional uses. Over time, the requirements of data and computation technologies are likely to increase significantly. Additional demand is likely, ironically, to come from attempts to combat climate change, such as processing additional or new materials for the energy transition as well as carbon capture and sequestration projects. The energy demand from these sources remains unquantified.

Energy Sources

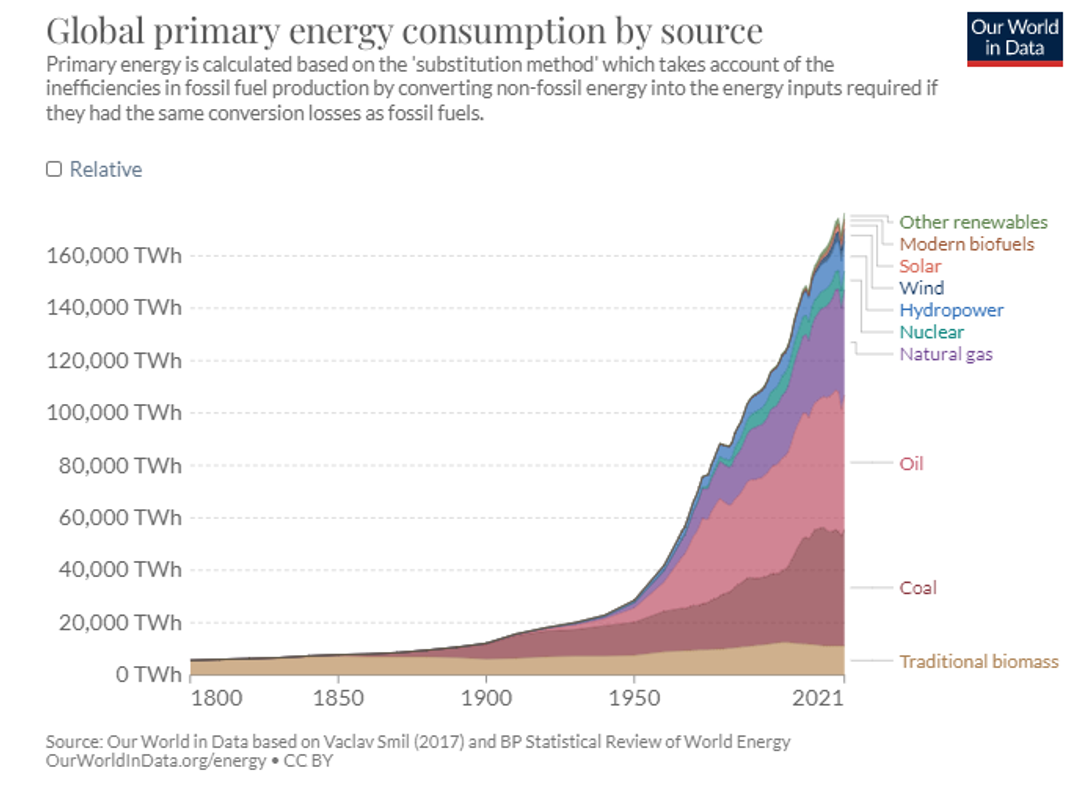

Global demand is met from a variety of sources.

Several points should be noted:

- Energy demand has historically been met primarily by fossil fuels.

- The mix of fossil fuels has changed over time with oil and more recently gas supplementing coal.

- Over the last few decades, new renewables (primarily solar and wind) have supplemented hydro and biomass power.

- Fossil fuels (which now make up around 80 percent of energy sources) are likely to remain a significant part of energy supply, primarily because of their advantages over alternatives.

- Renewables will increase as a proportion of the energy mix but, based on current technology, it is unlikely to become a dominant source in the foreseeable future.

Fossil Fuel Reserves

Given the importance of fossil fuels as an energy source, an important and frequently ignored question is the long term availability of inherently finite fossil fuels.

Estimated total global oil reserves are around 1,700 billion barrels. Estimated total global natural gas reserves are around 190 trillion cubic metres. Estimated total global coal reserves are around 1,070 billion tonnes. Based on current production and usage, oil will run out in 54 years, natural gas in 49 years, and coal in 139 years, assuming that fossil fuels will constitute 59 percent of the total primary energy demand in 2040.

Several issues should be highlighted:

- There is wide variation in reserve estimates and expected lives of fossil fuel reserves. For example, some oil companies have written down available reserves significantly in recent years.

- New discoveries as well as extending the life of known resources may increase reserves.

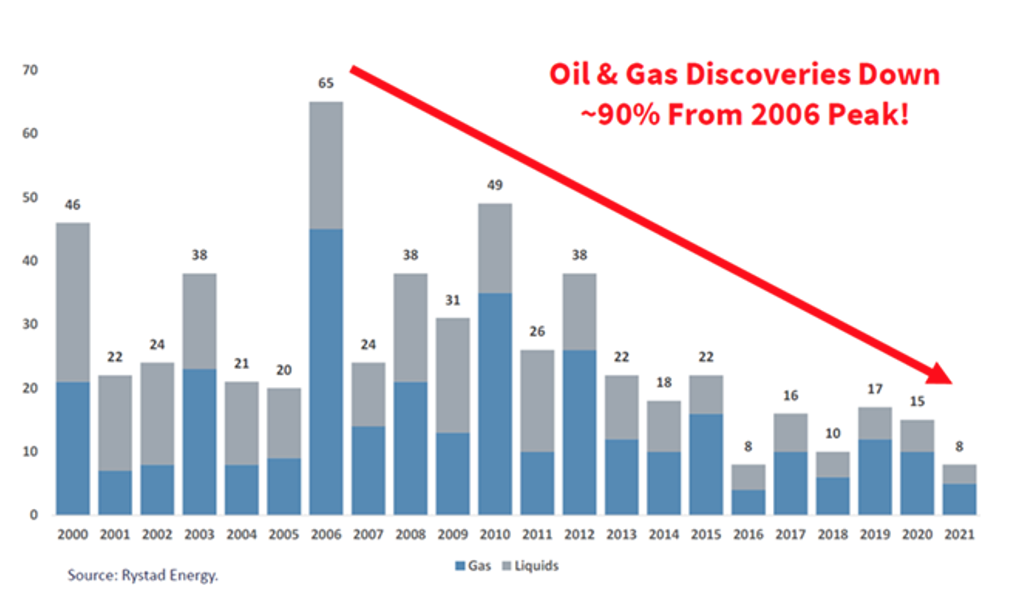

- The number of major oil and gas field discoveries has decreased, in part due to reduced investment in fossil fuels.

- Reserves may not be economically recoverable except at high prices due to technical difficulties in extraction. Many new resources are unconventional oil and gas fields, previously considered inaccessible or uneconomic resources, such as deep oceans or the Arctic. These typically require higher prices to be economic: currently around $80 per barrel for oil obtained using advanced recovery techniques, $90 per barrel for tar sands and extra-heavy oil, $50+ for shale gas, kerogen oils and Arctic oil, and $100+ for coal-to-liquids and gas-to-liquids.

- Reserves may also be difficult to access because of remote locations and politically instability.

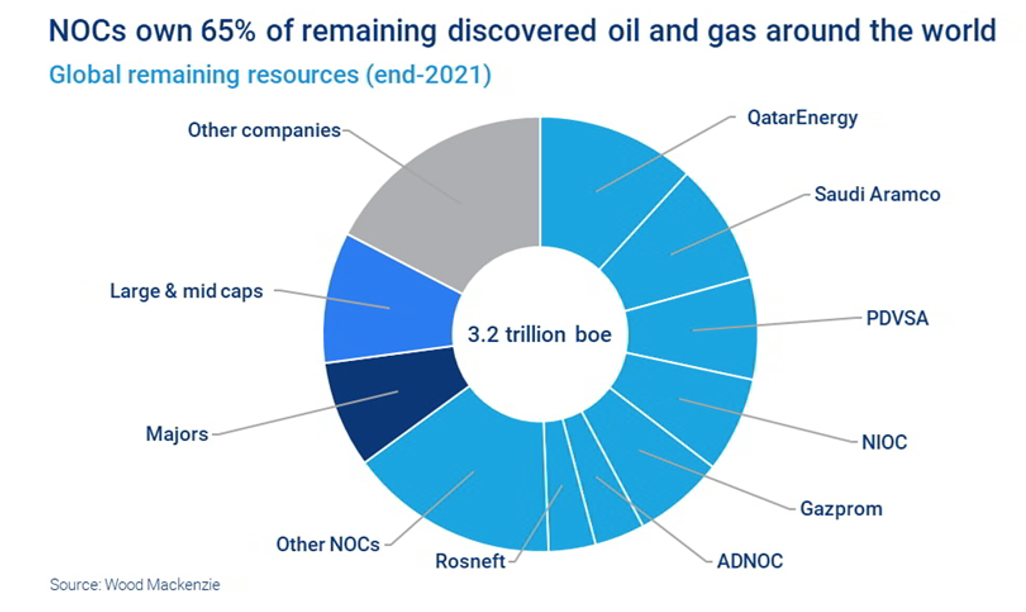

- A high proportion of reserves, especially oil and gas, are state controlled. National oil companies control around 65 percent of oil and gas reserves globally. Increasing resource nationalism means that concerns (ensuring domestic energy sufficiency as well as increasing royalty and tax revenues) and geo-politics may affect accessibility and costs.

EROEI

A critical element of energy physics is the concept of EROEI (Energy Return On Energy Invested). This is the ratio of the amount of usable energy (the exergy) delivered from a particular energy resource to the amount of exergy used to obtain that energy resource calculated as:

Energy Delivered/ Energy Required to Deliver that Energy

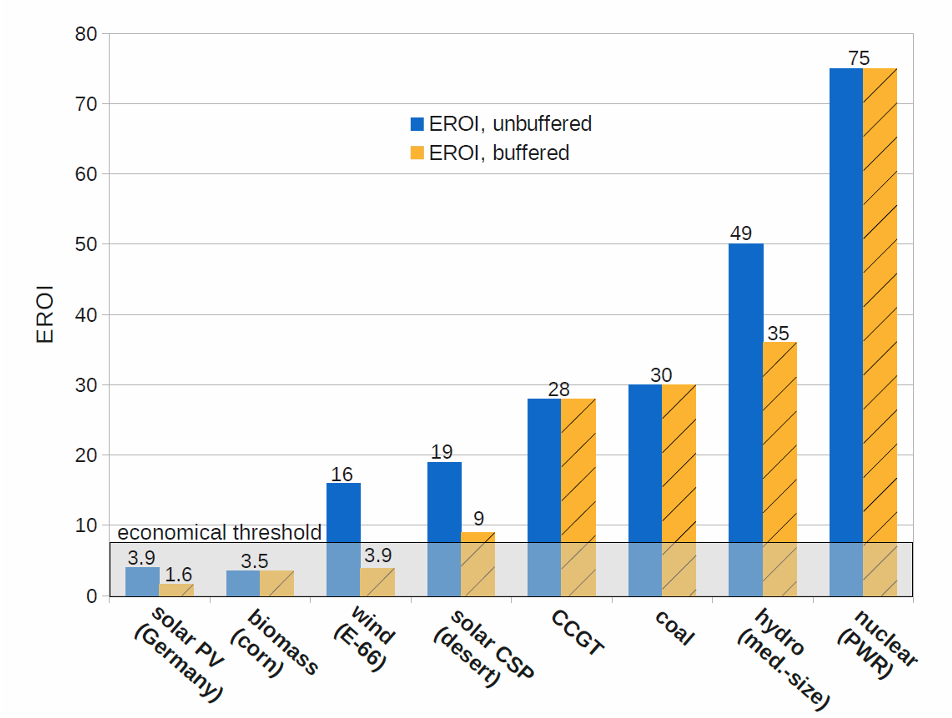

There are two types of EROEI:

- Buffered – which includes storage.

- Unbuffered – which excludes storage.

The differentiation allows capture of the problems of intermittent renewable energy sources. The need for storage will generally lower the buffered EROEI.

Although widely accepted, measurement present problems. While the total energy output is readily measurable, accurate determination of energy input is more difficult. The principal question is capturing the full energy use of the supply chains; for example, the energy input into materials like steel or other materials needs to generate energy. A complete accounting would also necessitate incorporating opportunity costs and comparing total energy expenditures in the presence and absence of this economic activity.

In practice, 3 different EROEI calculations are used:

- Point of Use EROI – which expands the calculation to include the cost of refining and transporting the fuel.

- Extended EROI – which includes point of use and also the cost of creating the infrastructure needed for transportation of the energy or fuel once refined.

- Societal EROI – a sum of all the EROIs of all the fuels used in a society or nation which may be practically impossible due to the number of variables that must be captured.

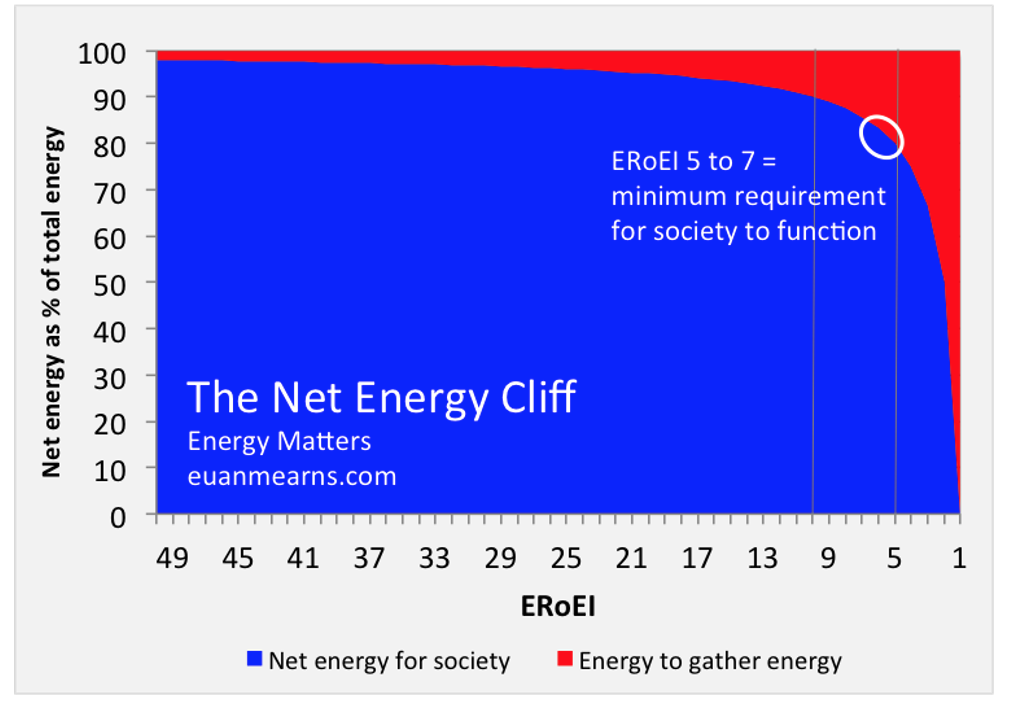

When the EROEI of a source of energy is less than or equal to one, that energy source becomes a net energy sink. While there is considerable debate around the exact number, an EROEI ratio of at least 3:1 (some put it as high as 5 or 7:1) is required for an energy source to be considered a viable fuel or energy source.

Estimates of the EROEI of different energy sources are set out below:

EROEI for a given source is not constant. In the 1930s, the EROEI of oil was probably near 100 reflecting ease of extraction; that is, only 1 percent of the oil being extracted was needed provide the energy necessary to pump and deliver the oil. In the 1950’s the EROEI had decreased to around 30. It is currently around 20, a decline by a factor of five. The EROEI of less accessible sources now being exploited is lower. Offshore drilling has an EROEI of about 5 while Brazil deep-sea Lula resource is lower still and may not be practical to develop. Oil shale has an EROEI of 1.1 to 2.2 but some put it much higher if only purchased energy is counted as input excluding self-energy (internal energy) from the conversion process used to power that operation.

The exhaustion of certain energy sources and the shift to renewables is likely to reduce EROEI of the whole energy system from current 6:1 to between 5:1 to under 3:1 by 2050 depending on the energy mix assumed. The reduction means that in order to satisfy the same level of final net power consumption, the system needs to process more energy and materials to make it available for the society. Currently energy costs around 5 percent of global GDP. As EROEI decreases more of income will need to be directed to energy costs. At 3, this would increase to 15 to 25 percent of GDP.

EROEI analysis highlight a central issue of energy use. Human development has been dependent on the availability coal, oil and gas reserves which can be utilised efficiently due to modest energy or financial investment needs. As the best resources are used up and climate change dictates a shift to less-polluting energy sources, EROEI decreases rapidly (known as the energy cliff). The risk is that EROEI falls below the minimum requirements for modern societies and economies to function.

Energy Pricing

The pricing of energy, especially long term, must be evaluated against a background of rising demand, constraints on supply, especially of traditionally dominant fossil fuels, and declining EROEIs. This does not incorporate important externalities such as the emissions from the use of fossil fuels which are not valued or charged for.

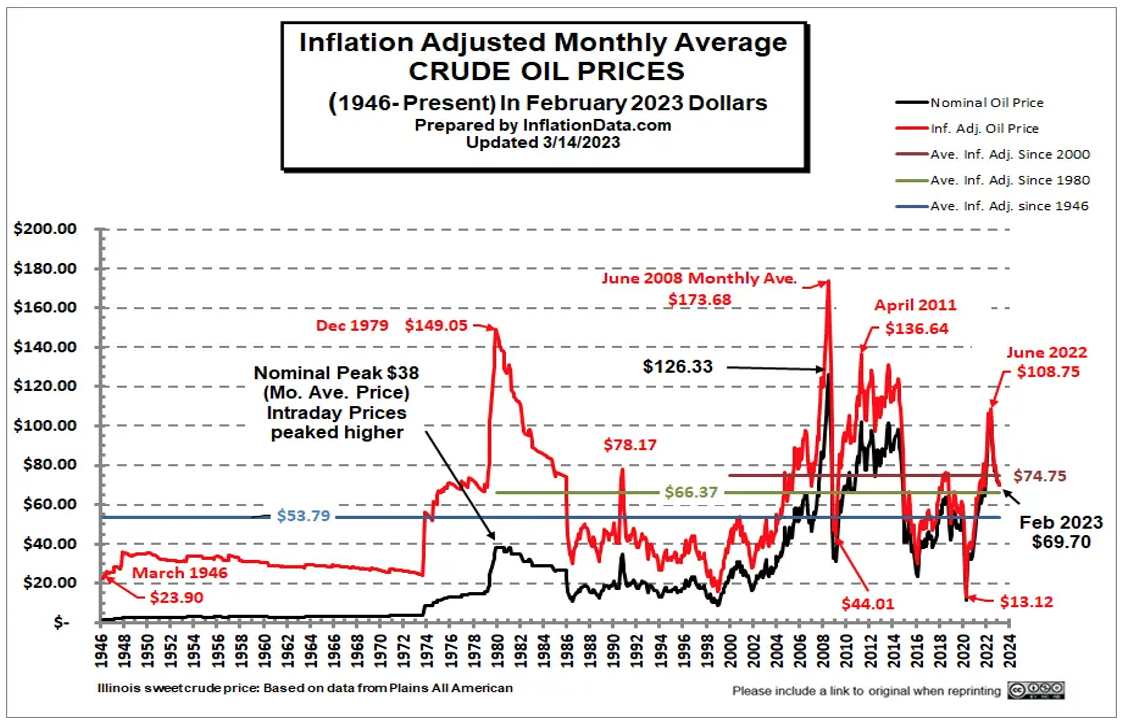

As an example, the real price of oil does not fully reflect the identified factors.

This means that cost of energy will have to increase significantly over the long term. The principal drivers include:

- Inelastic and rising demand, especially from developing economies such as China and India.

- Energy’s essential role in generating global growth and meeting expectations of improving living standards.

- Finite supply of fossil fuels which will remain an essential part of the energy mix due to difficulties of replacing it for some applications.

- Declining EROEI.

- Increasing political instability in energy producing regions.

- Management of energy resources consistent with national objectives and strategic independence.

Short-to-medium run energy prices will remain volatile because of inelasticity of both supply and demand for oil and event risk (a recession in China, or a rapid fall-off in tourism due to terrorist attacks on commercial airliners or pandemics). However, the long-term price dynamics are difficult to overlook.

The supply-demand imbalance may manifest quicker than expected as forward looking markets anticipate the shortfall pushing up prices sharply. For example, Saudi Arabia has warned that, without re-investing in the oil industry to find more deposits, the world could be short 30 million barrels a day within a decade or so. In effect, the price adjustment might take place well before the reserves of fossil fuels are anywhere near exhausted.

Keeping The Lights On

Current and expected demand for energy will progressively outstrip inherently finite fossil fuels. While renewables can bridge some of the deficit, energy physics dictates that less efficient energy sources will replace superior, ignoring emissions, fossil fuels. At a minimum, it will mean more expensive and more limited power. At worst, there might be shortages, especially of fuels needed for specific activities. This will have profound consequences for societies and economies that believe in a birthright of unlimited and cheap energy.

Such shortages are not new. In the mid-nineteenth century, the demand for fuel for lighting exceeded the supply of whale oil leading to higher prices. It also made illumination expensive for ordinary Americans meaning only the affluent could afford to light their homes regularly. Ironically, it was the discovery of oil in Western Pennsylvania that alleviated the shortfall.

The energy assumptions which have underpinned economic models and expectations, with the benefit of hindsight, were unwise. As poet Robert Frost mused in The Road Not Taken “way leads to way”. Choices made over centuries may be difficult to change or, in some case, irreversible. It is unlikely that our civilisation can go back, at least not without a major dislocation.

Well done! The outstanding analysis you get on Naked Cap!

Agreed, re silc. Almost all of which lead one to the inescapable conclusion: we’re f**ked! Unless we can agree upon, and then implement, a radical course correction. As Das ends his part one analysis: “Choices made over centuries may be difficult to change or, in some case, irreversible. It is unlikely that our civilisation can go back, at least not without a major dislocation.”

Running out of good EROEI oil should mean we have extra incentive to transition to more sustainable energy generation in addition to the CO2 emissions, but I fear that we will still pump it all until the handle breaks since the oil companies own our governments.

We could certainly have a happier society with less energy use despite what everyone believes. America has way higher GDP and per capita energy use than Mexico and yet Mexicans are happier, so we clearly aren’t getting any value (in fact perhaps negative value) out of our massively wasteful energy consumption.

All of this is why degrowth is not only necessary but the only path forward that doesn’t lead to massive misery, but degrowth would require socialism and we can’t have that!

Degrowth makes sense to those already grown. Try selling that to the ” Global South” where people are starting to see a way out of grinding poverty.

While I’m personally still ambivalent on degrowth (by what it would ACTUALLY entail once the rubber meets the road and you actually have to make decisions as a leader/party, the idea sounds fine and maybe even necessary), I don’t think any serious person in the degrowth camp is calling for us to rip down hospitals and power stations in, say, Honduras due to the carbon emissions they have.

The concept is, as far as I can tell, letting go of the need to have ever-increasing GDPs and various other “big money lines” simply for the purpose of having them and instead aiming for sustainability and stability and prioritizing the average human’s wellbeing. The ‘average human’ here is meant on a global scale, so the development of poorer countries must continue, but also the development of poorer areas within richer countries. I’m sure people in every developed nation can point to an area which is unpleasant to be in due to it being essentially abandoned, and the people there would also not be happy with the naive version of degrowth.

Dark future.

EROI table strongly suggests that “aesthetic energy”, solar, wind, biomass, is not an option for countries like India, Bangladesh or Africa, and nuclear energy tops other sources.

Nuclear energy calculations differ very widely, with different cost assumptions (RosAtom in Belarus and Turkey, of whoever made the recent nuclear plants in Georgia, USA), different pricing of time horizon (build 6-12 years, dependent on provider and regulatory situation, used for 60 years, account for nominal or real interest rates. Buffering cost depends on the usage, if the daily consumption cycle is close to constant, there is no storage, and if the daily cycle is balanced by easy to store fuels, the cost is low.

For that matter, buffering cost for solar and wind is drastically different in different scenario. If the intermittent supply is balanced with easy (medium easy) to store fuel, the cost can be moderate, but if we want the entire consumption to be based on them, we either adjust consumption pattern (sleep when the Sun is out, run the windmills when the wind blow and stockpile the goods, like flour was stored in ages past), or the costs blow up beyond economical threshold.

A final aspect is that if the carbon emissions are a VERY SERIOUS problems, pooling technologies across the globe can be essential. Trade wars, sanctions and patent exclusivity (intellectual property as a method to rule the world) should be avoided or, in the case of patents, kept in check lest innovation is killed, but without excessive monopoly rent and sanction pressure mechanisms.

I wonder if people tried planning exercises like: how much it would cost to bring standard of living of, say, Mali, to Indonesian level in a “sustainable way”, which current technologies would be best and most practical. And how, say, Mali could generate the needed resources.

Nice article with lots of information. However, the over arching picture is that we will have to return to an 18th century level of energy availability – yet we won’t have an 18th century level of clean water, clean air, and edible food. Prepare now or be prepared.

You probably mean early 18th century — before industry and the usage of coal took off.

Along with your course corrections — perhaps it should also be noted that the population in the early 18th Century was much smaller. I am curious how much difference the greater knowledge of our present age might modify life for Humankind.

And do not forget … modern materials like steel, iron, bronze, glass, ceramics and their progeny are reliant on substantial inputs of energy. Our 18th Century life may be much less provident than that of the original.

And do not forget the learning of leg power in the many mechanisms of bicycles. That power could power many uses of power in domestic appliances. Life could be 18th Century life+++.

Tim Morgan has a very good site called Surplus

energy economics. https://surplusenergyeconomics.wordpress.com/2023/04/28/254-a-tale-of-two-economies/

One of the basic results is that the financial system has issued more debt than there are resources to meet that demand . the real, physical economy has the potential to decline slowly but the financial system is fundamentally broken and has to be replaced .

I am so disappointed in the political campaigns so far. It’s even worse than I expected. Even the better candidates are lost in cliches and established patterns.

What slim hope remains that we’ll begin to deal with problems realistically in this country might be boosted if some candidate might address problems like climate in a way analogous to Ross Perot and his charts. With the video tools available these days, a candidate could do four or five multimedia presentations of an hour each on the emerging multipolar world, the degradation of the Earth and economic growth, public health and the decline in life expectancy, the social stresses from extreme economic inequality and social stresses and rapid cultural change. The American people have been kept from reality for decades. Part of the reason is that we have reacted in the past with childish selfishness when confronted with some problems, particularly those having to do with transportation. But part of the reason is that our elites routinely plot out a future according to their wishes, then dispatch their media and political salesmen to manipulate and nudge us into conformance to these plans while never leveling with us about where they have us headed.

Perot was the last Presidential candidate I remember–other than Bernie as Professor Bernie–who actually tried to increase citizens’ awareness of problems confronting us and the futures already plotted for us in order to give us a chance to consent or dissent. Otherwise, the media and politicians just want us on the hamster wheel, racking up profits for the billionaires, living in blessed ignorance of where our society is headed and why.

Not a winning strategy for politicians- folks do not want to hear, study, or deal with the truth, especially when it confronts all that they have worked for and believed in for their entire life….

This has been pointed out to me by friends and family— me– Donnie Downer– is not fun to be with–

Peter Pan/ Mister Happy is far more fun! However, Happy left the building with El Vez.

Delusional Cognitive Dissonance. DCD.

Between DCD and the power structure demanding and enforcing Bidnez-as-Usual (BAU)… well…

I have full confidence that humanity will enter a serious de-population phase, if not extinction–and it will be very pain-filled.

I know. It would be nice to give people one, last informed choice before we finish drivin’ down the road to ruin.

Oil and it’s co-product natural gas are critical for energy, but it’s even more critical as the basic building block nearly all pharmaceuticals, some fertilizers, plastics, civil engineering products, etc. I can’t recall the date, but I mentioned here before that I had a dream during undergraduate organic chemistry studies that a group of aliens studying our ” world civilization” slapping their forehead equivalents and turning to each other in utter disbelief and horror upon seeing that we were burning oil instead of using it to make necessary things,

Note that the EROEI estimates for the various energy sources come from a 2014 article (here is S. Das’ source). That’s ancient! Both the solar and wind industries are moving very quickly now, and so is the hydrogen energy industry.

I also didn’t see any mention of using solar to provide feedstocks for the petrochem (synthesize methane from CO2 and H2) nor fertilizer (synthesize ammonia from N2 (atmosphere) and H2 uses. That can “buffer” – to use his expression – quite a lot of energy if one were to locate those type industries immediately adjacent to wind or solar farms.

H2 can be obtained from water using solar- or wind-produced electricity.

As I’ve mentioned many times already, these solar-to-fuel / feedstock ideas are now tested and rolling out in industrial practice. No mention of that in the article, and that’s a glaring omission.

Where’s the discussion of conservation? Houses and most buildings bleed energy (heat movement in and or out). That’s not necessary; poor house design and construction is an artifact of the cheap-energy era of days gone by.

The 2nd and 3rd world should not implement Western economic systems as they spin up. They should be building the new stuff, not more dinosaurs that can’t pay back what’s invested in them.

Sajit Das reminds me of Gail Tverberg; he’s got those linear-thinking blinkers on, and isn’t paying attention to the technological and attitudinal shifts that are already occurring.

Mr. Das and Ms. Tverberg are indicative, though, of the general societal resistance to change. That is the main thing holding us back.

The good news is that the 2nd and 3rd world really _wants_ to change. They don’t have as much investment in old tech as we do – they’ve got more degrees of freedom to select the best economic systems (products and production systems) going forward.

There is a lot of opportunity for technological improvement to lower emissions. However, this crisis is more of a political problem than a technological one. Decision makers (and their masters) have squandered decades, and it’s looking more like a “too little too late” situation with the latest round of policy. The question isn’t if, but how bad and large-scale will it be.

I am guessing that most concerns about the depiction of energy resources, for the Hoi Poi of Humankind, focuses on the costs of food, light, and heat. [Transportation costs present a wild-card (to me). Transportation to and from work, and transportation of goods accounted separately and together — accrue costs that can eclipse the costs in other projections of the future.]

Yes. Transportation is poster child of “how we used to think”. So is mining.

Re-use: reclaim materials at end of life-cycle, and re-form them locally with highly efficient local mfg’g using local-sourced energy. That does away with a lot of transport related to mfg’g.

Work-at-home. We’re not a heavy industry economy any more, might not be again. Why bring the worker (heavy) and the worker’s car (way, way heavier) 150 miles round-trip to a place that has … a computer, a desk, a phone…and for the Big Thinkers…a white board.

I have all that stuff right here in my home. Why do I need to expend massive energy and material resources to go to the office to use the very same tools?

That does away with a lot of auto transport. Move the work (bunch of electrons, very light) to the worker, not the worker (very heavy, long trip) to the work.

Transportation and HVAC. Those are the two biggest hogs. Needless mfg’g is the other big hog.

And the cool thing about is … the new economy that doesn’t make these sort of mistakes is a much more pleasant experience. There’s time for art, and fun, and creativity.

A length article with a lot of graphs by a bunch of accountants that don’t understand energy. Saying that solar has the lowest energy return is just nuts. After the energy investment in the solar and battery system is accounted for, the panels produce electricity at about an 18% capacity factor for 20 to 30 years with no other energy inputs besides annual cleaning. There is NO WAY that solar has an energy return of less than 2 times!!

Take coal: 1) you need a mine (much in Australia) to continue to use energy to dig and transport the coal for thirty years, 2) a large factory needs to be built using lots of transported materials, 3) lots of labor (ie BTUs), continuing electricity, and maintenance, 4) energy to haul off and dispose of the ash, and 5) if we’re lucky the cost of storing the CO2 – all for 30 YEARS. There is NO WAY this has a 20 to 30 ratio of return on energy invested. If you doubt this, explain why major coal generating plants have shut down in Australia recently and most of them are projected to be shut down by 2030 because they are money losing propositions if they need to run at higher than a 70% capacity factor.

This article and EROEI is a backward looking view of an accountant that doesn’t look at the engineering dynamics. It ends up being just propaganda for fossil fuels, with the projected very high return on energy investment.

The concept is like calling PG&E a utility. PG&E is just the devil’s profit center and if the devil can’t get his return on the outrageous electric rates which make people homeless, he gets his return on investment by PG&E burning a 100 people to death here or there.

Lay it on ’em, Heresy.

We need to shuck this containment mind-set, and step into the already-present new world.

The (misinformed )images of Three Mile Island and Chernobyl are so thoroughly in the western ” proper thinking ” mindset, that the most obvious solution is taboo. Just curious re what conclusions are being drawn from the “Estimates of the EROEI” chart above, that nuclear gets nary a mention in the commentariat ?

I would agree with this. The big miss is the lack of discussion about the amount of uranium and thorium in the earth, along with the possibility of fast breeder technology.

Note the high returns of nuclear and hydro. I suspect that means that the future will involve many new reactors and water bodies seeing dam construction.

https://imageio.forbes.com/blogs-images/jamesconca/files/2015/02/EROI-Book-Figure.jpg?height=400&width=711&fit=bounds

Only 0.7 percent of uranium is the fissile U235, but a substantial amount of the U238 could be converted into Plutonium 239, then that leaves an enormous amount of energy. If we get a good fast breeder design, then the EROEI of uranium is going to be much better. Then there’s thorium, which is even more present in the earth.

China and Russia are going to be the leaders the way I see things going.

https://www.cnbc.com/2022/07/01/russian-and-chinese-designs-in-87percent-of-new-nuclear-reactors-iea-chief.html

https://swarajyamag.com/amp/story/world%2Fchina-and-russia-are-fast-becoming-leaders-in-nuclear-energy-as-the-west-falls-behind

I suspect that the West will be trying desperately to play ctach up eventuality.

One of the biggest mistakes that humanity has made is underinvestment in nuclear research. It easily ranks alongside the high inequality and economic rent seeking that exists.

Oops minor typos near the end.

The Forbes image is the same as The Energy Return on Investment in the article above.

The biggest issue for the West is that the Western world has lost competence in its attempt to make the rich richer. A small government whose main mission is to make rich people richer is one that has lost competence in running the nation, having left many roles to rent seekers such as shareholders and executives in the private sector. Building out effective energy infrastructure is something that needs a lot of state competence. That’s true whether the energy is from nuclear, renewables, or fossil fuels.

Michio Kanu – Quantum Supremacy. Fusion by 2050; until then a mix of oil and renewables. Besides, dark skies might be very nice and we’ll be fine with less illumination. We should already be insulated, or soon to be. EROEI should include all the human energy going into high gear. Besides which, it took time for people to learn to like gaslight and electricity. At first they didn’t.

A very interesting article, but I am a little baffled by the EROI of nuclear energy. It seems that something is being left out. These things are tremendously expensive to build and operate. If they were so great the electric utilities would be building them rather than shutting them down. As for the calculation of EROI, what is the energy input of a billion dollars of financing?, uranium mining is particularly nasty (what is the energy input of environmental remediation?). This analysis, IMHO, suffers from the same problem as a purely economic analysis that tries to explain everything in terms of what it does to the dependent variable – dollars, but in this case energy use.

It’s not necessarily that something is being left out. Just because something is very expensive doesn’t mean that the benefits aren’t high. It would be like only looking at the denominator of a fraction and not the numerator.

Perhaps it’s because I have spent a large part of my career in capital projects in manufacturing and now mining, but getting anything big done takes a lot of money.

– High speed rail on the scale that China has?

– The modern semiconductor fabs of firms like TSMC in the separatist Chinese province of Taiwan easily take tens of billions of dollars (USD)

The US has had its own big moments.

– Hoover Dam

– The US Interstate

– The Moon missions

– The Manhattan Project itself, regardless of what you may think about the weapons

All of these took a massive amount of money. That doesn’t mean that they didn’t in many ways transform the world. In other words, one can’t just look at the costs without considering the benefits.

Nuclear reactors being expensive doesn’t necessarily mean that the numbers are wrong. Nuclear reactors generate an extraordinary amount of power. The energy density locked in uranium and thorium is what makes the EROEI happen, even factoring the costs of mining the uranium, refining it, the reactor, and the costs of reprocessing / waste / reactor decommission. They certainly are expensive, but the large numerator is what gives it a high ratio even factoring in these costs.

It is also why something like this can happen, despite the full lifecycle costs of nuclear.

https://oilprice.com/Alternative-Energy/Nuclear-Power/Electricity-Prices-Plunge-By-75-As-Finland-Opens-New-Nuclear-Power-Plant.amp.html

In other words, we have to look at the full total costs versus the full total benefits and look at the ratios.

Sorry moderators – I think the Oil Price article is a repost from a site that isn’t permitted.

Here’s another article about Finland and the nuclear reactor.

https://www.thenationalnews.com/business/energy/2023/05/14/nuclear-power-helps-bring-down-electricity-prices-by-75-in-finland/

The point though is that although the nuclear reactor was costly, there are clearly advantages to nuclear. Otherwise, Finland would have gone exclusively wind, instead of relying on wind as a complement.

Nuclear in a way has also played a role in helping Finland from feeling the worst impacts of some very questionable geopolitical decisions as of late, such as cutting off Russia, a nation thagit heavily relies on.

Will nuclear be a cure all? Of course not. But it can play a big role in solving energy challenges.

Lawrence Livermore National Labs (LLNL) has a good resource for multi yearly summaries of US energy sources and consumption

https://flowcharts.llnl.gov/commodities/energy